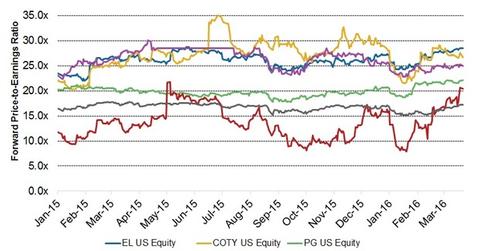

Favorable Valuation Multiples for Beauty Companies in 4Q15

Beauty companies are trading at higher valuations relative to the S&P 500 Index (SPY) and the Dow Jones Industrial Average (DIA).

March 29 2016, Updated 1:06 a.m. ET

Relative valuations

Beauty companies are trading at higher valuations relative to the S&P 500 Index (SPY) (IVV) (VOO) and the Dow Jones Industrial Average (DIA). Procter & Gamble (PG) and Avon (AVP) are trading at a PE (price-to-earnings) multiple of 22.1x and 20.4x forward earnings, respectively.

In comparison, the S&P 500 Index and the Dow Jones Industrial Average are trading at forward PE multiples of 17.3x and 16.1x, respectively. All of the valuations are as of March 22, 2016. P&G’s and Avon’s valuations are up by 8.6% and 73.9%, respectively, since January 2015, despite the negative impact from foreign currencies.

Higher valuation multiple for Coty and Estée Lauder

Estée Lauder (EL) and Coty (COTY) are trading at PE multiples of 28.4x and 26.6x forward earnings, respectively. Coty’s valuation has risen by 20.4% since the start of 2015. This increase is primarily due to the new consumer-centric and category-focused organizational structure and a stronger brand portfolio after merging with Procter & Gamble’s (PG) beauty segment.

Estée Lauder’s valuation has risen by ~21% since the start of 2015. This increase was mostly due to strong results from makeup and skincare, as well as its recent acquisition of By Kilian, which should help the company broaden its portfolio of luxury fragrances.

Beiersdorf (BDRFF) and L’Oréal (LRLCY) are trading at respective PE multiples of 26.1x and 25.0x forward earnings. L’Oréal’s valuation has risen by 8.4% since the start of 2015.

Revenue growth

Markets generally tend to value companies at higher multiples if their growth expectations are higher. Both Coty’s and Estée Lauder’s revenues grew at a CAGR (or compound annual growth rate) of 4.7% and 6.7%, respectively over the past five years. This was the highest among its peers, including Shiseido (SSDOY) and L’Oréal (LRLCY).

An overall increase in consumer spending and an increasing preference for luxury beauty products seem to be benefiting beauty companies in the US as well as in international markets. However, in order to beat the volatile markets, companies may increase prices of their products, which could adversely affect volumes.