Medtronic Plc

Latest Medtronic Plc News and Updates

Overview of Boston Scientific, a Leading Medical Device Company

Starting in 2011, Boston Scientific (BSX) has undertaken cost-cutting programs and reorganization efforts to turn the company’s battered financials around. In 2014, BSX started registering positive growth and profitability.

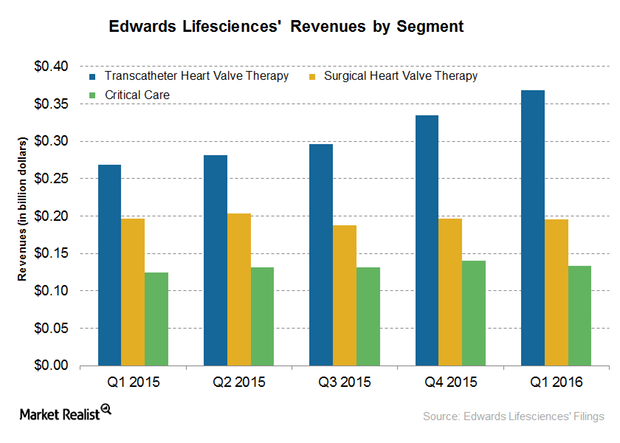

How Did Edwards Lifesciences’ Critical Care Segment Fare in 1Q16?

Edwards Lifesciences (EW) reported ~$697 million in total revenue in 1Q16. Of that, ~$134 million was contributed by the company’s Critical Care segment.

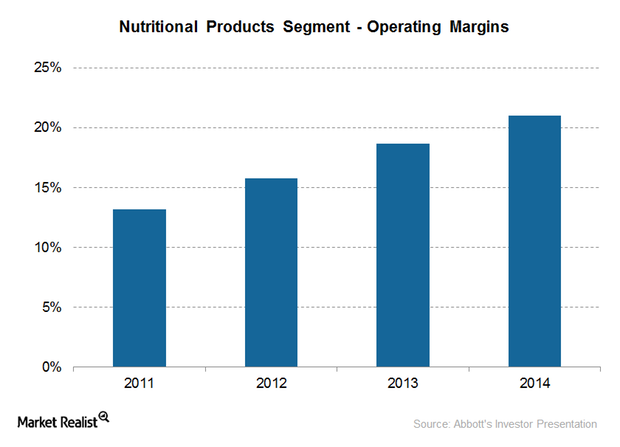

Why Abbott Laboratories Is a Leader in Nutritional Products

Abbott Laboratories’ Nutritional Products segment is the company’s leading segment, growing at a fast pace, with rapidly increasing margins and revenues.

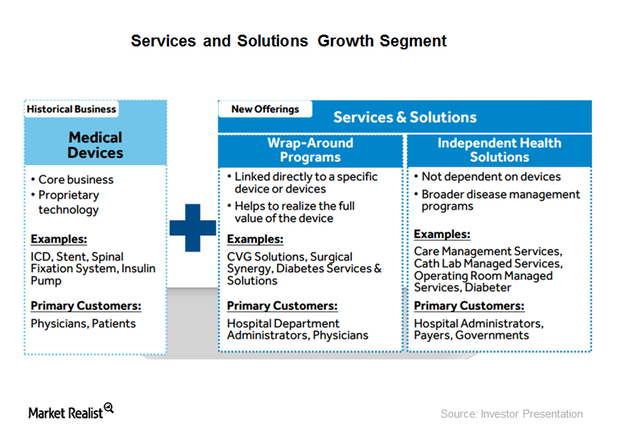

Why Medtronic Is Diversifying beyond Medical Devices

Medtronic established a services and solutions growth vector as one of its core strategies. It contributed ~20 basis points to Medtronic’s growth in 3Q16.

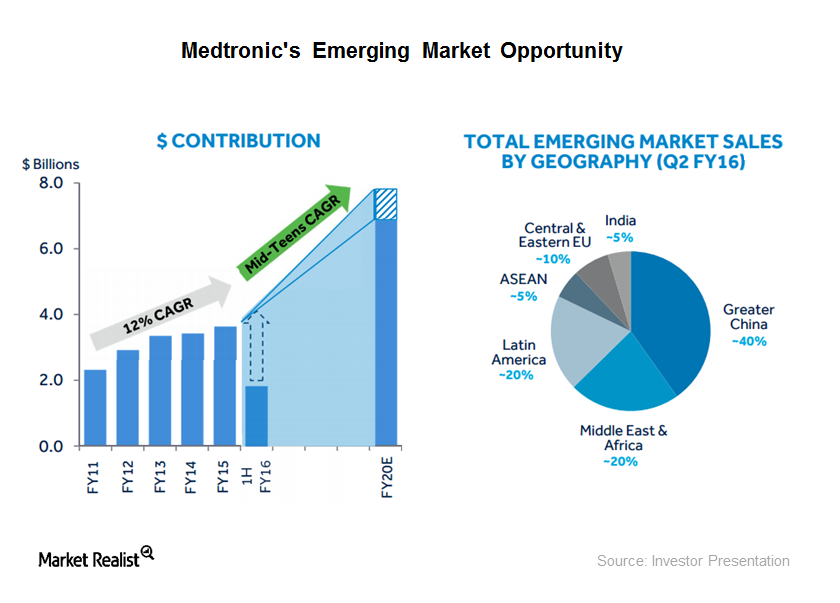

How Is Medtronic’s Globalization Strategy Driving Its Growth?

Medtronic’s (MDT) growth is driven by three of the company’s core strategies—therapy innovation, globalization, and economic value.

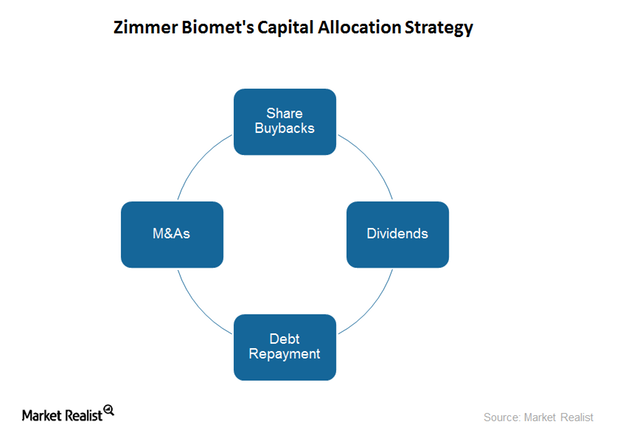

Zimmer Biomet’s Capital Allocation Strategy and Shareholder Value

Zimmer Biomet has spent $125 million in share repurchases so far in 2016. In February, it authorized up to $1 billion of the company’s common stock for share repurchases.

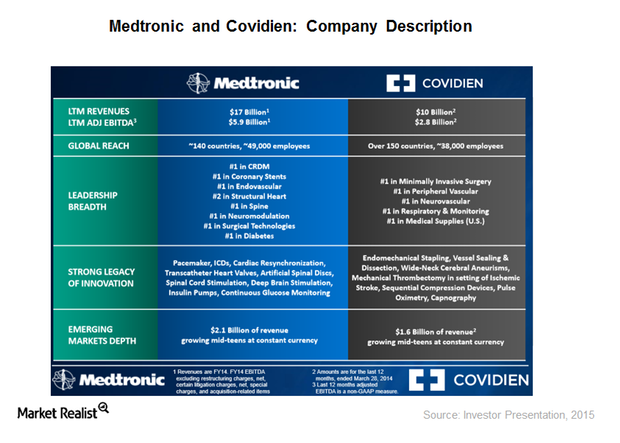

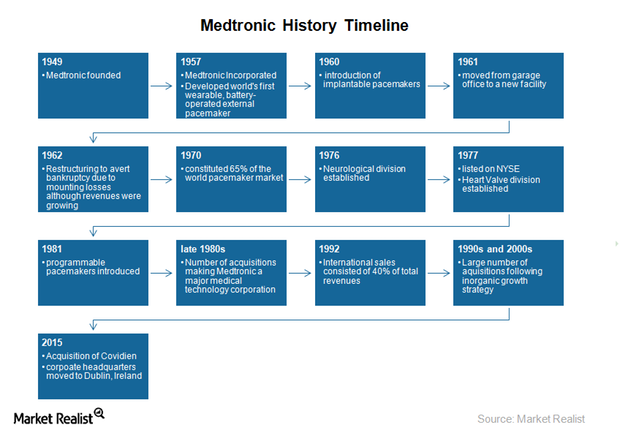

Sizing up Medtronic-Covidien, the Biggest Deal in the Medical Device Industry

On January 26, Medtronic completed the acquisition of Covidien for $42.9 billion in cash and Medtronic stocks and assumed Covidien’s debt of ~$5 billion.

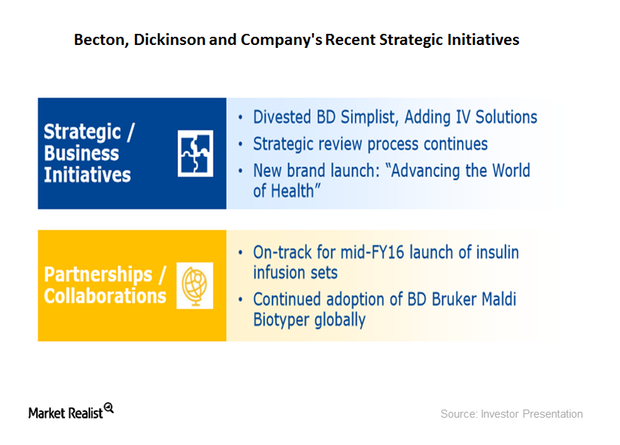

Behind Becton Dickinson’s Strategic Restructuring and Business Consolidation

To better position itself amid the changing medical device environment, Becton Dickinson has come to focus on restructuring and business model evolution.

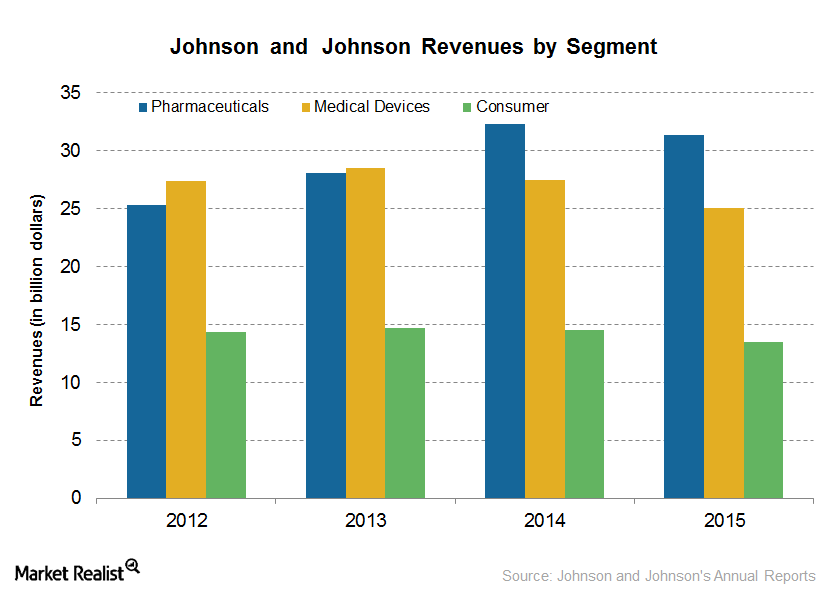

How Johnson & Johnson Hopes to Boost Its Medical Device Segment

Johnson and Johnson’s (JNJ) medical device business segment comprises of cardiovascular, diabetes care, orthopedics, surgery, and vision care divisions.

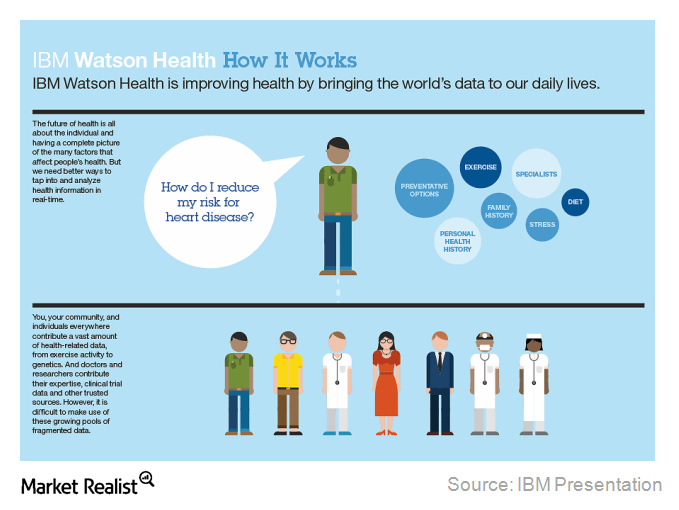

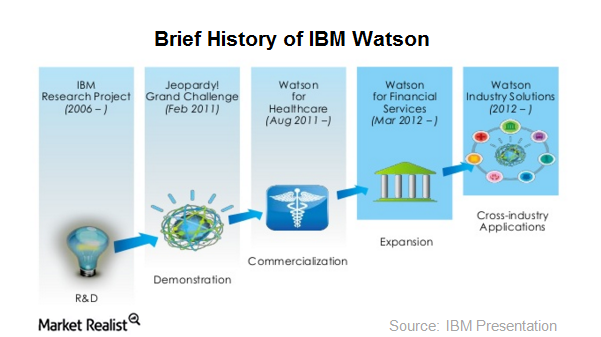

Truven: IBM’s Latest Buy, Attempt to Push Watson

On February 18, 2016, IBM announced the acquisition of Truven Health Analytics for $2.6 billion. Truven provides cloud-based healthcare data and analytics.

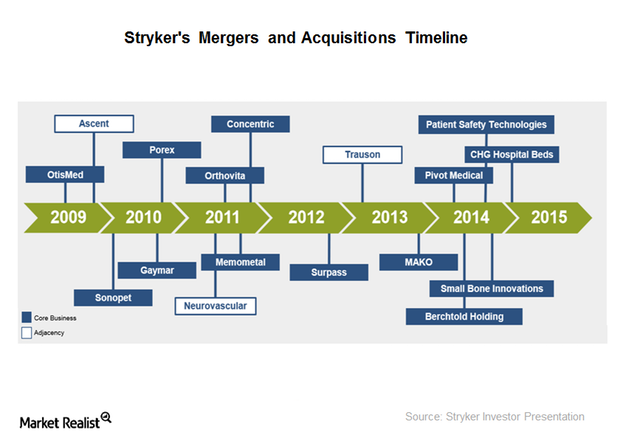

Growth and Profitability: How Does Stryker Do It?

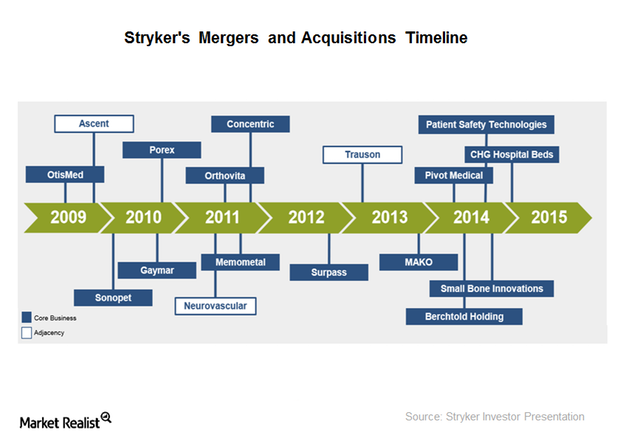

Between 2012 and 2014, Stryker (SYK) entered into a number of mergers and acquisition deals, investing ~$3.4 billion.

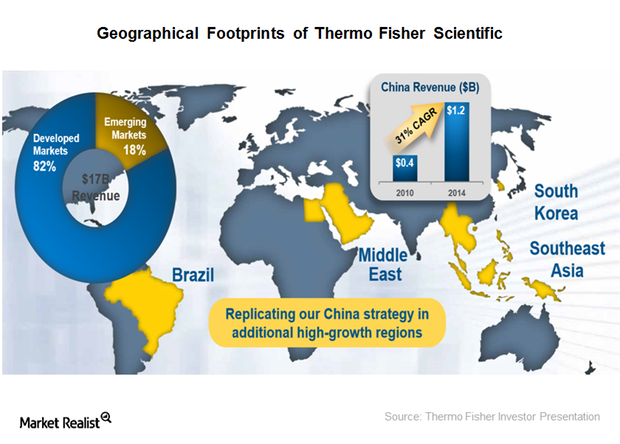

The Geographic Strategy of Thermo Fisher Scientific

Thermo Fisher Scientific is a global company, but the majority of its revenues are generated from the developed markets. The US is its largest market, generating ~48% of the company’s total revenues.

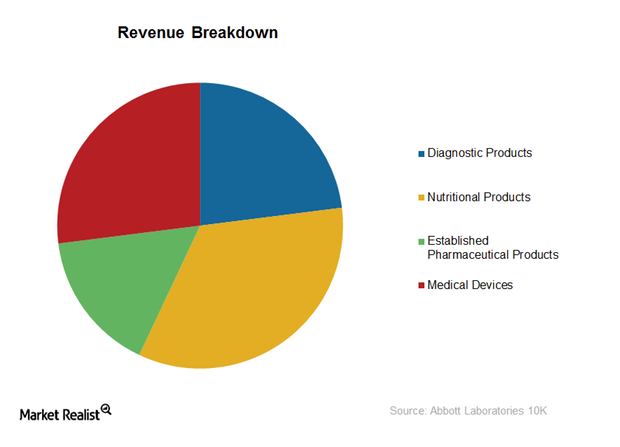

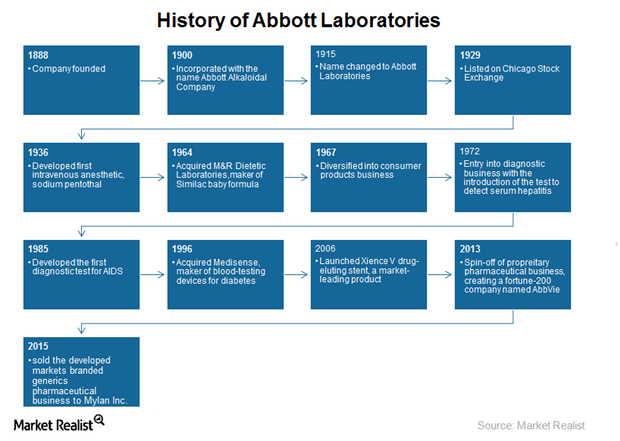

Dissecting Abbott Laboratories: A Key Business Model Analysis

Since 2013, Abbott Laboratories has generated revenues from a diversified healthcare business spanning across geographies and four primary segments.

Which IBM Partnerships and Acquisitions Have Boosted Watson?

Apart from acquisitions to further push the chances of Watson Health’s success in the healthcare space, IBM has partnered with Apple (AAPL), Johnson & Johnson (JNJ), and Medtronic (MDT).

How Inorganic Growth Strategy of Stryker Is Driving Growth

Stryker has expanded its portfolio and geographic reach through mergers and acquisitions and product development. It saw a 7.3% sales growth in 2014.

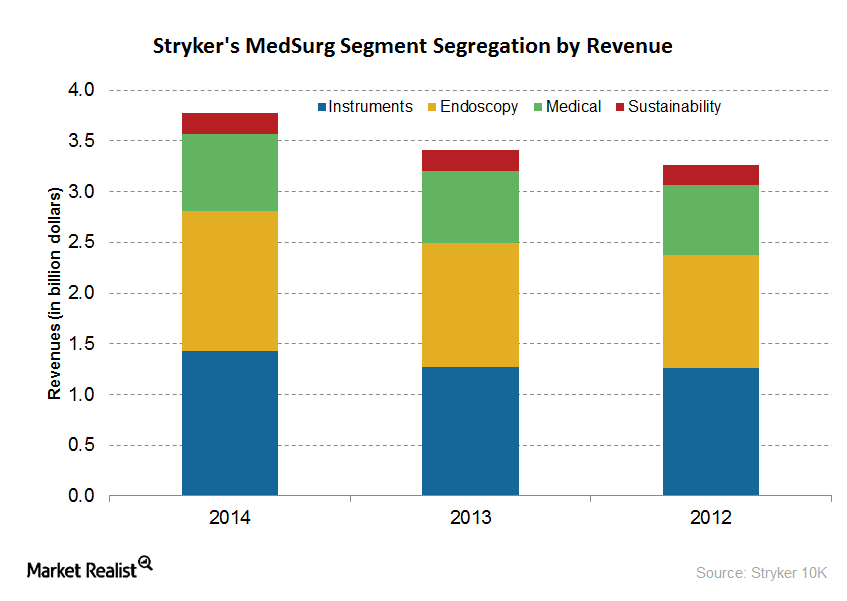

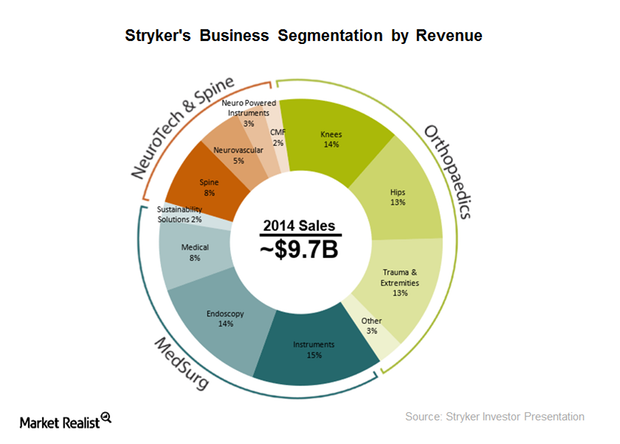

Breaking down Stryker’s MedSurg Segment

Stryker’s MedSurg segment reported an increase of 10.8% in net sales in 2014, driven by increased demand in instruments, medical products, and acquisitions.

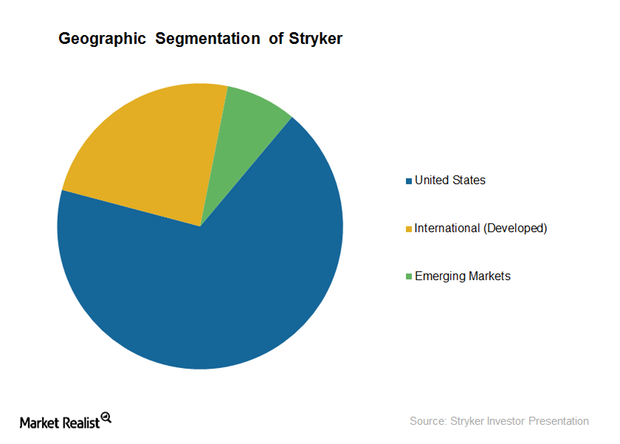

Understanding the Geographical Segmentation of Stryker

While Stryker is a global medical tech company focused on expanding its presence across international markets, the US makes up ~68% of its total revenues.

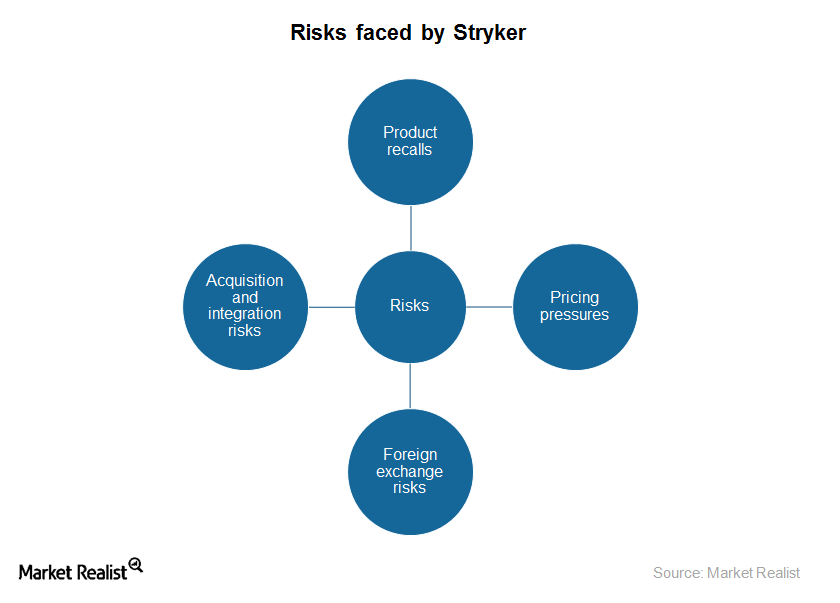

Assessing Stryker’s Major Risks at the Dawn of 2016

Stryker is a leading medical technology company and subject to big challenges impacting the medical technology industry, both systematic and unsystematic.

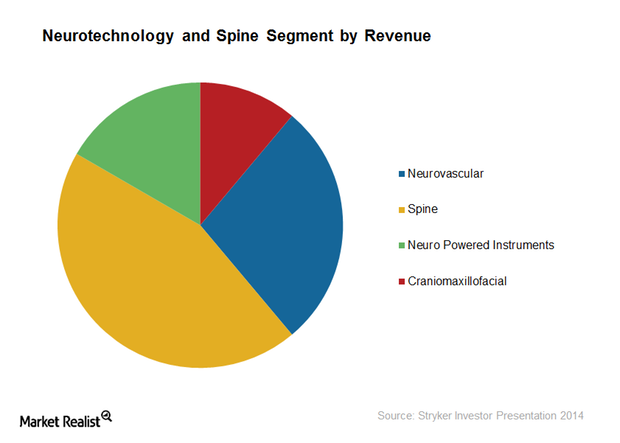

Understanding Stryker’s Neurotechnology and Spine Segment

Stryker’s Neurotechnology and Spine segment reported an increase of 5% in net sales in 2014, driven by increased demand for neurotechnology products.

Sizing up Stryker’s Business Model in 2015

Stryker offers a diversified portfolio of more than 60,000 products and services, with a focus on quality outcomes at lower costs through collaborations.

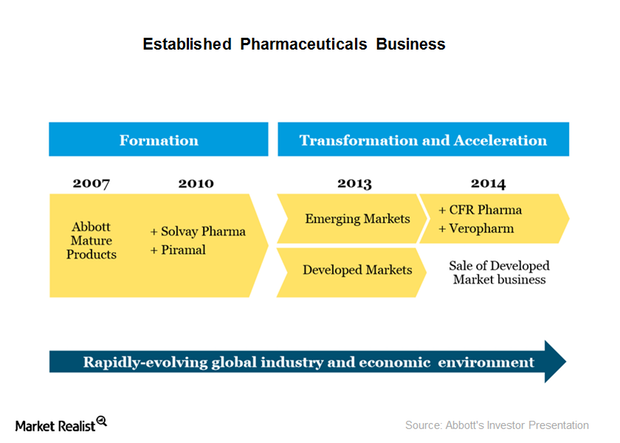

A Key Look at Abbott Laboratories’ Acquisitions and Divestments

Inorganic growth through acquisitions has led to the expansion of Abbott Laboratories across geographies and to the broadening of its product portfolio.

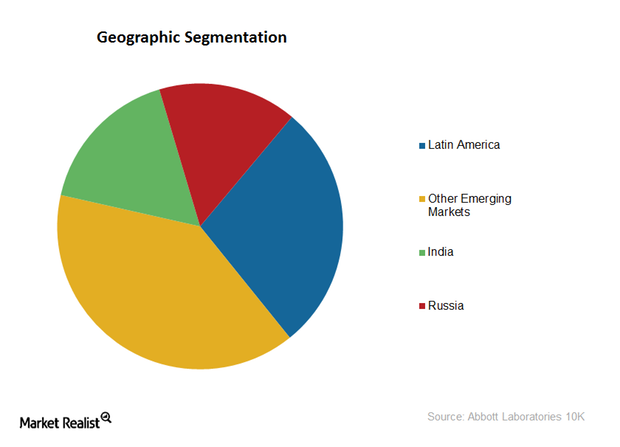

Established Pharmaceuticals Segment of Abbott Laboratories

Abbott’s Established Pharmaceuticals segment is a consumer-oriented segment with a consumer mix of around 75% self-pay consumers and 25% third-party payers.

A Look at Becton, Dickinson and Company’s Valuation

Becton, Dickinson and Company is one of the five biggest medical device companies in the United States.

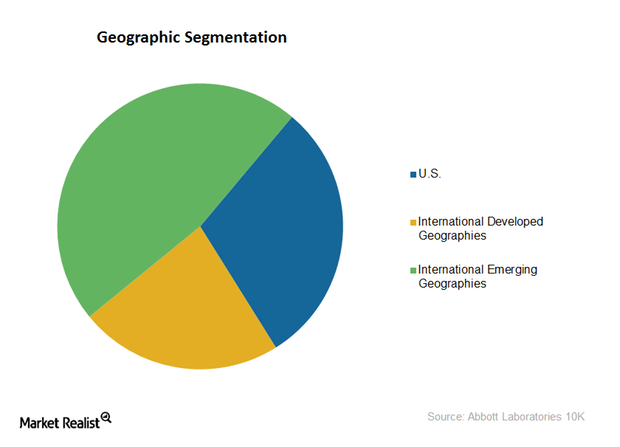

Mapping Abbott Laboratories’ Geographic Strategy

Abbott Laboratories is a global healthcare company that sees 70% of its total revenues generated in markets outside the United States.

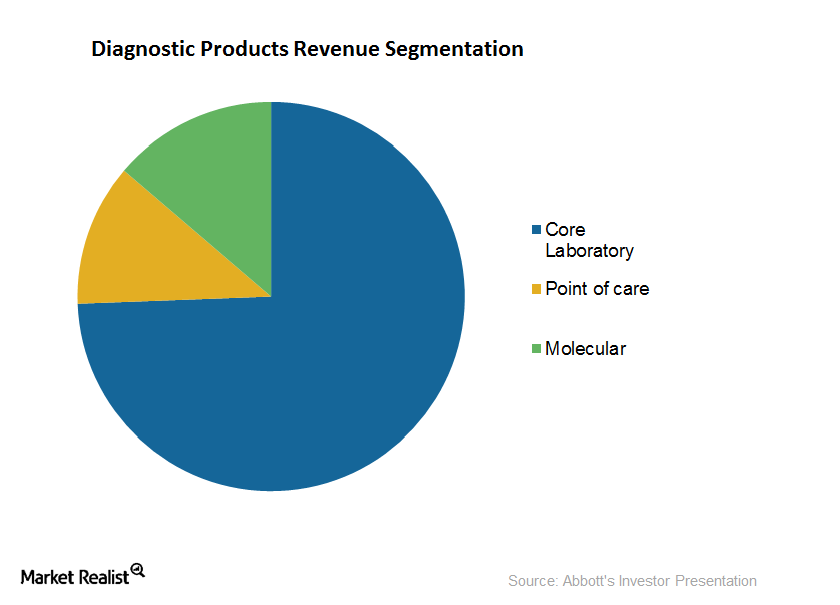

A Rundown of Abbott Laboratories’ Diagnostic Products Segment

Abbott Laboratories is one of the leading companies in the diagnostic products space in the United States, with sales of around $4.7 billion in 2014.

Introducing Abbott Laboratories, a Leading Global Healthcare Company

Abbott Laboratories operates across more than 150 countries, employs over 73,000 people, and is the global leader in the nutrition subsector.

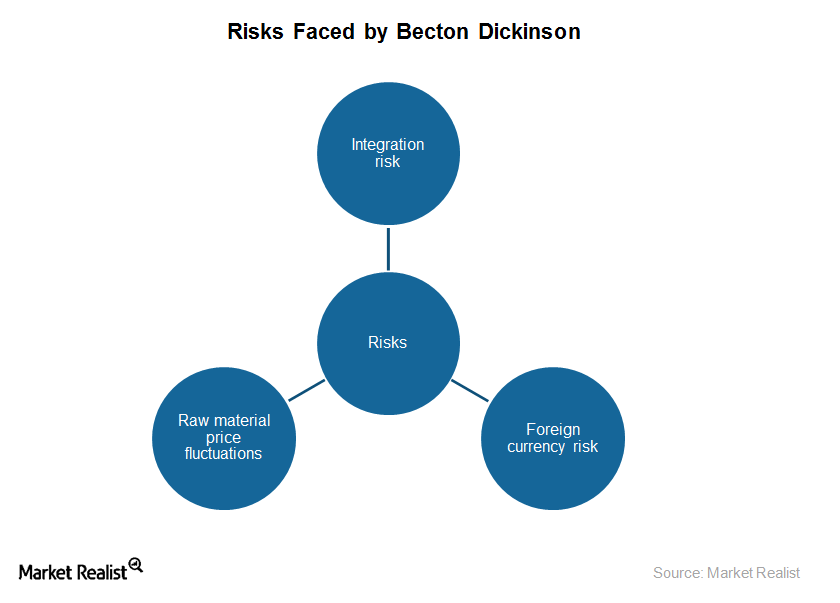

Risks Faced by Becton, Dickinson and Company

As it is susceptible to industry risks, Becton, Dickinson and Company (BDX), or BD, is transforming its business model.

Becton, Dickinson and Company’s Acquisitions and Collaborations

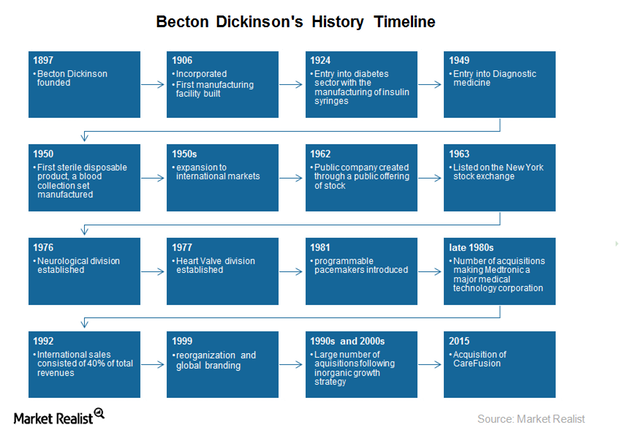

Becton, Dickinson and Company’s (BDX), or BD’s, growth strategy includes acquisitions and collaborations.

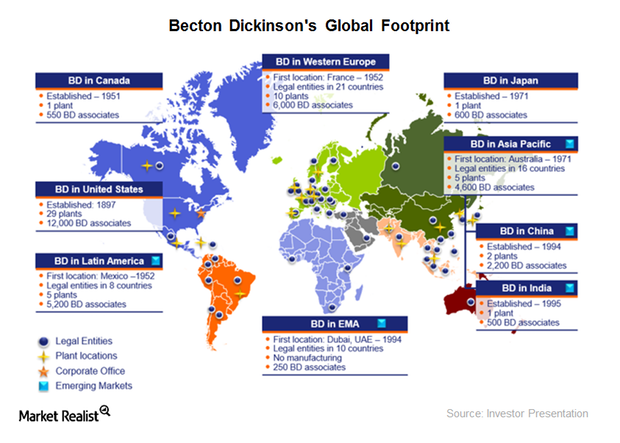

Analyzing Becton, Dickinson and Company’s Geographic Strategy

Becton, Dickinson and Company (BDX), or BD, has operations across the globe, with more than 50% of its 2015 revenues coming from international markets.

Becton, Dickinson and Company: A Leading Global Medical Device Company

Becton, Dickinson and Company, or BD, headquartered in Franklin Lakes, New Jersey, is one of the leading medical technology companies in the United States.

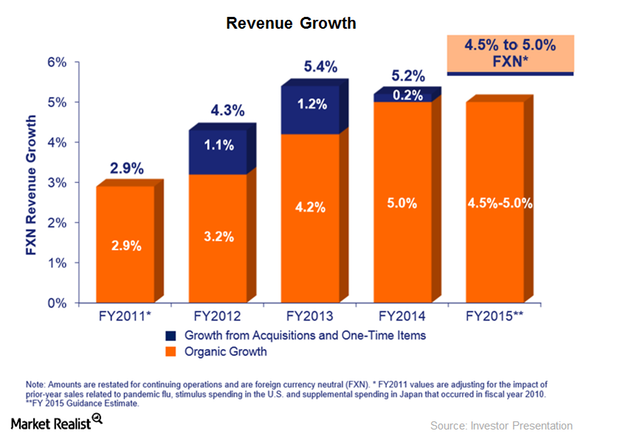

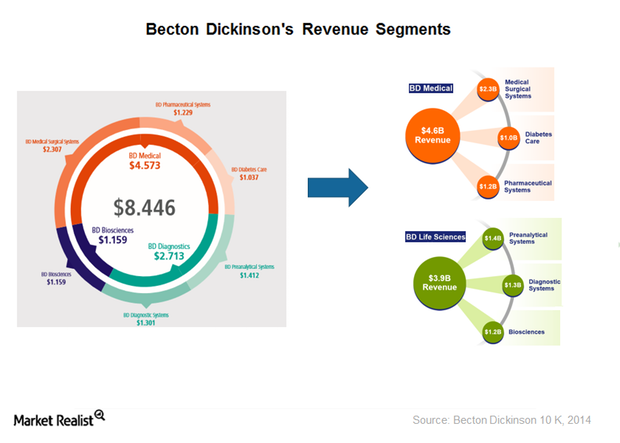

An Overview of Becton, Dickinson and Company’s Business Model

On October 1, 2015, BD underwent organizational restructuring to better align its business model to the strategic vision and goals of the company.

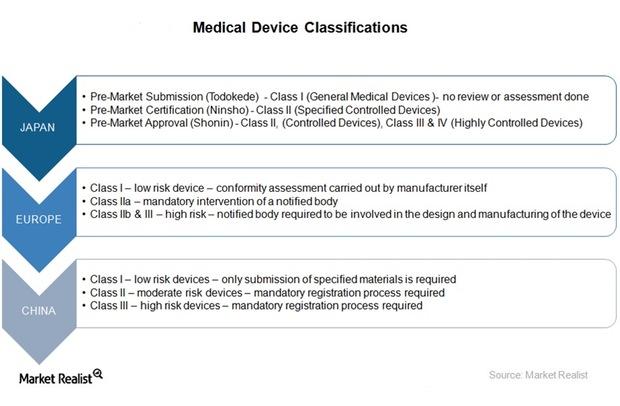

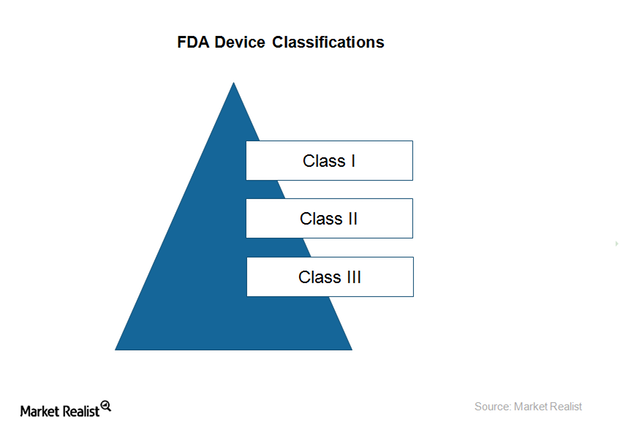

What Are the Medical Device Approval Processes in Major Markets?

In most countries, the approval process varies across different categories of devices classified as per their risk profiles.

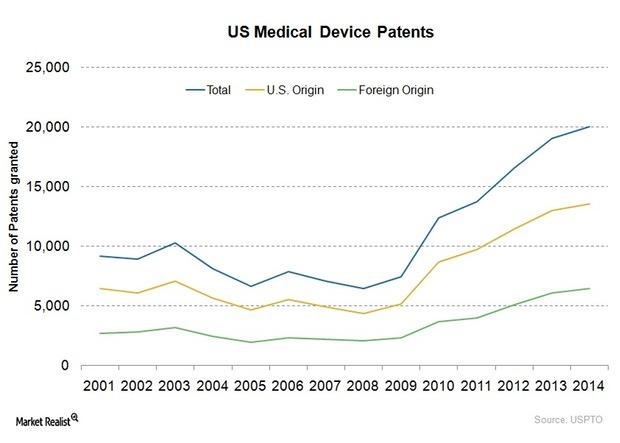

Why Are Patents Necessary for Medical Device Companies?

Medical device companies are driven by innovation and inventions that involve high research and development (or R&D) costs.

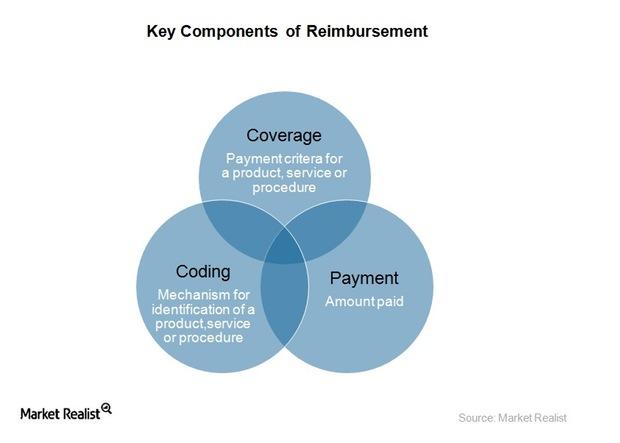

How Reimbursement Models Impact the Medical Device Industry

Coverage, coding, and payment are essential elements to obtaining adequate reimbursement for a new medical device.

How Does the FDA Classify Medical Devices?

Medical devices are classified as per the level of control required by the Food, Drug, and Cosmetic Act (or FD&C Act).

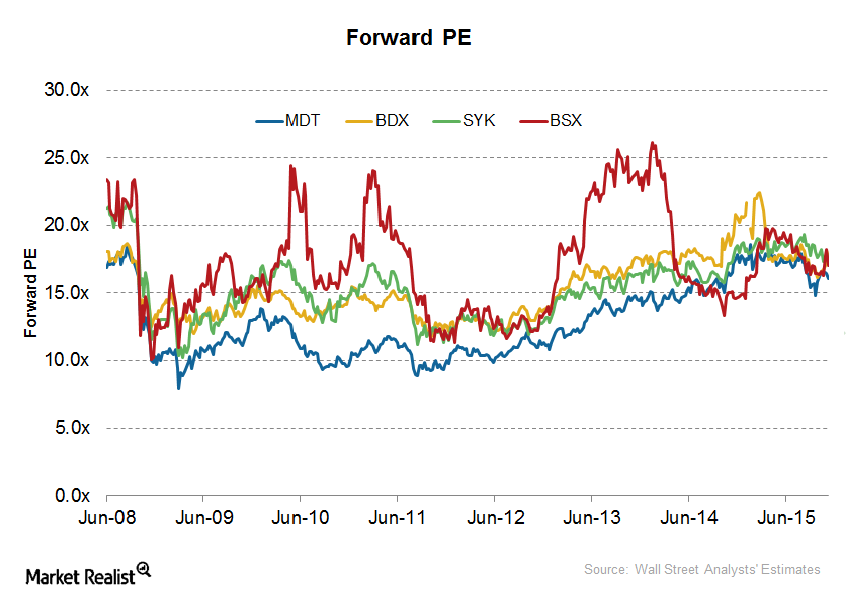

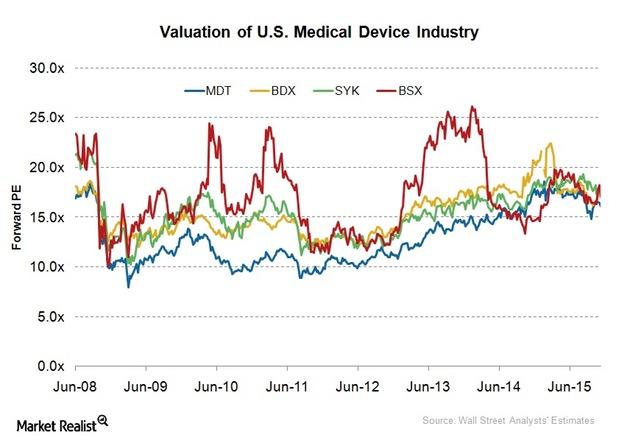

How Is the US Medical Device Industry Valued?

The US medical device industry has rebounded sharply since its 2008 decline, and it is trading at a high PE of 21.9x.

How Do Commodity Prices Impact the Medical Device Industry?

Medical device manufacturers source various medical components and parts from suppliers in order to assemble or develop medical devices.

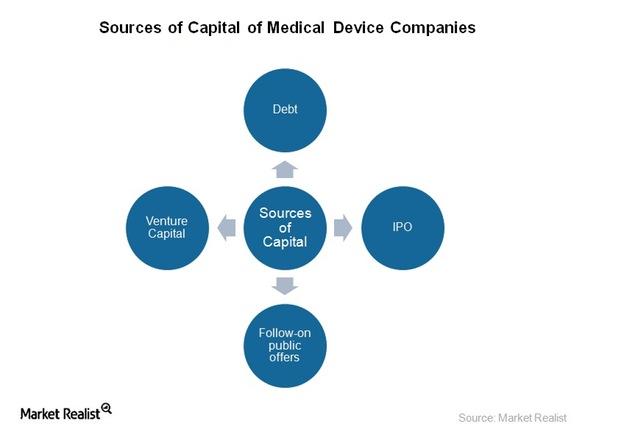

What Are the Major Sources of Capital for Medical Device Companies?

Venture capital is one of the major sources of capital for the US medical device industry.

Analyzing Cost Structure for Medical Device Companies

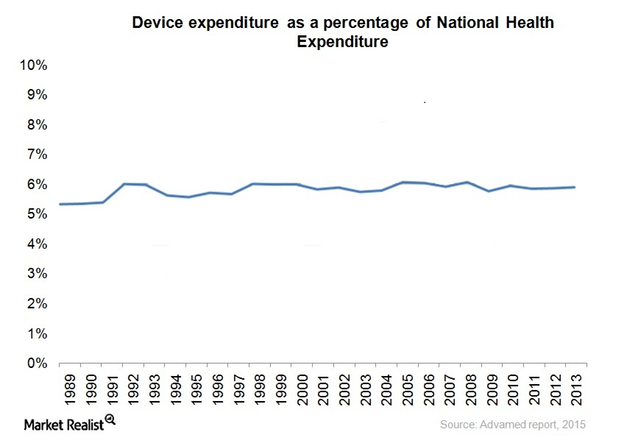

As per the US Census, spending on medical devices in the US has been constant for over a decade between 2005 to 2015.

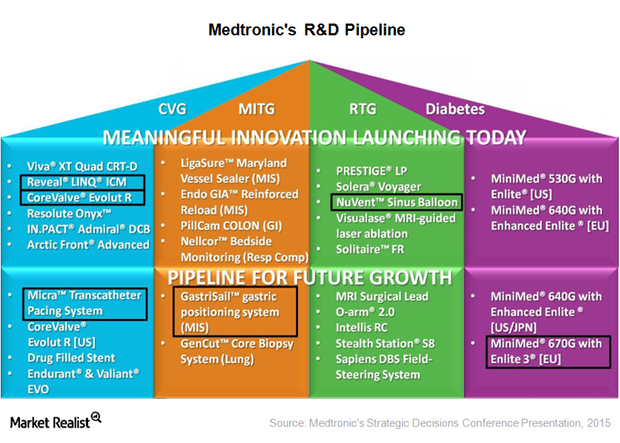

Probing Medtronic’s Research and Development Pipeline

Medtronic spent ~$1.6 billion—approximately 8.1% of its total sales—on research and development programs in fiscal 2015.

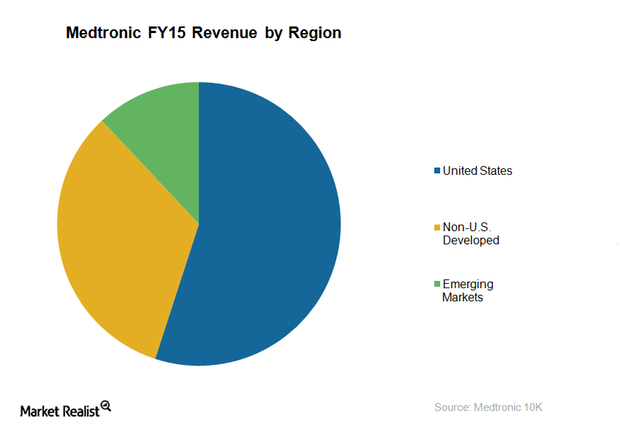

Gauging Medtronic’s Geographic Strategy in 2015

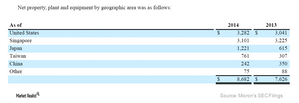

Medtronic’s US market YoY growth rate was 22% in 2015, compared to a 2% growth in 2014, whereas its emerging markets have grown by 23% in 2015.

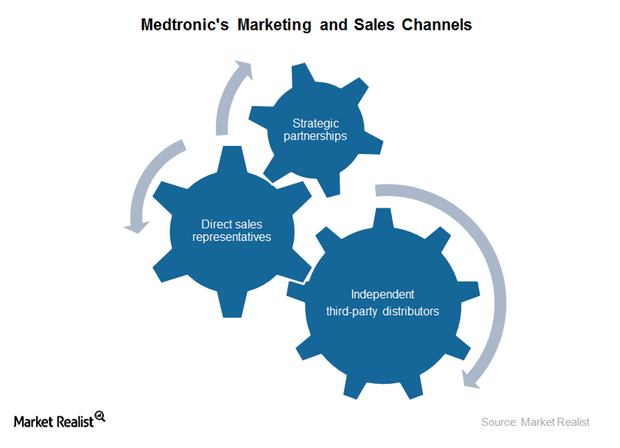

Assessing Medtronic’s Marketing and Sales Strategy in 2015

To extend cost-effective, high-quality medical devices and therapies, Medtronic aims to organize its marketing and sales teams around physician preferences.

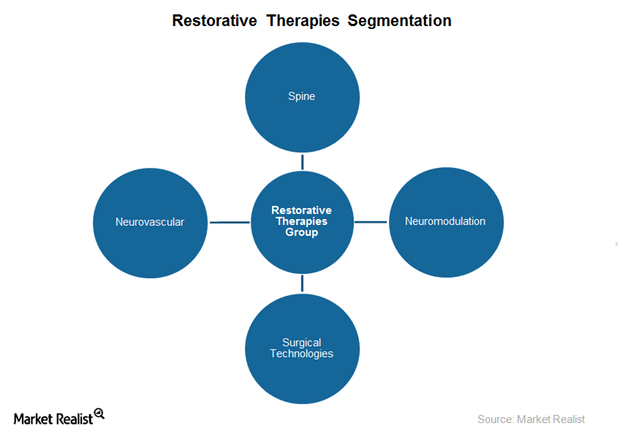

Analyzing Medtronic’s Restorative Therapies Group Segment

Medtronic’s Restorative Therapies Group’s net sales in fiscal 2015 reached ~$6.8 billion, which represents an increase of 4% over the prior fiscal year.

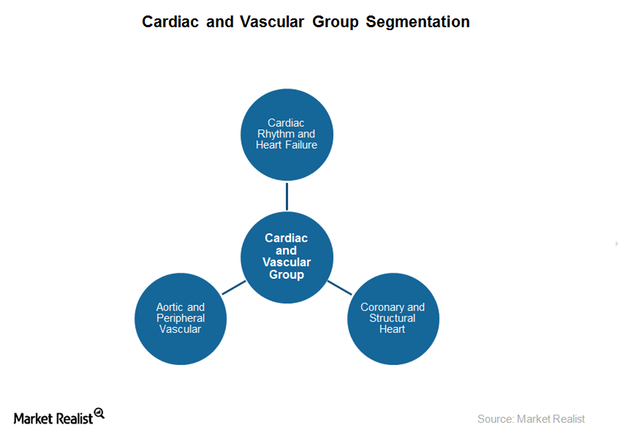

Evaluating Medtronic’s Cardiac and Vascular Devices Segment

Medtronic’s Cardiac and Vascular segment consists of Cardiac Rhythm and Heart Failure, Coronary and Structural Heart, and Aortic and Peripheral Vascular.

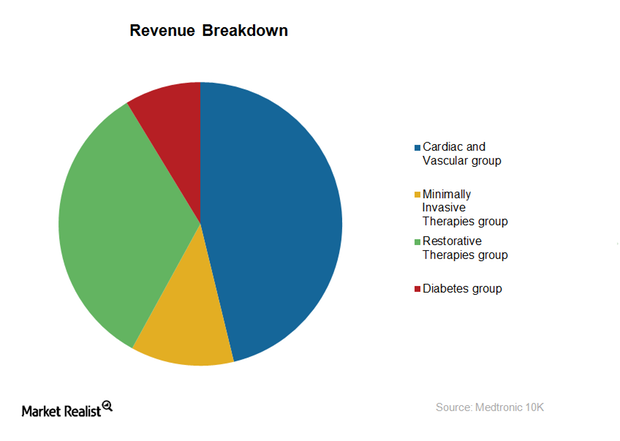

A Key Breakdown of Medtronic’s Business Model

Medtronic generates revenue through four segments: Cardiac and Vascular Group, Minimally Invasive Therapies, Restorative Therapies, and the Diabetes Group.

Introducing Medtronic, a Leading Medical Device Company

Headquartered in Minnesota, Medtronic is the world’s largest pure-play medical device company, with operations in 160 countries and over 85,000 employees.

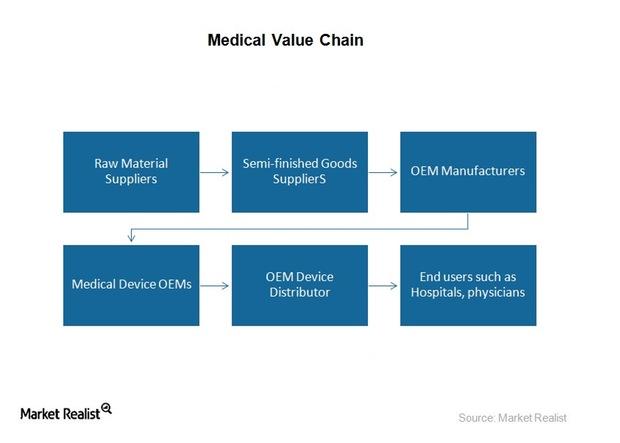

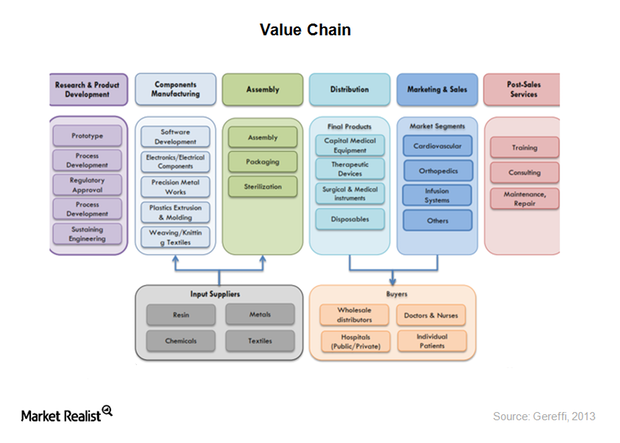

Analyzing Value Chain and Business Models in Medical Device Industry

The US medical device industry has been working on traditional business models based on R&D and innovation where physicians have been the target audience.

A Must-Read Overview of the Medical Device Industry

The US medical device market is projected to grow at a compound annual growth rate of 6.1% between 2014 and 2017.

Micron’s Manufacturing Base in the US and Overseas

Micron controls costs by developing a manufacturing base in countries where manufacturing costs are low, but it manufactures most of its chips in the US.

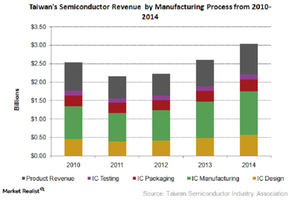

Factors Driving the Semiconductor Industry in Taiwan

Taiwan’s semiconductor revenue rose 16.7% year-over-year to $72.5 billion in 2014, driven by an increasing demand for chips used in smartphones and Internet of Things products.