Why HCP’s Dividend Yield Is Moving South

Revenue and earnings HCP (HCP) is a healthcare REIT specializing in US healthcare property investment. In 2016, the company’s revenue growth slowed to 10% from 19% in 2015. The growth was driven by its senior housing operating portfolio, life science segment, and medical office segment, and partially offset by its senior housing triple-net segment. Rental and […]

Sept. 18 2017, Updated 1:36 p.m. ET

Revenue and earnings

HCP (HCP) is a healthcare REIT specializing in US healthcare property investment. In 2016, the company’s revenue growth slowed to 10% from 19% in 2015. The growth was driven by its senior housing operating portfolio, life science segment, and medical office segment, and partially offset by its senior housing triple-net segment. Rental and related revenue, tenant recoveries, and resident fees and services posted impressive growth partially offset by interest income, which fell in 2016.

Its total costs and other expenses (including interest expenses), which rose 33% in 2015, recorded a 3% rise in 2016. The REIT posted positive EPS (earnings per share) in 2016, unlike in 2015. The 2016 EPS were supported by asset disposition gains and partially offset by a debt extinguishment loss. In 2015, chances of positive EPS were marred by a huge impairment charge. The company was able to generate positive FFO (funds from operations) in 2014 and 2016, but not in 2015.

Revenue and EPS in 1H17

In 1H17, the REIT’s revenue fell 10%, with only the medical office segment recording growth. Total costs and other expenses fell 9%, partially offset by impairment charges. Other income helped the company record 15% EPS growth. It managed to generate positive FFO, though they fell 31% from 1H16.

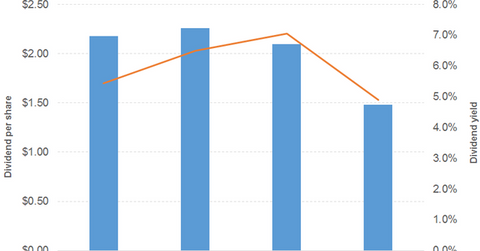

Dividend

The company raised its dividend in 2015 despite negative EPS, but saw dividend cuts in 2016 and 2017. Its dividend payout fell between 1H16 and 1H17.

Stock price

As shown in the chart above, HCP stock has been beaten by both the Financial Select Sector SPDR ETF (XLF) and the Vanguard REIT ETF (VNQ) by a wide margin. VNQ has exposure to healthcare REITs.

The WisdomTree Emerging Markets SmallCap Dividend ETF (DGS) offers a dividend yield of 3%, at a PE (price-to-earnings) ratio of 13x. It has a 15%, 10%, and 4% exposure to real estate, financials, and healthcare, respectively. It has major exposure to Asia. The WisdomTree US MidCap Dividend ETF (DON) offers a dividend yield of 2.4%, at a PE ratio of 23.6x. It has a 17%, 8%, and 2% exposure to real estate, financials, and healthcare, respectively.