Toll Brothers Inc

Latest Toll Brothers Inc News and Updates

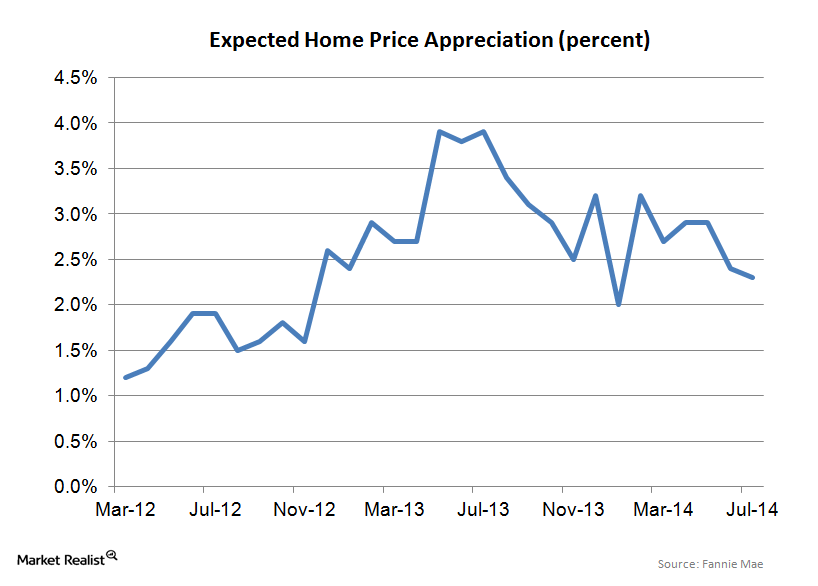

Consumers are tempering their home price appreciation expectations

The 2.3% home price expectation is much lower than the 6%–7% forecast we’re seeing out of the National Association of Realtors and the mid single-digit forecast we’re seeing from most Wall Street professionals.

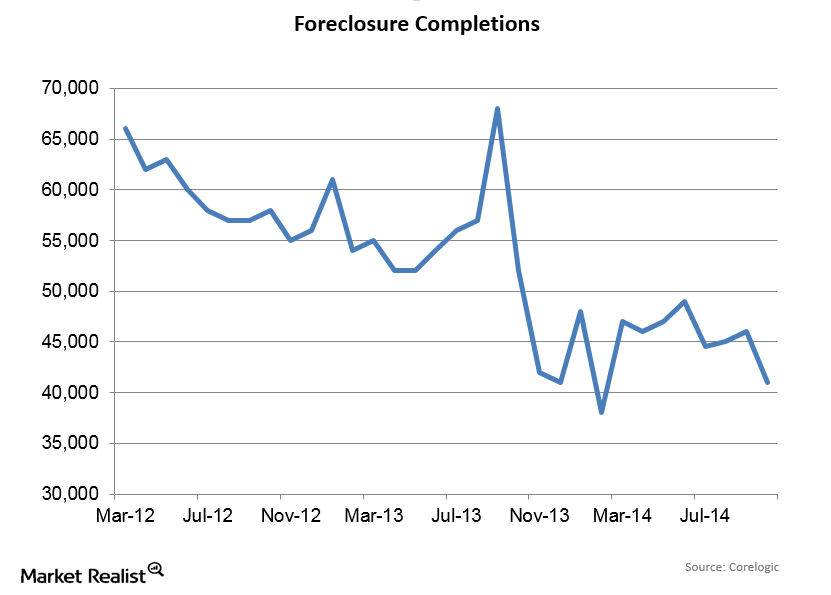

Foreclosure Completions Drop In October

Since foreclosures represent a process that may or may not wind up with the bank owning the home, foreclosure completions are a better indicator of foreclosure activity than foreclosure starts.

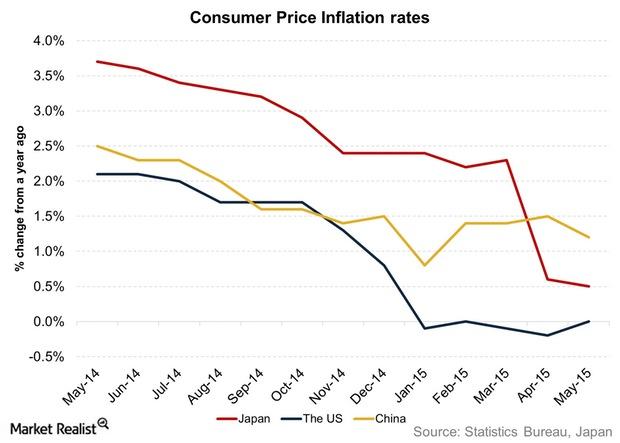

Key for Investors: Understanding Inflation and Its Implications

Inflation represents a rise in the general price level in a country or region. The higher the inflation, the lower the quantum of a particular good that can be purchased.

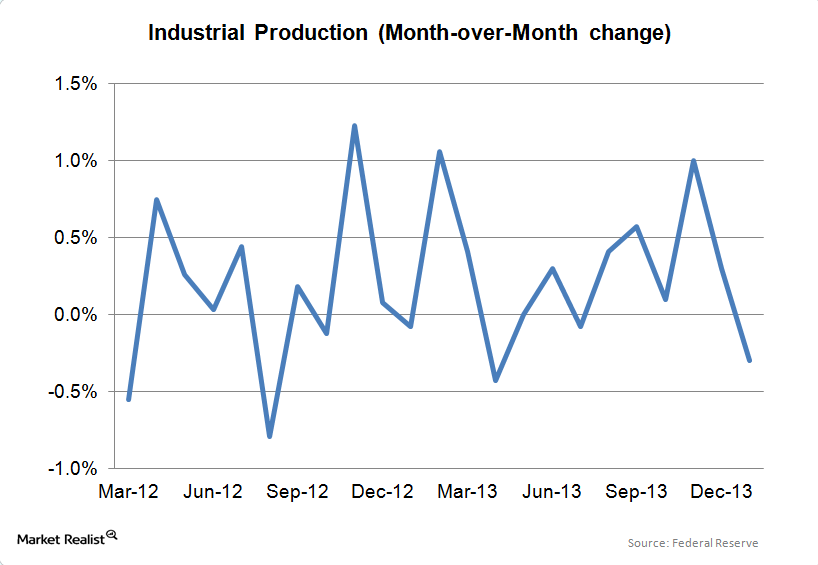

A decline in manufacturing causes industrial production to fall

Up until January, industrial production and manufacturing production had been accelerating, so it is premature to draw any major conclusions from one disappointing report.

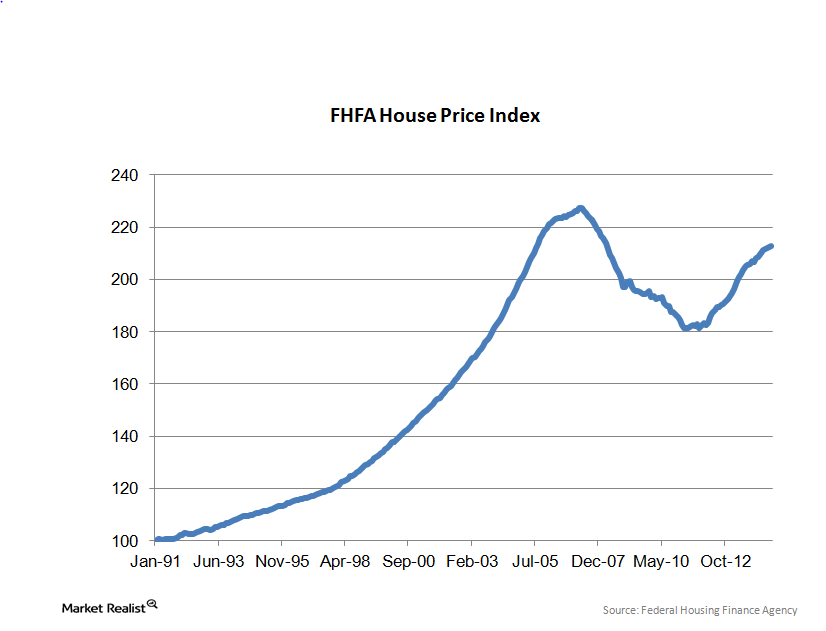

Must-know: Why home-price appreciation is leveling off

In July, home prices increased 0.1% month-over-month. They’re up 4.4% year-over-year (or YoY). Prices are now within 6.5% of their April 2007 peak. They correspond to the levels in July 2005. Real estate values drive consumer confidence and spending. They have an enormous impact on the economy.

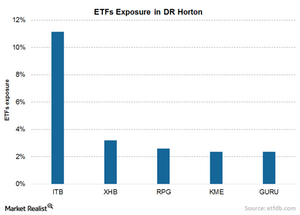

How to Invest in D.R. Horton through ETFs

D.R. Horton sees allocation in major homebuilding sector-specific ETFs like the iShares Dow Jones US Home Construction Index Fund (ITB).

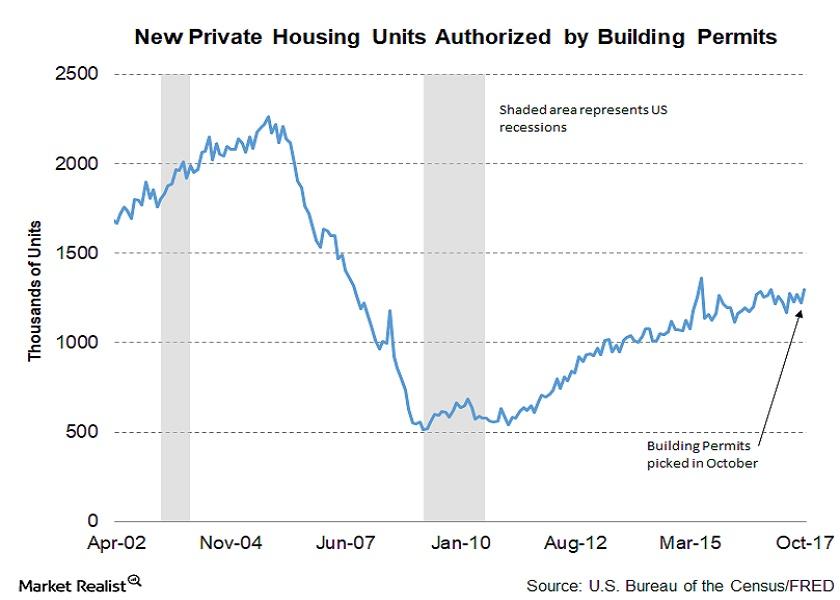

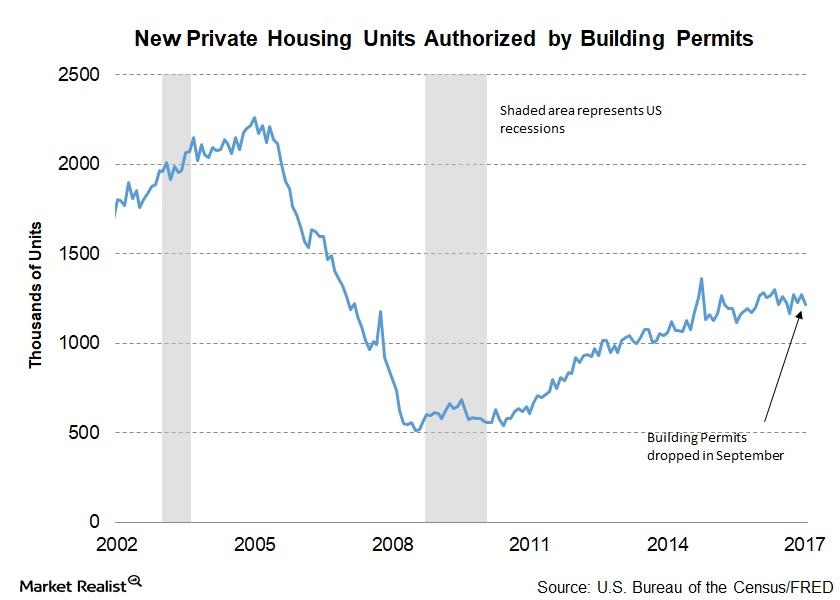

Housing Market: What a Rise in Building Permits Signals

In October 2017, building permits were at a seasonally adjusted rate of 1.297 million—an increase of 5.9% from the reading of 1.225 million in September.

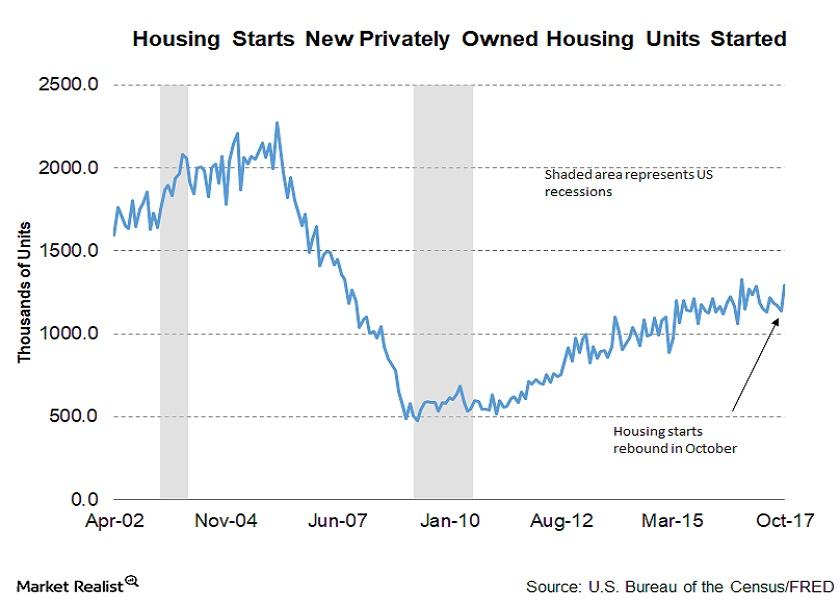

Analyzing Housing Starts in October 2017

In October 2017, housing starts rebounded sharply from the slump in September. October housing starts beat the market’s expectations.

Is the Drop in September Building Permits Cause for Concern?

In September 2017, building permits were at a seasonally adjusted annual rate of 1.215 million—a fall from August’s 1.272 million and 4.3% below September 2016.

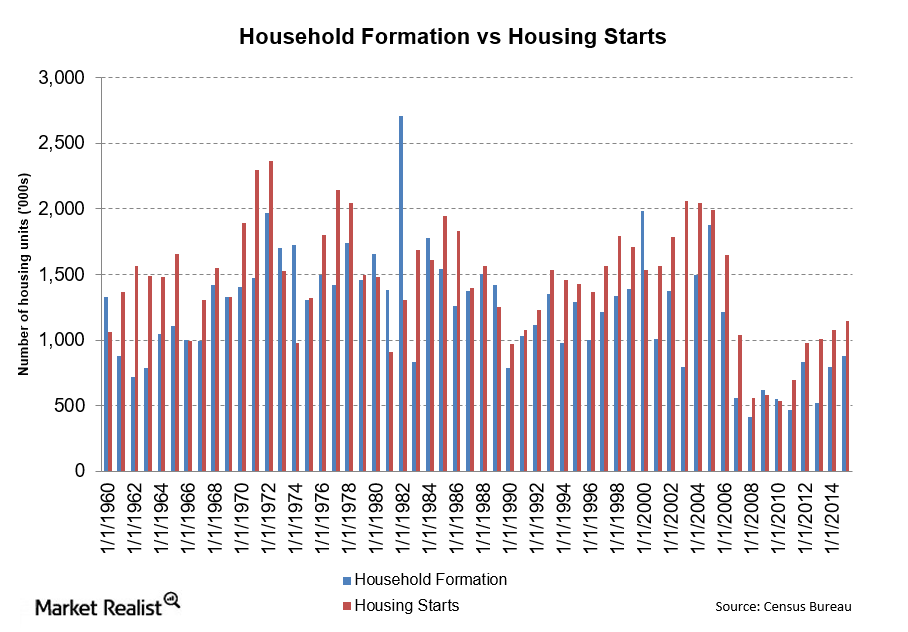

Limited Supply: Analyzing Housing Starts and Household Formations

There was a big fall in household formation in 2008. In 2005, household formation peaked at 1.9 million. By 2008, that number was just over 400 million.

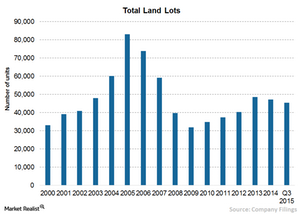

Understanding Toll Brothers’ Land Acquisition Strategy

Toll Brothers’ use of land option agreements reduces financial risks associated with long-term land holdings. The land acquisition strategy of other homebuilders also involves option contracts.

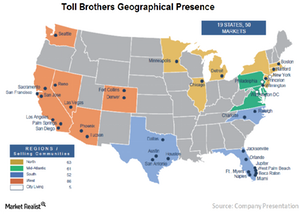

A Geographic Overview of Toll Brothers’ Homebuilding Operation

Toll Brothers (TOL) has a very geographically diverse homebuilding operation in the United States. The company has a presence in 50 markets, spanning 19 states as well as the District of Columbia.

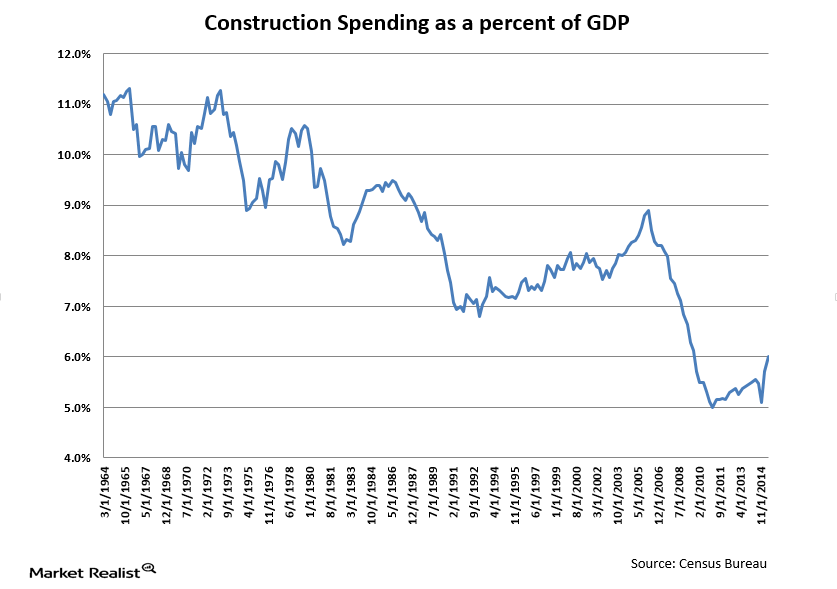

The Importance of Construction Spending to GDP

Historically, construction spending has led economies out of recessions. This didn’t happen in the most recent recession, however, because of the overhang from the real estate bubble.

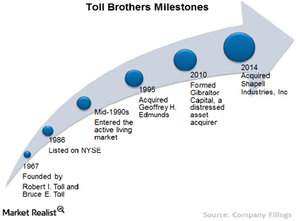

Investing in Toll Brothers: A Must-Know Company Overview

Toll Brothers is primarily engaged in the development of attached and detached homes in luxury residential communities. It’s a dominant player in the luxury segment with very few comparable competitors.

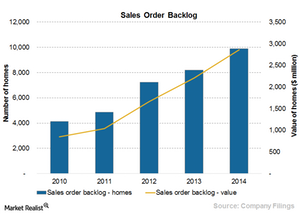

Why PulteGroup Saw a Modest Rise in Sales Order Backlog in 2014

Sales order backlog represents homes under contract but not closed or delivered. For orders in backlog, the company receives a customer contract and deposit, which may or may not be refundable.

What Is D.R. Horton’s Market Segmentation Strategy?

As part of its market segmentation strategy, D.R. Horton launched a variety of different brands, including D.R. Horton, America’s Builder, Express Homes, and Emerald Home.

D.R. Horton’s Huge Sales Order Backlog Ensures Sustainable Growth

Pretty much all of the homes in D.R. Horton’s sales order backlog at the end of fiscal 2014 are likely to close in fiscal 2015, which will boost the company’s revenues.

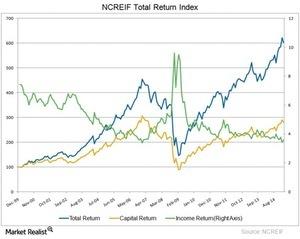

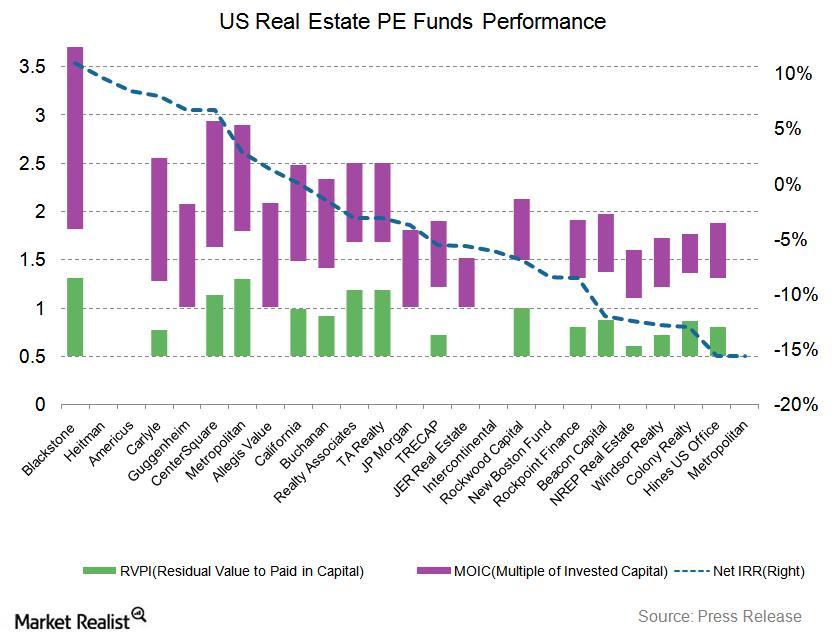

Direct Property Investment versus Private Equity Investment

In a private equity fund, you just have to put in the money, and the fund takes care of everything else.

All You Need to Know about Real Estate Private Equity

Real estate private equity funds have been attracting unprecedented amounts of capital, with assets under management reaching an all-time high of $724 billion.

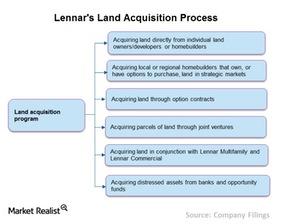

Lennar’s Diversified Land Acquisition Process

Lennar’s land acquisition process includes acquiring land from individual land owners, developers, or homebuilders. Lennar also creates JVs to acquire land.

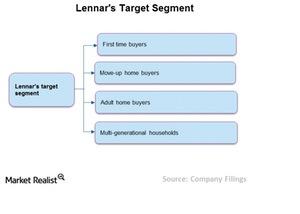

Market Segmentation in Lennar Corporation

Lennar’s market segmentation is primarily first-time, move-up, and active adult homebuyers in areas ranging from urban infill to golf course communities.

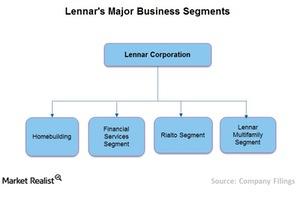

Lennar’s Four Main Business Segments

Lennar’s (LEN) four main business segments include Homebuilding, Lennar Financial Services, Rialto, and Lennar Multifamily.

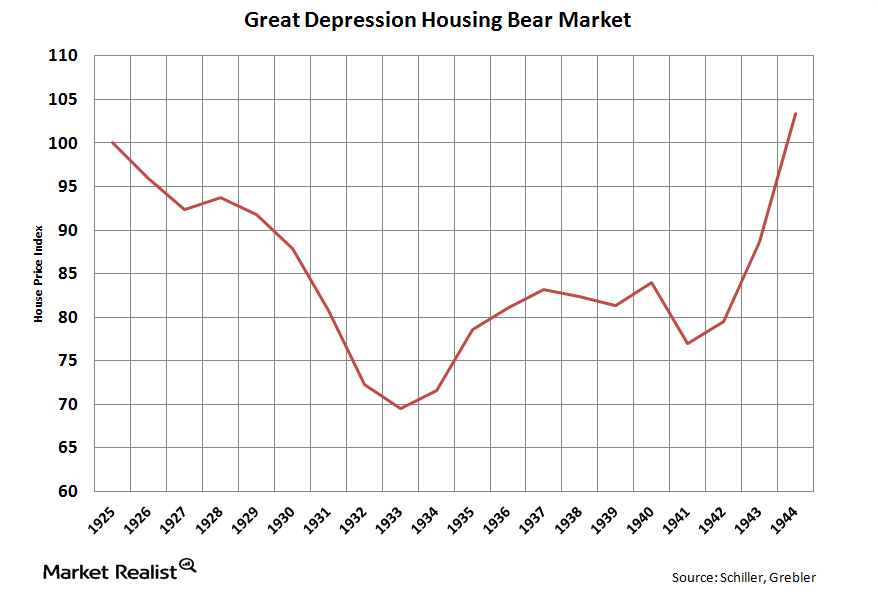

Comparing the Great Depression’s housing bear market with today’s

The real estate bubble of the 2000s was bigger than the real estate bubble of the 1920s In many ways, the dual stock market and real estate bubbles of the 1920s were a mirror image of the 2000s market collapse. The 1920s real estate boom peaked in 1925, and the stock market collapsed four years […]