Transcatheter Heart Valve Therapy: Growth Driver for Edwards Lifesciences

In 2Q17, Edwards Lifesciences’ (EW) Transcatheter Heart Valve Therapy segment reported revenues close to $316 million, which represents year-over-year growth of ~28%.

Aug. 1 2017, Updated 10:40 a.m. ET

Transcatheter Heart Valve Therapy segment

In 2Q17, Edwards Lifesciences’ (EW) Transcatheter Heart Valve Therapy segment reported revenues close to $316 million, which represents year-over-year (or YoY) growth of ~28%. The company’s most preferred heart valve, SAPIEN 3, also demonstrated exceptional clinical performance in both large and small valve centers.

Edwards Lifesciences witnessed healthy demand across its entire network of 550 hospitals as well as from the recently added centers.

If Edwards Lifesciences’ (EW) Transcatheter Heart Valve Therapy segment demonstrates solid revenue growth in future quarters, it could favorably affect the company’s stock prices as well as the Vanguard Mid-Cap ETF (VO). Edwards Lifesciences makes up ~0.70% of VO’s total portfolio holdings.

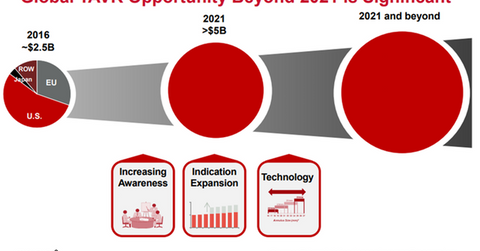

The chart above shows that the total market opportunity for transcatheter aortic valve replacement (or TAVR) could exceed $5.0 billion beyond 2021. Increasing awareness among the physician and patient community, indication expansion for TAVR therapy, and continually improving technology could be key drivers for the global TAVR opportunity.

As more aortic stenosis patients are identified, TAVR therapy could be increasingly adopted, especially in markets with already low treatment rates. This may prove to be a solid growth driver for major TAVR players such as Abbott Laboratories (ABT), Boston Scientific (BSX), and Medtronic (MDT).

Inventory in Germany

In 2017, Edwards Lifesciences (EW) also expects to benefit from increased demand for transcatheter aortic valve replacement therapy in international markets, where penetration is still significantly low. In 2Q17, the company reported underlying YoY revenue growth of 16%.

In 1Q17, Germany had stocked up $62 million of SAPIEN 3 inventory as a precaution against intellectual property litigation in the country. While Edwards Lifesciences has reported this as GAAP[1. generally accepted accounting principles] sales, it had been excluded from adjusted results to better reflect hospital usage. In 2Q17, the company has upwardly adjusted its sales to depict the $22 million of inventory that was used during the quarter.

In the next article, we’ll discuss financial projections for Edwards Lifesciences’ Transcatheter Heart Valve Therapy segment in greater detail.