Medtronic Plc

Latest Medtronic Plc News and Updates

Healthcare Farallon Capital adds a new position in Covidien

Ireland-based Covidien is a global healthcare leader that offers innovative medical technology solutions and patient care products to providers.

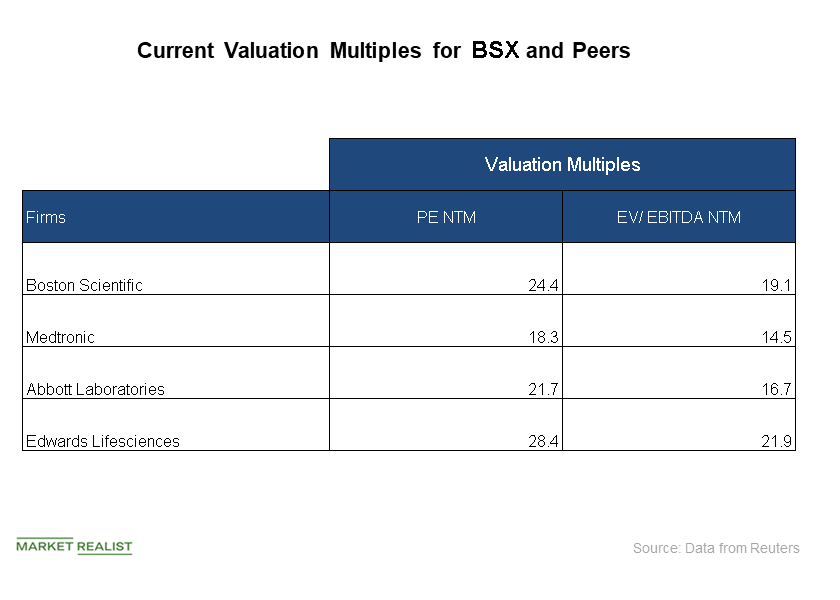

A Look at Boston Scientific’s Valuation Multiples in September

On September 14, Boston Scientific (BSX) was trading at a forward price-to-earnings ratio of 24.4x, compared to the industry’s average PE ratio of 22.4x.

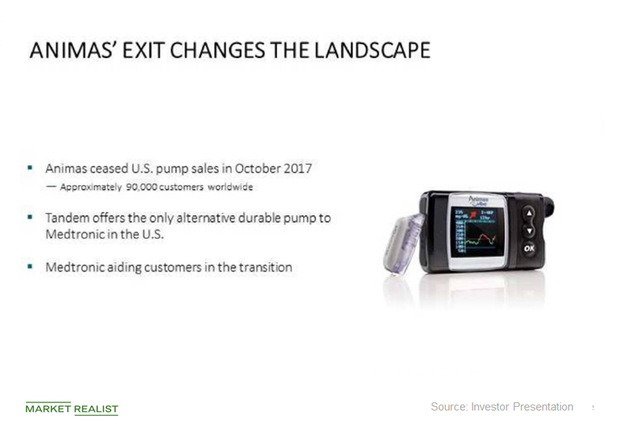

Tandem Diabetes Care’s International Expansion Strategy

Tandem Diabetes Care (TNDM) is slated to begin its international expansion later this year to capture opportunities arising after Johnson & Johnson’s (JNJ) exit from the insulin pump market, which was announced in October 2017.

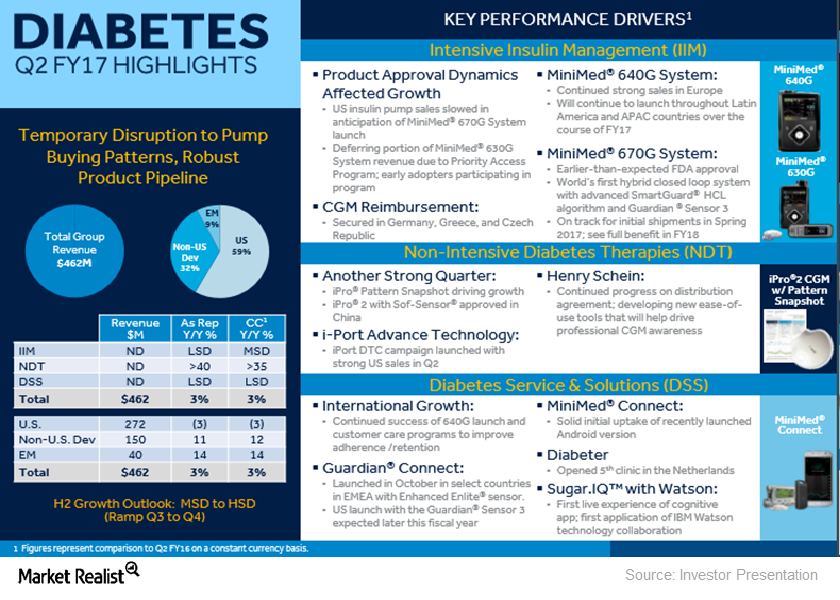

What Really Disrupted Medtronic’s Diabetes Segment Sales in Fiscal 2Q17?

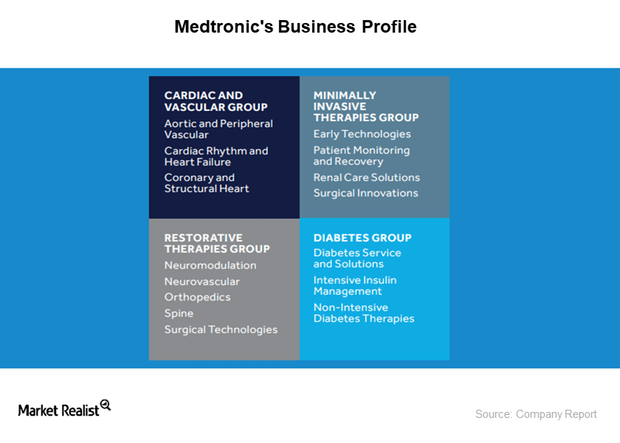

Of Medtronic’s ~$7.3 billion in worldwide revenues in fiscal 1Q17, ~$0.46 billion came from its Diabetes segment, representing ~6% of the company total.

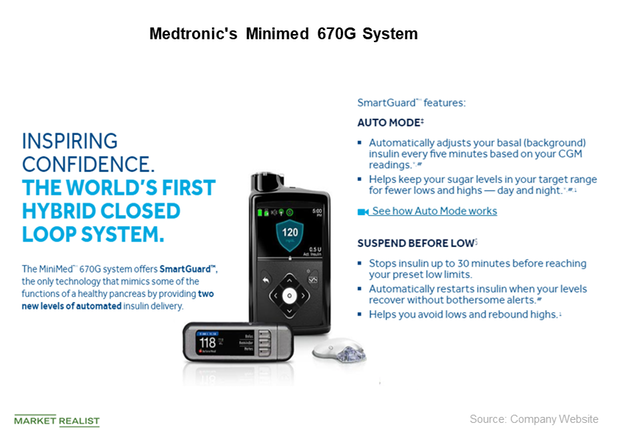

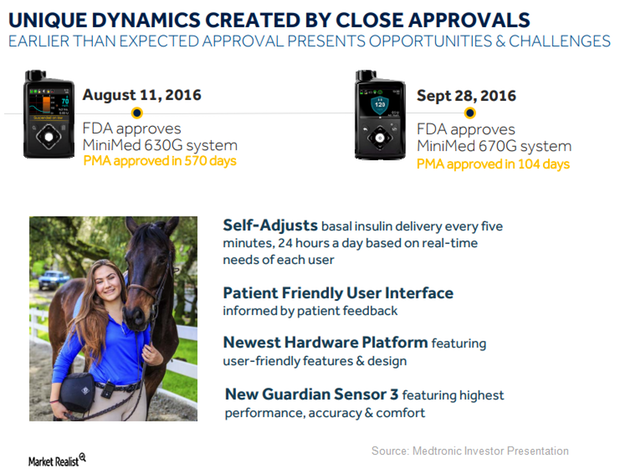

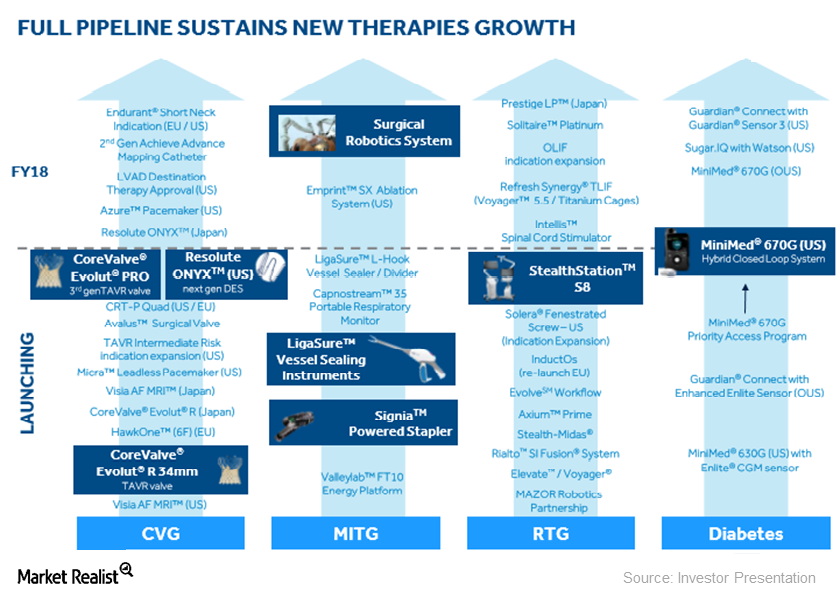

Medtronic’s Key Growth Driver: MiniMed 670G Hybrid Closed Loop

Medtronic’s Diabetes Group performance in fiscal Q4 2018 was driven by a 25% growth for its MiniMed 670G hybrid closed-loop insulin pump.

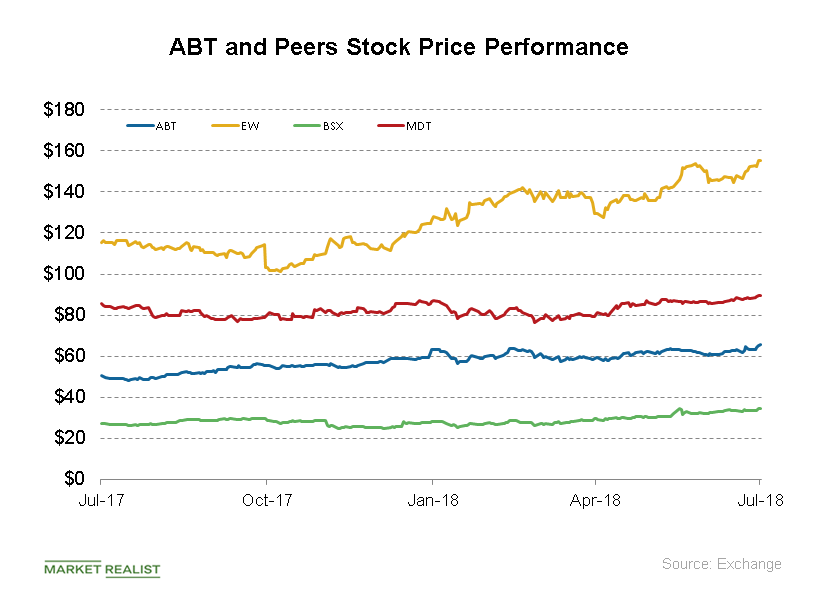

Abbott Laboratories’ Stock Price Performance in July

Year-to-date, ABT stock has risen 12.8%. Over the last month, the stock has returned ~4.0%.

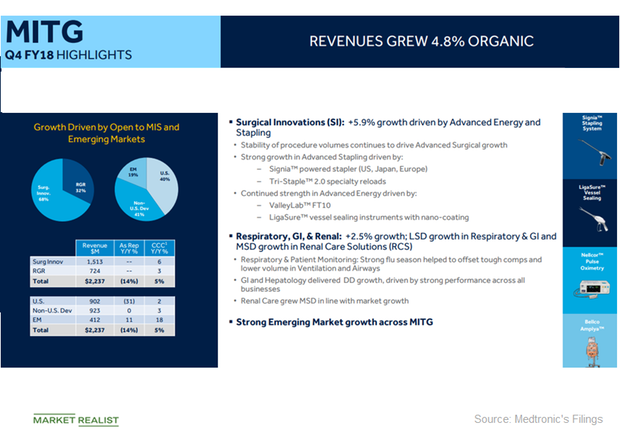

Innovative Products Driving Medtronic’s Growth

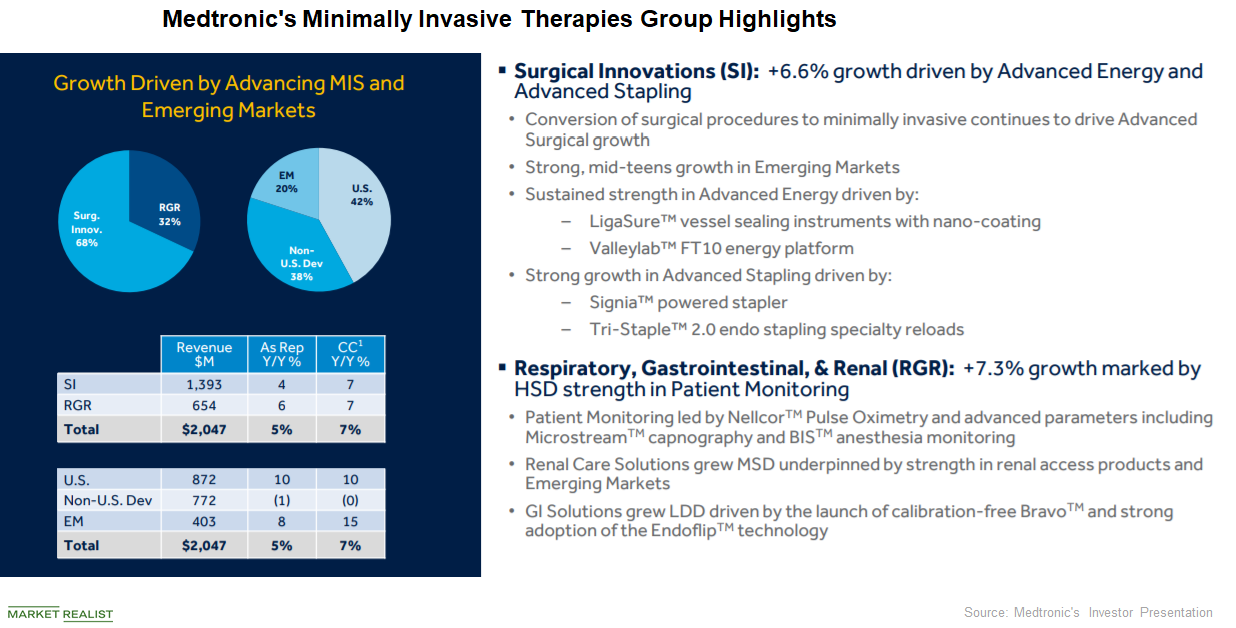

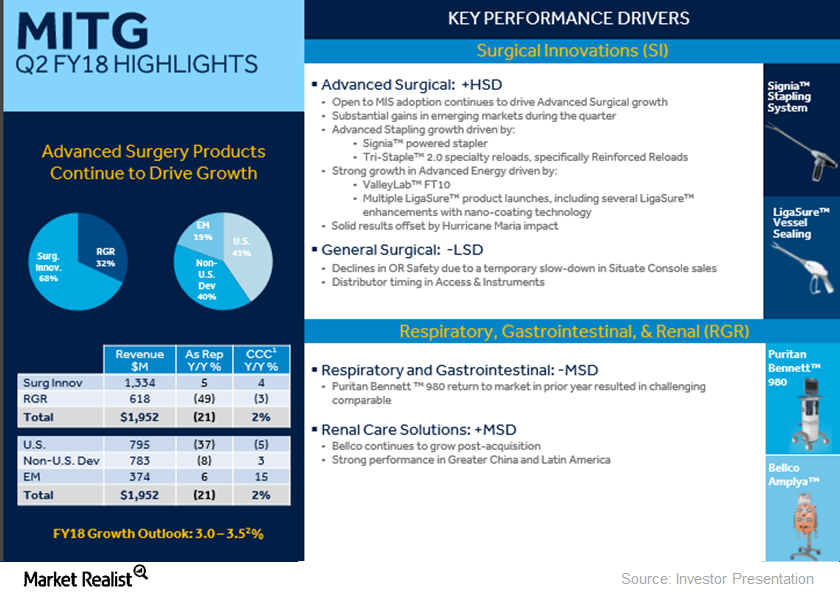

Medtronic expects its MITG segment to have an organic growth rate of 4% in fiscal 2019.

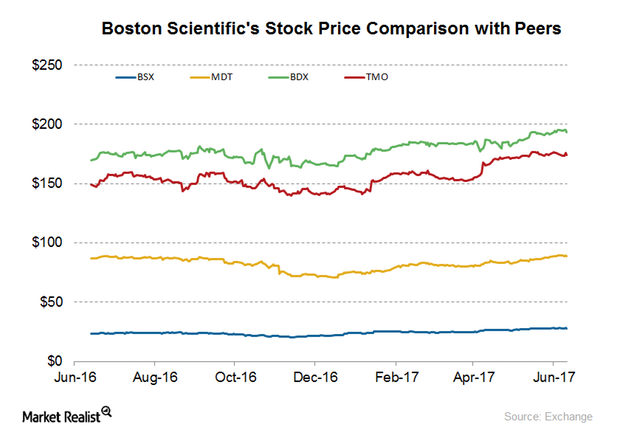

How Has Boston Scientific Stock Performed Recently?

Boston Scientific (BSX) was trading at $27.9 on June 29, 2017.

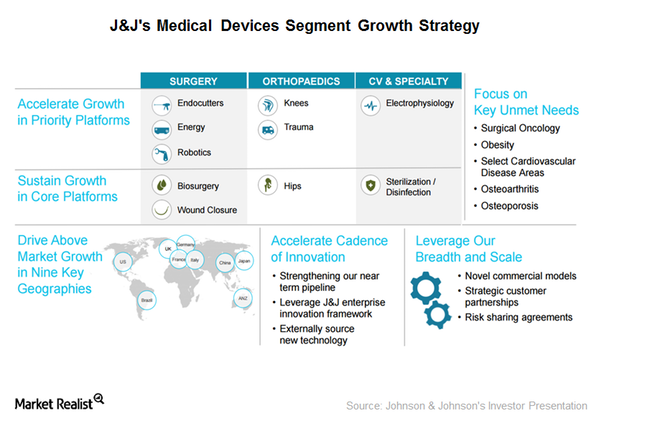

How Johnson & Johnson’s Partnerships Enhance Customer Value

Johnson & Johnson’s key innovation strategies include creating value through strategic customer partnerships and solutions.

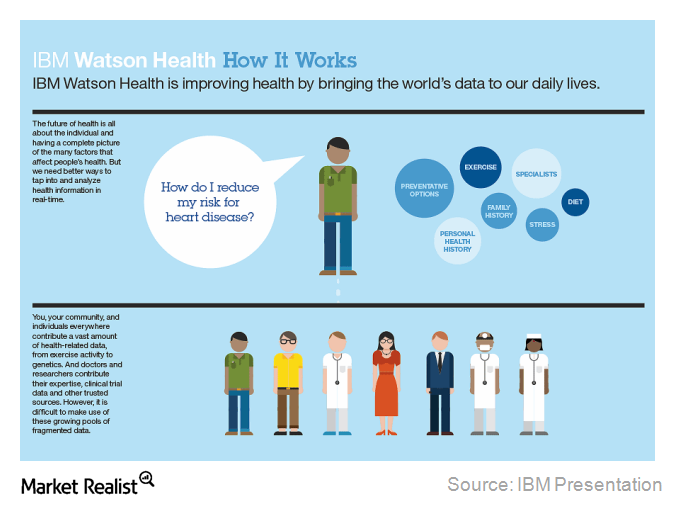

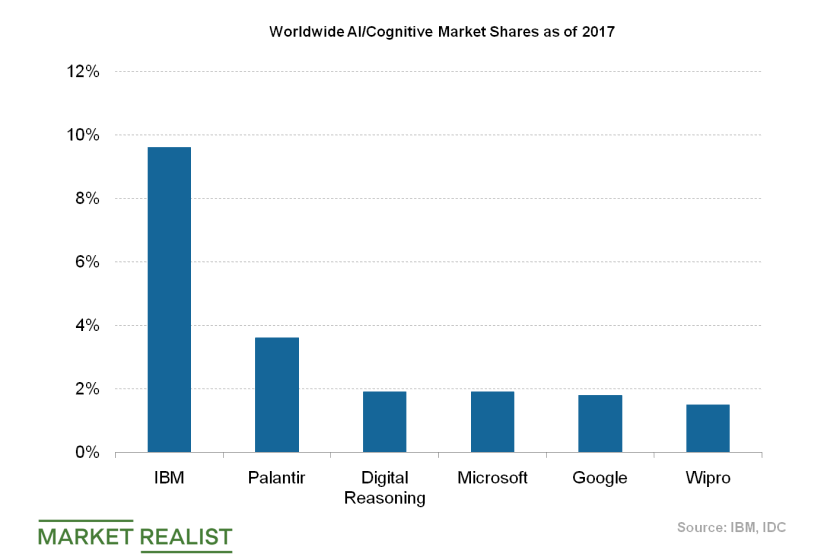

IBM Is Paving the Way for Watson Health: Acquisitions and Deals

IBM’s partnership with Apple is especially appealing. Watson Health will bring cloud services and analytics to Apple’s HealthKit and ResearchKit.

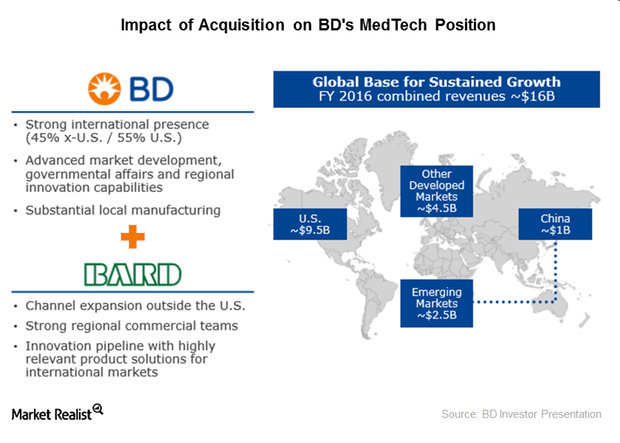

How BD-Bard Acquisition Will Strengthen International Presence

C.R. Bard (BCR) has grown significantly outside the United States in recent years, driven by its international channel expansion strategy.

Amazon Partners with over 30 Companies: VI Initiative

On September 24, Amazon (AMZN) announced the Voice Interoperability Initiative. The announcement was one day before the Amazon hardware event.

These Developments Impacted Abbott Laboratories the Most in Fiscal 2017

Abbott Laboratories posted a strong earnings results on January 24, surpassing Wall Street estimates and posting earnings at the high end of its guidance.

Why Pfizer Stock Continues to Tank after Mylan Deal

Pfizer stock (PFE) has fallen 10% in the past two days on its deal with Mylan (MYL) and its lower earnings guidance.

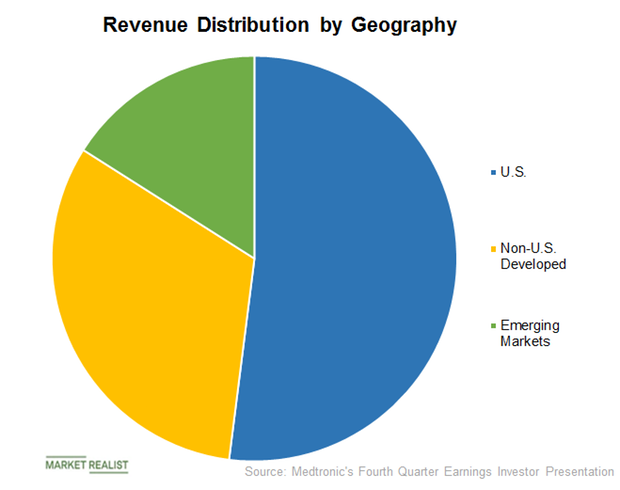

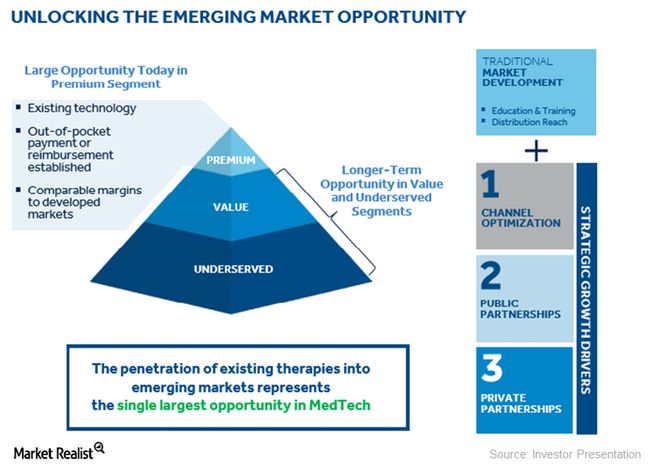

Emerging Markets: Medtronic’s Key Revenue Driver in 2019

In the fourth quarter, Medtronic earned revenue of $4.28 billion in the US market, a YoY (year-over-year) rise of 2.3% on a reported and constant-currency basis.

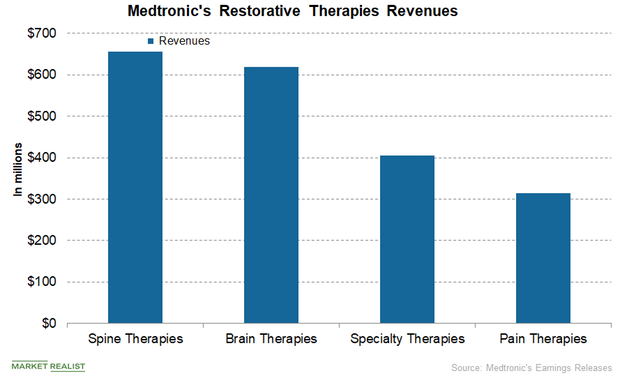

How Did Medtronic’s Restorative Therapies Group Perform?

Medtronic’s (MDT) Spine Therapies generated revenues of $1.3 billion in the first half of fiscal 2019.

How Medtronic’s Minimally Invasive Therapies Group Has Performed

Medtronic’s MITG segment generated revenues of $4.1 billion in the first half of fiscal 2019 compared to $4.4 billion in the first half of fiscal 2018.

How IBM Is Investing in AI Solutions

AI is the buzzword these days, and the market has huge growth potential.

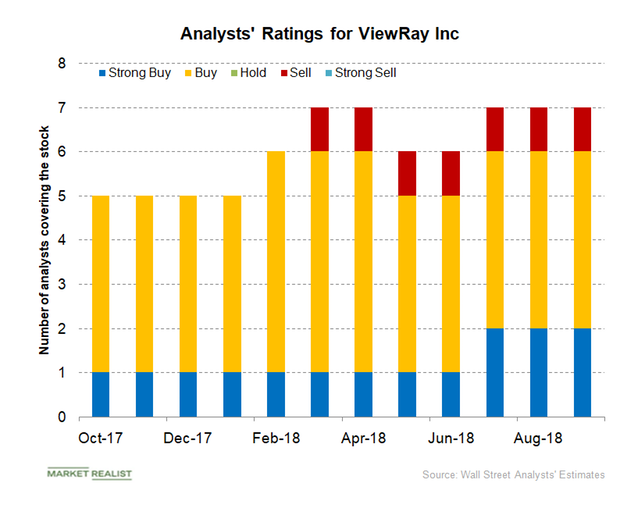

What ViewRay’s Valuation Trend Indicates

In September, of the seven analysts covering ViewRay (VRAY), six have given its stock “buy” or higher ratings, and one analyst has given it a “sell” rating.

Do Abiomed’s Valuations Look Attractive?

Abiomed’s (ABMD) revenues rose 36% YoY to ~$180 million in fiscal Q1 2019 compared to $133 million in Q1 2018.

What Analysts Expect from Haemonetics in Q1 2019

Haemonetics is expected to report 4.3% growth in revenues to $219.9 million during Q1 2019 as compared to $210.9 million during Q1 2018.

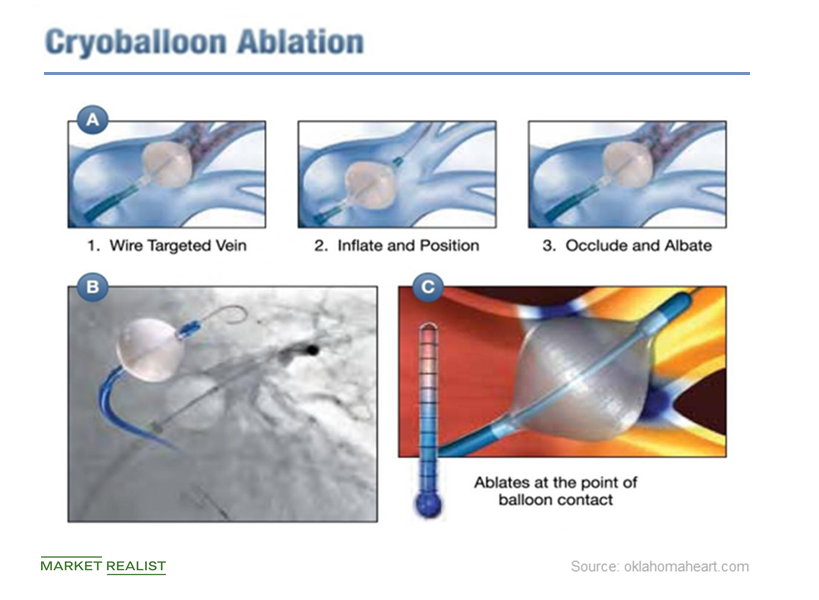

Assessing BSX’s Recently Acquired Cryterion Cryoablation Platform

On July 5, Boston Scientific announced its acquisition of Cryterion Medical, which will add Cryterion’s cryoablation platform to BSX’s atrial fibrillation treatment portfolio.

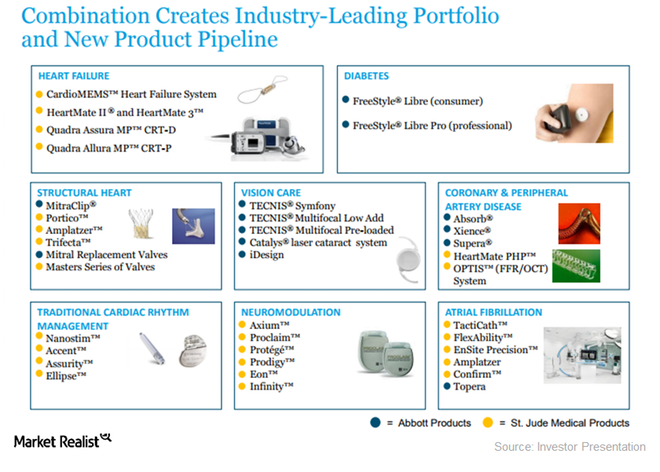

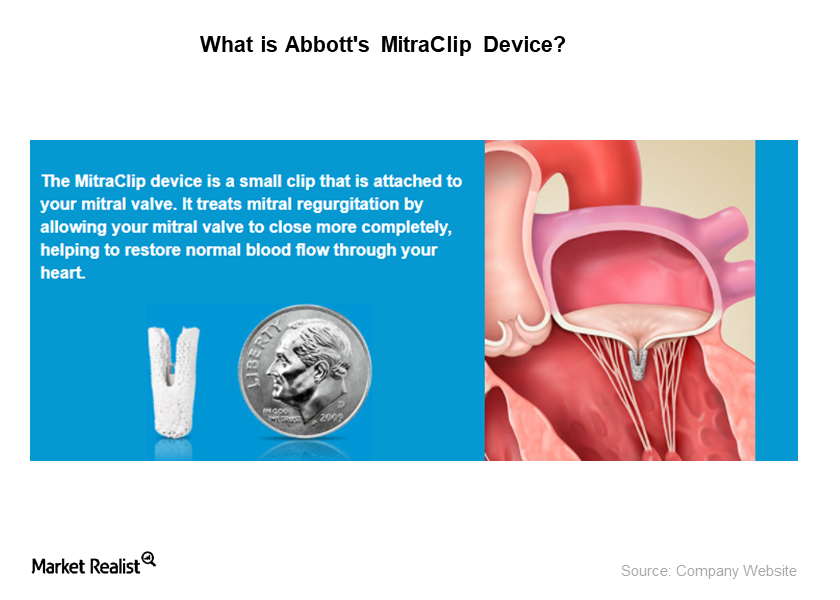

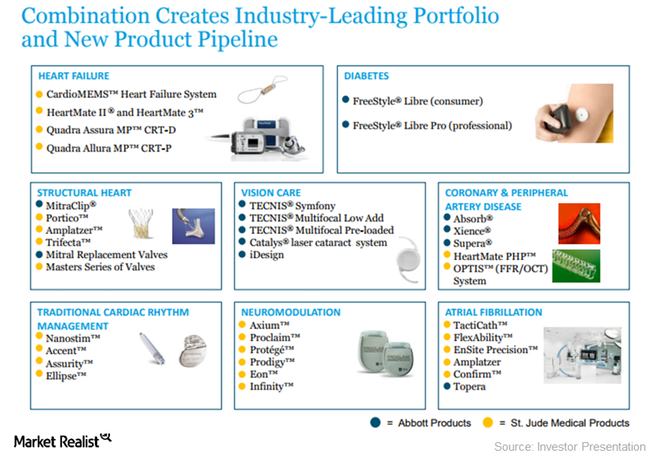

MitraClip Drives Growth, Gets Reimbursement Approval in Japan

On March 19, 2018, Abbott Laboratories (ABT) announced that it had received reimbursement approval for its MitraClip device in Japan.

Medtronic Strengthens Diabetes Business with MiniMed Infusion Set

On February 21, 2018, Medtronic (MDT) announced the launch of its MiniMed Mio Advance infusion set.

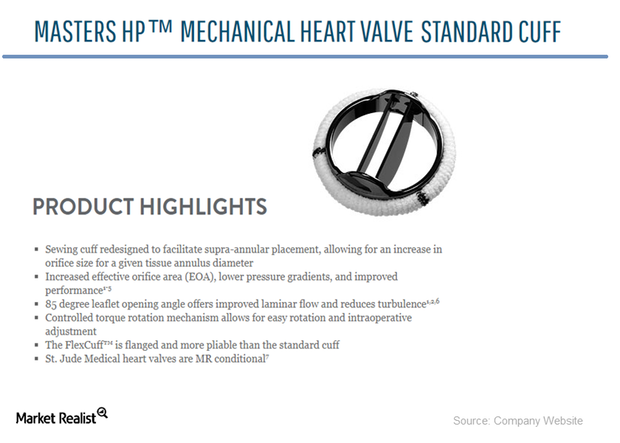

ABT Gets FDA Approval for World’s Smallest Mechanical Heart Valve

Abbott announced that it received FDA approval for its Masters HP 15-mm rotatable mechanical heart valve, which is the first and only heart valve developed for newborns and infants.

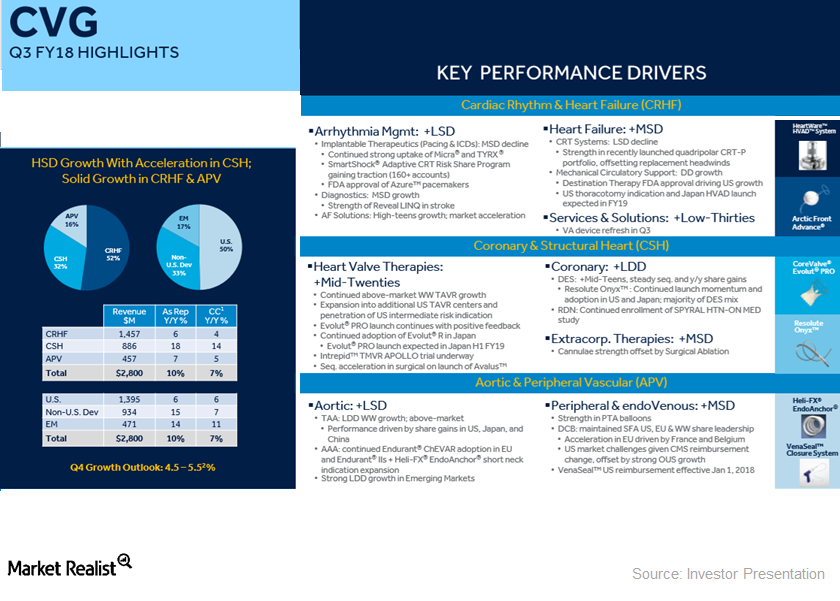

What Drove Medtronic’s Cardiac and Vascular Group in 3Q18

Cardiac and Vascular Group in fiscal 4Q17 Medtronic (MDT) reported total sales of ~$7.4 billion in fiscal 3Q18. Of that total, ~38% (~$2.8 billion) was contributed by Medtronic’s CVG (Cardiac and Vascular Group). CVG sales grew ~10% YoY (year-over-year) and ~7% on a constant-currency basis. US CVG sales grew ~6% YoY, while developed nation CVG sales […]

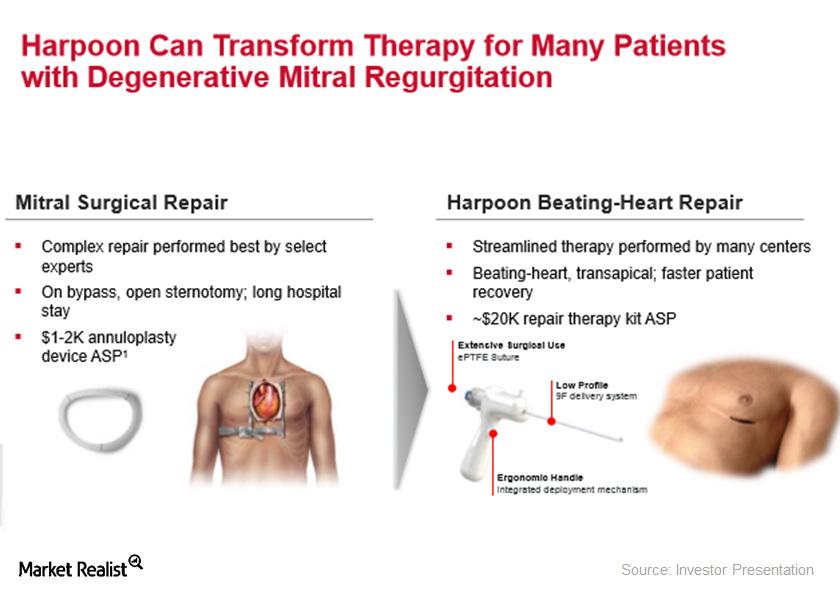

Edwards Lifesciences Expands Portfolio with Harpoon Medical Acquisition

On December 6, 2017, Edwards Lifesciences (EW) announced the completion of its acquisition of Harpoon Medical for $100 million in cash on December 1, 2017.

Discussing the Recent Management Changes at Medtronic

On December 20, 12 of 24 analysts surveyed by Reuters rated Medtronic (MDT) stock as a “buy,” and the remaining 12 analysts recommended a “hold.” There were no “sell” ratings given to MDT stock.

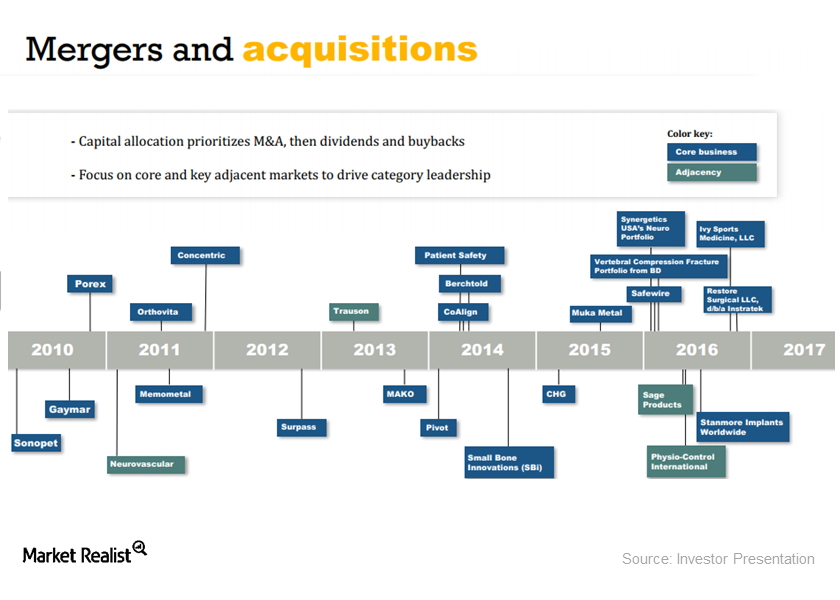

Stryker’s Inorganic Growth Strategy Continues to Boost Growth

Stryker’s acquisition-driven growth strategy Stryker (SYK) has been growing at a fast pace through inorganic growth. It has undertaken a number of strategic acquisitions recently. In 3Q17, acquisitions contributed approximately 0.6% of the company’s YoY (year-over-year) sales growth, and in the first three quarters of 2017, Stryker acquisitions contributed ~3.2% of the company’s sales growth […]

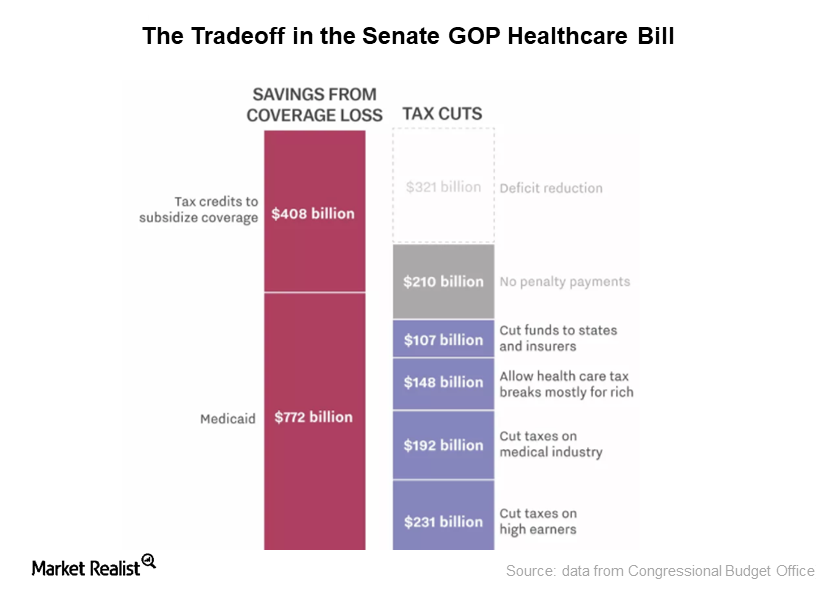

How the Corporate Tax Rate Cut Could Affect R&D in the Medtech Industry

The repeal of the tax deduction for high medical expenses may reduce the number of taxpayers opting for costly medical technologies and services.

How the Medical Expense Tax Deduction Affects the Healthcare Industry

According to AARP, around 75% the population claiming these medical expense deductions from their income are 50 years or older.

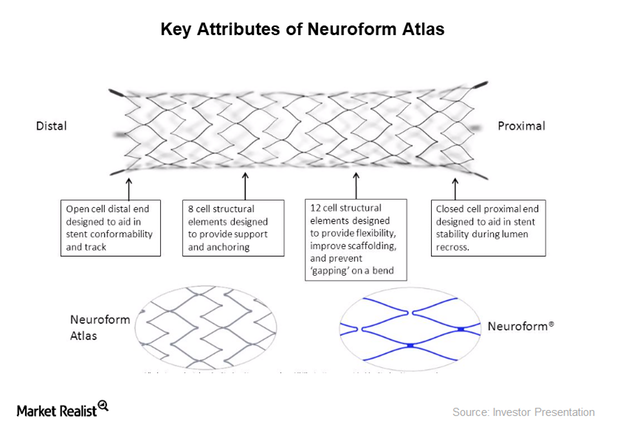

Stryker’s FDA Approval Accelerates Neck Aneurysm Treatments

On November 9, 2017, Stryker (SYK) announced FDA approval for the Neuroform Atlas Stent System, which is approved for marketing under an HDE.

Emerging Markets Growth Is Driving Medtronic’s Geographic Strategy

In fiscal 2Q18, Medtronic registered sales of ~$1.1 billion from emerging markets.

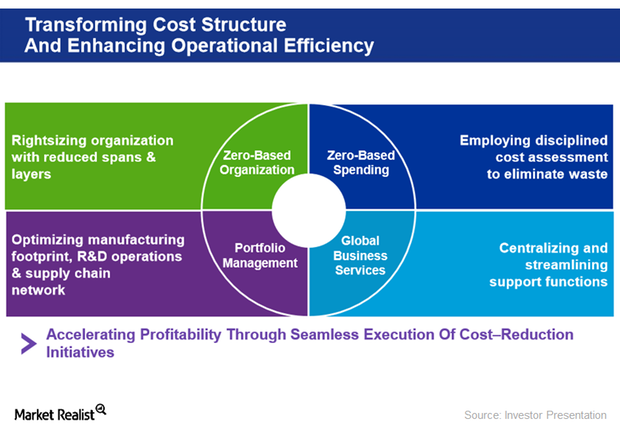

Medtronic’s Disappointing MITG Business Performance in Fiscal 2Q18

Due to the disappointing fiscal 2Q18 results, Medtronic made a downward revision to its estimates for MITG sales growth in fiscal 2018 to 3.0%–3.5%.

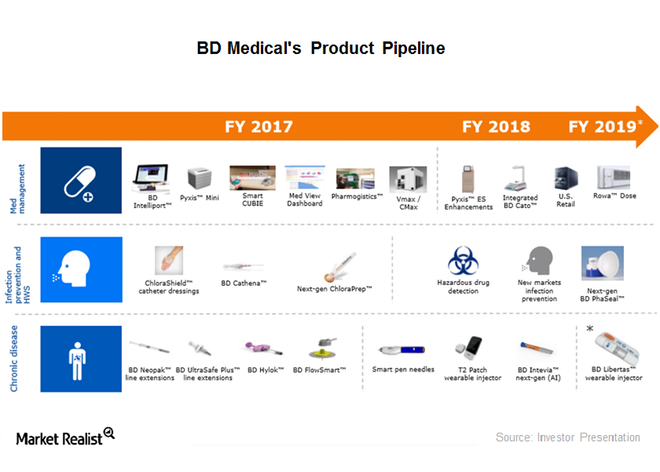

What’s Driving BD’s Operating Margin Expansion

Overview BD (BDX) has registered strong operating margin expansion in recent years. Its margin improved by 100 basis points in fiscal 2015 and 200 basis points in fiscal 2016. In fiscal 2017, BD’s margin expanded by ~180 basis points. In 4Q17, BD’s operating margin grew ~14.6% YoY (year-over-year), limited by 700 basis points due to the divestiture of BD’s […]

Inside Abbott’s Neuromodulation Business Growth

Abbott’s Medical Devices segment has products for rhythm management, heart failure, electrophysiology, structural heart diseases, neuromodulation, and more.

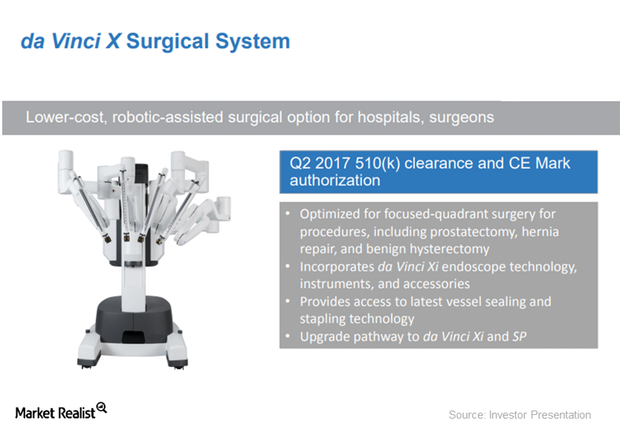

How Intuitive Surgical Is Expanding Its Da Vinci X Systems Worldwide

Intuitive Surgical’s (ISRG) Da Vinci X received early FDA approval in May 2017 and was given a CE Mark in Europe in April 2017.

J&J Completed the Divestiture of Its Neurosurgery Business

Johnson & Johnson’s (JNJ) medical device business has been restructuring in order to focus on higher growth areas with potential expansion opportunities.

What’s BD’s Latest News in the Diabetes Management Market?

On September 19, 2017, Becton, Dickinson, and Company (BDX), or BD, introduced a new pen needle for its pen injection devices.

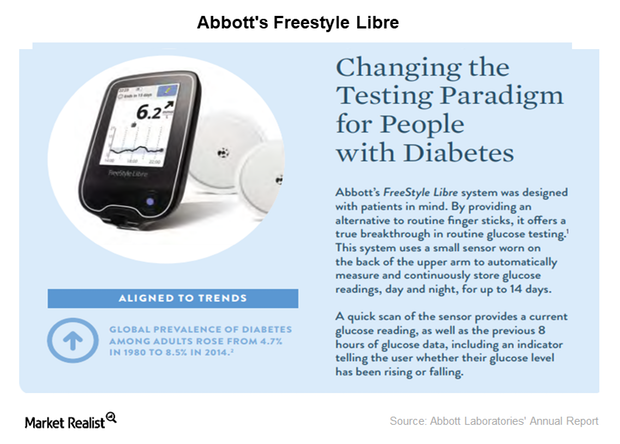

Abbott’s Breakthrough CGM Device Freestyle Libre Wins FDA Approval

On September 27, Abbott Laboratories (ABT) announced the FDA approval of its Flash CGM (continuous glucose monitoring) device, Freestyle Libre.

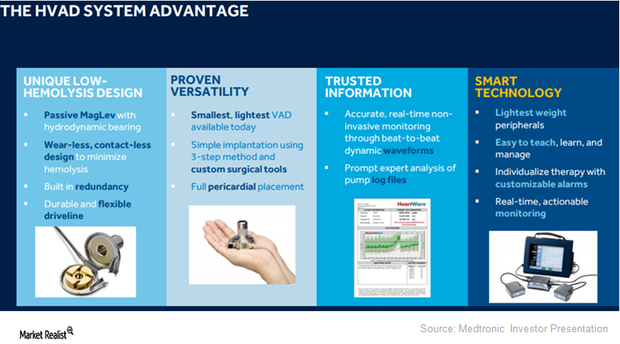

HVAD Expected to Expand Medtronic’s Presence in LVAD Segment

On September 27, 2017, the FDA approved Medtronic’s HVAD (HeartWare ventricular assist device) system as a destination therapy for advanced heart failure patients.

Atrial Fibrillation Ablation Could Be a Short-Term Growth Driver for MDT

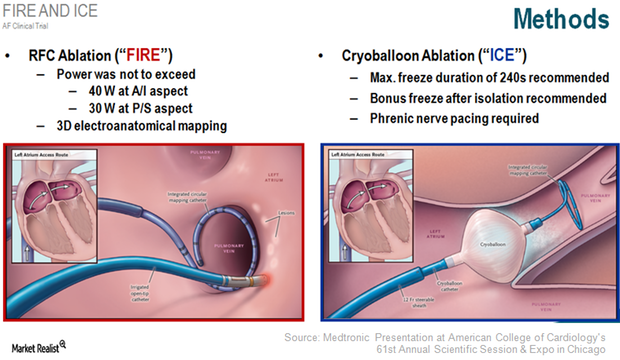

More than 33 million patients suffer from AF, the most common form of heart arrhythmia. About 30% of these patients respond to antiarrhythmic drugs (or AAD).

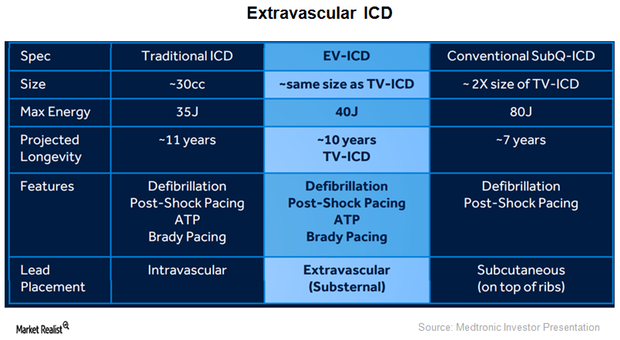

Medtronic Expands Capabilities of Implantable Cardioverter Defibrillators

On May 2, 2016, the FDA approved Medtronic’s (MDT) Visia AF and Visia AF MRI Surescan. These devices are single-chamber implantable cardioverter defibrillators (or ICDs) capable of detecting asymptomatic and undiagnosed atrial fibrillation.

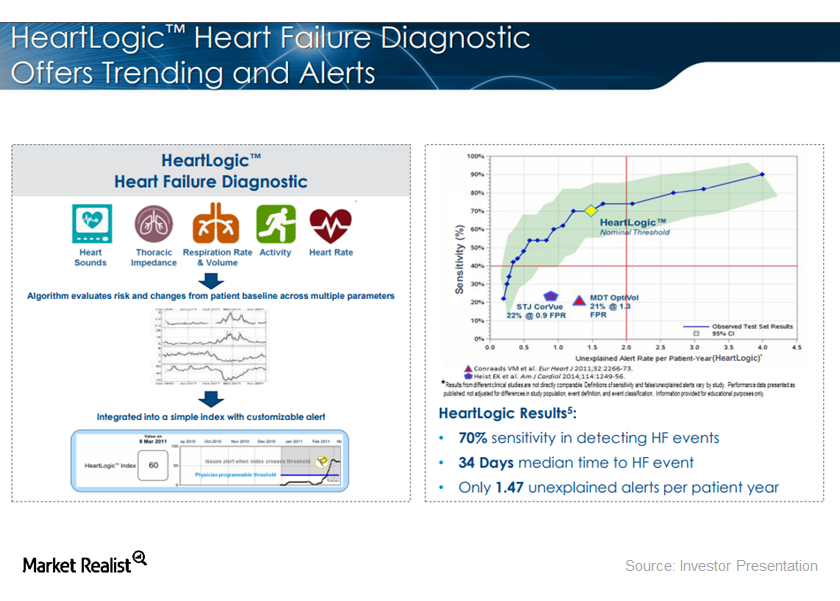

New Data Confirms the Efficiency of BSX’s HeartLogic Diagnostic

On September 19, 2017, Boston Scientific announced new data from its MultiSENSE (Multisensor Chronic Evaluation in Ambulatory Heart Failure Patients) study.

Medtronic Saw Several Challenges during Launch of MiniMed 670G

In fiscal 2H17, Medtronic launched the priority access program to first target those patients who were interested in purchasing MiniMed 670G.

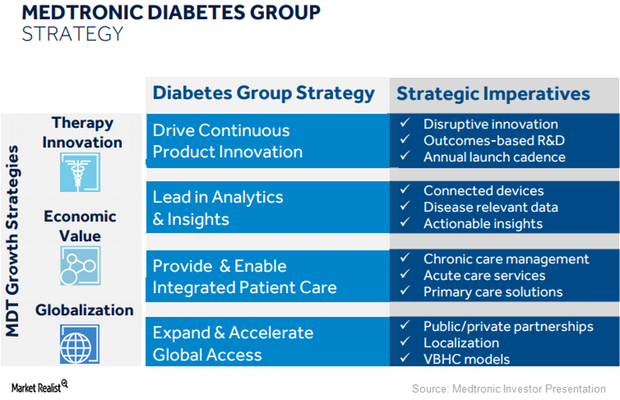

What’s Medtronic’s Long-Term Growth Strategy for Its Diabetes Business?

Medtronic (MDT) expects its diabetes business to witness a temporary sequential drop in revenues in 2Q18 and then return back to growth in the second half of fiscal 2018.

Management Changes at Baxter International: What You Should Know

Baxter International (BAX) has been going through a cost transformation and reorganization process for some time. The initiative includes some leadership and management changes.

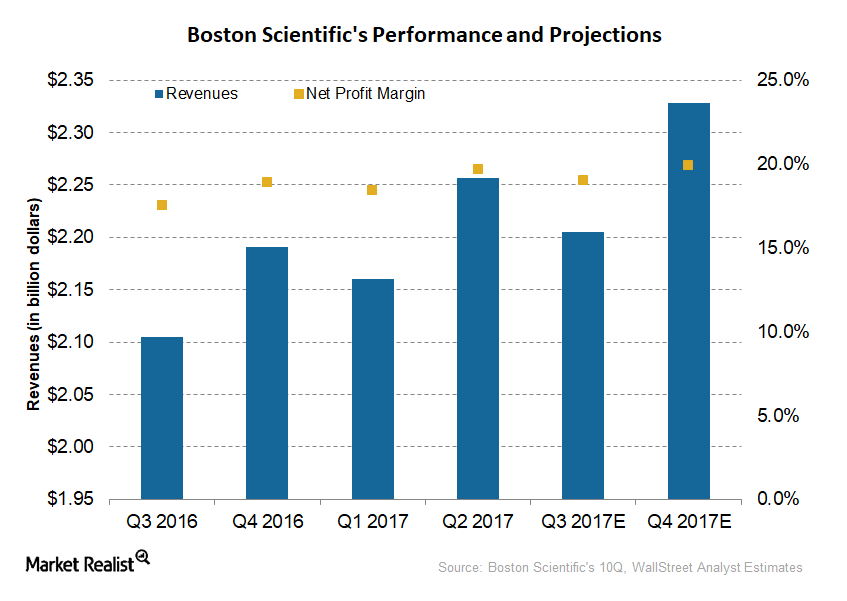

Boston Scientific’s Updated 2017 Guidance

Boston Scientific (BSX) expects to register 2017 revenues of $8.9 billion–$9.0 billion compared to its previous guidance of $8.8 billion–$8.9 billion.

Medtronic’s Robust Product Pipeline

On May 1, 2017, Medtronic announced the FDA approval of its Resolute Onyx DES (drug eluting stent) for adult patients suffering from coronary artery disease.

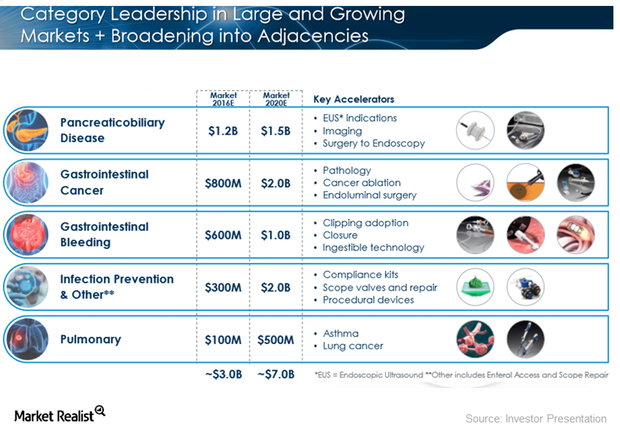

Boston Scientific Is Accelerating Category Leadership Strategy

Boston Scientific (BSX) currently has a global market opportunity of $40.0 billion, which is expected to grow to $50.0 billion by fiscal 2020.