Lennar’s Four Main Business Segments

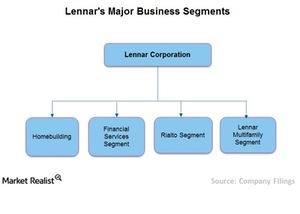

Lennar’s (LEN) four main business segments include Homebuilding, Lennar Financial Services, Rialto, and Lennar Multifamily.

March 24 2015, Updated 10:06 a.m. ET

Lennar’s diverse segments

Let’s take a look at Lennar Corporation’s (LEN) business segments. Lennar started as a single-family homebuilder but has now become one of the largest homebuilding companies in the United States alongside D.R. Horton (DHI), PulteGroup (PHM), and Toll Brothers (TOL).

Lennar (LEN) also operates as a provider of real estate related financial services, commercial real estate investment, investment management, and financing through its Rialto segment. The company also operates as a developer of multifamily rental properties in select US markets. Lennar’s (LEN) commercial operations are handled by its spinoff LNR Property Corporation.

Below are the profiles of Lennar’s (LEN) four main business segments.

Homebuilding

Lennar’s Homebuilding segment primarily includes the construction and sale of single-family attached and detached homes as well as the purchase, development, and sale of residential land. Homebuilding is the most significant part of the company’s business, earning a revenue of $7 billion, or 90% of the total in fiscal 2014, and having an employee strength of 3,578.

Lennar Financial Services

Lennar Financial Services includes primarily mortgage financing, title insurance, and closing services for buyers of the company’s homes. In 2014, financial services subsidiaries of the company provided loans to 78% of homebuyers who obtained mortgage financing. The company originated approximately 23,300 residential mortgage loans totaling $6 billion compared to $5.3 billion in the previous year.

Rialto

The Rialto segment comprises a commercial real estate investment, investment management, and finance company. Rialto’s primary focus is to manage third-party capital and originate commercial mortgage loans, which it sells into securitizations. It also has invested its own capital in mortgage loans, properties, and real estate related securities.

Rialto is the sponsor of and an investor in private equity vehicles that invest in and manage real estate related assets. Such funds invest in distressed real estate assets and other related investments. Rialto also earns fees for its role as a manager of these vehicles and for providing asset management and other services to those vehicles and other third parties.

Lennar Multifamily

Lennar Multifamily focuses on developing a geographically diversified portfolio of superior quality multifamily rental properties in select US markets. The company currently uses third-party management companies to rent the apartments, although it plans to have its own management unit in the near future.

Major homebuilding ETFs such as the SPDR S&P Homebuilders ETF (XHB) and the iShares Dow Jones U.S. Home Construction Index Fund (ITB) have invested in Lennar with an exposure of 3.36% and 10.8%, respectively.