PulteGroup Inc

Latest PulteGroup Inc News and Updates

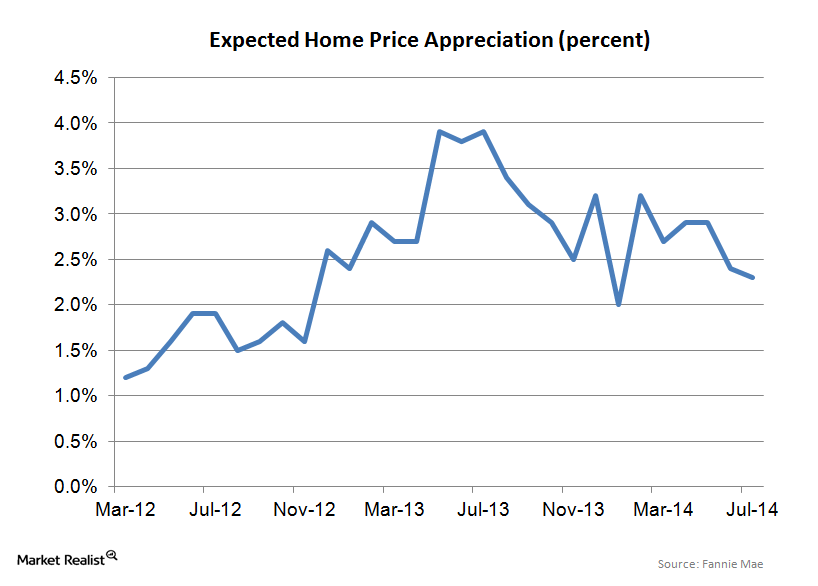

Consumers are tempering their home price appreciation expectations

The 2.3% home price expectation is much lower than the 6%–7% forecast we’re seeing out of the National Association of Realtors and the mid single-digit forecast we’re seeing from most Wall Street professionals.

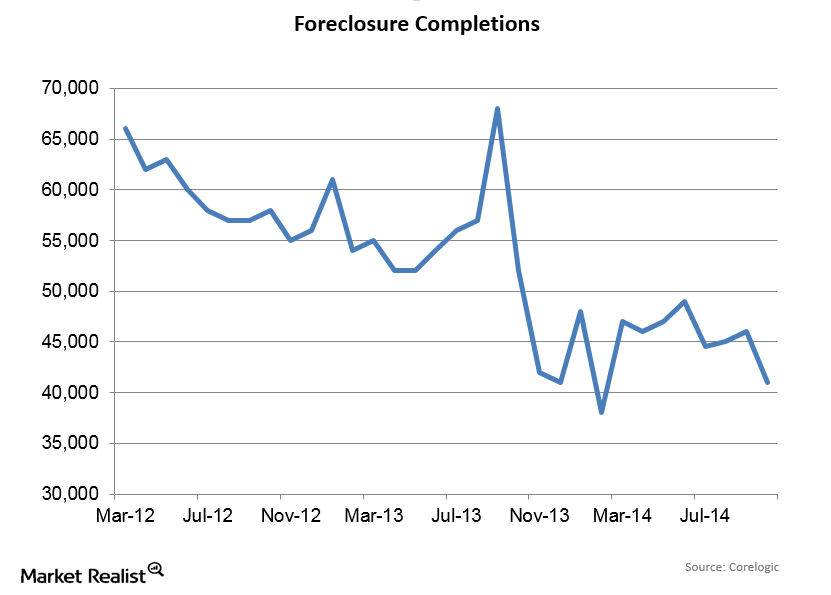

Foreclosure Completions Drop In October

Since foreclosures represent a process that may or may not wind up with the bank owning the home, foreclosure completions are a better indicator of foreclosure activity than foreclosure starts.

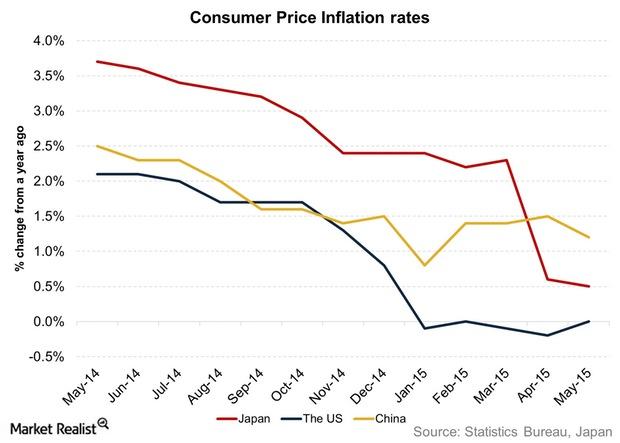

Key for Investors: Understanding Inflation and Its Implications

Inflation represents a rise in the general price level in a country or region. The higher the inflation, the lower the quantum of a particular good that can be purchased.

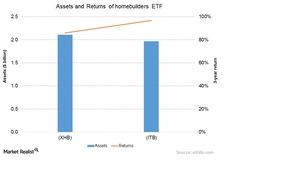

Why you should invest in homebuilder ETFs like XHB and ITB

ETFs present another investment avenue. Apart from pure homebuilder ETFs, there are many other ETFs that offer exposure to homebuilders.

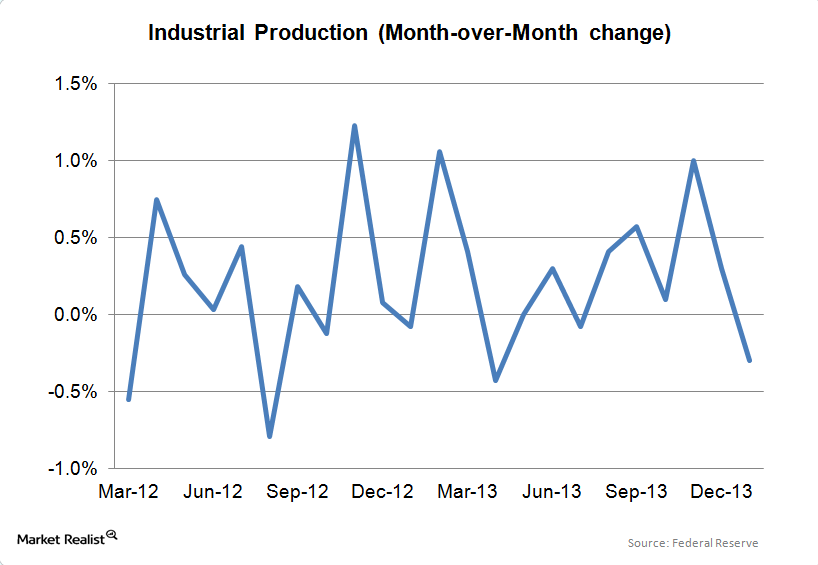

A decline in manufacturing causes industrial production to fall

Up until January, industrial production and manufacturing production had been accelerating, so it is premature to draw any major conclusions from one disappointing report.

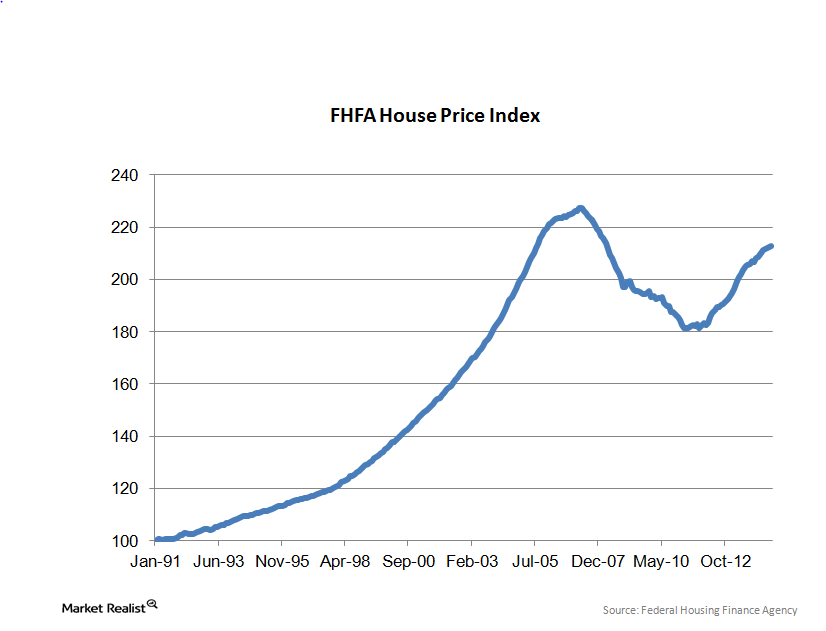

Must-know: Why home-price appreciation is leveling off

In July, home prices increased 0.1% month-over-month. They’re up 4.4% year-over-year (or YoY). Prices are now within 6.5% of their April 2007 peak. They correspond to the levels in July 2005. Real estate values drive consumer confidence and spending. They have an enormous impact on the economy.

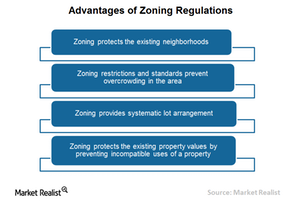

How Zoning Regulations Impact City Development

Zoning is the way that governments supervise land development and the kinds of uses each individual property may be directed toward for the public interest.

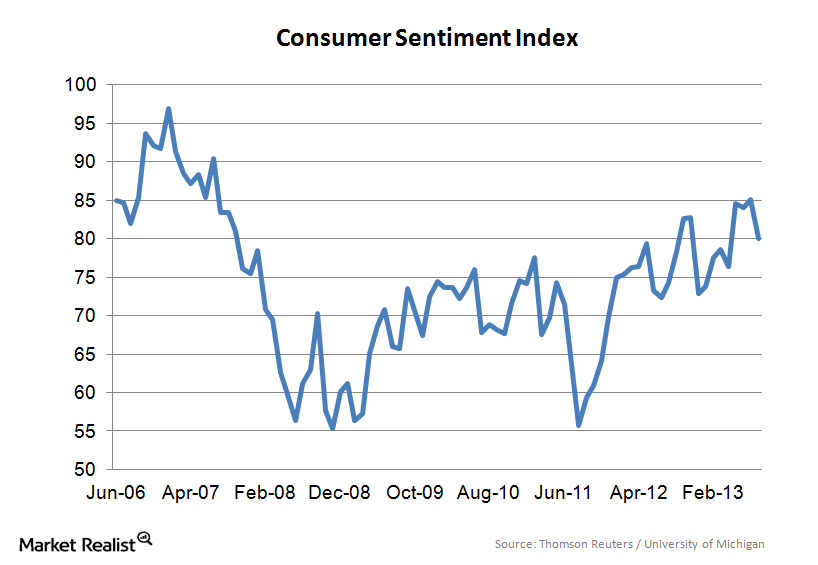

University of Michigan Consumer Confidence Index dips in August

The Thomson Reuters/University of Michigan Consumer Confidence Index is a leading indicator for the U.S. economy The Thomson Reuters/University of Michigan Consumer Confidence Index is an important indicator of the consumer’s perception of the U.S. economy. Similar to other consumer confidence measures, it asks consumers about their views on the current economic conditions and their […]

Is Walmart the Ultimate Recession-Proof Stock?

Walmart (WMT) has a long history and strong brand name recognition. But is there reason to believe WMT stock could actually withstand an economic meltdown?

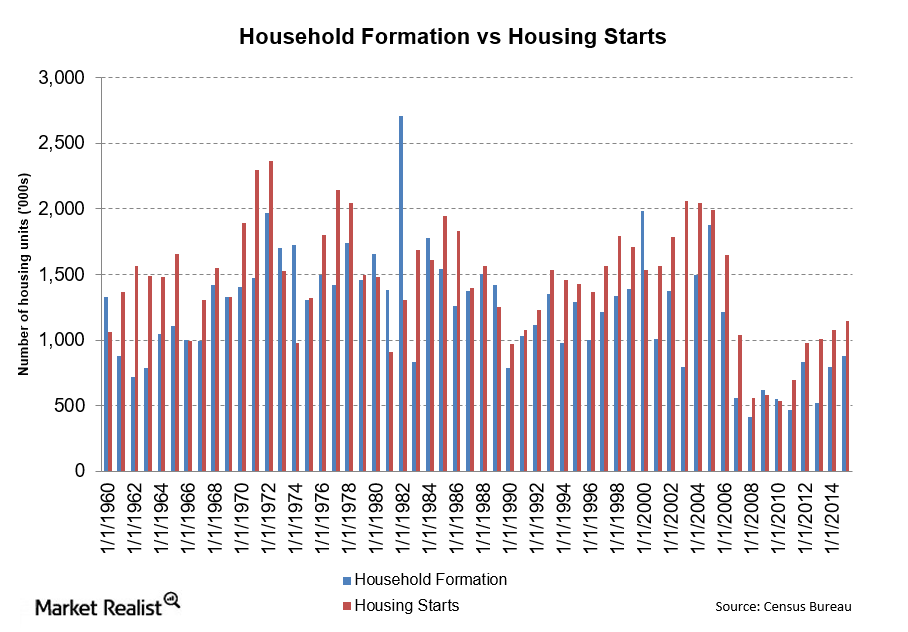

Limited Supply: Analyzing Housing Starts and Household Formations

There was a big fall in household formation in 2008. In 2005, household formation peaked at 1.9 million. By 2008, that number was just over 400 million.

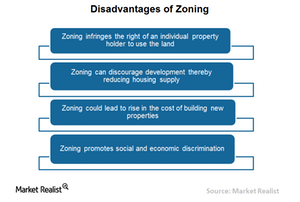

How Zoning Can Be a Hindrance to Housing Market Growth

Zoning restricts the freedom of property holders and REITs to use land however they want, given their specific development and investment interests.

How Zoning Regulations Benefit Communities

Zoning protects existing property values by preventing incompatible uses of a property. It also protects residential properties from commercial development.

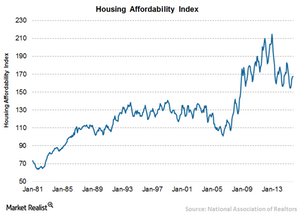

What Are the Factors Driving Housing Affordability?

Housing affordability took a beating in July 2015 after reaching its high in January 2013. The higher ratio of the home affordability index signifies relatively higher home affordability to buyers.

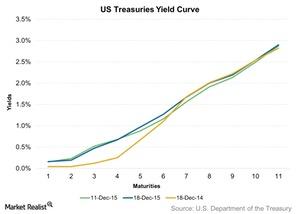

Treasury Yield Curve Flattened after US Interest Rate Hike

The US Treasury yield curve was flat for the week ended December 18, 2015, as short-term yields fell. Medium- to long-term yields rose after US interest rates rose by 25 basis points.

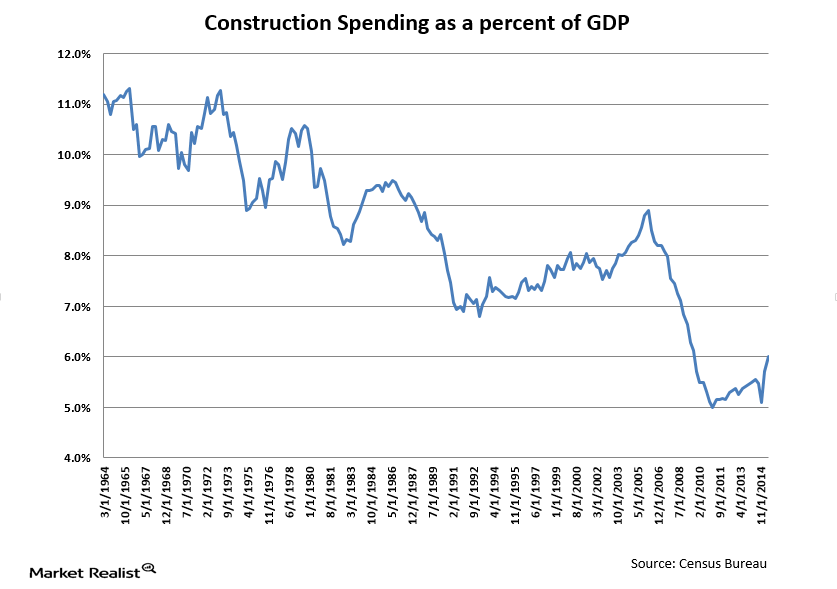

The Importance of Construction Spending to GDP

Historically, construction spending has led economies out of recessions. This didn’t happen in the most recent recession, however, because of the overhang from the real estate bubble.

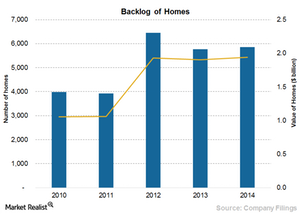

Why PulteGroup Saw a Modest Rise in Sales Order Backlog in 2014

Sales order backlog represents homes under contract but not closed or delivered. For orders in backlog, the company receives a customer contract and deposit, which may or may not be refundable.

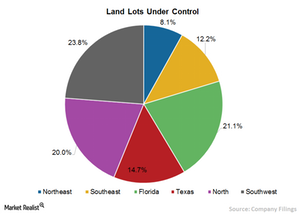

Understanding PulteGroup’s Land Acquisition Strategy

PulteGroup (PHM) mainly acquires land to complete sales of housing units within 24 to 36 months from the date of opening a community.

What Is PulteGroup’s Market Segmentation Strategy?

The move-up buyers in Pulte Homes communities tend to place more premium on location and amenities.

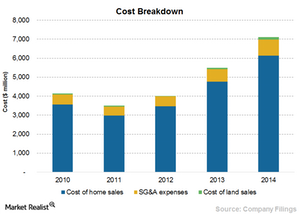

What Was D.R. Horton’s Cost Structure Breakdown in 2014?

Cost of homes sold is the highest of the company’s costs at 78.1%, followed by SG&A at 10.6%, and cost of land sold at 1.6%.

What Is D.R. Horton’s Market Segmentation Strategy?

As part of its market segmentation strategy, D.R. Horton launched a variety of different brands, including D.R. Horton, America’s Builder, Express Homes, and Emerald Home.

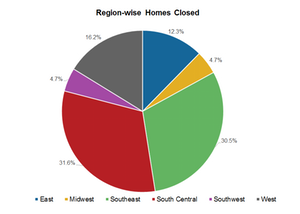

An Overview of D.R. Horton’s Homebuilding Segment

The homebuilding segment of D.R. Horton, which mainly focuses on single-family attached and detached homes, is divided into six divisions.

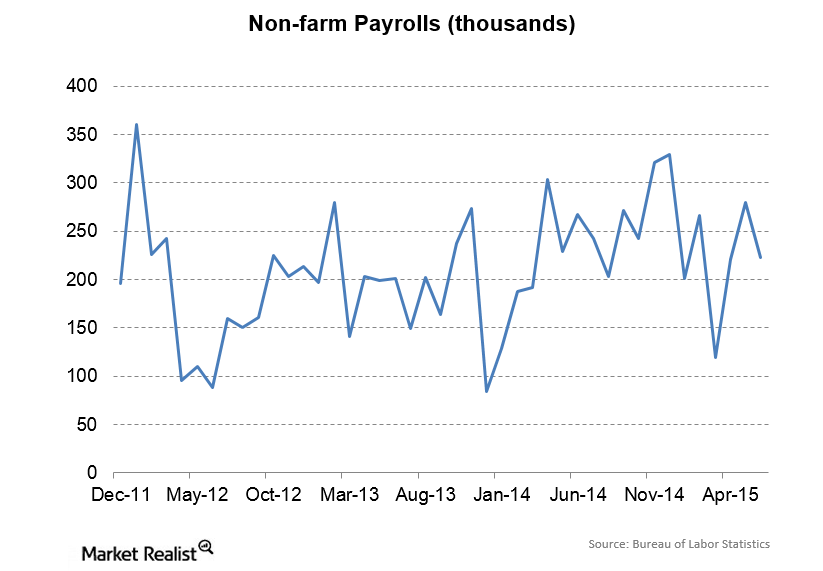

June Payrolls Increase

Private payrolls increased by 223,000 in June, while government jobs growth was flat and manufacturing employment barely increased.

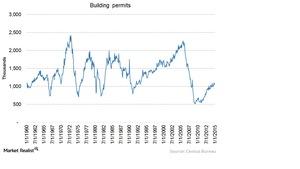

Understanding building permits and their impact on homebuilders

Along with housing starts, building permits are also a leading indicator of the health of the US housing market.

The basics of the US homebuilding industry for investors

The US homebuilding industry comprises many large, publicly traded residential construction companies. Top homebuilders mainly focus on specific categories.