Understanding Clorox’s Lifestyle Product Segment

Clorox’s Lifestyle segment’s revenue increased 1.5% to $1 billion in fiscal 2015 compared to $0.9 billion in fiscal 2014. The increase was primarily due to higher shipments in natural personal care.

Dec. 3 2015, Updated 10:06 a.m. ET

Clorox’s Lifestyle segment

Clorox’s (CLX) lifestyle segment sells and markets food products, water-filtration systems and filters, and natural personal care products in the United States. Products within this segment include dressings and sauces, primarily under the Hidden Valley, KC Masterpiece, and Soy Vay brands. The water-filtration systems and filters are under the Brita brand, and natural personal care products are under the Burt’s Bees brand.

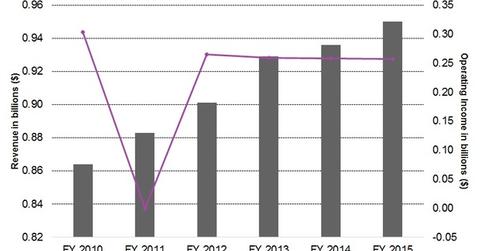

Revenue

Clorox’s Lifestyle segment’s revenue increased 1.5% to $1.0 billion in fiscal 2015 compared to $0.9 billion in fiscal 2014. The increase was primarily due to higher shipments in natural personal care, largely due to Burt’s Bees face and lip care products. However, the increase was partially offset by decreases in dressings, sauces, and water filtration. The Lifestyle segment contributes 16.8% of Clorox’s total revenue.

Operating income

The Lifestyle segment’s operating income decreased ~0.4% to $0.25 billion in fiscal 2015 compared to $0.26 billion in fiscal 2014. The decrease was primarily due to higher performance-based incentive costs and incremental demand-building investments to drive the trial on new dressings and sauces items.

Improving salad dressings growth

With increasing health-consciousness, companies are producing innovative products in order to gain a competitive advantage in a highly competitive food and beverage industry. For example, Clorox’s Hidden Valley brand sells and markets light, fat-free, and organic salad dressings and sauces in addition to flavored dressings.

Unilever’s (UL) Best Foods salad dressing and Knorr sauces compete with CLX’s products in the United States and internationally. Other companies such as Procter & Gamble (PG) and Colgate-Palmolive (CL) don’t operate in the salad dressings and sauces categories.