Shiseido Company, Limited

Latest Shiseido Company, Limited News and Updates

Estée Lauder’s Growth Initiative: Leading Beauty Forward

With increasing competition from L’Oréal, Shiseido, and Coty, Estée Lauder continues to expand its position in Western Europe and emerging markets.

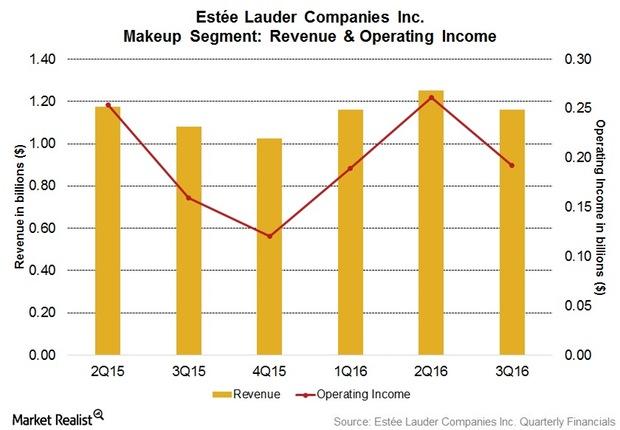

Estée Lauder’s Makeup Segment Boosted Its Operating Income

Estée Lauder’s makeup segment’s net revenue rose 7.3% in reported terms and 11% in constant currency terms to $1.2 billion in fiscal 3Q16.