iShares Mortgage Real Estate Capped

Latest iShares Mortgage Real Estate Capped News and Updates

Why Student Debt May Not Affect the US Economy Like Sub-Prime

According to the White House Council of Economic Advisers, “Student debt is less likely to make a recession more severe or slow an expansion in the way that mortgage debt may have.”

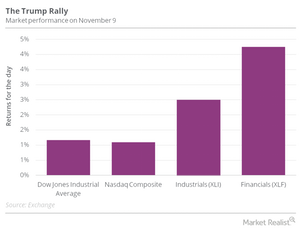

Gundlach: Invest in Industrials, Materials, Financial Sectors

“Industrials, materials, and financials are the sectors. . .you want to be invested in,” said Jeffrey Gundlach recently in a CNBC interview.

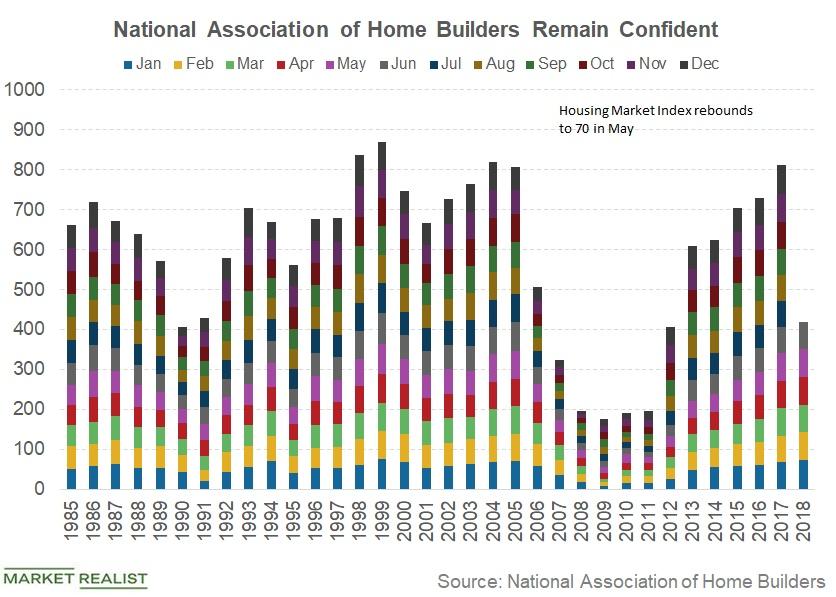

What American Builders Were Worried about in June

The HMI was reported to have decreased by two points to 68 in June as compared to a May reading of 70.

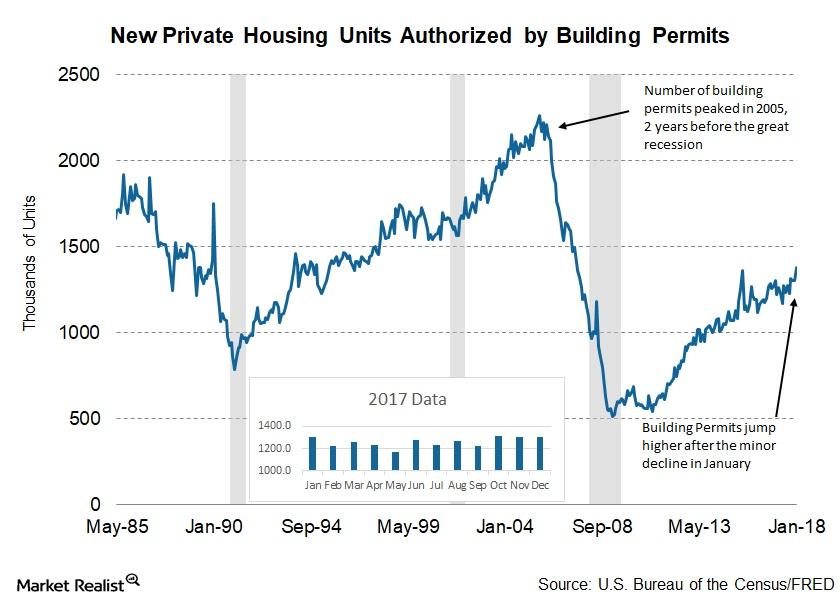

Why the Rebound in Building Permits Is Positive for the US Economy

The Conference Board uses the number of building permits issued as one of the key constituents of its LEI (Leading Economic Index) model.

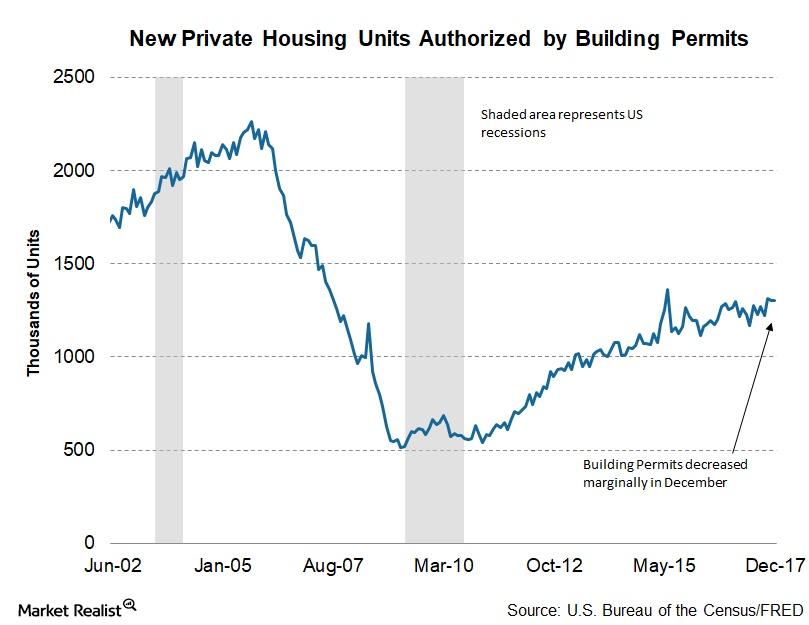

Why Building Permits Didn’t Change in December

For 2017, 1,263,400 housing units have been authorized by building permits—a 4.7% increase from 1,206,600 housing units in 2016.

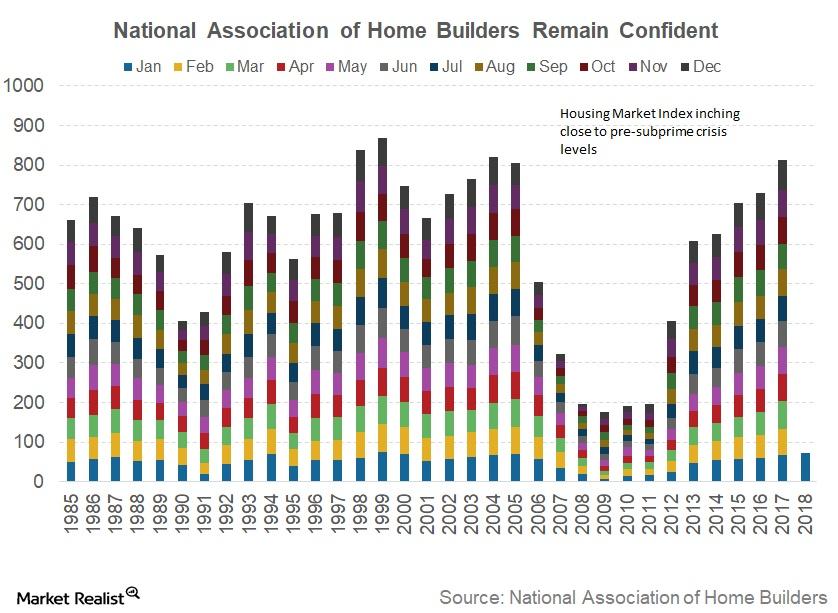

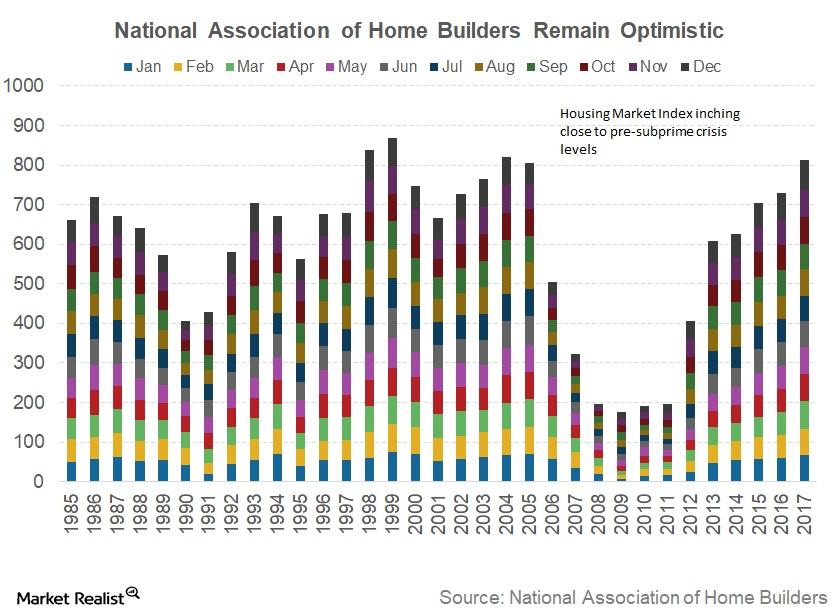

How Confident Are Homebuilders at the Beginning of 2018?

Comments from NAHB members indicated that homebuilders are optimistic about the future demand and projected increased activity in the housing sector.

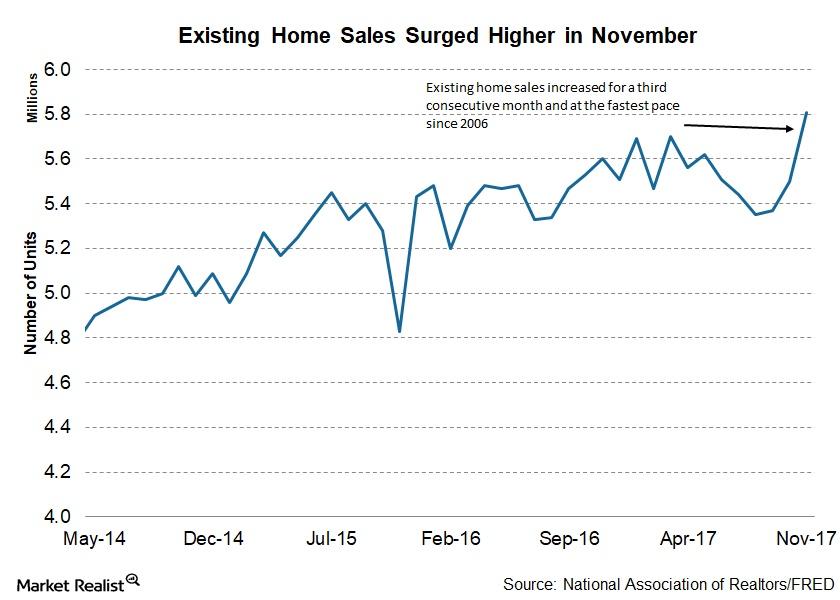

Existing Home Sales: Strongest Pace in 11 Years

According to the latest report from NAR, existing home sales rose 5.6% to a seasonally adjusted annual rate of 5.81 million homes in November.

Housing Market: Builders’ Confidence Reaches an 18-Year High

For November, the NAHB Housing Market Index was reported as 74—an increase of five from October and an 18-year high.

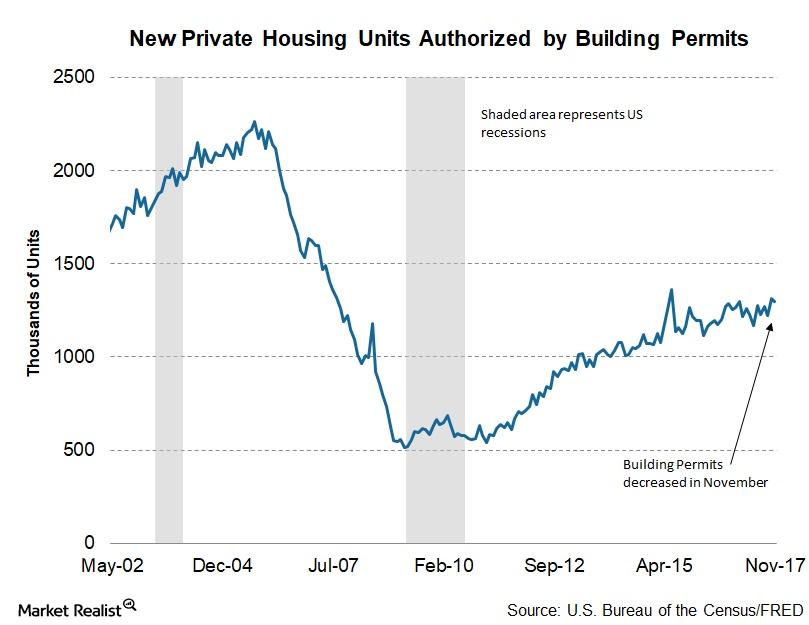

Should Investors Be Concerned about Fewer Building Permits?

In November 2017, housing units (XHB) authorized by building permits were at a seasonally adjusted rate of 1.298 million—a decrease of 1.4% from October.

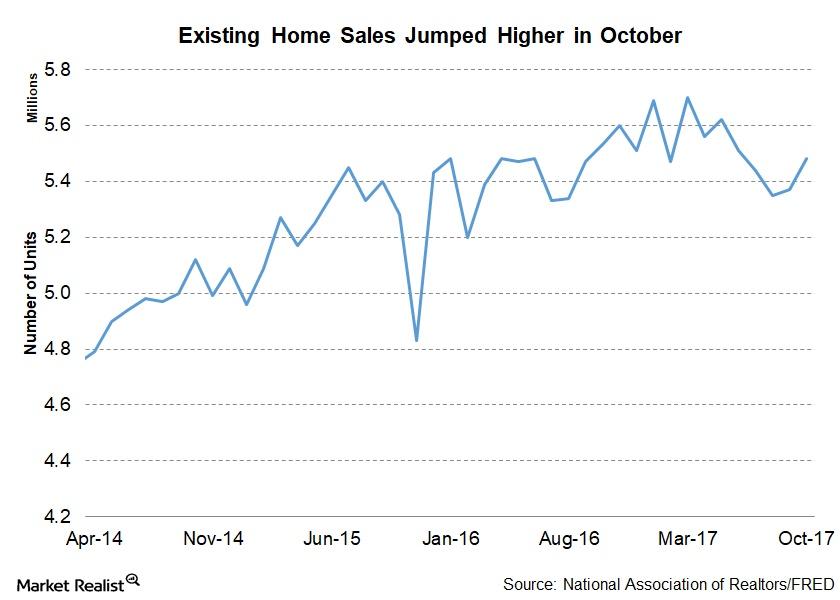

Households Think It’s a Good Time to Buy a Home

According to the latest report from NAR, existing home sales have risen 2% to a seasonally adjusted annual rate of 5.48 million in October.

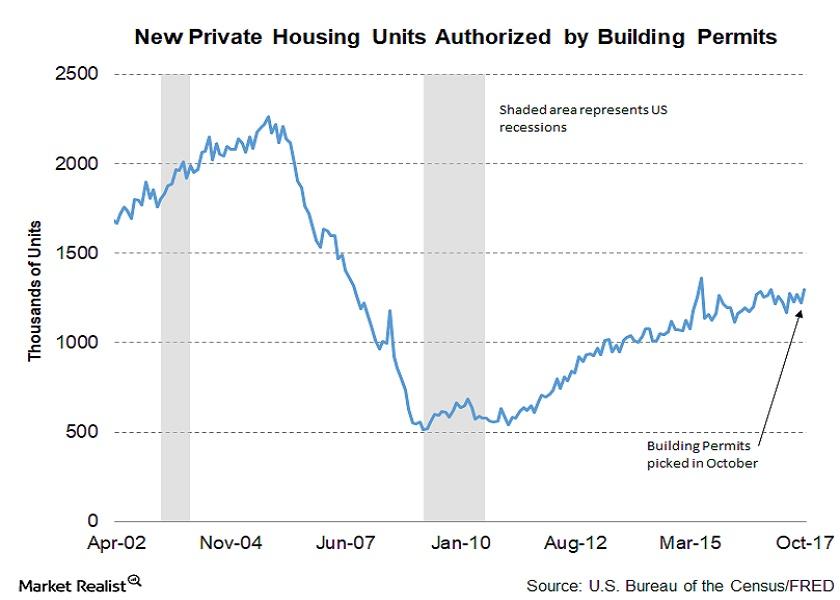

Housing Market: What a Rise in Building Permits Signals

In October 2017, building permits were at a seasonally adjusted rate of 1.297 million—an increase of 5.9% from the reading of 1.225 million in September.

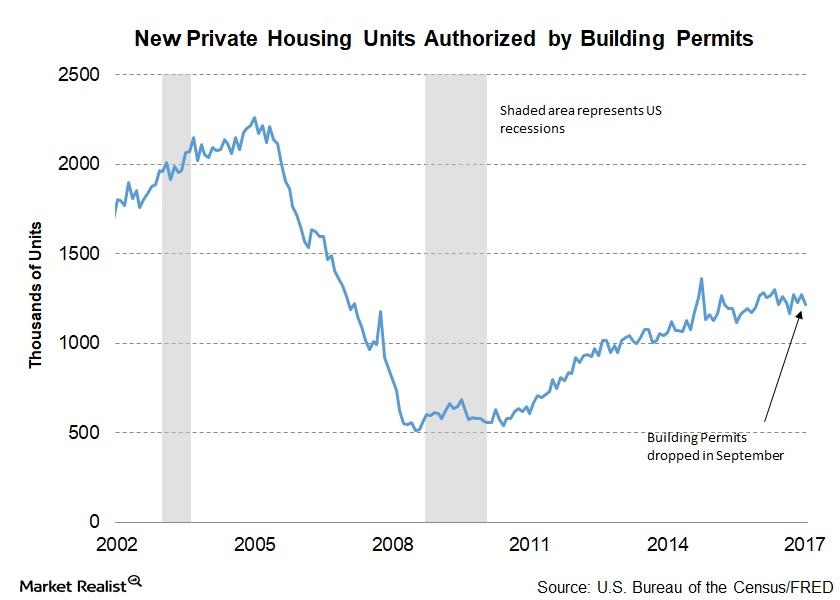

Is the Drop in September Building Permits Cause for Concern?

In September 2017, building permits were at a seasonally adjusted annual rate of 1.215 million—a fall from August’s 1.272 million and 4.3% below September 2016.

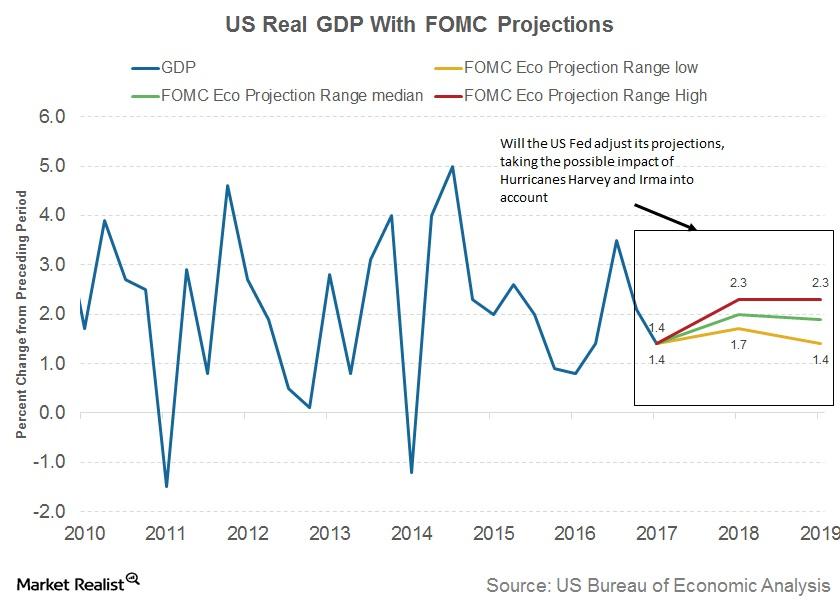

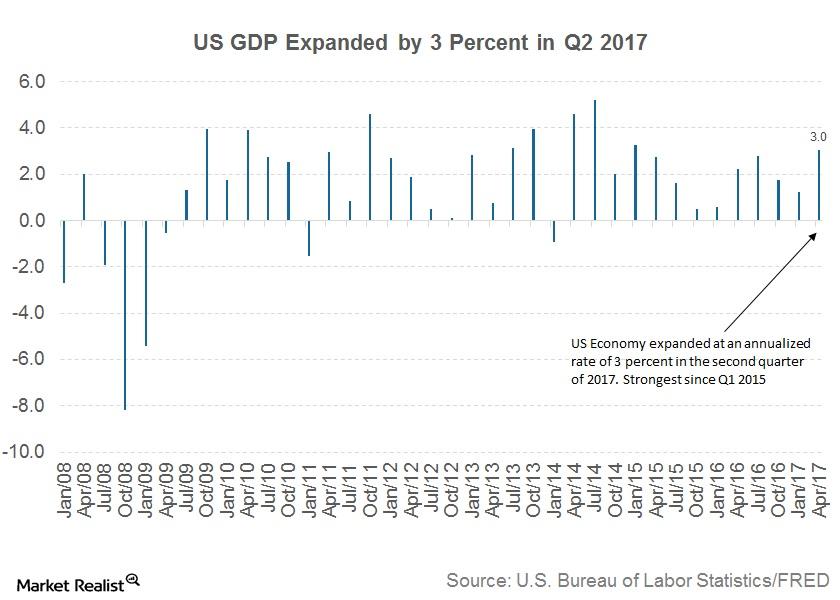

How Has the US Economy Fared since the Last FOMC Meeting?

Since the last FOMC meeting in July, economic conditions in the US have continued to improve.

Why Improving Economic Conditions Aren’t Enough for the FED

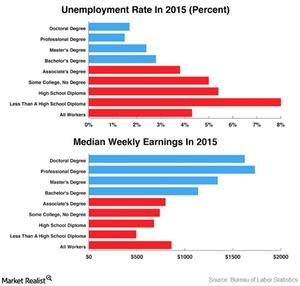

In the last few months, the performance of the US economy has been impressive. The unemployment rate fell to 4.3% in August.

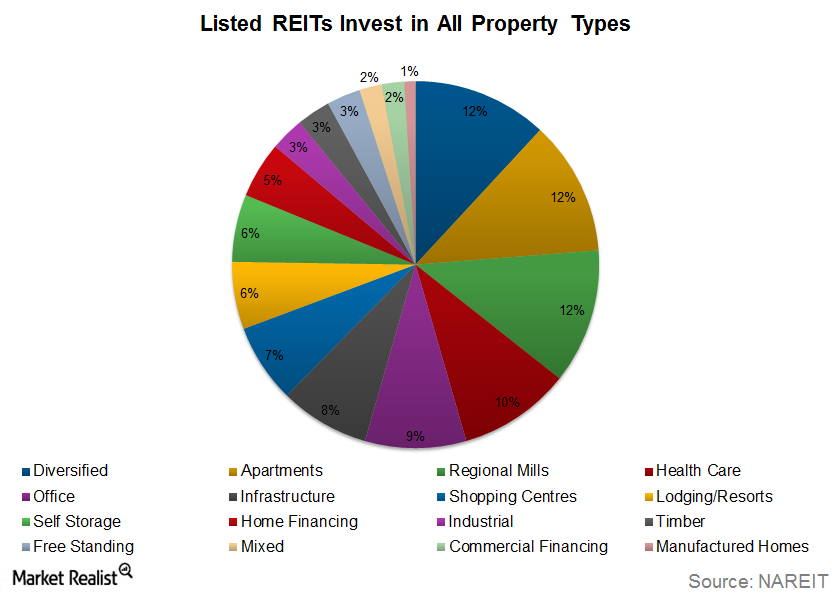

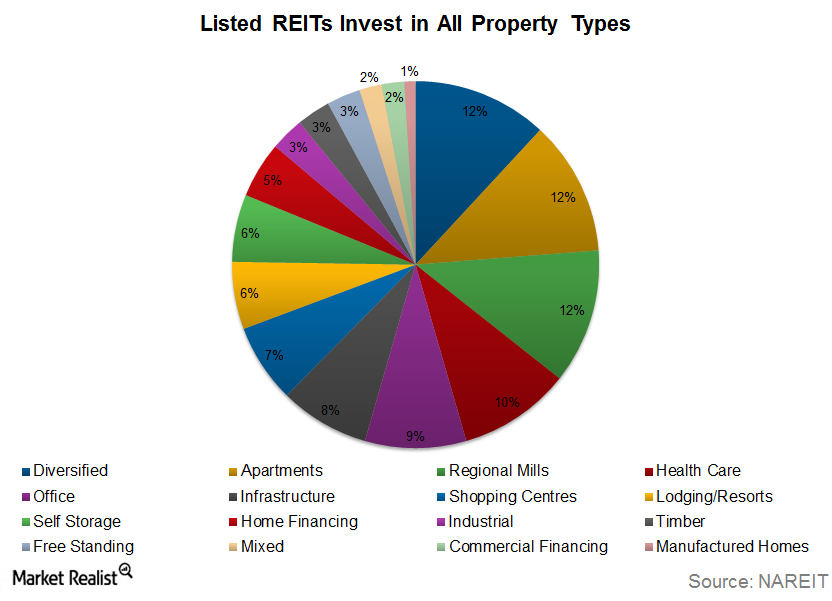

REITs Explained: Qualifications and Types of REITs

To qualify as a REIT, a company must have most of its assets and income tied to real estate investment and must pay out almost all of its taxable income to shareholders in the form of dividends. In the U.S., a REIT must meet the following four requirements. The REIT must distribute at least 90% […]

REIT Explained: Qualifications and Types of REITs

Let’s talk about the two main types of REITs (ICF)—equity REITs and mortgage REITs.

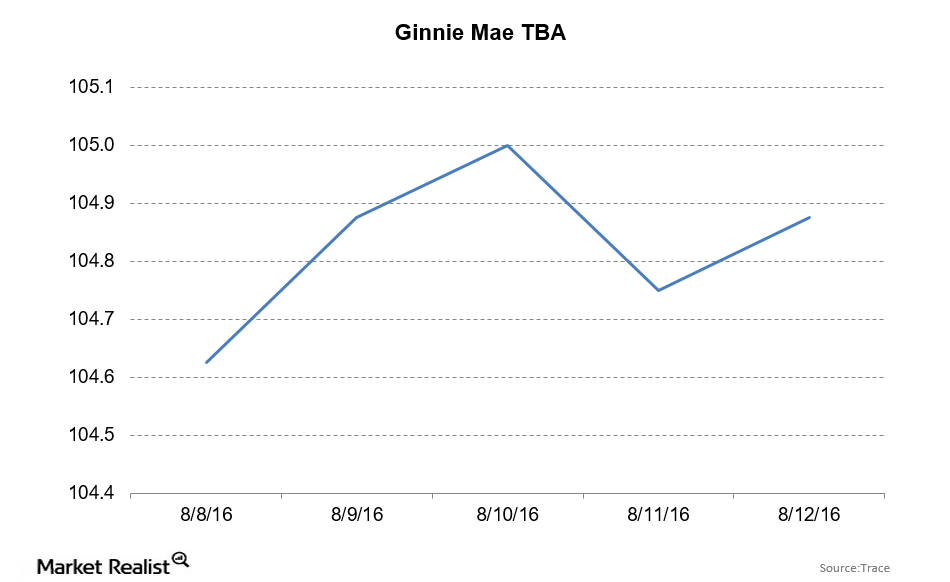

Ginnie Mae TBAs Rise with the Bond Market

The ten-year bond yield fell by 8 basis points to 1.51% for the week ending August 12, 2016. Ginnie Mae TBAs rose by 4 ticks and closed at 104 28/32.

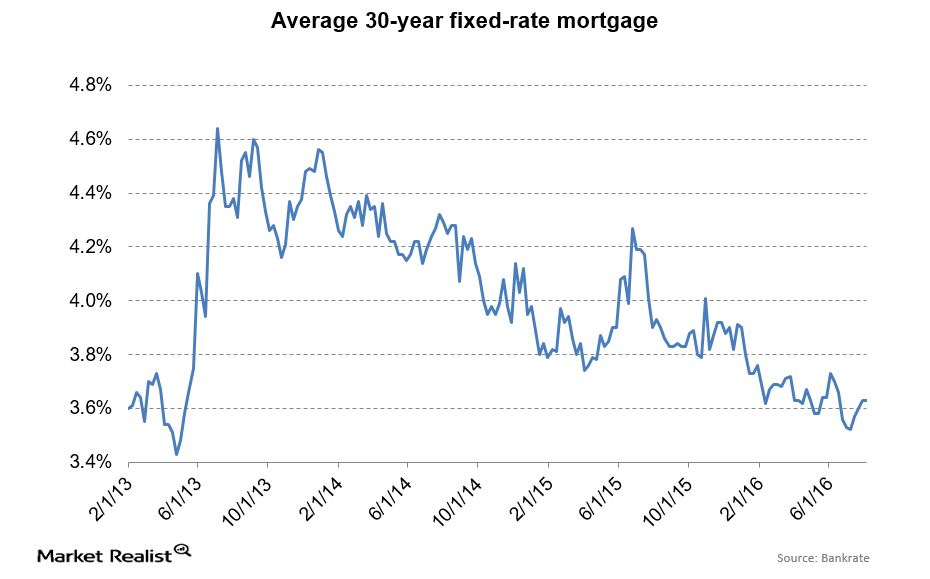

Mortgage Rates Didn’t Move despite a Volatile Bond Market

Lately, mortgage rates and bond yields have shown a weak correlation. Treasury yields have fallen in the past month, while mortgage rates have been steady.

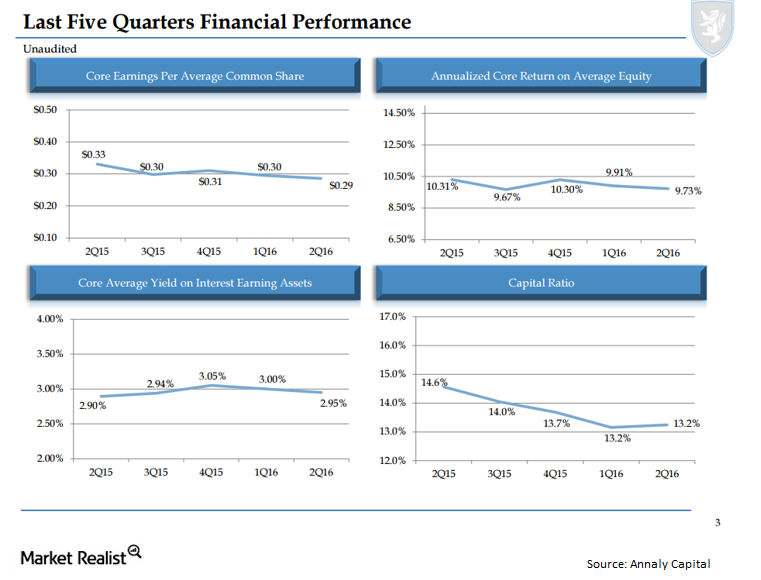

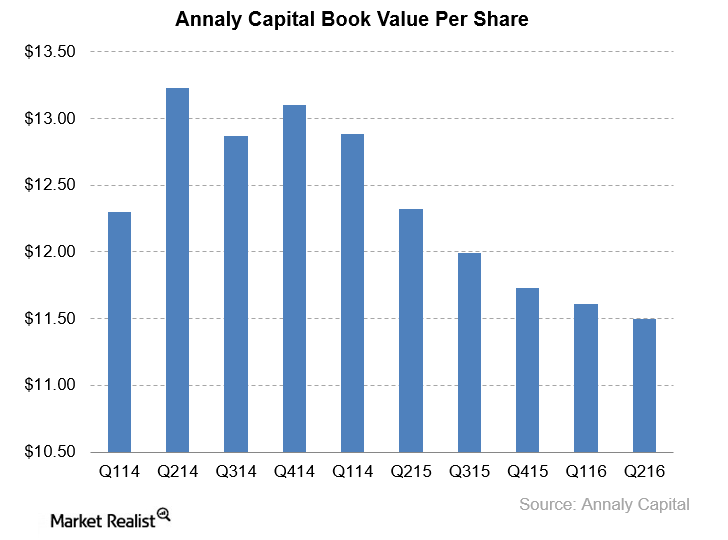

What’s Annaly Capital’s Take on the Bond Market’s Volatility?

Annaly positioned itself to reduce its interest rate risk and increase its credit risk. Since 2009, global bond markets have risen in value by about $17 trillion.

How’s Annaly Capitalizing on Commercial Real Estate?

By investing in commercial real estate, Annaly Capital is increasing its returns. At the same time, it’s taking on credit risk.

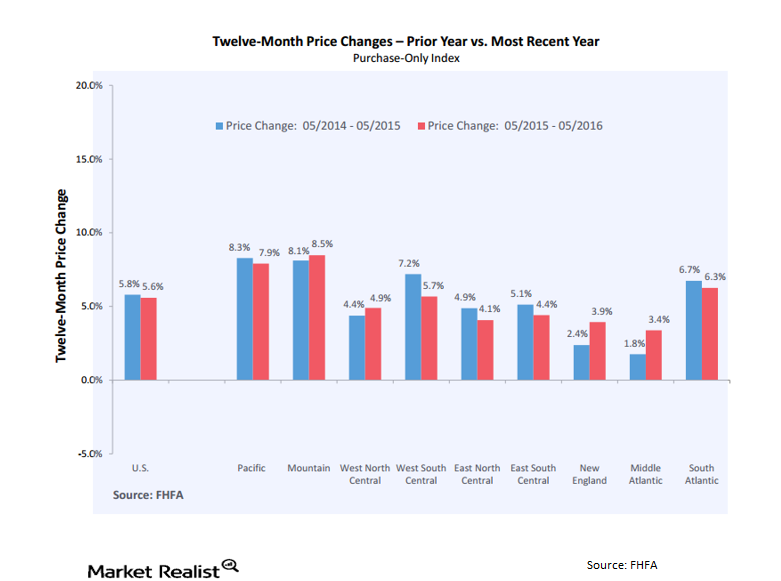

Real Estate Market Hot in the West, Cold in the Northeast

Home prices in the Pacific and Mountain states have outperformed prices in the rest of the country over the past two years.

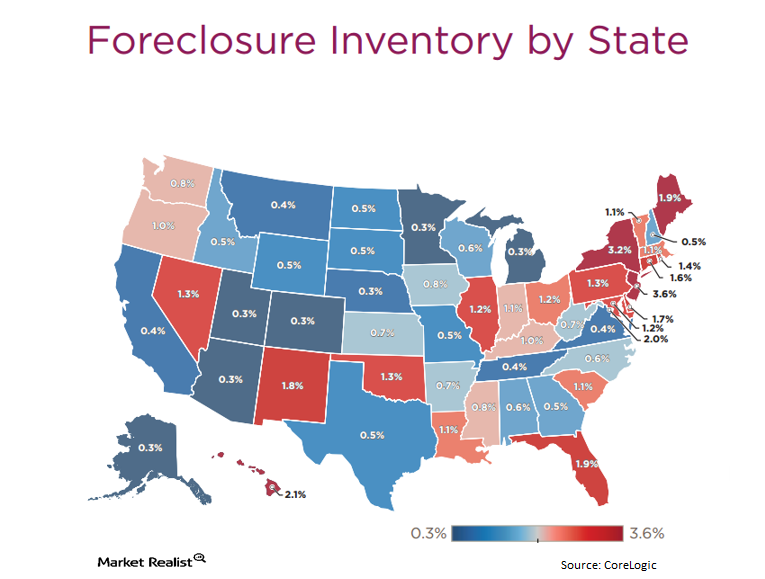

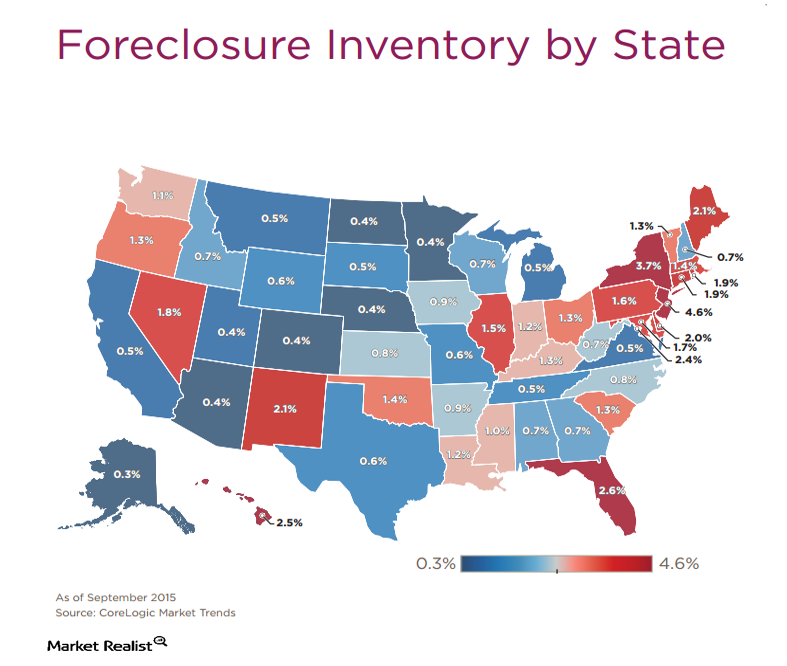

Why Are State Foreclosure Laws Important?

There are two basic types of state foreclosure laws—judicial and non-judicial. In non-judicial states, foreclosures are handled through a streamlined process.

Why Is the Median Income to Median Home Price Ratio Elevated?

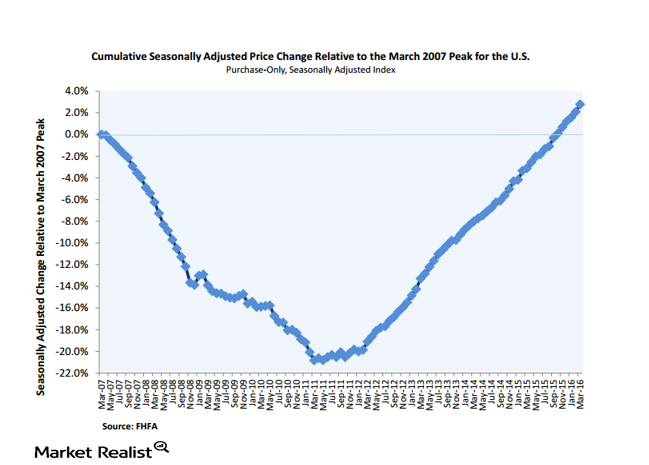

The recent 5.5% year-over-year gain for home prices has put the FHFA House Price Index about 3% above its April 2007 level.

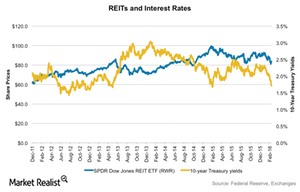

How Would Negative Interest Rates Impact REITs?

A fall in interest rates makes REITs more attractive dividend-yielding investments compared to bonds. This is because REITs have been traditionally viewed as dividend-yielding investments.

Why Home Price Appreciation Differs from State to State

In the judicial states, particularly New York, New Jersey, and Connecticut, we’re seeing much lower home price appreciation.

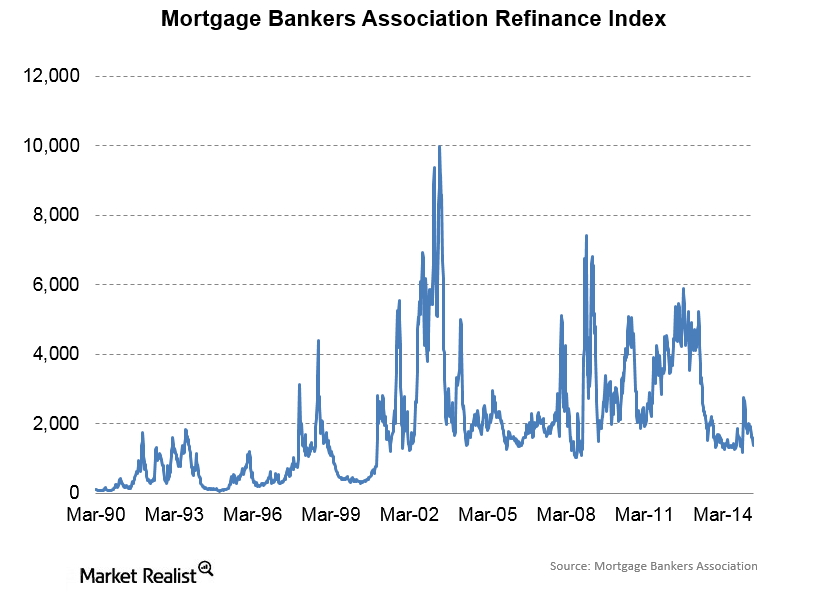

Mortgage Refinances Are Hit by Prepayment Burnout

Refinancing activity affects prepayment speeds. Prepayment speeds occur because homeowners are allowed to pay off their mortgages early and without penalty.

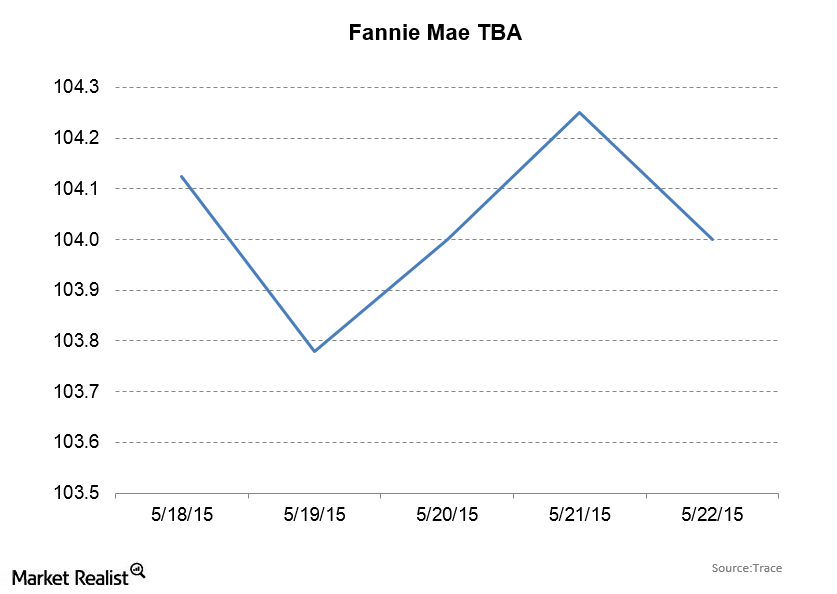

REIT Outlook: Fannie Mae Securities Close at 104 1/32

Fannie Mae TBAs started the week at 104 15/32 and gave up 7/16 to close at 104 1/32. The ten-year bond yield increased by 7 basis points.