Should Investors Be Concerned about Fewer Building Permits?

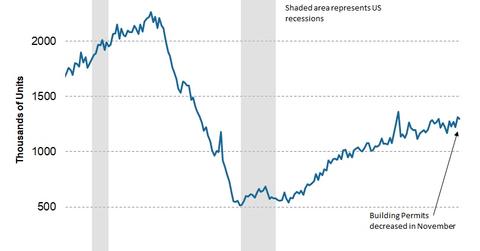

In November 2017, housing units (XHB) authorized by building permits were at a seasonally adjusted rate of 1.298 million—a decrease of 1.4% from October.

Dec. 27 2017, Updated 9:02 a.m. ET

Housing industry and building permits

The US Census Bureau and Department of Housing and Urban Development report monthly data on building permits issued in the US. Changes in the number of building permits can help investors access the housing industry’s (REM) health. If the number of building permits issued increased during the observation period, it signals increased activity in the housing (ITB) sector. Building permits have a lower predictive power compared to the housing starts. The lag between issuing the permit and the start of construction activity could be high.

In November 2017, housing units (XHB) authorized by building permits were at a seasonally adjusted rate of 1.298 million—a decrease of 1.4% from the revised reading of 1.316 million in October. The fall could be a result of a smoother number of new applications after the spike in the last two months. Rebuilding efforts in hurricane-impacted areas increased the demand.

Single-family versus multi-family housing permits

The trend of increasing applications for single-family units continued in November. Single-family homes have a higher positive impact on the economy than multi-family units. The number of permits for single-family homes has risen 1.4% to 862,000 units—compared to a revised reading of 850,000 units in October. Building permits for multi-family units (apartments) have fallen from 416,000 units in October to 395,000 units in November.

Housing sector’s outlook

The incoming economic data related to the housing market (PKB) have been encouraging. Companies in the construction space (DHI) benefited from the higher demand for housing. In 2017, we witnessed three rate hikes from the Fed. There will likely be three more hikes in 2018 as well as 2019. Will higher rates dissuade buyers? The National Association of Home Builders doesn’t think so. Homebuilder confidence peaked to an eight-month high in November.

In the next part of this series, we’ll discuss the National Association of Home Builders Housing Market Index. We’ll also discuss how changes in taxation could impact housing interest payment deduction.