D.R. Horton’s Huge Sales Order Backlog Ensures Sustainable Growth

Pretty much all of the homes in D.R. Horton’s sales order backlog at the end of fiscal 2014 are likely to close in fiscal 2015, which will boost the company’s revenues.

July 21 2015, Published 12:27 p.m. ET

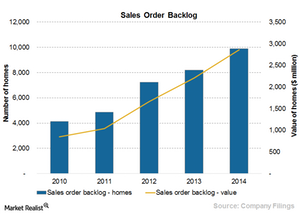

Sales order backlog

The sales order backlog represents homes under contract, but not closed or delivered. At the end of fiscal 2014, D.R. Horton’s (DHI) sales orders backlog amounted to $2.86 billion, an increase of 29% over the previous year. In terms of number of homes, the company’s sales order backlog increased by 21% in fiscal 2014 to 9,888 homes from 8,205 homes in the previous year. For 2Q15, the sales backlog stood at 12,177 homes.

Positive impact of acquisitions

The South Central region has the largest backlog of 3,358 homes, representing 34% of the total backlog. The Southeast is the second largest region with a backlog of 2,901 homes, or 29%, of the company’s total homes. The largest percentage increase of 86% in sales order backlog to 1,451 homes occurred in the East, reflecting the positive impact of acquisitions of the homebuilding operations of Regent Homes and Crown Communities, which contributed 377 homes to the East region backlog in fiscal 2014. Crown Communities also contributed 305 homes to the Southeast region backlog.

Large backlog to boost revenue

The period between the signing of the sales contract and the delivery of the home (or the closing) is generally two to six months. A portion of the contracts in backlog will not result in closings due to cancellations. As a percentage of gross sales orders, cancellations of sales contracts were 23% and 24% in fiscal 2014 and 2013, respectively.

So even if we take those figures as a benchmark, pretty much all of the homes in the sales backlog at the end of fiscal 2014 are likely to close in fiscal 2015, boosting the company’s revenues. The average sales price of homes in the backlog was $289,100 for fiscal 2014.

In the next article, we’ll look at how D.R. Horton’s average selling price (or ASP) is increasing, albeit gradually, and compare the company’s ASP with that of industry peers like Lennar (LEN) and Toll Brothers (TOL).

Investors who are interested in trading the sector as a whole should look at the SPDR S&P Homebuilders ETF (XHB) and the iShares Dow Jones US Home Construction Index Fund (ITB).