Margaret Patrick

Margaret Patrick joined Market Realist in September 2014 and has written close to 3,000 articles. She has covered the healthcare sector, which includes pharmaceutical and biotechnology companies, medical device companies, health insurance companies, and hospital companies. Currently, she is following the cannabis sector.

Prior to joining Market Realist, Margaret worked as equity and data analyst at MSCI for a year and as a financial research analyst at Deloitte for two years. She completed her MBA with finance specialization in 2011. She also passed all three CFA levels.

Besides writing on stocks, Margaret loves to read about nutrition, culture, and mythology. She's also fond of traveling to new places.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Margaret Patrick

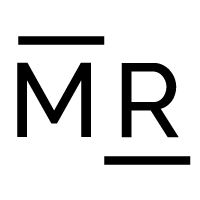

How Does Aetna Compare to Its Peers in Medical Care Ratio?

The medical care ratio of health insurance companies is calculated as the ratio of the total money spent in health care claims to premiums earned.

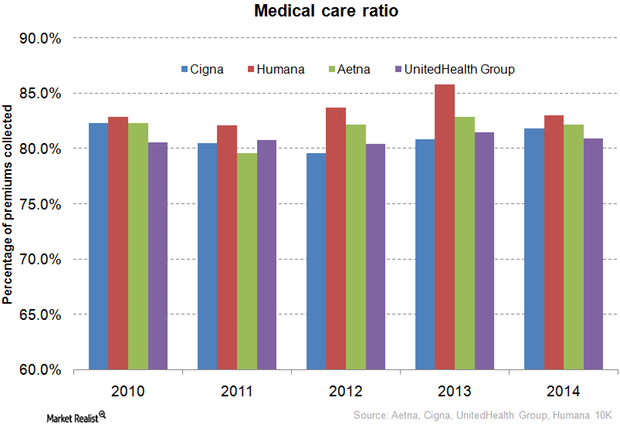

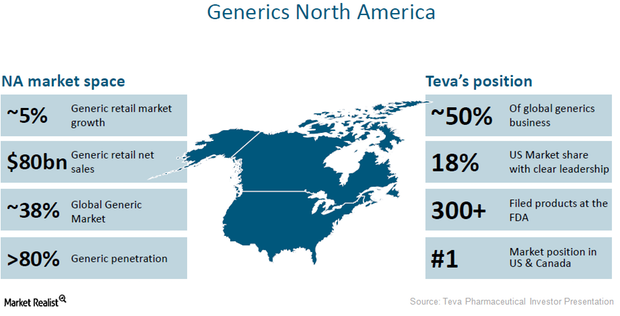

Teva Can Benefit by Acquiring Allergan Generics

The combined Teva–Allergan generics entity should have approximately 320 Abbreviated New Drug Applications (or ANDAs), including 110 first-to-file ANDAs (or FTF) in the US.

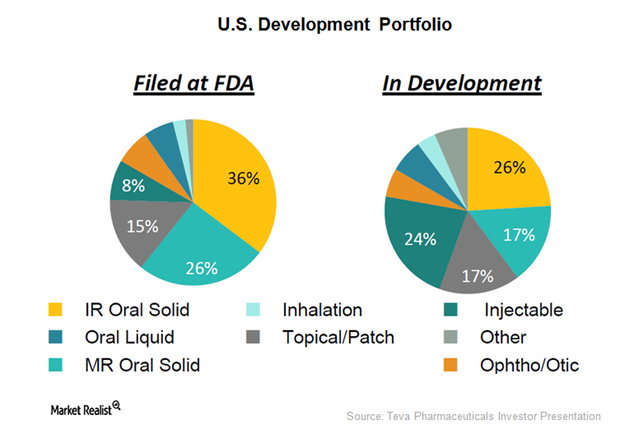

Merck Expects Modest Revenue Growth in Fiscal 2016

Merck provided revenue guidance of $39.7 billion–$40.2 billion in 2016. It expects negative foreign exchange fluctuations to reduce its fiscal 2016 revenue.

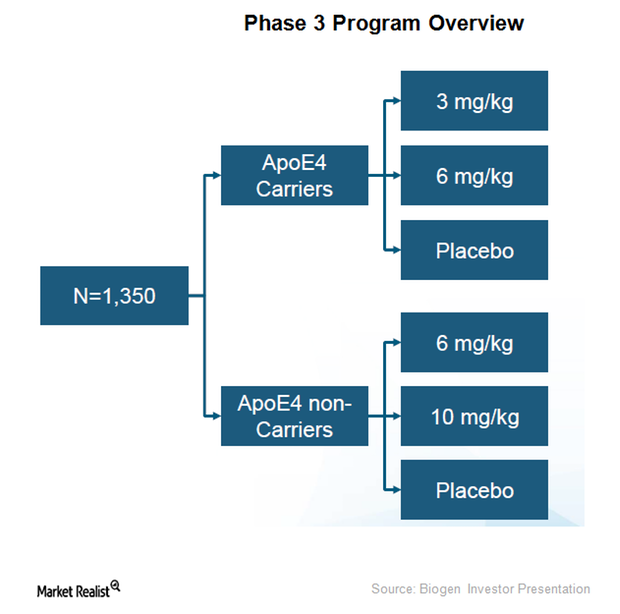

Biogen’s Experimental Alzheimer Therapy: Limited 2Q15 Success

On July 22, 2015, Biogen (BIIB) released data from a Phase 1b study, also called the PRIME Study, that looked at the effectiveness of its investigational Alzheimer’s drug, BIIB037.

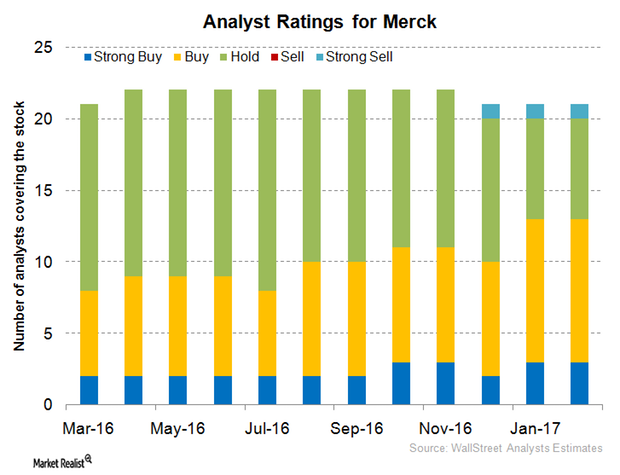

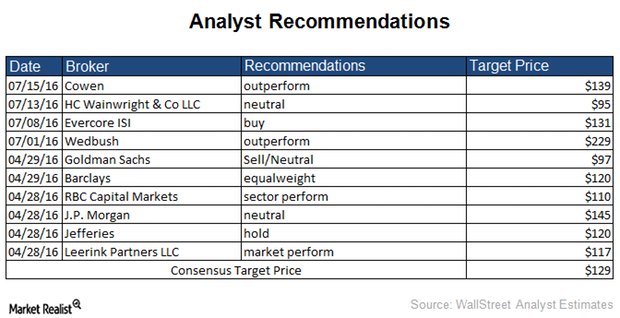

What Are Analysts’ Recommendations for Merck in 2017?

For 2016, Merck & Co. (MRK) reported revenue close to $39.8 billion, a year-over-year (or YoY) rise of ~1%. New product launches have played major roles in boosting Merck’s 2016 revenue.

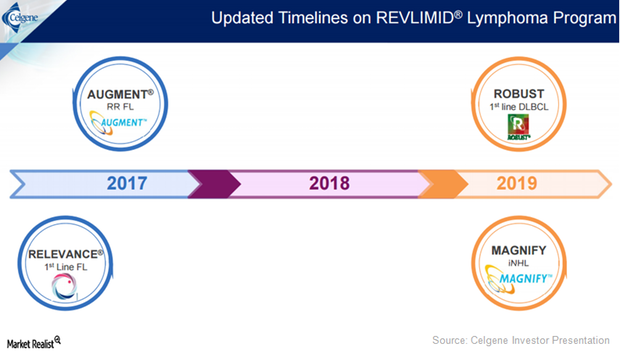

Celgene’s Revlimid Expected to Post Strong Revenue in 2017

According to unaudited financial results published by Celgene (CELG) on January 9, 2017, Revlimid sales for 2016 are about $7.0 billion, a YoY rise of about 20.0%.

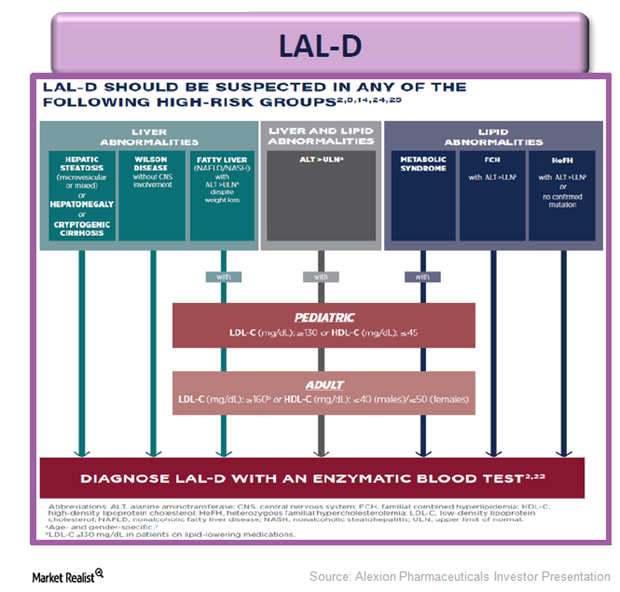

Alexion Pharmaceuticals Adds Metabolic Drug Kanuma to Portfolio

Kanuma was acquired by Alexion Pharmaceuticals on completion of the acquisition of Synageva Pharmaceuticals in June 2015.

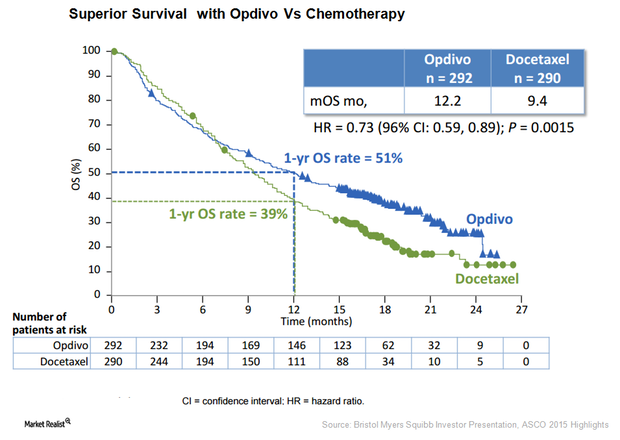

Bristol-Myer Squibb’s Opdivo Is Keytruda’s Strong Competitor

the U.S. Food and Drug Administration accepted the filing of a supplemental Biologics License Application for Bristol-Myers Squibb’s Opdivo.

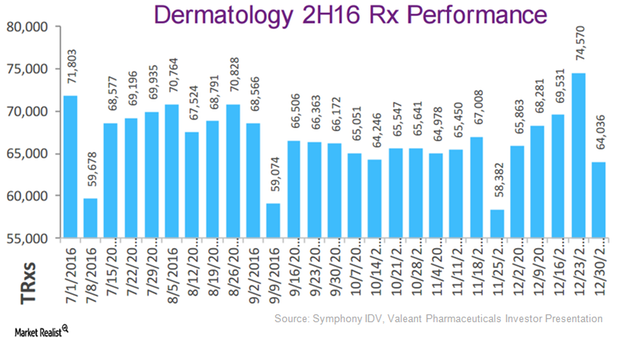

Valeant’s Dermatology Business Felt Pricing Pressure in 2016

Dermatology pricing trends Valeant Pharmaceuticals’ (VRX) dermatology business witnessed intense pricing pressure in 2016, due to a change in the company’s distribution model in 4Q15. While Valeant previously marketed its dermatology drugs through specialty pharmacies, the company now distributes its products through Walgreens. To learn about the company’s current distribution model, please refer to How Valeant Plans […]

Aurora Cannabis’s Price Target Cut by 30%

Aurora Cannabis (ACB) stock is currently down 29.23% on the NYSE on a YTD (year-to-date) basis. The company has lost 14.81% of its value since October 1.

The Pet Cannabis Industry Is a Lucrative Opportunity

Spending on pet care is gradually rising in the US. As reported by CNBC, Nielsen estimated Americans spent $33 billion on pet food and treats last year.

Marijuana to Treat New Conditions in Minnesota

In August 2020, chronic pain and age-related macular degeneration would be eligible for treatment under Minnesota’s medical marijuana program.

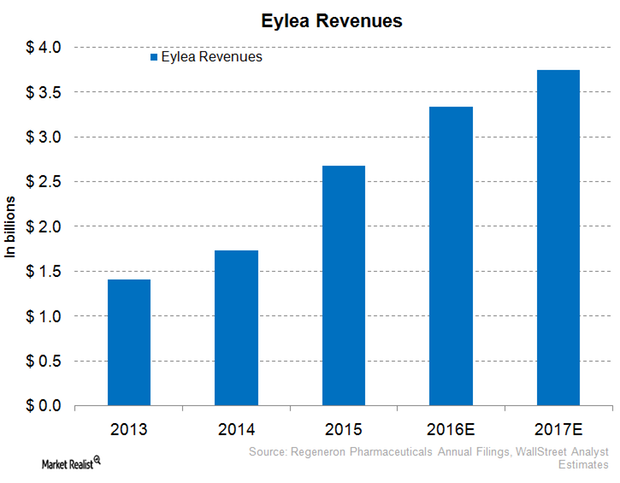

Why Eylea Could Face Tough Competition in 2016

In 2016, Regeneron expects to face increased competition from Roche Holding’s Lucentis (Ranibizumab) and Avastin (Bevacizumab) for Eylea.

Emerging Markets Drive Abbott’s Nutritional Business Growth

In 1Q17, Abbott Laboratories’ (ABT) Nutritional segment reported revenue of nearly $1.6 billion, a year-over-year (or YoY) fall of ~1%.

An Overview of Canopy Growth and Its Brands

Canopy Growth (CGC) announced the US launch of First & Free, its hemp-derived CBD product line. CGC offers softgels, oil drops, and creams.

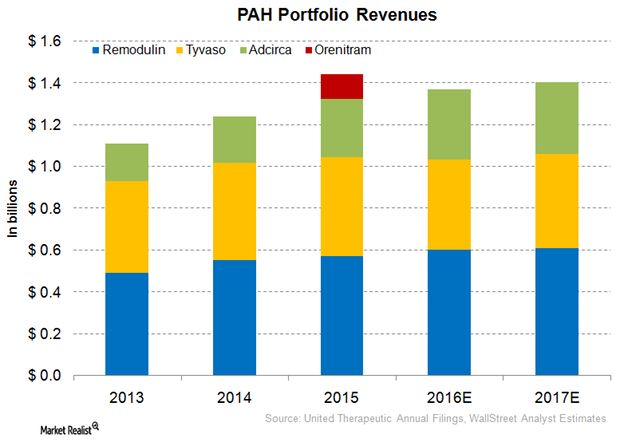

Strong Growth Projected for UTHR’s Hypertension Drugs

United Therapeutics has projected that in 2016, its trepostinil pulmonary arterial hypertension drugs will benefit from patients’ shifting away from Uptravi.

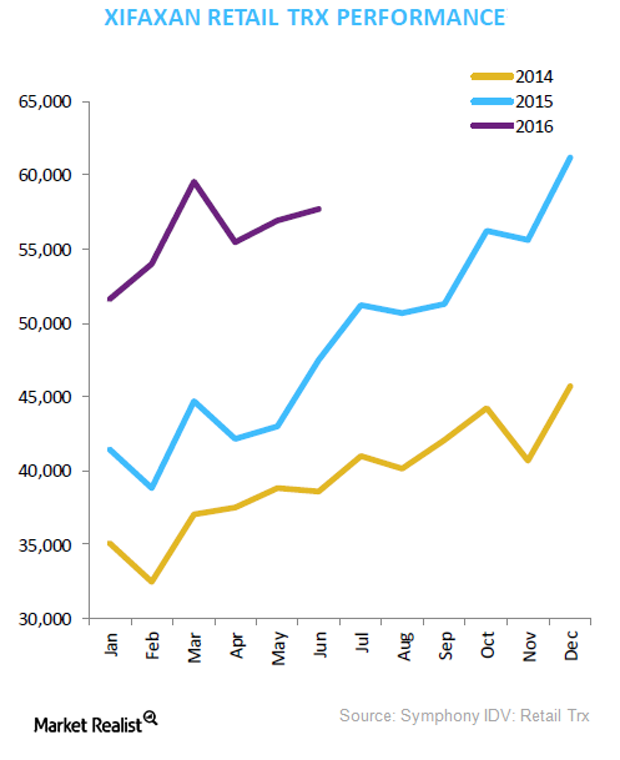

This Space Presents a Market Opportunity for Valeant

In Valeant’s 2Q16 earnings, Xifaxan reported a year-over-year (or YoY) increase in monthly prescriptions of about 28.0%.

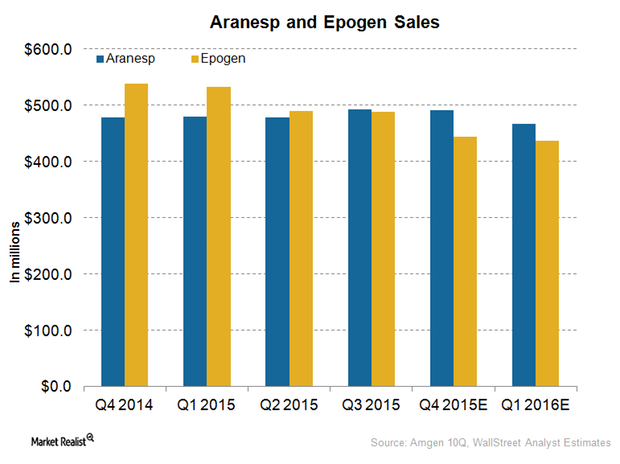

Amgen’s Nephrology Drugs Expect Falling Revenue in 4Q15

Analysts projected a fall in the revenue for Amgen’s nephrology drugs, Aranesp and Epogen, in 4Q15. The drugs are expected to suffer in the coming quarters.

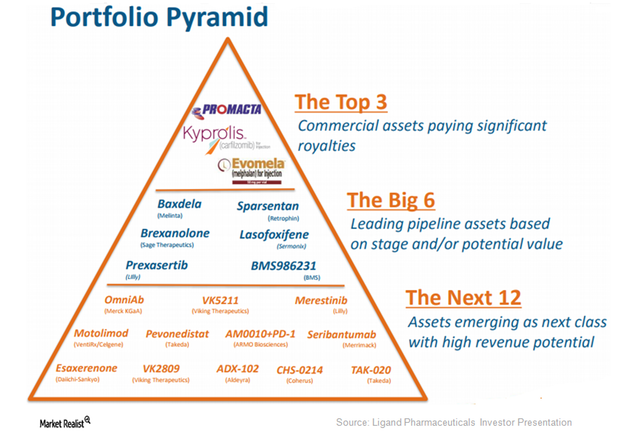

Ligand Pharmaceuticals Focuses on Increasing Returns for Shareholders

Ligand Pharmaceuticals has developed a product portfolio that spans more than 700 patents offering varying degrees of protection to the assets.

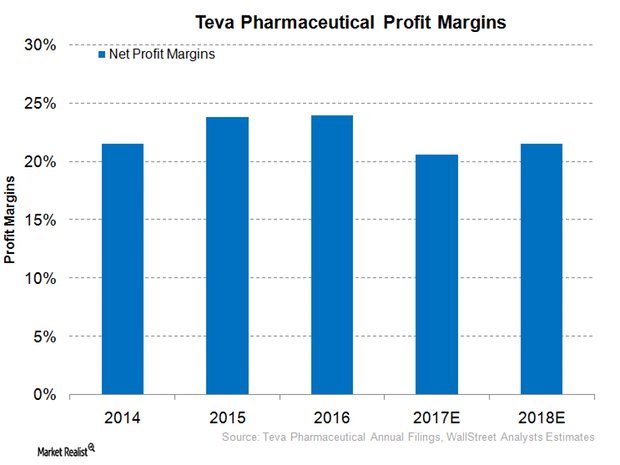

Teva Is Expected to See a Fall in Its Profit Margins in 2017

Teva Pharmaceutical (TEVA) expects its 2017 non-generally accepted accounting principles (non-GAAP) earnings per share (or EPS) to fall in the range of $4.9–$5.3.

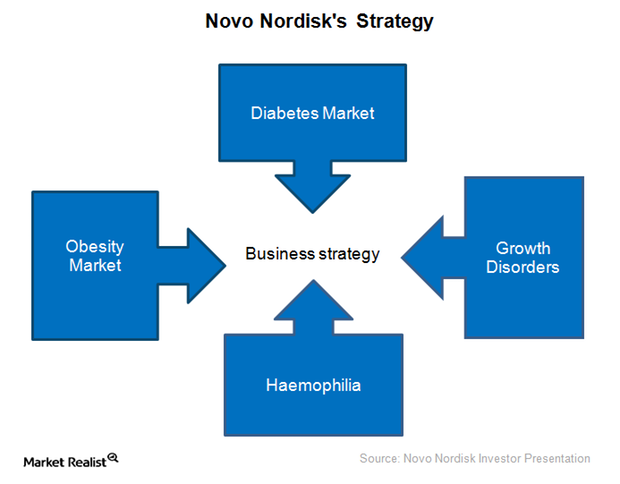

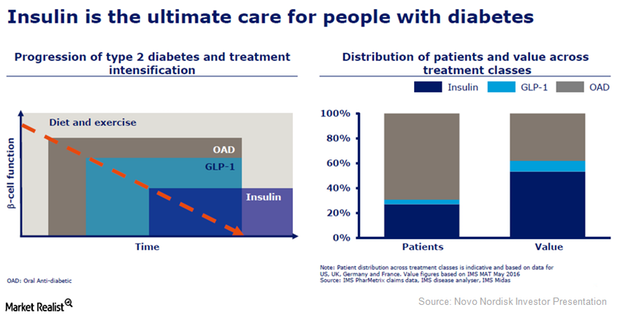

Novo Nordisk Is Focusing on These Strategic Areas in 2016

With 642 million people expected to suffer from diabetes globally by 2040, the disease is expected to offer multiple growth opportunities for Novo Nordisk.

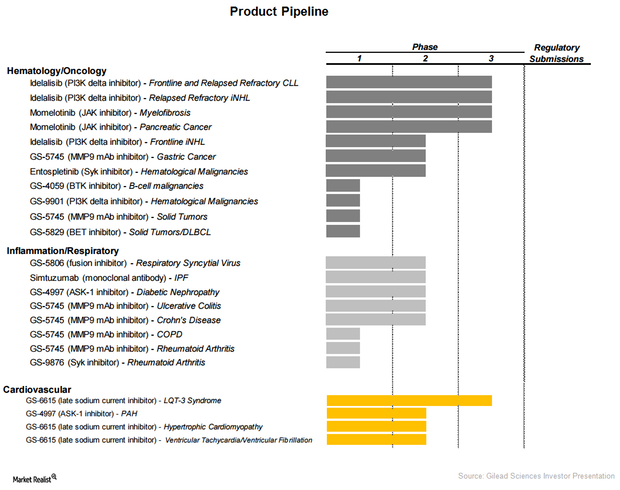

Gilead Sciences’ Product Line Extension

As part of its significant product line extension, Gilead Sciences (GILD) is entering therapeutic areas such as oncology, pulmonology, and cardiology.

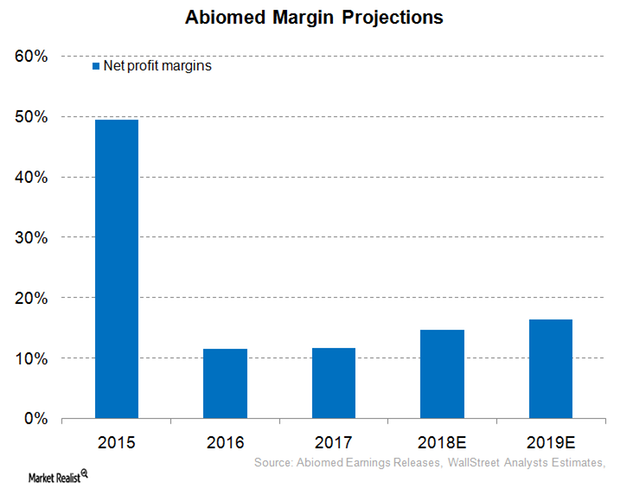

Inside Abiomed’s Profit Margin Expectations for Fiscal 2018

For fiscal 2018 (ended March 31, 2018), Abiomed (ABMD) has projected that its operating margins will be in the range of 22%–24%.

CBD: Japan Welcomes NBEV, Stock Pops

Today, New Age Beverages Corporation (NBEV) announced that it would launch its CBD (cannabidiol) based products. Share prices jumped by 14.96% to $3.20.

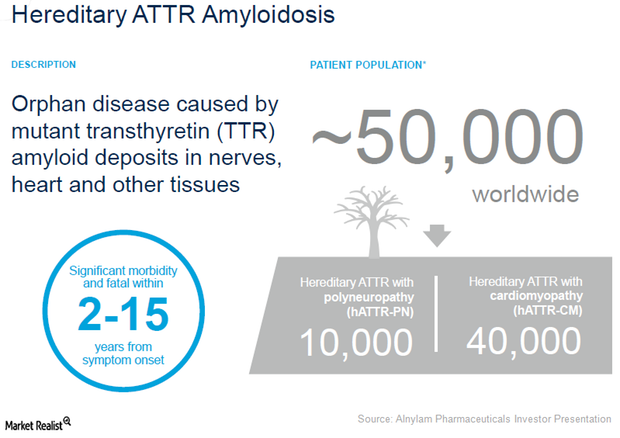

Alnylam Pharmaceuticals: Developing Therapies for Hereditary ATTR Amyloidosis

Alnylam Pharmaceuticals (ALNY) is currently developing three investigational therapies—Patisiran, Revusiran, and ALN-TTRsc02—for the treatment of patients with hereditary ATTR amyloidosis.

What Do Analysts Recommend for United Therapeutics?

23.1% of analysts gave United Therapeutics (UTHR) a “buy” recommendation while 69.2% of analysts rated the company a “hold.”

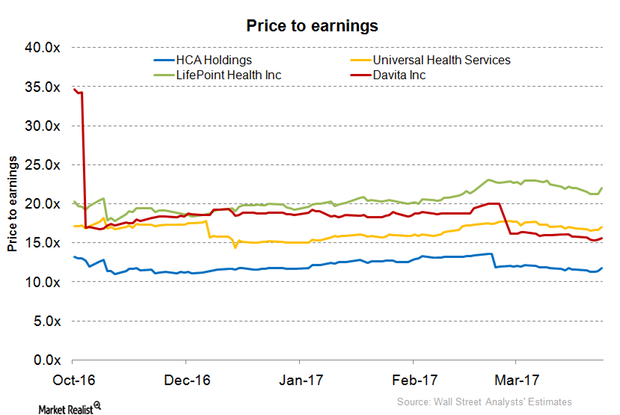

Which Hospital Stocks Are Expected to Benefit Most?

Trumpcare’s failure is considered to be a boon by hospital companies treating a significant portion of Medicaid members.

What to Expect from IIPR’s Earnings for Q3

Innovative Industrial Properties (IIPR) is scheduled to release its Q3 earnings results on November 6. Find out what cannabis investors can expect.

New York: Curaleaf Launched Cannabis Flower Products

On Monday, Curaleaf (CURA) (CURLF) became the first company to launch medical cannabis flower products in New York. The state offers growth opportunities.

What Legalizing Cannabis Means for Mexico

Mexico is fast approaching its October 23 marijuana legalization deadline. Multiple legalization proposals before parliament are creating confusion.

Was CGC a Big Mistake for Constellation Brands?

Canopy Growth (CGC) has seen dizzying ups and gloomy downs in 2019. The stock jumped up by 79.91% from $28.92 on January 2 to $52.03 on April 29.

Novo Nordisk Continues to Be a Leader in the Global Insulin Market

Accounting for a ~46% market share, Novo Nordisk (NVO) is expected to continue to benefit from the positive trends in the global insulin market

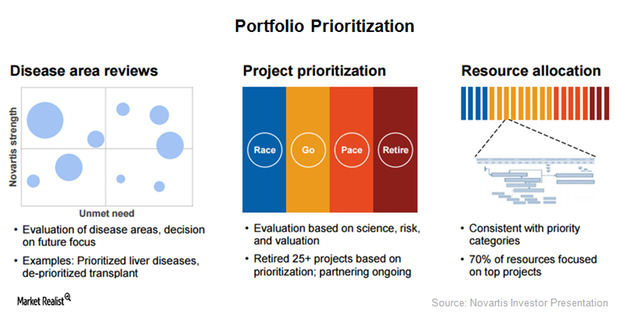

Novartis Focuses on Portfolio Prioritization to Boost Profitability

To ensure long-term relevance as well as quick adaptability to changing market needs, Novartis (NVS) is focusing on five major initiatives in 2017.

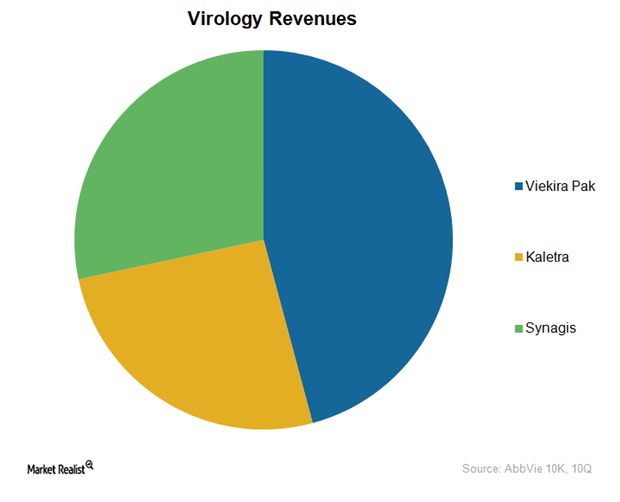

AbbVie Strengthens Its Position in the Virology Segment

In addition to Humira, AbbVie also offers several virology drugs targeting diseases such as hepatitis C, HIV, and respiratory syncytial virus.

Analysts’ Recommendations for Haemonetics and Peers in March 2018

In its fiscal 3Q18, which ended on December 31, 2017, Haemonetics (HAE) reported revenue of close to $234 million.

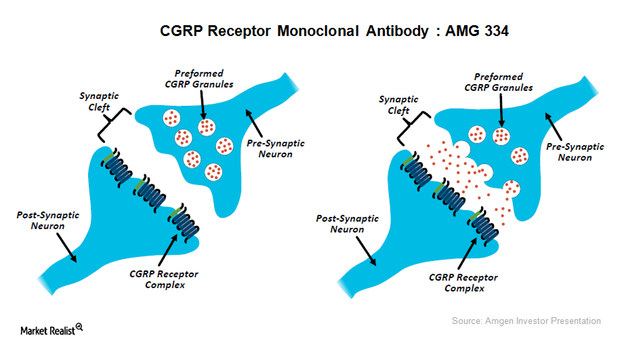

Entering Migraine Market Won’t Be Easy for Novartis, Amgen

Novartis (NVS) and Amgen (AMGN) recently announced that the CGRP inhibitor therapy, AMG 334, reported positive results in a Phase 2 clinical trial as a therapy for preventing chronic migraine.

CGC: How the Future Looks Under Its New CEO

On December 9, Canopy Growth (CGC) appointed David Klein as its new CEO effective January 14. He’s the current CFO of Constellation Brands.

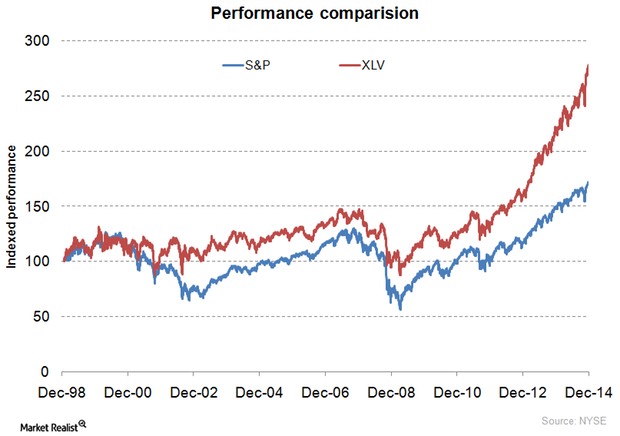

Must-read: Is the US hospital industry truly non-cyclical?

The hospital sector is widely considered a non-cyclical or defensive industry, meaning demand for hospital services doesn’t change with the economic cycle.

Teva’s Share of the US Generics Market Could Boost Its Stock

Teva Pharmaceutical Industries accounts for 18% of the US generic drug market. This share is significantly higher than those of Mylan, Novartis, and Pfizer.

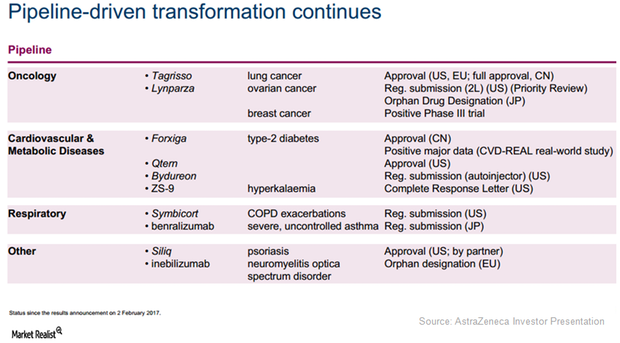

AstraZeneca May Witness a Fall in 2017 Net Profit Margin

Wall Street analysts have projected AstraZeneca’s (AZN) 2017 net profit margins at about 12.2%, which is lower by 300 basis points on a YoY basis.

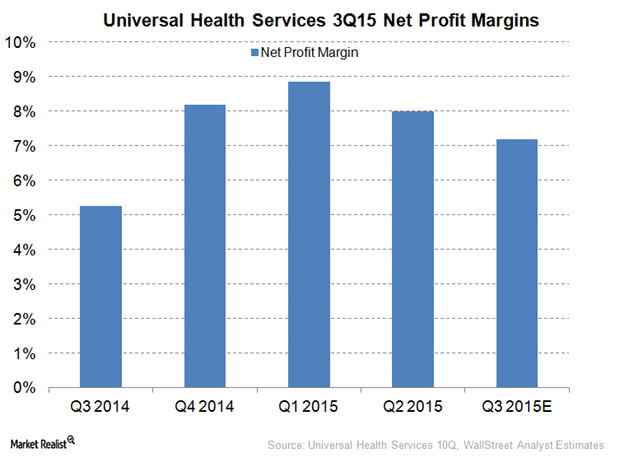

Universal Health Services’ Net Profit Margin Expected to Rise

Wall Street analysts expect that Universal Health Services (UHS) will report higher net profit margins in 3Q15 compared to margins in 3Q14.

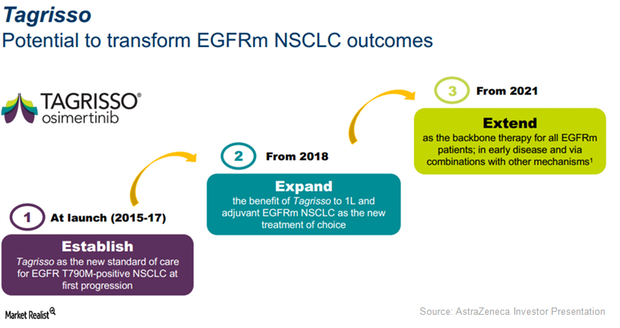

Tagrisso Expected to Be a Key Growth Driver for AstraZeneca in 2017

Launched in Japan in 2Q16, AstraZeneca’s (AZN) 1Q17 revenues for Tagrisso approached $39 million in this major emerging market.

Cannabis Stocks: What Happens in a Recession?

As market analysts increasingly predict an upcoming global recession, we take a look at the impact of a recession on cannabis stocks.

What’s the Market Potential for CBD?

The FDA has issued warning letters to 15 companies involved in illegal sales of non-psychoactive CBD products. What’s the legal market’s potential?

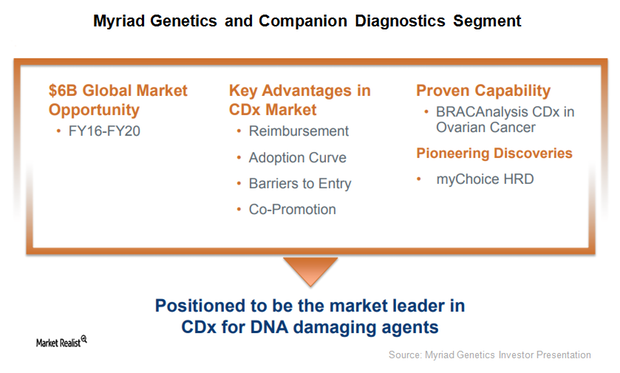

This Could Be a Solid Growth Driver for Myriad Genetics in 2018

Myriad Genetics (MYGN) announced the U.S. Food and Drug Administration’s (or FDA) acceptance of its supplementary premarket approval application for BRACAnalysis CDx, a DNA sequencing companion diagnostic test.

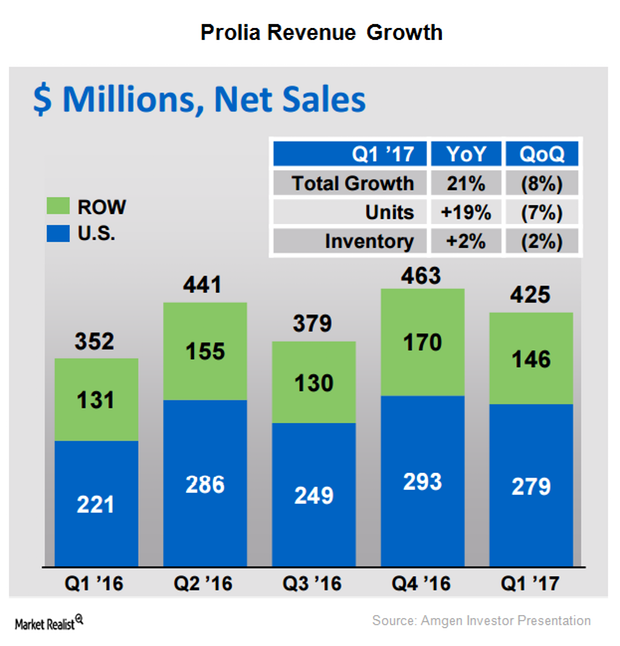

Prolia Continued to Lead in the Bone Health Segment in 1Q17

In 1Q17, Amgen’s (AMGN) Prolia continued to be a dominant player in the bone health segment. Indicated for postmenopausal osteoporosis, the drug managed to gain market share across all geographies in 1Q17.

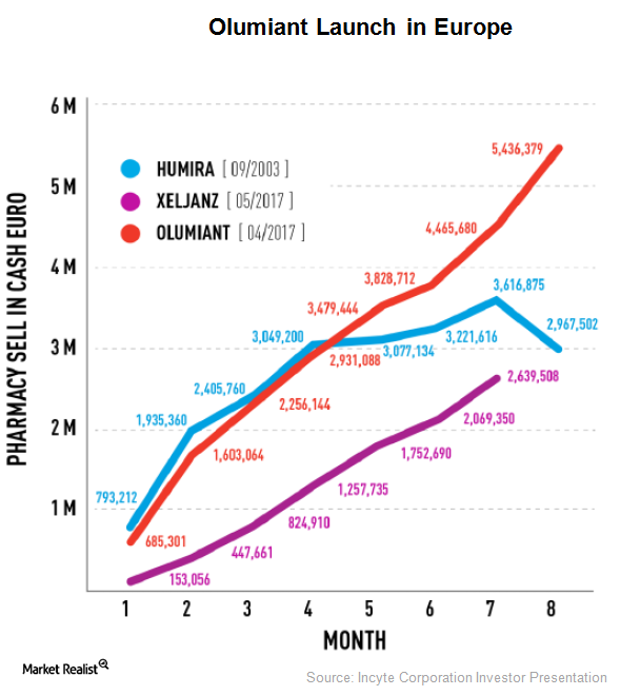

Olumiant Could Boost Incyte’s Revenues

In February 2017, Eli Lilly (LLY) secured approval for Olumiant (baricitinib) from the European Medicines Agency (or EMA) for patients suffering from moderate-to-severe rheumatoid arthritis.

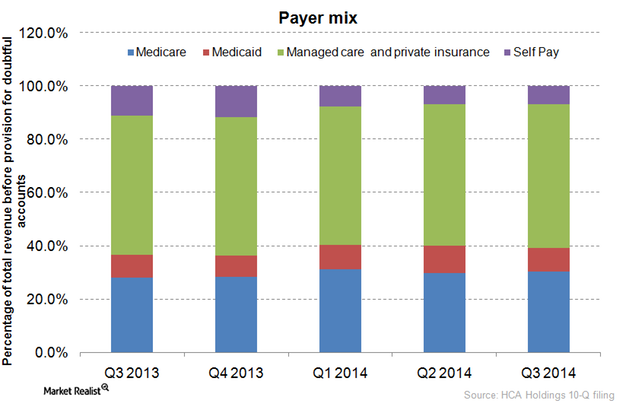

Exploring payer mix trends at HCA Holdings

In terms of payer mix, the percentage of HCA Holdings revenues contributed by Medicare rose from 28.0% in 3Q13 to 30.3% in 3Q14.

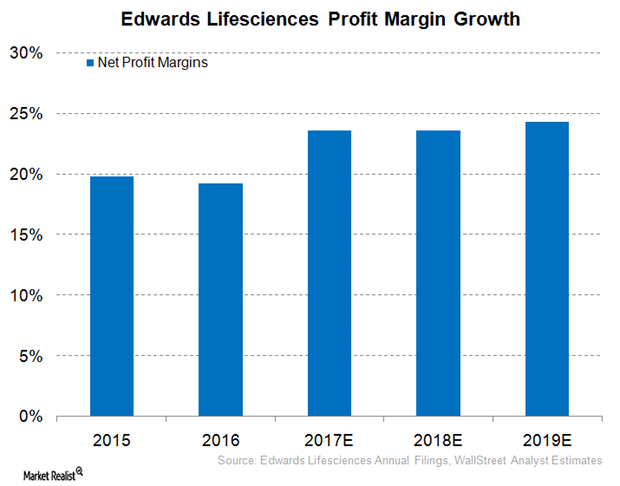

Can Edwards Lifesciences See Robust Net Profit Margin in 2017?

In its 2Q17 earnings conference call, Edwards Lifesciences (EW) projected 2017 adjusted EPS to fall to $3.65–$3.85, which is higher than the previous $3.43–$3.55.

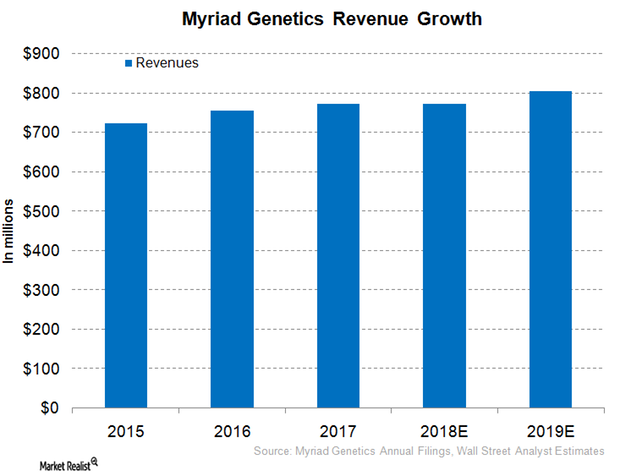

Myriad Genetics Expected to Report Flat Revenue Growth in Fiscal 2018

Myriad Genetics (MYGN) expects to report revenues in the range of $750 million–$770 million in fiscal 2018 (ended June 30, 2018).