Penny Morgan

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Penny Morgan

Estée Lauder Sees Positive Outlook in China

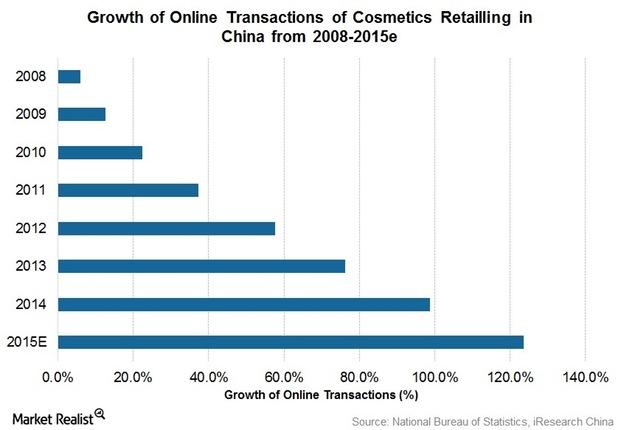

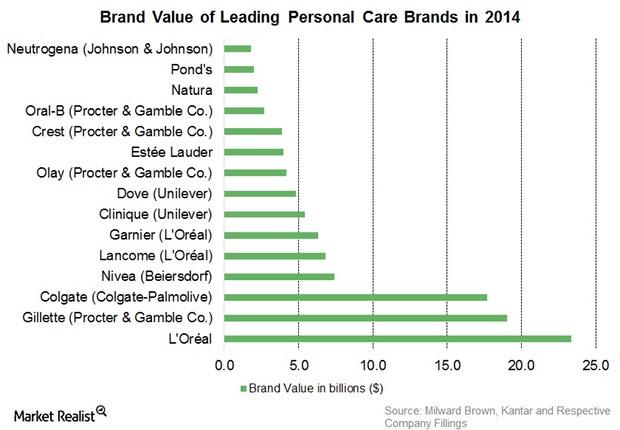

International brands such as Estée Lauder (EL), L’Oréal (LRLCY), Procter & Gamble (PG), Shiseido (SSDOY), and Nivea (BDRFF) dominate the cosmetics market in China.

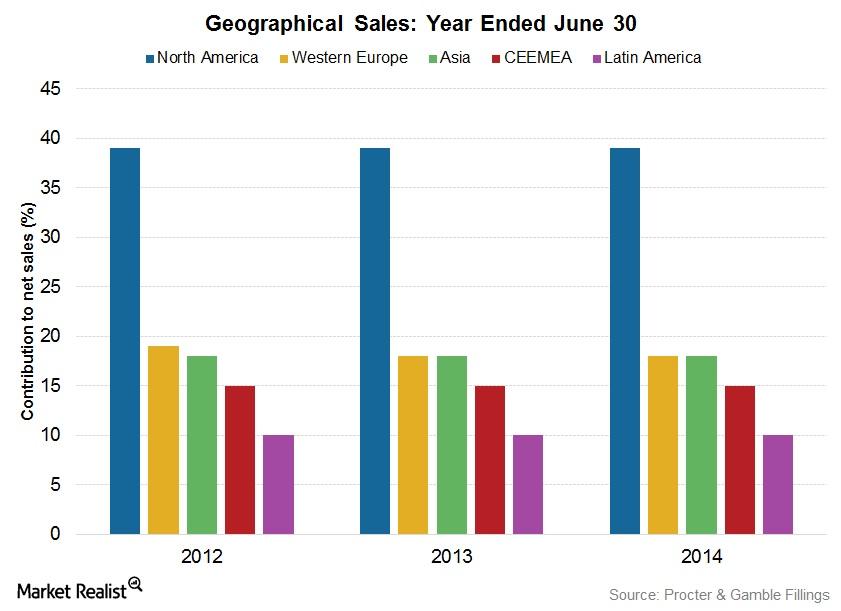

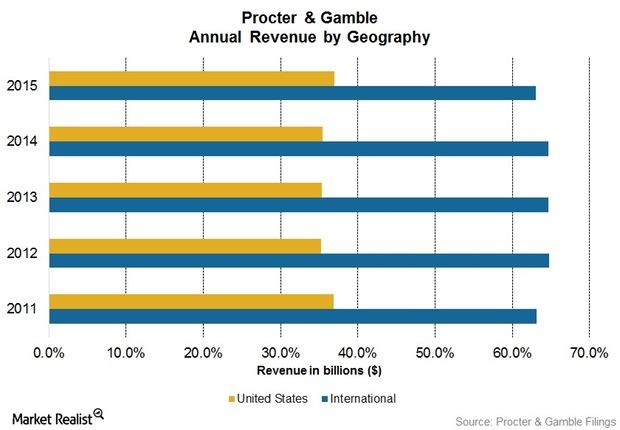

Procter & Gamble: Global Giant in Household, Personal Products

The Procter & Gamble Company, or P&G, is the largest household and personal products company in the world. It was established in 1837 by William Procter and James Gamble.

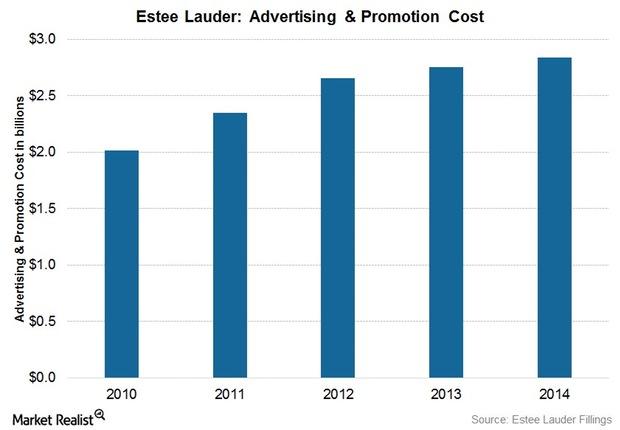

Estée Lauder’s Marketing Strategies to Reach New Consumers

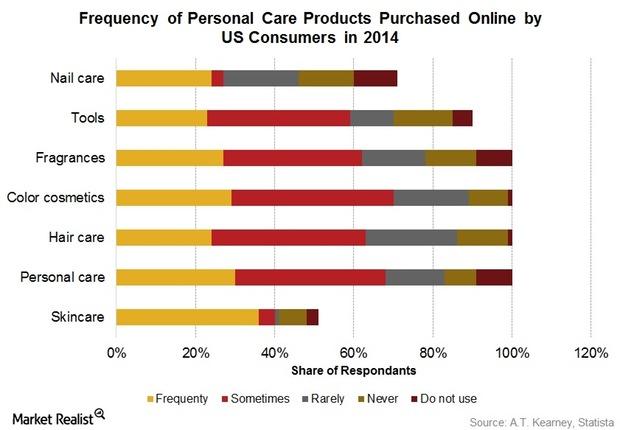

Estée Lauder aims to partner with key brick-and-mortar retailers to strengthen their prestige beauty shopping e-commerce websites to better meet consumer online shopping preferences.

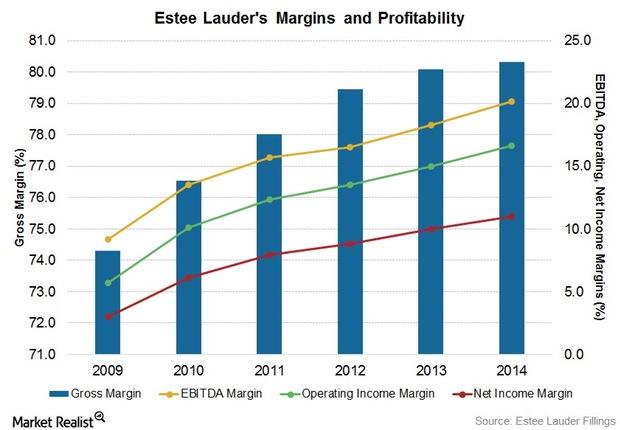

Why Estée Lauder’s Margins and Profitability Are Rising

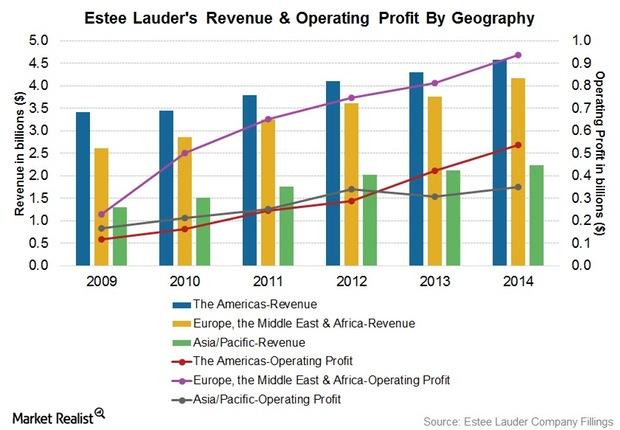

Despite currency headwinds, Estée Lauder’s (EL) worldwide gross profit margin increased to 80.3% in fiscal 2014 from 80.1% in fiscal 2013.

How Is Procter & Gamble Trying to Improve Local Profit Margin?

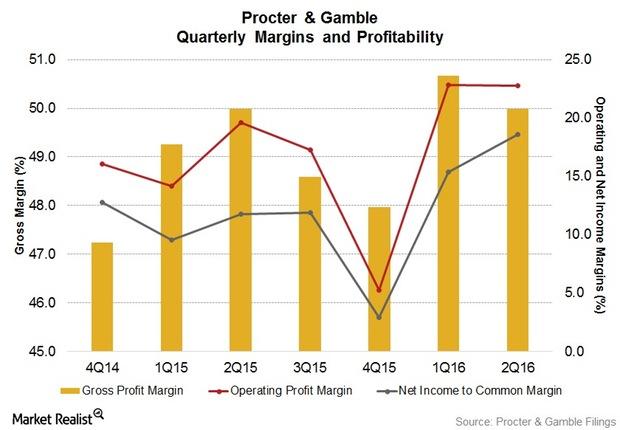

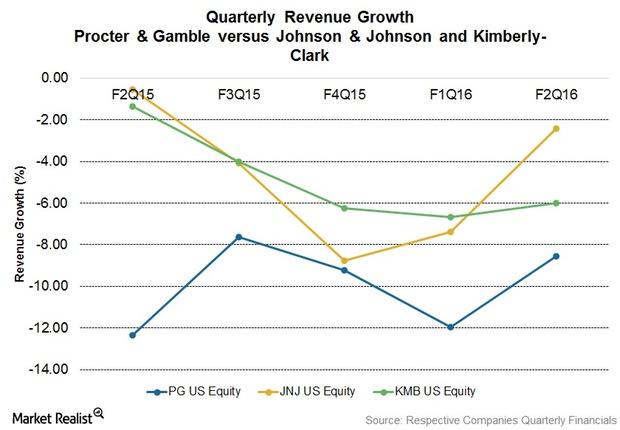

Procter & Gamble (PG) reported a slight improvement in its core gross margin in 2Q16. Its reported gross profit margin increased 170 basis points that quarter.

Will Colgate’s Geographic Segments See Improvement in 1Q16?

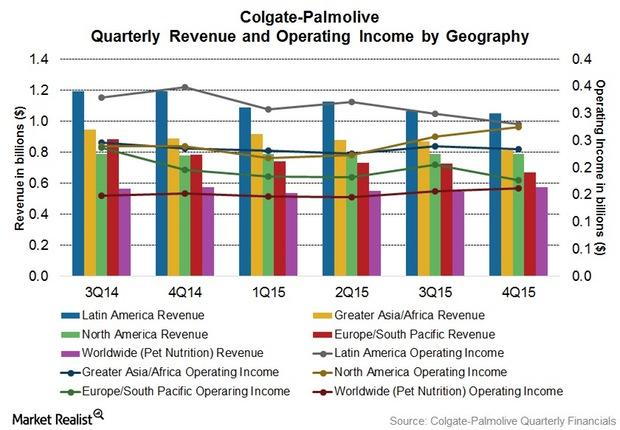

Colgate-Palmolive (CL) is geographically diverse and derives 77% of its total revenue from outside the United States.

Why Coty’s Capital Expenditure Could Rise

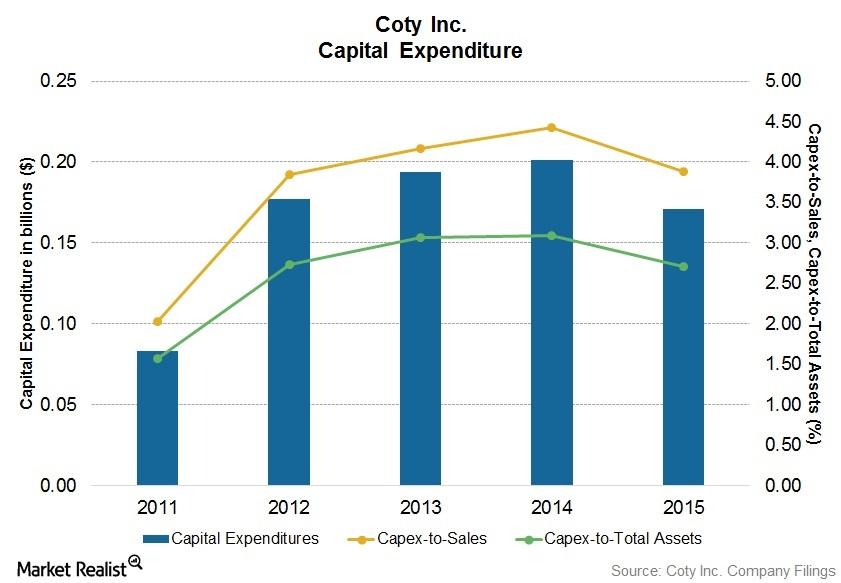

Coty Inc.’s capital expenditure decreased 15.2% to $0.17 billion in fiscal 2015, compared to $0.20 billion in fiscal 2014.

Estée Lauder’s Growth Initiative: Leading Beauty Forward

With increasing competition from L’Oréal, Shiseido, and Coty, Estée Lauder continues to expand its position in Western Europe and emerging markets.

Estée Lauder’s Strategies to Improve Supply Chain Performance

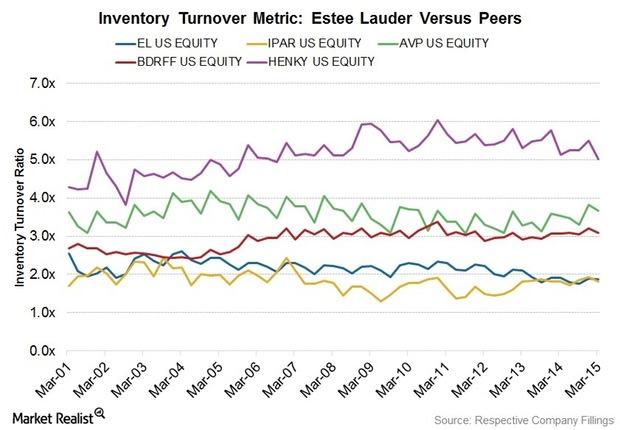

To improve its supply chain efficiency, Estée Lauder aims to utilize a network of third-party manufacturers on a global basis, including in the Asia Pacific region.

Business Overview of Estée Lauder

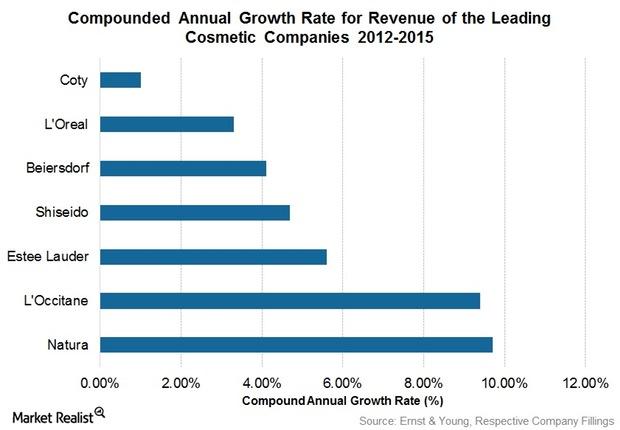

Estée Lauder’s sales growth was ranked third-highest globally among leading cosmetic companies between the years 2012 to 2015, with net revenue of $11 billion in fiscal year 2014.

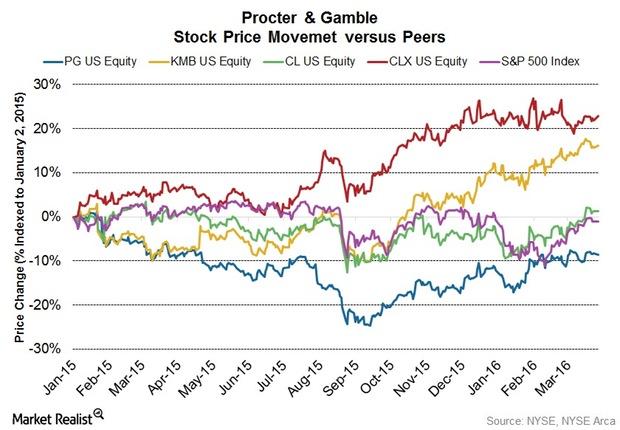

Procter & Gamble: Can Focus on 10 Product Categories Help 3Q16?

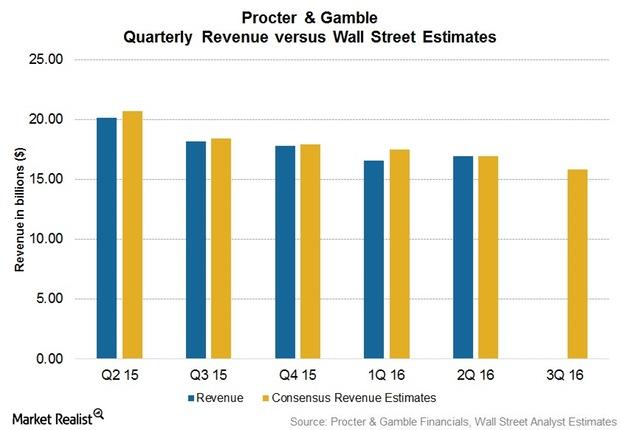

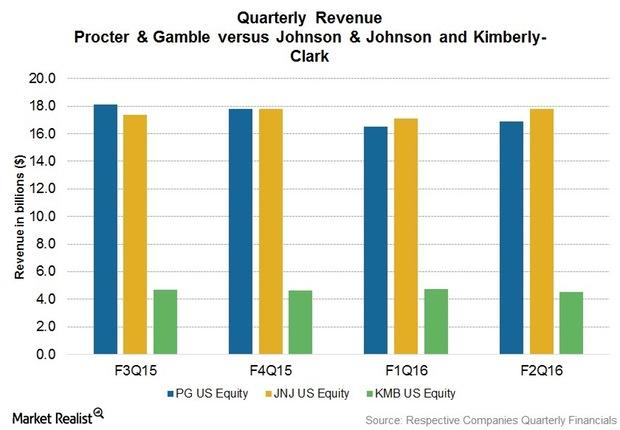

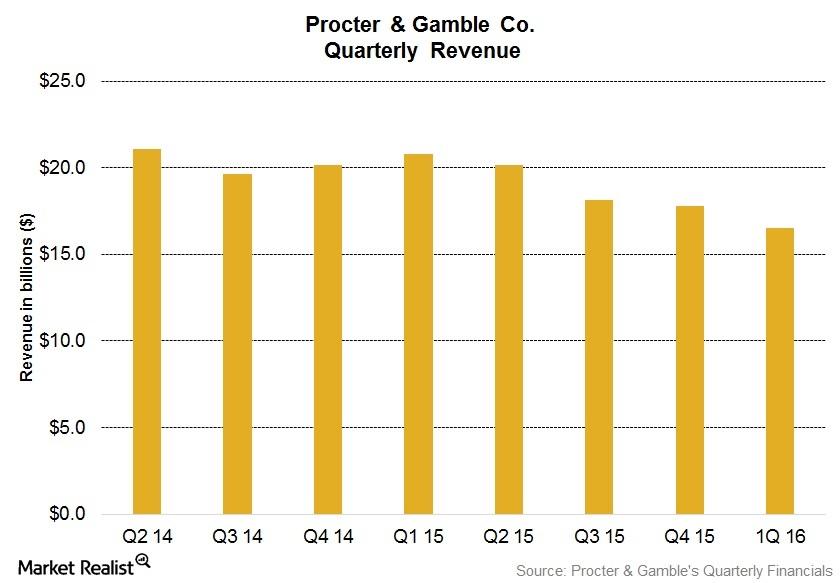

Procter & Gamble (PG) is set to release its fiscal 3Q16 earnings before the Markets open on April 26, 2016. In fiscal 2Q16, P&G missed revenue estimates for the fifth consecutive quarter.

How Is Clorox Improving Product Distribution?

For distribution in the United States, Clorox (CLX) sells or markets its products primarily through mass retail outlets, e-commerce channels, wholesale distributors, and medical supply distributors.

Mega Brands Set to Dominate in P&G’s New Product Portfolio

P&G plans to focus on superior brands in the 10 product categories in its portfolio. It expects one-third of them to surpass $1 billion in annual sales.

Estée Lauder’s Efforts to Expand Its Geographical Presence

Estée Lauder aims to expand its geographical market share in China, the Middle East, Eastern Europe, Brazil, and South Africa by focusing on consumers who purchase in travel retail channels.

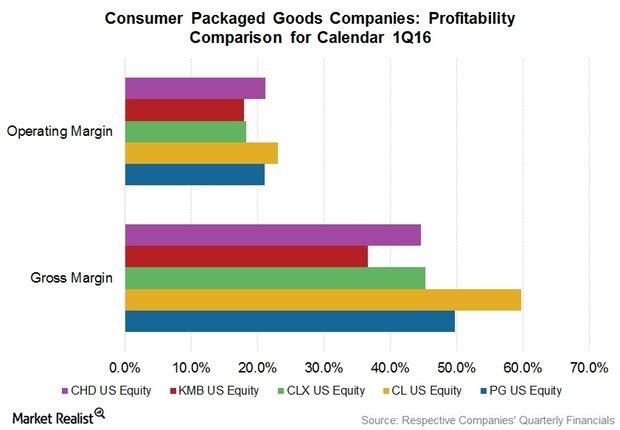

Weak Currencies, but Consumer Packaged Goods Margins Improved

The 1Q16 margins of consumer packaged goods (or CPG) companies sent strong signals. These companies have been investing heavily in innovative products and other growth initiatives.

Procter & Gamble and Its Profitable Divestitures

P&G reported $0.15 billion in gains from divestitures in fiscal 2014 and $0.63 billion in 2013. The sale of Wella and Clairol could be the biggest divestments yet.

Why P&G Transferred Its Duracell Business to Berkshire Hathaway

On February 29, 2016, Procter & Gamble (PG) announced the completion of the transfer of its Duracell business to Berkshire Hathaway (BRK-B).

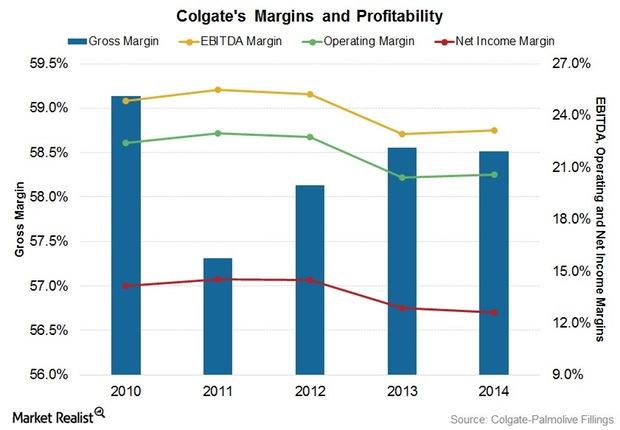

How Colgate Is Maintaining Margins in the Face of Headwinds

Colgate’s worldwide gross profit margin fell to 58.5% in 2014 from 58.6% in 2013.

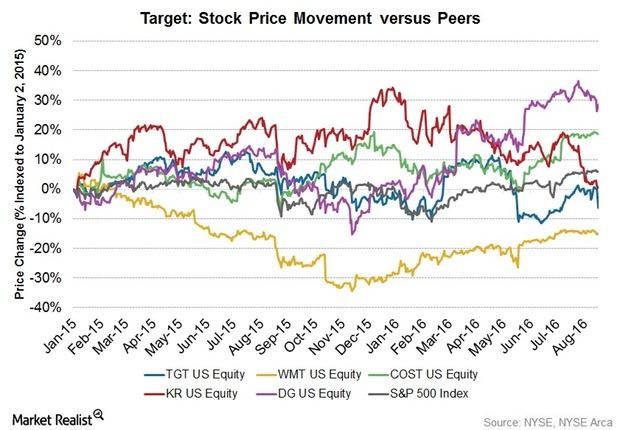

Target’s Stock Price Fell 6.4% after Fiscal 2Q16 Earnings

Target’s (TGT) stock price fell 6.4% to $70.63 on August 17, 2016, after the company released its fiscal 2Q16 earnings.

Target’s Signature Categories Beat Overall Business in Fiscal 2Q

Target’s (TGT) Signature Categories include Style, Baby, Kids, and Wellness. Target’s Signature Categories outpaced the total business by 3 percentage points in fiscal 2Q16.

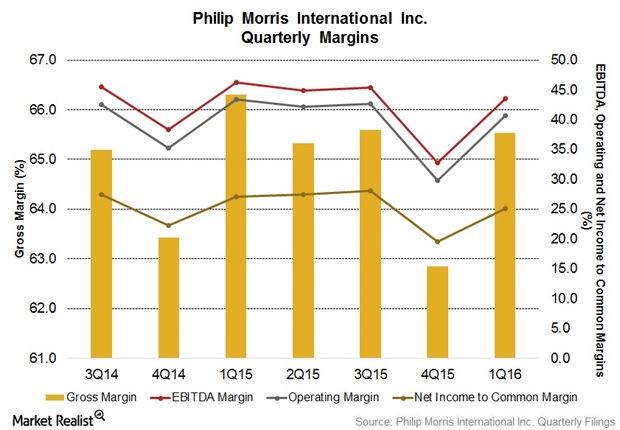

Can ~6% Pricing Variance Help Philip Morris’s Margin Rise in 2Q16?

As a result of decreased operating income, Philip Morris’s (PM) operating margin fell by 2.8% to 41.9% in 1Q16.

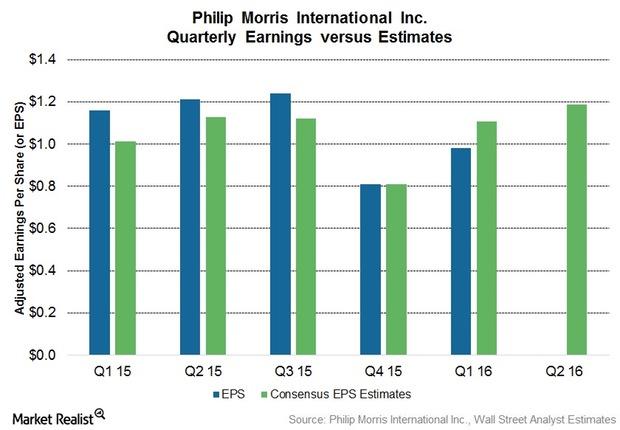

Can Philip Morris Beat Its 2Q16 Earnings Expectations?

The Wall Street consensus analyst expectation for Philip Morris’s adjusted diluted EPS in 2Q16 is $1.19 per share.

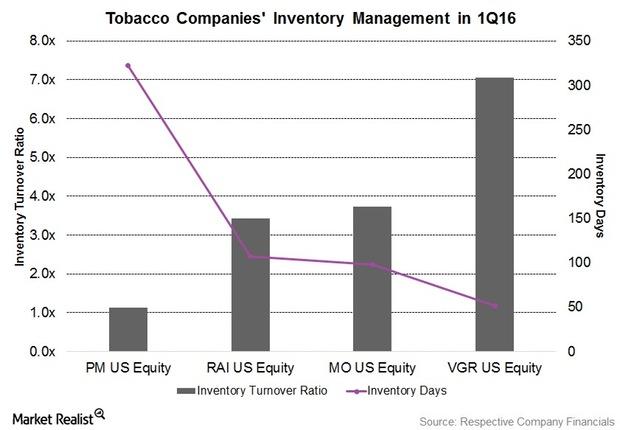

Analyzing Tobacco Companies’ 1Q16 Inventory Levels

1Q16 inventory levels were lower for tobacco companies due to falling cigarette shipment volumes.

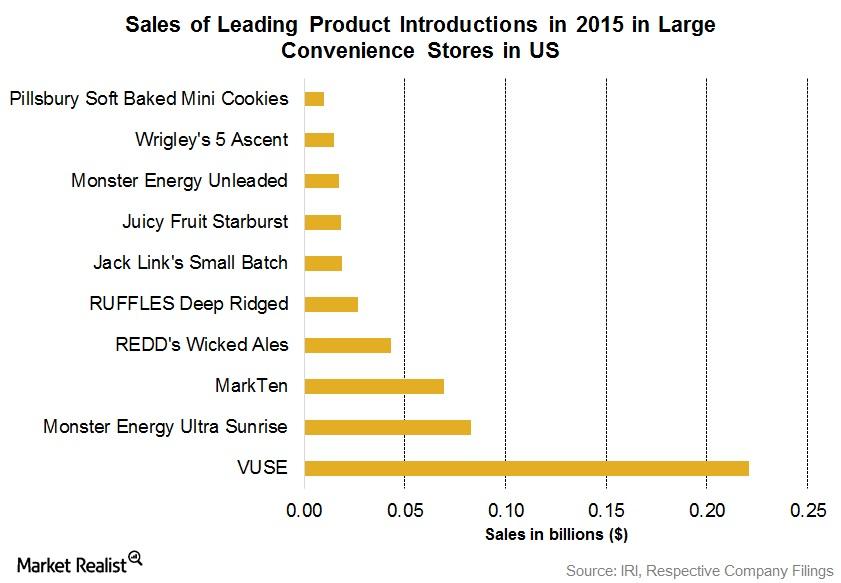

Why Tobacco Companies Are Shifting to Innovative Products

Due to increased health consciousness, most of the tobacco companies’ 1Q16 cigarette shipment volumes have seen falls.

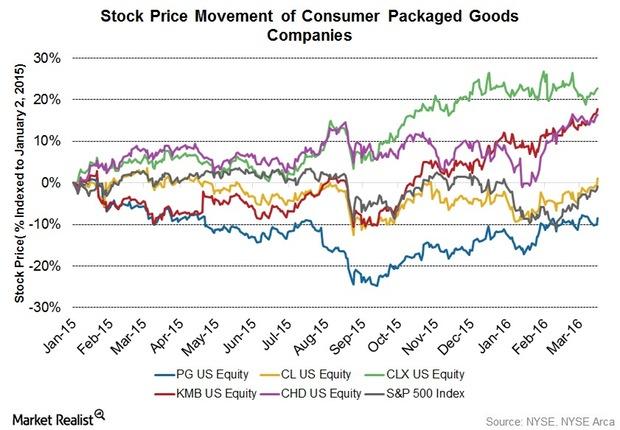

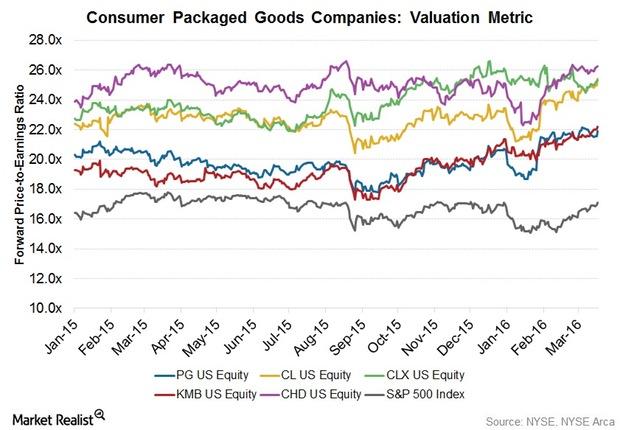

Valuation Multiples Higher for Consumer Packaged Goods in 1Q16

Consumer packaged goods (or CPG) companies are trading at higher valuations compared to the S&P 500 Index (IVV) (SPY) (VOO) and the Dow Jones Industrial Average (DIA).

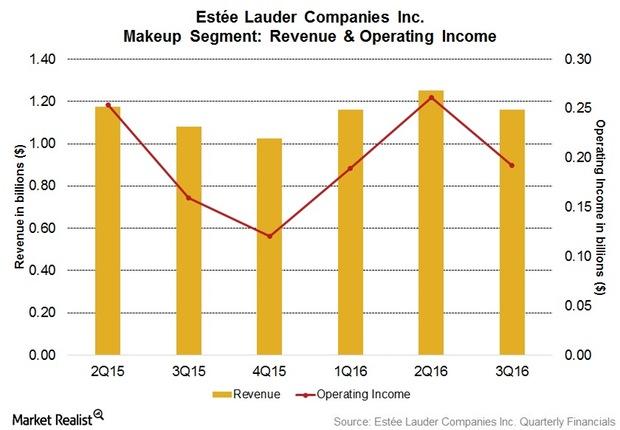

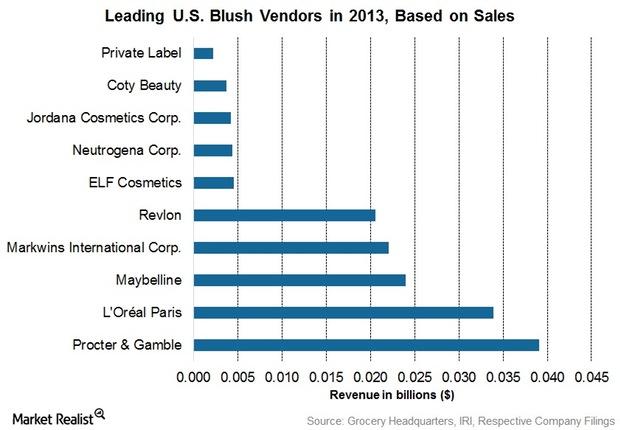

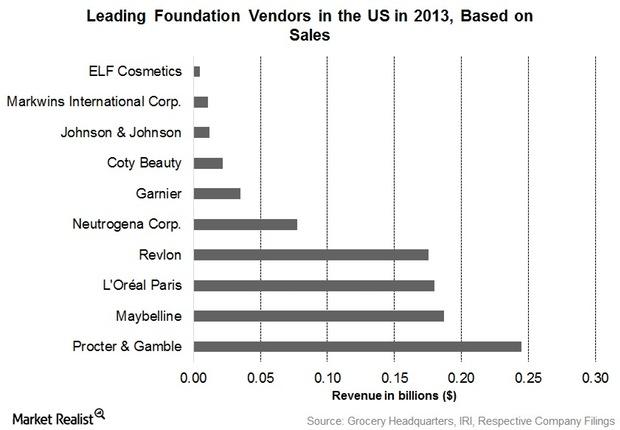

Estée Lauder’s Makeup Segment Boosted Its Operating Income

Estée Lauder’s makeup segment’s net revenue rose 7.3% in reported terms and 11% in constant currency terms to $1.2 billion in fiscal 3Q16.

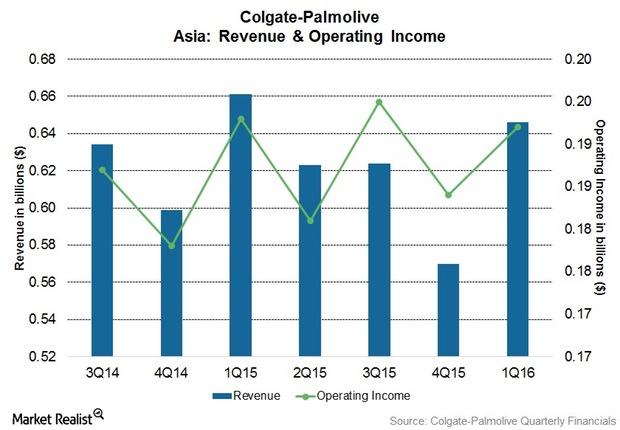

How Colgate Improved Market Share in Its Asia Segment in 1Q16

Colgate’s (CL) Asia segment’s net revenue decreased 2.3% to $0.6 billion in 1Q16.

Will Negative Foreign Exchange Affect Procter & Gamble in 3Q16?

Since December 2015, FX (foreign exchange) headwinds have increased $0.3 billion after tax. That includes devaluations in Argentina, Russia, and Mexico.

The Story behind Colgate-Palmolive’s Commercial Strategies

Colgate-Palmolive’s global market share is ~45%. It is the leading toothpaste compared to Oral-B and Close-up, especially in emerging markets like India.

P&G’s Stock Price Reaction to the Old Spice Lawsuit

After a lawsuit was filed against Procter & Gamble (PG), or P&G, for its Old Spice deodorant, P&G’s stock price opened with a fall of 0.4% to $82.46 on March 24, 2016.

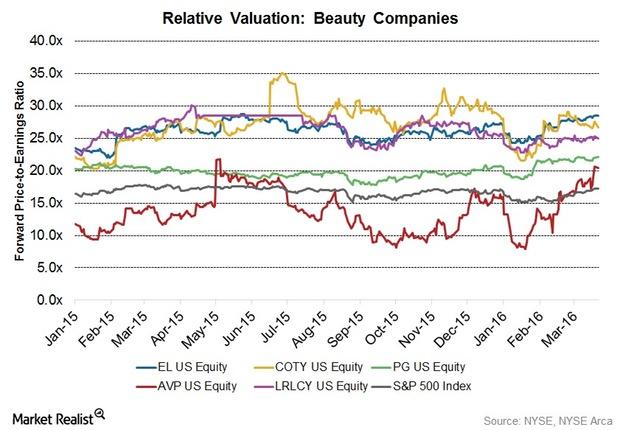

Favorable Valuation Multiples for Beauty Companies in 4Q15

Beauty companies are trading at higher valuations relative to the S&P 500 Index (SPY) and the Dow Jones Industrial Average (DIA).

Behind CPG Companies’ High Valuation Multiples in 4Q15

As of March 17, 2016, CPG companies were trading at higher valuations relative to the S&P 500 Index (SPY) and the Dow Jones Industrial Average (DIA).

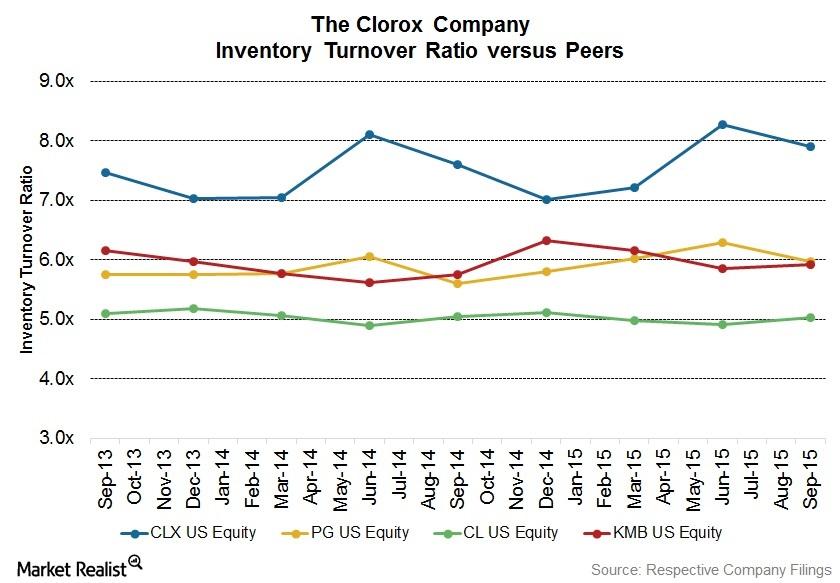

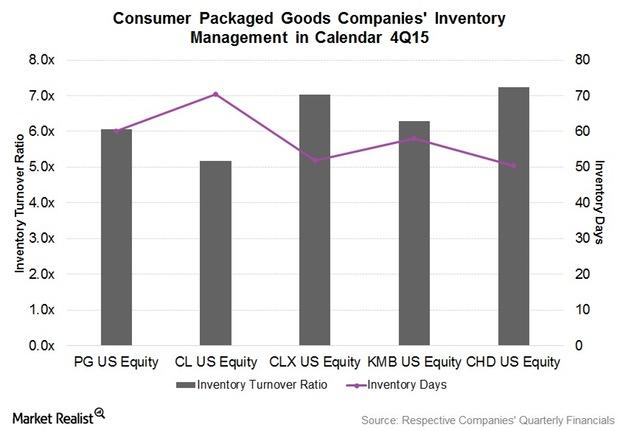

How CPG Companies’ Inventory Levels Were Looking in 4Q15

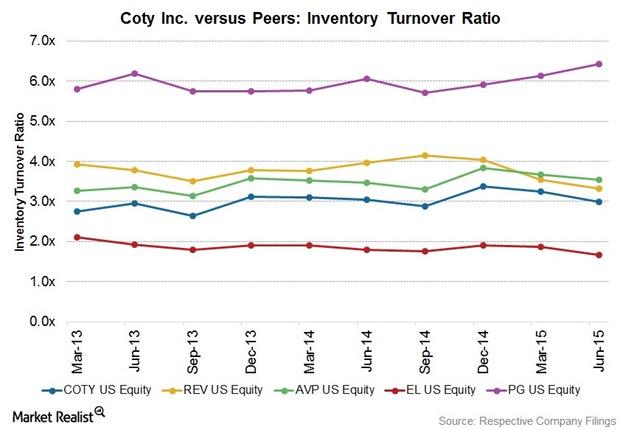

Inventory levels in 4Q15 increased for most CPG companies YoY. The inventory turnover ratio for P&G in 4Q15 increased by 6.1% to 6.1x versus 5.7x in 4Q14.

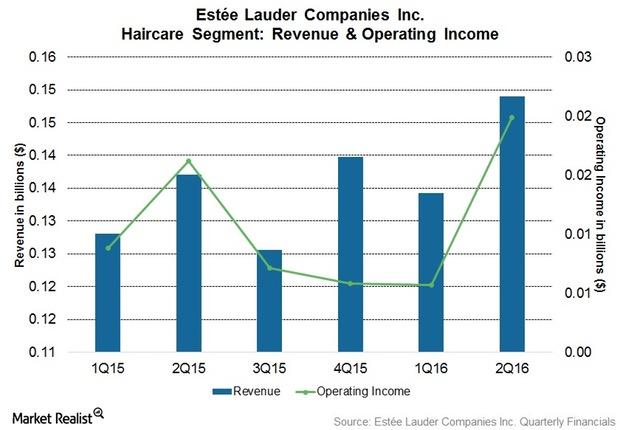

Estée Lauder’s Aveda Haircare Brand’s Healthy Growth in 2Q16

Estée Lauder’s (EL) haircare segment’s revenue increased 8.7% in reported terms and 14% on a constant-currency basis to $0.15 billion in fiscal 2Q16.

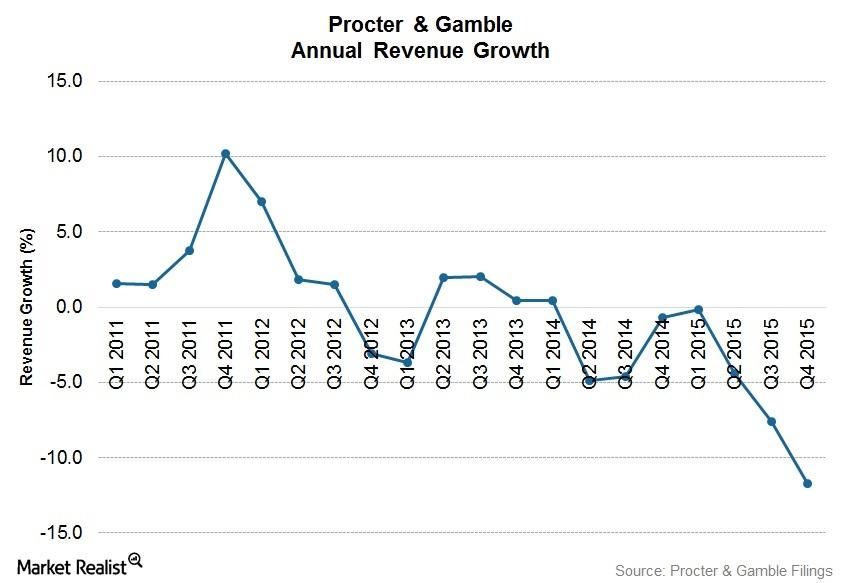

Why Procter & Gamble Is Selling Some of Its Brands

Procter & Gamble is on a mission to trim brands that are holding back its overall financial performance.

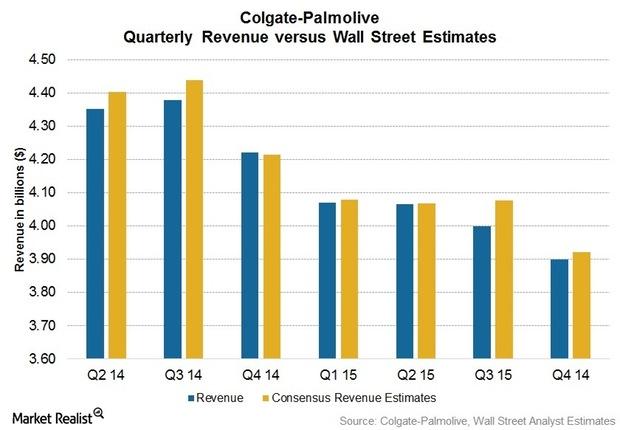

Why Does Colgate’s Revenue Keep Falling?

Colgate’s (CL) revenue declined 7.5% to $3.9 billion in 4Q15. The reported revenue was negatively impacted by foreign exchange and divestitures.

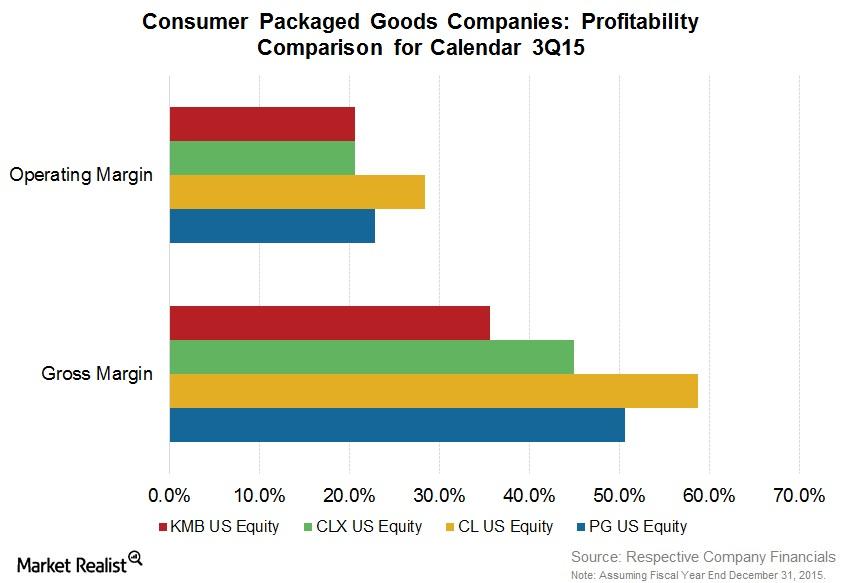

Consumer Packaged Goods Companies Saw Improved Margins

CPG companies’ 3Q15 margins sent strong signals. They have been investing in innovative products and other growth initiatives. This is impacting their margins.

Gillette Seeks to Grow Online Market Share with Sales Initiatives

Gillette, which controls more than 60% of the US retail (XRT) market, has 20% of the online shaving market.

P&G’s Gillette Files a Lawsuit against Dollar Shave Club

P&G alleges that Dollar Shave Club is violating Gillette’s intellectual property by selling its razors.

Weighing Clorox’s Strengths and Opportunities

Clorox (CLX) has a strong research and development (or R&D) team and devotes significant resources and attention to product development.

Hurdles in Clorox’s Growth: Weaknesses and Threats

Advertising and promotional events from Unilever and PG’s home cleaners and a rise in the popularity of store brands pose threats to Clorox.

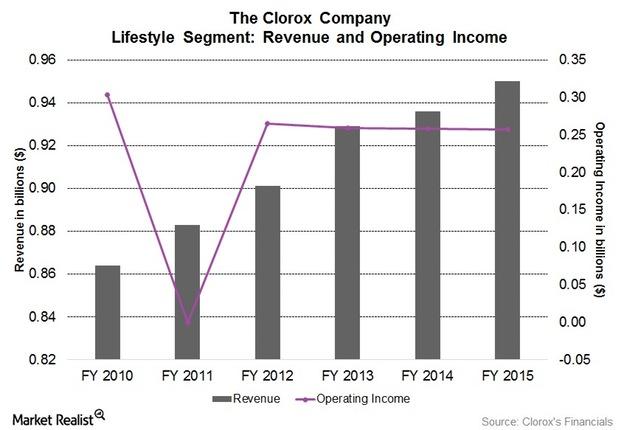

Understanding Clorox’s Lifestyle Product Segment

Clorox’s Lifestyle segment’s revenue increased 1.5% to $1 billion in fiscal 2015 compared to $0.9 billion in fiscal 2014. The increase was primarily due to higher shipments in natural personal care.

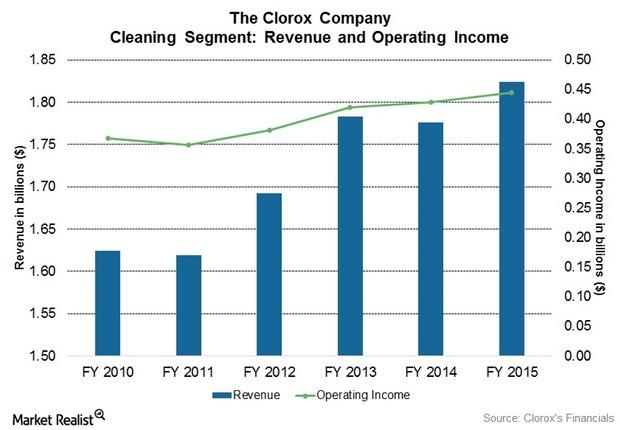

Clorox’s Largest Operating Segment: Cleaning

The Cleaning segment contributed 32.3% to the total consolidated sales of Clorox, the highest among all the segments. The increase was primarily due to higher volume growth.

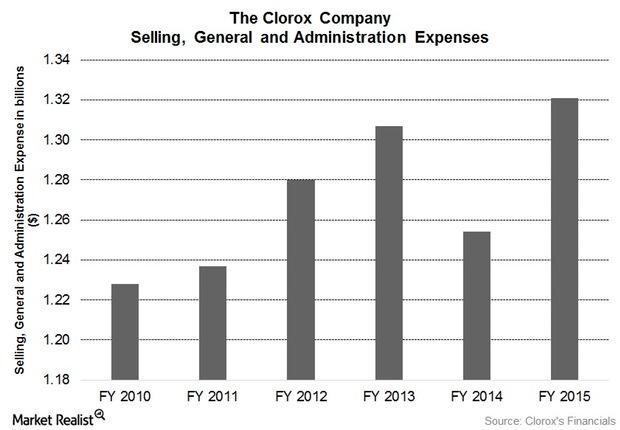

Why Clorox’s Marketing Strategies Are Reaching More Households

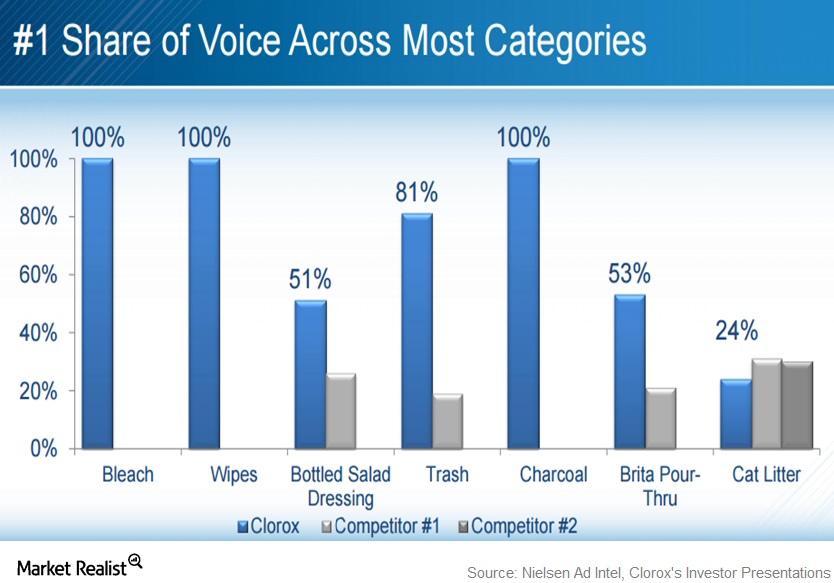

Clorox’s (CLX) SG&A expenses increased 5.3% in fiscal 2015 compared to fiscal 2014. The increase was primarily due to increased advertising and marketing programs.

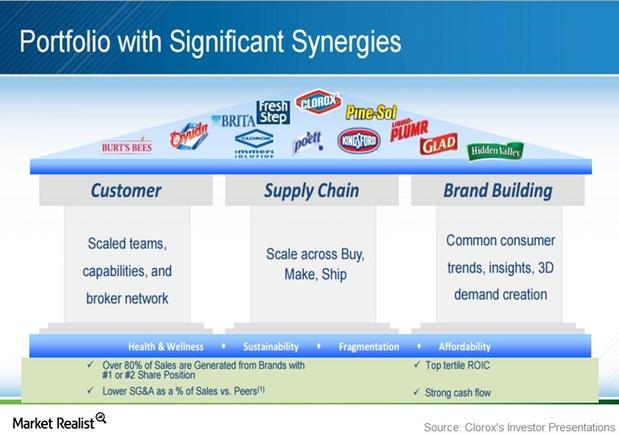

Why It’s Hard to Compete with Clorox

Due to Clorox’s diverse product portfolio and the competitive nature of the consumer products market, it’s difficult for a new company to compete with similar products.oducts.

Coty’s Growth Barriers: Weaknesses and Threats

A limited distribution strategy led to Coty’s high reliance on specific channels or departments for specific products. Coty faces stiff competition from established luxury brands and local regional brands.

Assessing Coty’s Strengths and Opportunities

Coty operates in over 130 countries through key distribution channels in both the prestige and mass markets channels.

Analyzing Coty’s Level of Competition

High-end companies like Coty rely on repeat customers and mainly compete on the basis of product quality and product differentiation.

Coty’s Marketing Strategies to Reach New Consumers

Coty plans to expand with a multipronged strategy that includes digital marketing efforts through websites, brand sites, social networking campaigns and blogs, and e-commerce.

How Coty Is Improving Its Distribution Channels

Coty sells its products through a multichannel distribution strategy across several price points in prestige and mass market channels of distribution.