How Zoning Can Be a Hindrance to Housing Market Growth

Zoning restricts the freedom of property holders and REITs to use land however they want, given their specific development and investment interests.

Feb. 8 2016, Updated 12:04 a.m. ET

Zoning laws as hurdles

In the preceding part of this series, we discussed the many public and communal advantages of zoning laws. In this part, we’ll discuss the downsides of zoning and why it has been criticized for creating hurdles to affordable housing.

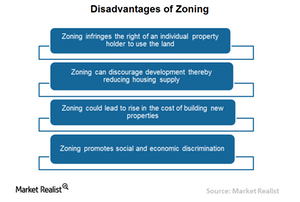

Assessing the disadvantages of zoning for housing

Zoning restricts the absolute freedom of property holders, housing development companies, and REITs (real estate investment trusts) to use land however they want, given their specific development and investment interests. Below are several other downsides of zoning for private land development companies:

- Zoning requires the property owners to put the benefits of the larger public or common good before their own development and investment interests.

- In some markets, zoning rules can discourage development, thereby putting downward pressure on housing supply in select cases. This can potentially cause the market to shift toward more expensive homes, which may not be affordable to the median income households.

- Zoning restricts the development of existing land uses and old structures that do not conform to standards, which can lead to a rise in the cost of building new properties in the area.

- Zoning involves a long-term commitment from residents about a certain level of spending.

- Zoning has also been criticized as a means of promoting social and economic discrimination by excluding low-income households.

Many developers see zoning as an obstacle to revenue

Most major homebuilders argue that zoning rules are obstacles to the development of all real estate markets in the United States because they reduce the supply of homes. In addition, real estate companies and developers blame zoning laws for rising project costs, which affect EBITDA (earnings before interest, taxes, depreciation, and amortization) margins of homebuilders like Lennar Corporation (LEN), D.R. Horton (DHI), and PulteGroup (PHM).

Investors can get exposure to the residential real estate sector by investing specifically in residential REITs like Equity Residential (EQR) or by investing in funds like the Vanguard REIT ETF (VNQ), which has about 4.1% of its total portfolio in Equity Residential (EQR).

In the next part of this series, we’ll discuss affordability issues in regional markets.