CBL& Associates Properties, Inc.

Latest CBL& Associates Properties, Inc. News and Updates

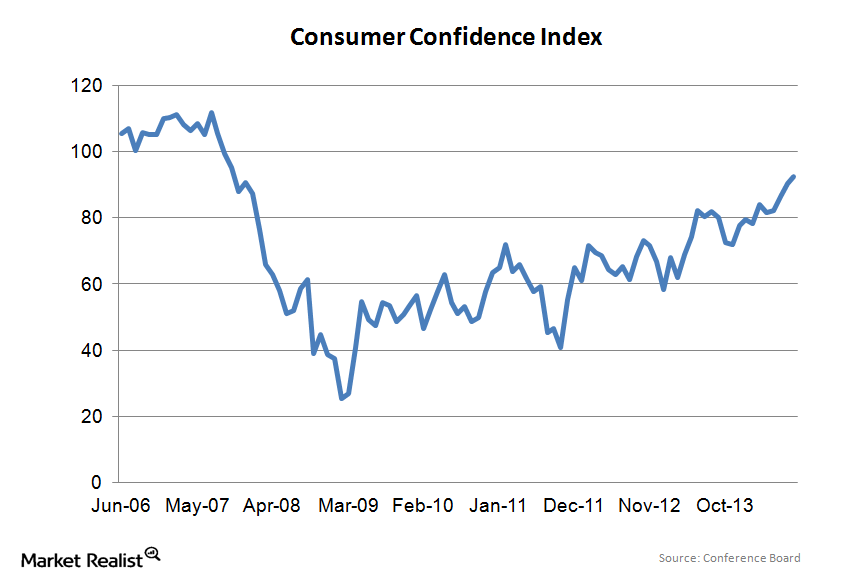

Why rising asset prices are driving consumer confidence higher

The CCI is one of the oldest consumer surveys, originally started as a mail-in survey in 1967. It asks respondents whether certain conditions are positive, negative, or neutral.

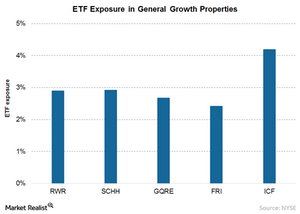

How to Invest in General Growth Properties through ETFs

General Growth Properties has a market cap of $22.1 billion, is part of S&P 500 index, and sees allocation in the major REIT-specific ETFs like ICF.

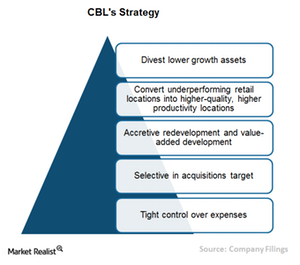

How CBL Plans to Increase Shareholder Returns

CBL’s (CBL) long-term strategy is to maximize shareholder returns while maintaining prudent risk profile.

General Growth Properties’ Top Tenants in Retail

The malls in GGP’s portfolio receive a smaller percentage of their operating income from anchor tenants than from specialty retailers who lease space.

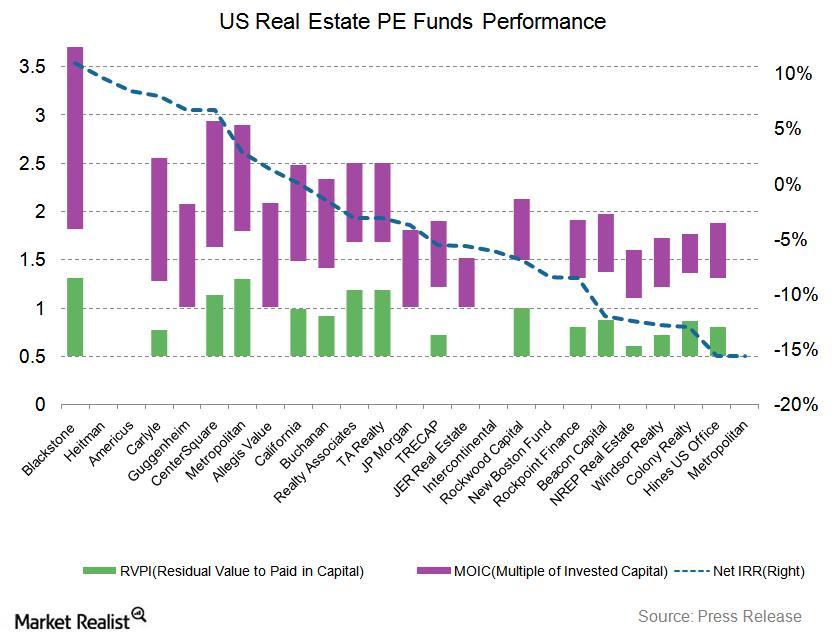

All You Need to Know about Real Estate Private Equity

Real estate private equity funds have been attracting unprecedented amounts of capital, with assets under management reaching an all-time high of $724 billion.