Ricky Cove

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ricky Cove

How Could Equity Markets React to the Fed’s Optimism?

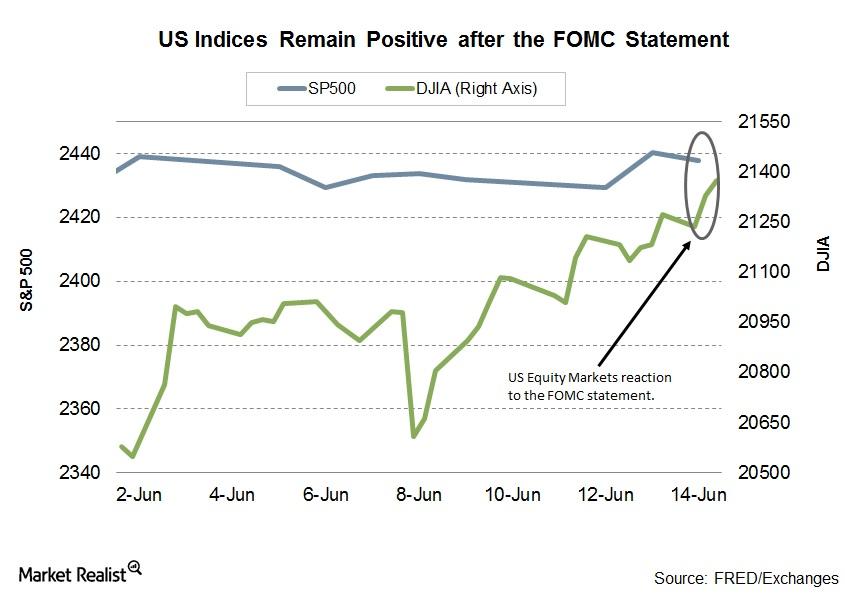

On June 15, the day after the FOMC statement, most global markets traded with a negative tone.

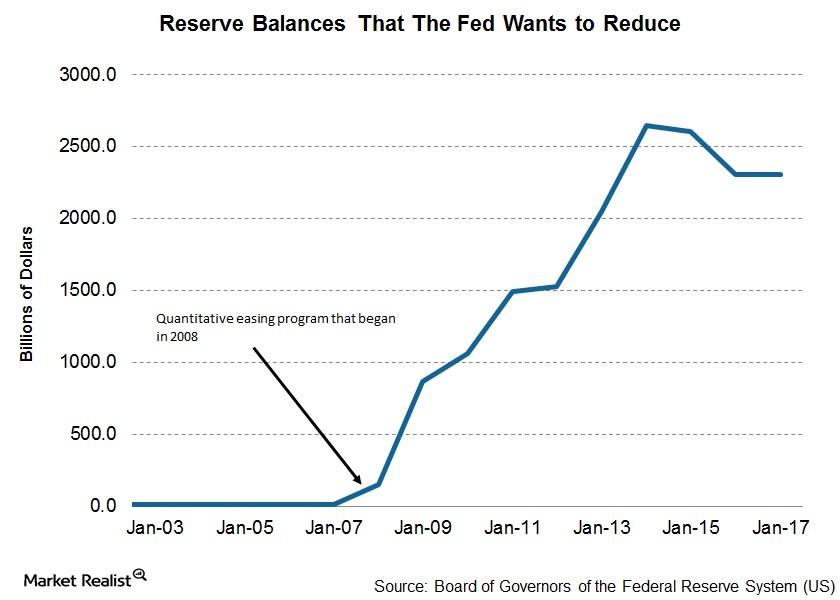

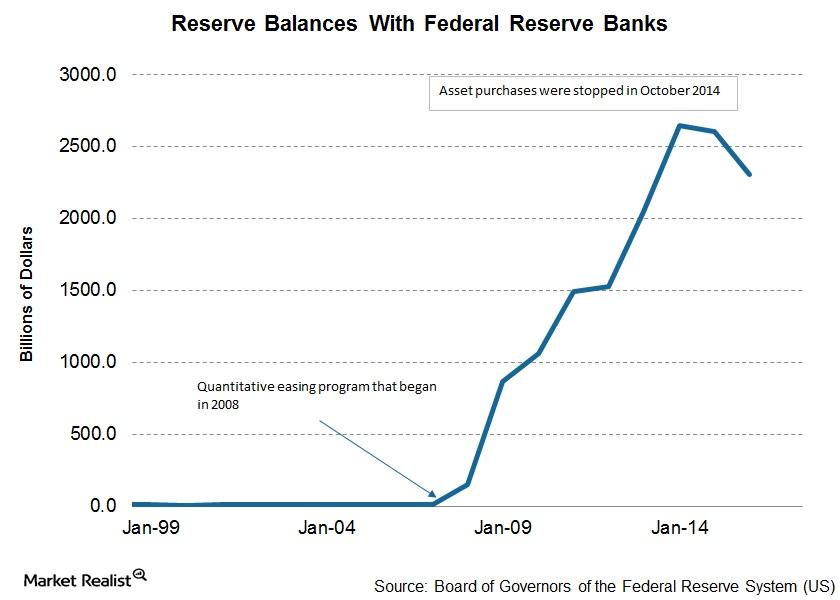

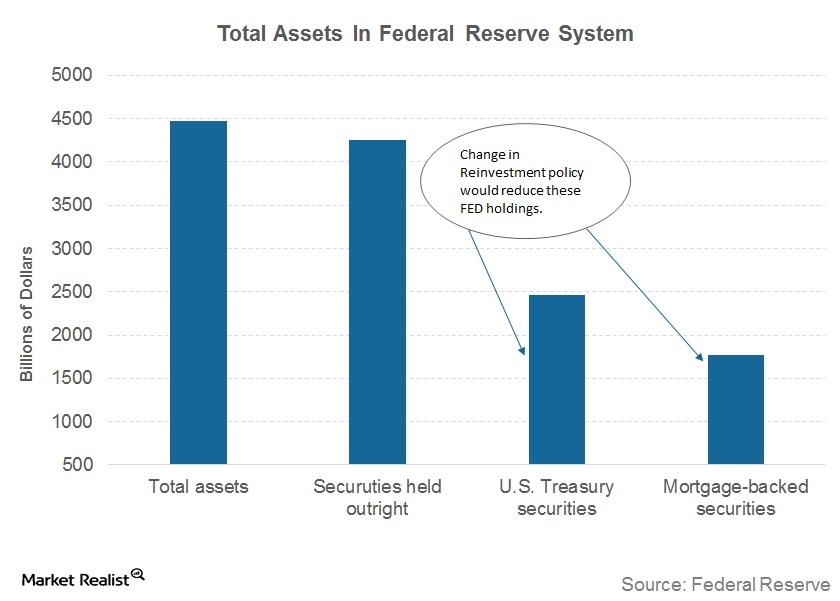

Fed Chair Yellen Warns about Its $4.5 Trillion Balance Sheet Unwinding

In her post-meeting press conference, Janet Yellen warned that the Fed could implement its balance sheet unwinding process soon if the economy continues to perform as expected.

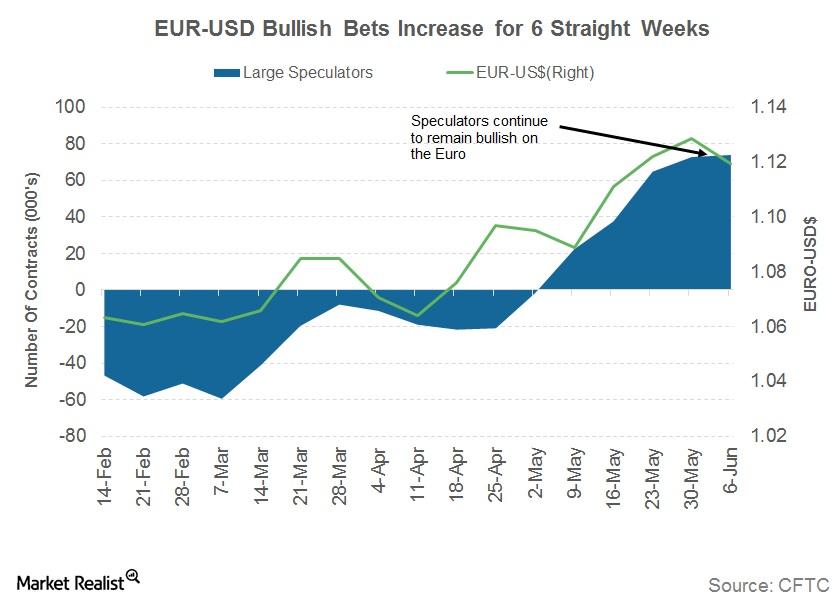

Has the ECB Been Successful in Taming the Euro?

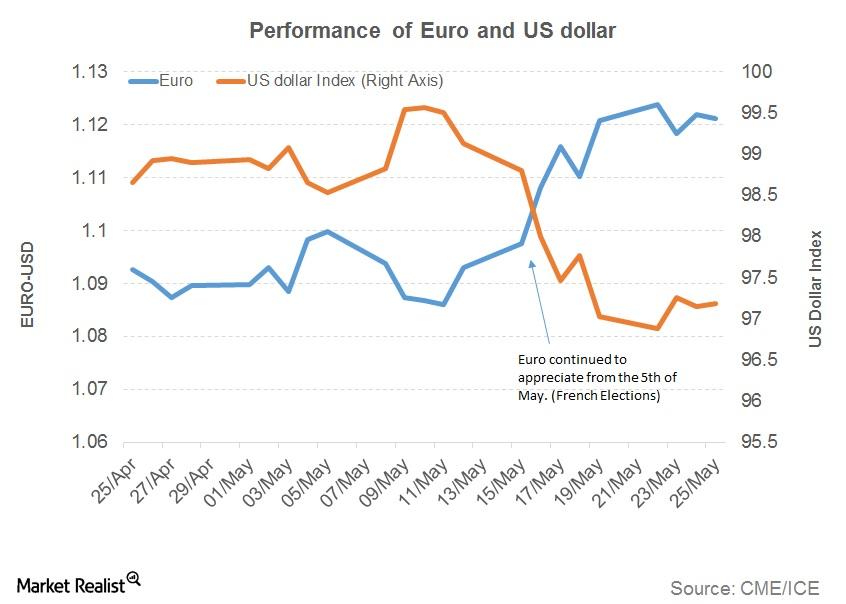

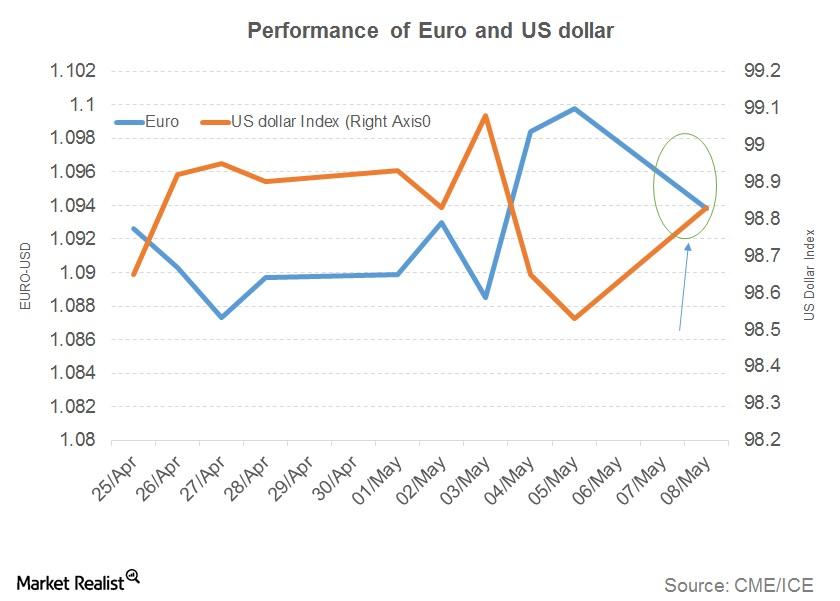

The euro (FXE) closed the week at 1.1196 to the US dollar (UUP), posting a 0.76% loss compared to the previous week.

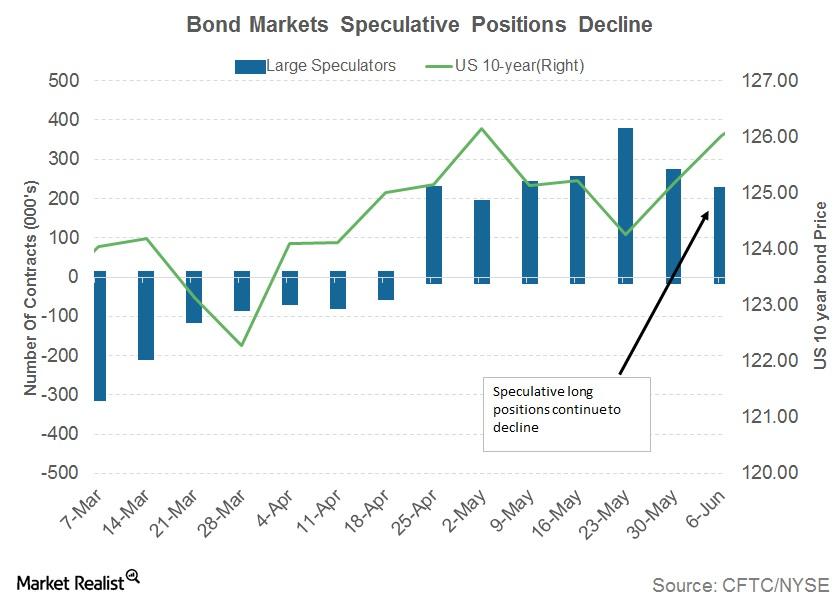

Could an FOMC Rate Hike Drive Bond Yields Higher?

Bond yields of U.S. Treasuries managed to recover from the losses of the previous week. Demand for US bonds receded.

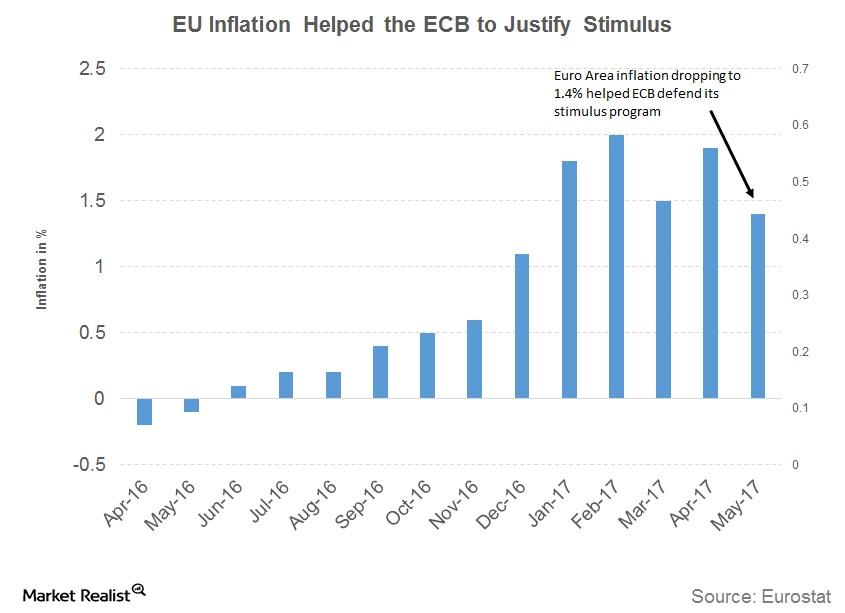

Why the ECB Closed the Door on Further Rate Cuts

The ECB (European Central Bank) left interest rates unchanged at 0% in the rate-setting meeting that was held on Thursday, June 8.

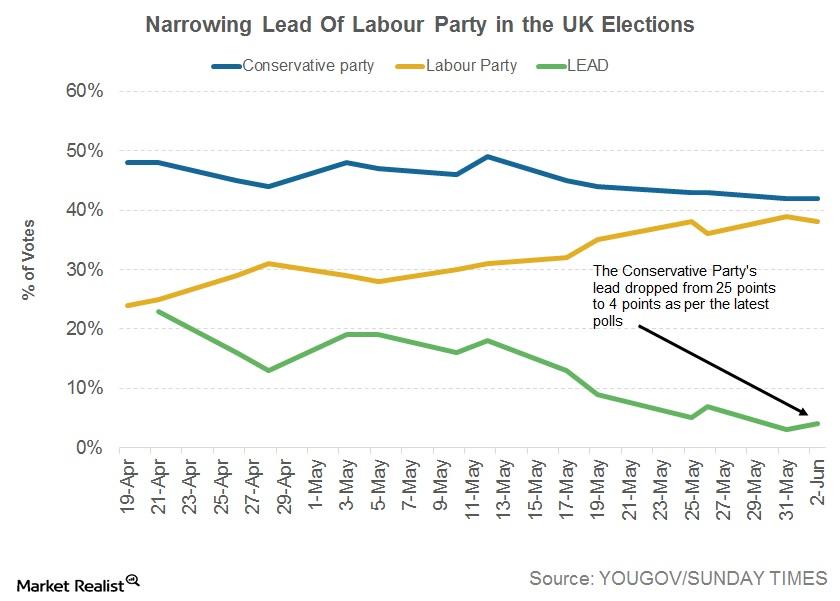

Will UK Elections Give the Markets Another Shock?

After the surprising Brexit vote, the United Kingdom is bracing for another possible election surprise on Thursday, June 8.

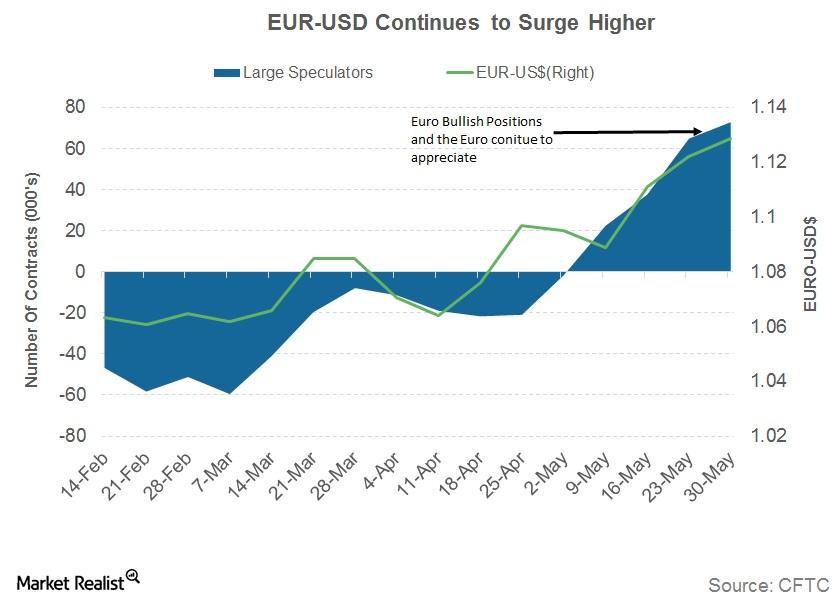

Will the ECB Stop the Surging Euro?

Last week (ended June 2), the euro continued to appreciate against the US dollar.

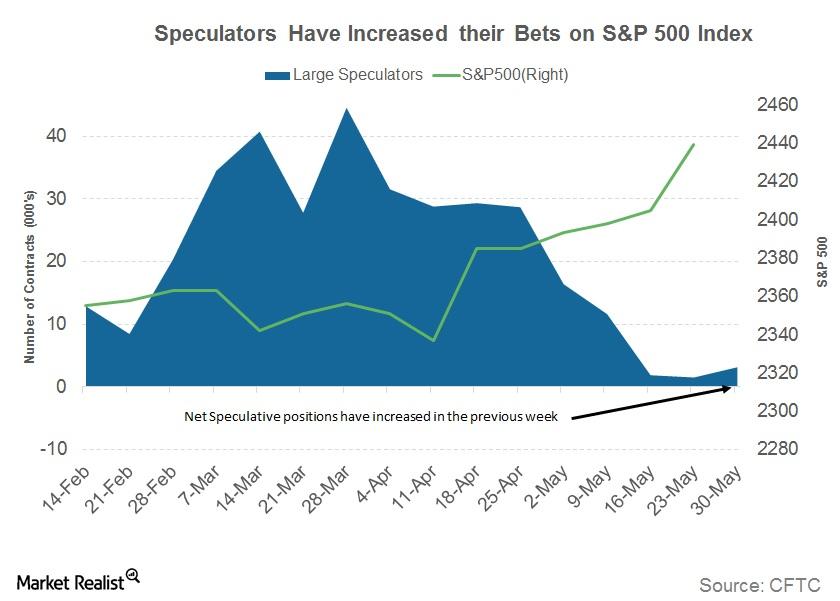

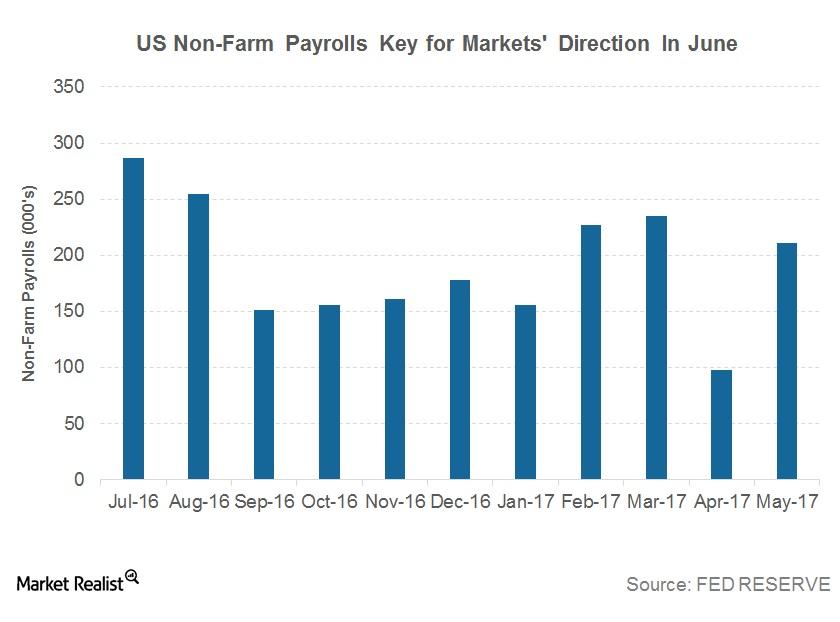

Can the S&P 500 Index Keep Rallying amid Slow Job Growth?

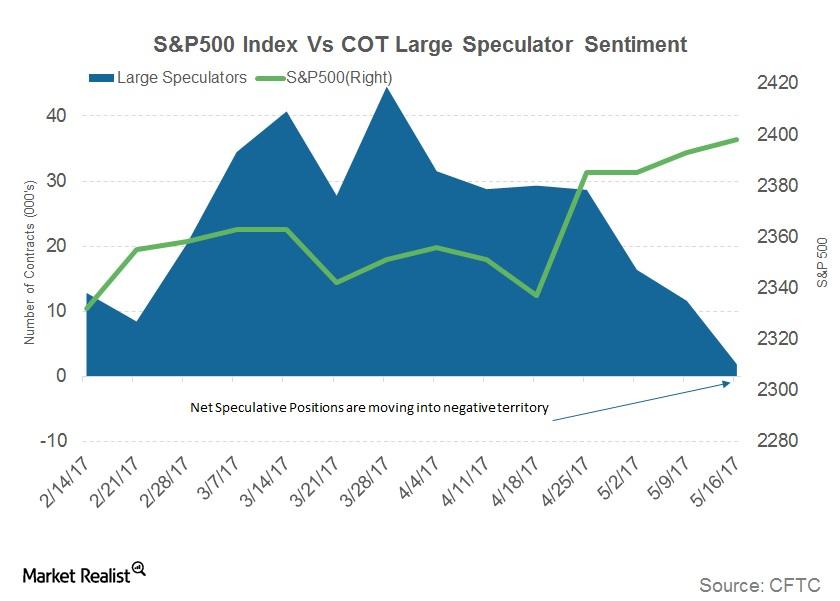

SPY recorded yet another lifetime high of 2,440.04 on Friday, June 2, gaining 0.96% for the week and continuing its 1.43% gain from the previous week.

How the Weak Jobs Data Could Spell Doom for the US Dollar

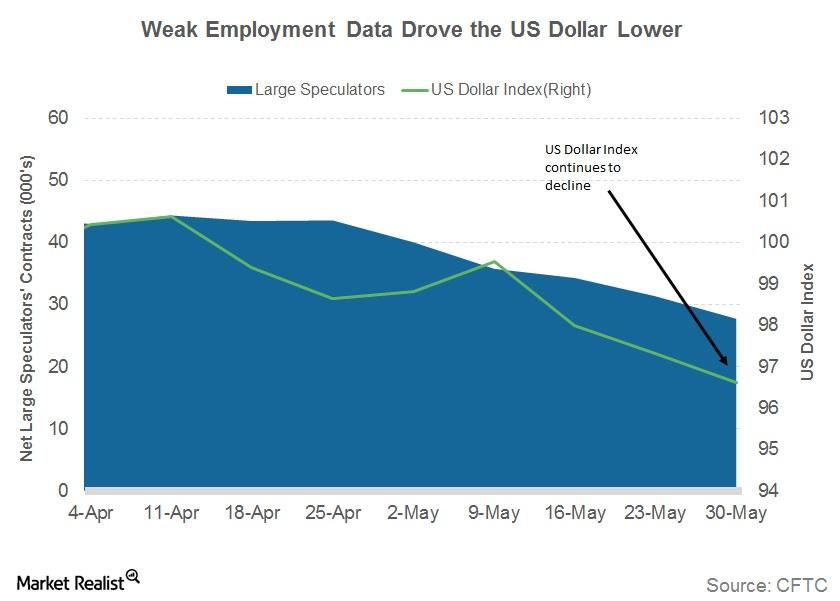

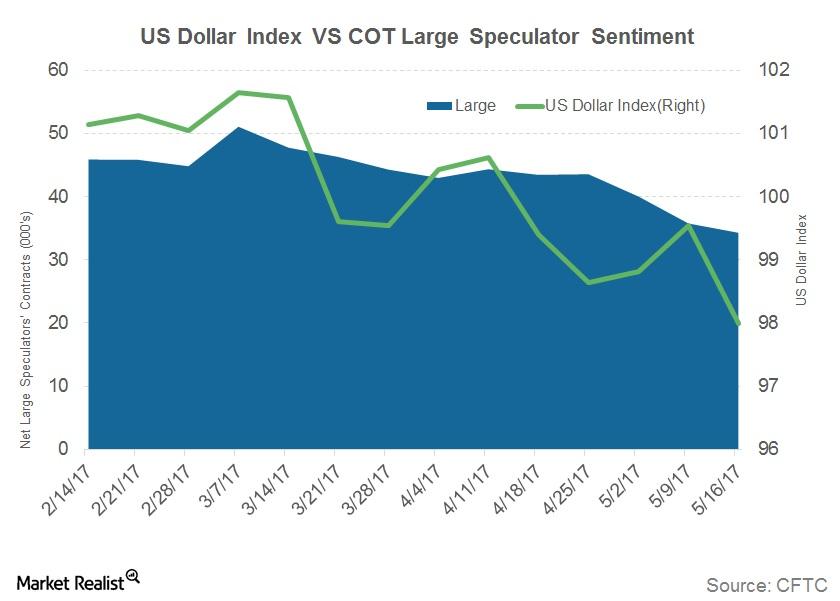

The US dollar came into focus after the weak US jobs data on June 2. The payroll data was a negative surprise, with only 138,000 jobs being added in May.

What to Look Forward to in June

In recent weeks, we’ve witnessed volatile behavior in the markets (SCHB) due to political turbulence in the United States and increased investor impatience.

What the Falling US Dollar Could Indicate for Investors

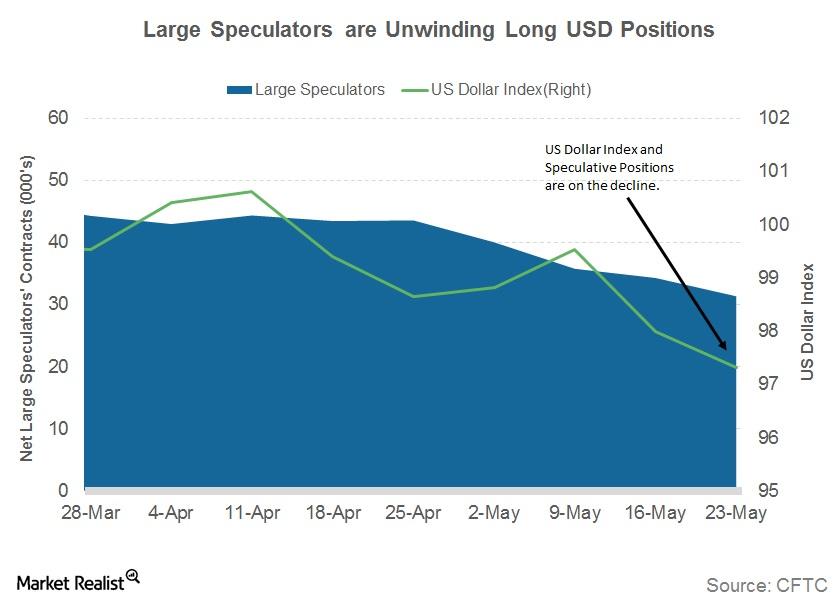

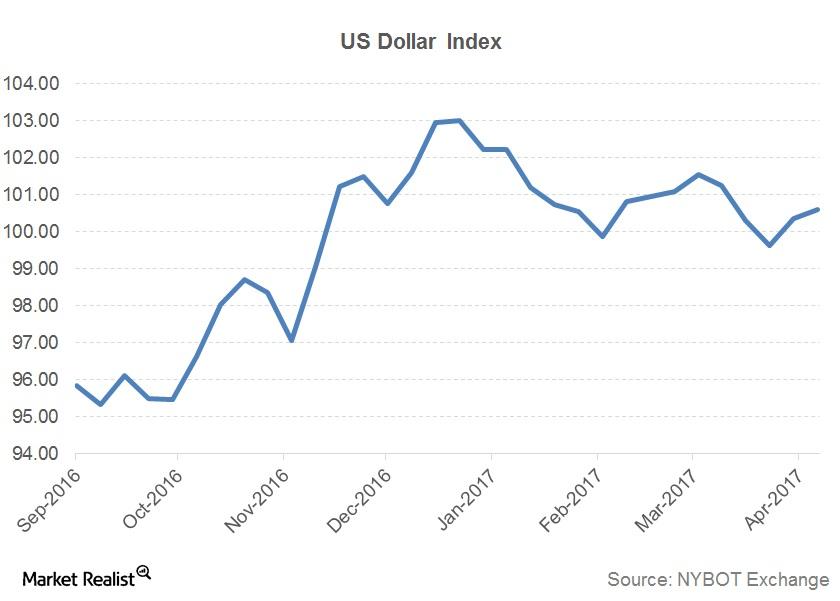

The US dollar (UUP) has continued to lose its value with respect to its trading partners. The US Dollar Index fell 1.6% in the week ended May 26, 2017.

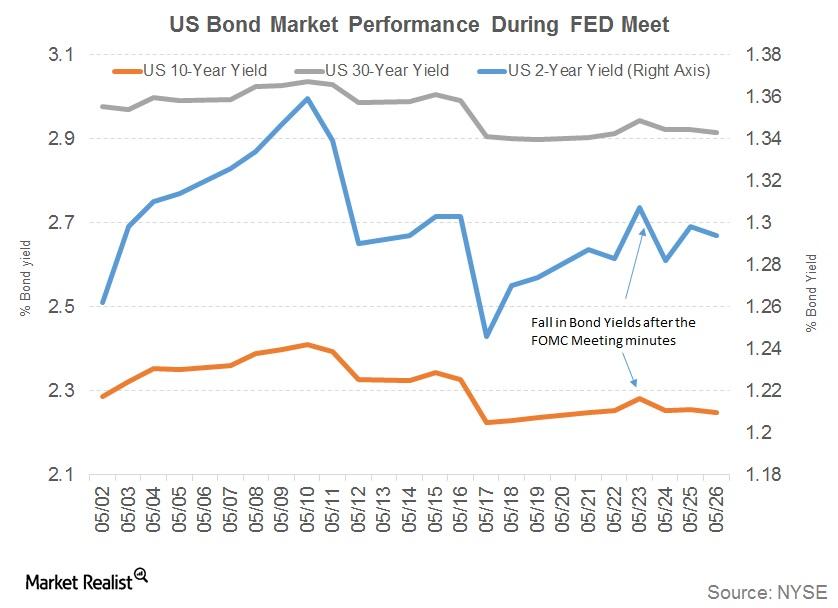

Why Did Bond Yields Fall after the FOMC’s Meeting Minutes?

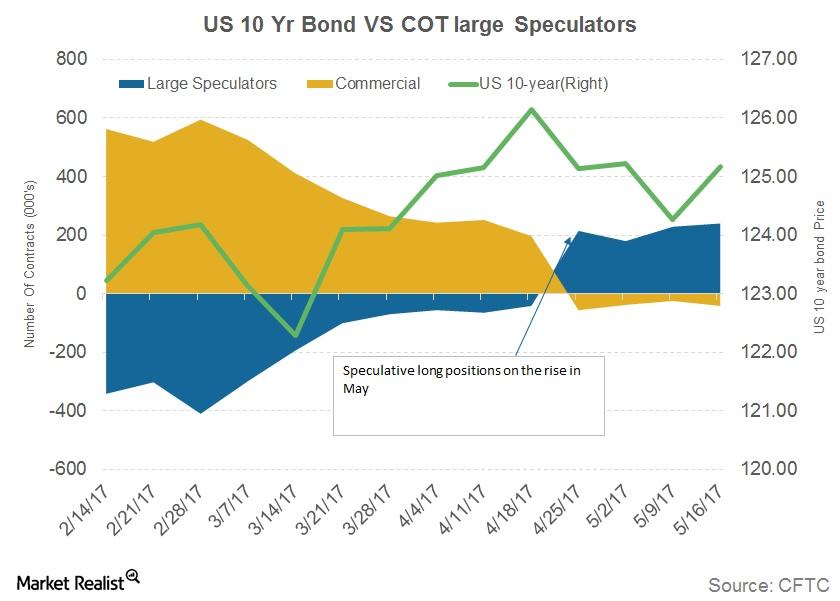

Bond (BND) traders weren’t prepared for the FOMC’s meeting minutes. Expectations were biased for a rate hike in the June meeting.

Forex Markets: Will the Euro Dominate?

The euro-US dollar (FXE) continued to rise and claimed a new six-month peak above 1.1250 after the FOMC minutes didn’t revive the US dollar (UUP) on May 23.

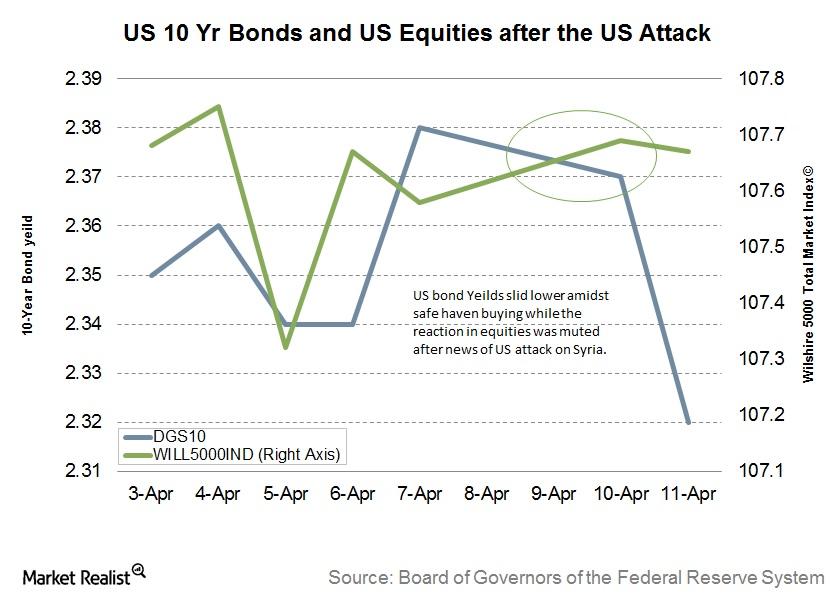

Why Bond Yields Were Unaffected by Trump News

US Treasuries (SCHO) rallied all through the previous week supported by heavy safe-haven inflows into US bonds.

Is the US Dollar the Only Positive for US Economy Right Now?

The US dollar (UUP) continued to trend lower against its trading partners with the US Dollar Index (DXY) losing 2.1% in the week ending May 19, 2017.

Why S&P 500 Speculative Bets Are off the Table

CFTC data released on Friday indicated that commercial traders maintained a net position of 5,756 contracts in the previous week.

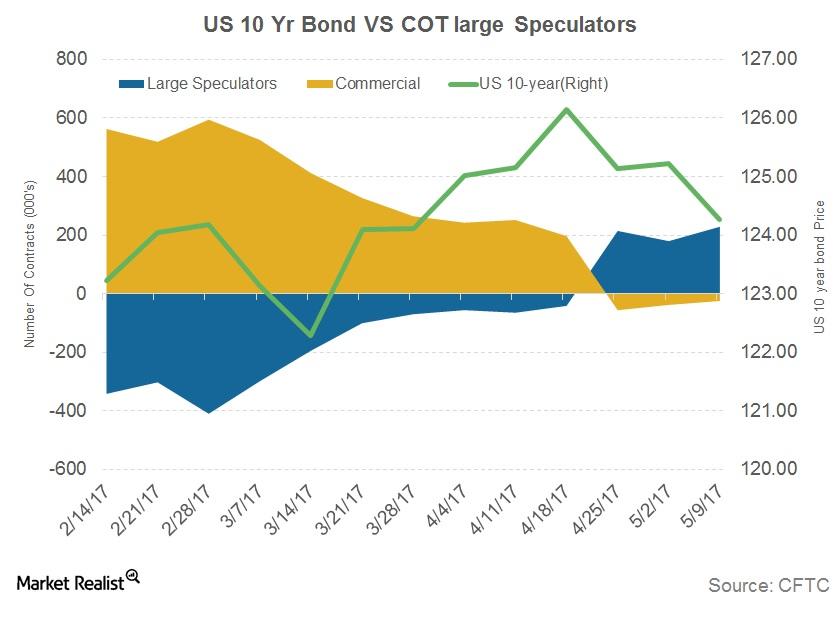

Why Are Bond Traders Increasing Their Net Positions?

US bond markets are trading on the expectation of an interest rate hike by the US Federal Reserve in June 2017. Last week, bond yields extended their slides.

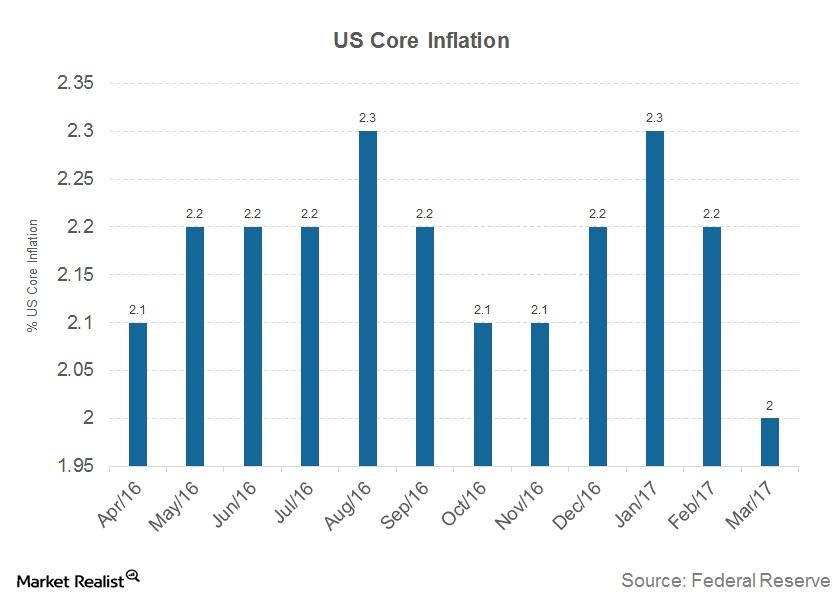

Why Charles Evans Thinks It’s Important to Reach Inflation Goals

Charles L. Evans, president of the Federal Reserve Bank of Chicago, said it’s extremely important that the Fed reach its inflation (VTIP) goal.

Will the Fed’s Balance Sheet Rebalancing Act Disrupt the Markets?

In Rosengren’s view, the markets can absorb the rebalancing of the Fed’s balance sheet only if the entire process is done gradually.

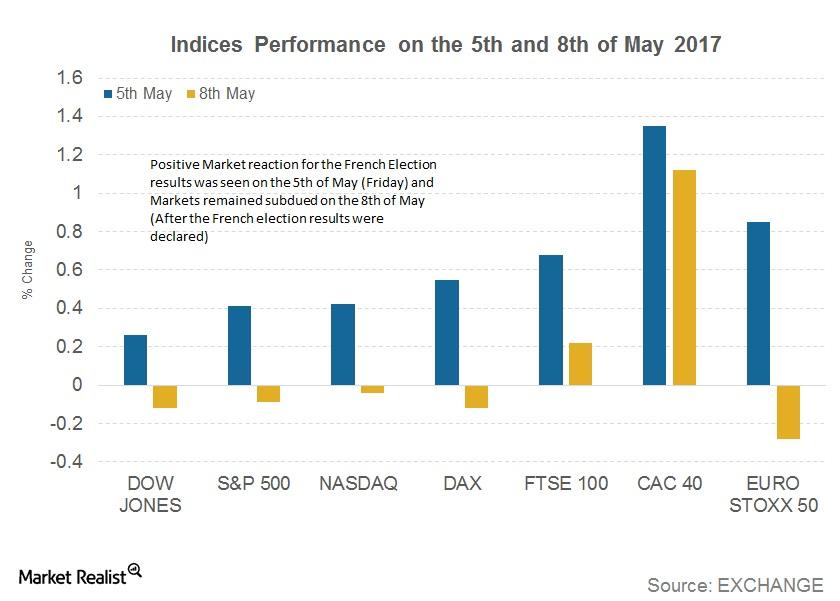

Will Market Optimism Continue after the French Election Results?

The celebration of Emmanuel Macron’s victory in the French election began when the markets opened in Asia on May 8, 2017. Asian markets excluding China (YINN) rose.

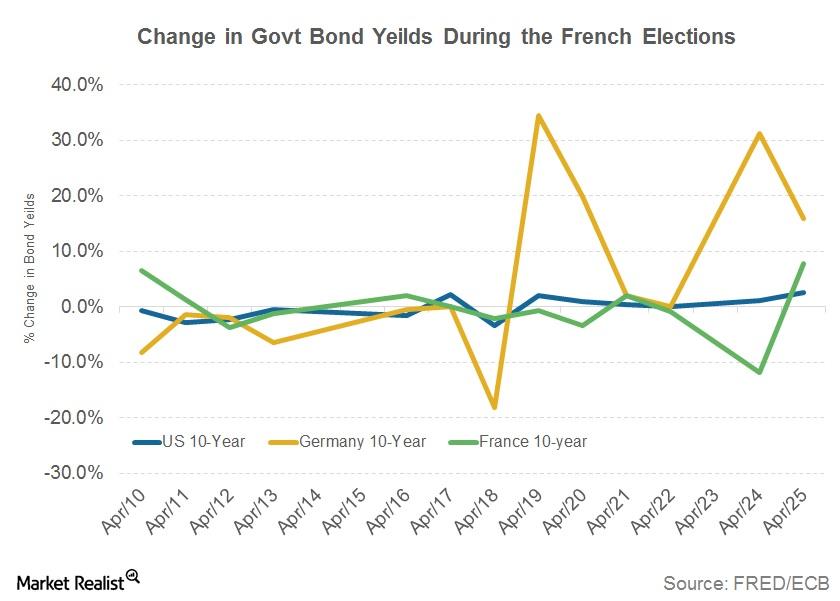

How Fixed Income, Currency Markets Reacted to the French Election

European bonds (BWX) started showing signs of celebration late May 5 as opinion polls pointed toward an Emmanuel Macron win in the French presidential election.

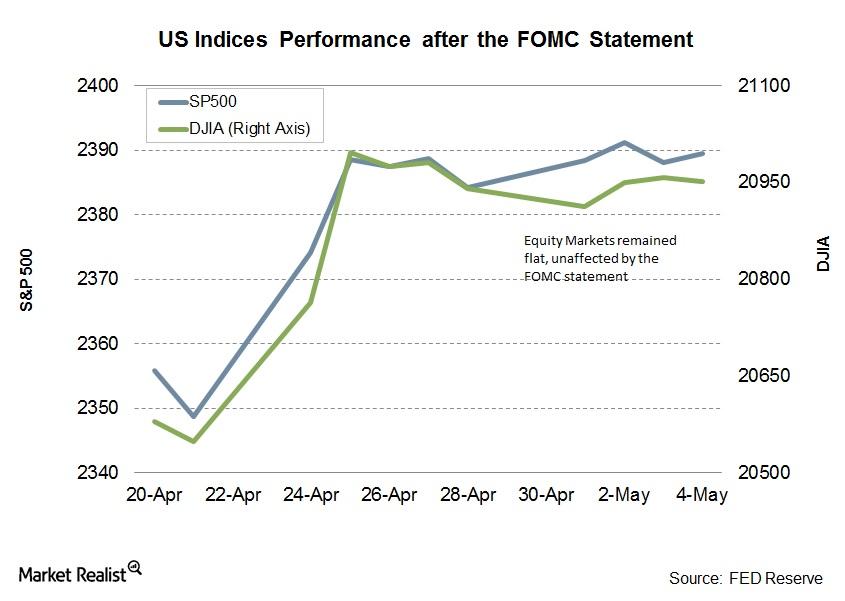

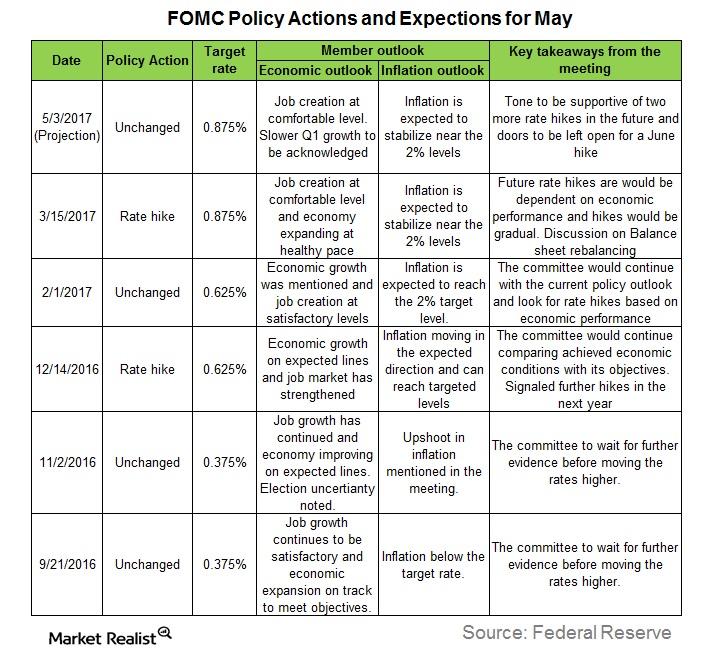

Why the FOMC Statement Didn’t Affect Equity Markets

Since the previous Fed meeting in March, where the Fed announced a 0.25% rate hike, equity markets (IWV) around the globe remained dovish.

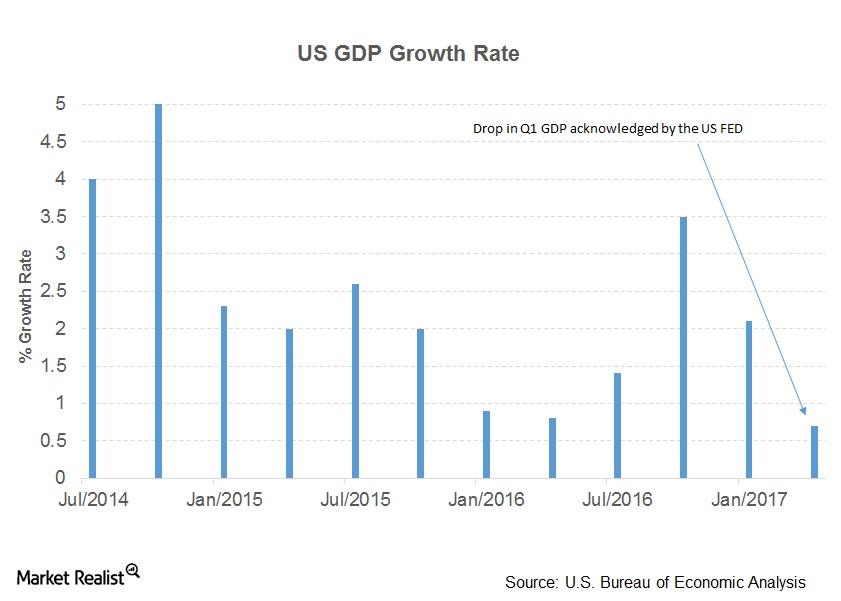

Unpacking the Fed’s Outlook on the US Market

In its May statement, the Fed seems to have gone the extra mile to explain the slowdown in the first quarter.

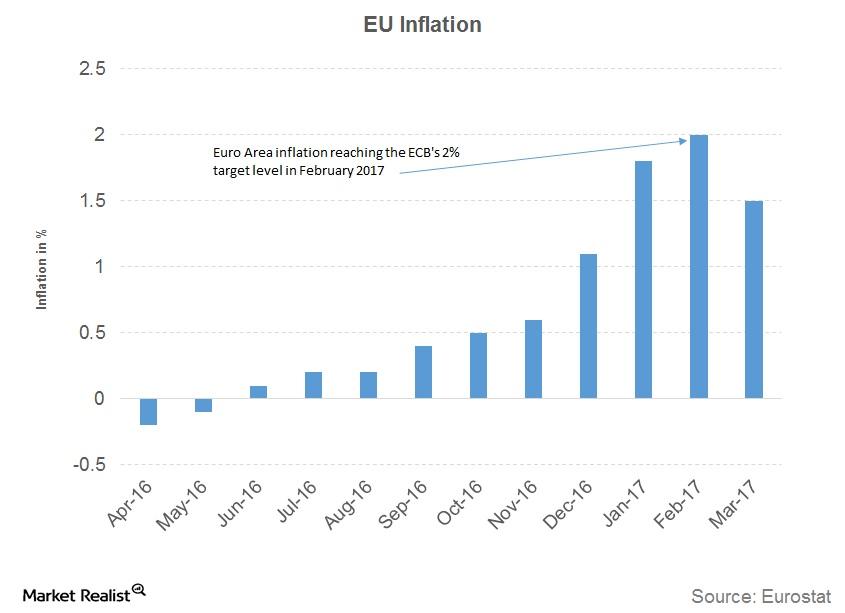

Why the ECB Is Struggling to Hide Its Excitement

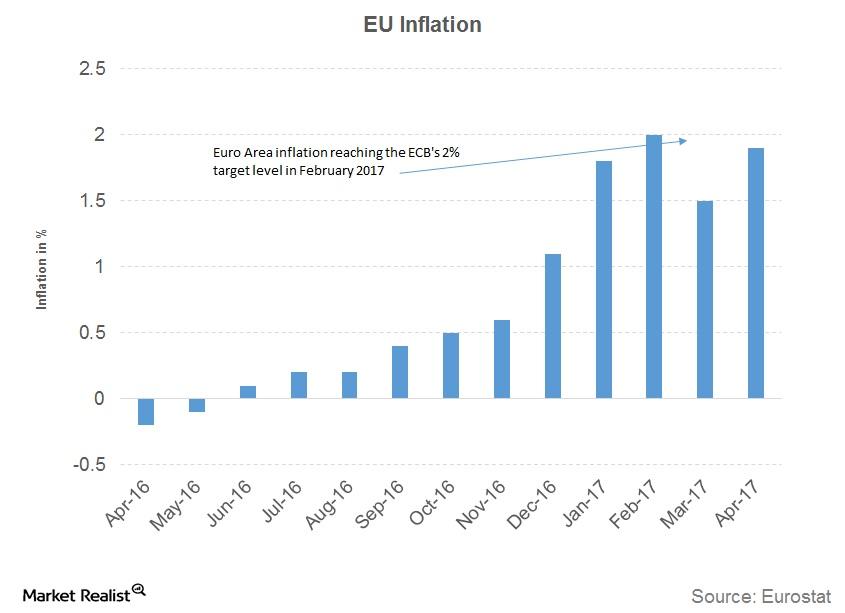

The European Central Bank’s (or ECB) policy statement that was released on April 28 reported that the ECB left monetary policy unchanged, which was in line with expectations.

Will the FOMC Remain Hawkish?

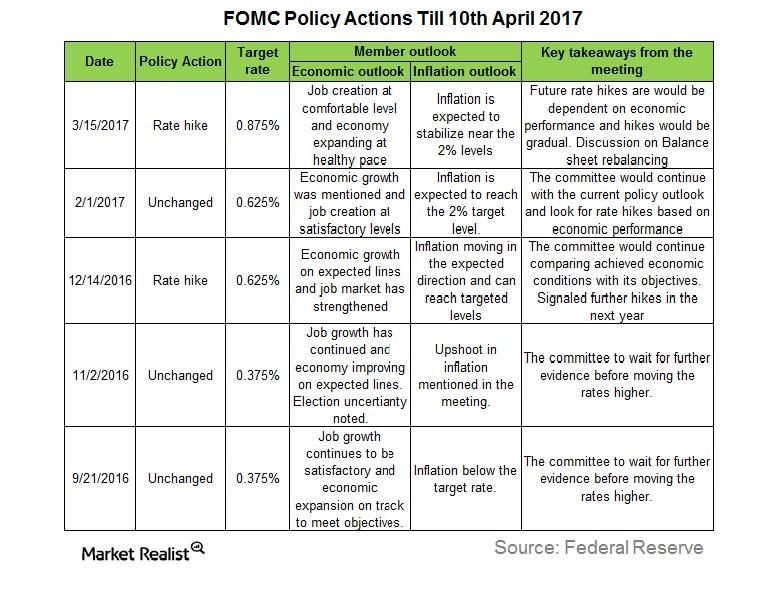

In its last meeting in March, the Fed increased interest rates (SCHZ) by 0.25% and sounded hawkish about the US economy.

How Did Fixed Income Markets React to the First Round?

Demand for fixed income securities will likely be subdued because of excess supply this week, which would mean additional support for bond yields.

Will the European Central Bank Follow the Fed?

On its own stage across the Atlantic from the US Fed, the ECB (European Central Bank) has had its own quantitative easing program.

Inside the Latest Geopolitical Risks: North Korea, Syria, and More

Markets these days are concerned about geopolitical risks more than ever, given the rapid growth in globalization and the interconnections between global markets.

Your Update on the FOMC March Meeting Minutes

The minutes from the FOMC meeting on March 14 and 15 were reported on April 5 and revealed the tone of the conversation among members to be hawkish.

What Do Fed Officials Have to Say after the March Meeting Minutes?

Markets will be monitoring any comments from the Fed going forward, and every future meeting will likely be lively in terms of the possibility of another rate hike.

Inside the Fed’s Balance Sheet (The Biggest in the World)

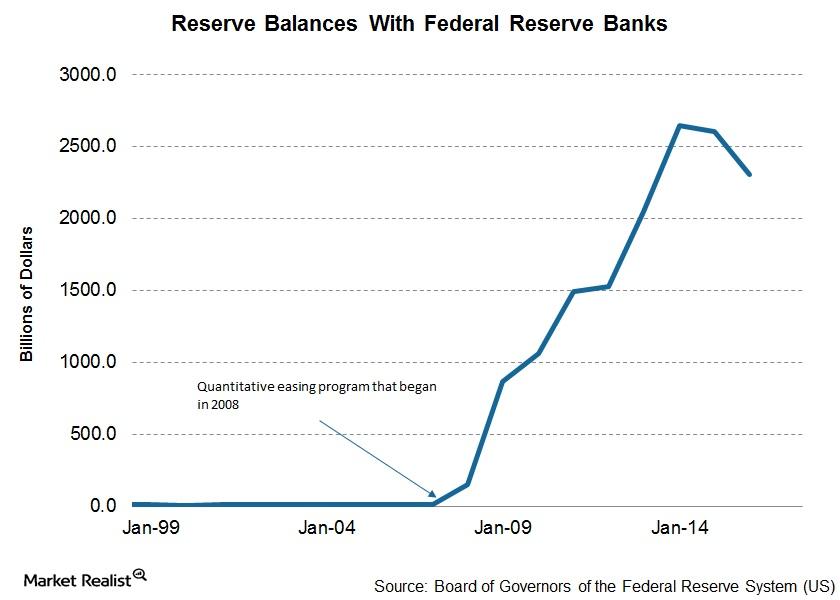

The Fed has started the rate normalization process only recently and has a long way to go before the rates come back to pre-Lehman-collapse levels.

Will the US Dollar Rally?

After the election results were announced in the US, the Dollar Index (UUP) surged to levels above the 103 mark in anticipation of fiscal stimulus, tax breaks, improving economic conditions, and the possibility of rate hikes.