Ricky Cove

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ricky Cove

How Could the US Dollar Fare in 2018?

The US dollar’s long-term outlook looks marginally better in 2018 than in 2017.

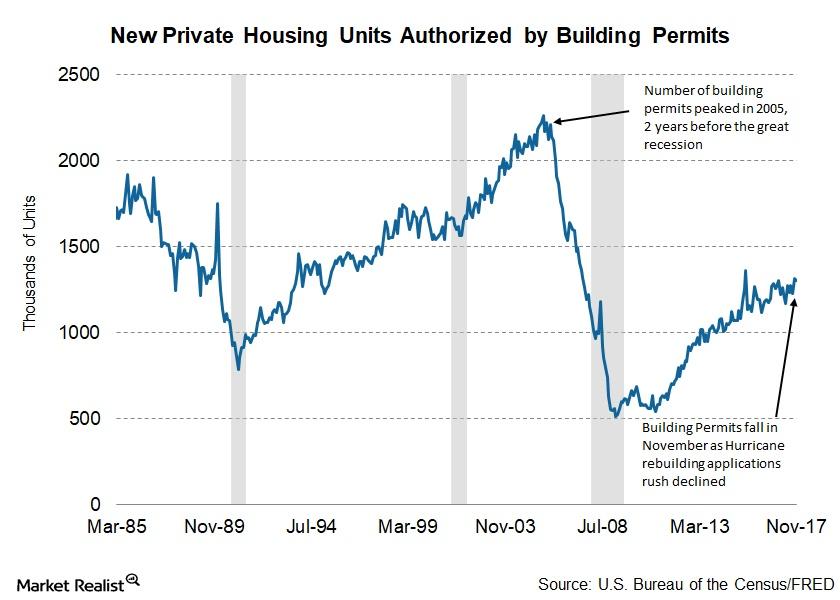

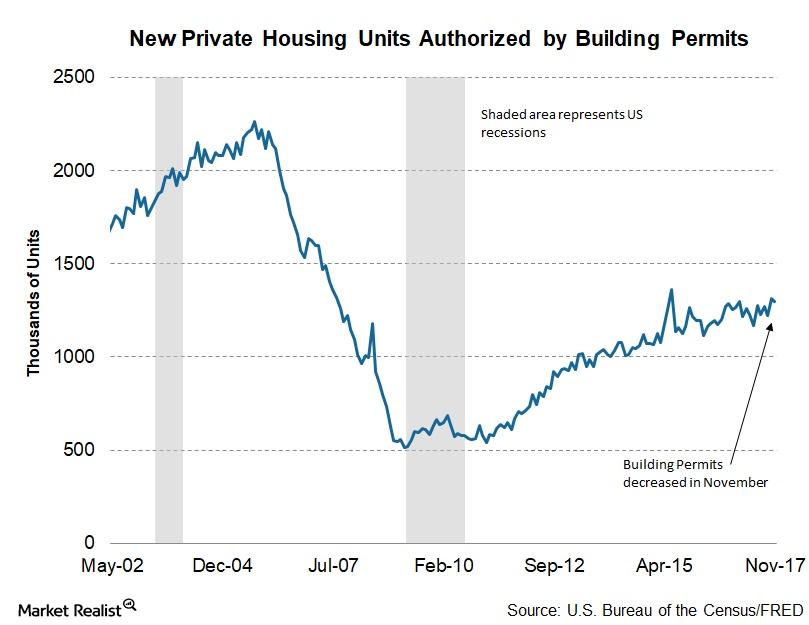

Building Permits Fall in November: Should We Worry?

Building permits and the economy The number of building permits issued each month is a constituent of the Conference Board LEI (Leading Economic Index). The construction and housing industry (PKB) is a major job provider in the economy, and changes in activity in the sector affect employment conditions and aggregate demand. A higher number of building permits is a leading […]

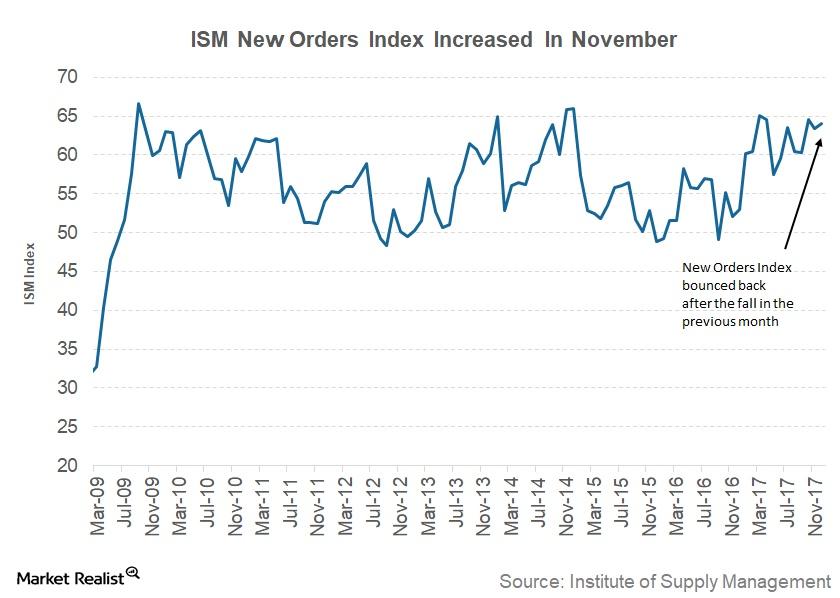

Analyzing the Institute of Supply Management’s New Orders Index

The Institute of Supply Management’s New Orders Index The ISM’s (Institute of Supply Management) New Orders Index is a monthly report on changes in new orders, supplier deliveries, inventories, production, and employment. New orders are a measure of future activity in any industry (VIS), as companies’ production depends on incoming orders. The ISM’s New Orders […]

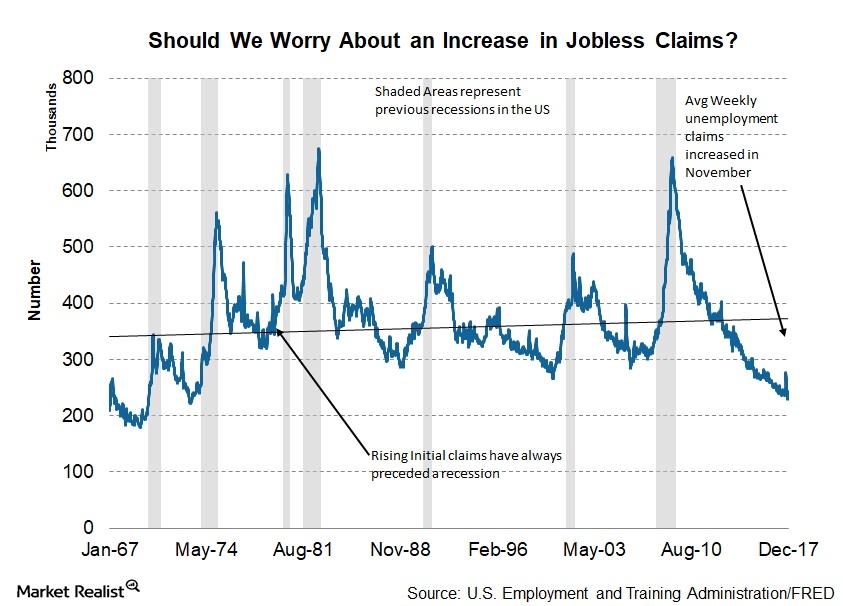

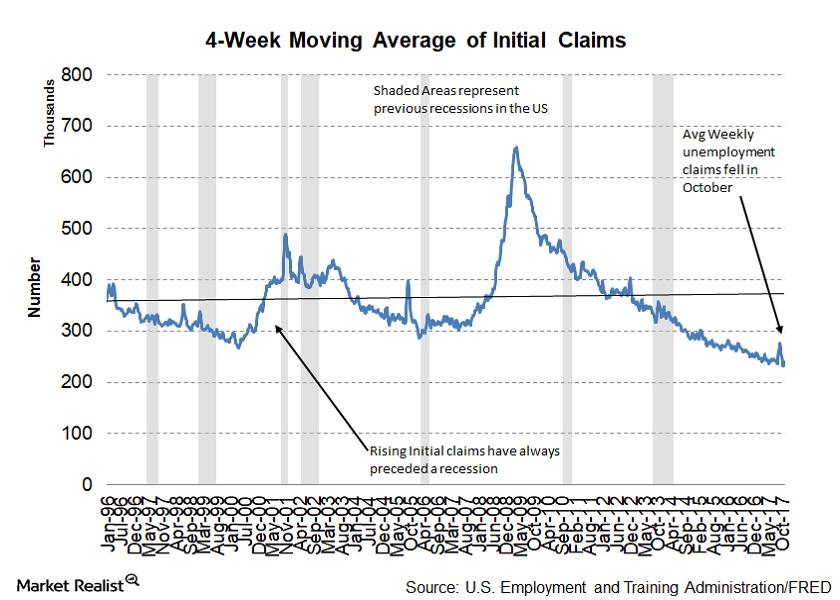

Should We Worry about Rising Unemployment Claims?

Average weekly claims and the economy Average weekly unemployment claims are a constituent of the Conference Board LEI (Leading Economic Index). Claims have a 3% weight in the LEI. Weekly unemployment claims, if adjusted for seasonality, give investors a clear understanding of changes in the employment market. Though the Bureau of Labor Statistics releases a monthly […]

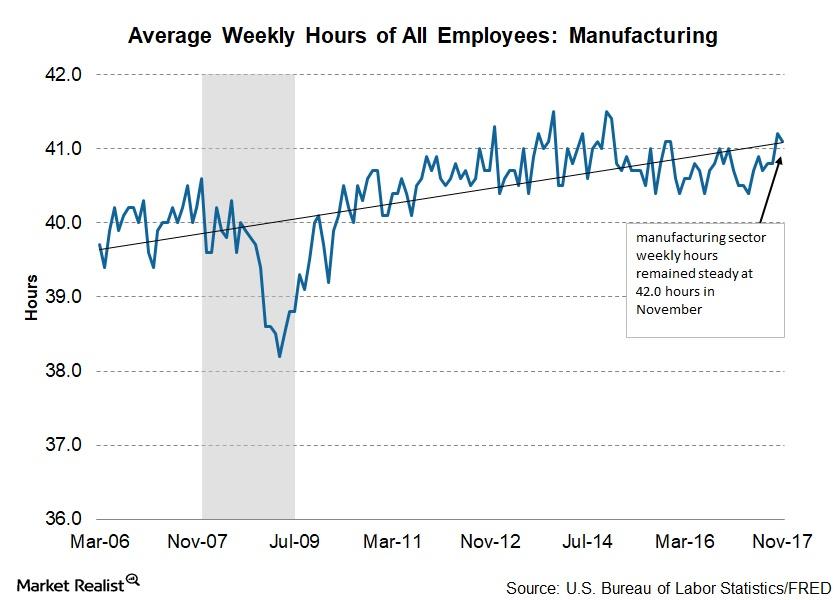

The Effects of Flat Manufacturing Production Hours

The average work week The US Bureau of Labor Statistics’ establishment survey includes data on the number of hours worked by manufacturing employees. Changes in the number of working hours help investors assess the health of the sector. A rise in the number of working hours signals that companies are projecting higher demand in the manufacturing sector […]

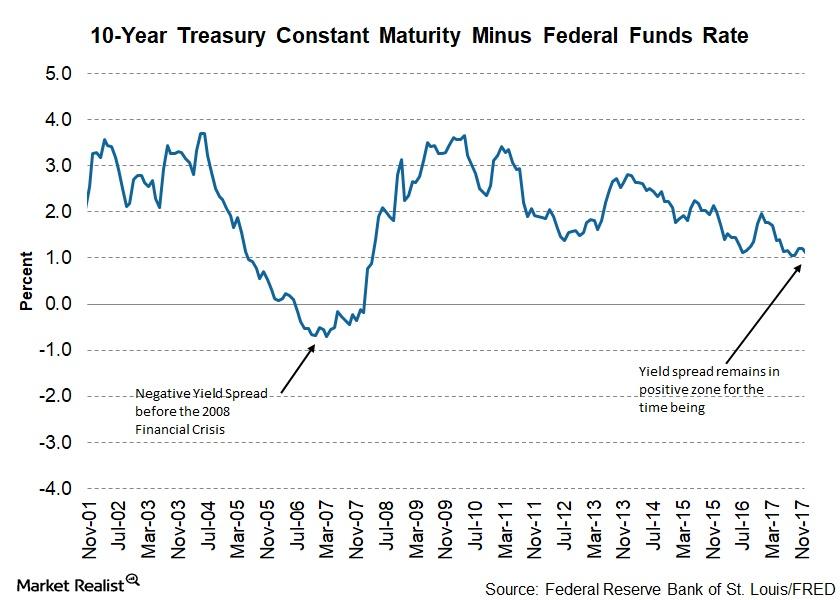

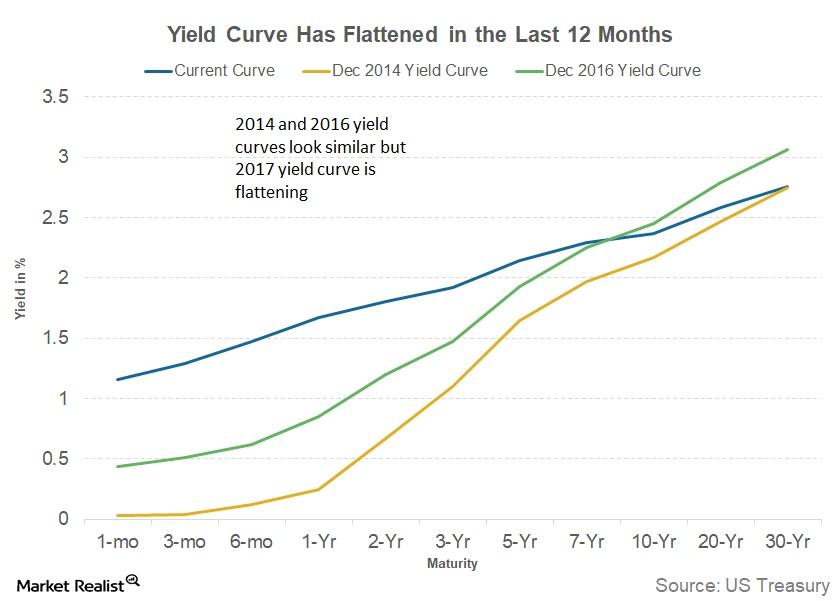

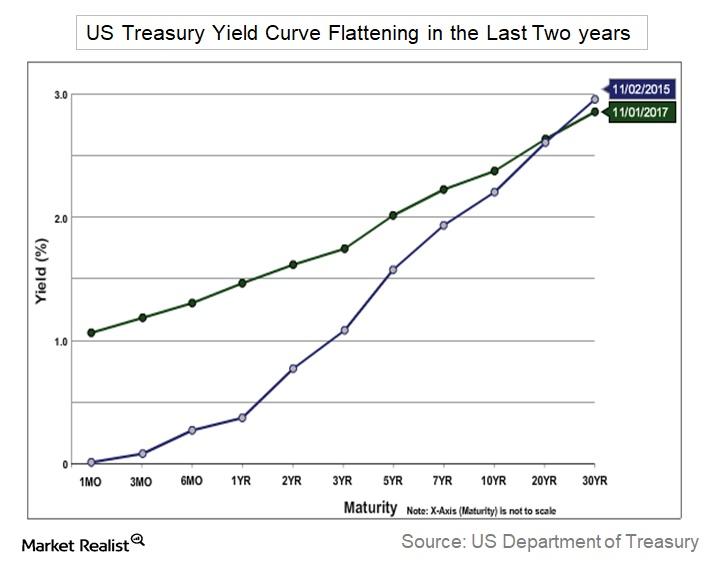

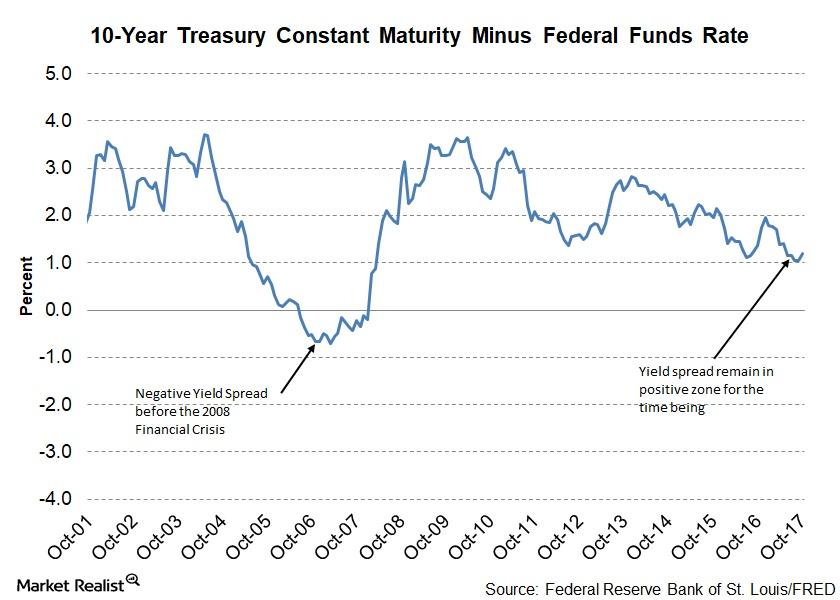

Analyzing the Yield Curve’s Ongoing Flatness

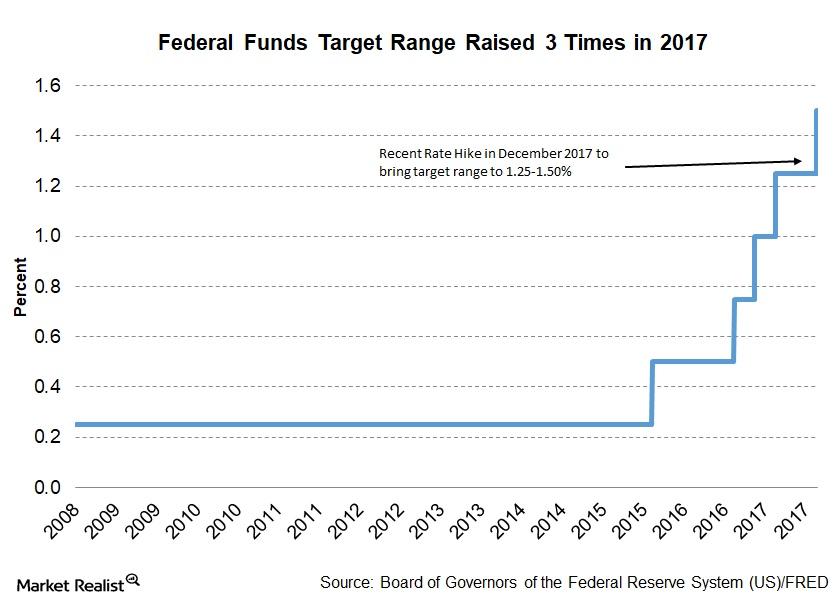

A December rate hike and a flattening yield curve The Fed rolled out another rate hike at its final meeting of 2017. The target range for the federal funds rate was increased by 0.25% to 1.25%–1.50%, and the Fed has signaled three more rate hikes in 2018. Two members dissented to the rate hike due to lower […]

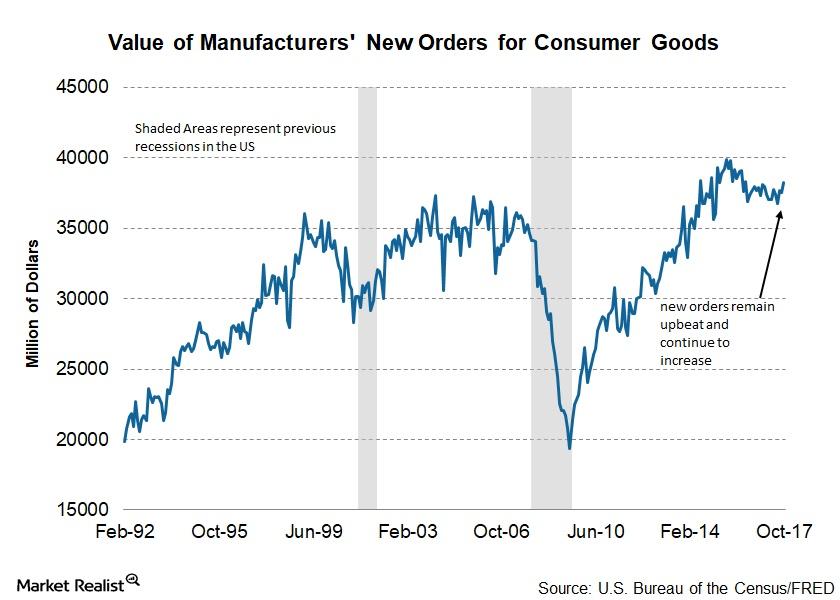

What Rising Consumer Goods and Material Orders Signal

Manufacturers’ new orders for consumer goods and materials New orders for consumer goods and materials give investors an insight into the demand for goods and form an important constituent of the Conference Board LEI (Leading Economic Index). Changes to demand in the consumer goods sector impact the performance of FMCG (fast moving consumer goods) companies, which include large retailers such […]

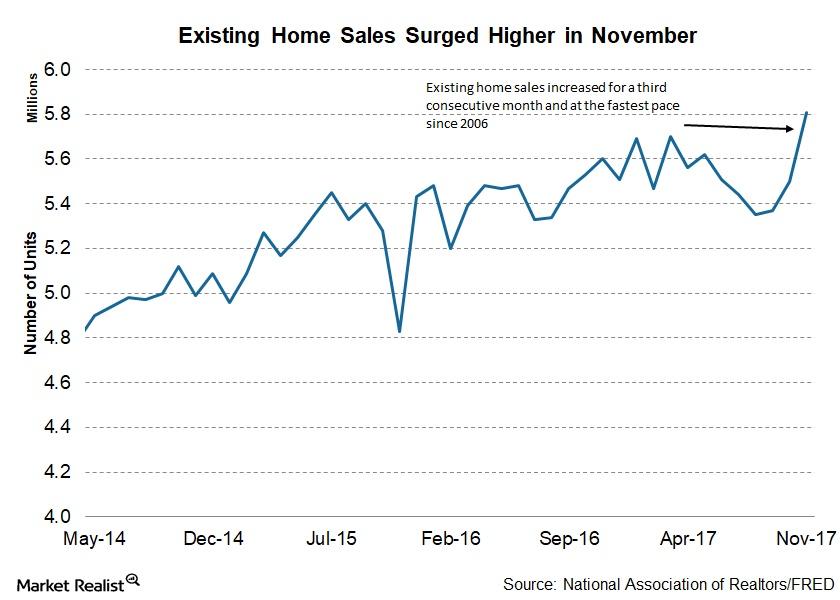

Existing Home Sales: Strongest Pace in 11 Years

According to the latest report from NAR, existing home sales rose 5.6% to a seasonally adjusted annual rate of 5.81 million homes in November.

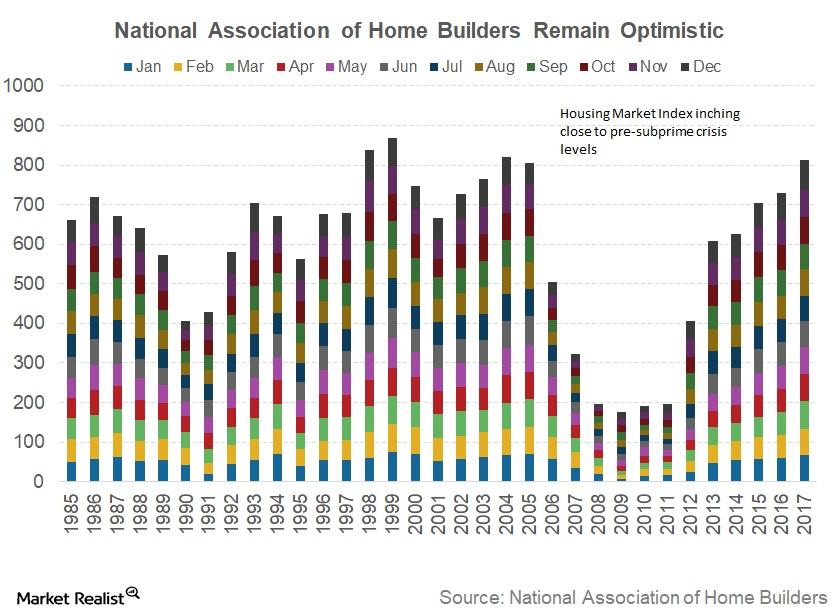

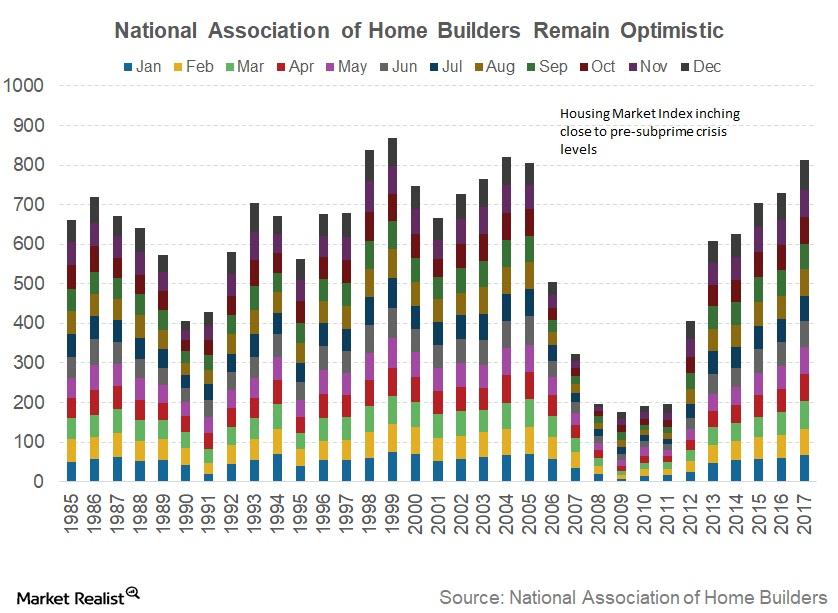

Housing Market: Builders’ Confidence Reaches an 18-Year High

For November, the NAHB Housing Market Index was reported as 74—an increase of five from October and an 18-year high.

Should Investors Be Concerned about Fewer Building Permits?

In November 2017, housing units (XHB) authorized by building permits were at a seasonally adjusted rate of 1.298 million—a decrease of 1.4% from October.

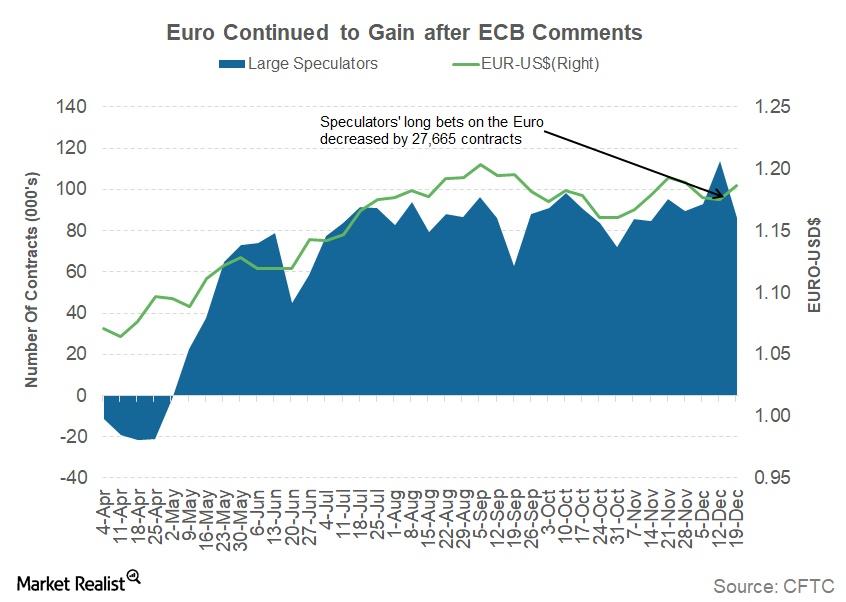

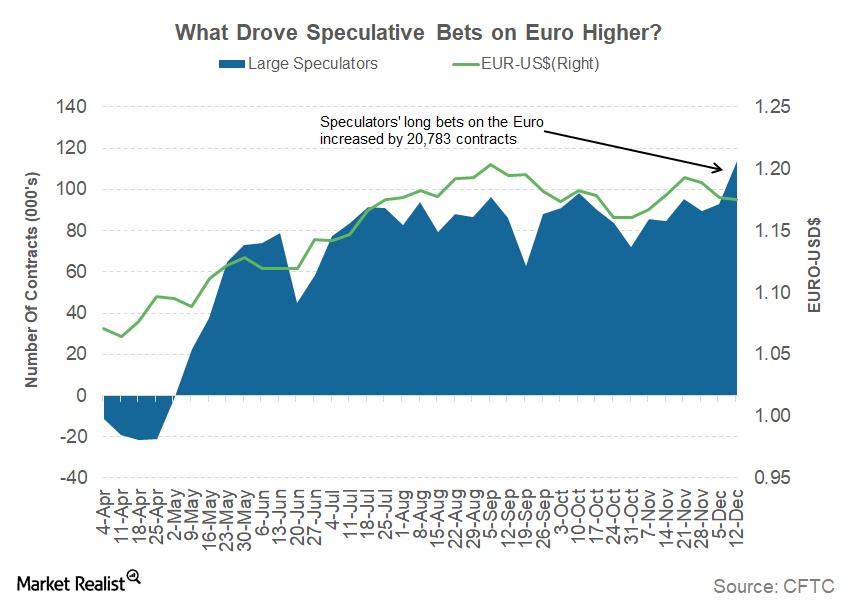

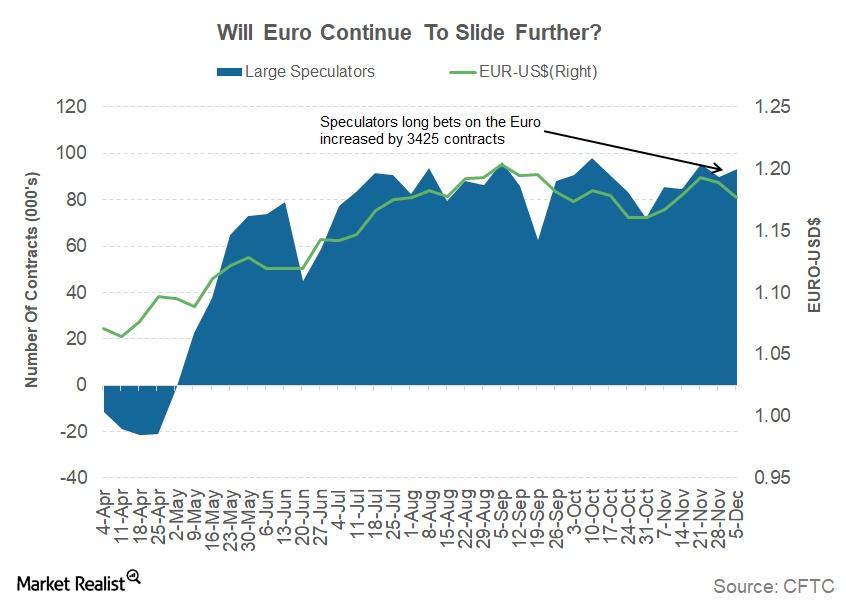

Here’s What Drove the Euro Higher Last Week

The euro (FXE) closed the week ended December 22, 2017, at 1.1864, appreciating 0.94% against the dollar (UUP).

Can the US Dollar Gain Back Lost Ground This Week?

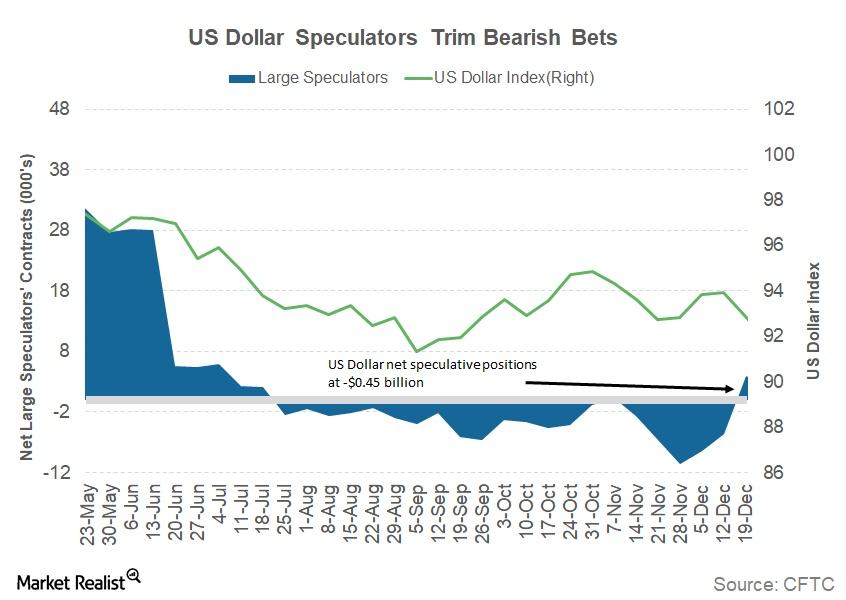

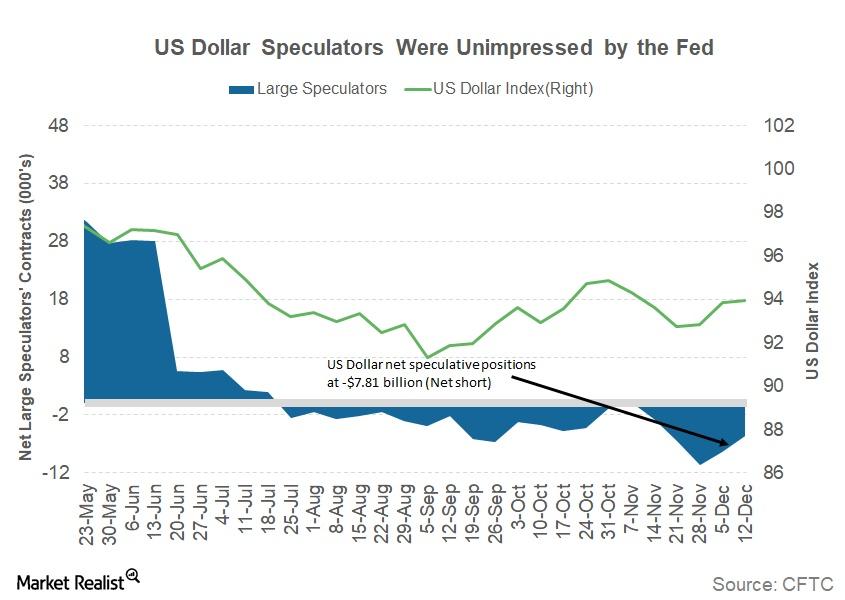

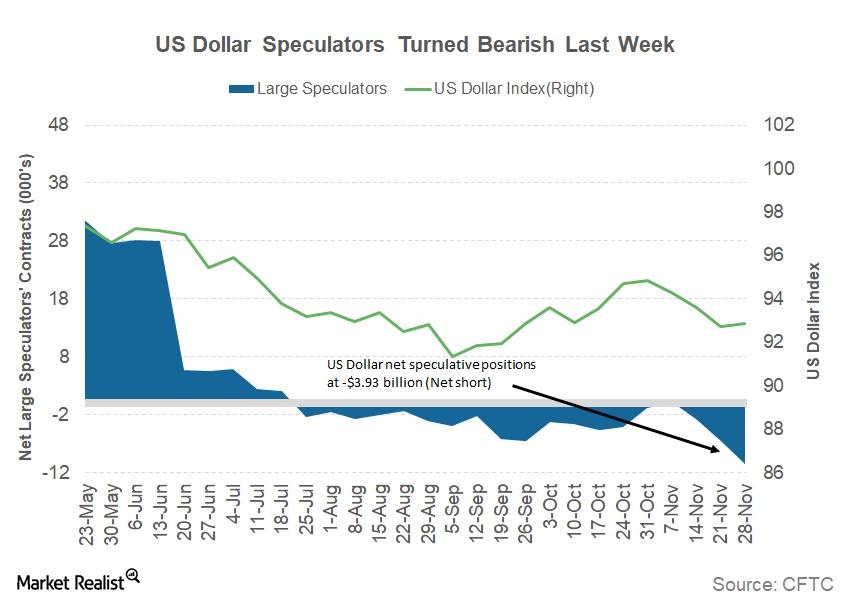

The US Dollar index (UUP) failed to capitalize last week on the optimism from Congress passing the US tax reform bill.

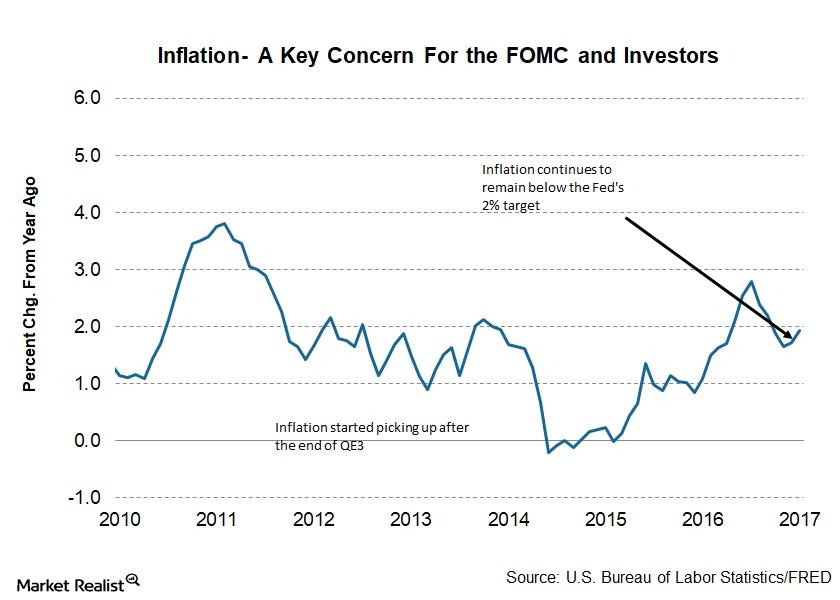

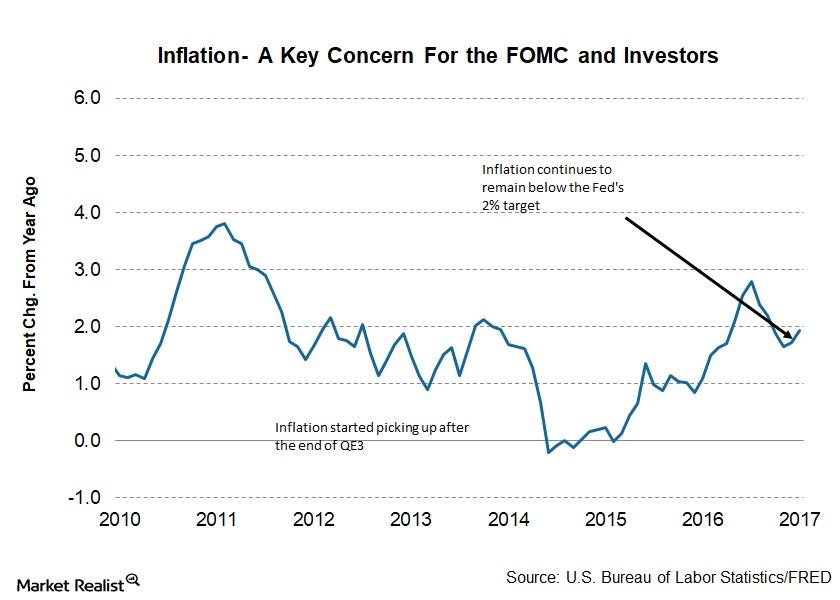

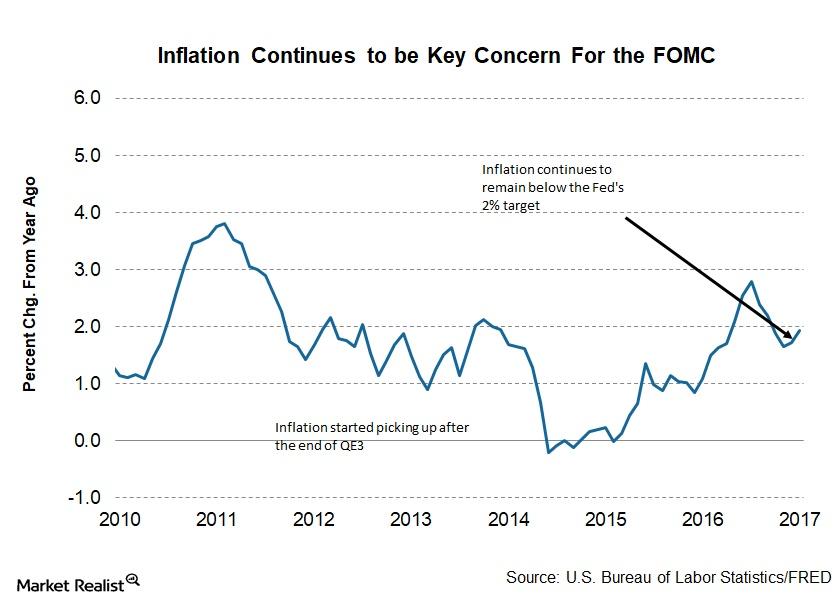

The Curious Case of Low Inflation in 2017

The last statement from the US Fed, which was released with its recent rate hike decision, cited lower levels of inflation but hopes that the inflation target could be achieved in 2018.

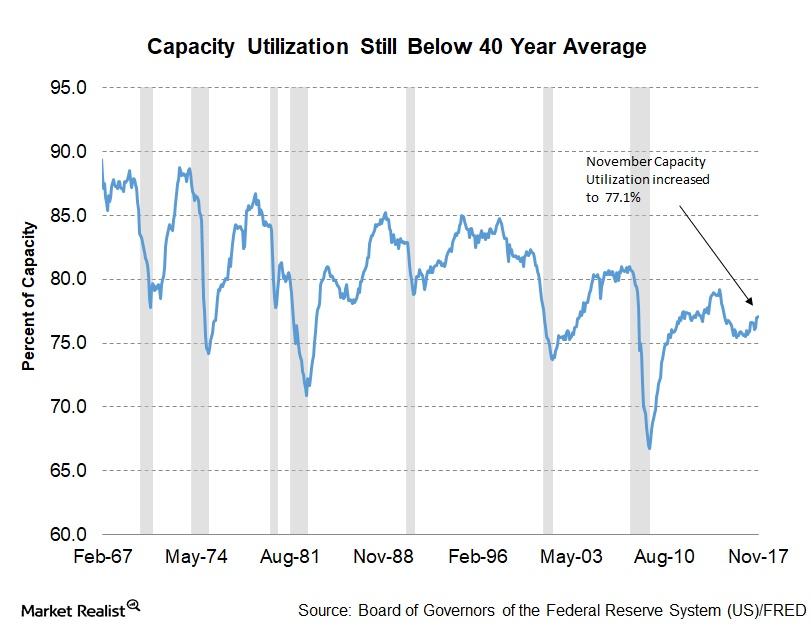

A Look at Capacity Utilization across US Industries in November

In the November capacity utilization report, the manufacturing sector remained strong with 76.4% capacity utilization, the highest level since May 2008.

Strength of the Manufacturing Sector: Purchasing Managers’ Index

This has been one of the best years since 2004 for manufacturing activity, viewed through the Purchasing Managers’ Index (or PMI).

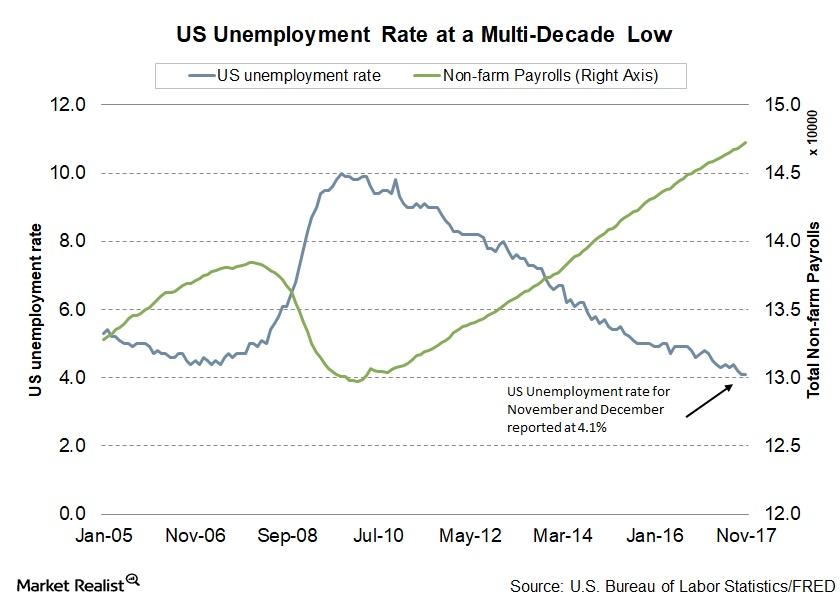

Will US Unemployment Rate Fall below 4% in 2017?

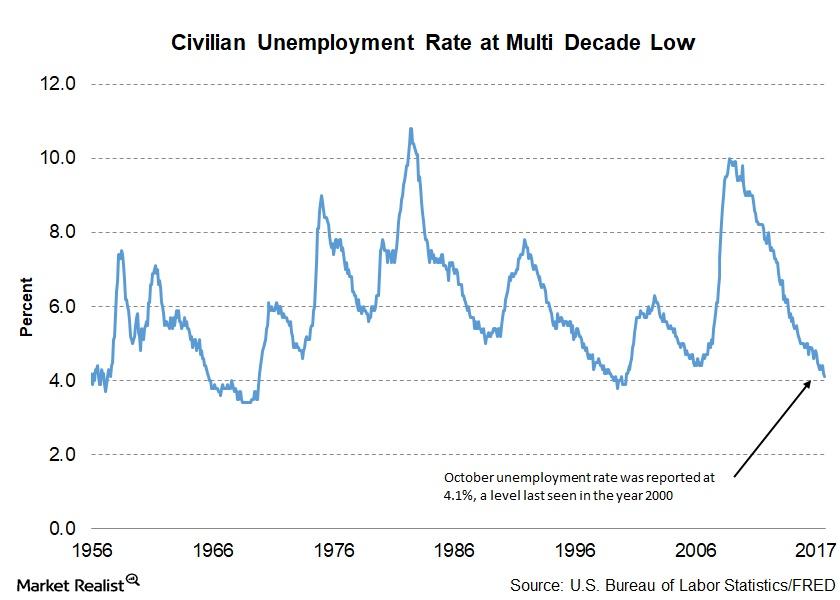

A lower unemployment rate is one of the key objectives of the Fed. In 2017, the unemployment rate fell, reaching 4.1% in its latest November reading.

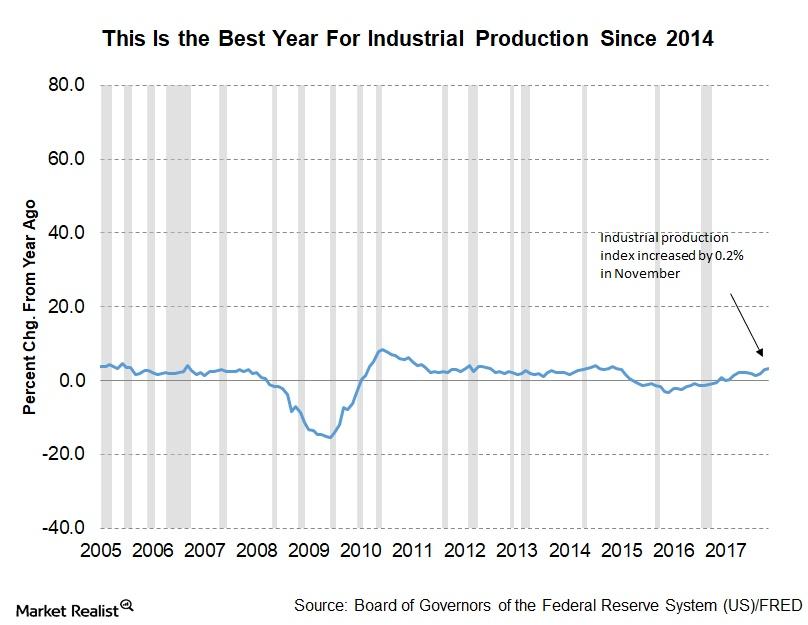

Why Industrial Production Fell from 1.2% to 0.2% in November

The Federal Reserve released its November industrial production report on December 15, 2017. The report indicated that industrial production improved 0.2% in November.

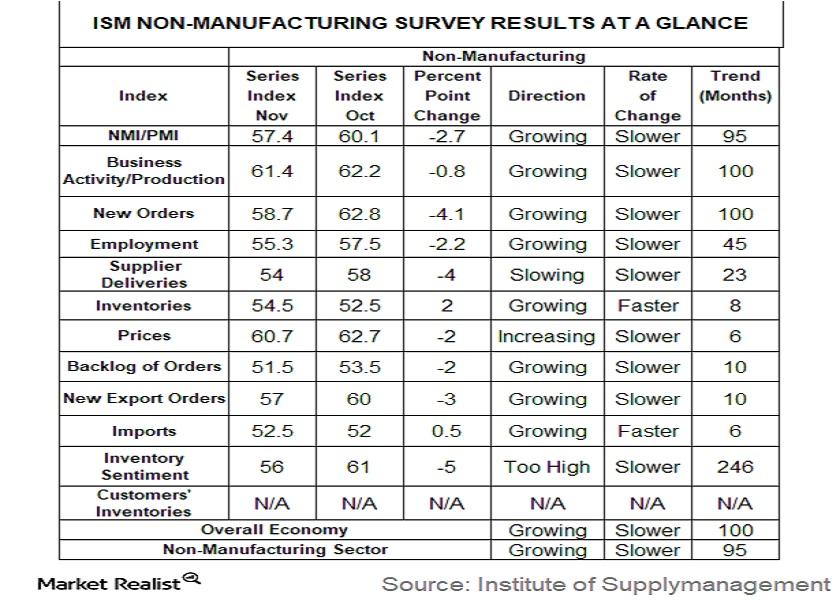

What Rising Services Activity Means for the US Economy

After reaching a lifetime high in October 2017, the ISM (Institute of Supply Management) non-manufacturing index fell 2.7 percentage points to 57.4%.

A Double Dose of Tightening from the Fed in 2017

In its December monetary policy statement, the Fed projected three interest rate hikes in 2018 and three in 2019, depending on the incoming economic data.

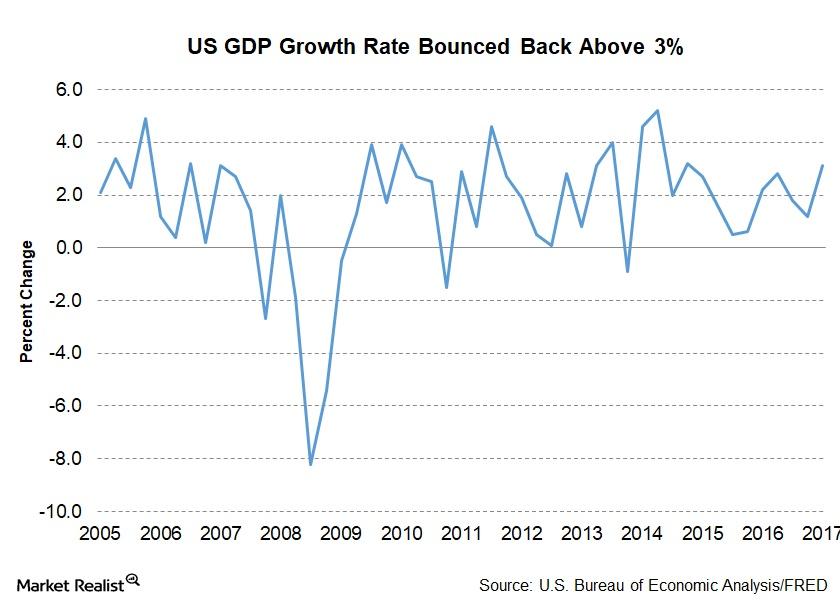

How the US Economy Performed in 2017

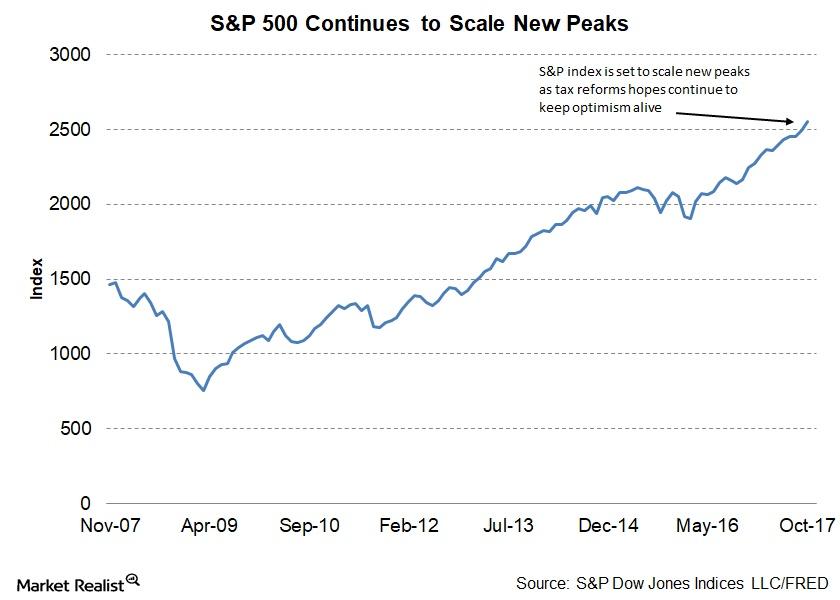

This year has been a year to watch the US economy. Hopes for change, tax reform, and industry-friendly policies drove the markets (SPY) higher.

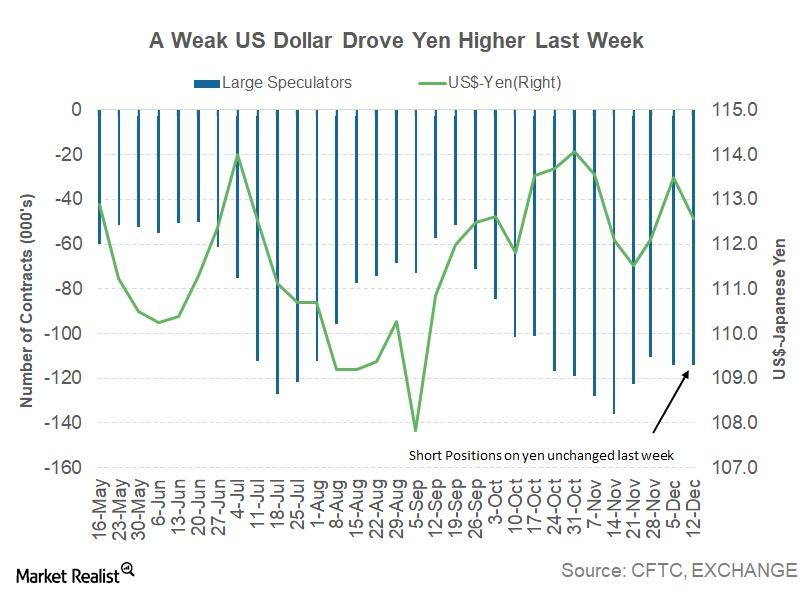

How the Bank of Japan Could Have an Impact on the Yen This Week

For the week ended December 15, the Japanese yen (FXY) closed at 112.58 against the US dollar (UUP), appreciating by 0.79%.

What Drove the Euro Higher Last Week?

The total net speculative bullish positions on the euro (EUFX) increased from 93,106 contracts to 113,889 contracts in the previous week.

Why the US Dollar Resisted the Fed’s Latest Rate Hike

According to Reuters, the US dollar (USDU) net short positions increased to ~-$7.8 billion during the week ended December 15 compared to ~-$4.3 billion in the previous week.

Will the US Dollar Surge Higher after FOMC Meeting?

The US Dollar Index (UUP) continued its ascent against the other major currencies as investors positioned for a rate hike from the Fed and reacted to the increased possibility of tax reforms by the end of this year.

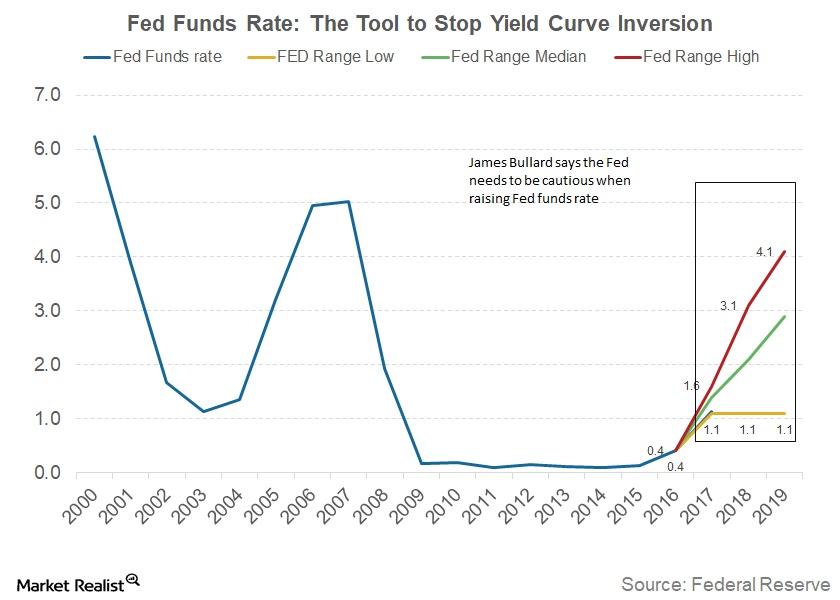

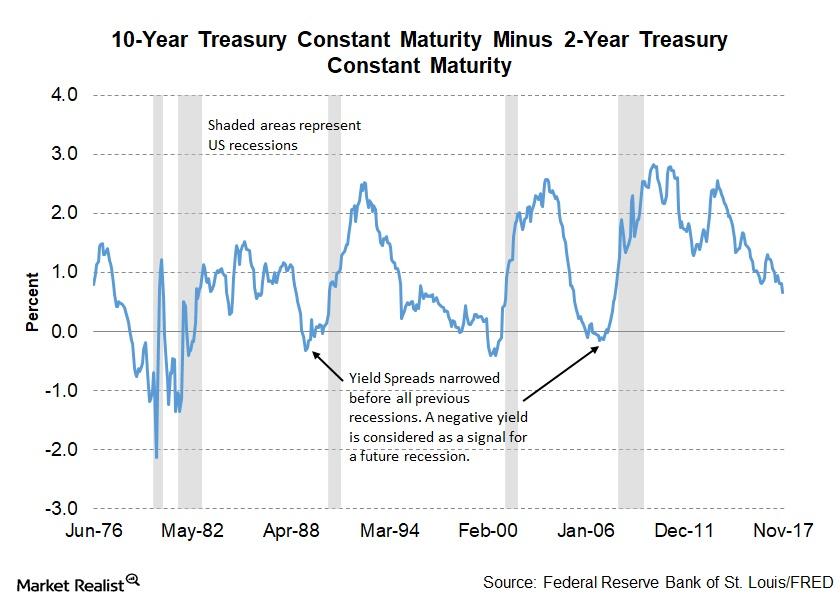

How We Could Avoid Yield Curve Inversion

Could yield curve inversion be avoided? St. Louis Fed president and CEO James Bullard gave a presentation at a regional economic briefing on December 1. Previously, we looked at the causes of yield curve inversion. In this part, we’ll review Bullard’s suggestions to avoid yield curve inversion. Bullard said that yield curve inversion could be avoided […]

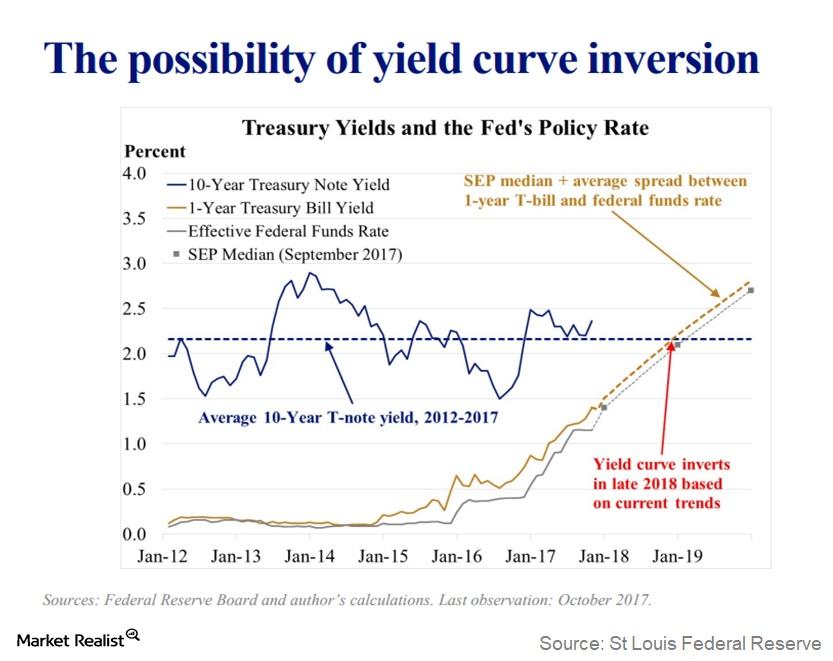

The US Yield Curve Could Invert in Late 2018

When could the yield curve invert? St. Louis Fed president and CEO James Bullard gave a presentation at a regional economic briefing on December 1. In his presentation, Bullard laid out some conditions that could lead to yield curve inversion in 2018. As discussed previously in this series, an inverted yield curve is considered a sign of […]

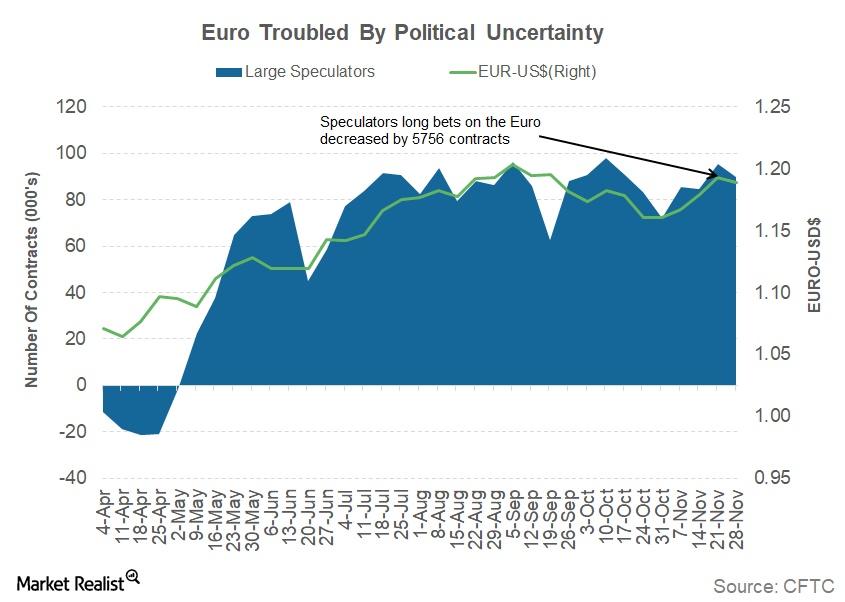

Why the Euro Continued to Fall Last Week

The euro-dollar (FXE) closed the week ending December 8 at 1.18, depreciating by 1.1% against the US dollar (UUP).

The Primary Cause of Yield Curve Flattening

Interest rates and inflation The pace of interest rate hikes and inflation rate growth have a profound influence on the US yield curve. The US Fed has been communicating its intent to increase interest rates from the current ultra-low level to a target rate of 2.5% over the next few years. The conditions required for […]

What Leads to Yield Curves Flattening

Factors leading to yield curves flattening There are multiple factors that can affect the shape of yield curves. Bonds (BND) with different maturities react differently to changes in economic conditions and expectations. For example, when the US Fed announces an interest rate hike, short-term bonds (SHY), which are to the left side of a yield curve, react […]

Assessing the Risk of a Flattening Yield Curve

St. Louis Fed president and CEO James Bullard gave a presentation at a regional economic briefing on December 1. Throughout this series, we’ll analyze Bullard’s take on the risks of an inverted yield curve.

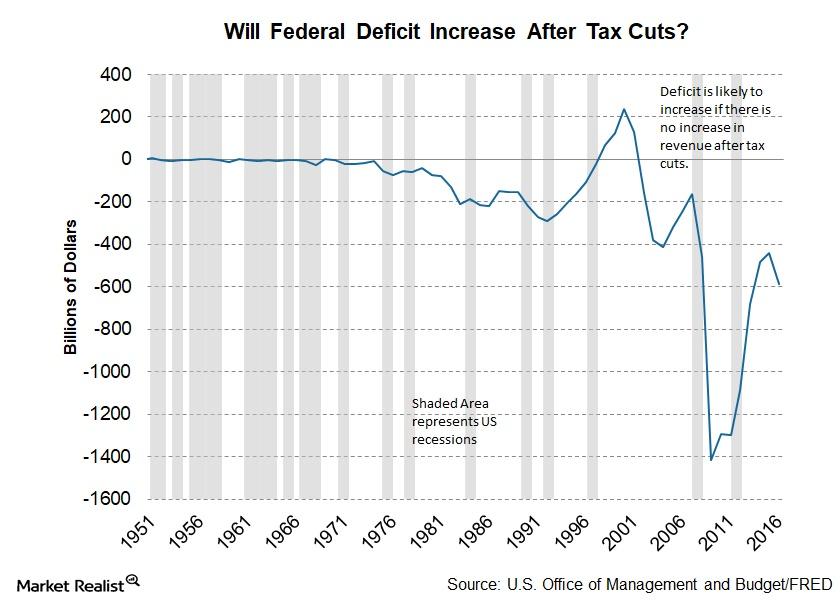

How Will Tax Cuts Impact the Federal Deficit?

The report from the Joint Committee on Taxation included an estimate of budgetary deficits for 2018–2027. Tax reforms could have a limited impact in 2018.

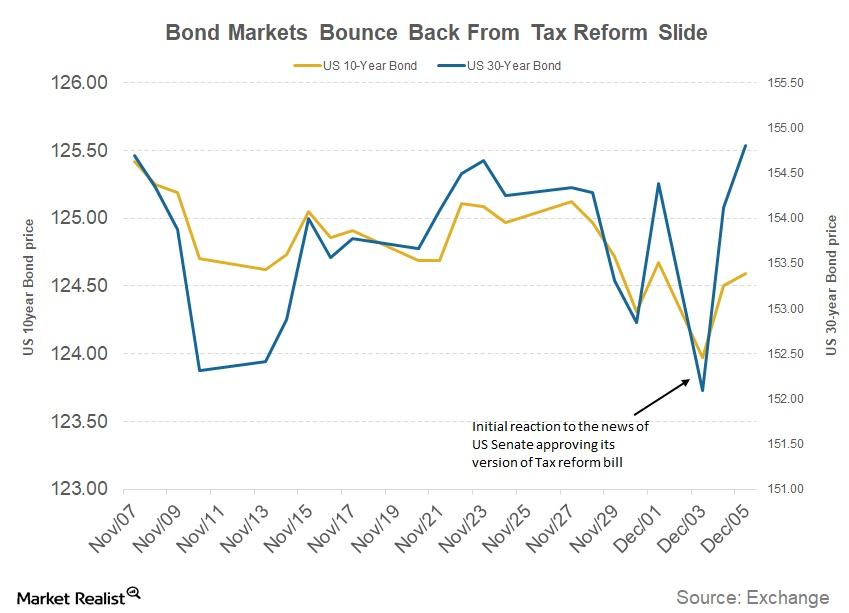

Tax Cuts and Rate Hikes Could Impact the Fed

The proposed tax cuts and the resulting increase in the federal deficit are expected to impact bond markets. It’s important to consider the Fed’s stance.

Are Politics Holding the Euro Back?

The euro-dollar (FXE) closed the week ending December 1 at 1.19, depreciating by 0.33% against the US dollar (UUP).

Will the US Dollar Surge on Tax Reform News?

The US Dollar Index (UUP) managed to close the week ending December 1 in positive territory with a gain of 0.14%.

Fed’s November Beige Book and Restrained Hiring Plans

The inability of employers to find suitable workers is leading to wage increases, especially in the professional, technical (XLK), and production (XLI) sectors.

The Economic Indicators Covered by the Fed’s Beige Book

Comparing the economic performance with economic expectations and the previous cycles gives investors an idea of whether the economy is expanding or contracting.

Rising Price Pressures: A Sign of Relief for the Bond Markets?

The increase in price pressure, although reassuring for the Fed, might not lead to a higher rate of inflation in the short term.

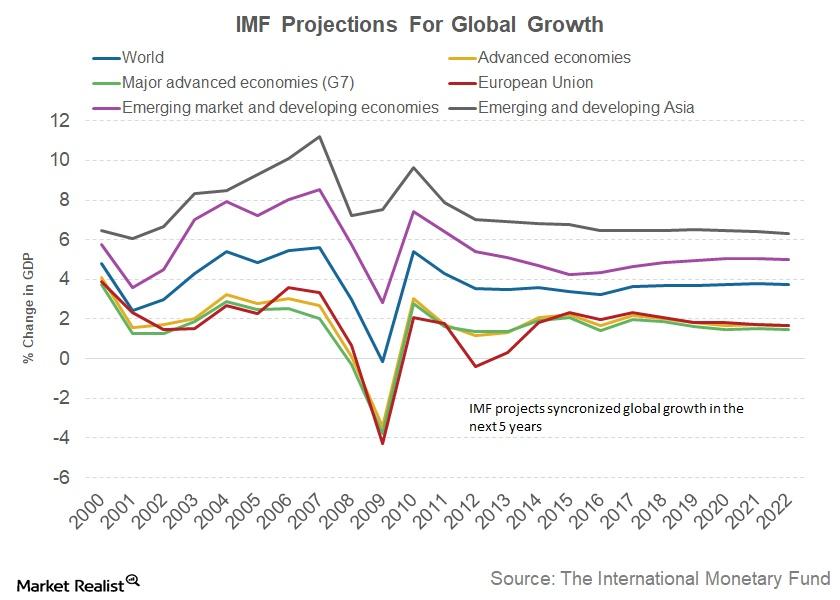

When the United States Sneezes, Will the World Catch a Cold?

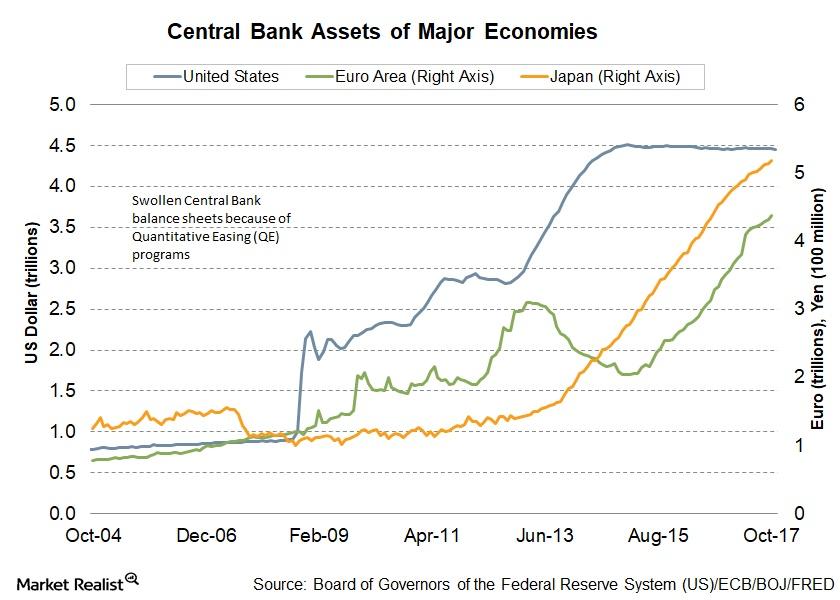

Williams suggested that the monetary policy framework should be designed considering the global scenario rather than central banks looking at their economies in isolation.

The Problem with the Current Interest Rates

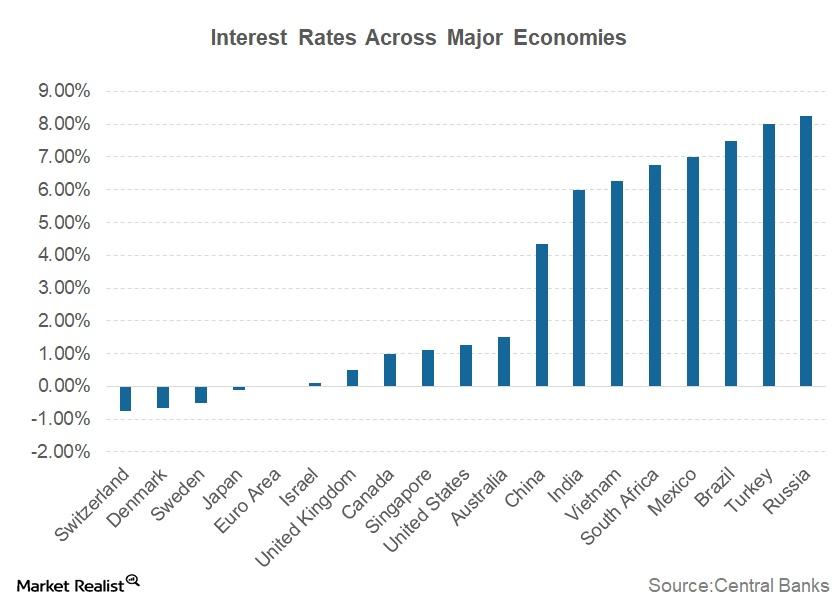

With global economies progressing toward normalcy or the “new normal,” as Williams called it, central banks are moving toward normalizing policy by signaling interest rate hikes.

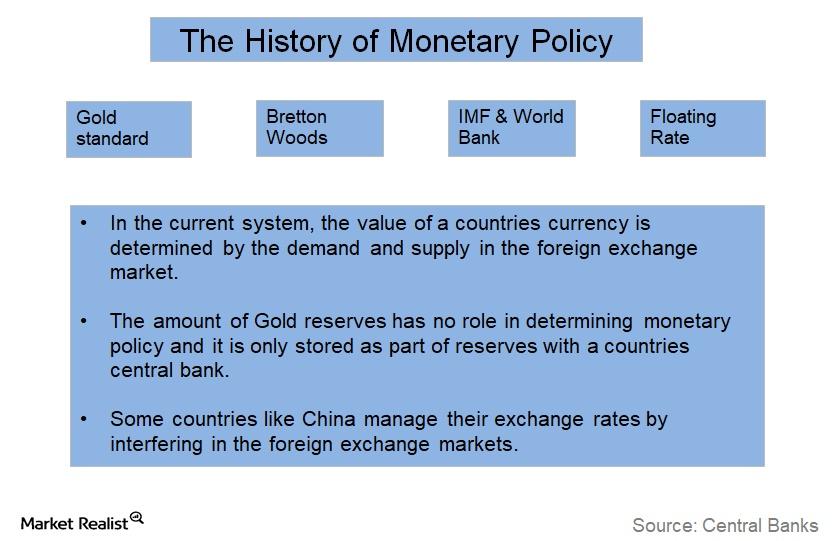

Fed John Williams and a Brief History of Monetary Policy

In his speech at the 2017 Asia Economic Policy Conference on November 16, 2017, John Williams, CEO of the Federal Reserve Bank of San Francisco, spoke about the history of monetary policy.

San Francisco Fed John Williams and Monetary Policy Challenges

John Williams, president and CEO of the Federal Reserve Bank of San Francisco, spoke on November 16, 2017, at the 2017 Asia Economic Policy Conference in San Francisco.

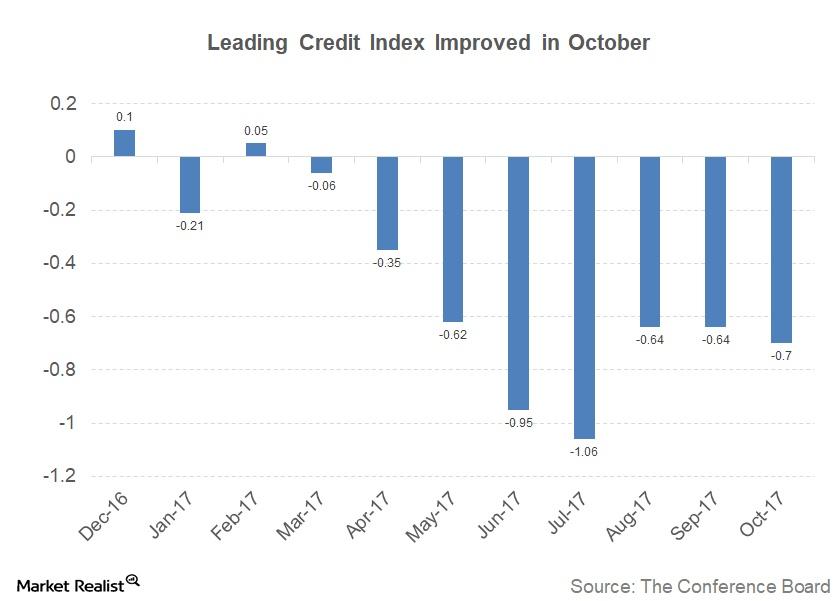

The Leading Credit Index: October Update

The Leading Credit Index for October was reported to be -0.70, improving from the revised September reading of -0.64.

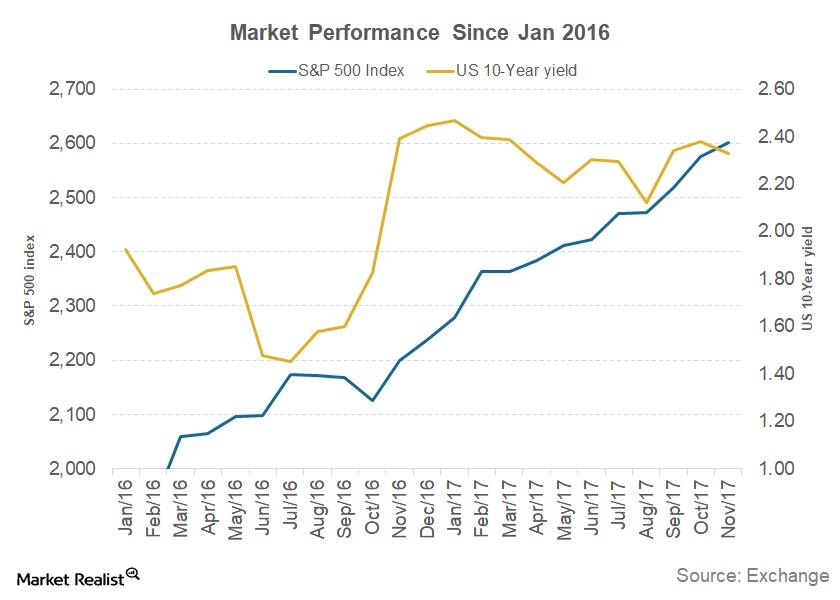

Why the S&P 500 Index Is Considered a Leading Indicator

The S&P 500 Index has risen 2.2% in October and is en route to its eighth straight positive monthly close.

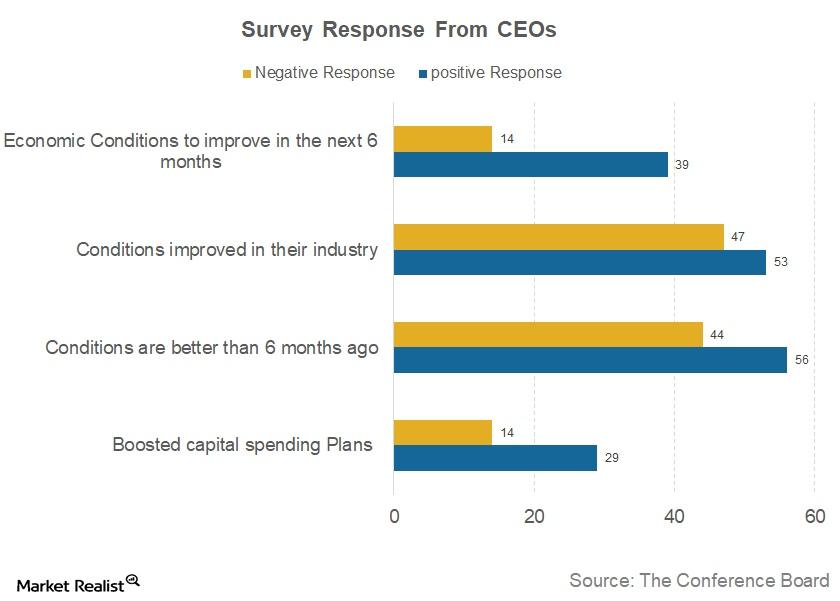

How Does CEO Confidence Index Assess US and Global Economies?

The Conference Board CEO Confidence Survey is a quarterly report based on a survey that collects responses from approximately 100 CEOs who represent a variety of industries.

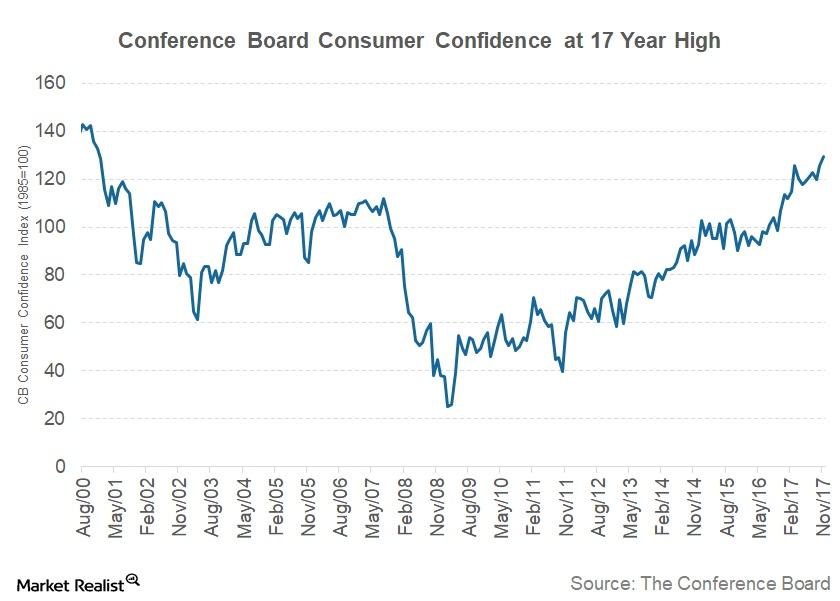

Conference Board Consumer Confidence Rose in November

The Conference Board Consumer Confidence Index for November came in at 129.5, up from 126.2 in October.

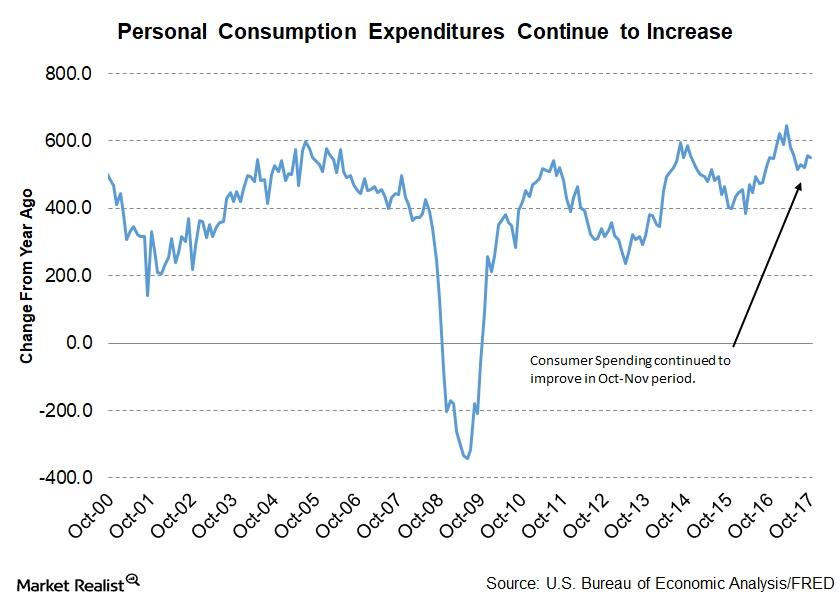

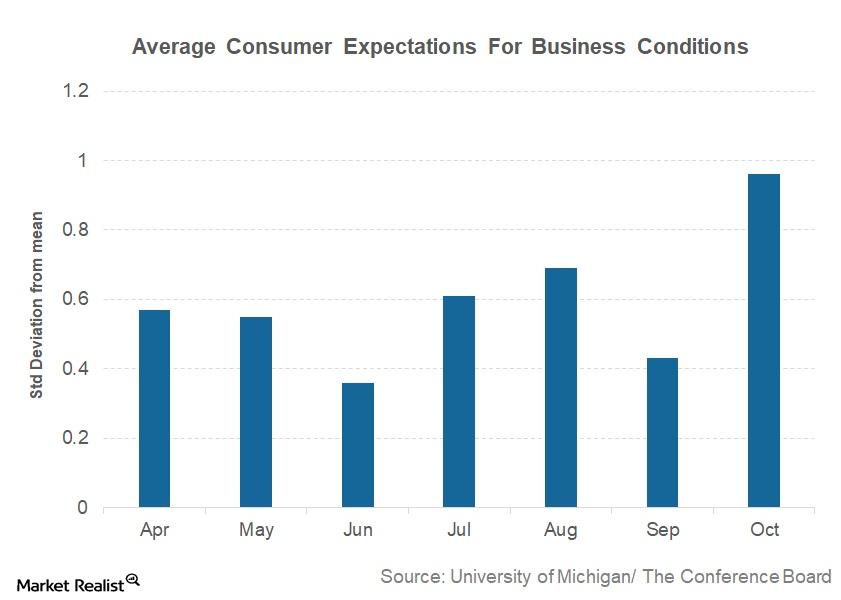

Understanding the Sharp Rise in Consumer Expectations in October

The November Conference Board LEI reported the average consumer expectations for business conditions for October at 0.96, a sharp increase from the September reading of 0.43.

Why Decreasing Credit Spreads Are a Cause for Concern

The November Conference Board report, which takes October data into account, reported the credit spread at ~1.2—an improvement from the September reading of ~1.1.

What Decreasing Weekly Unemployment Claims Say about the US Economy

In the Conference Board Leading Economic Index, the average weekly unemployment claims have 3.0% weight.

The FOMC’s View of the Equity and Bond Markets

The FOMC’s November meeting minutes deemed the bond market’s yield curve to be flattening between meetings. The report indicated that bond yields have risen since the September FOMC meeting for multiple reasons.

The FOMC’s Outlook for the US Economy

As per economic projections prepared by the FOMC, US real GDP is expected to improve in the final quarter of this year.