How to Invest in General Growth Properties through ETFs

General Growth Properties has a market cap of $22.1 billion, is part of S&P 500 index, and sees allocation in the major REIT-specific ETFs like ICF.

Nov. 20 2020, Updated 12:33 p.m. ET

ETFs best way to meet asset allocation

Asset allocation is a primary factor when considering investment returns, and so ETFs (exchange-traded funds) are a convenient way for investors to build portfolios that meet specific asset allocation needs. ETFs are also a convenient and easy way of portfolio diversification across a number of asset classes.

Most ETFs also track a market index, mirroring the performance of an entire market in a single trade. In this article, we’ll see how sector-specific and sector-agnostic ETFs are investing in General Growth Properties’ (GGP) stock.

Sector-specific ETFs

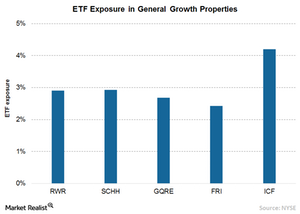

General Growth Properties (GGP) is a major stock on the NYSE (New York Stock Exchange), with a market capitalization of $22.1 billion, and GGP is part of S&P 500 index. Consequently,GGP sees allocation in most of the major REIT-specific (real estate investment trust) ETFs, such as the iShares Cohen & Steers REIT ETF (ICF), which has 4.20% exposure in the company.

Another major REIT ETF, the Schwab U.S. REIT ETF (SCHH), has 2.93% exposure in GGP, while the SPDR DJ Wilshire REIT ETF (RWR) has 2.90% exposure in the company.

The iShares Cohen & Steers REIT ETF (ICF) is the biggest of the lot, with $2.9 billion in assets under management and an expense ratio of 0.35%. The SPDR DJ Wilshire REIT ETF (SCHH) has $2.76 billion in assets under management, with an expense ratio of 0.25%.

REIT ETFs invest in other REIT stocks beyond General Growth Properties (GGP), having exposure to companies like Macerich (MAC), CBL & Associates Properties (CBL), and Taubman Centers (TCO).

Sector-agnostic ETFs

The holdings of a particular company in an ETF depend on the investment objective of the ETF. Consequently, sector-specific ETFs should have a higher exposure to companies in the sector than sector-agnostic ones. The Global Quality Real Estate Index Fund (GQRE), for example, has 2.68% exposure in GGP. GQRE had an asset base of $103 million and an expense ratio of 0.45%.

Please visit Market Realist’s REIT page to learn more about this industry.