Medtronic Plc

Latest Medtronic Plc News and Updates

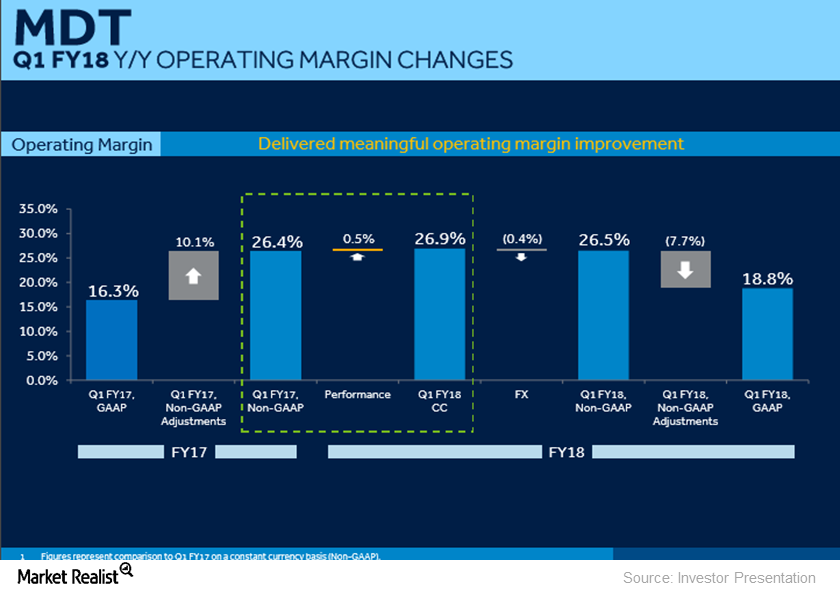

What’s behind Medtronic’s Accelerating Margin Expansion?

In fiscal 1Q18, Medtronic (MDT) reported ~26.9% of operating margin on a constant currency basis. This represented year-over-year growth of ~50 basis points.

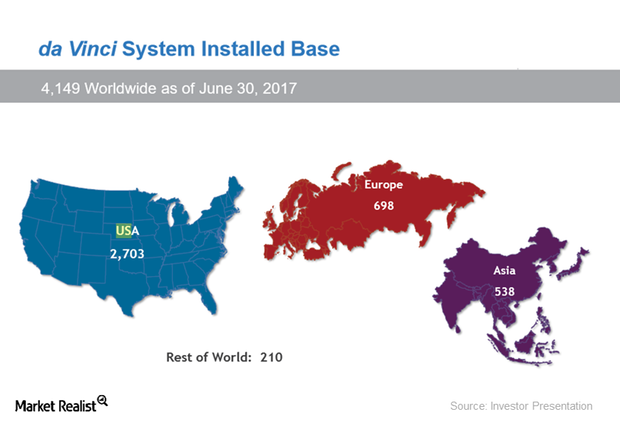

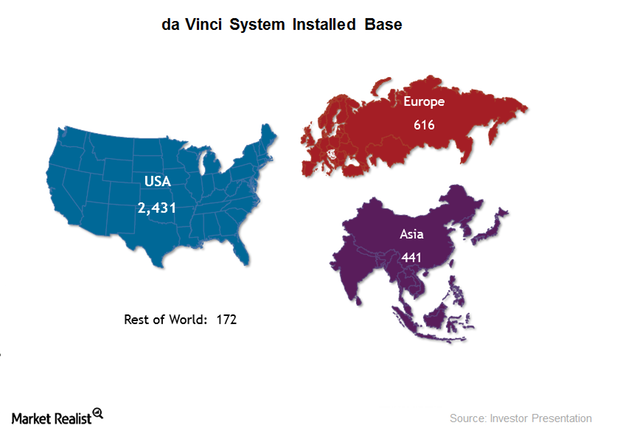

Intuitive Surgical Plans to Expand in Europe and Asia

Although Intuitive Surgical leads the surgical robotics market, there are competitive threats from other major players in the market.

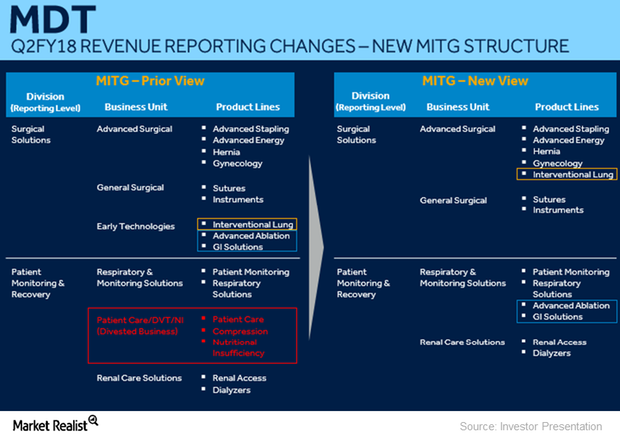

Divestiture of a Part of Medtronic’s PMR Business to Cardinal Health

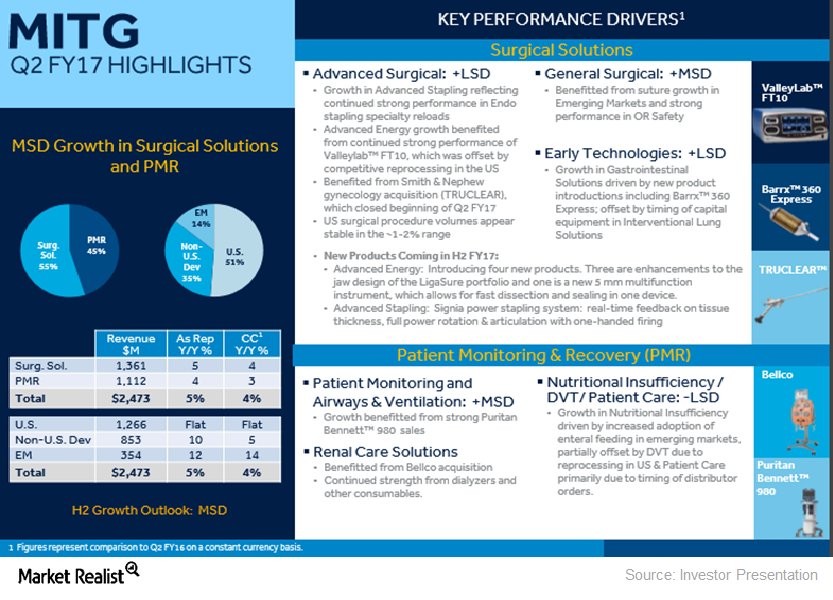

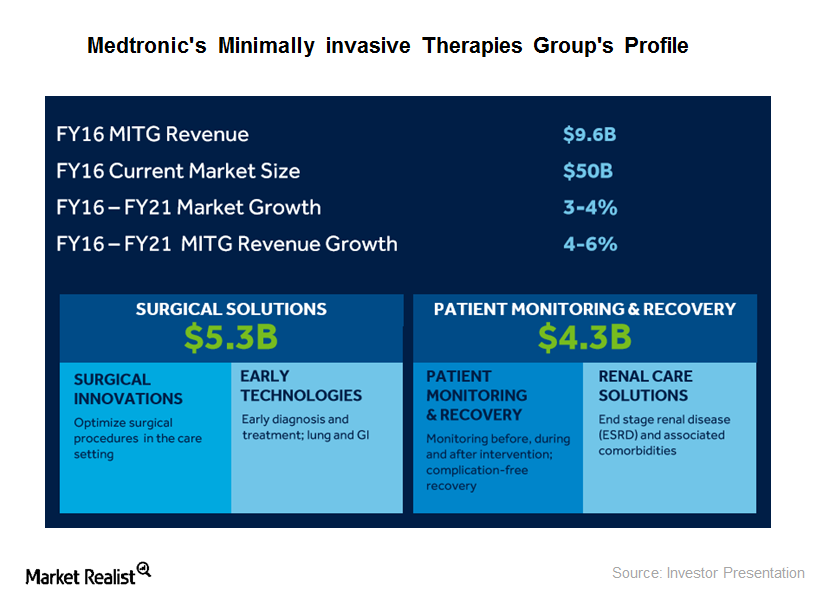

Medtronics’ MITG (Minimally Invasive Therapies Group) business is expected to grow 3.5%–4.5%.

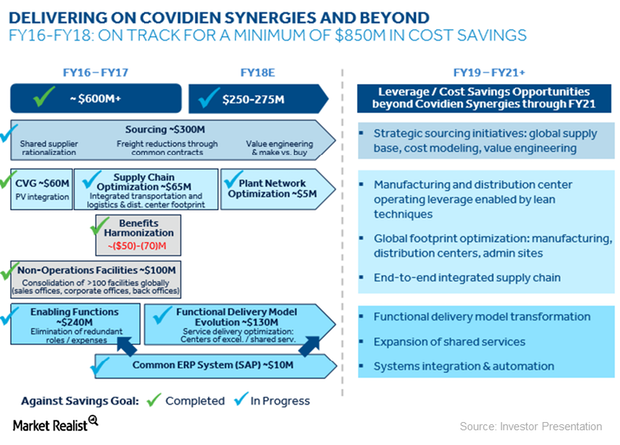

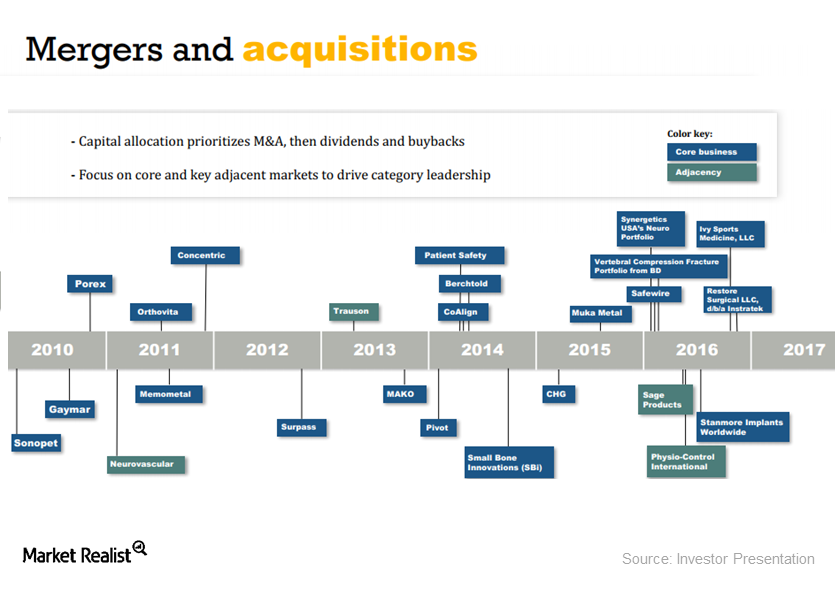

How Medtronic Is Delivering on Its Covidien Synergies

In January 2015, Medtronic (MDT) acquired Covidien for ~$43 billion in cash and MDT stock in a tax inversion deal.

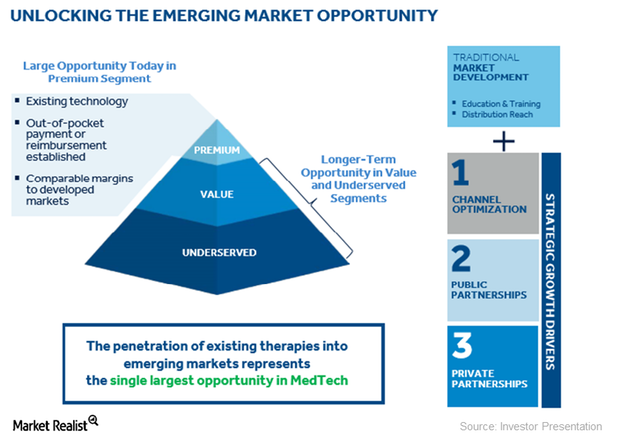

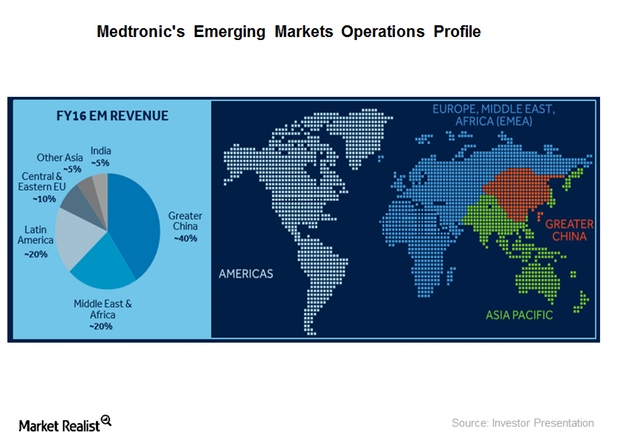

Medtronic’s Emerging Market Position and Opportunities for Fiscal 2018

Medtronic (MDT) registered revenues of ~$1.0 billion revenues from emerging markets in fiscal 1Q18, which represents YoY (year-over-year) sales growth of ~11% in that market.

Stryker Stock Falls Due to the Impact of the Sage Products Recall

On August 23, Stryker (SYK) announced a voluntary product recall of specific lots of oral care products that form part of the company’s Sage business unit.

What Zimmer Biomet’s Leadership Transition Could Mean for Its Core Growth Strategy

In July 2017, David Dvorak stepped down as chief executive officer and president of Zimmer Biomet (ZBH) and resigned from its board of directors.

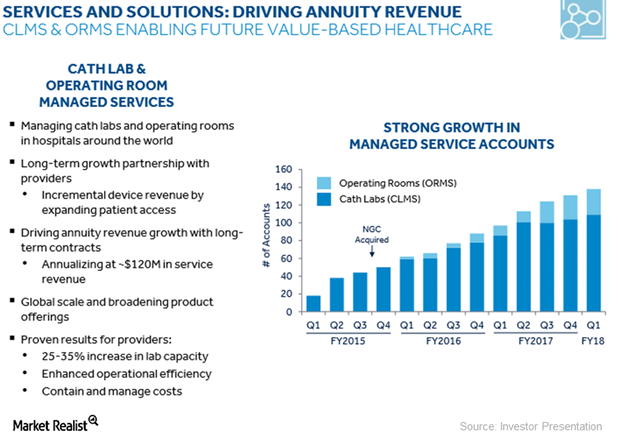

How Medtronic Is Accelerating Its Economic Value Growth Strategy

Medtronic’s (MDT) Hospital Solutions segment registered double-digit growth in fiscal 1Q18.

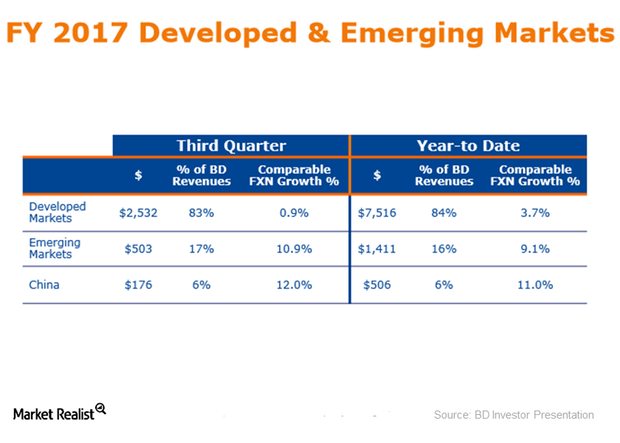

How Is Becton Dickinson Progressing with Emerging Market Growth?

Becton Dickinson’s (BDX) emerging markets registered a strong double-digit growth of 10.9% in 3Q17.

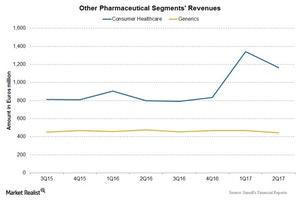

Sanofi’s General Medicines and Consumer Healthcare in 2Q17

General Medicines Sanofi’s (SNY) generic business contributed ~5.1% of its total revenue in 2Q17. The business reported revenue of 442 million euros in 2Q17, an 8% decrease from 2Q16. Revenue fell due to lower sales in US markets, European markets, and emerging markets. This fall was partially offset by the growth in the rest of […]

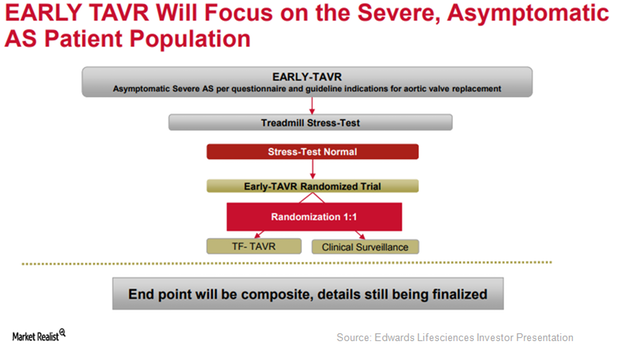

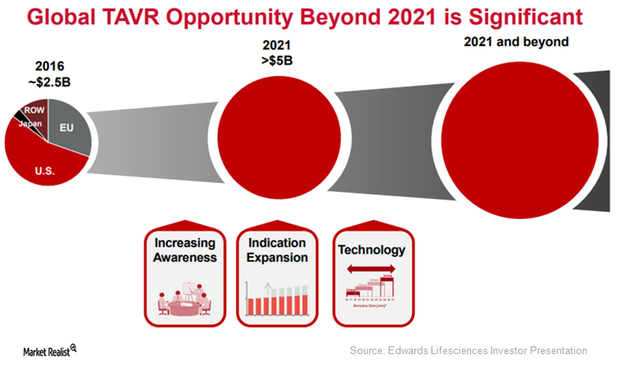

Edwards Lifesciences Focuses on Indication Expansion of SAPIEN 3 in 2017

To further expand the label of its transcatheter heart valve (or THV), SAPIEN 3, Edwards Lifesciences (EW) is currently involved in enrolling patients in its EARLY-TAVR trial.

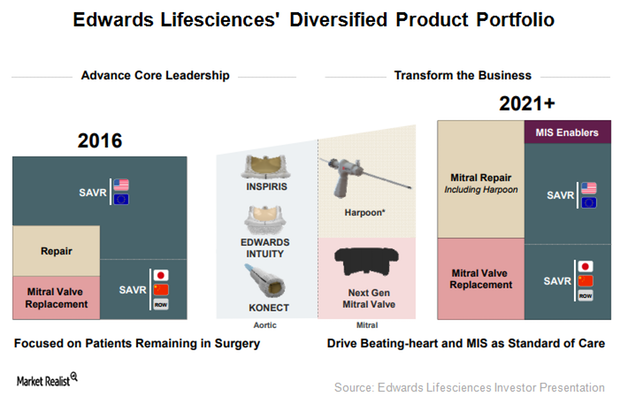

Edwards Lifesciences’ Mitral Regurgitation Segment

To diversify its focus beyond aortic structural heart conditions, Edwards Lifesciences (EW) acquired CardiAQ Valve Technologies in August 2015.

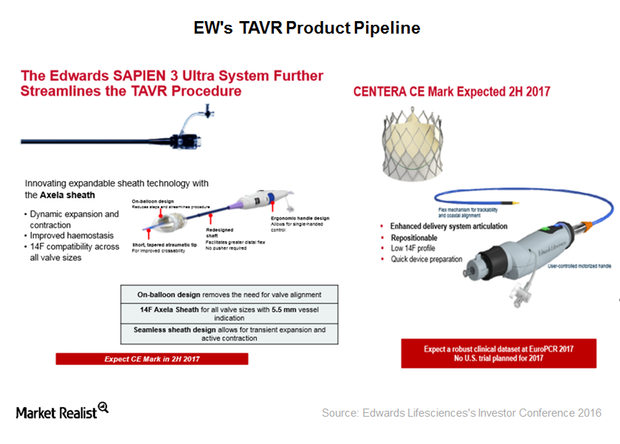

Edwards Lifesciences Focuses on Launch of SAPIEN 3 Ultra and CENTERA Valves

Edwards Lifesciences’ (EW) SAPIEN 3 Ultra system is a next-generation platform, with expandable Axela sheath technology and on-balloon delivery design.

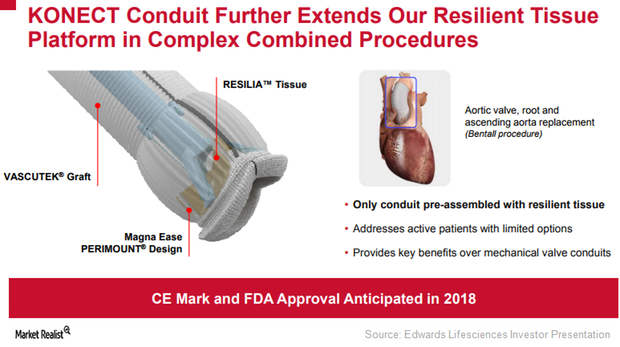

Edwards Lifesciences: Focused on Inspiris Resilia and Konect

To extend the durability of the Inspiris Resilia surgical aortic valve, Edwards Lifesciences (EW) has incorporated a new tissue platform, Resilia tissue.

Can Edwards Intuity Elite Boost Edwards Lifesciences’ Revenues?

With the Edwards Intuity Elite valve system, Edwards Lifesciences aims to offer a minimally invasive therapy to complex aortic stenosis patients.

Transcatheter Heart Valve Therapy: Growth Driver for Edwards Lifesciences

In 2Q17, Edwards Lifesciences’ (EW) Transcatheter Heart Valve Therapy segment reported revenues close to $316 million, which represents year-over-year growth of ~28%.

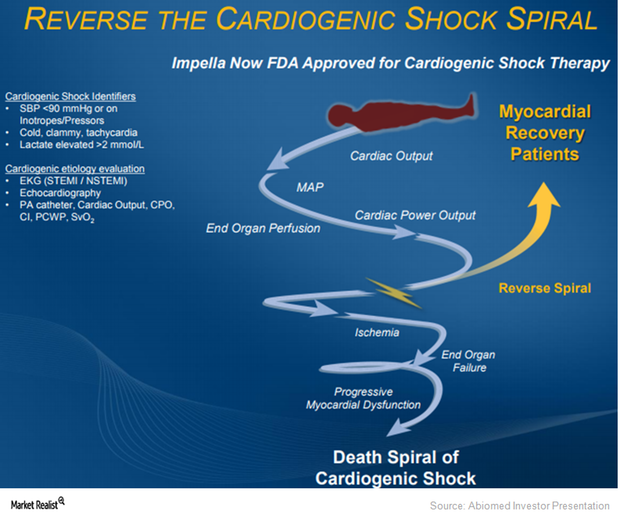

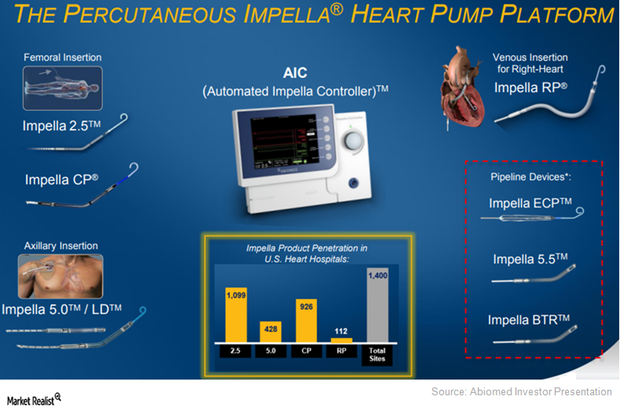

Where Abiomed Plans to Expand Impella CP’s Label

About 40% of patients succumb to heart failure within five years. Abiomed believes that it is reperfusion injuries that cause these problems.

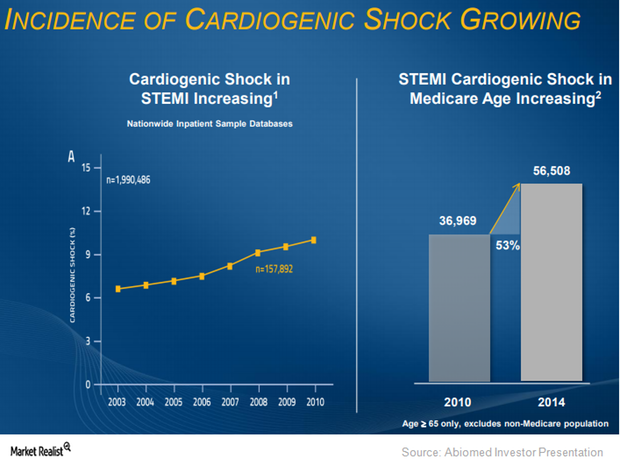

Why Abiomed Expects to Benefit from Impella in Cardiogenic Shock

On March 23, 2015, the FDA approved Abiomed’s Impella 2.5 heart pump as a temporary ventricular support device.

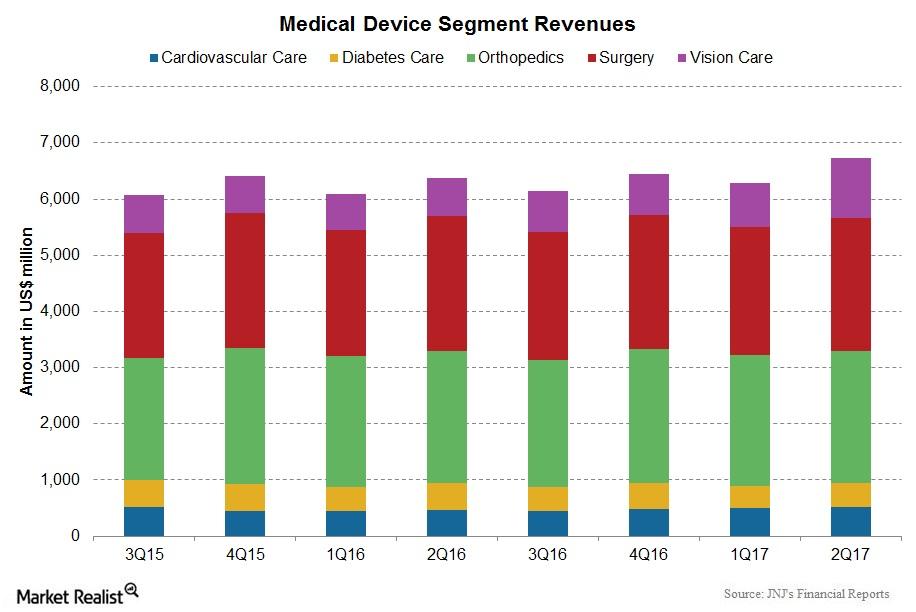

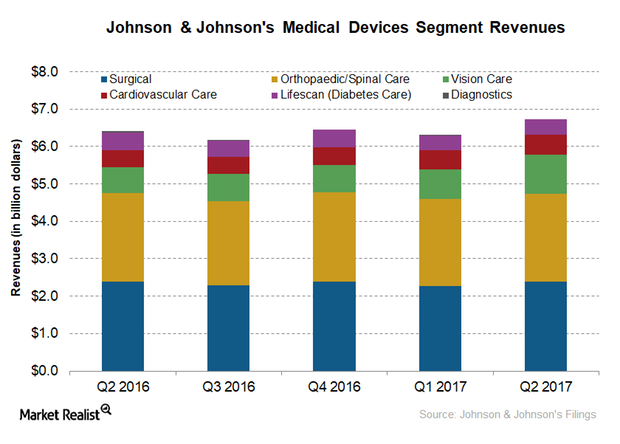

Johnson & Johnson: Medical Devices in 2Q17

Medical devices segment Johnson & Johnson’s (JNJ) medical devices segment grew ~4.9% to ~$6.7 billion for 2Q17, compared with $6.4 billion in 2Q16. This rise included an operational increase of 5.9%, and was offset by a 1% impact of foreign exchange. Cardiovascular care franchise Cardiovascular care franchise sales rose 11.3% to $523 million for 2Q17. This […]

Behind Abiomed’s Plans to Create a Greater Awareness of Impella

To target patients across communities, Abiomed (ABMD) has been developing a hub-and-spoke model with hospitals.

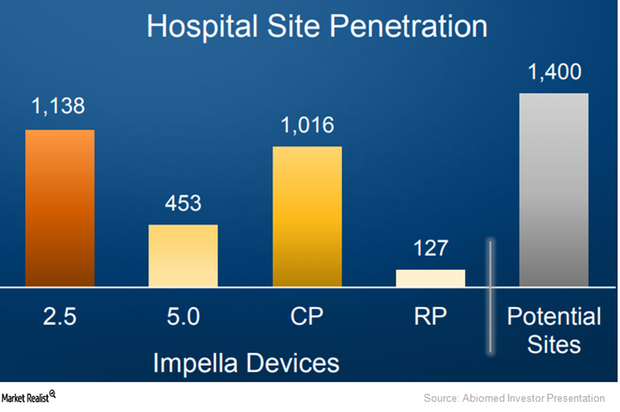

Abiomed Aims to Expand Impella RP’s Penetration Going Forward

In March 2017, Abiomed (ABMD) submitted premarket approval (or PMA) to the FDA for its Impella RP device far ahead of schedule.

Behind the Major Drivers of JNJ’s Medical Device Growth

Johnson & Johnson (JNJ) reported Medical Devices segment sales of ~$6.7 billion in 2Q17, compared with $6.4 billion in 2Q16.

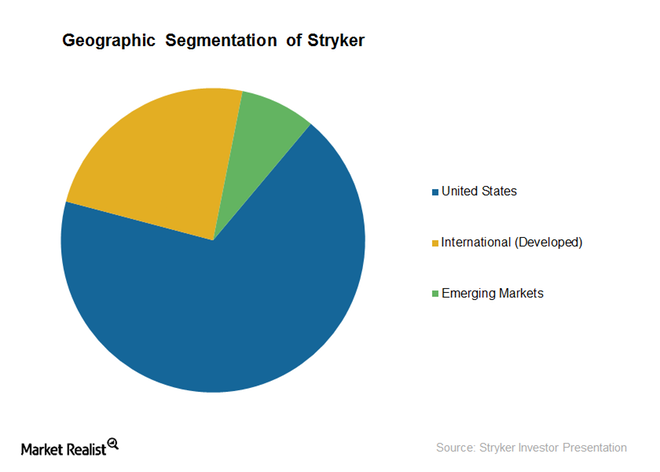

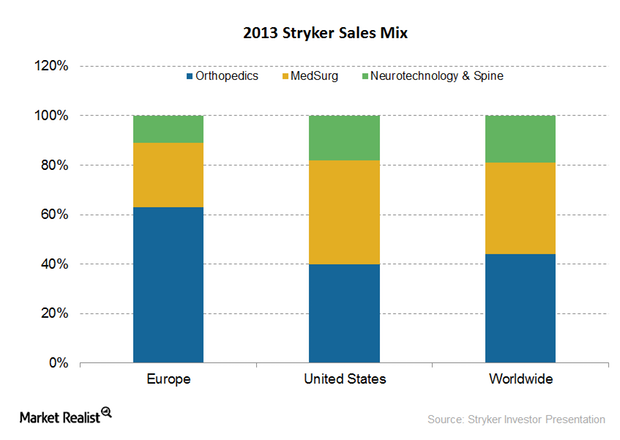

How Stryker Plans to Capture the International Markets

Most of Stryker’s emerging market sales are from China. However, Europe and emerging markets sales have witnessed high growth in recent quarters.

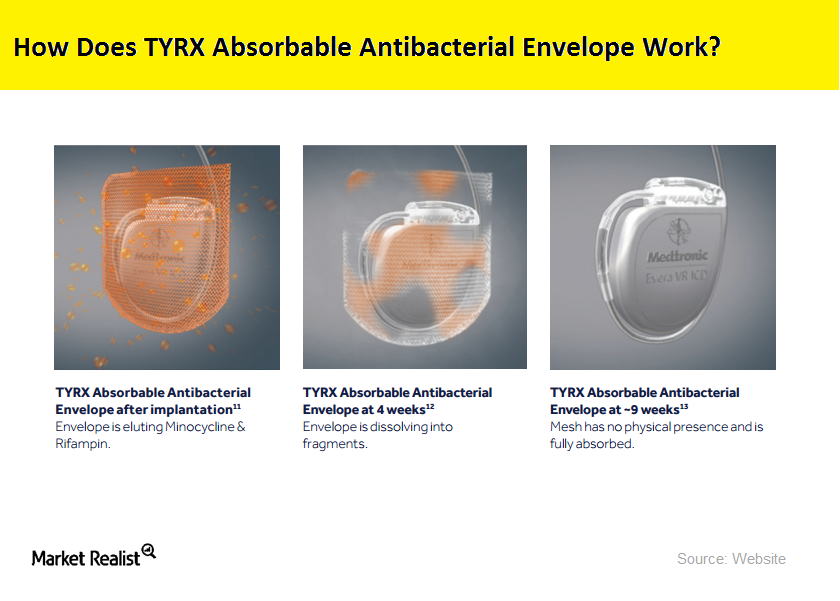

Medtronic’s Agreement Will Expand the Use of Its Tyrx Envelopes

Medtronic’s (MDT) Tyrx envelope is an antibacterial and fully-absorbable device that helps prevent surgical site infections.

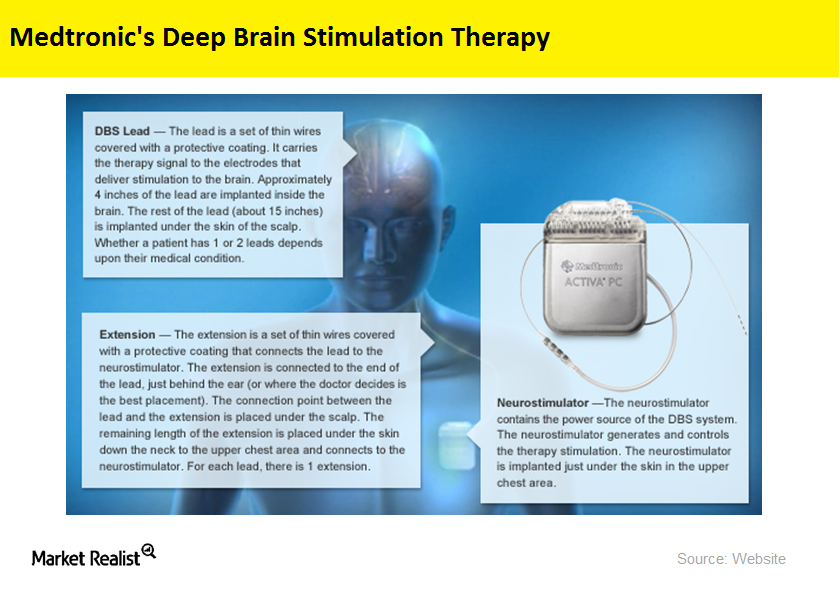

Medtronic Received Health Canada License for SureTune3

On June 6, 2017, Medtronic (MDT) received the Health Canada license for its SureTune3 software for DBS (deep brain stimulation) therapy.

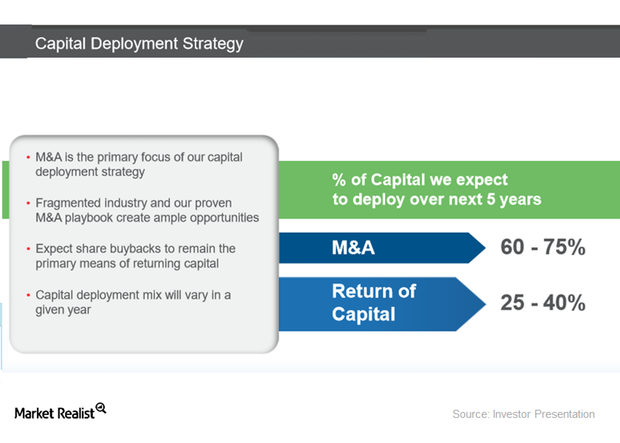

Understanding Thermo Fisher’s Capital Deployment Strategy

Thermo Fisher Scientific expects to deploy 60%–75% of its capital toward M&As (mergers and acquisitions).

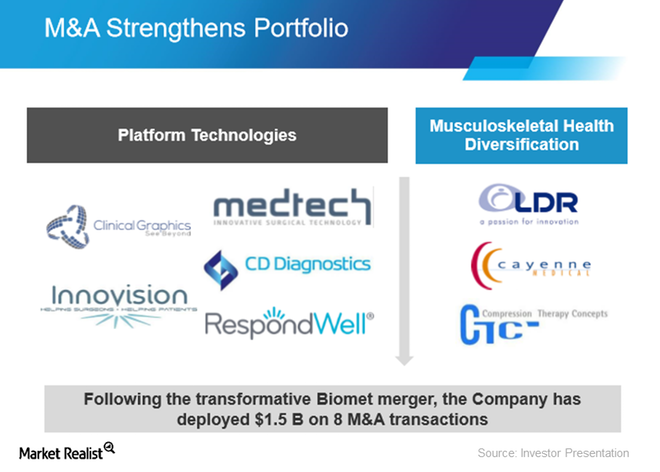

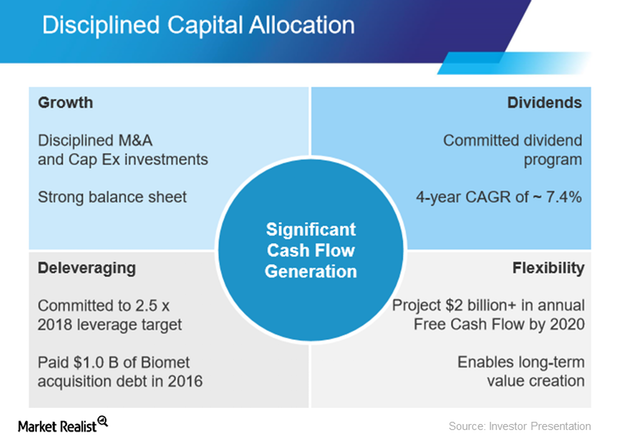

Zimmer Biomet’s Capital Allocation Strategy to Create Value

In February 2016, Zimmer Biomet authorized up to $1.0 billion of the company’s common stock for share repurchases, all of which remains authorized to date.

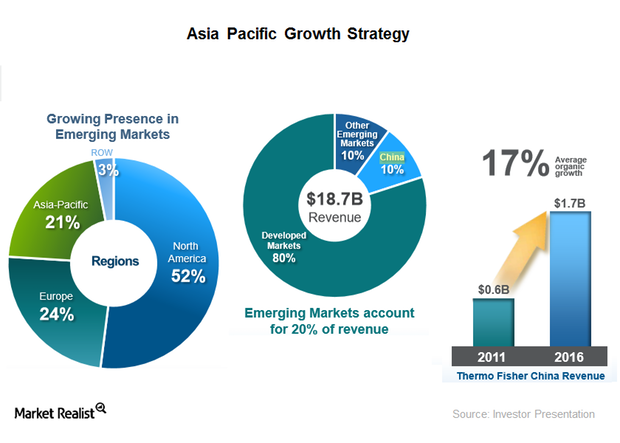

How Long Can Thermo Fisher Scientific’s Asia-Pacific Growth Momentum Last?

Thermo Fisher Scientific (TMO) has a presence around the globe, but around 80% of its revenues are generated from developed markets.

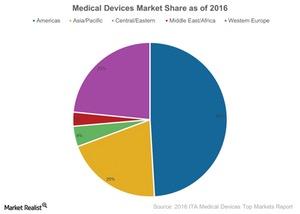

Is Medical Technology Driving the US Healthcare Industry?

The US medical device industry is a global leader. Its market was valued at ~$140 billion for 2016. It represents ~45% of the global market.

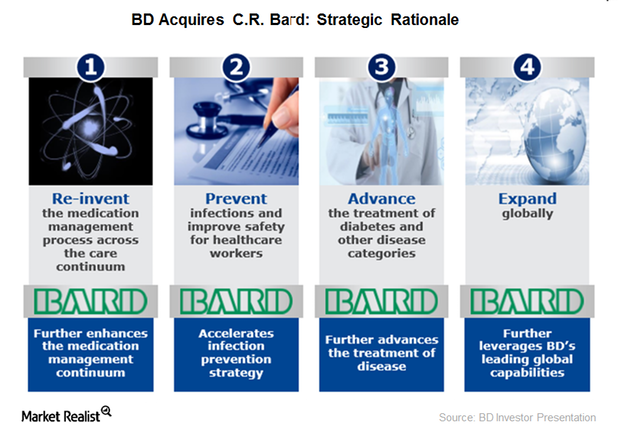

A Look at BD’s Deal Rationale in Its C.R. Bard Acquisition

BD’s acquisition of C.R. Bard is aimed at providing a comprehensive product portfolio to customers at more reasonable costs and enhanced efficiency.

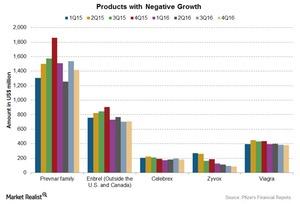

These Pfizer Products Saw Declining Revenues in 2016

The overall share of revenues for the Essential Health Products business fell marginally to 44.7% of the total revenues for 2016 from 45.2% of the total revenues for 2015.

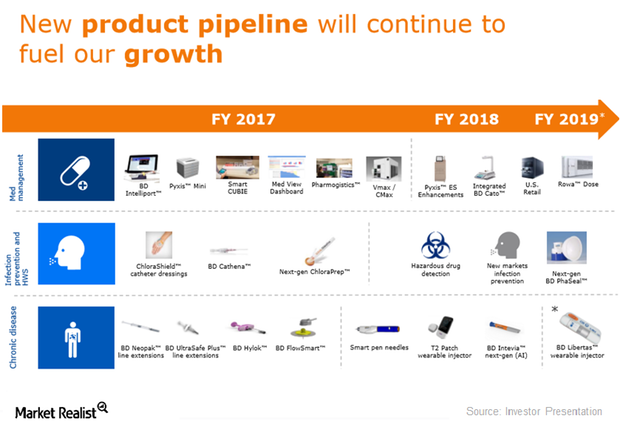

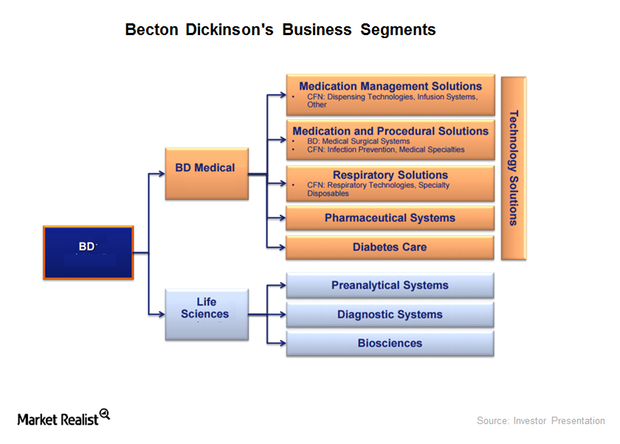

Analyzing the BD Medical Segment’s Product Pipeline

Becton, Dickinson and Company (BDX) generates ~$1 billion from its Infection Prevention business.

Inside Edwards Lifesciences’ THV Product Pipeline and Future Growth Estimates

Edwards Lifesciences (EW) has a robust product pipeline in its THV (transcatheter heart valve) segment, with Sapien 3 as the segment’s leading product.

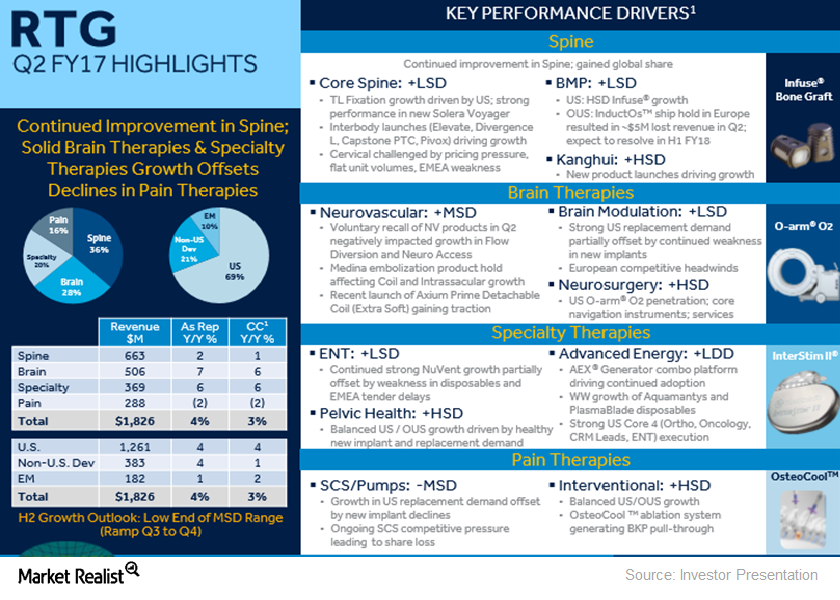

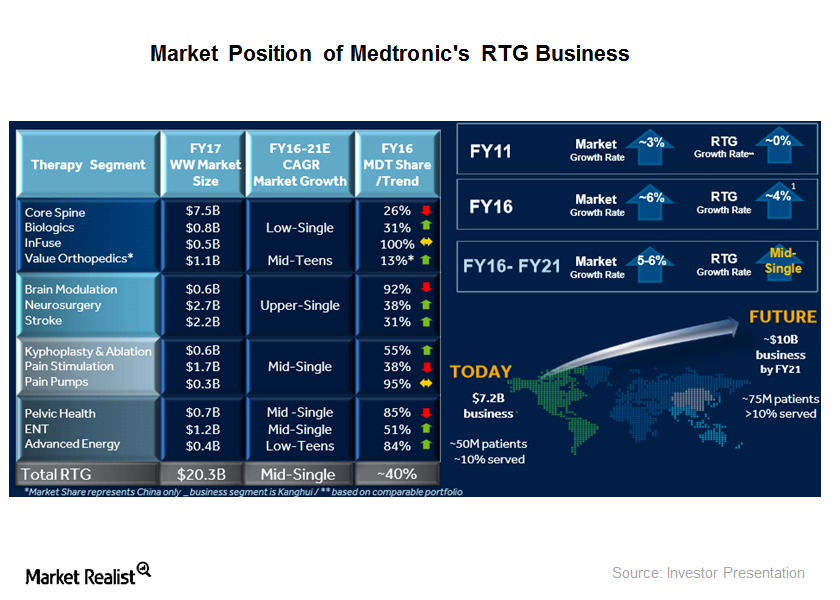

Medtronic’s RTG Sales in Fiscal 2Q17: The Brain and Restorative Therapies Story

Of Medtronic’s ~$7.3 billion in worldwide revenue in fiscal 2Q17, ~$1.8 billion came from its RTG segment, representing ~25% of the company total.

Here’s What’s Driving Medtronic’s MITG Segment

Of Medtronic’s ~$7.3 billion in worldwide revenues in fiscal 2Q17, ~$2.5 billion came from Medtronic’s MITG segment, representing ~34% of the company’s total revenues.

How Stryker Plans to Leverage the Under-Tapped Europe Opportunity

Europe represents a potential growth opportunity for Stryker, as the company currently has a low market share in Europe compared to other developed markets.

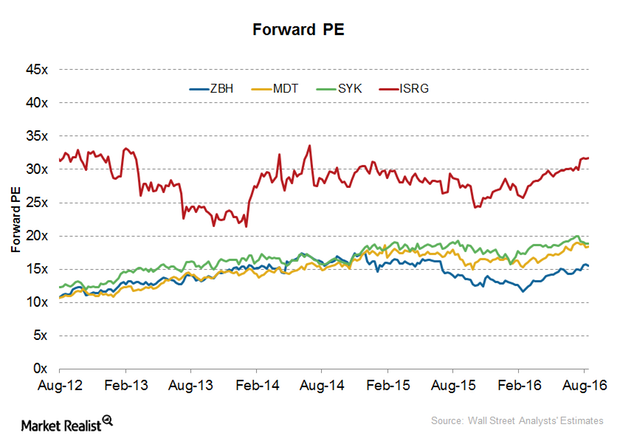

A Look at Zimmer Biomet’s Latest Valuation

After the release of its 2Q16 earnings results on July 28, 2016, Zimmer Biomet Holdings (ZBH) was trading at a forward price-to-earnings multiple in the range of 15.5x–16.2x.

Medtronic’s Minimally Invasive Therapies Group: Major Drivers

Medtronic plans to launch more than 80 products over the next three years.

A Look at Medtronic’s Geographic Strategy in 2016

Globalization is one of Medtronic’s (MDT) key growth strategies.

What Drives Medtronic’s Restorative Therapies Group’s Growth?

Medtronic’s (MDT) Restorative Therapies Group (or RTG) segment, formed around seven years ago, has a strong market position today.

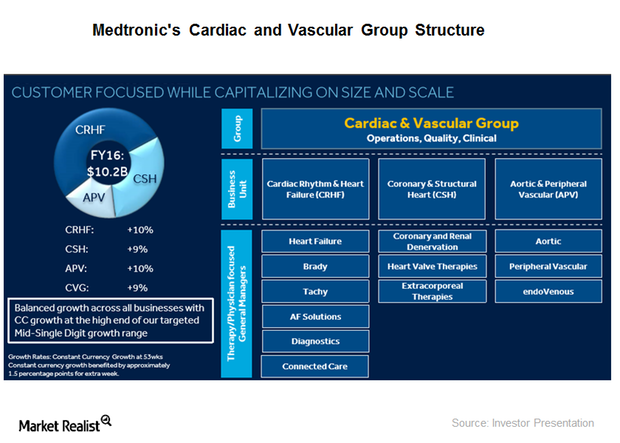

What Drives Medtronic’s Cardiac Vascular Group’s Revenues?

Medtronic’s (MDT) Cardiac and Vascular Group (or CVG) is its largest segment.

What’s the Verdict on Becton Dickinson’s Strategic Portfolio Review?

Becton Dickinson (BDX) completed its annual strategic review of its portfolio, which was initiated after the acquisition of CareFusion.

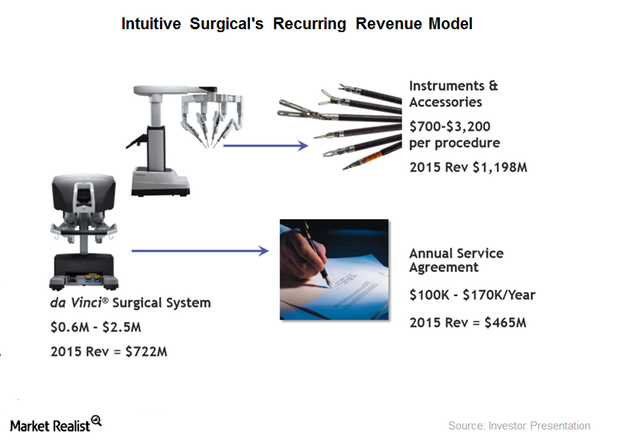

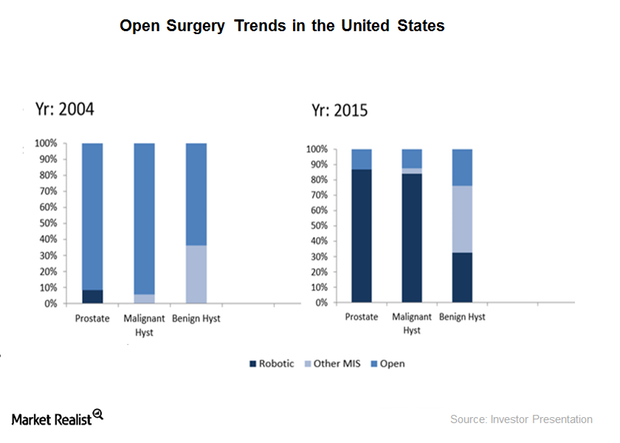

What Does Intuitive Surgical’s Business Model Look Like?

Intuitive Surgical (ISRG) defines its business model as a “razor/razor blade” model. What does this mean?

Exploring Intuitive Surgical’s Sales Model

Intuitive Surgical follows a diversified sales strategy and doesn’t generate more than 10% of its revenue through any one customer.

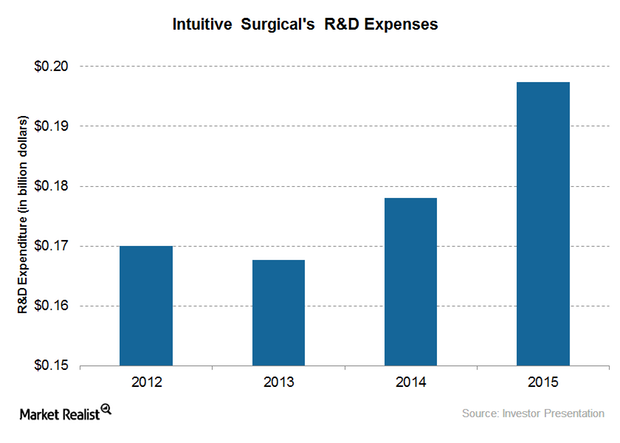

Analyzing Intuitive Surgical’s R&D Strategy and Innovations

Intuitive Surgical is continuously enhancing its product offerings, enabling more efficient procedures through internal research and development (or R&D).

A Closer Look at Intuitive Surgical’s Business Strategy

Intuitive Surgical aims to include a larger patient population under its MIS treatments and to provide better surgery outcomes and lower recovery times.

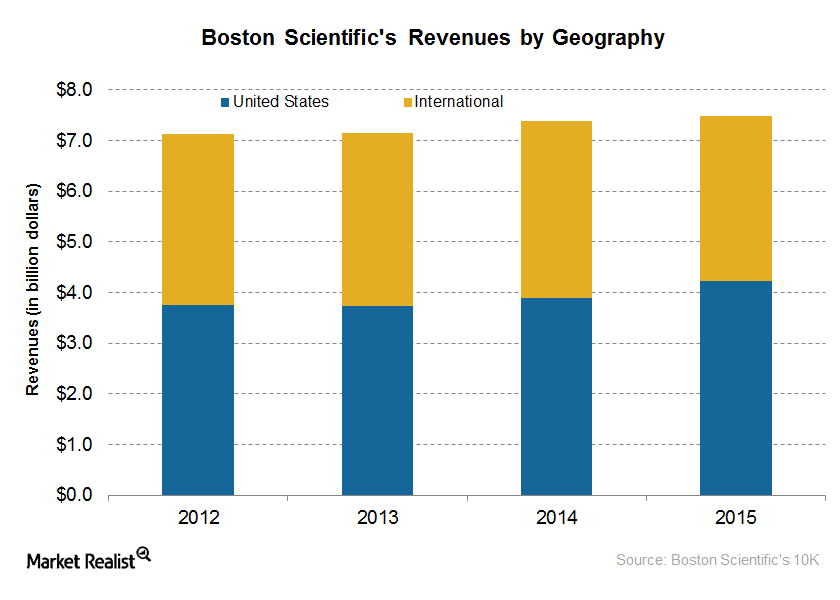

How Is Boston Scientific’s Geographic Strategy Driving Growth?

Boston Scientific has strategically expanded in these geographies through organic as well as inorganic strategies.

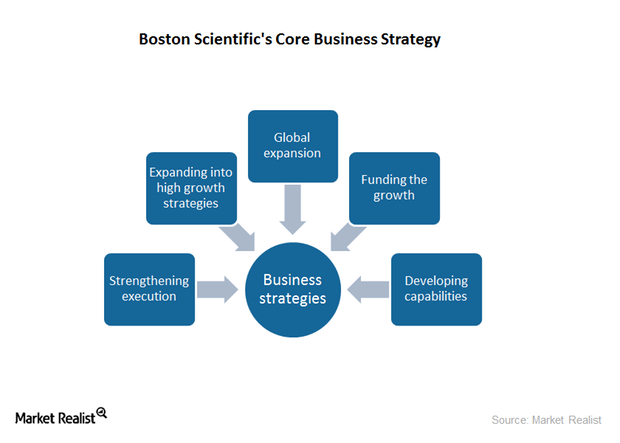

The Business Strategies Driving Boston Scientific’s Growth

Boston Scientific registered emerging market sales growth of approximately 13% in 2015, representing a steady growth in international markets.

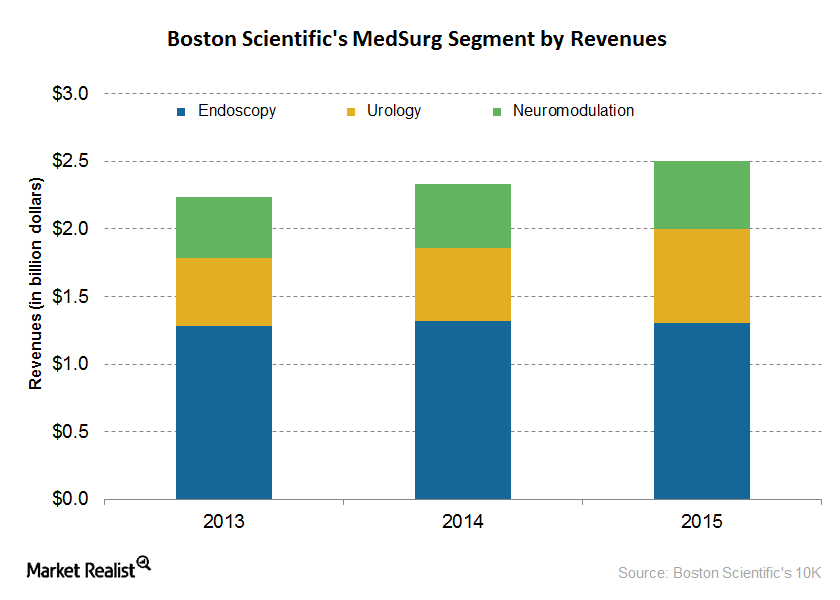

Understanding Boston Scientific’s MedSurg Segment

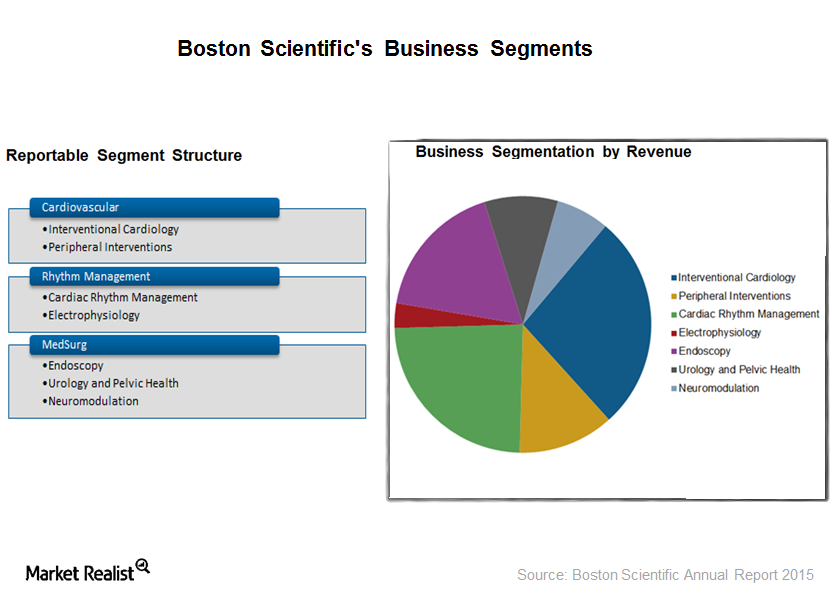

Boston Scientific’s (BSX) MedSurg segment contributes around 33% to the company’s total revenues and is the company’s second-largest segment.

A Brief Look at Boston Scientific’s Business Model

Boston Scientific’s (BSX) Cardiovascular segment consists of minimally invasive technologies to treat patients with a wide range of heart and vascular diseases. It is BSX’s largest business segment and generated ~39% of the company’s total revenues in 2015.