A Look at the Possible Effects of Balance Sheet Unwinding

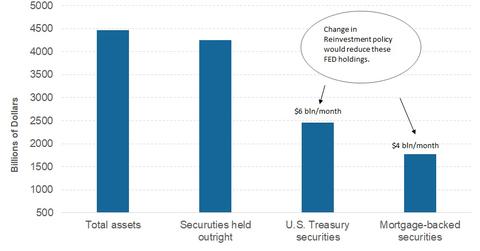

The US Fed has amassed a huge number of fixed income (BND) securities as part of its quantitative easing (or QE) programs 1, 2, and 3.

Oct. 24 2017, Updated 12:36 p.m. ET

Benefits from the asset purchase program

In this speech on lessons learned from ultra-loose monetary policy, Atlanta Federal Reserve president and CEO, Raphael Bostic, first explained the benefits of the asset purchase programs. He said that these asset purchase programs during the recovery phase of the US economy had positive macroeconomic effects.

The US Fed has amassed a large amount of fixed income (BND) securities as part of its quantitative easing (or QE) programs 1, 2, and 3. These QE programs were intended to lift the US economy from the great recession of 2007 and 2008.

How will markets react to the balance sheet unwinding?

Bostic said that a recent report by the Federal Reserve Board of Governor’s staff estimated that the three asset buying programs resulted in a 100-basis-point decline in the ten-year (IEI) yield. With the US Fed being the largest buyer and the safety net provided by the government, investors are settling for lower returns from bonds (AGG). Will the impact on Treasuries (GOVT) be reversed due to the Fed’s plans to offload its holdings?

The path to normalization remains uncertain

Bostic said that much remains uncertain about the impact of unwinding. He, however, hoped that the effects of a gradual and predictable balance sheet unwinding program will be smaller than that of the balance sheet expansion. In simpler terms, he doesn’t expect a 100-basis-point rise in yields. Bostic said that the exit will be less dramatic than the entry. His views up until this point seem to be correct, as markets have only seen a minor disturbance in October. We must remember that other forces that impact the bond markets (SCHR) are also in play. Tax reforms, change of guard at the Fed, and geopolitical tensions will have a combined impact on the bond markets.

In the next part of this series, we’ll look at lessons learned from unconventional monetary policy.