Ricky Cove

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ricky Cove

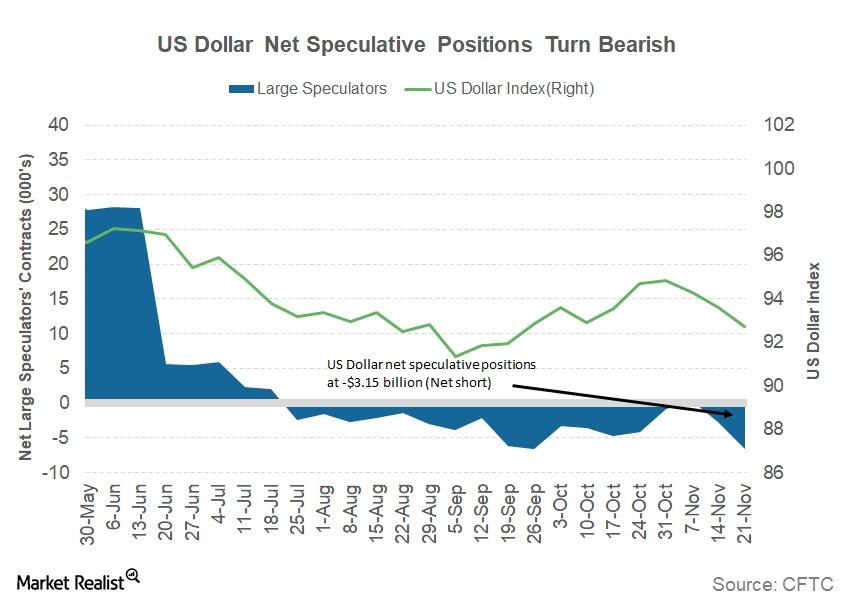

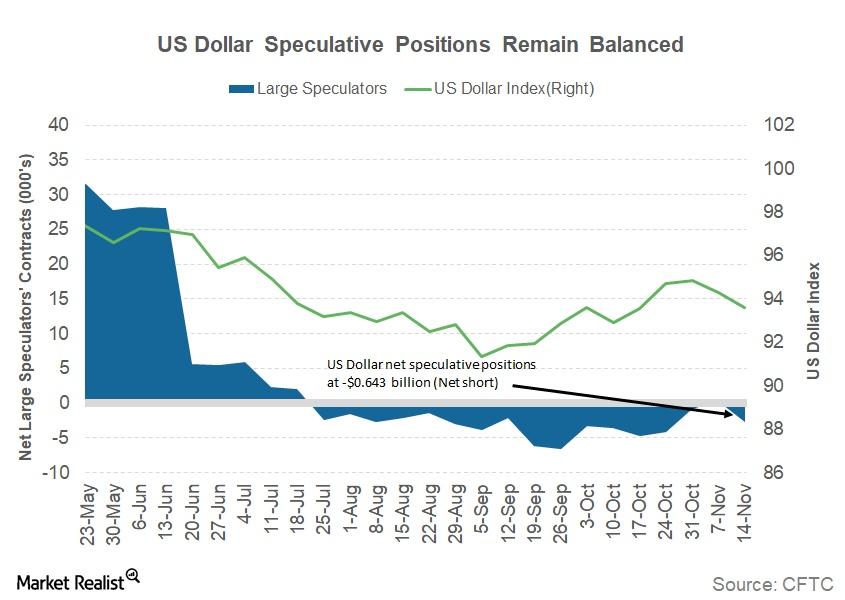

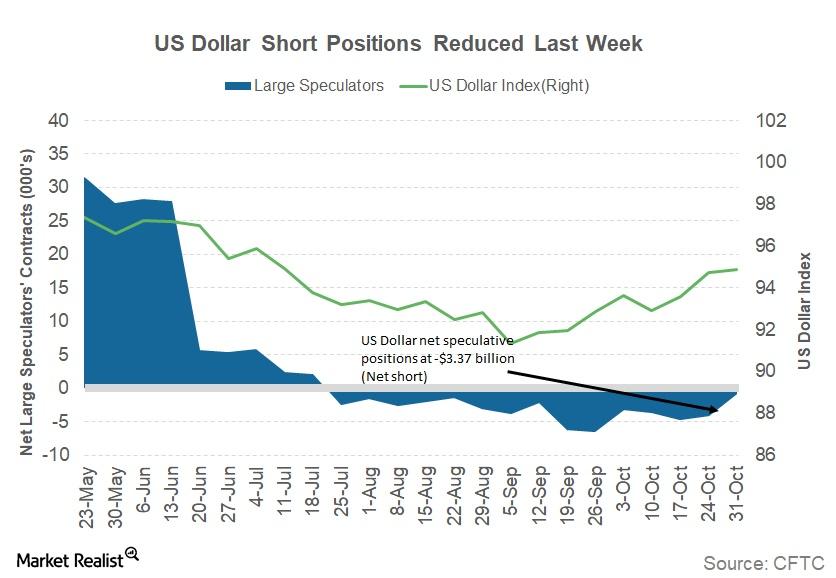

Reasons behind a 3rd Weekly Loss for the US Dollar

The US Dollar Index (UUP) had another bad week as traders offloaded long dollar positions amid tax reform uncertainty last week.

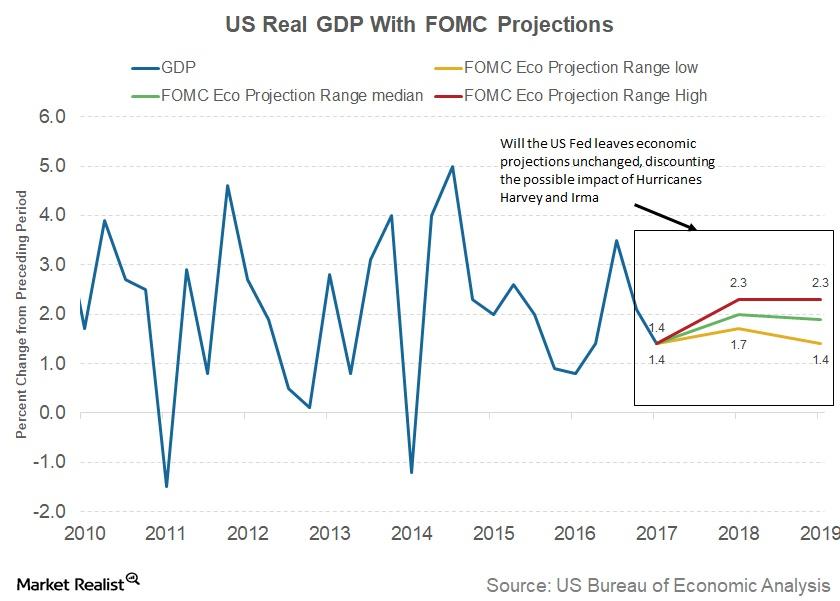

The FOMC’s View on the US Economy

At the November meeting, the FOMC staff review indicated that US labor market conditions continued to strengthen and that the US economy continued to expand at a solid pace.

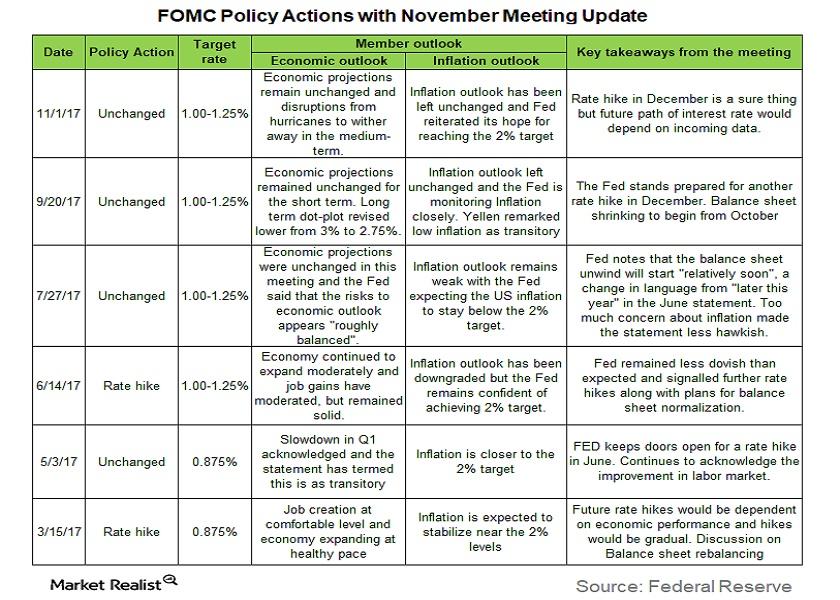

The November FOMC Meeting Minutes: Must-Knows

The last Federal Open Market Committee (or FOMC) meeting took place on October 31–November 1. The target range for the federal funds rate stayed unchanged at 1%–1.25%.

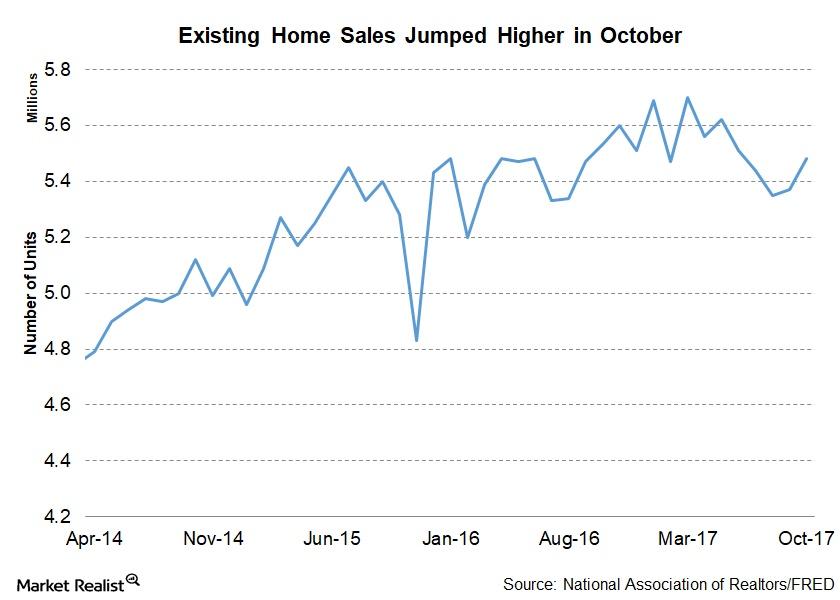

Households Think It’s a Good Time to Buy a Home

According to the latest report from NAR, existing home sales have risen 2% to a seasonally adjusted annual rate of 5.48 million in October.

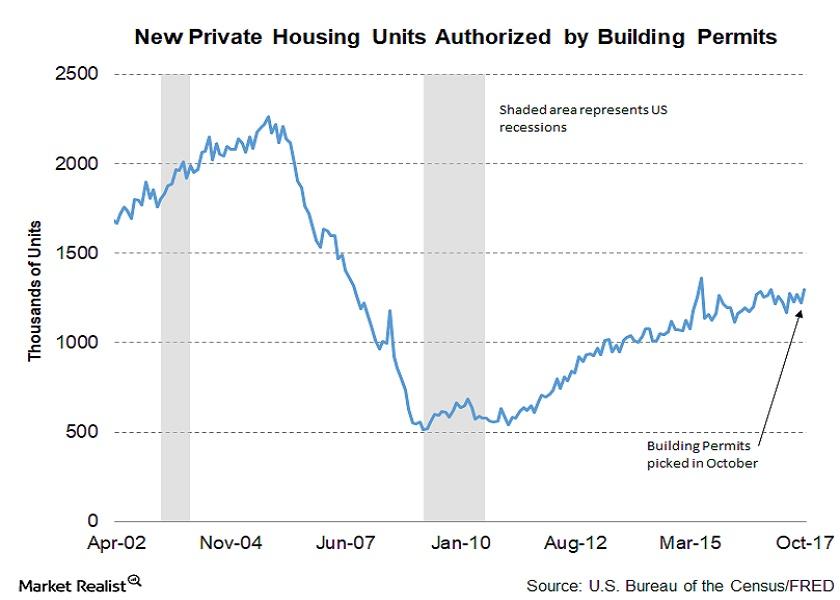

Housing Market: What a Rise in Building Permits Signals

In October 2017, building permits were at a seasonally adjusted rate of 1.297 million—an increase of 5.9% from the reading of 1.225 million in September.

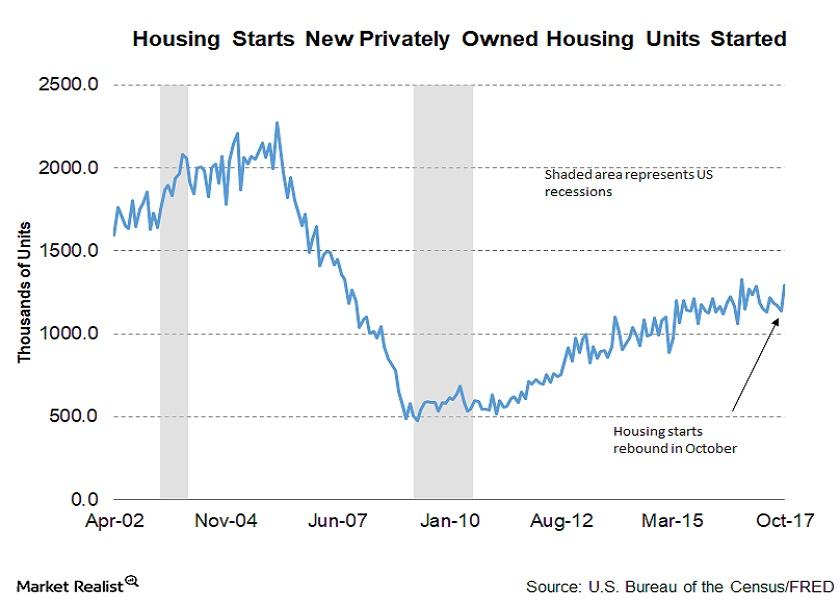

Analyzing Housing Starts in October 2017

In October 2017, housing starts rebounded sharply from the slump in September. October housing starts beat the market’s expectations.

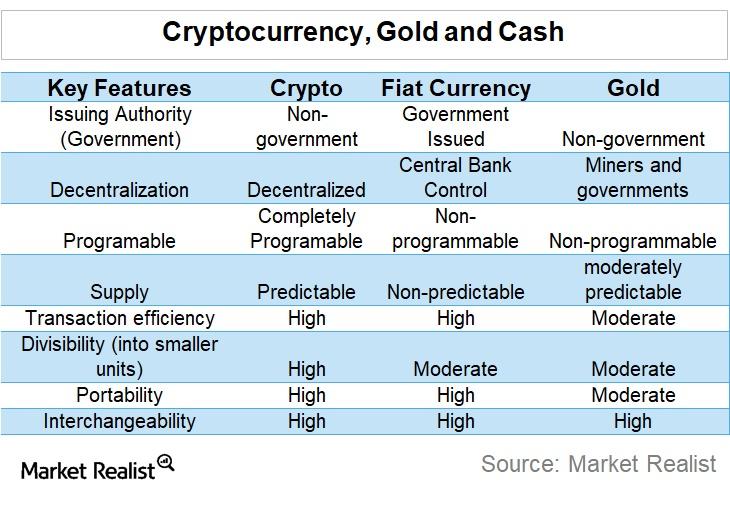

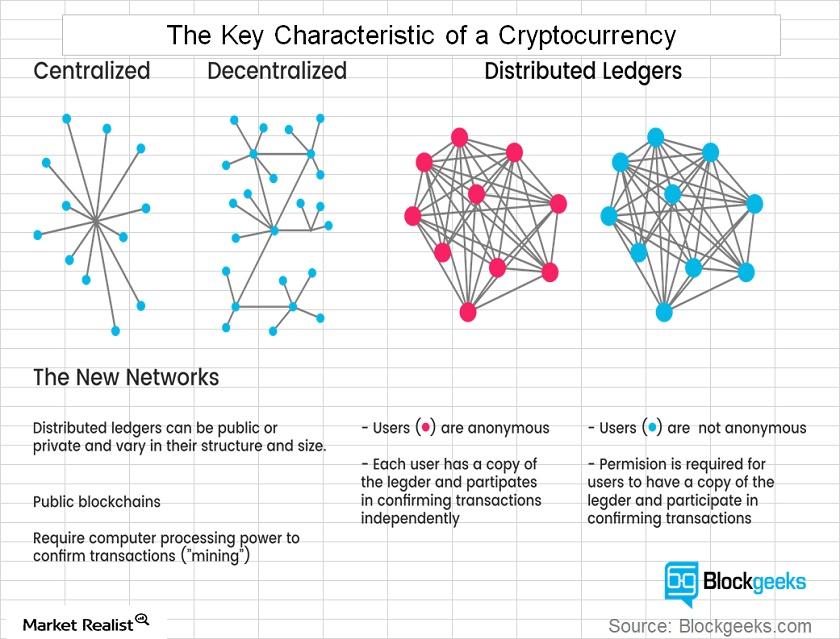

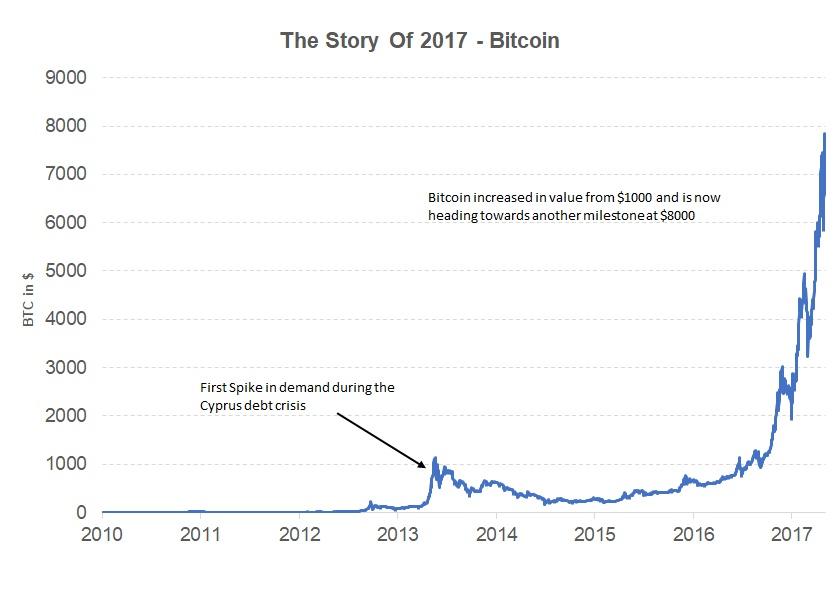

How Bitcoin Differs from Other Currencies

Bitcoin has been rallying for the past year, with some proponents advocating that it could replace fiat currencies in the future.

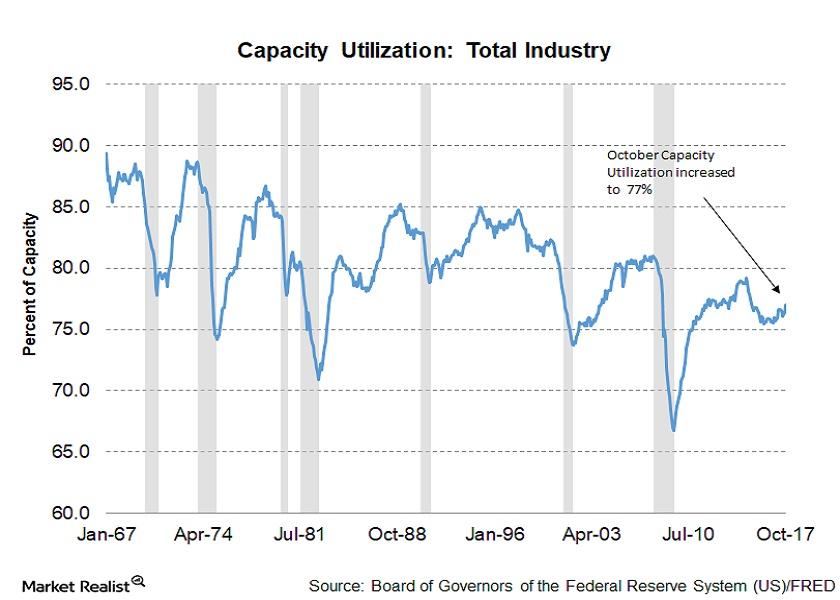

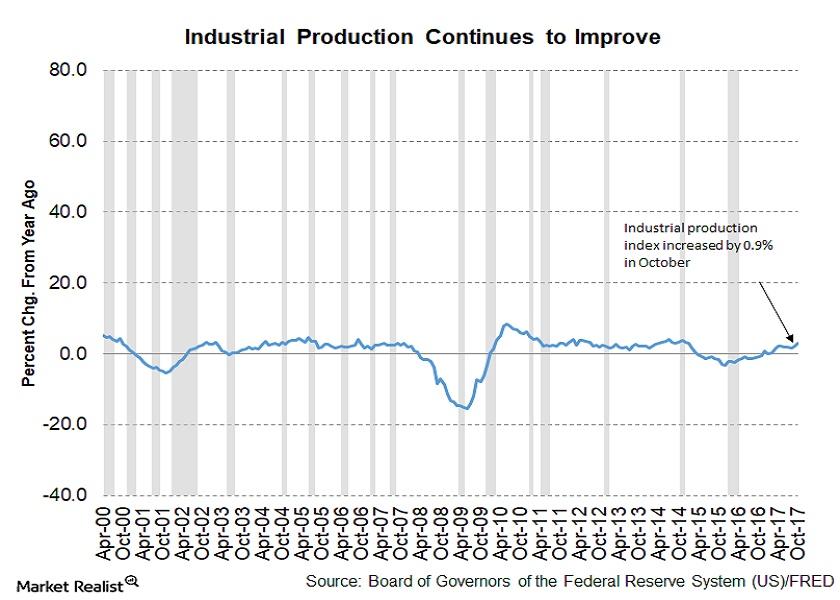

Reading the Trends in Capacity Utilization across US Industries in October

Among the key macroeconomic indicators published by the Fed, capacity utilization in US industries helps investors forecast business cycle changes.

Which Industries Increased Industrial Production in October?

The October Industrial Production report was released by the Fed on November 16 and showed a continued rebound in key sectors of the US economy.

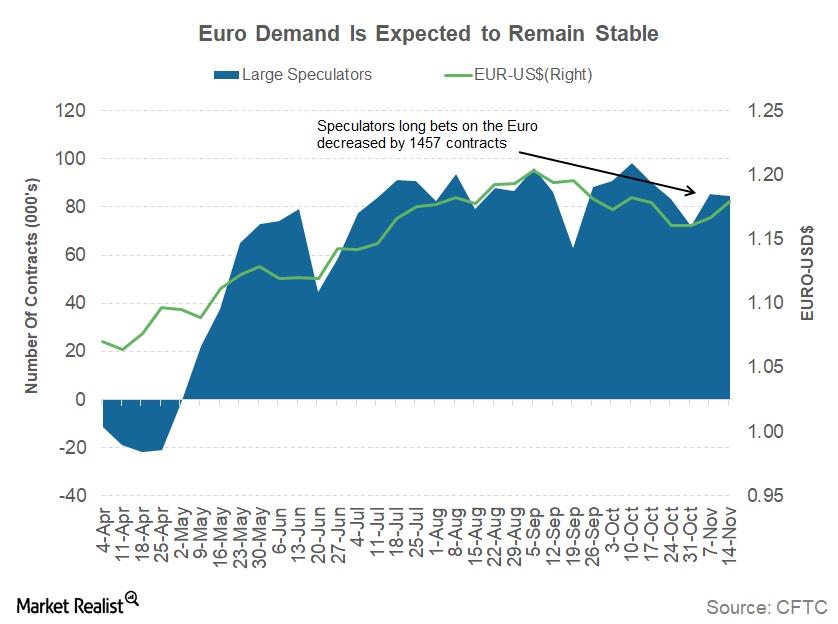

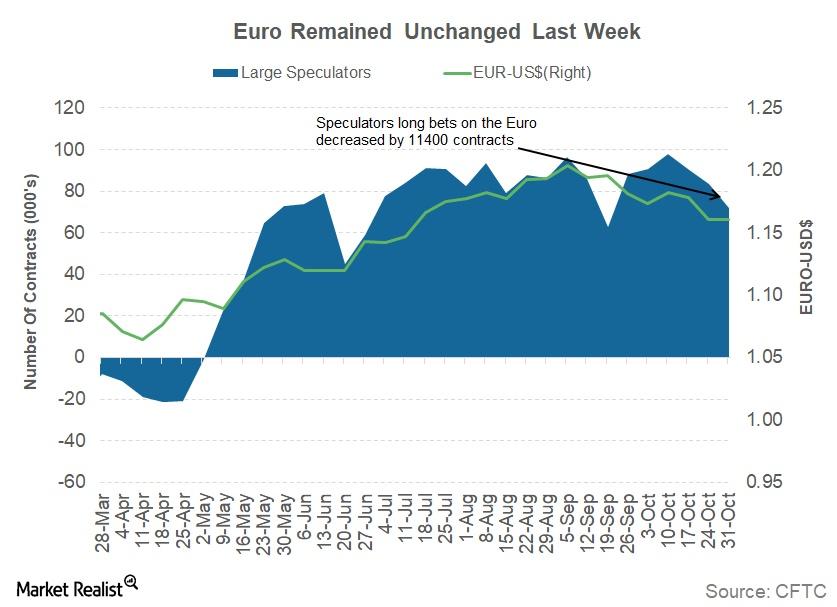

What Drove the Euro Higher against the Dollar Last Week?

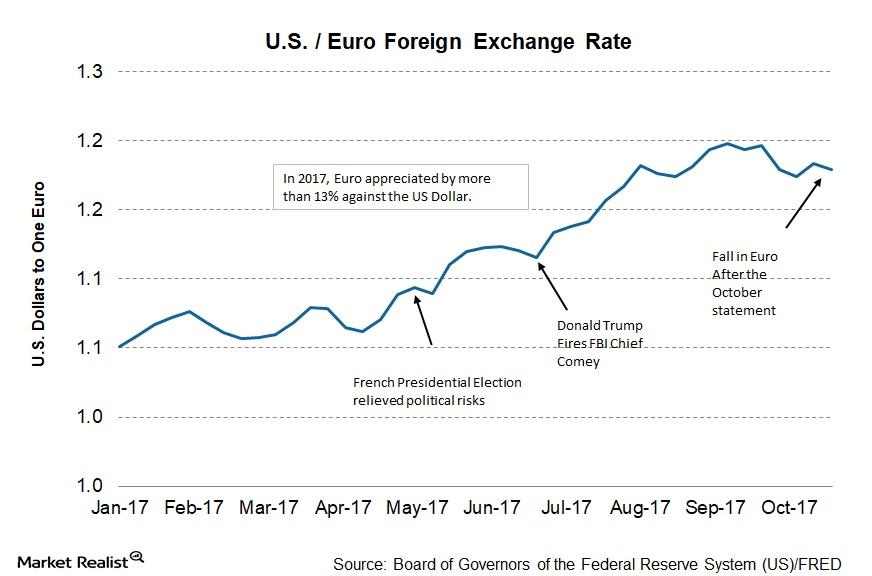

The euro-dollar (FXE) closed the week ending November 17 at 1.2, appreciating by 1.1% against the US dollar (UUP).

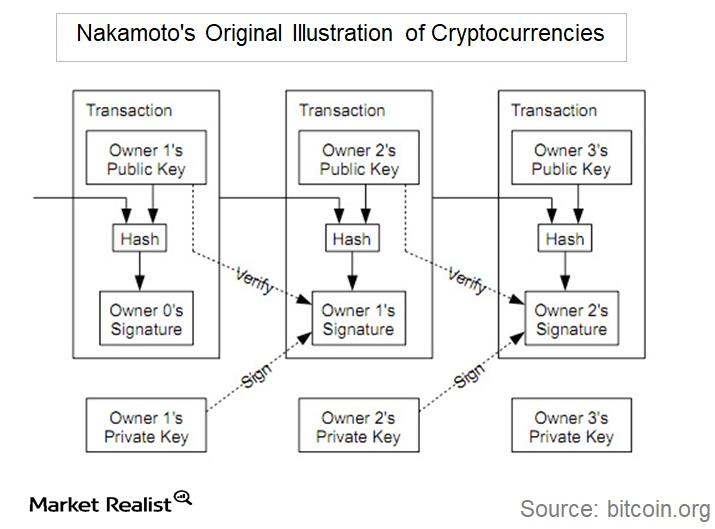

Breaking down Bitcoin and Cryptocurrencies: Key Characteristics

In the case of bitcoin, the safety of the system is linked with the bitcoin algorithm, which miners keep solving to generate new coins and maintain the system.

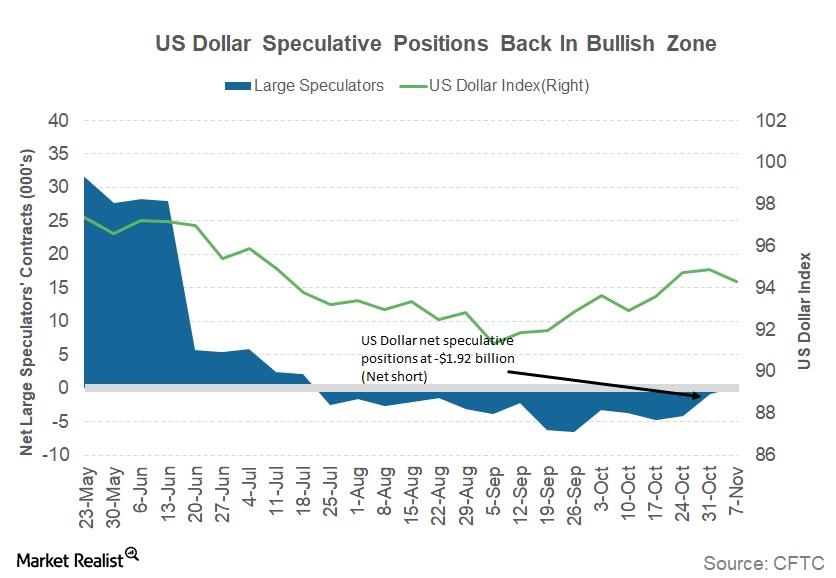

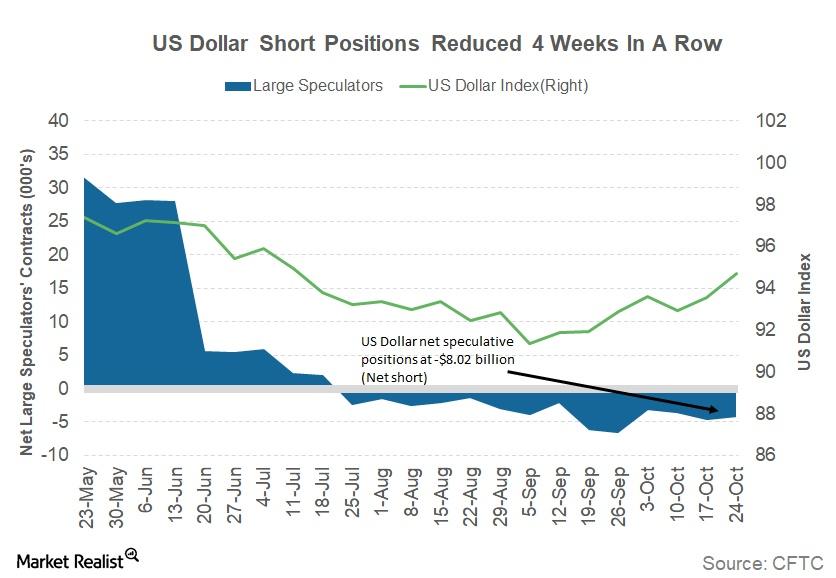

Could US Dollar Recover This Week?

The US Dollar Index (UUP) continued to struggle as the fate of US tax reform remains uncertain.

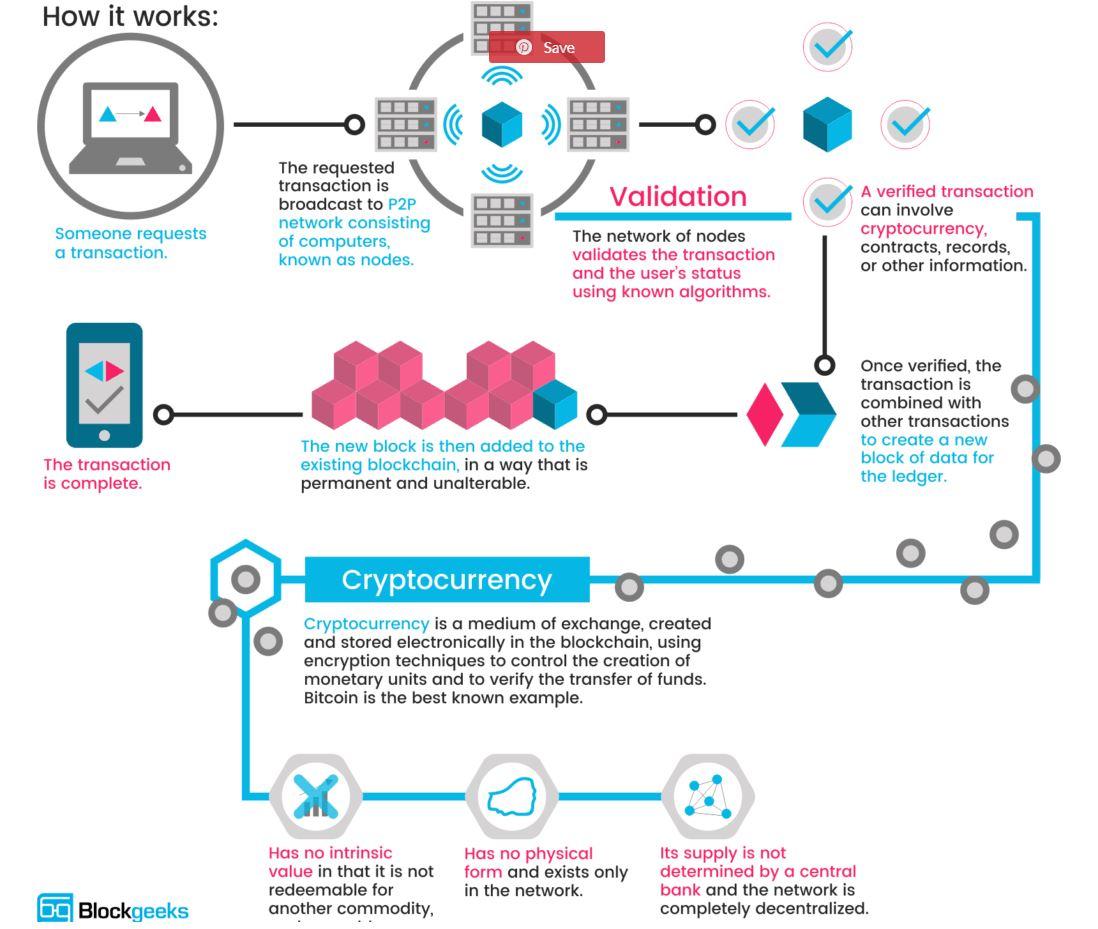

Is Blockchain Technology Really the New Internet?

It’s important that we understand the core technology behind cryptocurrencies if we want to appreciate the ingenuity of the bitcoin creation.

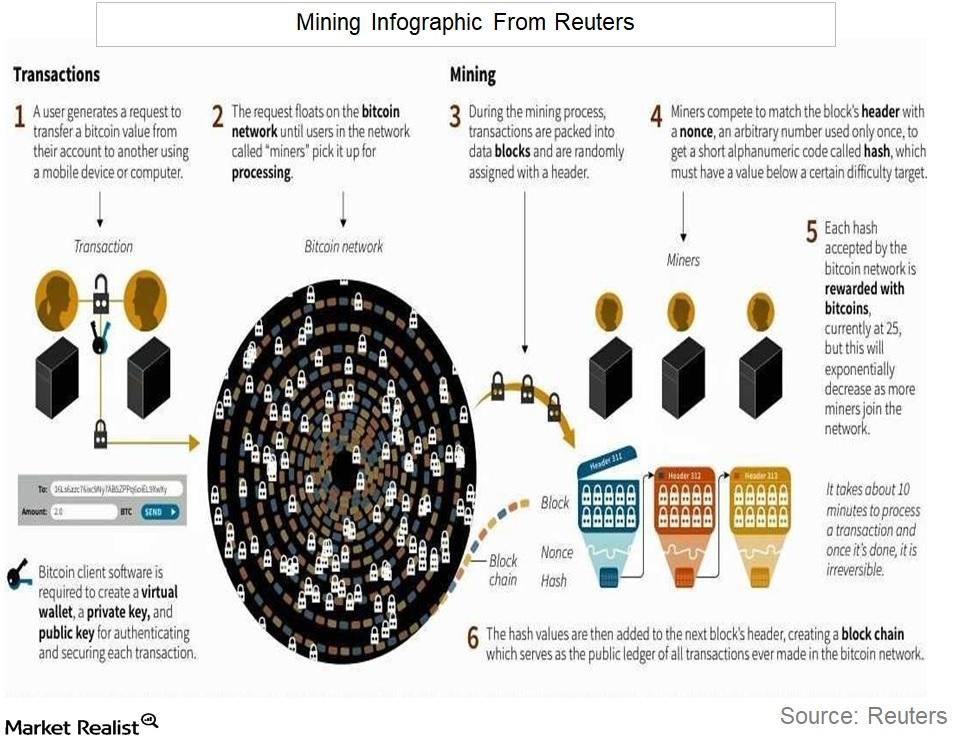

How Bitcoins Are Created Today

In the bitcoin world, mining involves investing a lot of capital in computer hardware and competing with fellow miners to solve a complex mathematical problem.

How the First Bitcoin Was Created

Satoshi Nakamoto is considered to be the founder of bitcoin, but the actual identity of Satoshi Nakamoto is not known.

How Did Bitcoin Come to Be?

The idea behind bitcoin is simple: to create a new platform for transactions that are independent of central banks and involve minimal transaction costs.

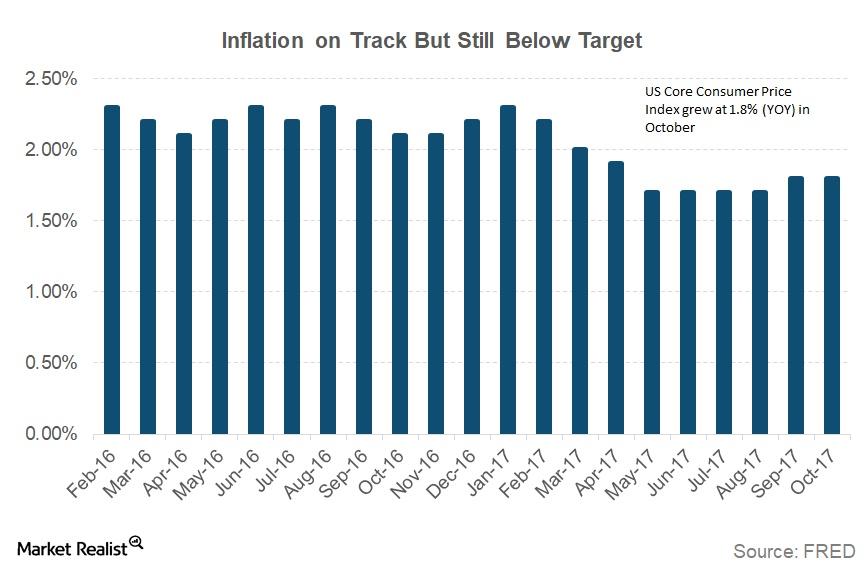

Chart in Focus: The Consumer Price Index Rose in October

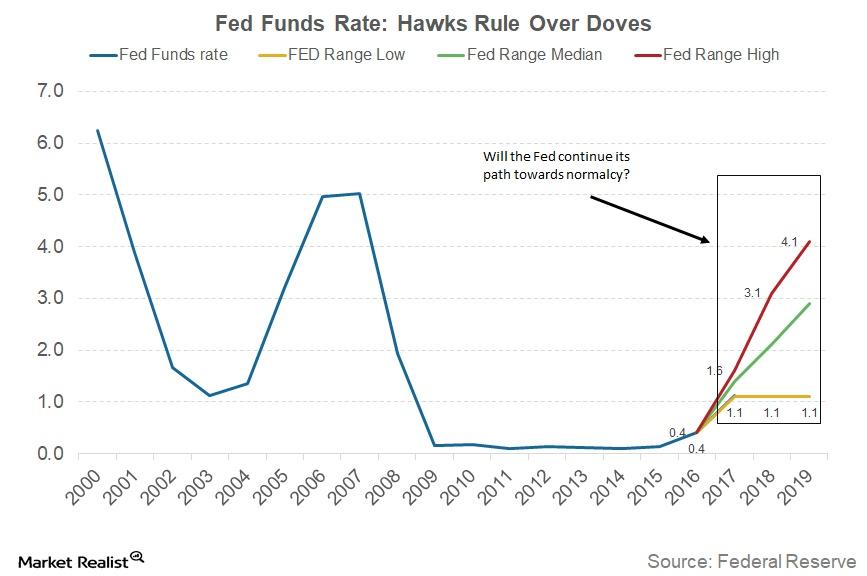

The Fed is expected to increase the target funds rate by 0.25% at its December meeting.

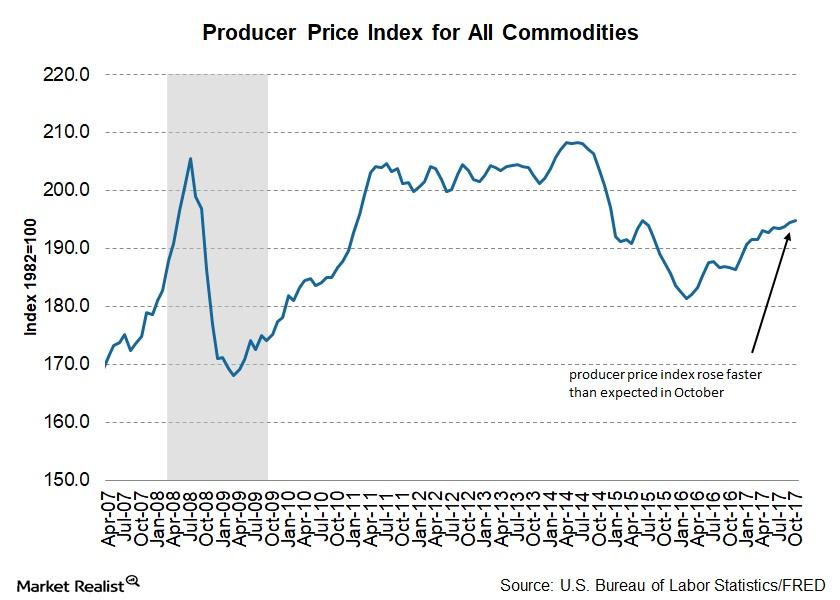

How an Increase in the Producer Price Index Affects the Economy

The October Producer Price Index rose 0.4% month-over-month, and it was unchanged compared to the September reading. On a year-over-year basis, the index has risen 2.8%.

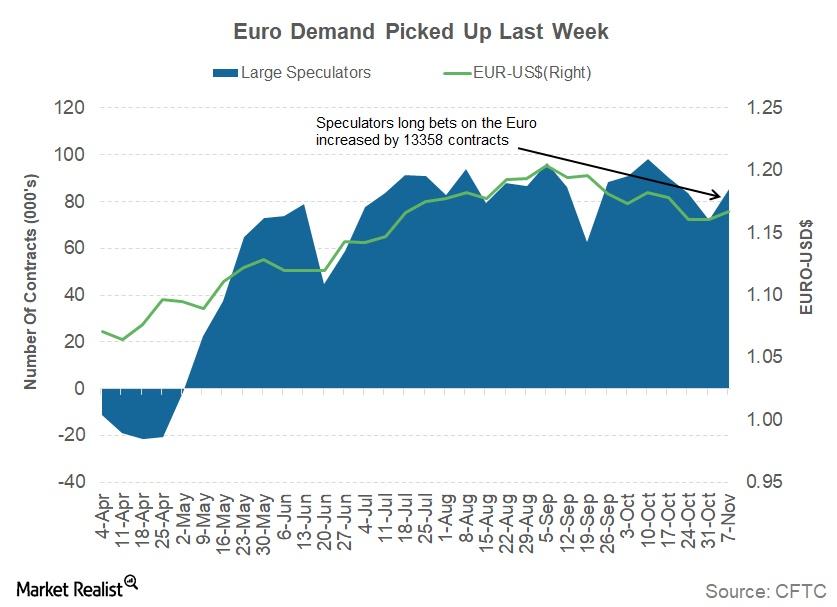

How Euro Managed to Bounce Back Last Week

The euro-dollar (FXE) pair closed the week ending November 10 at 1.2, appreciating 0.48% against the US dollar (UUP).

Will US Dollar Survive Tax Reform Uncertainty?

The US Dollar Index (UUP) lost steam last week after posting three consecutive weekly gains.

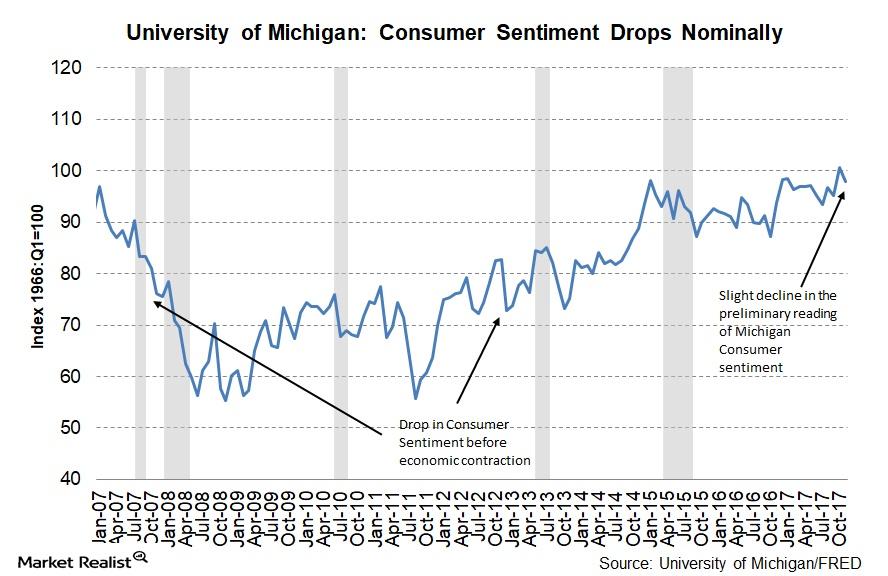

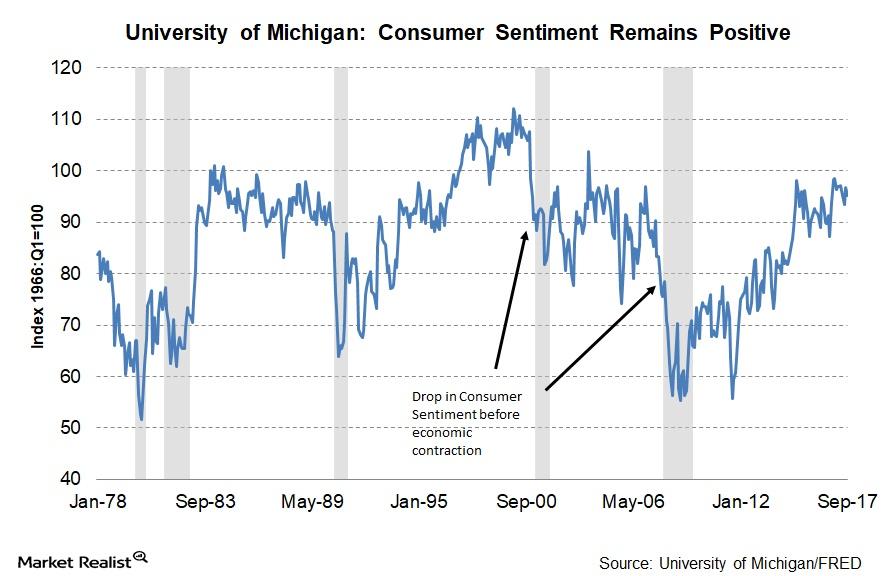

Here’s What Drove Consumer Expectations Lower in November

The University of Michigan Preliminary Consumer Sentiment for November was reported at 97.8, which was 2.9 lower than the final October reading of 100.7.

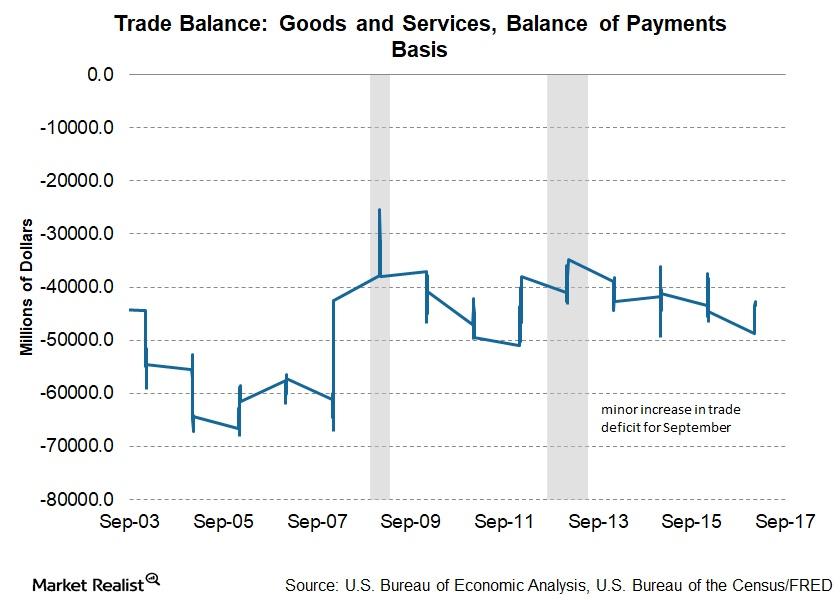

What Led to the Rise in the US Trade Deficit in September?

The latest report was released on November 3 and indicated that the goods and services deficit was $43.5 billion in September, or $0.7 billion higher than in August.

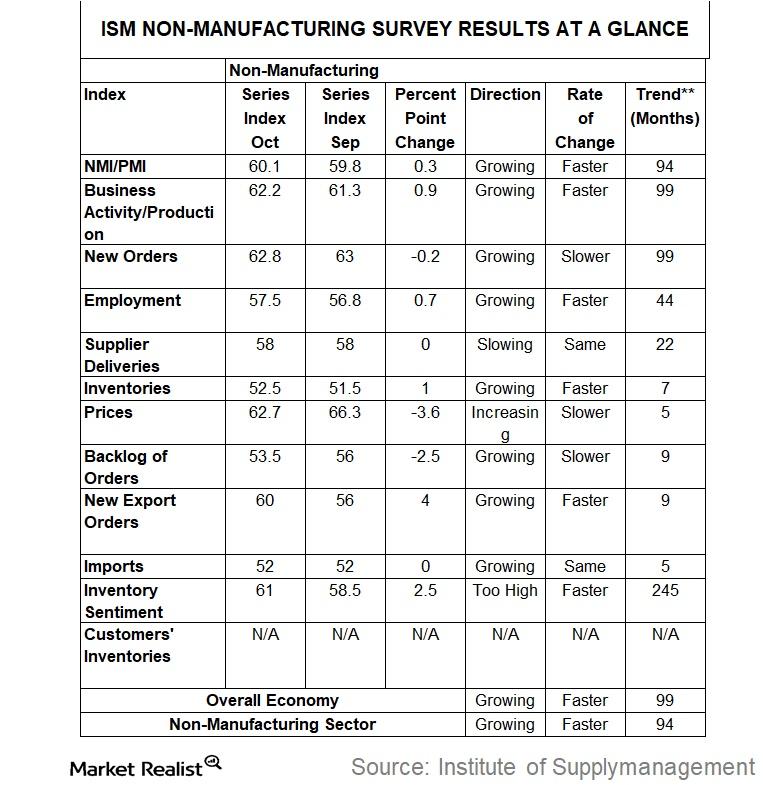

This ISM Index Hit a Lifetime High in October

For October, service sector activity rose at a pace not seen since the inception of the report. The non-manufacturing index reached a lifetime high of 60.1.

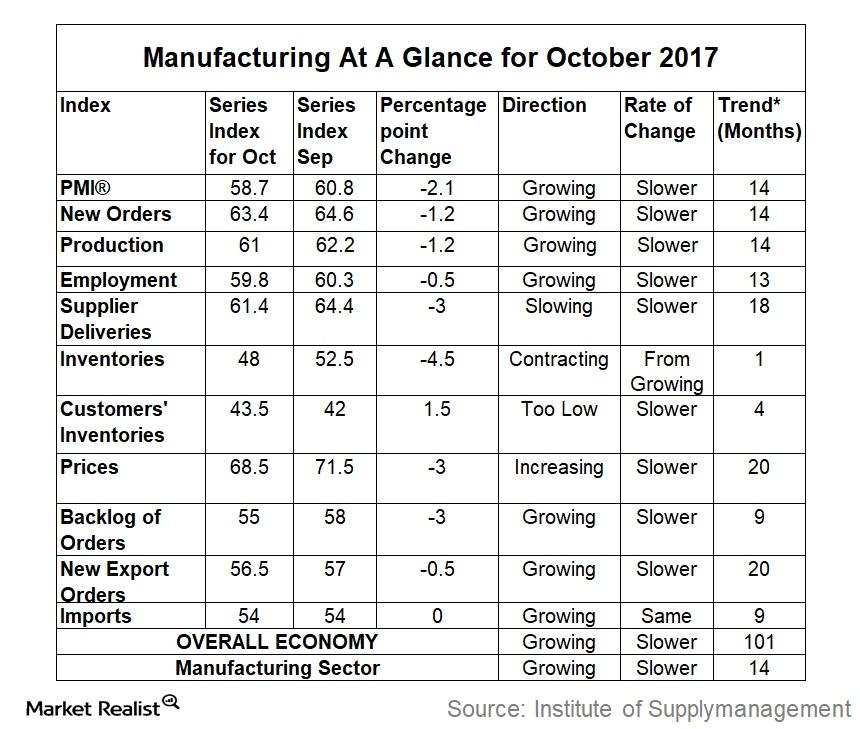

What Caused the Fall in Manufacturing Activity in October?

The US Manufacturing PMI (purchasing managers’ index) for the month of October fell to 58.7, compared with 60.8 in September.

Key FOMC Insights and the New Fed Chair

The US FOMC left rates unchanged after the November 2017 meeting, as expected, setting the stage for a potential rate hike in December.

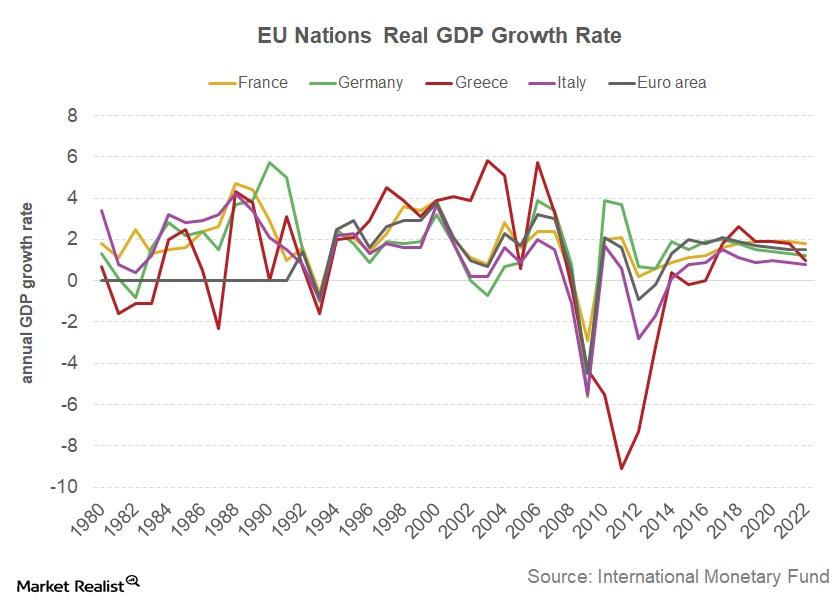

Why the IMF Upgraded Its Eurozone Growth Forecast

The International Monetary Fund (or IMF) has upgraded its growth projections for Eurozone countries, including France, Germany, Italy, and Spain.

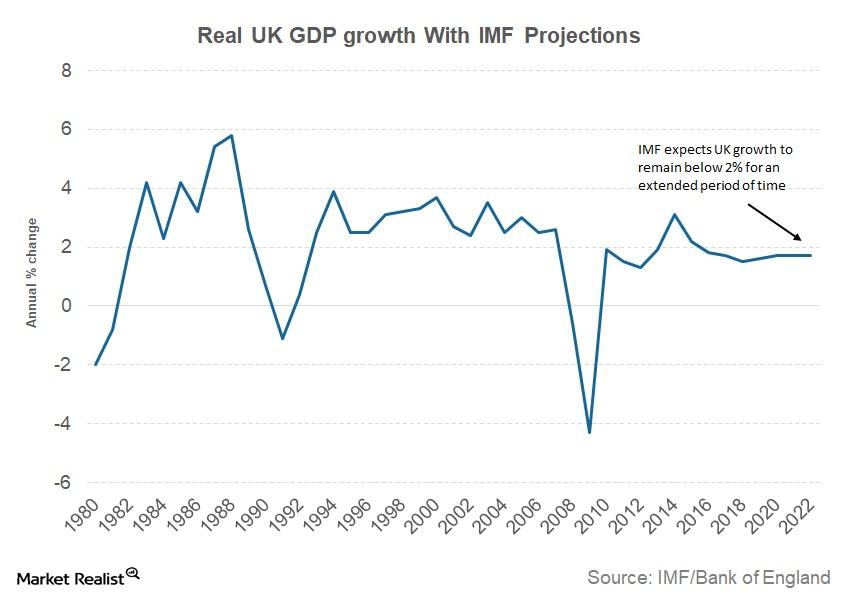

Why the IMF Sees Continued Uncertainty in the UK

The International Monetary Fund (or IMF), in its October world economic outlook, downgraded its growth outlook for the United Kingdom.

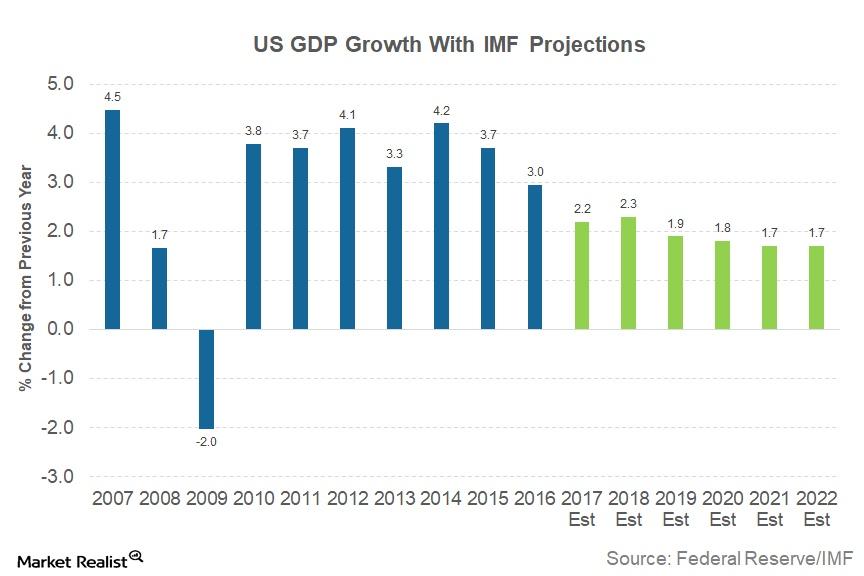

IMF: Why US Economic Growth Could Slow

The International Monetary Fund (or IMF), in its “World Economic Outlook” (or WEO) released in October, upgraded the economic forecast for the United Statess for 2017.

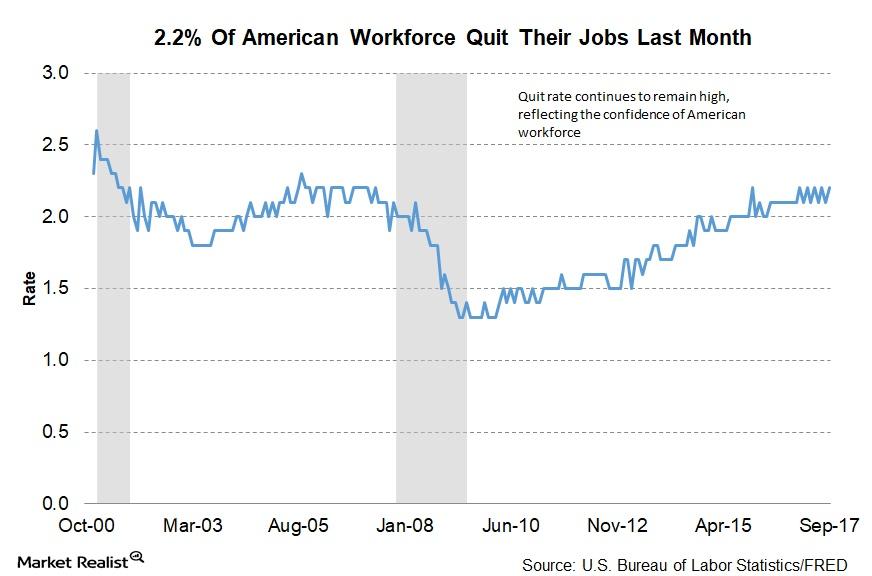

3.2 Million Americans Quit Their Jobs in September

As per the latest JOLTS report, about 3.2 million American workers quit their jobs voluntarily in September.

Did Job Openings Rise in September?

The Job Openings and Labor Turnover Survey (or JOLTS) report for September came out on November 7. Job openings remained unchanged at 6.1 million as of the last business day in September.

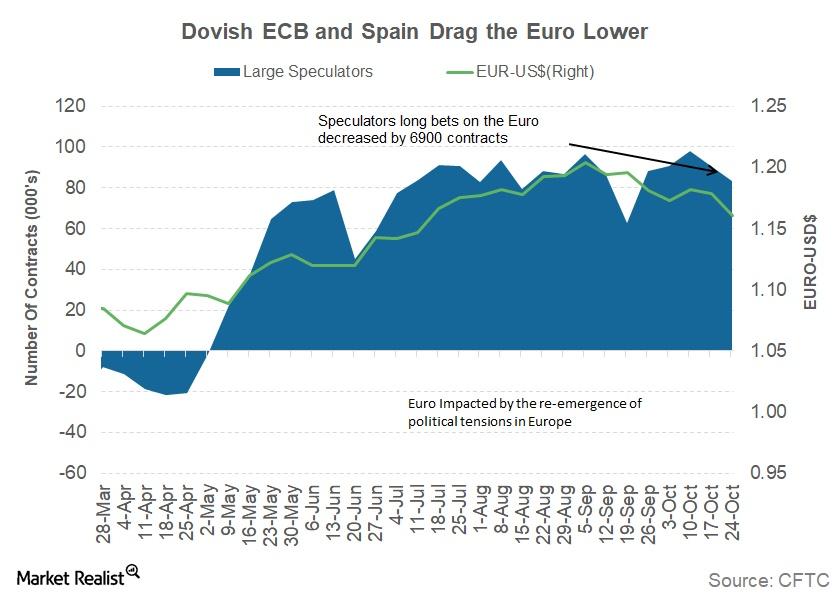

Why the Euro Is Likely to Remain Quiet this Week

The euro-dollar pair (FXE) closed the week ending November 3 at 1.1609 against the US dollar (UUP). Worries about a possible escalation of tensions in Spain’s Catalonia region proved futile.

US Dollar Survived Dovish FOMC Statement, Lackluster Jobs Report

The US dollar index (UUP) remained supported last week despite a dovish FOMC statement and a lower-than-expected rise in monthly non-farm payrolls.

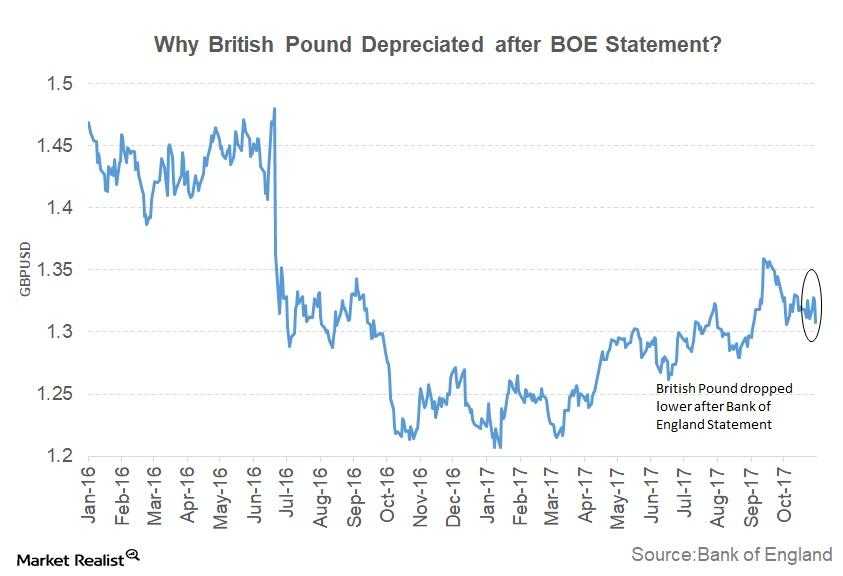

Why the British Pound Fell—Despite the Bank of England’s Rate Hike

The British pound depreciated 1.41% against the US dollar after the policy statement from the BOE (Bank of England) on November 2.

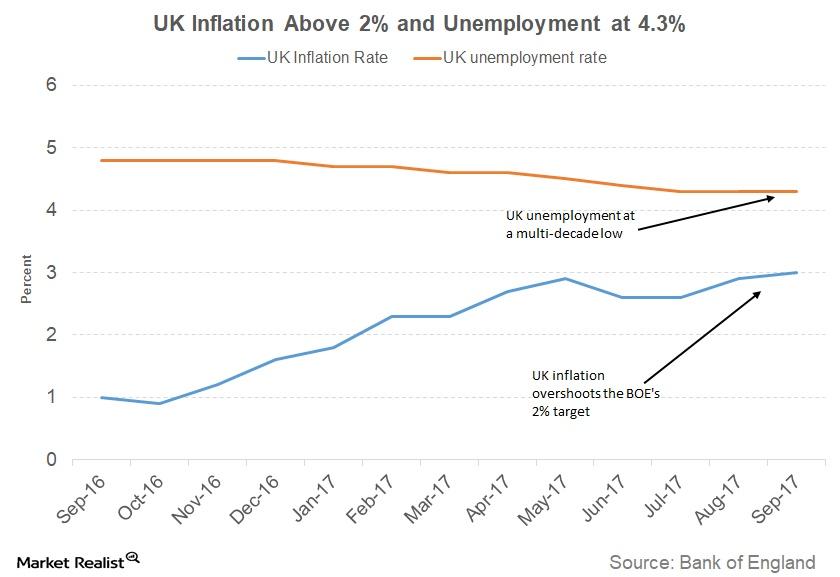

Why the Bank of England Wants Inflation to Fall

The central bank said that the key reason for such sharp increase in prices was due to the depreciation of the British pound after the Brexit referendum.

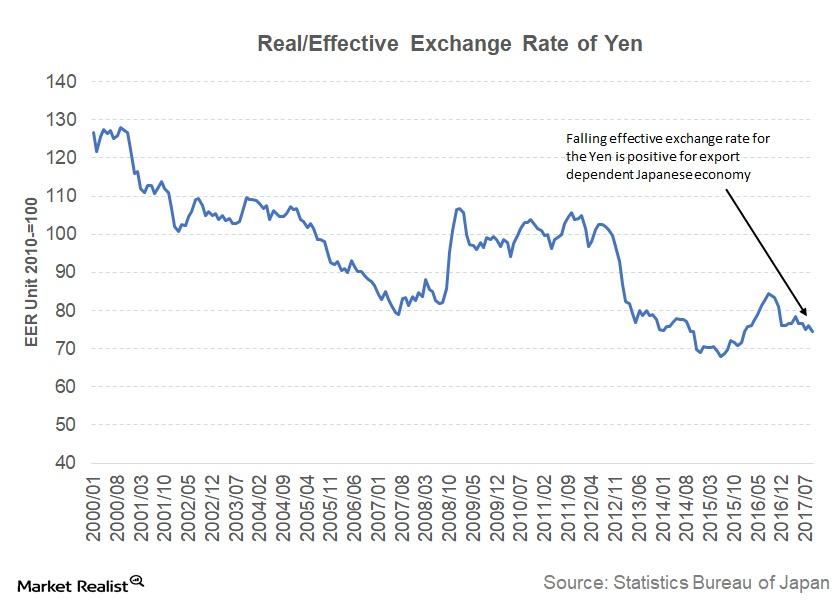

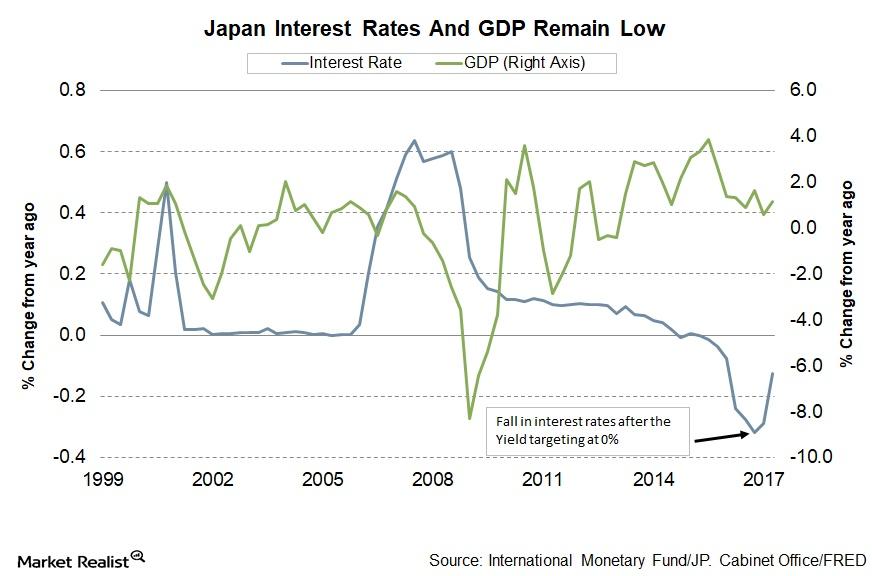

Japanese Yen Is Expected to Depreciate More

Since the Japanese election results, the Japanese yen has depreciated. The Bank of Japan is expected to continue the accommodative policy.

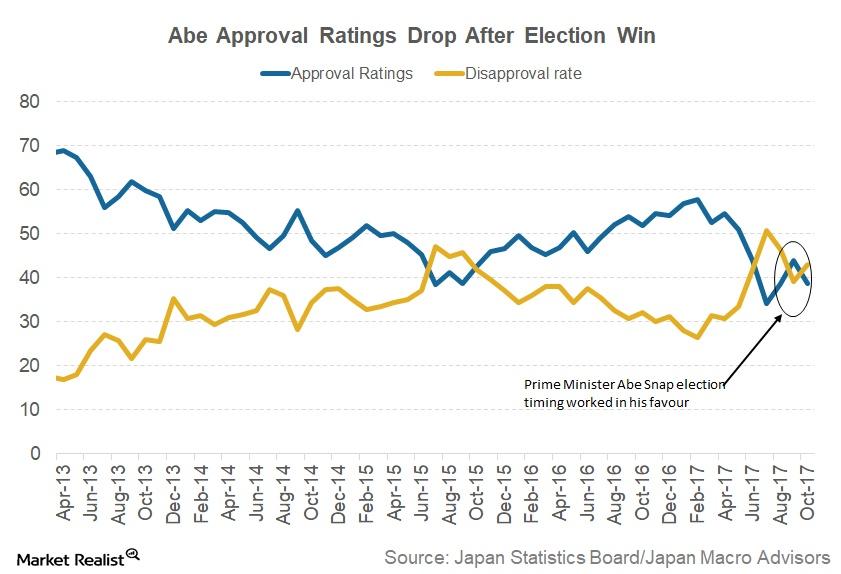

Why the Recent Election Results Are Positive for Japan

Japanese Prime Minister Shinzo Abe’s call for an early election worked in his favor. He called for a snap election to take advantage of his high ratings.

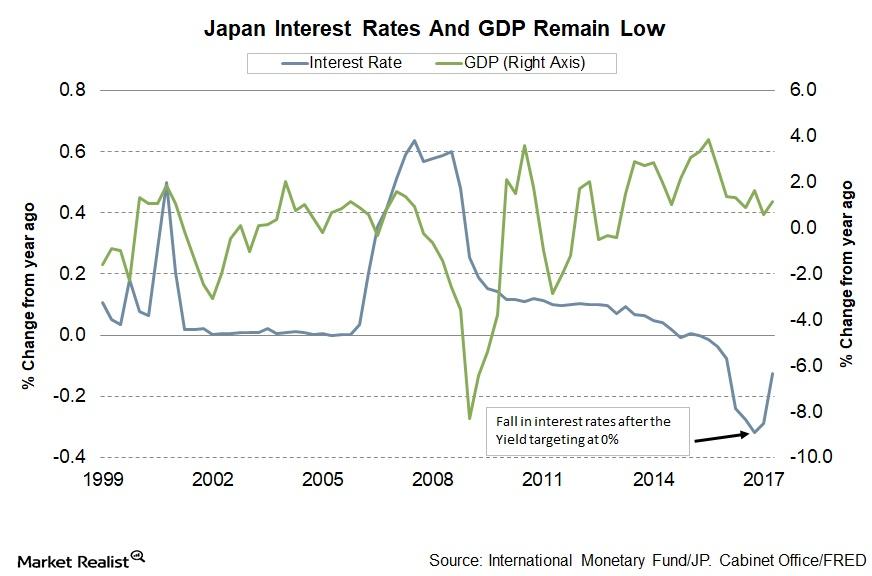

Bank of Japan Thinks the Inflation Target Can Be Achieved by 2019

For Japan’s economy, the main struggle has been the low level of inflation. Japan’s inflation has been low for the past three decades.

Bank of Japan: No Changes in the October Policy Meeting

At its October policy meeting, the Bank of Japan left its ultra-loose monetary policy unchanged. The decision was made by an 8-1 majority vote.

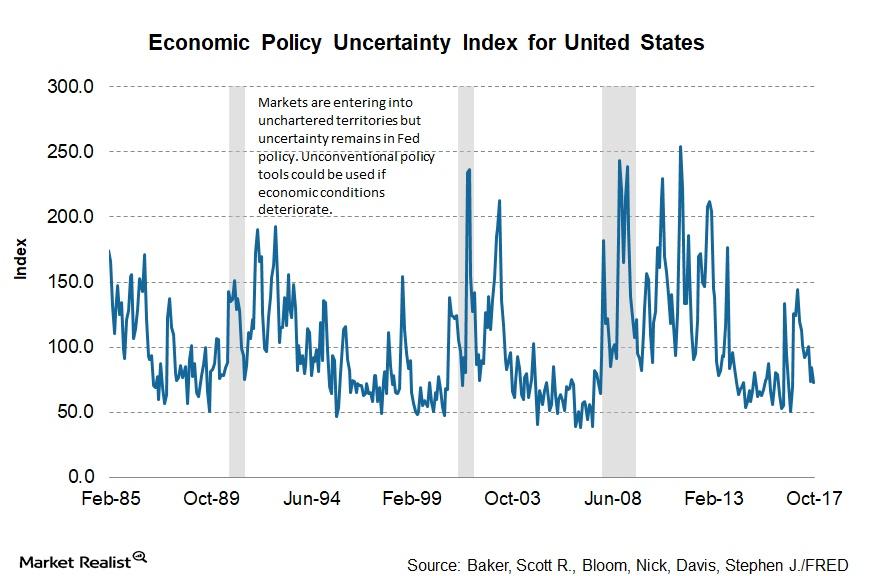

Janet Yellen: A Key Question for the Future

In a speech at the 2017 Herbert Stein Memorial Lecture, Fed Chair Janet Yellen shared her thoughts on monetary policy for the future and discussed whether there will be any role for unconventional policy again.

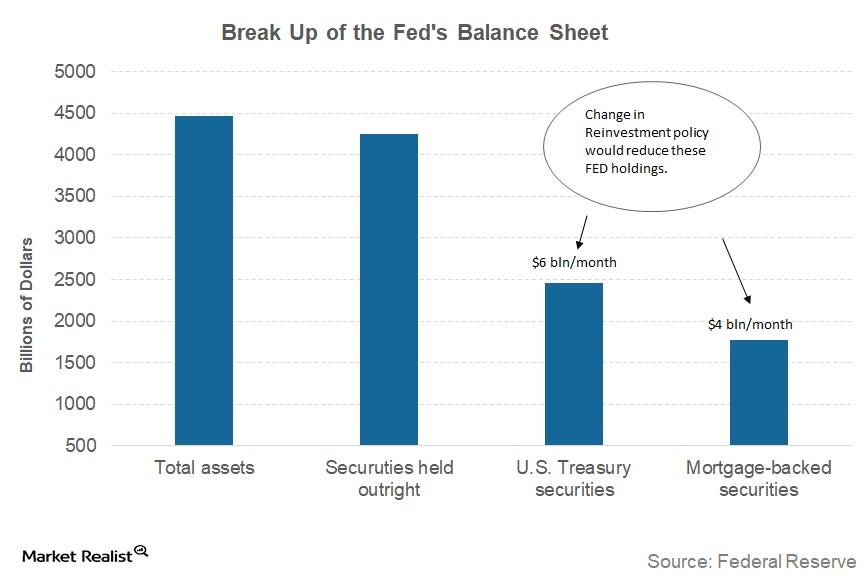

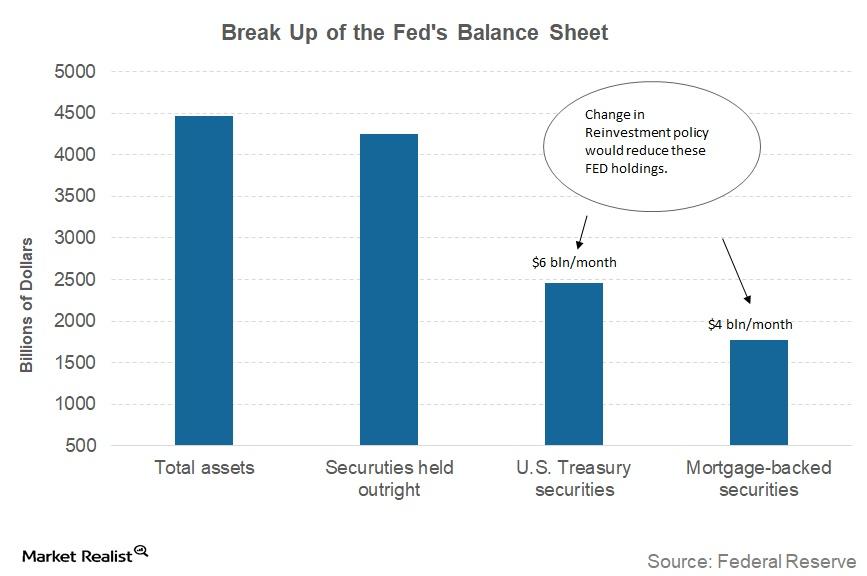

Janet Yellen Balance Sheet Strategy a Closer Look

Fed Chair Janet Yellen, in her speech at the 2017 Herbert Stein Memorial Lecture, offered some more insight into the Fed’s balance sheet reducing strategy.

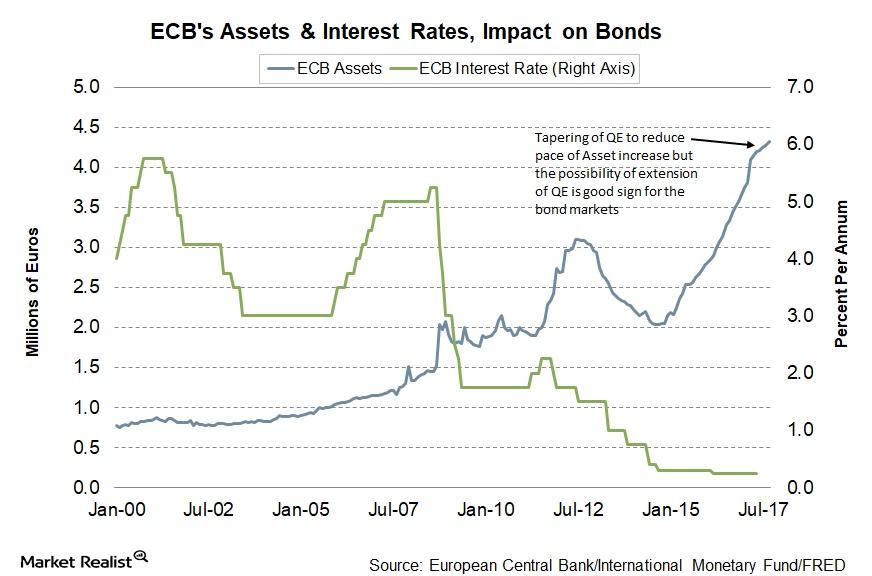

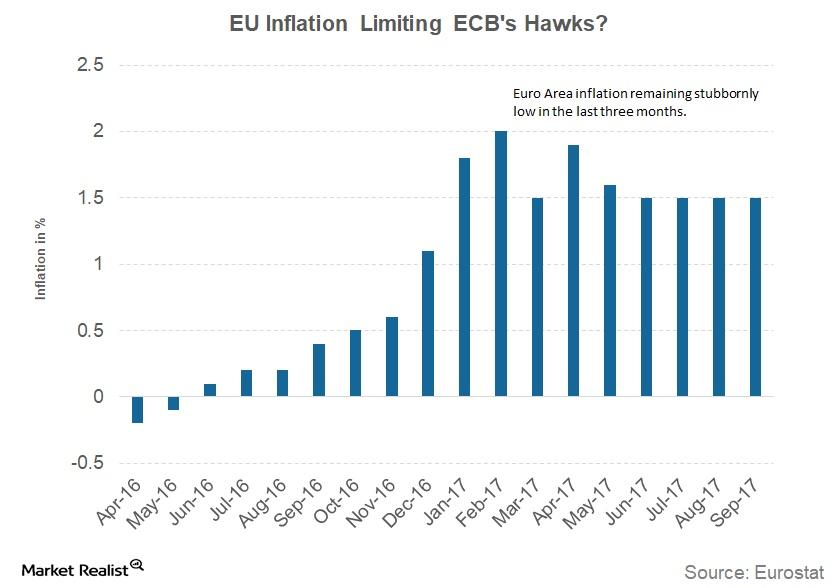

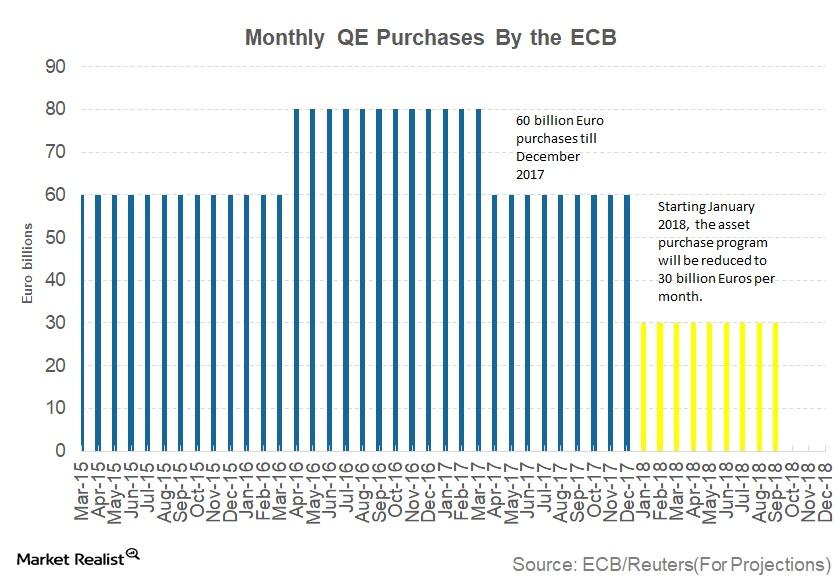

Analyzing the European Central Bank’s October Statement

The reduction to the ECB’s bond-buying program will likely have a mixed impact on the bond markets of countries in the European Union.

Why the ECB Isn’t Worried about the Appreciating Euro

In the ECB’s (European Central Bank) October policy meeting, the ECB didn’t explicitly talk about the appreciating euro.

What’s behind the European Central Bank’s Normalization Plans?

Economic growth has picked up in recent quarters. According to data from Eurostat, the European economy (VGK) grew 2.3% in the recent quarter.

Update from the European Central Bank’s October Policy Statement

In the ECB’s (European Central Bank) October policy meeting, its laid out its plans for the QE (quantitative easing) program.

How Political Drama and ECB’s Dovish Statement Affected the Euro

The euro-dollar (FXE) pair closed the week ending October 27 at 1.16 against the US dollar (UUP).

How the US Dollar Could React to November FOMC Meeting

The US Dollar Index (UUP) continued its ascent last week.

Why Expectations for Business Conditions Fell 50% in September

The October Conference Board LEI reported that average consumer expectations for business conditions for September are 0.37 above the mean.

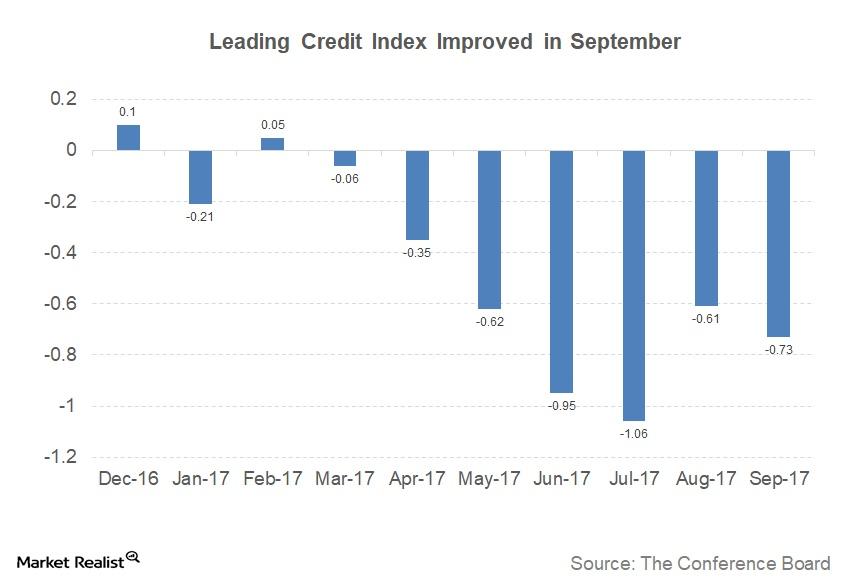

Understanding the Leading Credit Index for September 2017

The Leading Credit Index is an economic model that’s modeled on the performance of six major financial market instruments.

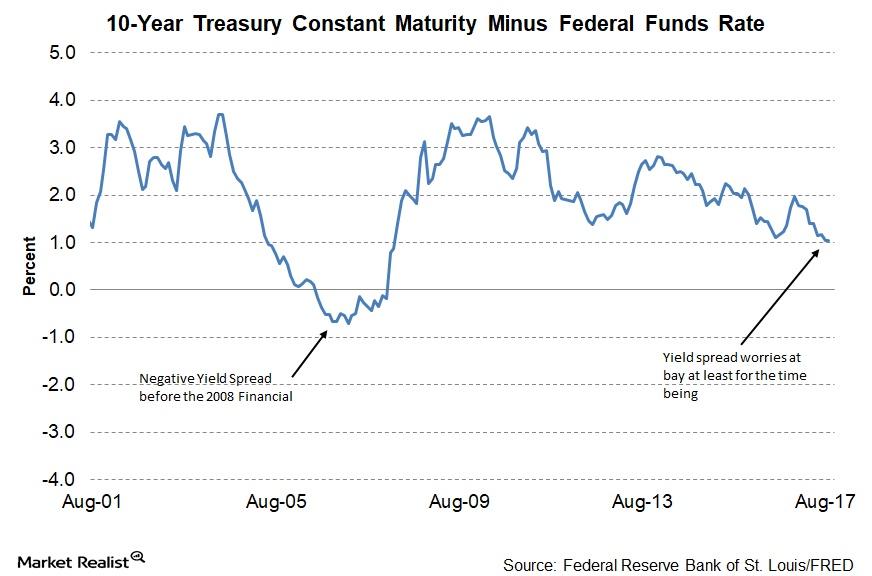

Are Declining Yield Spread Worries Done for Now?

At the last FOMC (Federal Open Market Committee) meeting on September 20, 2017, Fed members decided to initiate a balance sheet normalization process starting in October.

A Look at the Possible Effects of Balance Sheet Unwinding

The US Fed has amassed a huge number of fixed income (BND) securities as part of its quantitative easing (or QE) programs 1, 2, and 3.