Peter Barnes

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Peter Barnes

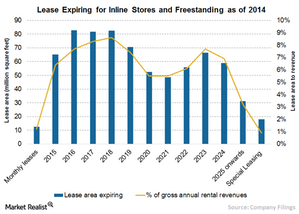

Simon Property Group’s Lease Length Exposure

Only 1.2% of Simon Property’s gross annual revenues from inline or freestanding stores comes from month-to-month leases. 6.5% of leases will expire in 2015.

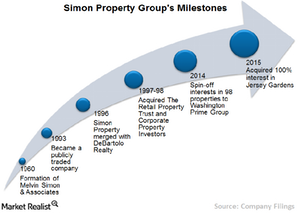

Simon Property Group’s Acquisition Growth Strategy

Simon Property has a strong track record of aggressive acquisitions. Since its IPO in 1993, the company has completed acquisitions worth $40 billion.

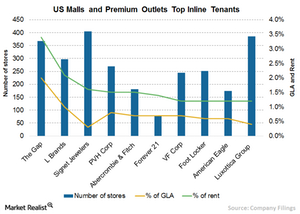

Simon Property Group’s Top Real Estate Tenants

Simon Property Group’s retail malls have two types of tenants, anchor and inline. Anchor tenants are large, big names, while inline tenants are small.

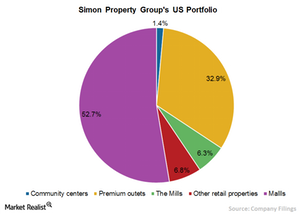

Simon Property Group’s Retail Mall Business

Simon Property’s US properties consist of malls, premium outlets, community centers, and retail properties that make up ~182 million square feet of GLA.

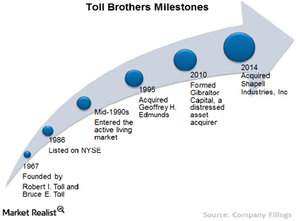

Investing in Toll Brothers: A Must-Know Company Overview

Toll Brothers is primarily engaged in the development of attached and detached homes in luxury residential communities. It’s a dominant player in the luxury segment with very few comparable competitors.

Introducing Simon Property Group: A Must-Know Company Overview

Headquartered in Indianapolis, Simon Property Group formed in 1993 when the shopping center division of Melvin Simon & Associates became publicly-traded.

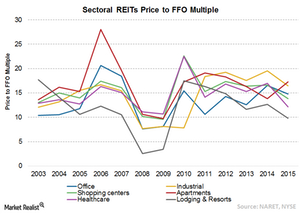

Most of the REITs Are Trading near Historic Multiples

The most common way of calculating the relative value of a REIT is the price-to-FFO multiple. FFO is widely used because it’s the main earnings metric for REITs.

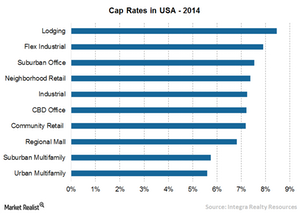

Why Are Capitalization Rates Important for Investors?

The capitalization rate, or cap rate, is an important concept in the commercial real estate industry. It’s defined as an initial yield on a real estate investment.

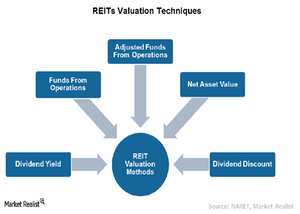

What Methods Are Used to Determine REITs’ Valuation?

Traditional valuation methods don’t apply to REITs because their operations are different from traditional companies. REITs are valued based on three main techniques.

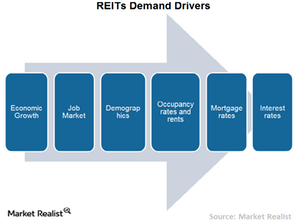

What Factors Drive REIT Earnings?

Economic growth is the major factor that determines REITs’ growth. An uptick in economic fundamentals positively affects the REITs by increasing business growth.

What Are the Different Types of REITs?

There are three types of REITs—equity REITs, mortgage REITs, and hybrid REITs. Mortgage REITs lend money to landlords and their operators to purchase a property.

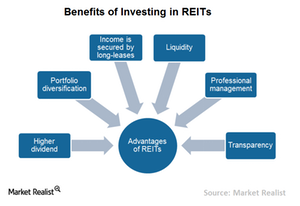

Advantages and Disadvantages of Investing in REITs

Every investment comes with certain advantages and disadvantages. REITs are no exception. There are benefits and risks associated with investing in REITs.

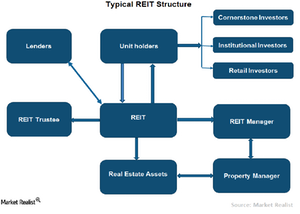

Why Did REITs Come into Existence?

US REITs came into existence in 1960 when President Eisenhower signed the REIT Act contained in the Cigar Excise Tax Extension.

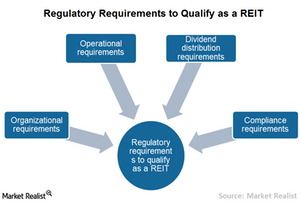

What Are the Regulatory Requirements to Qualify as a REIT?

To qualify as a REIT, a company must make REIT election by filing a Form 1120-REIT with the IRS. This is essential to reduce or eliminate corporate tax.

Why PulteGroup Saw a Modest Rise in Sales Order Backlog in 2014

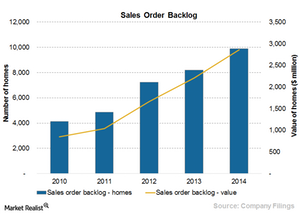

Sales order backlog represents homes under contract but not closed or delivered. For orders in backlog, the company receives a customer contract and deposit, which may or may not be refundable.

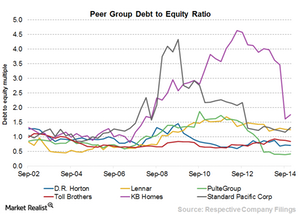

PulteGroup’s Debt-to-Equity Ratio Is the Lowest in the Industry

PulteGroup’s debt-to-equity ratio peaked to 1.7x in 2011. Since then it has been declining consistently due to debt reduction and stock repurchase initiatives.

Understanding PulteGroup’s Land Acquisition Strategy

PulteGroup (PHM) mainly acquires land to complete sales of housing units within 24 to 36 months from the date of opening a community.

What Is PulteGroup’s Market Segmentation Strategy?

The move-up buyers in Pulte Homes communities tend to place more premium on location and amenities.

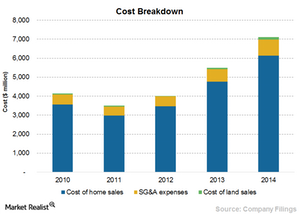

What Was D.R. Horton’s Cost Structure Breakdown in 2014?

Cost of homes sold is the highest of the company’s costs at 78.1%, followed by SG&A at 10.6%, and cost of land sold at 1.6%.

What Is D.R. Horton’s Market Segmentation Strategy?

As part of its market segmentation strategy, D.R. Horton launched a variety of different brands, including D.R. Horton, America’s Builder, Express Homes, and Emerald Home.

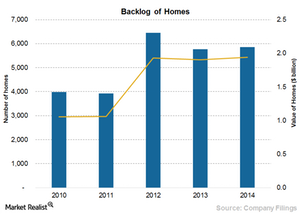

D.R. Horton’s Huge Sales Order Backlog Ensures Sustainable Growth

Pretty much all of the homes in D.R. Horton’s sales order backlog at the end of fiscal 2014 are likely to close in fiscal 2015, which will boost the company’s revenues.

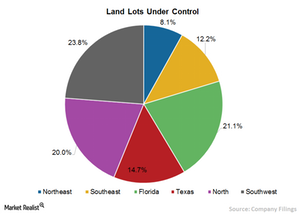

Understanding D.R. Horton’s Land Acquisition Strategy

D.R. Horton directly acquires almost all of its land and lot positions. The company has initiated few joint ventures for land acquisitions.

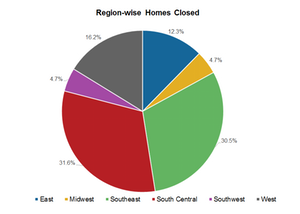

An Overview of D.R. Horton’s Homebuilding Segment

The homebuilding segment of D.R. Horton, which mainly focuses on single-family attached and detached homes, is divided into six divisions.

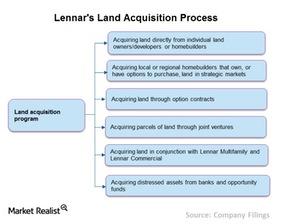

Lennar’s Diversified Land Acquisition Process

Lennar’s land acquisition process includes acquiring land from individual land owners, developers, or homebuilders. Lennar also creates JVs to acquire land.

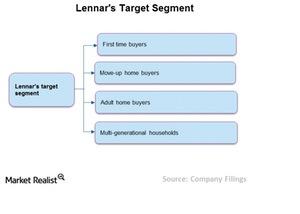

Market Segmentation in Lennar Corporation

Lennar’s market segmentation is primarily first-time, move-up, and active adult homebuyers in areas ranging from urban infill to golf course communities.

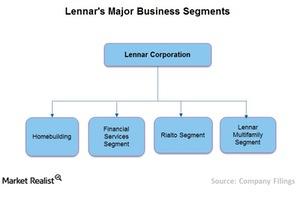

Lennar’s Four Main Business Segments

Lennar’s (LEN) four main business segments include Homebuilding, Lennar Financial Services, Rialto, and Lennar Multifamily.

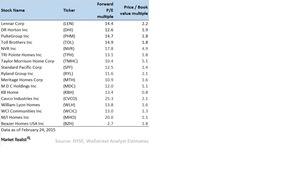

Valuing homebuilders: Buying at the right price

Homebuilders earn substantial profits buying land at a cheaper rate, allowing it to appreciate over time, constructing a house on it, and selling it.

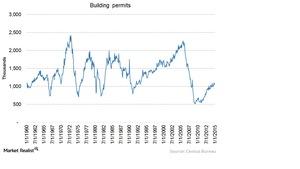

Understanding building permits and their impact on homebuilders

Along with housing starts, building permits are also a leading indicator of the health of the US housing market.

The basics of the US homebuilding industry for investors

The US homebuilding industry comprises many large, publicly traded residential construction companies. Top homebuilders mainly focus on specific categories.