Penny Morgan

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Penny Morgan

Coty Inc.’s Heritage and Power Brand Portfolio

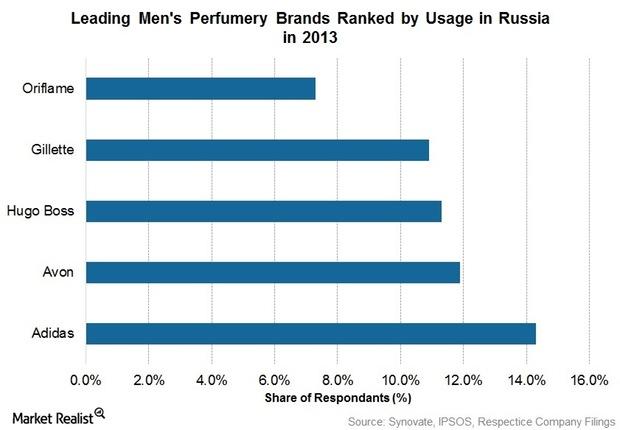

Coty’s biggest licensed brand in the global mass skin and beauty care segment, Adidas maintains a significant presence in deodorants. It faces stiff global competition from Unilever’s Axe deodorants.

Weighing Altria Group’s Strengths and Opportunities

Altria’s major strength is its diversified portfolio, which includes wine and beer assets. Altria has the most diverse business model among US peers.

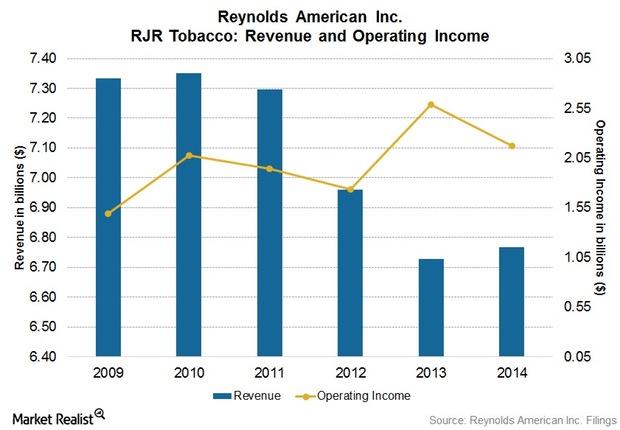

Reynolds American’s Largest Operating Segment: R. J. Reynolds Tobacco

R. J. Reynolds is Reynolds American’s largest operating segment. Its brands include the two best-selling cigarettes in the US, Camel and Pall Mall.

P&G’s Grooming and Hair Care Brands Lead Market

P&G’s Gillette, Fusion, and Venus are its largest male and female grooming brands. It has continued to grow with ProGlide and FlexBall in the US.

Obstacles to Altria Group’s Growth: Weaknesses and Threats

Altria’s business faces threats of high scrutiny, taxation, and regulation. Prohibitions on cigarette sales and smoking bans in public places affect sales.

P&G’s Strategies for Revamping its Product Portfolio

P&G plans to focus on stronger, consumer meaningful brands—brands with which P&G has the leading market position—and accordingly chooses its portfolio.

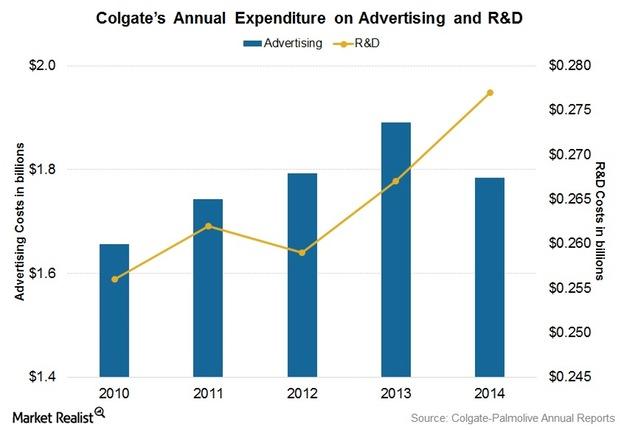

Colgate’s Efforts to Engage Consumers to Build Brand Awareness

In order to attract consumers in retail stores, Colgate has increased its commercial investment in advertising, promotions, trade spending, and creative brand building.

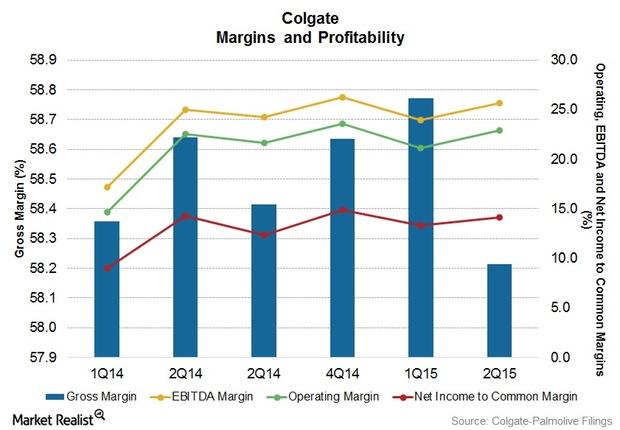

Colgate’s Efforts to Generate Savings to Fund Growth

Colgate’s funding-the-growth technique is the key component of the company’s financial strategy, according to comments by Ian Cook, the company’s CEO.

How Colgate is Gaining Share in Key Global Markets

Colgate faces stiff competition from large international and local players worldwide. However, the company aims to have a disciplined approach to pricing management.

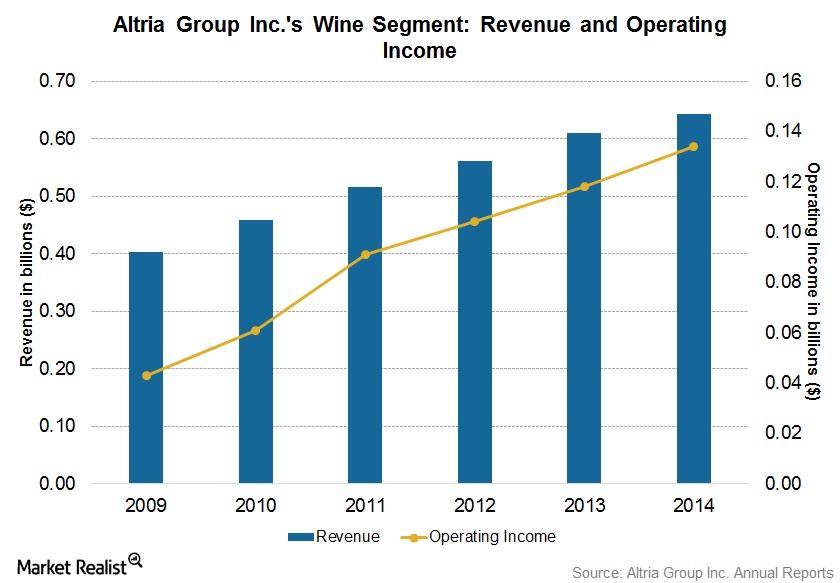

Understanding Altria’s Wine Business Segment

Altria’s subsidiary Ste. Michelle is a leading producer of Washington state wines. It owns wineries and distributes wines in several regions and countries.

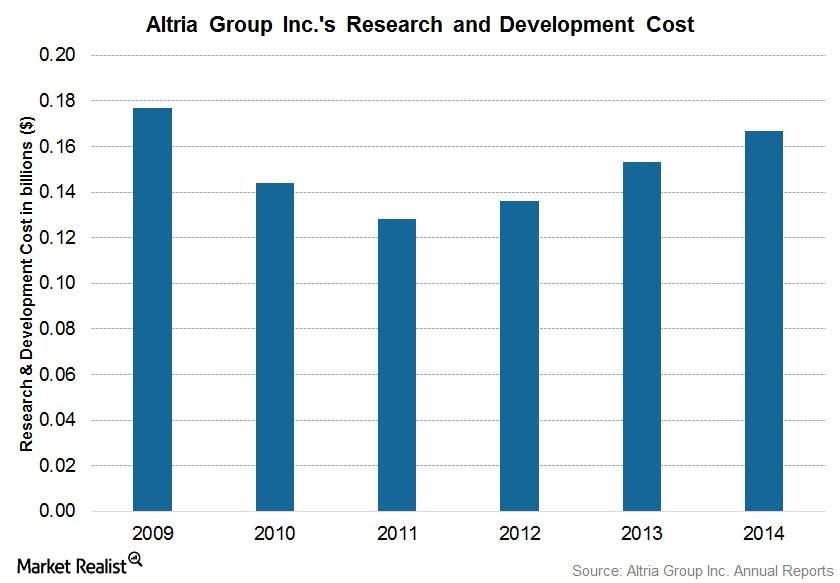

Altria’s Heritage of Innovation and Investments in R&D

Altria’s R&D expenses for fiscal 2014 were $0.2 billion, or 0.9% of net sales. Its R&D expenses upped by 9.2% in 2014, reflecting a trend toward innovation.

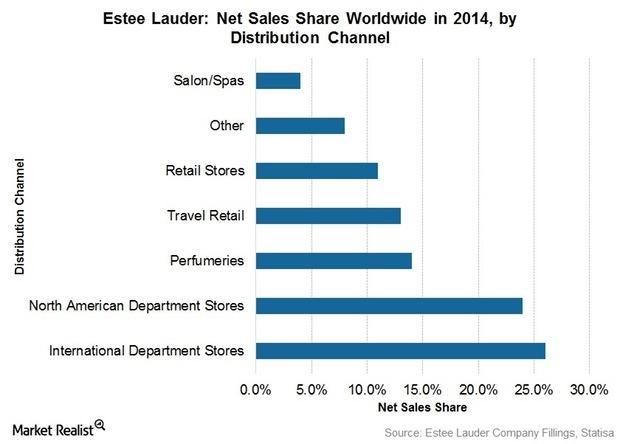

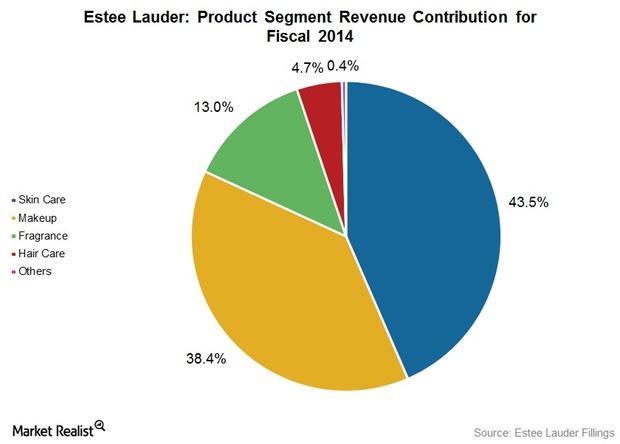

Estée Lauder Expands Business through Brand Acquisitions

Estée Lauder’s management aims to generate at least 1% of its total sales growth through acquisitions over the next three years.

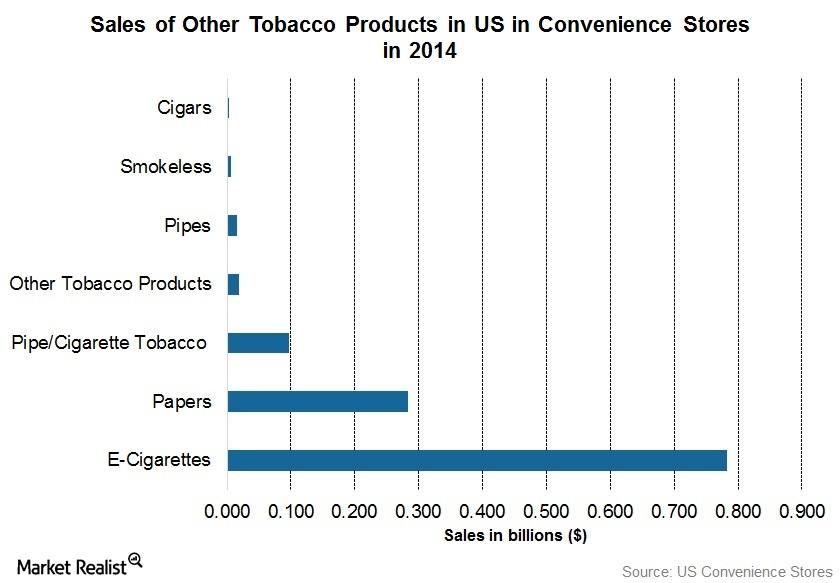

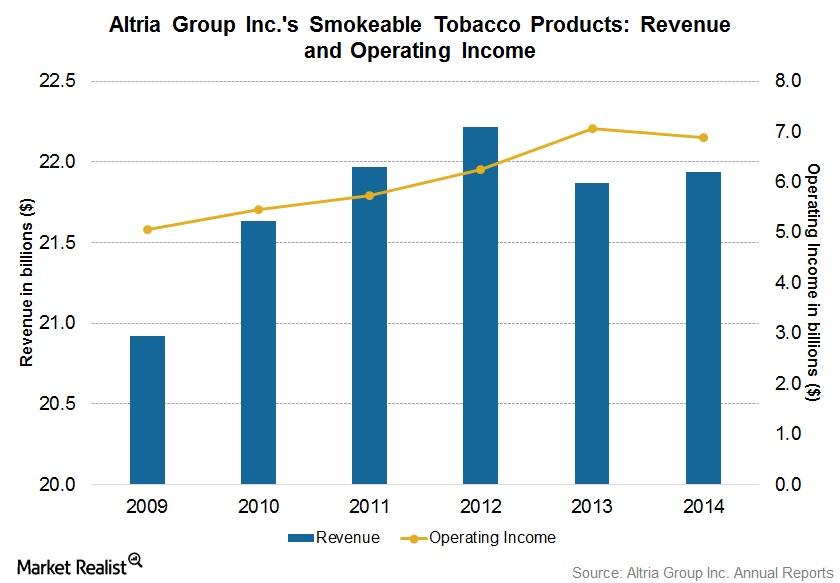

Altria Group’s Smokeable Tobacco Product Segment

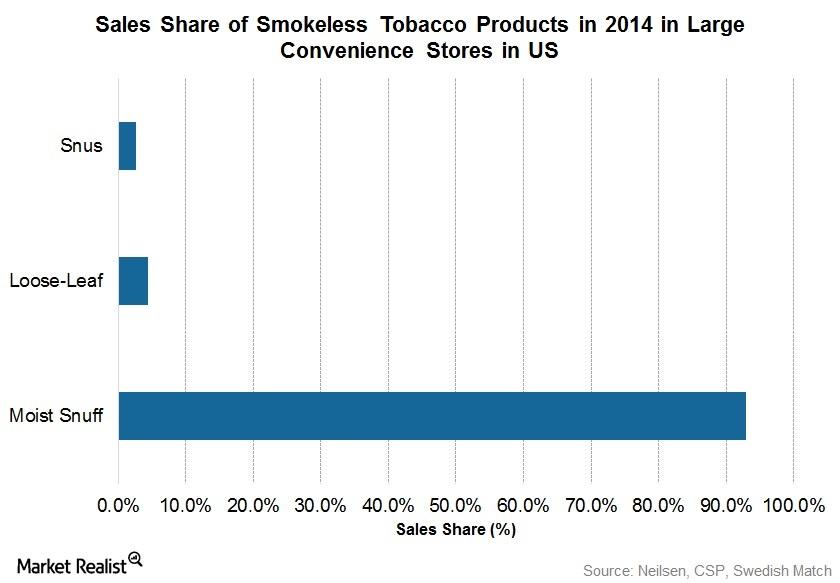

MO’s tobacco business segment consists of smokeable and smokeless tobacco products. The company’s smokeable tobacco companies include PM USA and Middleton.

Philip Morris’s Growth Hurdles Ahead: Weaknesses and Threats

Philip Morris faces an exceptional level of scrutiny, taxation, and regulation. Global health consciousness and ongoing litigation also pose a threat.

Philip Morris’s Strengths and Growth on the Horizon

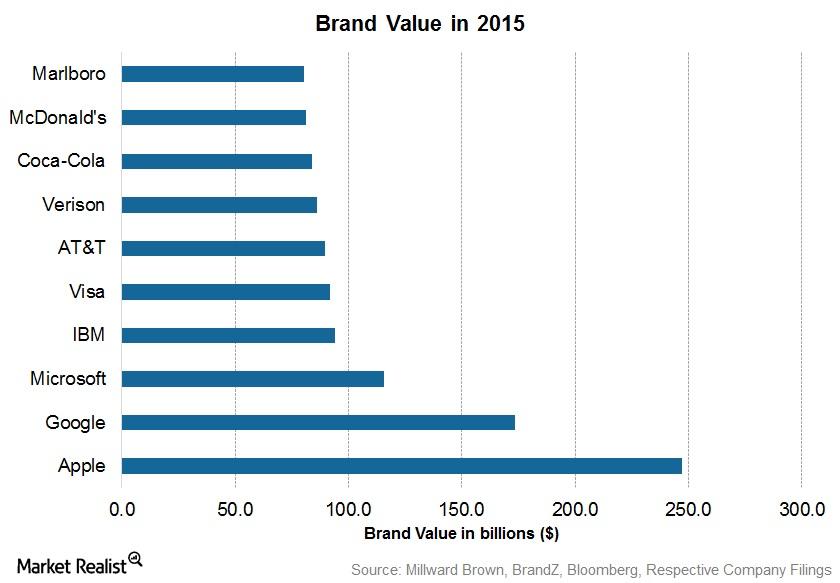

One of Philip Morris’s biggest strengths is its large brand portfolio. The global demand for its products fuels its cash flow growth and innovations.

Philip Morris’s Initiatives to Boost Distribution and Manufacturing Channels

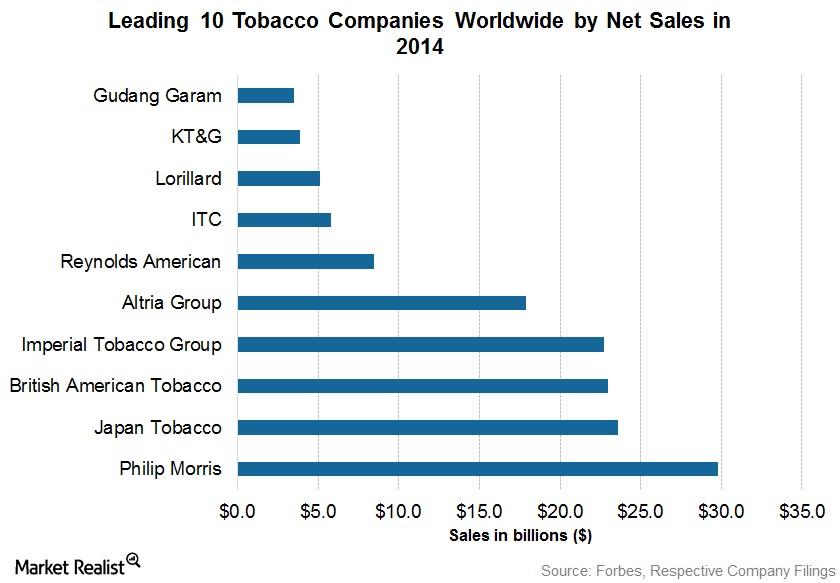

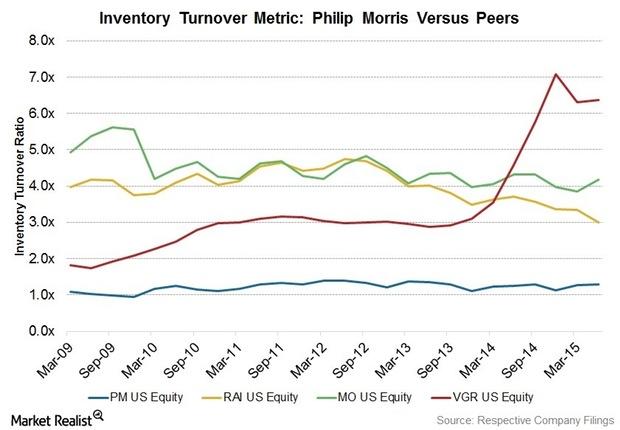

Philip Morris oversees the distribution of tobacco products in more than 180 countries and territories and owns 50 manufacturing facilities across 23 markets.

Estée Lauder’s Social and Digital Marketing Strategies

In addition to social media initiatives, Clinique’s “Forecast” mobile application provides weather information and skincare tips related to weather conditions.

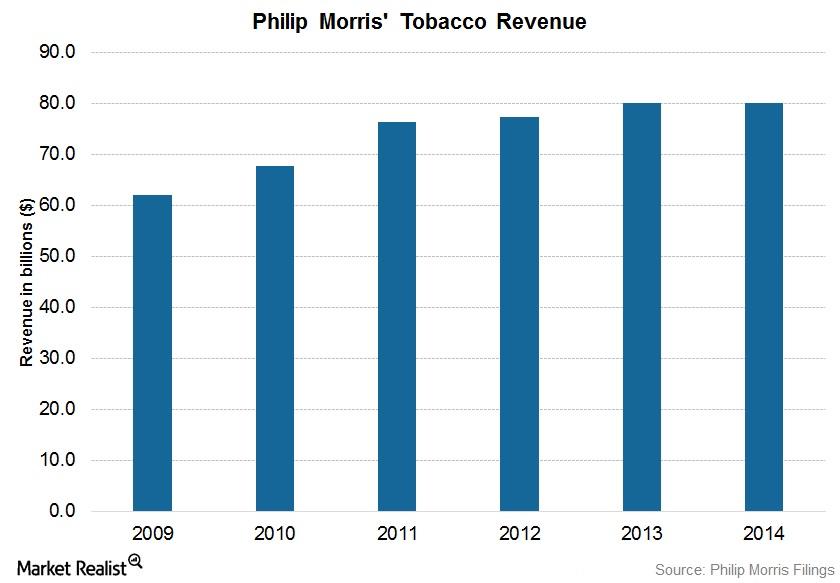

Introducing Philip Morris International

Incorporated in Virginia in 1987, Philip Morris is a leading tobacco company whose revenue in 2014 was ~$80 billion—$29.8 billion after excise taxes.

Assessing Estée Lauder’s Strengths and Opportunities

Estée Lauder’s large geographical footprint diversifies its revenue stream, which is one of its chief strengths.

Estée Lauder’s Growth Barriers: Weaknesses and Threats

The abundance of counterfeit goods and accessories is adversely affecting the sales of Estée Lauder’s products. This also hurts EL’s brand image.

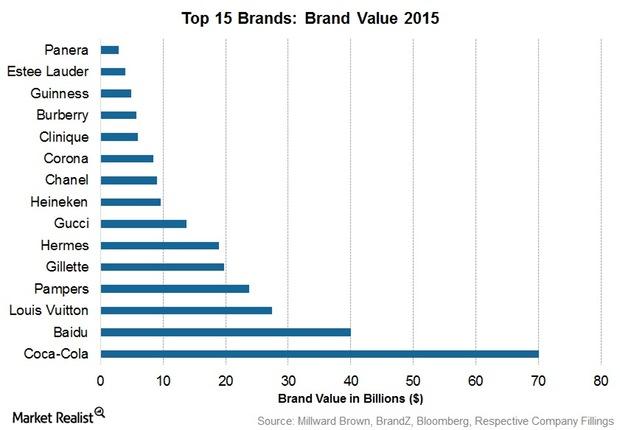

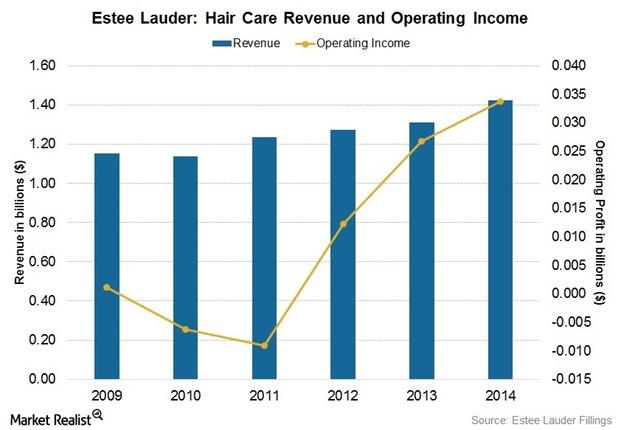

Estée Lauder’s Gains in the Hair Care Business

Estée Lauder’s Aveda brand manufactures innovative plant-based hair care products. This helps to attract customers and adds to Estée Lauder’s brand value.

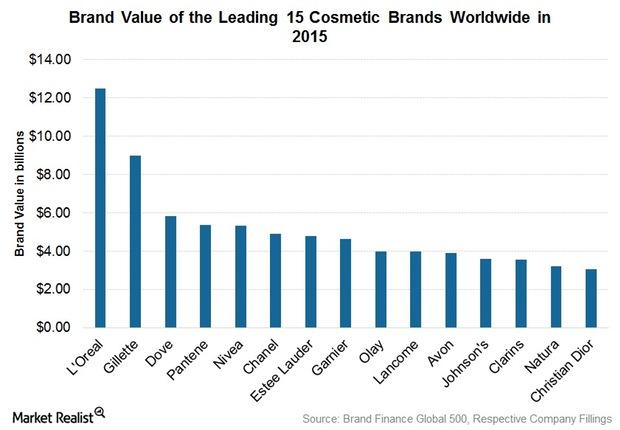

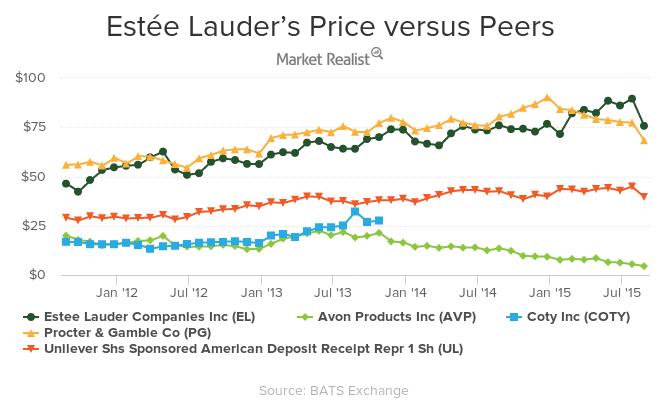

Porter’s Five Forces Model: Estée Lauder’s Competitive Analysis

Highly competitive in the beauty and cosmetics market, Estée Lauder’s revenue reached $11 billion in fiscal year 2014. However, the cosmetics company faces stiff competition from L’Oréal, Coty, and Avon (AVP).

Estée Lauder’s Most Promising Brands

Catering to the premium market, Estee Lauder’s heritage brands include Aramis and Designer Fragrances, Clinique, and Origins.

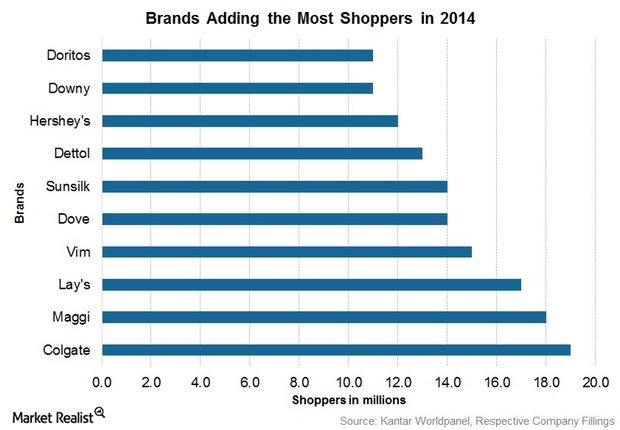

Colgate Has the Highest Brand Penetration in the World

Colgate has the highest brand penetration in the world. At a brand penetration rate of 64.6%, Colgate reaches more than half the households in the world, more than even Coca-Cola.

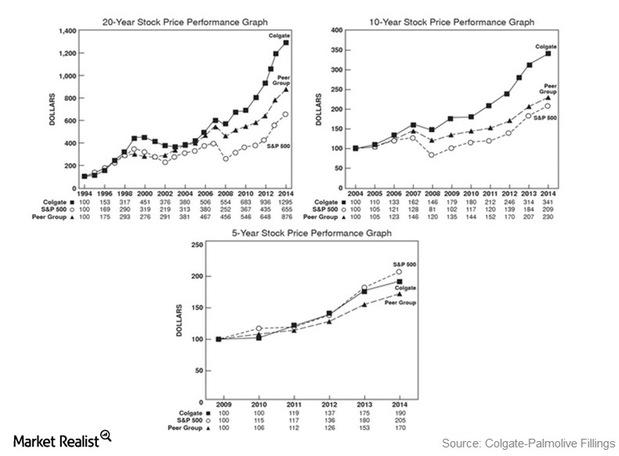

What Are Colgate’s Strengths and Opportunities?

A strong market position and brand image are some of Colgate’s chief strengths. Colgate holds 44.4% of the global market share in toothpaste.

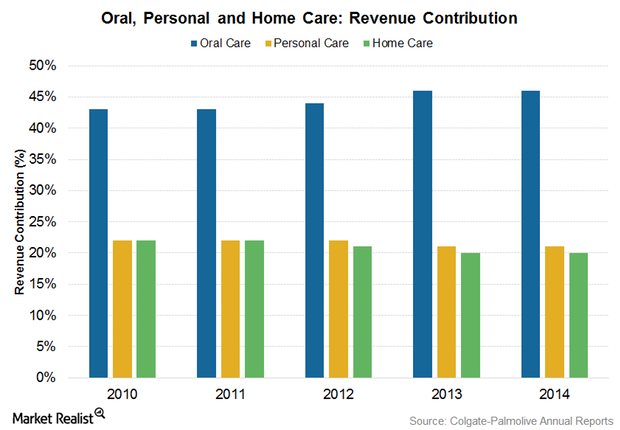

Colgate’s Oral Care Business Is the Jewel in Its Crown

Colgate estimated its share of the global toothpaste market and the global manual toothbrush market at 44.4% and 33.4%, respectively, in 2014.

How Much of the Market Share Do Colgate’s Leading Brands Have?

In North America, innovations in the Colgate Optic White Franchise increased market share of toothpaste from 5.3% to 5.6% in 2014.

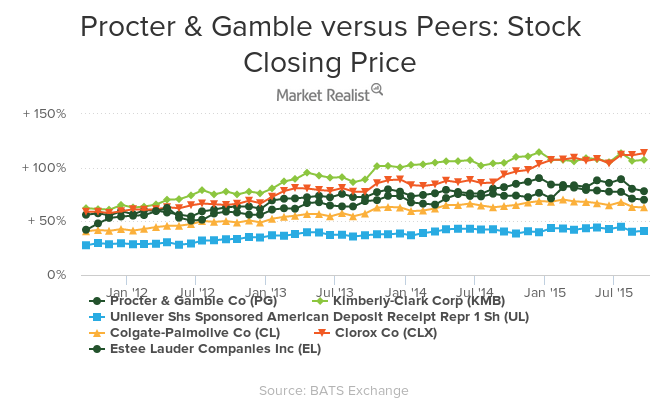

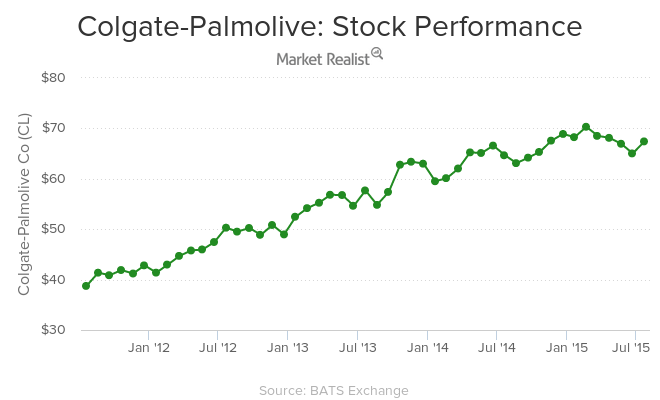

Key Performance Drivers for Colgate’s Stock Price

Colgate’s stock price has always been fairly stable primarily due to its oral care business.

Analyzing Colgate’s Competitive Position

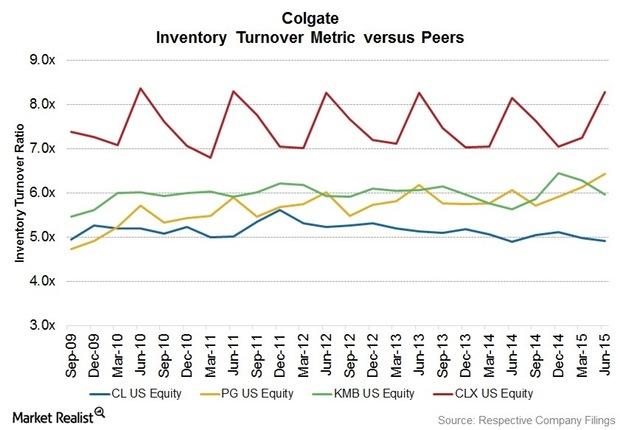

As the consumer staples (XLP) sector is highly competitive, Colgate faces local as well as global competition from various local and international players worldwide.

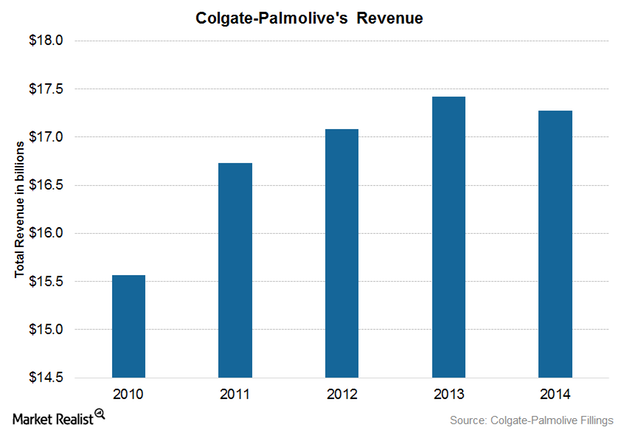

Colgate-Palmolive Is a Leading Fast-Moving Consumer Goods Firm

Colgate-Palmolive is a multinational consumer staples (XLP) firm, focused on the production, distribution, and provision of household products.

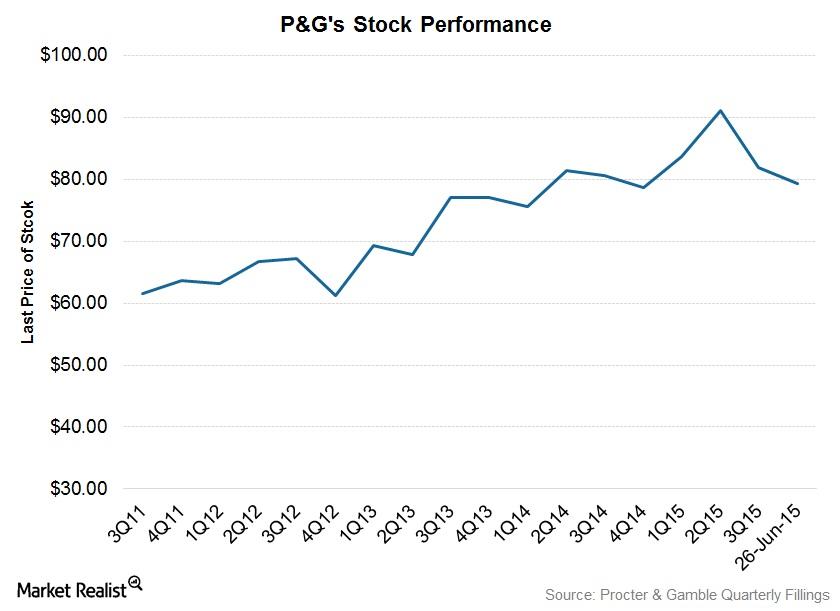

Procter & Gamble: Strategies to Improve Long-Term Profitability

Procter & Gamble continues to look at large developing markets where it thinks it can win enough market share to take a leadership position.

Procter & Gamble: Successes, Weaknesses along the Road to Success

Procter & Gamble aims to harness opportunities in developing countries like China, India, and Russia to enhance its market share as well as stabilize its top-line growth.

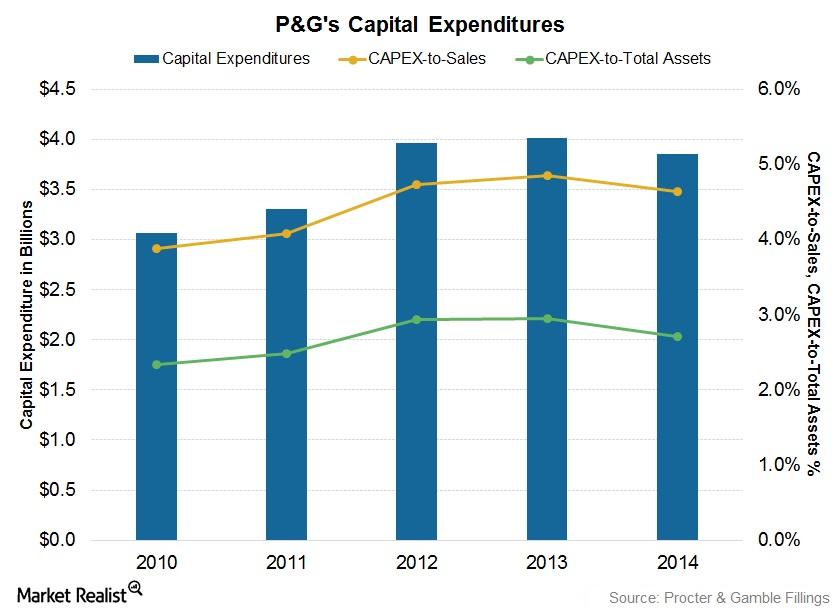

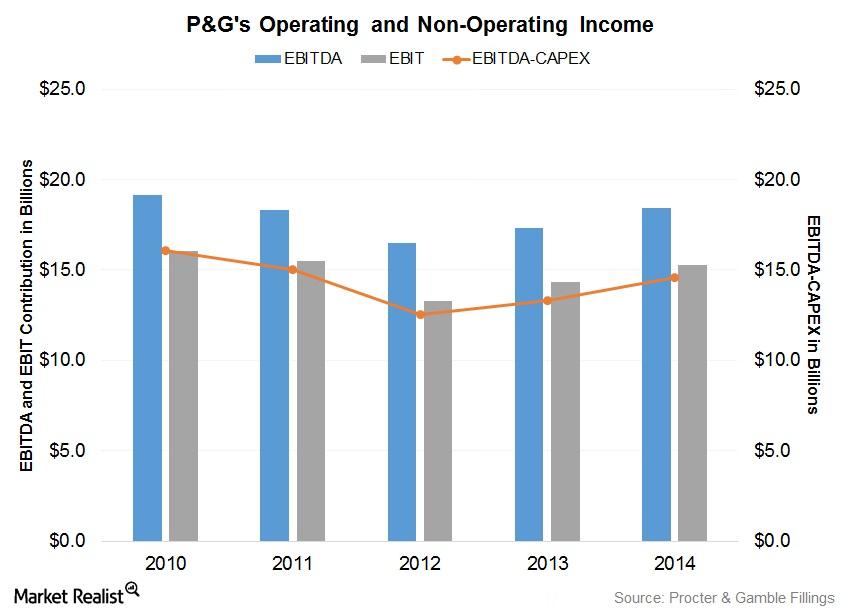

Procter & Gamble’s Efforts to Reduce Capex

Less capex has been required since P&G reduced the number of brands as well as the research and development, marketing, and innovation costs associated with them.

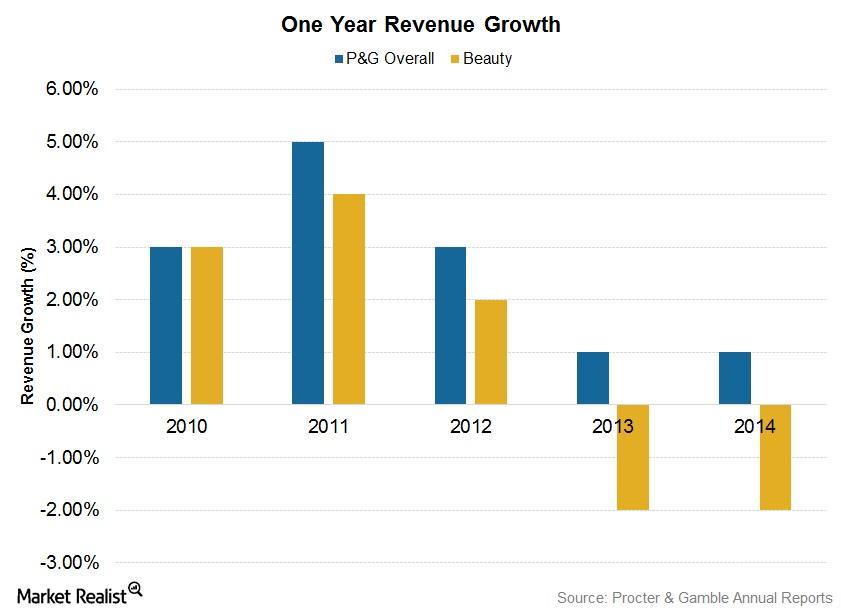

Procter & Gamble: Beauty Segment Sales Trail Overall Growth

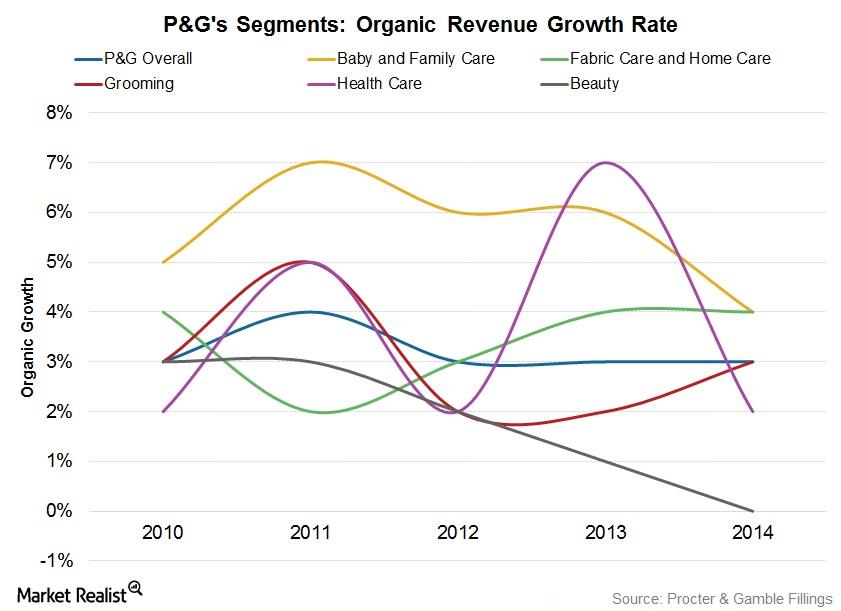

Procter & Gamble’s Beauty segment includes products such as deodorants, cosmetics, personal cleansing, skin care, and hair care.

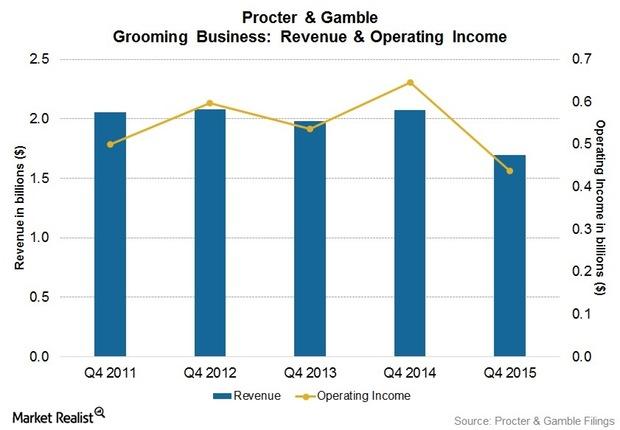

Why Procter & Gamble Dominates in Grooming Products

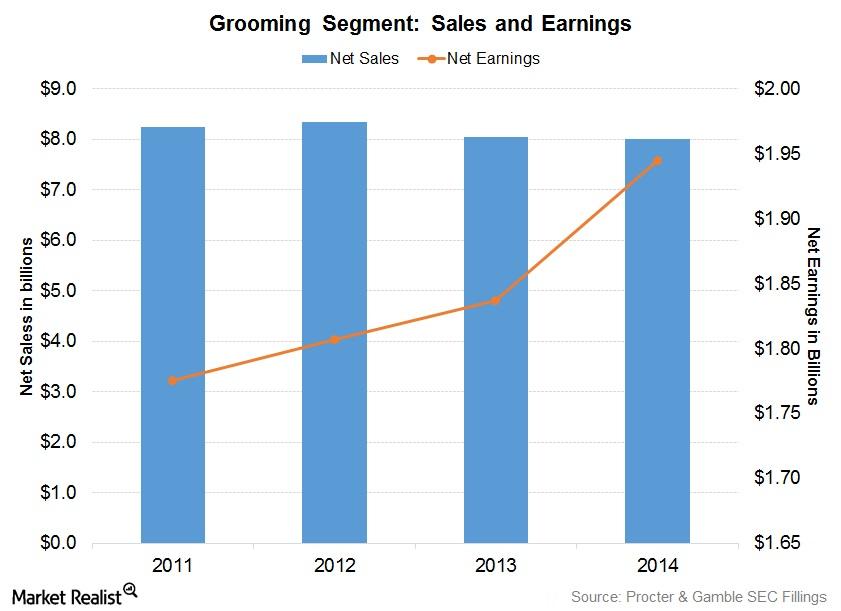

In the six months ending December 31, 2014, P&G’s net sales stood at $40.3 billion. Of this, 9.6% came from the Grooming segment.

How Innovation is Helping Procter & Gamble Develop Premium Brands

In 2001, P&G established an innovation strategy program called “Connect and Develop.” The program has allowed the company to better understand consumer behaviour.

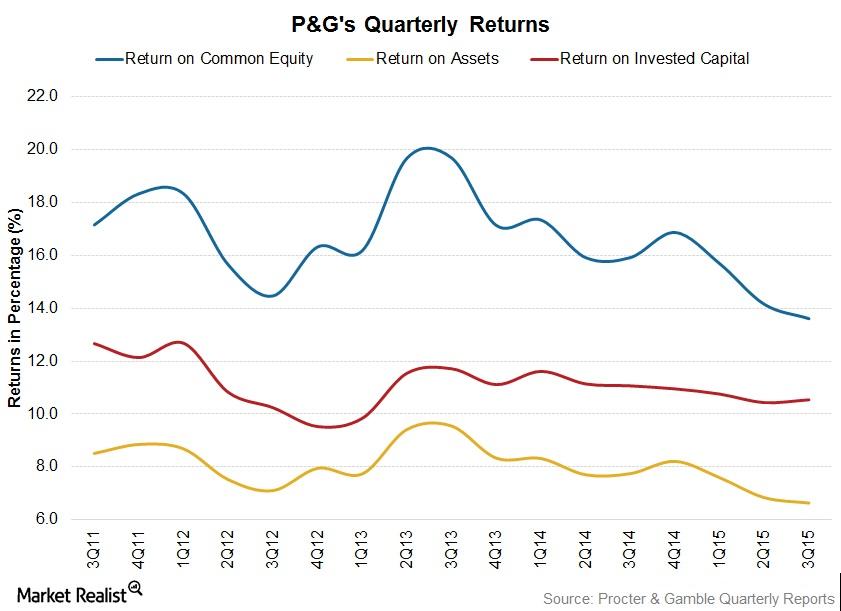

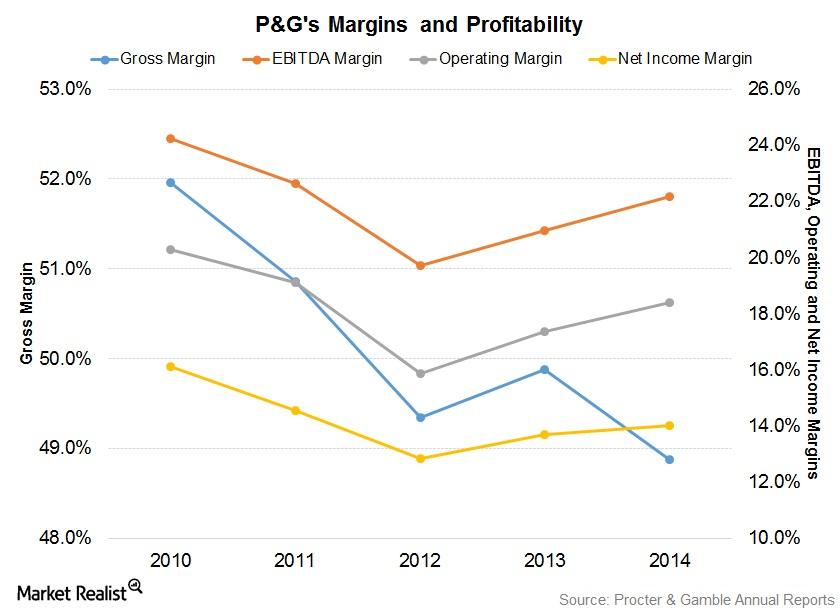

What Are the Drivers Affecting Procter & Gamble’s Profitability?

Last August, P&G announced it was working on exit options for ~100 brands to improve sales and profitability. All of the brands contributing little to growth will be disposed of.

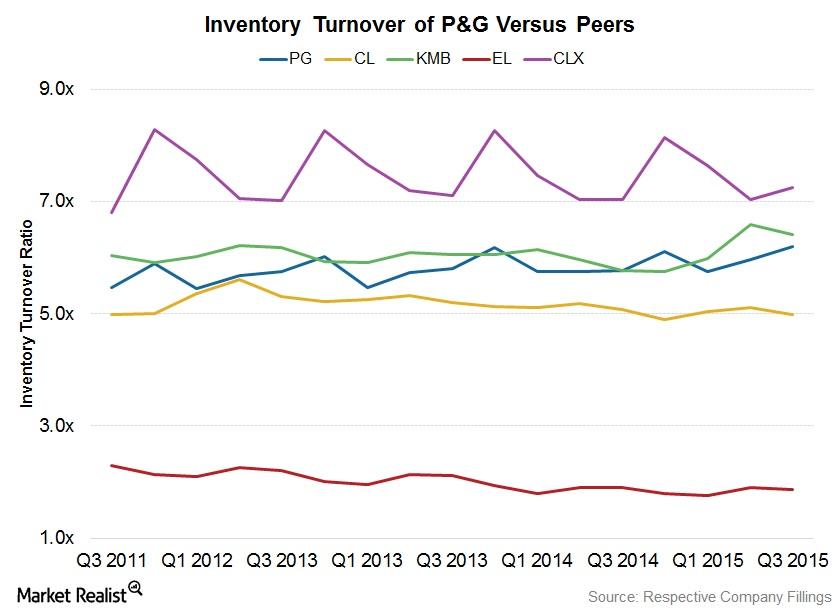

Procter & Gamble Supply Chain Initiatives Improve Productivity

In an effort to partially digitize its supply chain, P&G has introduced an automated re-ordering system. It maintains a count of inventory in stores and relays the information to its suppliers.

What Drives Procter & Gamble’s Growth?

The emerging markets of Asia, Eastern Europe, and Latin America offer ample growth opportunities for the consumer staples sector.

Procter & Gamble: A Brand Marketing Pioneer

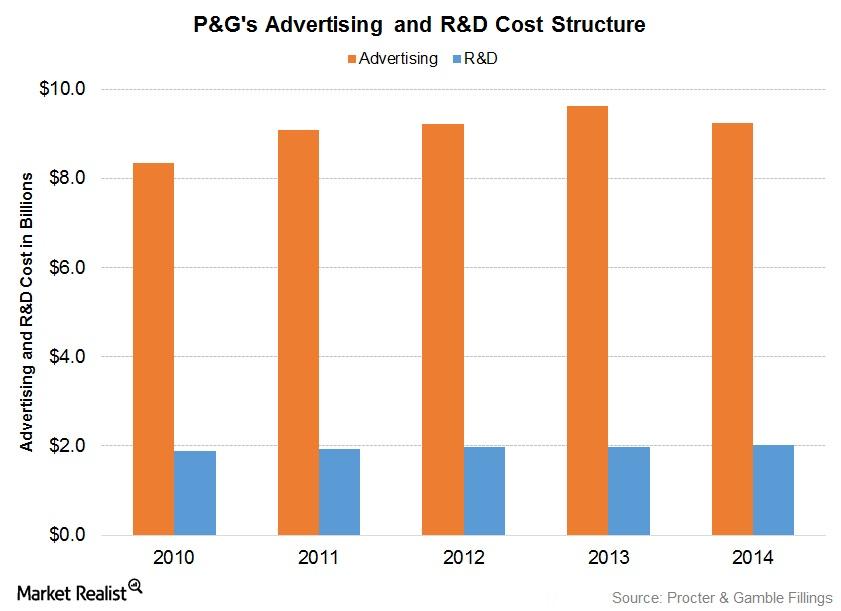

P&G is one of the world’s biggest advertisers. The company has defined many of the marketing strategies used globally.

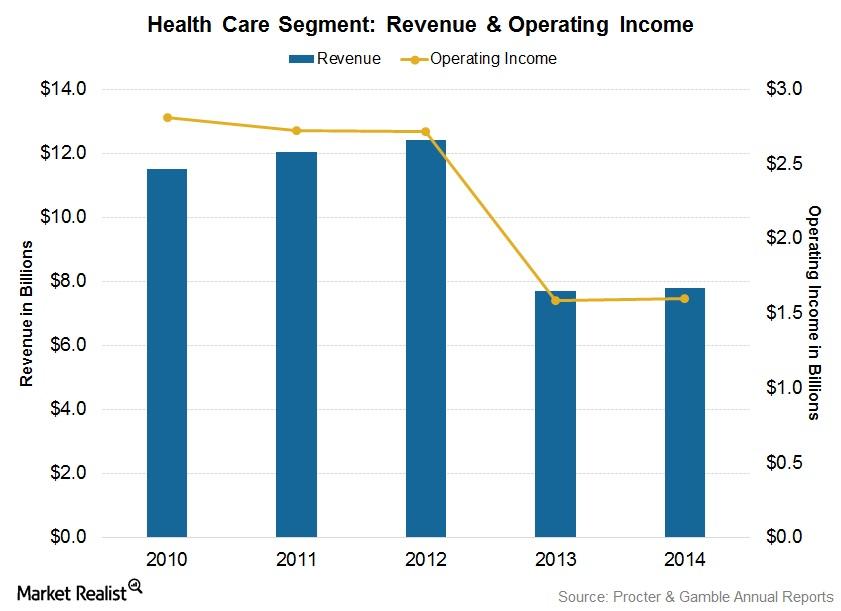

Crest and Oral-B: Stars in Procter & Gamble’s Health Care Segment

The Health Care segment is P&G’s smallest segment. The segment’s net revenue for the year ending June 30, 2014, was $7.8 billion, or 9.5% of the company’s total net revenue.

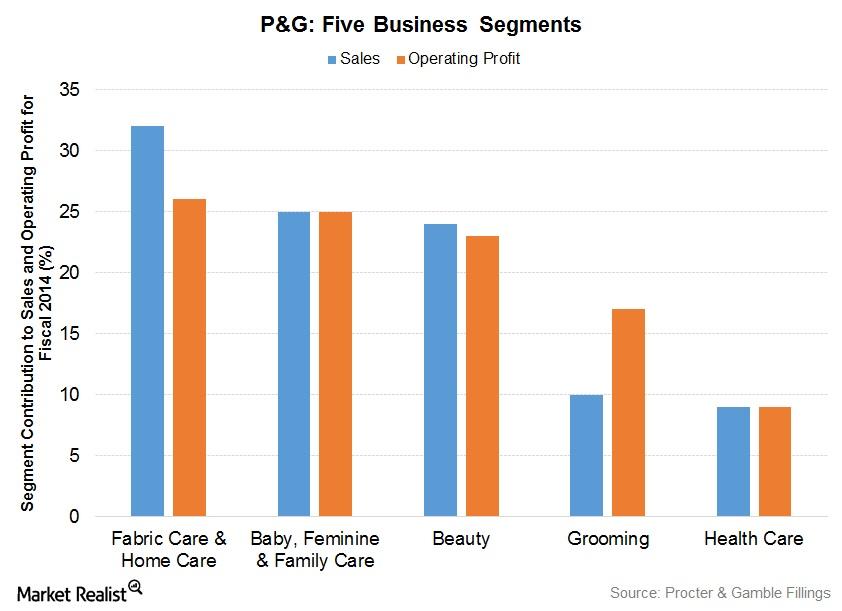

Procter & Gamble Leads the Market in Baby, Feminine, Family Care

The company’s Baby, Feminine and Family Care segment is the second-largest grossing segment at Procter & Gamble.

Procter & Gamble: Global Leader in Fabric Care and Home Care

P&G’s Fabric Care and Home Care segment’s annual revenue was reported to be $26.1 billion in fiscal 2014. It contributed 31.7% of the company’s total net sales.

An Overview of Procter & Gamble’s 5 Segments, Product Categories

Of its five business segments, the majority of P&G’s sales and earnings are derived from its Fabric Care and Home Care business.

Porter’s Five Forces: Procter & Gamble’s Competitive Position

In examining Porter’s five forces at work at P&G, we find that three competitive forces are horizontal in nature and two are vertical.