An Overview of Procter & Gamble’s 5 Segments, Product Categories

Of its five business segments, the majority of P&G’s sales and earnings are derived from its Fabric Care and Home Care business.

July 9 2015, Updated 9:06 a.m. ET

Overview

The Procter & Gamble Company, or P&G (PG), manufactures and sells consumer-based packaged products. The company has five reportable business segments:

- Fabric Care and Home Care

- Baby, Feminine and Family Care

- Beauty

- Grooming

- Health Care

Each segment has its own set of global business units, or GBUs. GBUs are major product categories within the segments. For example, the Beauty segment’s GBUs are Beauty Care, Hair Care and Color, Prestige, and Salon Professional.

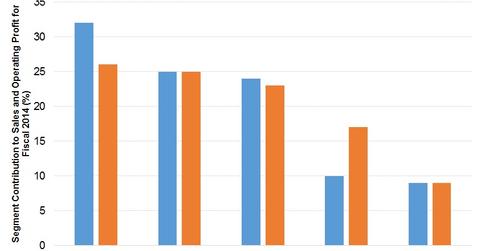

The above chart shows that the majority of P&G’s sales and earnings are derived from its Fabric Care and Home Care segment. Each segment includes various products and brands listed next.

P&G’s top brands

Fabric Care, Home Care and Personal Care include brands such as Ariel, Tide, Dawn, and Downy.

P&G’s Baby Care, Feminine Care and Family Care segment includes products such as Always, Bounty, Charmin, and Pampers. Pampers competes with Kimberly-Clark’s (KMB) Huggies brand in baby care.

The Beauty Care segment includes brands such as Head & Shoulders, Pantene, SK-II, and Olay. The beauty care segment competes with Unilever’s (UL) TRESemmé, Vaseline, Dove, and AXE brands.

Grooming is P&G’s fourth-largest segment in terms of revenue and operating profit. It includes shaving products such as blades and razors. Major brands in this segment are the Gillette franchise, Mach3, and Fusion.

P&G’s Health Care brand Oral-B competes with Colgate-Palmolive’s (CL) Colgate brand, and is the second-largest brand in oral care.

Under Personal Care, Vicks and Prilosec OTC are among the top ten brands in their categories.

The iShares Core S&P 500 ETF (IVV) and the SPDR S&P 500 ETF Trust (SPY) provide exposure to P&G. IVV and SPY each invest about ~1.2%[1. All figures of the ETF portfolio weights are as of June 27, 2015] of their respective portfolios in P&G.

Read more about P&G’s major segments, the market share of its leading global brands, and its brand competitors in Parts 4 thru 8.