iShares Morningstar Mid-Cap

Latest iShares Morningstar Mid-Cap News and Updates

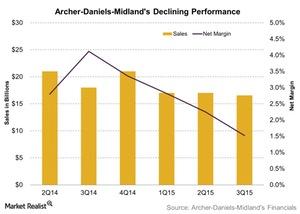

Archer Daniels Midland Reports Another Disappointing Quarter

In 3Q15, Archer Daniels Midland earned $684 million in operating profit, down $257 million from 3Q14. Its net revenue for the quarter was $16.6 billion.

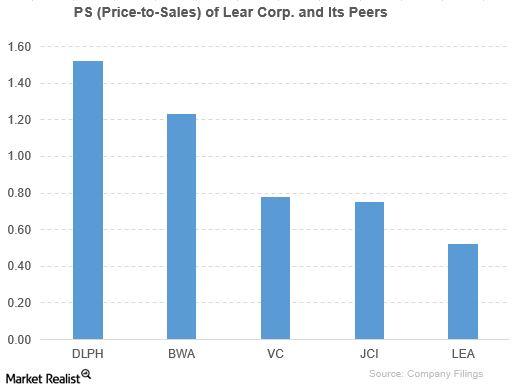

How Has Lear Performed Compared to Its Peers?

Competitors have outperformed Lear based on PE and PS. However, Lear is way ahead of its peers based on PBV. Lear is way ahead of its ETFs based on price movement.

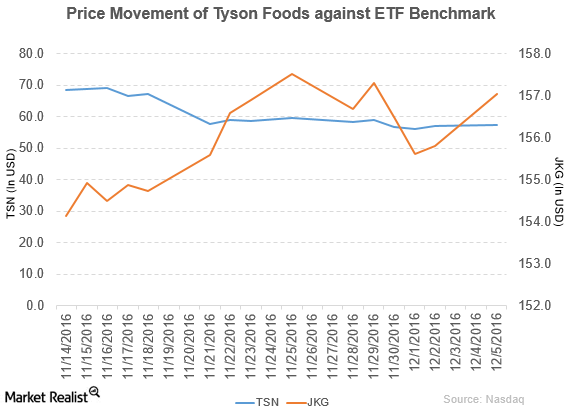

Tyson Foods Forms a New Venture Capital Fund to Focus on Growth

In fiscal 2016, Tyson Foods (TSN) reported sales of $36.9 billion, a fall of 10.9% year-over-year.

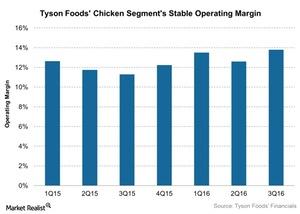

How Is Tyson Foods Improving Its Chicken Operating Margin?

In fiscal 3Q16, Tyson Foods’ Chicken segment reported an operating margin of 13.9% with an improved product mix.

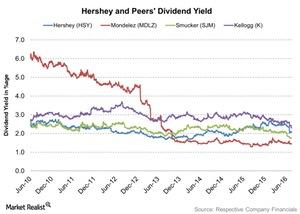

Hershey’s Returns, Including a 6% Dividend Hike, Hit a Sweet Spot

On July 28, 2016, Hershey (HSY) declared its 347th consecutive regular dividend on its common stock and 128th consecutive regular dividend on its Class B common stock.

Hershey Shareholders Thrive on 346 Straight Dividend Payouts

On May 4, Hershey (HSY) announced that its board of directors approved quarterly dividends of $0.58 on the common stock and $0.53 on the Class B common stock.

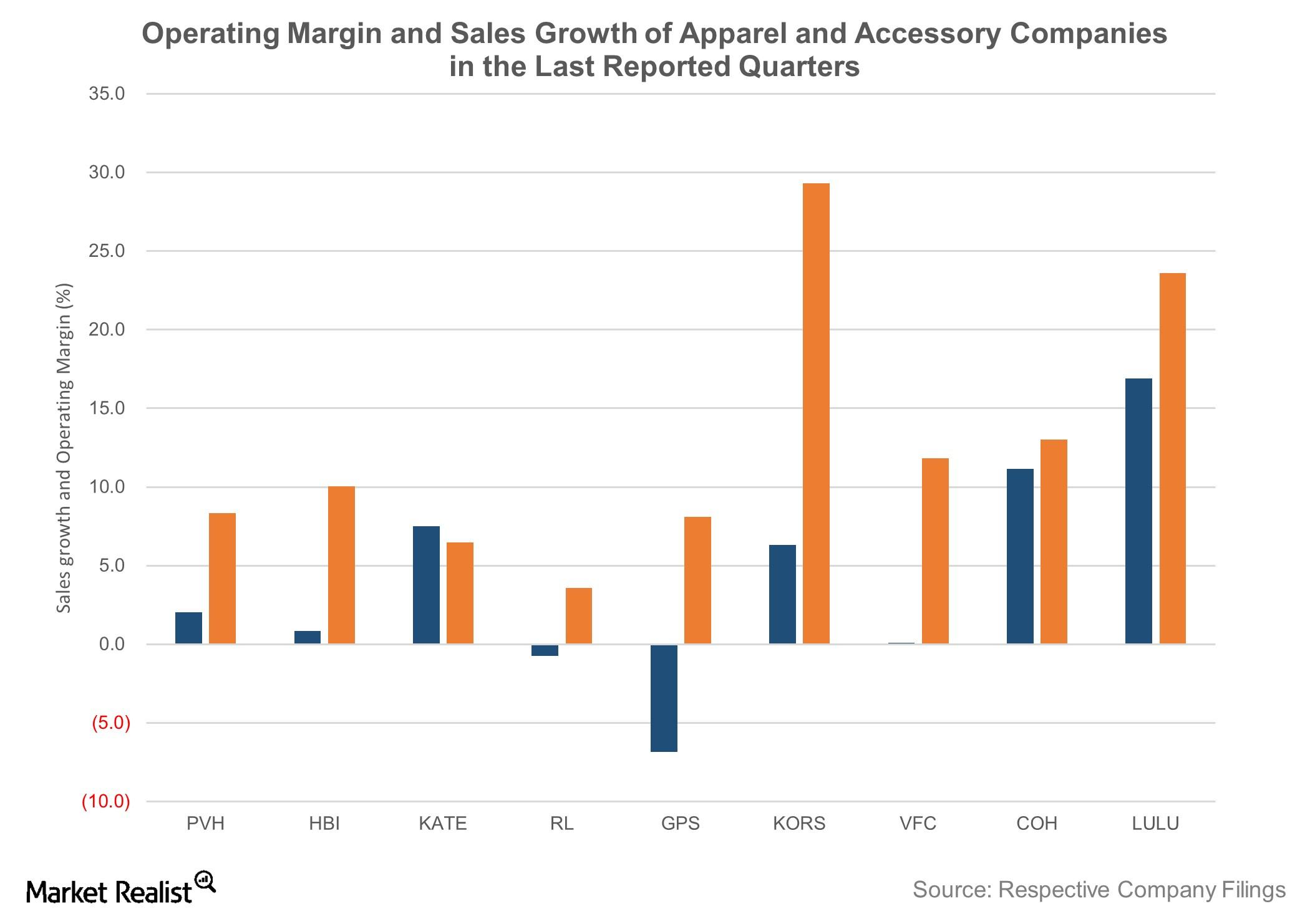

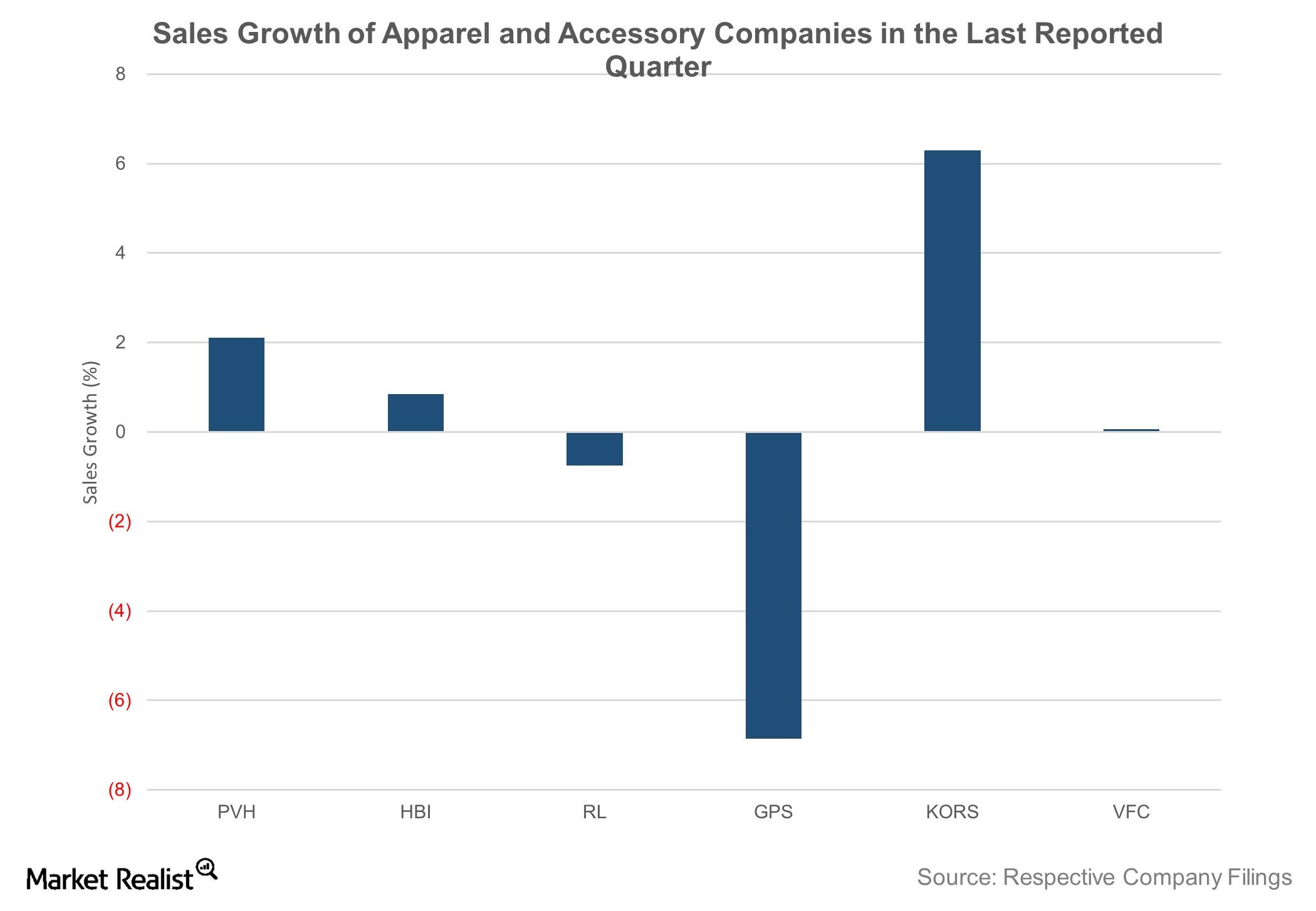

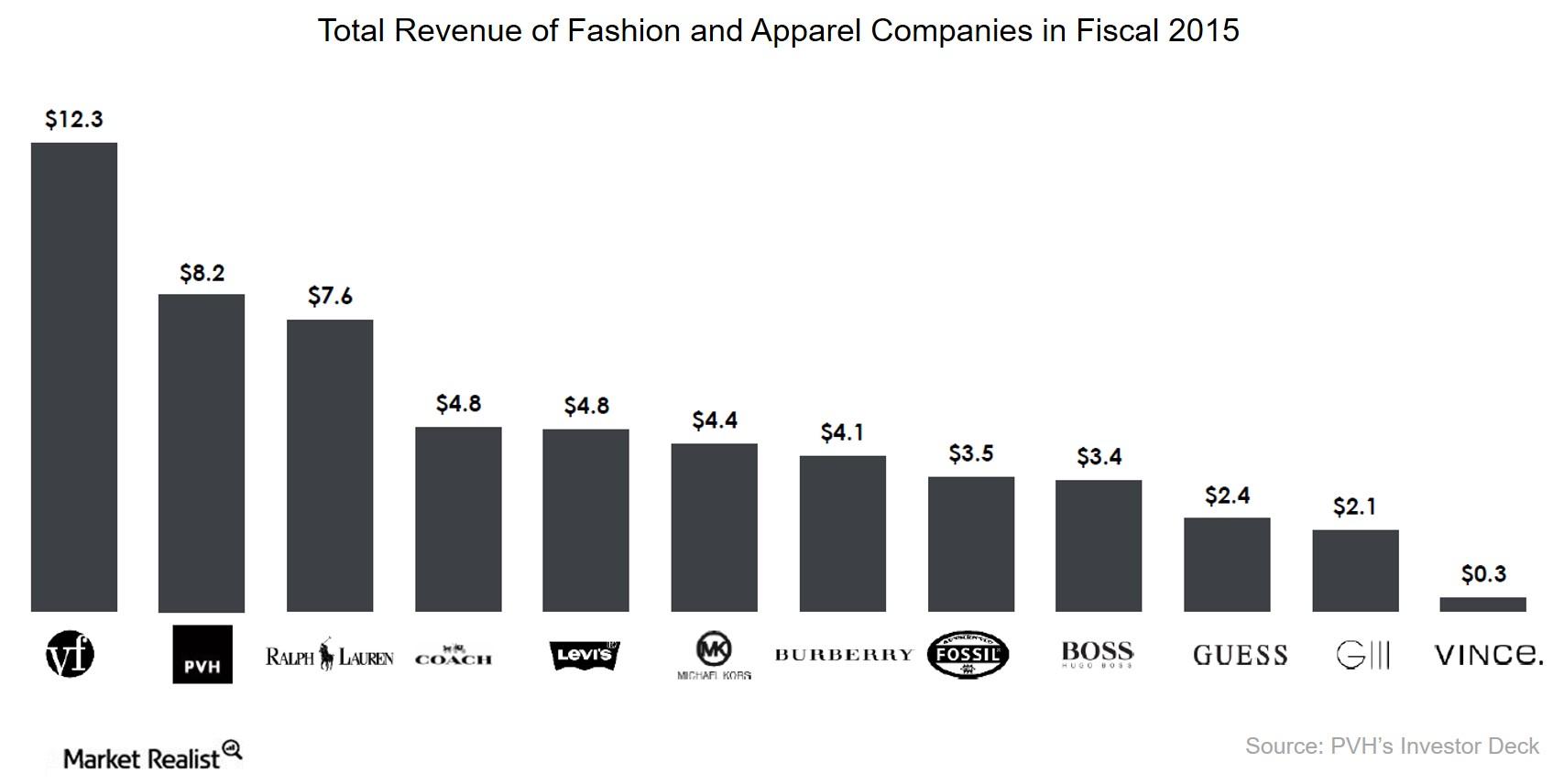

How Calvin Klein and Tommy Hilfiger Gave PVH a Strong 1Q16

Phillips-Van Heusen (PVH) posted $1.9 billion in revenue for fiscal 1Q16. That’s a 2.1% YoY increase on a GAAP basis.

PVH Delivered a Solid 4Q15 on Strong Calvin Klein Performance

PVH Corp. (PVH) registered a 2.1% year-over-year increase in its top line in fiscal 4Q15, which ended January 31, 2016, to $2.1 billion.

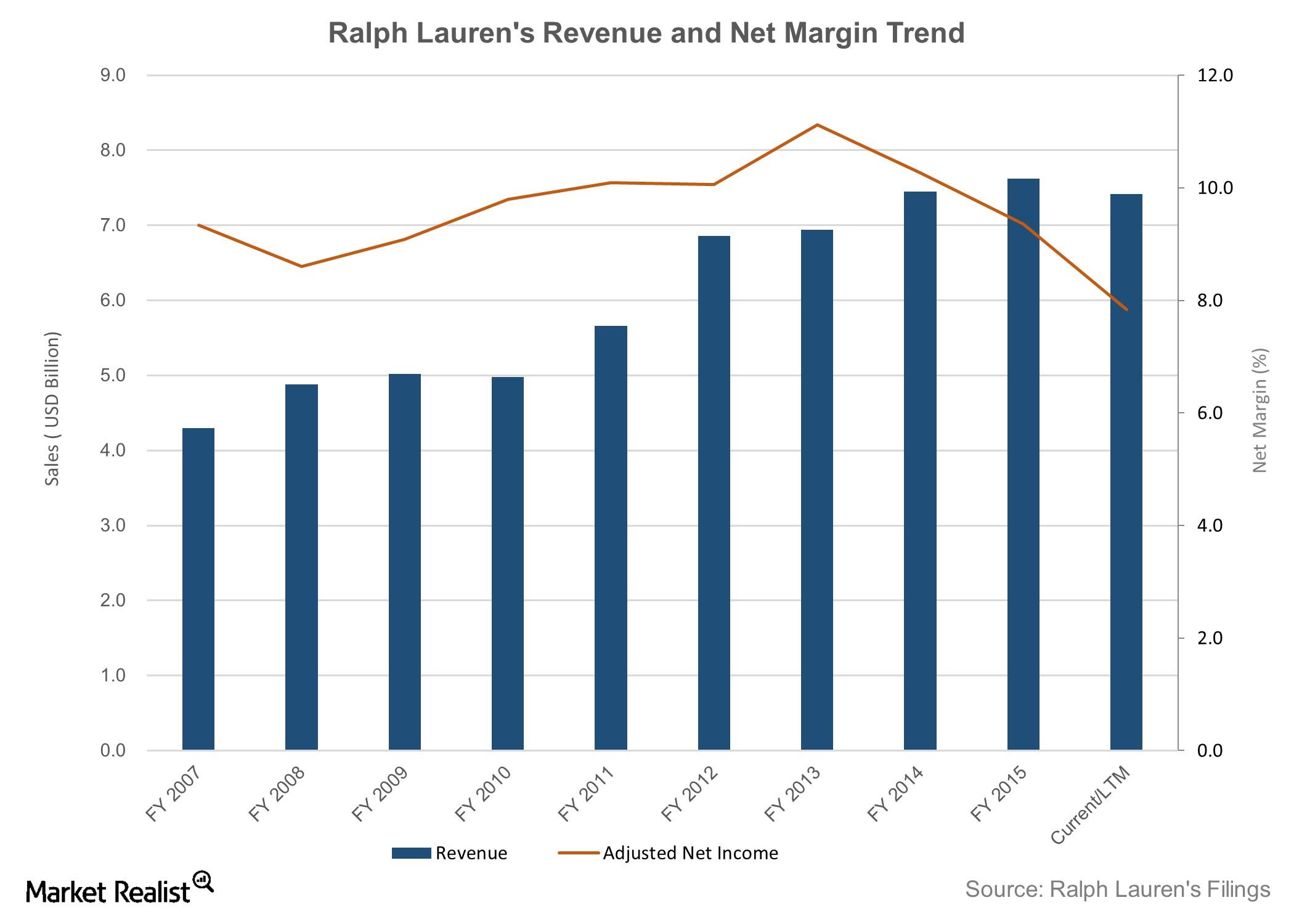

Behind Ralph Lauren’s Historical Financial Performance

Ralph Lauren’s top line has grown by a CAGR of around 9% over the past five fiscal years to reach $7.6 billion in fiscal 2015.

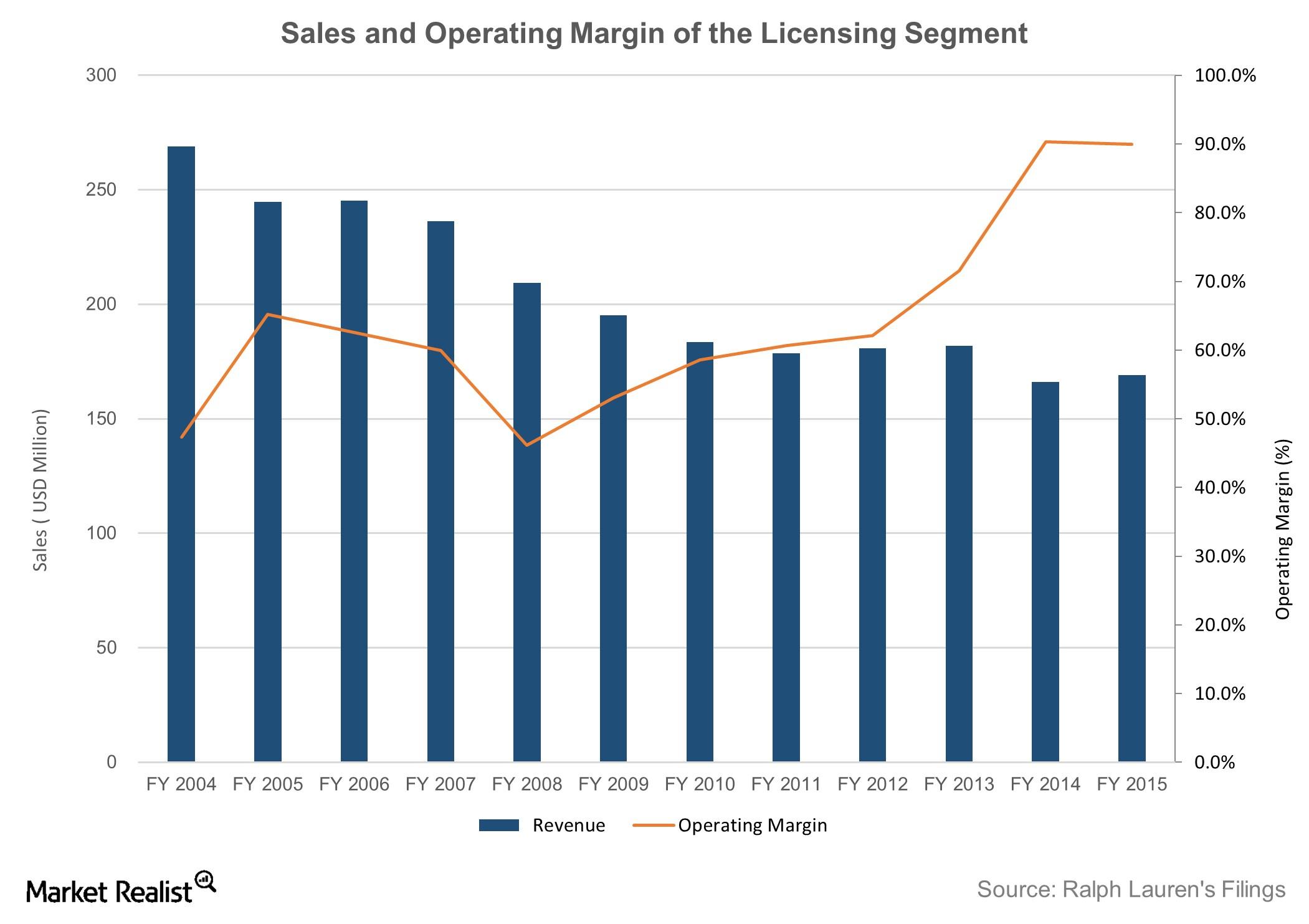

Inside Ralph Lauren’s Licensing Business

Ralph Lauren earns royalties from licensing the use of its trademarks or the right to operate stores to third parties for apparel, eyewear, and fragrances.

Introducing Ralph Lauren: Everything You Need to Know at a Glance

Ralph Lauren is the third-largest branded apparel company (by revenue) in the US and has grown at a CAGR of around 9% over the past ten years.

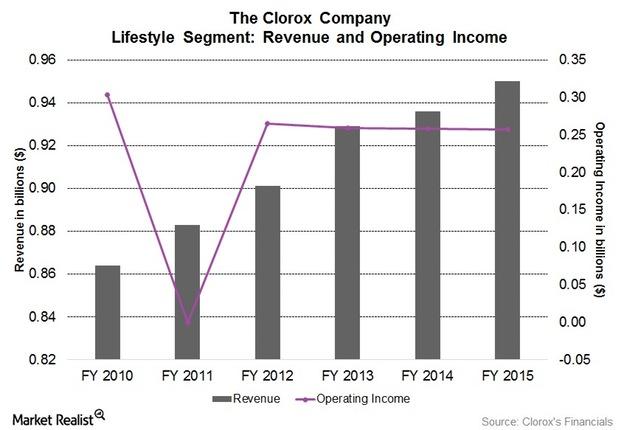

Understanding Clorox’s Lifestyle Product Segment

Clorox’s Lifestyle segment’s revenue increased 1.5% to $1 billion in fiscal 2015 compared to $0.9 billion in fiscal 2014. The increase was primarily due to higher shipments in natural personal care.