IQ Real Return ETF

Latest IQ Real Return ETF News and Updates

Will the Sudden Rise in Inflation Change the US Fed’s Outlook?

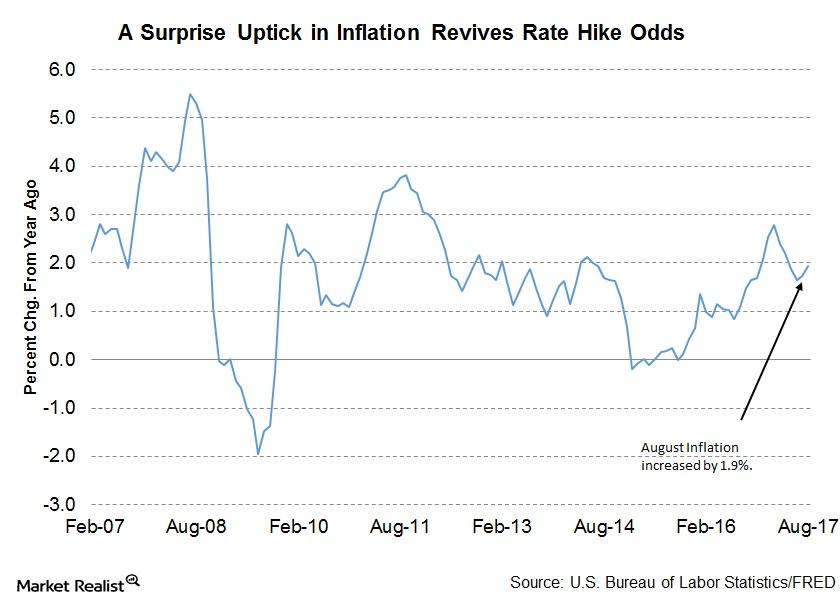

The consumer price inflation (CPI) data reported on Thursday indicated an increase of 0.4% in August. The year-over-year rate improved from 1.7% to 1.9% for August.

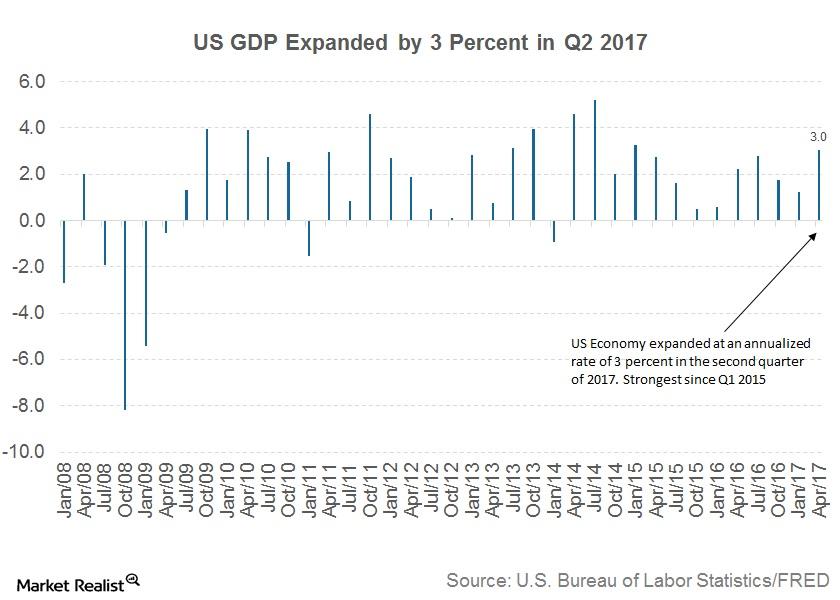

Why Improving Economic Conditions Aren’t Enough for the FED

In the last few months, the performance of the US economy has been impressive. The unemployment rate fell to 4.3% in August.