Avon Products Inc

Latest Avon Products Inc News and Updates

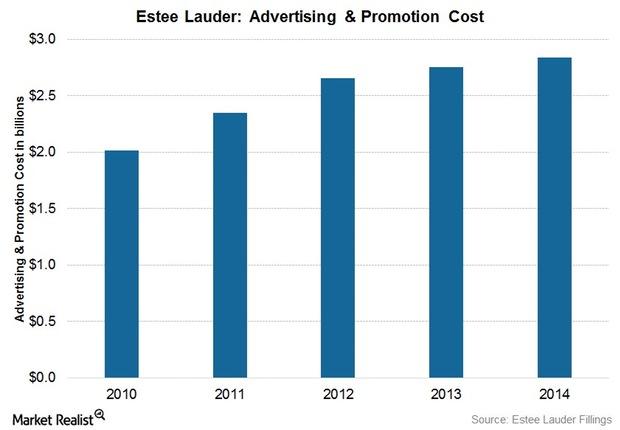

Estée Lauder’s Marketing Strategies to Reach New Consumers

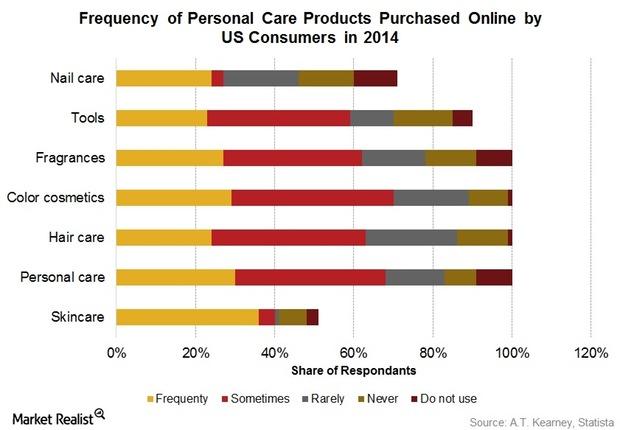

Estée Lauder aims to partner with key brick-and-mortar retailers to strengthen their prestige beauty shopping e-commerce websites to better meet consumer online shopping preferences.

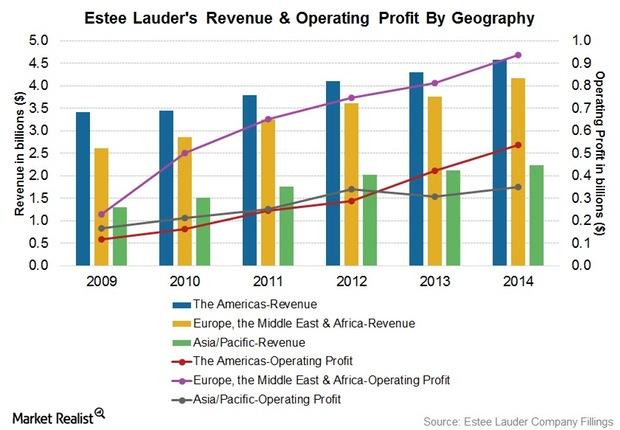

Estée Lauder’s Efforts to Expand Its Geographical Presence

Estée Lauder aims to expand its geographical market share in China, the Middle East, Eastern Europe, Brazil, and South Africa by focusing on consumers who purchase in travel retail channels.

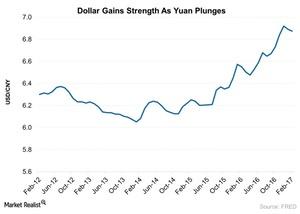

How Much Is China Really Devaluing Its Currency?

China had pegged its currency, the yuan, to the US dollar as it was a developing nation.

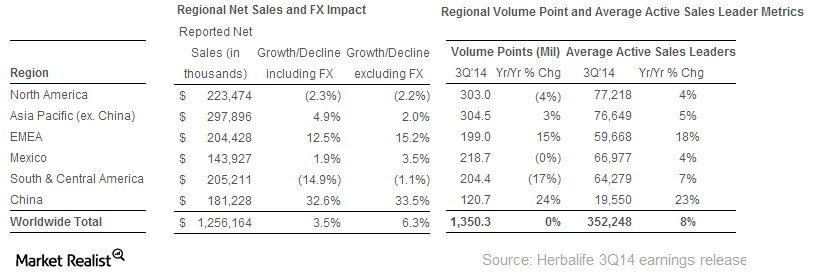

Short-term effects of changes to Herbalife’s marketing plan

Pershing Square Capital Management commented on Herbalife’s marketing plan in its latest shareholder letter.

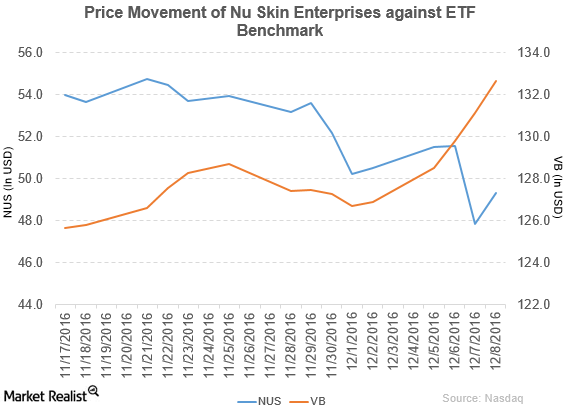

Sidoti Upgrades Nu Skin Enterprises to ‘Buy’

Price movement Nu Skin Enterprises (NUS) has a market cap of $2.7 billion. It rose 3.1% to close at $49.32 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.8%, -7.9%, and 34.7%, respectively, on the same day. NUS is trading 6.3% below its 20-day moving average, […]

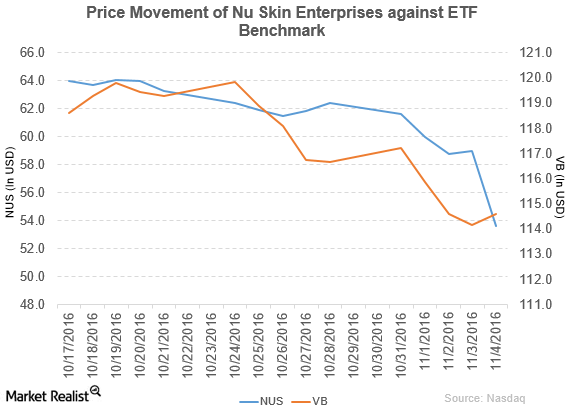

Nu Skin Enterprises Declares Its 3Q16 Results and Quarterly Dividend

Nu Skin Enterprises (NUS) has a market cap of $3.0 billion. It fell by 9.1% to close at $53.61 per share on November 4, 2016.

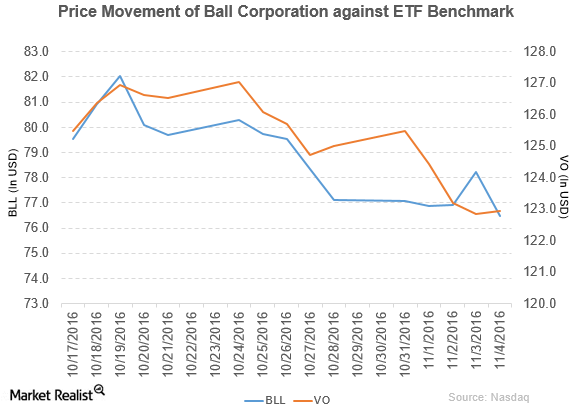

How Did Ball Corporation’s 3Q16 Results Turn Out?

Ball Corporation (BLL) fell 0.80% to close at $76.48 per share during the first week of November 2016.

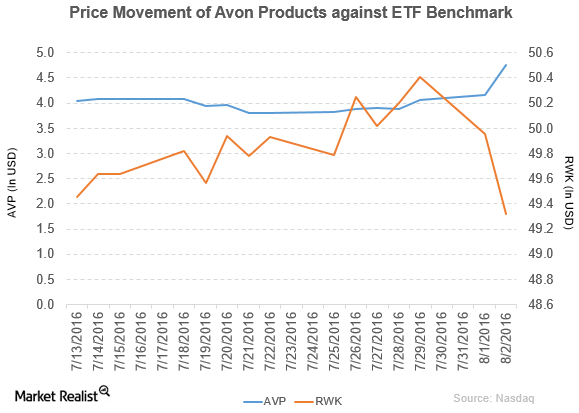

Avon’s Beauty Sales Show Fewer Are Dolling Up with Its Products

Avon Products (AVP) has a market cap of $2.1 billion. It rose by 14.4% to close at $4.76 per share on August 2, 2016.

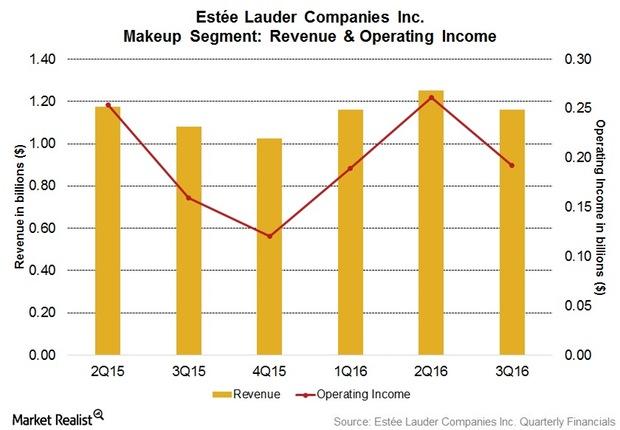

Estée Lauder’s Makeup Segment Boosted Its Operating Income

Estée Lauder’s makeup segment’s net revenue rose 7.3% in reported terms and 11% in constant currency terms to $1.2 billion in fiscal 3Q16.

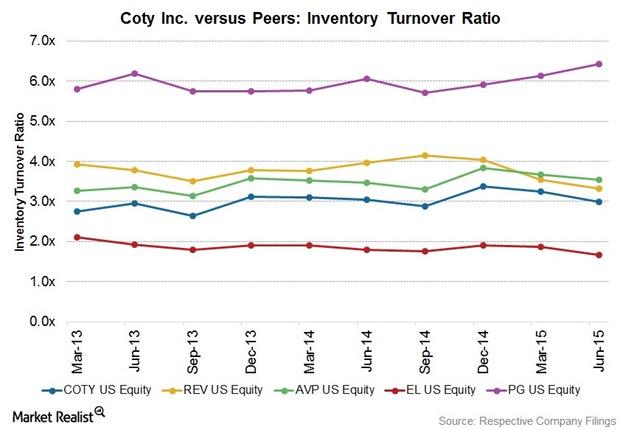

Assessing Coty’s Strengths and Opportunities

Coty operates in over 130 countries through key distribution channels in both the prestige and mass markets channels.

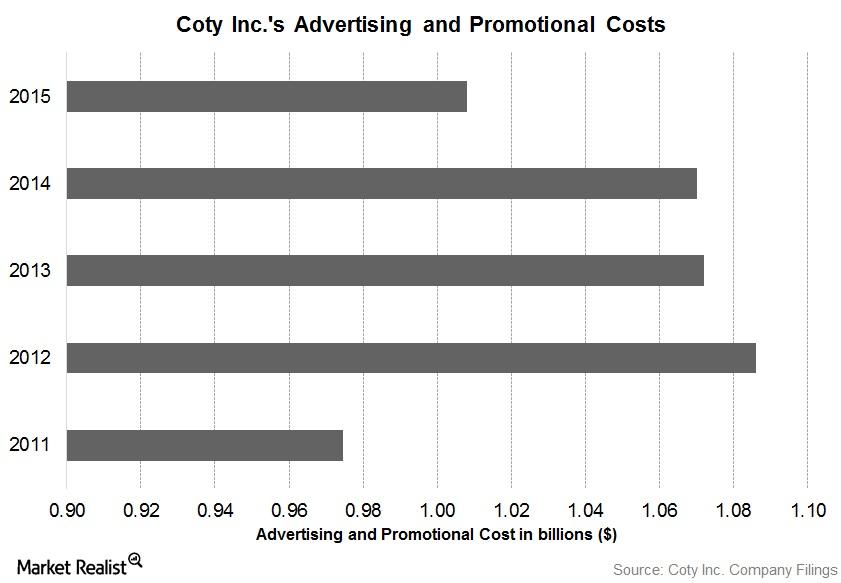

Coty’s Marketing Strategies to Reach New Consumers

Coty plans to expand with a multipronged strategy that includes digital marketing efforts through websites, brand sites, social networking campaigns and blogs, and e-commerce.

How Coty Is Improving Its Distribution Channels

Coty sells its products through a multichannel distribution strategy across several price points in prestige and mass market channels of distribution.

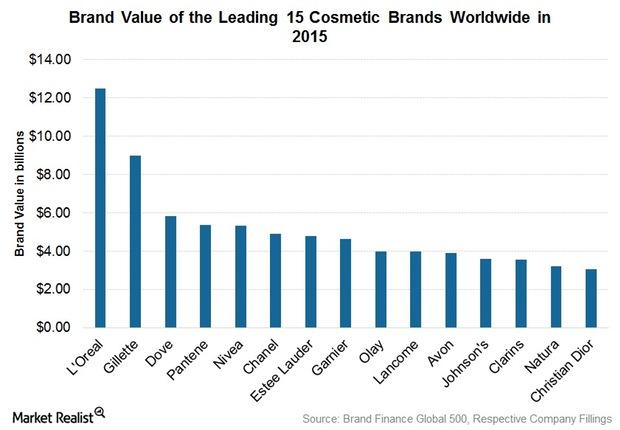

Assessing Estée Lauder’s Strengths and Opportunities

Estée Lauder’s large geographical footprint diversifies its revenue stream, which is one of its chief strengths.Consumer Why Ackman targeted Herbalife’s nutrition clubs

Ackman has campaigned against Herbalife since December 2012. He has released numerous presentations and reports alleging the nutritional company’s multilevel marketing model is a fraud and a “pyramid scheme.”Consumer Must-know: An overview of Herbalife’s direct selling model

The founder and CEO of Pershing Square Capital Management, William Ackman, issued a presentation about global nutrition company Herbalife Ltd. (HLF).