WisdomTree U.S. MidCap Dividend Fund

Latest WisdomTree U.S. MidCap Dividend Fund News and Updates

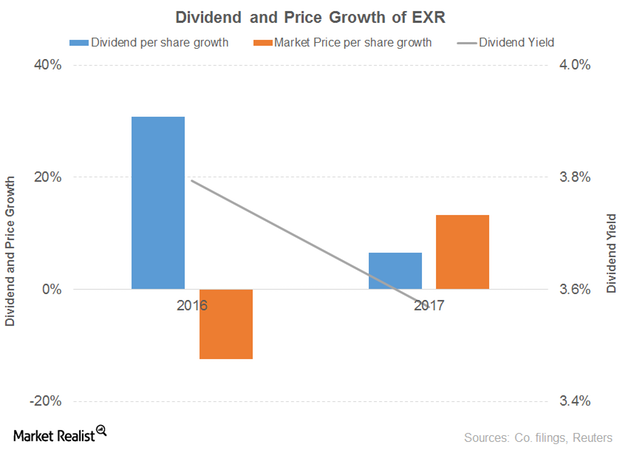

What’s the Outlook for Extra Space Storage?

Extra Space Storage’s (EXR) revenue grew 27% and 13% in 2016 and 9M17, respectively.

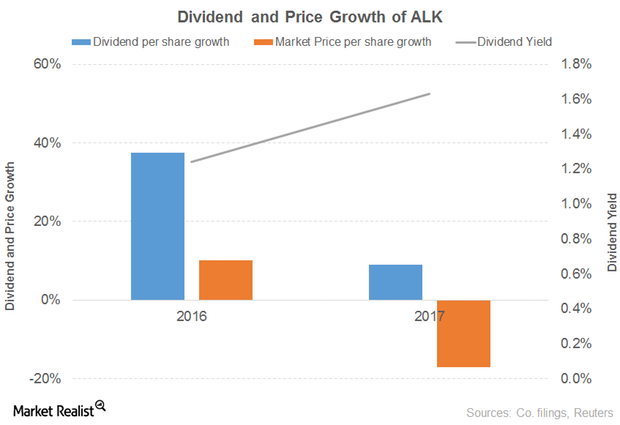

What’s the Outlook for Alaska Air Group?

Alaska Air Group’s (ALK) operating revenue rose 6% and 35% in 2016 and 9M17, respectively.

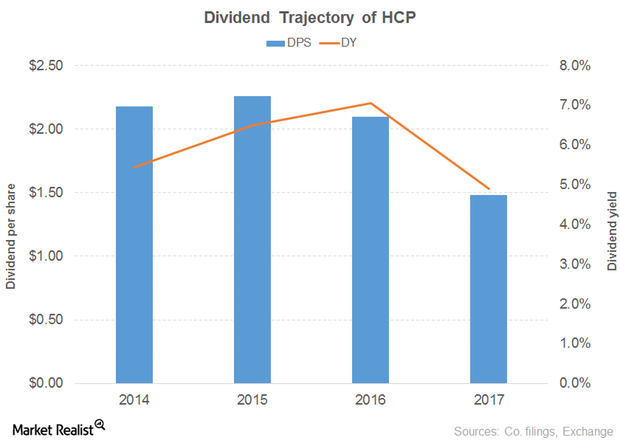

Why HCP’s Dividend Yield Is Moving South

Revenue and earnings HCP (HCP) is a healthcare REIT specializing in US healthcare property investment. In 2016, the company’s revenue growth slowed to 10% from 19% in 2015. The growth was driven by its senior housing operating portfolio, life science segment, and medical office segment, and partially offset by its senior housing triple-net segment. Rental and […]