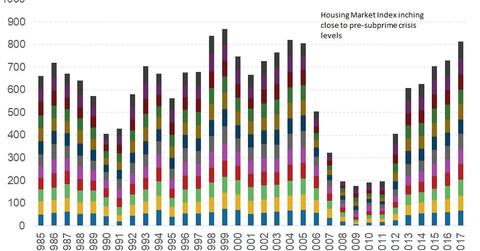

Housing Market: Builders’ Confidence Reaches an 18-Year High

For November, the NAHB Housing Market Index was reported as 74—an increase of five from October and an 18-year high.

Dec. 27 2017, Updated 10:32 a.m. ET

NAHB Housing Market Index

The NAHB (National Association of Home Builders) consists of 700 state and local associations of homebuilders (REM), remodelers, and housing sales and marketing professionals. The NAHB Housing Market Index is a monthly survey of NAHB members. They rate the conditions in the single-family housing market (ITB). The survey reports current conditions and expected conditions for the next six months. The report also publishes the traffic of prospective buyers for new homes.

Reading for November

The NAHB Housing Market Index can range between zero and 100. The NAHB survey has three different sets of diffusion indexes. The final reading is the weighted average of these three surveys. For a diffusion index, any reading above 50 is considered to be a positive reading.

For November, the reading was reported as 74—an increase of five from October and an 18-year high. Two of the three components recorded gains in November. Components measuring current sales and buyer traffic increased by two points each, while the index measuring sales expectations fell by one point.

Possible impact of new tax rules

The NAHB released a statement on December 16 supporting the new tax bill. The new tax bill reduced the principle limit against which borrowers can claim an interest deduction from $1 million to $750,000. It shouldn’t have a large impact on the housing (PKB) market.

Comments from key members of the NAHB indicated that builders are optimistic about the future demand and project increased activity in the housing (XHB) sector. NAHB Chief Economist Robert Dietz said increasing employment and economic growth and rising homeownership and a limited housing inventory could help maintain demand in the housing (PAVE) sector.

In the next part, we’ll analyze the trends in existing home sales.