Vanguard REIT ETF

Latest Vanguard REIT ETF News and Updates

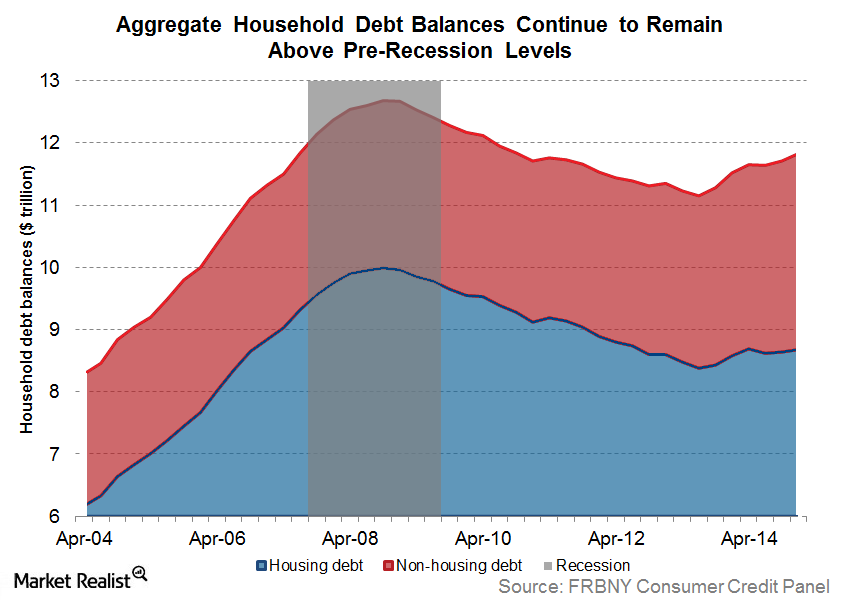

The Great American Deleveraging: Fact or Myth?

The great American deleveraging has largely been limited to the financial sector (XLF) (IYF). Non-financial debt is still much higher than historical averages.

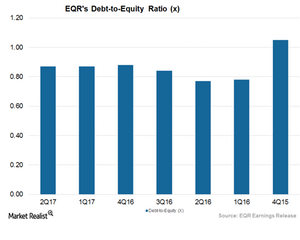

How Equity Residential Improved Its Balance Sheet in 2Q17

During 2Q17, Equity Residential (EQR) reported higher-than-expected top-line and bottom-line results backed by robust rent growth and occupancy levels.

GGP and Other Retail REITs Struggle to Exist in Digital Era

During 1Q17, General Growth Properties’ (GGP) occupancy rate (same-store leased percentage) fell to 95.9% from 96.6% in 1Q16.

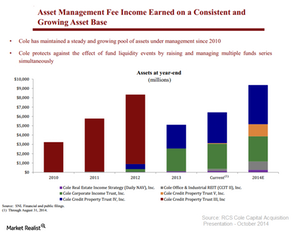

ARCP’s Cole Capital acquisition ended due to accounting issue

In November, RCS Capital terminated a $700 million deal to acquire Cole Capital from ARCP.

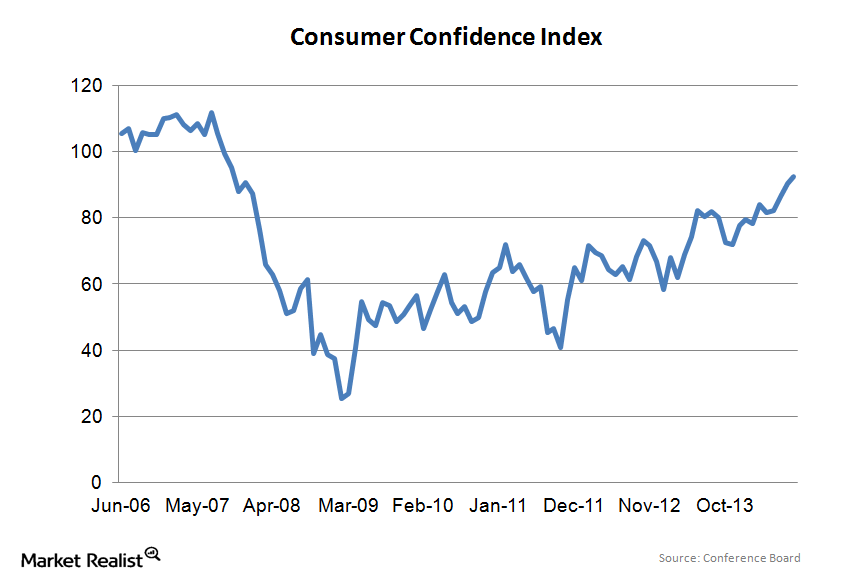

Why rising asset prices are driving consumer confidence higher

The CCI is one of the oldest consumer surveys, originally started as a mail-in survey in 1967. It asks respondents whether certain conditions are positive, negative, or neutral.

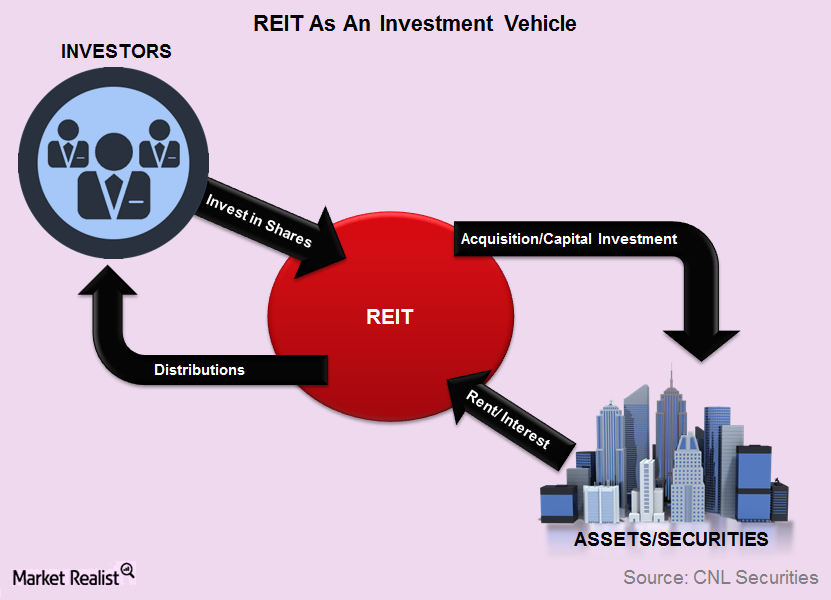

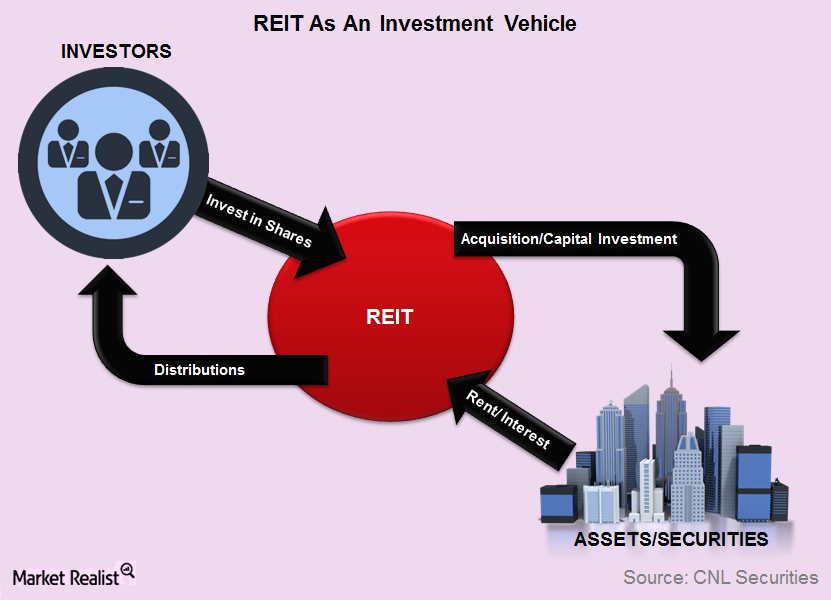

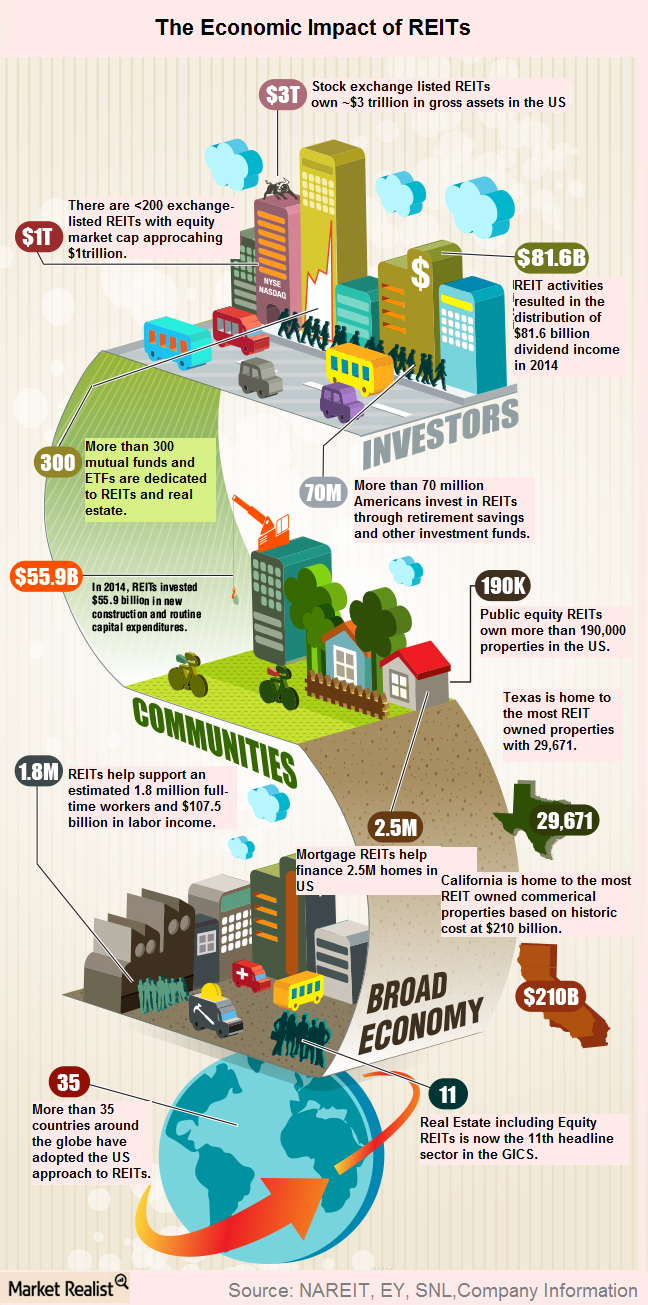

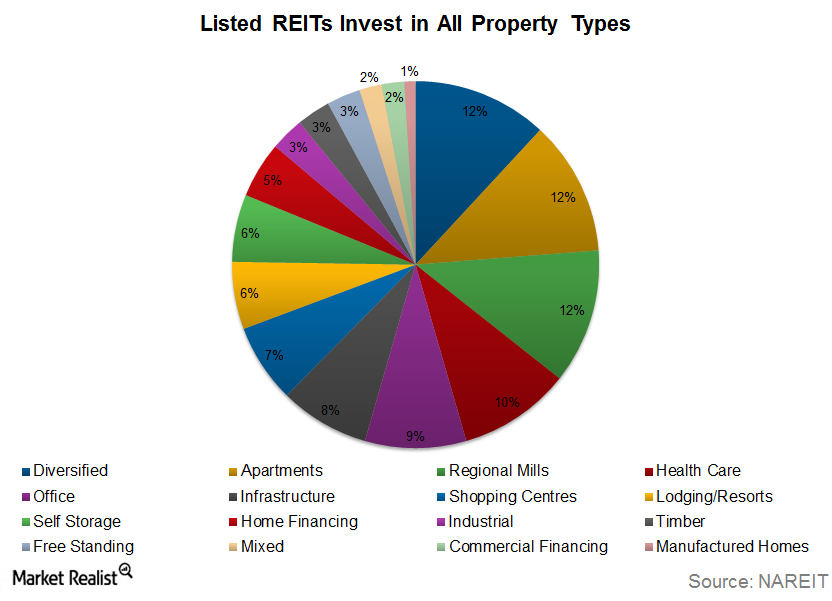

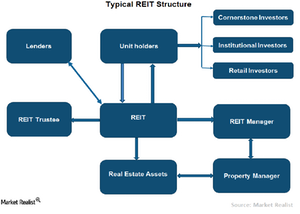

REITs 101: Understanding this Investment Vehicle

In this series, we’ll get down to the brass tacks of investing in the REIT sector, the market’s current landscape, and the benefits you can expect from this type of investment.

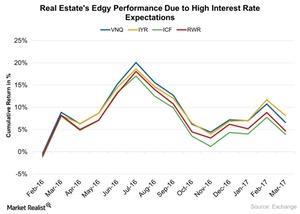

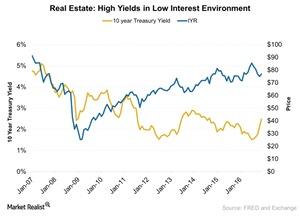

The Real Estate Reaction: Gauging the Impact of the Fed’s Rate Hikes

The rising interest rate is expected to boost the economy in the long run, but it could severely impact sectors like real estate.

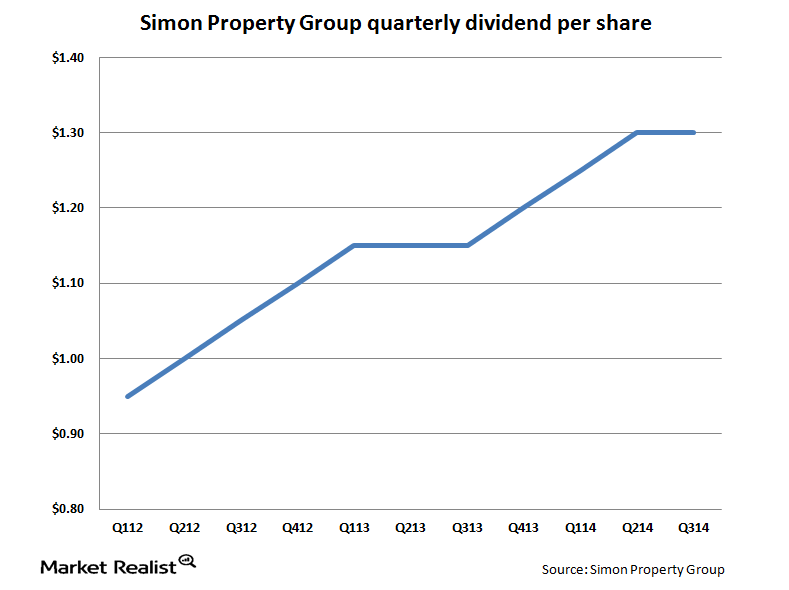

Simon Property Group’s Key Business Segments

Simon Property is the only REIT in the S&P 100 Index and has heavy asset concentration on the US east coast and in the central US.

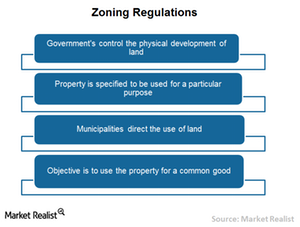

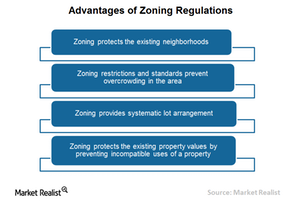

How Zoning Regulations Impact City Development

Zoning is the way that governments supervise land development and the kinds of uses each individual property may be directed toward for the public interest.

The Benefits of Real Asset Investing

In essence one of the things we have accomplished with these three products is to reduce the volatility inherent in all markets, and in particular very volatile markets like the real asset sectors.

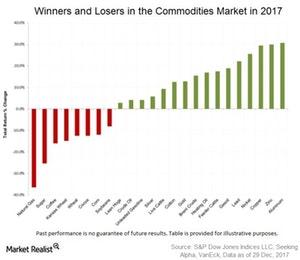

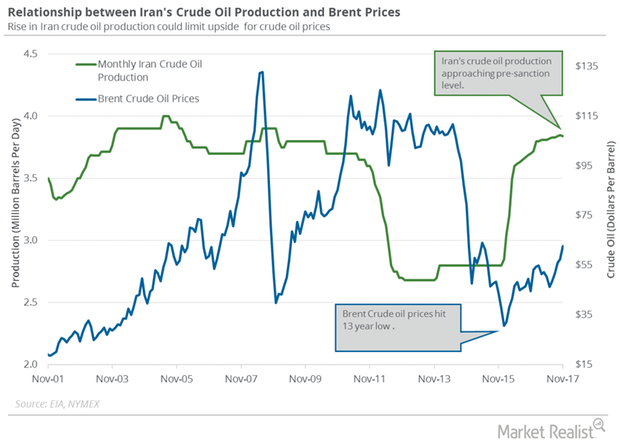

Will Crude Oil Futures and S&P 500 Move in the Same Direction?

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

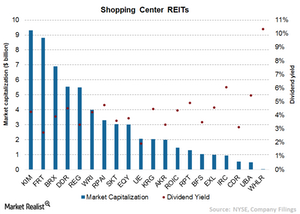

Simon Property Group faces competition from online retailers

Simon Property Group is by far the biggest shopping center REIT in the U.S., with a market capitalization of $53 billion. The next biggest REITs are less than half Simon’s size.

REITs 101: Understanding this Vehicle

By Michael Orzano, Director, Global Equity Indices Publicly traded property stocks, including real estate investment trusts (or REITs) and real estate operating companies (or REOCs), allow investors to gain exposure to real estate, which is generally an illiquid asset class, without sacrificing the liquidity benefits of listed equities. They also typically offer higher yields than […]

Shopping Center REITs Are Sensitive to Economic Cycles

Shopping center REITs mainly own and operate shopping centers that are smaller than retail malls. They’re mainly driven by higher consumer spending.

Why Elliott Management Might Be in Trouble

Last week, Elliott Management filed its 13F for the first quarter of 2020. In the last quarter, the hedge fund’s AUM was worth around $73.15 billion.Financials How close is the FOMC to achieving its dual mandate?

We’ve talked about the dual mandate and factors constraining the Federal Reserve from achieving this mandate. Let’s now assess how close the Fed has come to achieving its macroeconomic objectives.

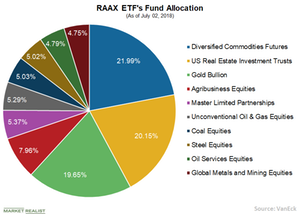

RAAX ETF: Capturing Real Benefits of Real Assets

RAAX’s allocation process provides exposure to segments with better returns profiles while managing overall portfolio risk.

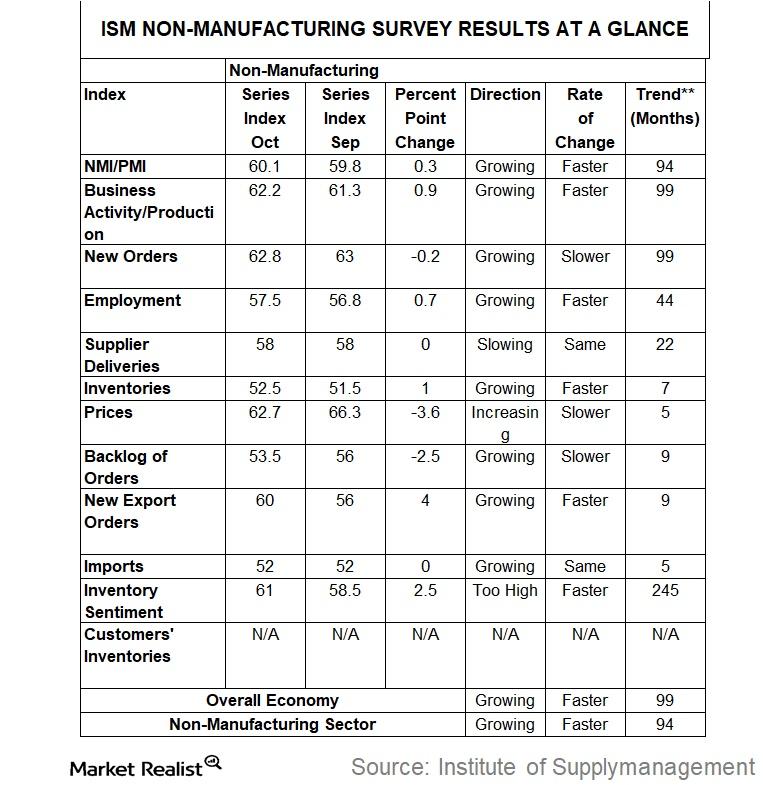

This ISM Index Hit a Lifetime High in October

For October, service sector activity rose at a pace not seen since the inception of the report. The non-manufacturing index reached a lifetime high of 60.1.

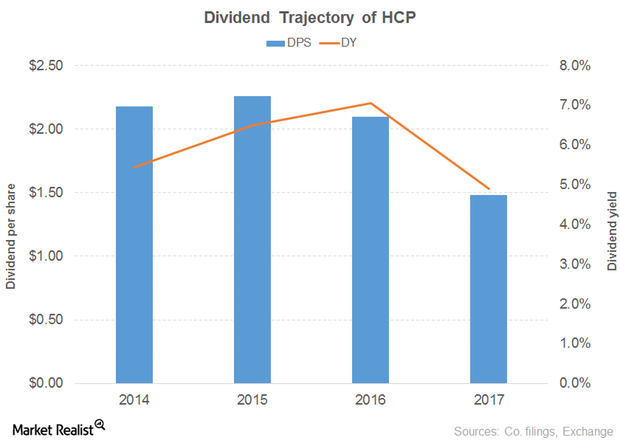

Why HCP’s Dividend Yield Is Moving South

Revenue and earnings HCP (HCP) is a healthcare REIT specializing in US healthcare property investment. In 2016, the company’s revenue growth slowed to 10% from 19% in 2015. The growth was driven by its senior housing operating portfolio, life science segment, and medical office segment, and partially offset by its senior housing triple-net segment. Rental and […]

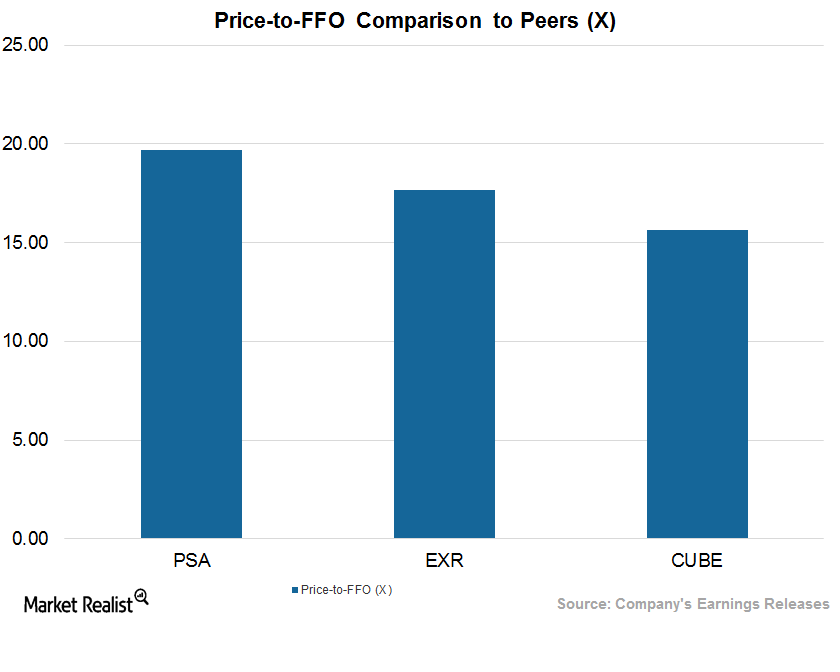

Comparing the Valuations of 3 Leading Self-Storage REITs after 2Q17

Public Storage (PSA) trades at an EV-to-EBITDA multiple of ~21.5x.

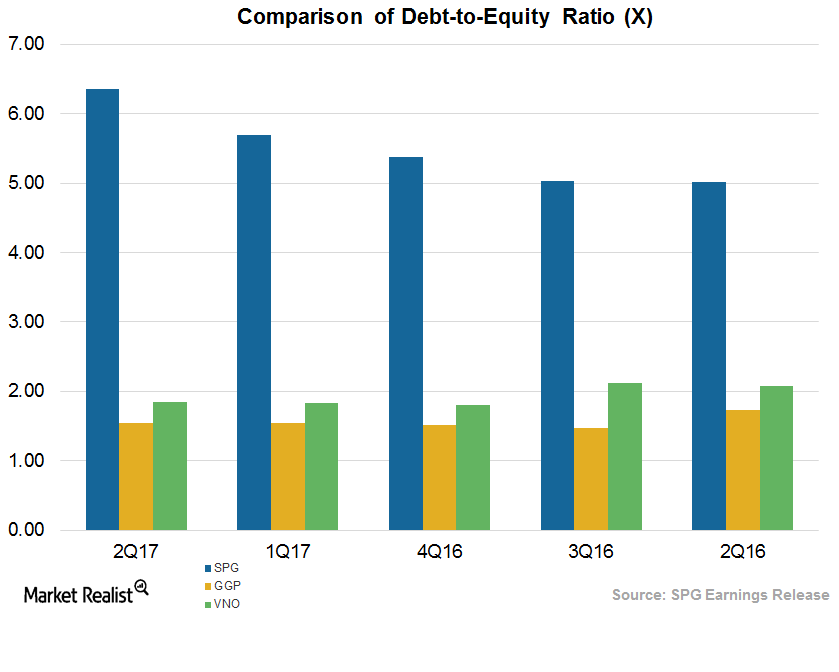

Commercial REITs Have Higher Debt-to-Equity Ratios

GGP’s (GGP) debt-to-equity was 1.55x for 2Q17, which was higher than the industrial mean of 1.07x. As of 2Q17, GGP had $2.0 billion of liquidity.

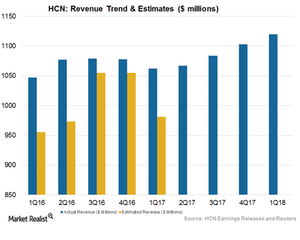

Will Welltower Maintain Its Business Momentum in the Future?

Welltower’s (HCN) strategic presences in high-barrier and affluent markets help it to maintain its leadership in the healthcare infrastructure industry.

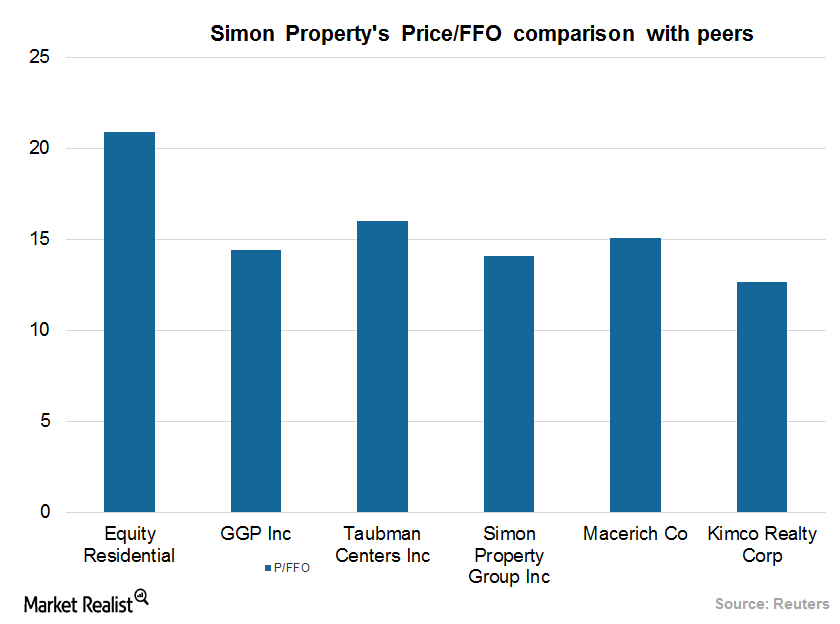

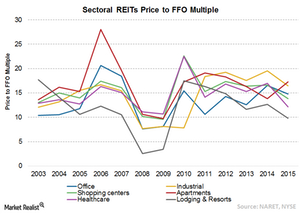

Investing in Simon Property Group: Relative Valuation

Simon Property Group’s current price-to-FFO multiple is ~14.1x.

How Would an Interest Rate Hike Affect Real Estate Valuations?

The real estate sector’s (VNQ) (IYR) performance was subdued in 2016 due to its supply-demand dynamics.

Why Look to REITs for Opportunities?

HEDGING AGAINST INFLATION Property stocks and REITs have often been viewed as inflation hedges because expected inflation will affect prices of real estate, and rental income tends to rise along with generalized inflation. However, other factors may mitigate the impact of inflationary forces. Some of these additional factors may include real estate supply and demand […]

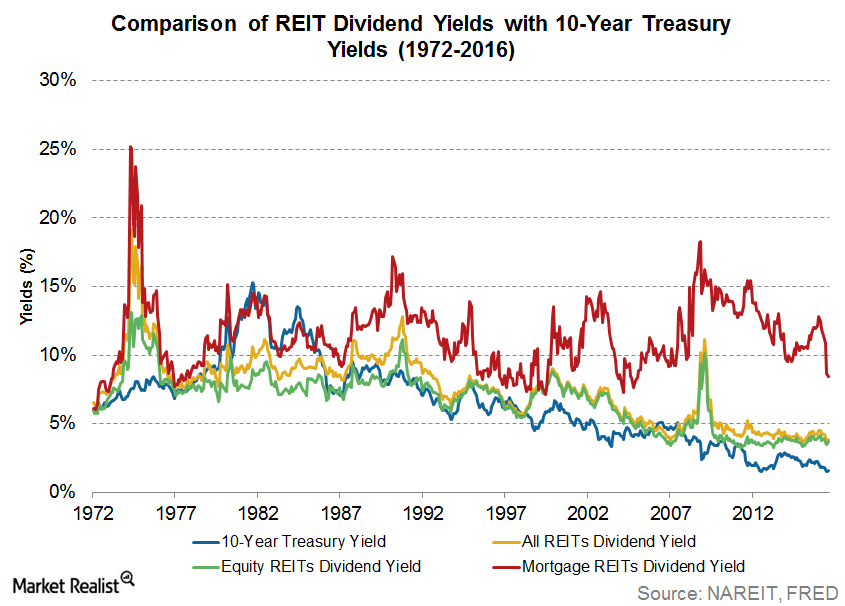

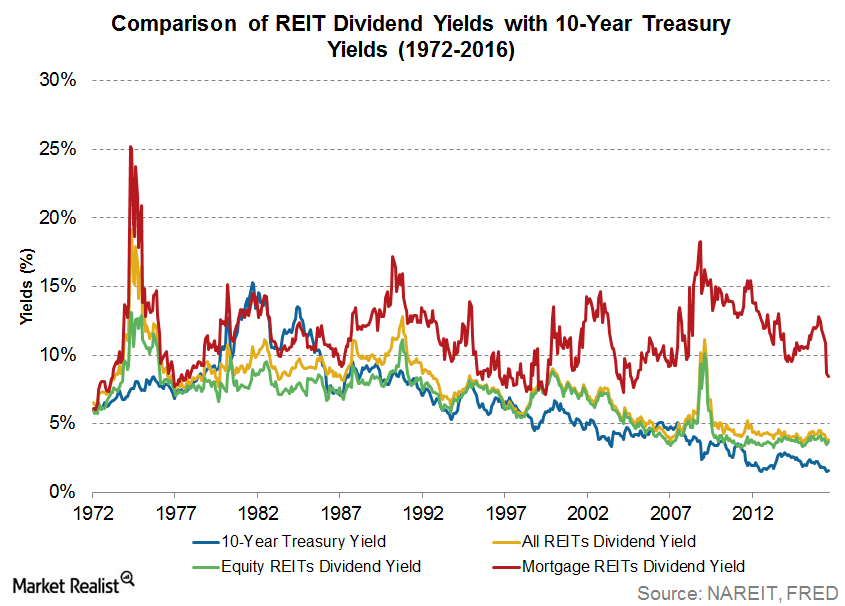

Why REITs Tend to Offer High Dividend Yield

COMPARING DIVIDEND YIELDS ACROSS ASSET CLASSES Since 1999, approximately half of the total return of the Dow Jones U.S. Select REIT Index has come from dividends. During periods of heightened volatility, this income could act as a buffer and may mitigate negative price movements. Historically, the Dow Jones U.S. Select REIT Index has produced higher […]

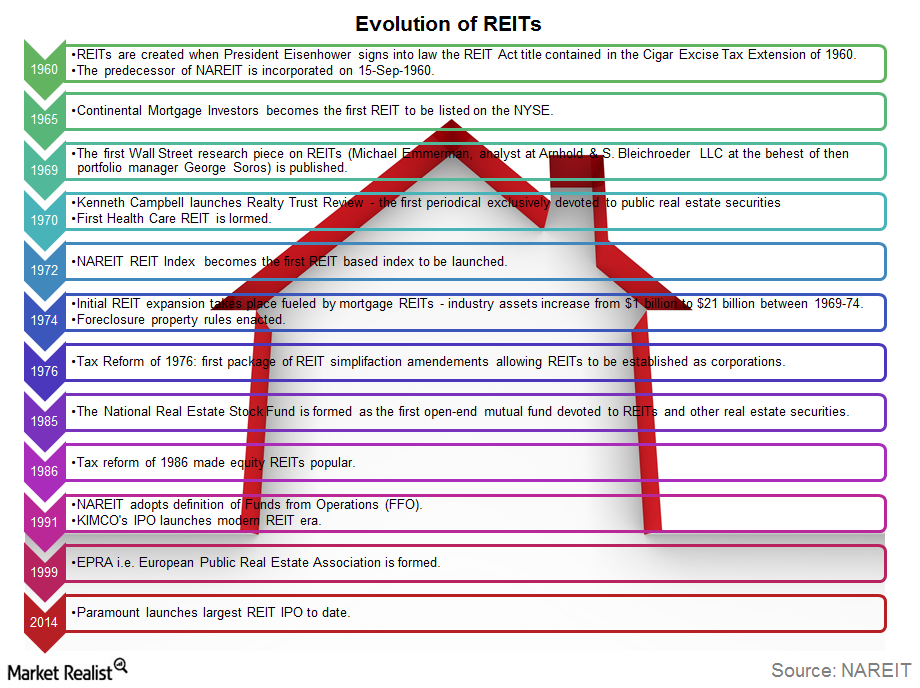

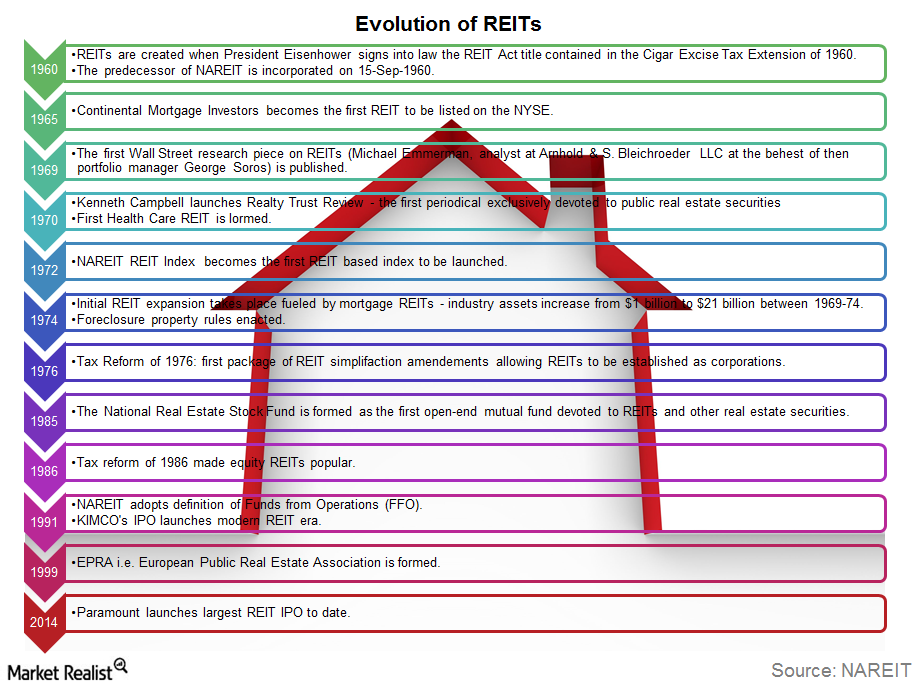

The Evolution of the REIT

The Evolution of REITs The basic concept of REITs originated with the business trusts that were formed in Massachusetts in the mid-19th century, when the wealth created by the industrial revolution led to a demand for real estate investment. The first REIT was set up in 1961, but it took several decades before REITs were […]

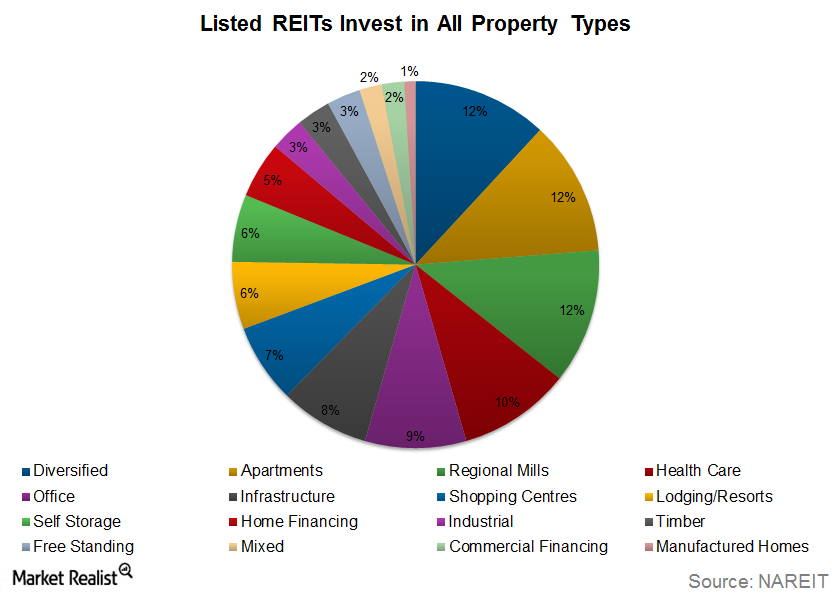

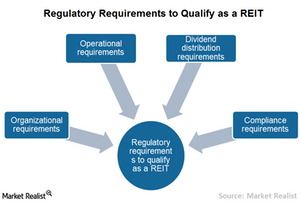

REITs Explained: Qualifications and Types of REITs

To qualify as a REIT, a company must have most of its assets and income tied to real estate investment and must pay out almost all of its taxable income to shareholders in the form of dividends. In the U.S., a REIT must meet the following four requirements. The REIT must distribute at least 90% […]

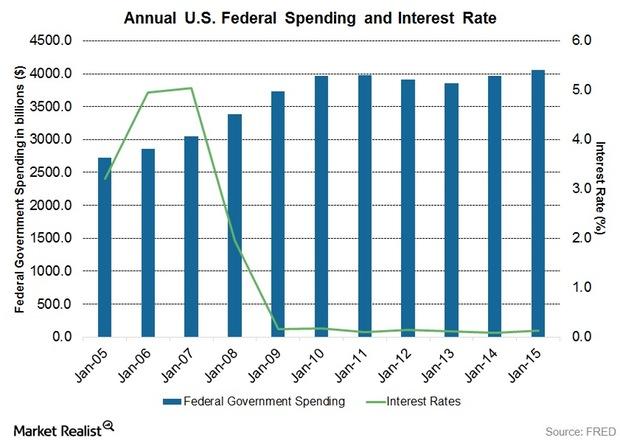

Federal Spending and Interest Rates: Analyzing the Connection

What about the impact on interest rates? Here again, there is no consistent relationship between spending and interest rates.

Why Look to the REIT Sector for Opportunities?

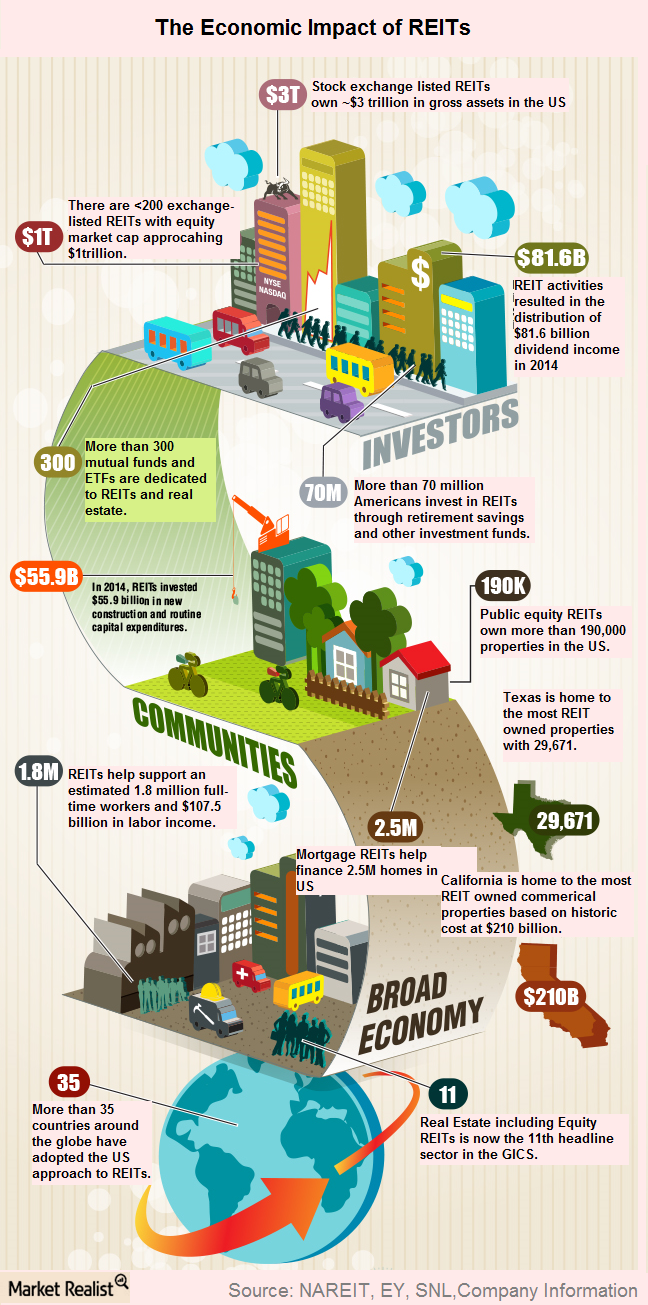

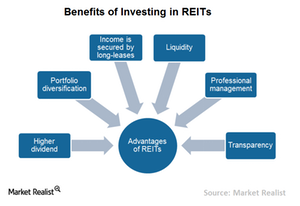

Not only do REITs (RWR)(ICF) help diversify a portfolio, but they also bolster portfolio income with their steady dividends and their long-term capital appreciation.

Why REITs Tend to Offer High Dividend Yields

REITs (IYR)(VNQ) are known for their high dividend yields, outclassing almost all other broad market indices.

The Evolution of REITs

The REITs (IYR) sector has shown phenomenal growth over the years. In the past five decades, REITs have grown to a market cap of nearly $1 trillion.

REIT Explained: Qualifications and Types of REITs

Let’s talk about the two main types of REITs (ICF)—equity REITs and mortgage REITs.

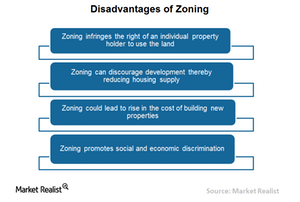

How Zoning Can Be a Hindrance to Housing Market Growth

Zoning restricts the freedom of property holders and REITs to use land however they want, given their specific development and investment interests.

How Zoning Regulations Benefit Communities

Zoning protects existing property values by preventing incompatible uses of a property. It also protects residential properties from commercial development.

Specialized REITs: The Unsung Heroes

With the growing economy and global investment horizons, investments have shifted beyond the traditional options to specialized REITs.

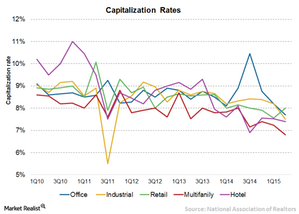

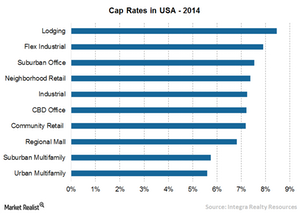

REIT Capitalization Rates Fall as Prices Surge

Average capitalization rates in 2Q15 fell to 7.5% across all the property types compared to 8.35% in 2Q14.

Investing in Equity Residential: A Company Overview

Equity Residential was formed as a REIT. It became a publicly traded company in 1993. It’s part of the S&P 500 Index. It employs about 3,500 people.

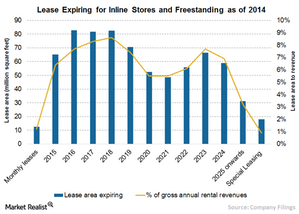

Simon Property Group’s Lease Length Exposure

Only 1.2% of Simon Property’s gross annual revenues from inline or freestanding stores comes from month-to-month leases. 6.5% of leases will expire in 2015.

Simon Property Group’s Acquisition Growth Strategy

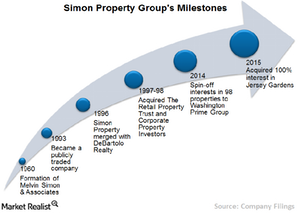

Simon Property has a strong track record of aggressive acquisitions. Since its IPO in 1993, the company has completed acquisitions worth $40 billion.

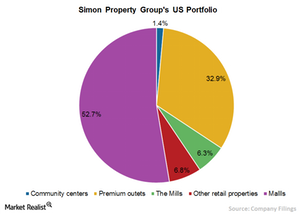

Simon Property Group’s Retail Mall Business

Simon Property’s US properties consist of malls, premium outlets, community centers, and retail properties that make up ~182 million square feet of GLA.

Introducing Simon Property Group: A Must-Know Company Overview

Headquartered in Indianapolis, Simon Property Group formed in 1993 when the shopping center division of Melvin Simon & Associates became publicly-traded.

Most of the REITs Are Trading near Historic Multiples

The most common way of calculating the relative value of a REIT is the price-to-FFO multiple. FFO is widely used because it’s the main earnings metric for REITs.

Why Are Capitalization Rates Important for Investors?

The capitalization rate, or cap rate, is an important concept in the commercial real estate industry. It’s defined as an initial yield on a real estate investment.

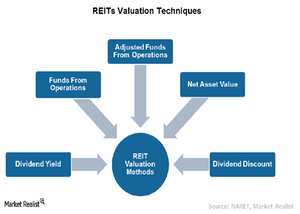

What Methods Are Used to Determine REITs’ Valuation?

Traditional valuation methods don’t apply to REITs because their operations are different from traditional companies. REITs are valued based on three main techniques.

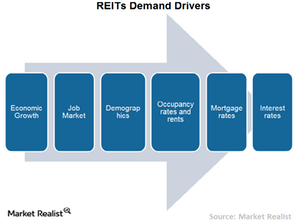

What Factors Drive REIT Earnings?

Economic growth is the major factor that determines REITs’ growth. An uptick in economic fundamentals positively affects the REITs by increasing business growth.

What Are the Different Types of REITs?

There are three types of REITs—equity REITs, mortgage REITs, and hybrid REITs. Mortgage REITs lend money to landlords and their operators to purchase a property.

Advantages and Disadvantages of Investing in REITs

Every investment comes with certain advantages and disadvantages. REITs are no exception. There are benefits and risks associated with investing in REITs.

Why Did REITs Come into Existence?

US REITs came into existence in 1960 when President Eisenhower signed the REIT Act contained in the Cigar Excise Tax Extension.

What Are the Regulatory Requirements to Qualify as a REIT?

To qualify as a REIT, a company must make REIT election by filing a Form 1120-REIT with the IRS. This is essential to reduce or eliminate corporate tax.