Peter Barnes

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Peter Barnes

Boston Properties among REITs: Kind of a Big Deal

Boston Properties is a Boston-based REIT that completed its initial public offering in 1997 and is now the largest publicly traded office REIT in the US.

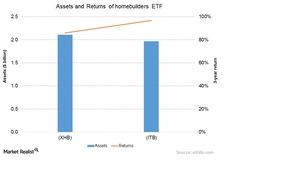

Why you should invest in homebuilder ETFs like XHB and ITB

ETFs present another investment avenue. Apart from pure homebuilder ETFs, there are many other ETFs that offer exposure to homebuilders.

Simon Property Group’s Key Business Segments

Simon Property is the only REIT in the S&P 100 Index and has heavy asset concentration on the US east coast and in the central US.

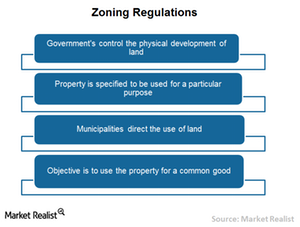

How Zoning Regulations Impact City Development

Zoning is the way that governments supervise land development and the kinds of uses each individual property may be directed toward for the public interest.

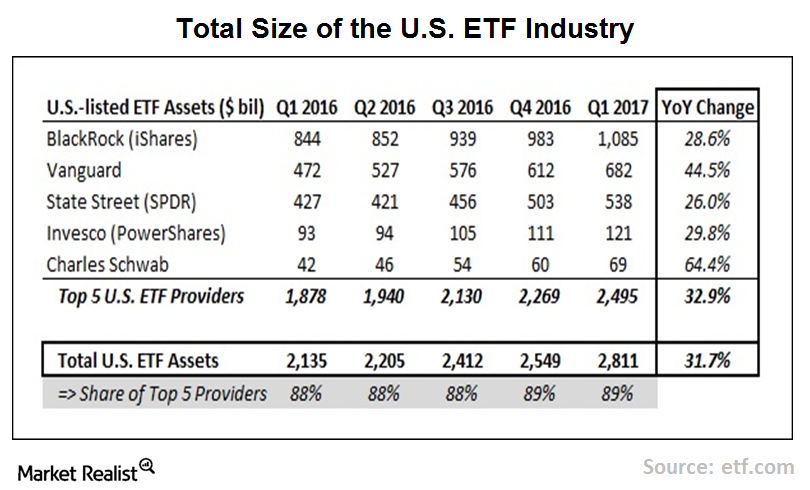

New Kid in Town: Introducing TETF

Although the ETF industry posted stellar growth, no one thought of issuing an ETF dedicated to ETF providers. The gap was filled by TETF in April 2017.

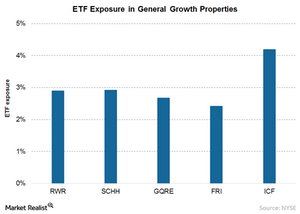

How to Invest in General Growth Properties through ETFs

General Growth Properties has a market cap of $22.1 billion, is part of S&P 500 index, and sees allocation in the major REIT-specific ETFs like ICF.

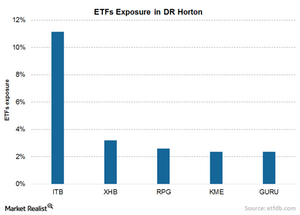

How to Invest in D.R. Horton through ETFs

D.R. Horton sees allocation in major homebuilding sector-specific ETFs like the iShares Dow Jones US Home Construction Index Fund (ITB).

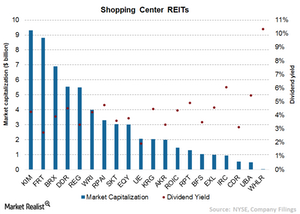

Shopping Center REITs Are Sensitive to Economic Cycles

Shopping center REITs mainly own and operate shopping centers that are smaller than retail malls. They’re mainly driven by higher consumer spending.

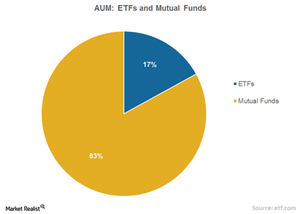

Why ETFs Are Seeing Increased Popularity

Mutual fund ownership of equities is at the lowest level in ~13 years, while ETFs (SPY) (IVV) are gradually increasing their share in the stock market.

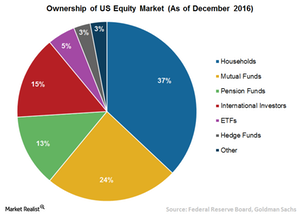

Jury Hasn’t Decided on ETFs’ Role in Stock Market Rise

Although ETF (VTV) ownership increased substantially during the last 20 years, it still isn’t high enough to meaningfully impact stock prices.

Rethink Your Emerging Market Story

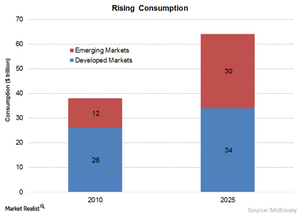

In the previous articles of this series, we discussed population and economic growth as the two major drivers leading to a rise in emerging markets (EMQQ).

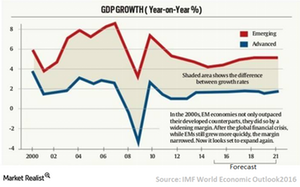

Emerging Market Economic Growth Outpaced Developed Markets

In recent years, emerging markets have experienced rapid economic growth compared to developed markets.

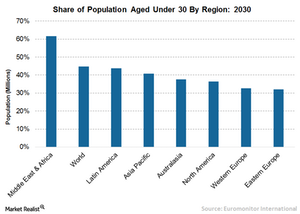

Why Emerging Markets Have Better Demographics

Achieving higher returns amid the rising market volatility, record-low interest rates, and global uncertainties is a huge challenge for investors.

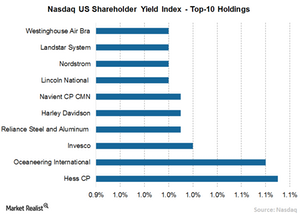

Shareholder Buyback: A Powerful Tool to Achieve Higher Income

What products single out specifically the share buyback companies?

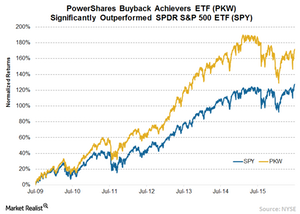

Buyback Achievers Strategy Significantly Outperforms Benchmark

Historically, we have seen Buyback does perform very well across all interest rate environments. Looking at the data back to the mid-80s, it does well.

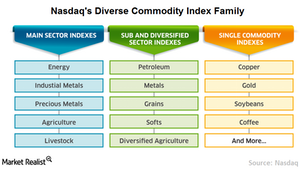

Nasdaq Commodity Index: Reflecting the Global Commodity Market

On the commodities side, we have broad-based commodity benchmark, the Nasdaq Commodity Index, aptly named.

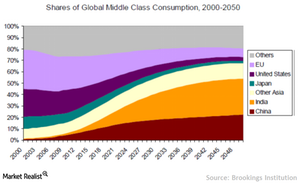

Young People, Middle Class Contributing to E-Commerce Growth

Emerging market economies (EEM) have followed diverse trends that are likely to drive global growth in the coming decades.

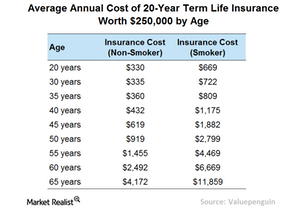

Why Term Life Is Most Beneficial to Young Adults

Term life (IYF) is most beneficial to young adults who are relatively free from any financial responsibilities.

How to Pick a Life Insurance Policy

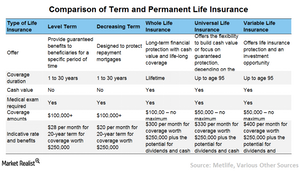

Term life insurance provides guaranteed benefits to beneficiaries for a specific period of time in case of the sudden death of the insured person.

What Are the Different Types of Life Insurance Policies?

Life insurance (PRU) (MET) policies come in various forms that cater to people in different age groups and with different financial goals.

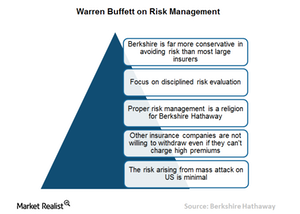

Why Buffett Thinks Risk Management Should Be a Disciplined Affair

Berkshire Hathaway has reported an underwriting profit for 13 straight years, showing a pre-tax gain of $26.2 billion for the period. Buffett states that this was due to Berkshire’s insurance manager’s daily focus on disciplined risk evaluation.

How Zoning Can Be a Hindrance to Housing Market Growth

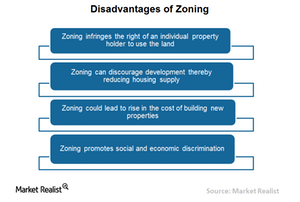

Zoning restricts the freedom of property holders and REITs to use land however they want, given their specific development and investment interests.

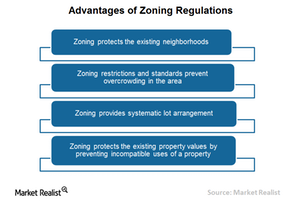

How Zoning Regulations Benefit Communities

Zoning protects existing property values by preventing incompatible uses of a property. It also protects residential properties from commercial development.

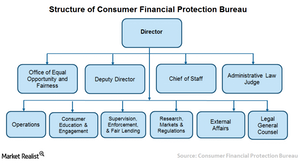

A Look at the Role of the Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau was established to protect consumers’ interests by implementing federal consumer financial laws.

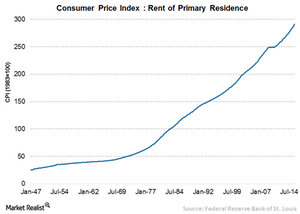

Why Rent Is Going through the Roof

As more and more people seek apartments, rent has also been rising rapidly. In fact, rent has been rising faster than the overall cost of living in the US.

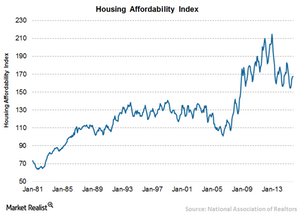

What Are the Factors Driving Housing Affordability?

Housing affordability took a beating in July 2015 after reaching its high in January 2013. The higher ratio of the home affordability index signifies relatively higher home affordability to buyers.

An Investor’s Introduction to BioMed Realty Trust

BioMed Realty is now the fifth-largest publicly traded office REIT in the United States and is a part of the S&P 400 Index.

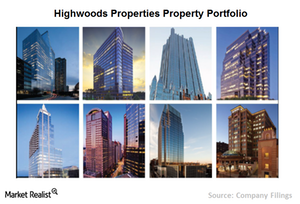

Highwoods Properties: What Does It Do?

Highwoods Properties (HIW) is a fully integrated, self-administered, and self-managed REIT.

Kilroy Realty Corporation: What Does it Do?

Kilroy Realty Corporation (KRC) was founded in 1996 by John B. Kilroy Jr.

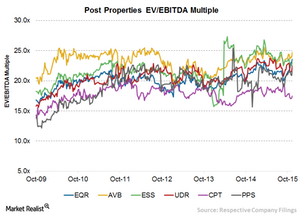

What Post Properties’ Higher-than-Average EV-to-EBITDA Multiple Means

Post Properties’ EV-to-EBITDA ratio is in line with its historical valuation, ranging between 12.2x–25.5x, with a current EV-to-EBITDA ratio of ~21.7x.

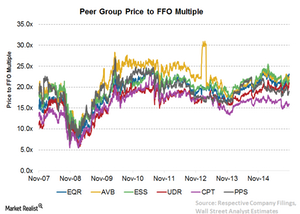

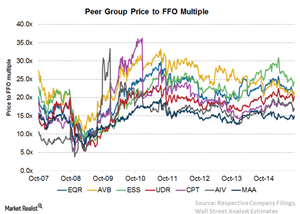

Assessing Post Properties’ Average Price-to-FFO Multiple

Post Properties’ TTM price-to-FFO multiple is in line with its historical valuation at around 18.9x.

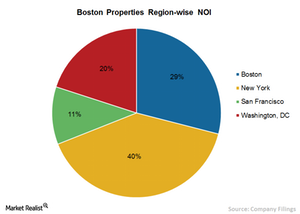

Making Sense of Boston Properties’ Geographically Concentrated Portfolio

Boston Properties concentrates on some of the highest-growth markets in the US, including Boston, New York, San Francisco, and Washington, D.C.

A Must-Read Company Overview of Post Properties

Headquartered in Atlanta, Georgia, Post Properties is structured as an REIT and completed its initial public offering in 1993.

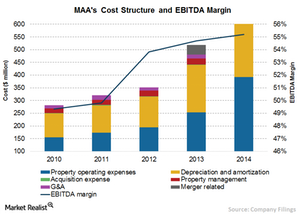

MAA’s EBITDA Margin: Lower than Industry Average

MAA’s EBITDA margin is lower than the industry average of 57.7%, as well as the margins reported by some of the company’s peers.

How Does Competition Affect American Campus Communities?

American Campus Communities (ACC) faces competition from university-owned on-campus student housing, off-campus student housing, and traditional multifamily housing units.

Camden Property Trust: Its History and Its Business

Camden Property Trust (CPT) is the fifth largest apartment REIT in the United States. At the end of fiscal 2014, it had 181 multifamily properties comprised of 63,163 apartment homes.

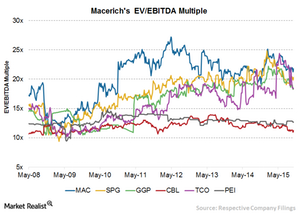

Macerich’s Highest EV-to-EBITDA Multiple Compared to Peers

Over the past eight years, Macerich’s EV-to-EBITDA has ranged between 11.9x–27.2x, with a current EV-to-EBITDA multiple of around 21.8x.

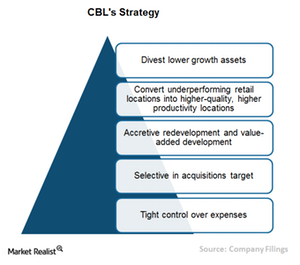

How CBL Plans to Increase Shareholder Returns

CBL’s (CBL) long-term strategy is to maximize shareholder returns while maintaining prudent risk profile.

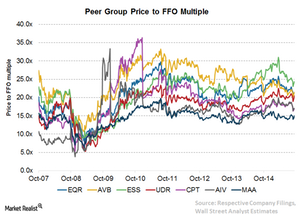

Why Essex Property Trust Trades at a High Price-to-FFO Multiple

A close look at Essex Property Trust’s trailing-12-month price-to-FFO multiple shows that it’s in line with its historical valuation.

Investing in Macerich: a Must-Know Company Overview

Macerich is a self-managed REIT headquartered in Santa Monica, California. The company was founded in New York in 1964.

Analyzing Equity Residential’s Higher Price-to-FFO Multiple

The most common way to calculate the relative value of a REIT like Equity Residential (EQR) is the price-to-FFO (funds from operations) multiple.

What Are the Major Brands of AvalonBay Communities?

AvalonBay Communities’ brands focus on consumer preference as well as location and price. They help differentiate its apartments from the competition.

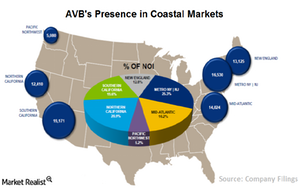

An Overview of AvalonBay Communities’ Geographic Coverage

The distribution of properties in attractive US coastal markets reflects AvalonBay Communities’ geographic diversification strategy.

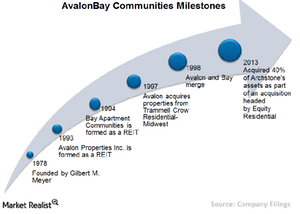

Investing in AvalonBay Communities: A Must-Know Company Overview

AvalonBay Communities is a REIT focused on developing, redeveloping, acquiring, and managing high-quality apartment communities in high barrier-to-entry US markets.

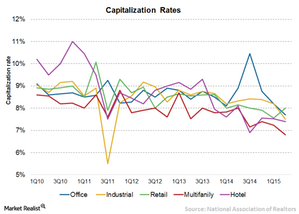

REIT Capitalization Rates Fall as Prices Surge

Average capitalization rates in 2Q15 fell to 7.5% across all the property types compared to 8.35% in 2Q14.

Investing in Equity Residential: A Company Overview

Equity Residential was formed as a REIT. It became a publicly traded company in 1993. It’s part of the S&P 500 Index. It employs about 3,500 people.

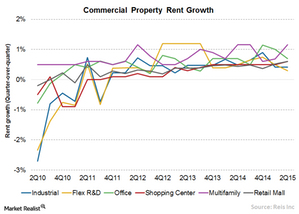

The Rise in Commercial Property Rent Is Beneficial to REITs

Rent increased 0.4% for industrial properties in 2Q15, which was unchanged from the previous quarter, but lower than the 0.5% 2Q14 growth.

General Growth Properties’ Top Tenants in Retail

The malls in GGP’s portfolio receive a smaller percentage of their operating income from anchor tenants than from specialty retailers who lease space.

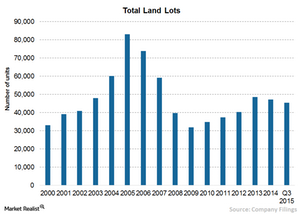

Understanding Toll Brothers’ Land Acquisition Strategy

Toll Brothers’ use of land option agreements reduces financial risks associated with long-term land holdings. The land acquisition strategy of other homebuilders also involves option contracts.

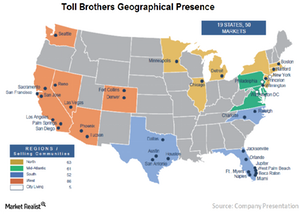

A Geographic Overview of Toll Brothers’ Homebuilding Operation

Toll Brothers (TOL) has a very geographically diverse homebuilding operation in the United States. The company has a presence in 50 markets, spanning 19 states as well as the District of Columbia.