HCP Inc

Latest HCP Inc News and Updates

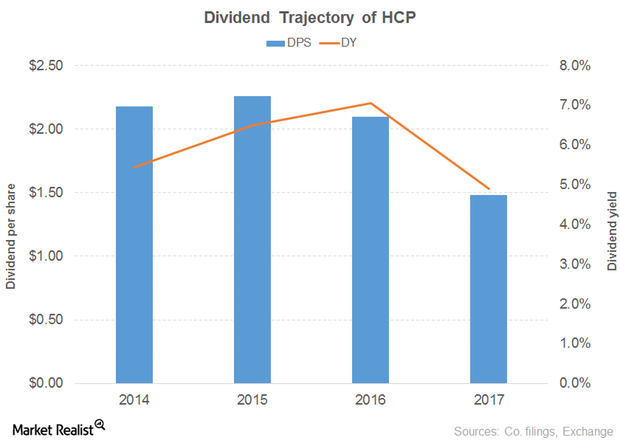

Why HCP’s Dividend Yield Is Moving South

Revenue and earnings HCP (HCP) is a healthcare REIT specializing in US healthcare property investment. In 2016, the company’s revenue growth slowed to 10% from 19% in 2015. The growth was driven by its senior housing operating portfolio, life science segment, and medical office segment, and partially offset by its senior housing triple-net segment. Rental and […]

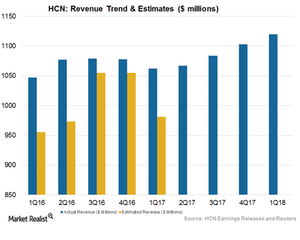

Will Welltower Maintain Its Business Momentum in the Future?

Welltower’s (HCN) strategic presences in high-barrier and affluent markets help it to maintain its leadership in the healthcare infrastructure industry.