Edwards Lifesciences Corp

Latest Edwards Lifesciences Corp News and Updates

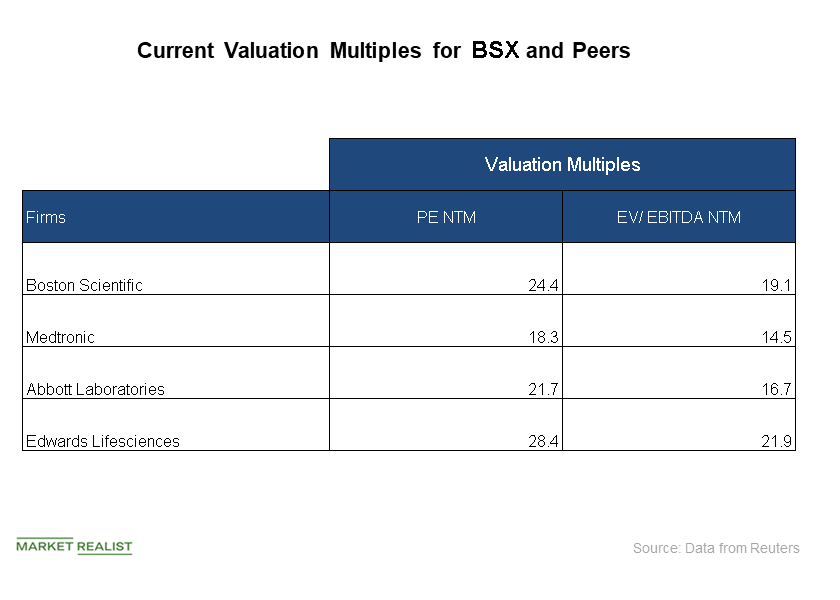

A Look at Boston Scientific’s Valuation Multiples in September

On September 14, Boston Scientific (BSX) was trading at a forward price-to-earnings ratio of 24.4x, compared to the industry’s average PE ratio of 22.4x.

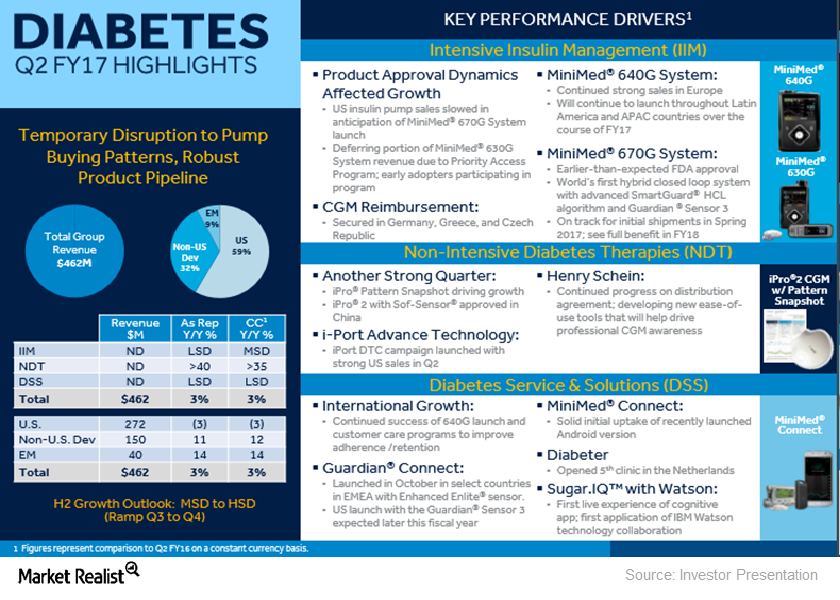

What Really Disrupted Medtronic’s Diabetes Segment Sales in Fiscal 2Q17?

Of Medtronic’s ~$7.3 billion in worldwide revenues in fiscal 1Q17, ~$0.46 billion came from its Diabetes segment, representing ~6% of the company total.

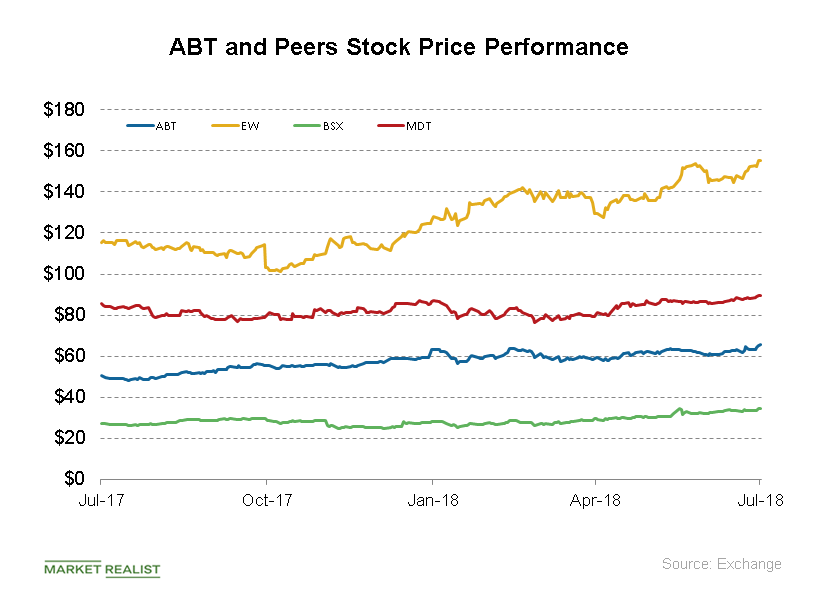

Abbott Laboratories’ Stock Price Performance in July

Year-to-date, ABT stock has risen 12.8%. Over the last month, the stock has returned ~4.0%.

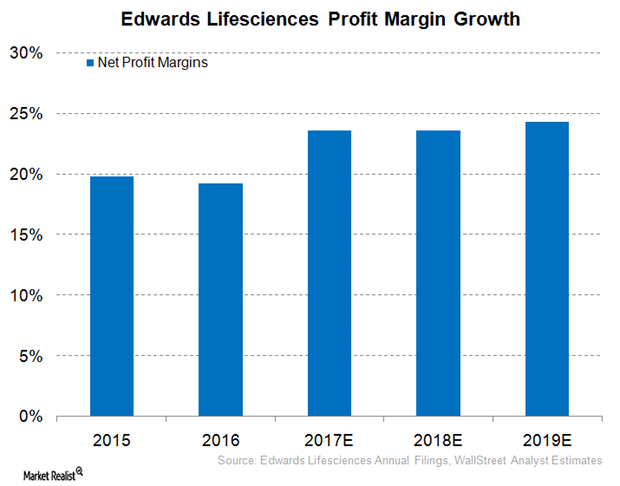

Can Edwards Lifesciences See Robust Net Profit Margin in 2017?

In its 2Q17 earnings conference call, Edwards Lifesciences (EW) projected 2017 adjusted EPS to fall to $3.65–$3.85, which is higher than the previous $3.43–$3.55.

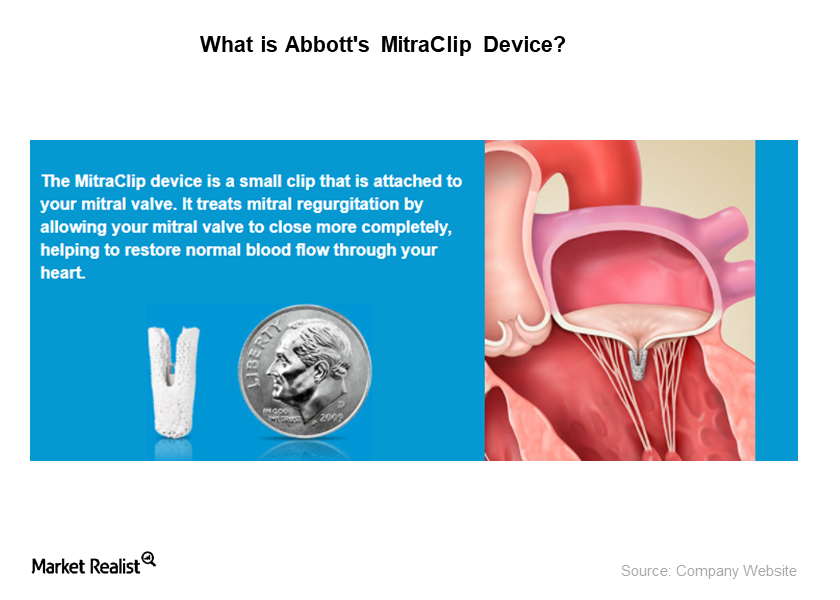

MitraClip Drives Growth, Gets Reimbursement Approval in Japan

On March 19, 2018, Abbott Laboratories (ABT) announced that it had received reimbursement approval for its MitraClip device in Japan.

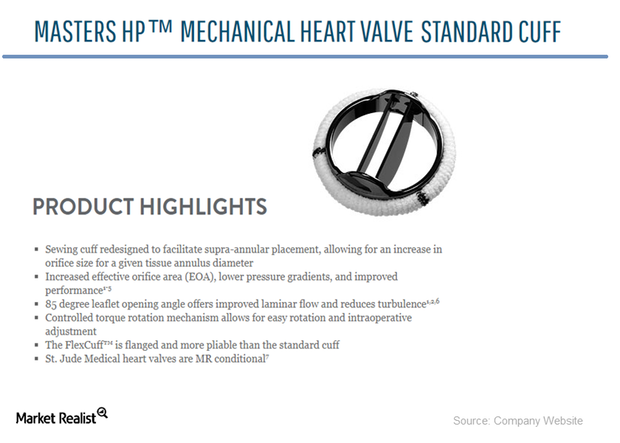

ABT Gets FDA Approval for World’s Smallest Mechanical Heart Valve

Abbott announced that it received FDA approval for its Masters HP 15-mm rotatable mechanical heart valve, which is the first and only heart valve developed for newborns and infants.

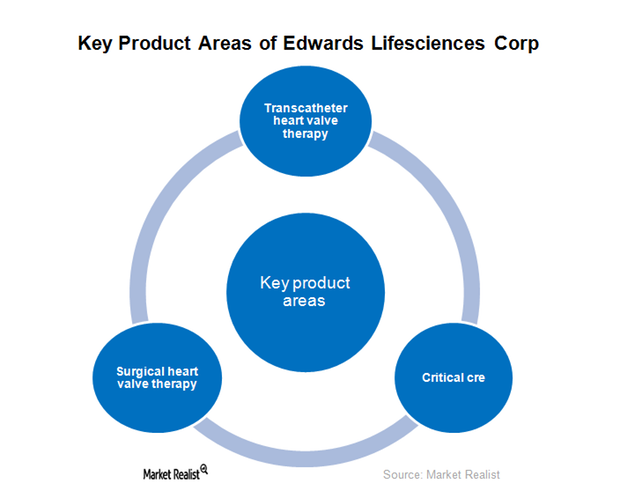

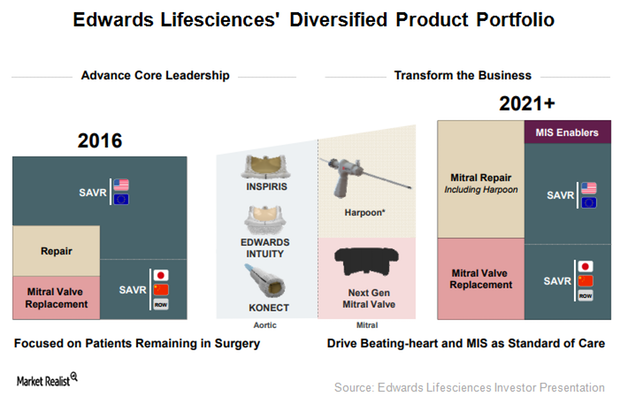

Edwards Lifesciences’ Strong Product Portfolio Bodes Well

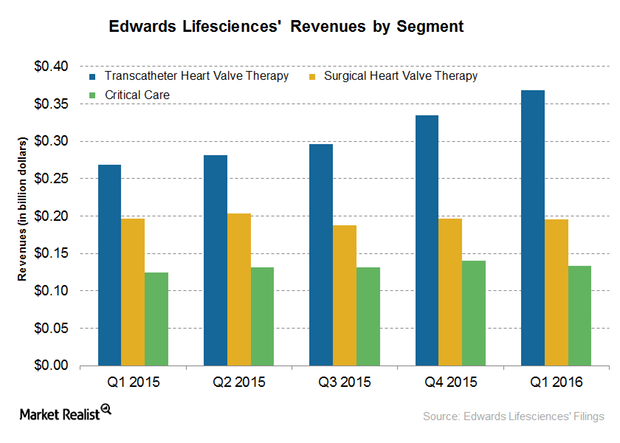

Edwards Lifesciences’ (EW) products can be categorized into three therapeutic areas: transcatheter heart valve, surgical heart valve, and critical care.

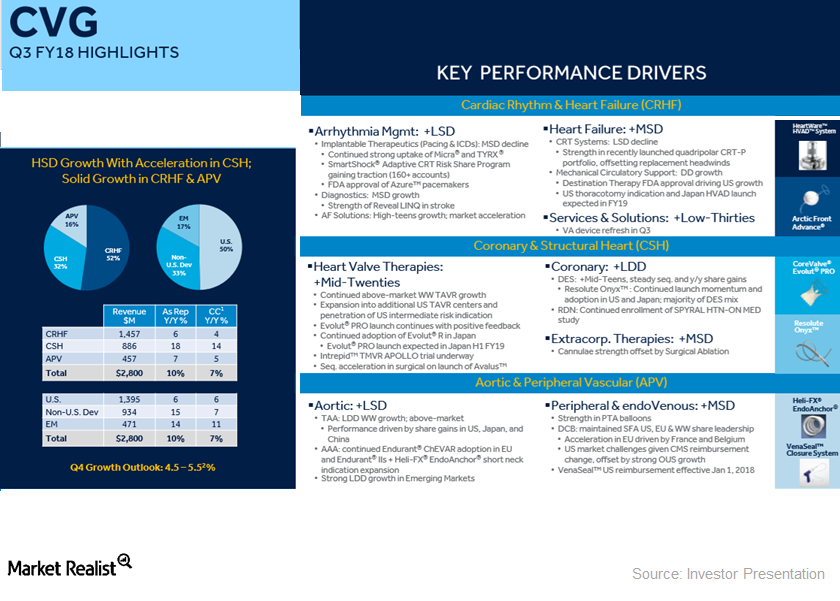

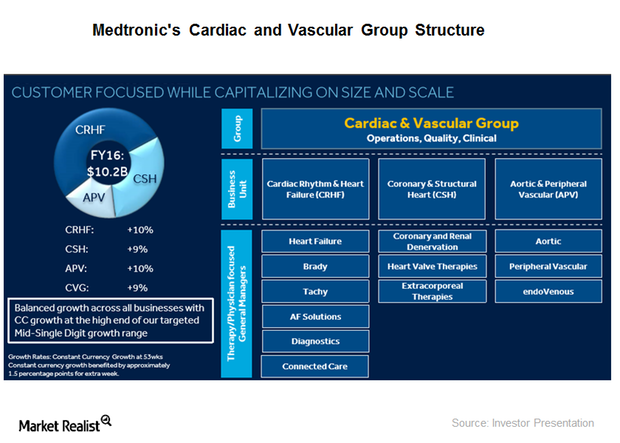

What Drove Medtronic’s Cardiac and Vascular Group in 3Q18

Cardiac and Vascular Group in fiscal 4Q17 Medtronic (MDT) reported total sales of ~$7.4 billion in fiscal 3Q18. Of that total, ~38% (~$2.8 billion) was contributed by Medtronic’s CVG (Cardiac and Vascular Group). CVG sales grew ~10% YoY (year-over-year) and ~7% on a constant-currency basis. US CVG sales grew ~6% YoY, while developed nation CVG sales […]

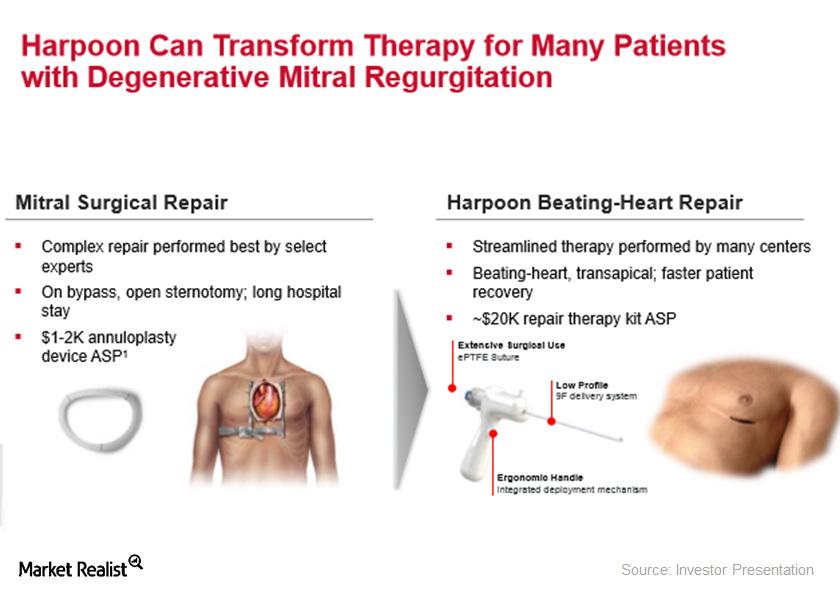

Edwards Lifesciences Expands Portfolio with Harpoon Medical Acquisition

On December 6, 2017, Edwards Lifesciences (EW) announced the completion of its acquisition of Harpoon Medical for $100 million in cash on December 1, 2017.

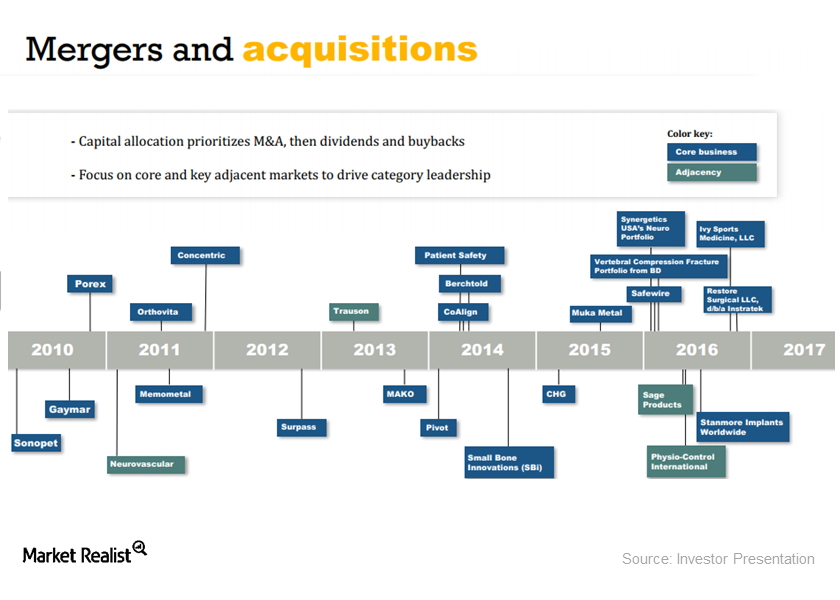

Stryker’s Inorganic Growth Strategy Continues to Boost Growth

Stryker’s acquisition-driven growth strategy Stryker (SYK) has been growing at a fast pace through inorganic growth. It has undertaken a number of strategic acquisitions recently. In 3Q17, acquisitions contributed approximately 0.6% of the company’s YoY (year-over-year) sales growth, and in the first three quarters of 2017, Stryker acquisitions contributed ~3.2% of the company’s sales growth […]

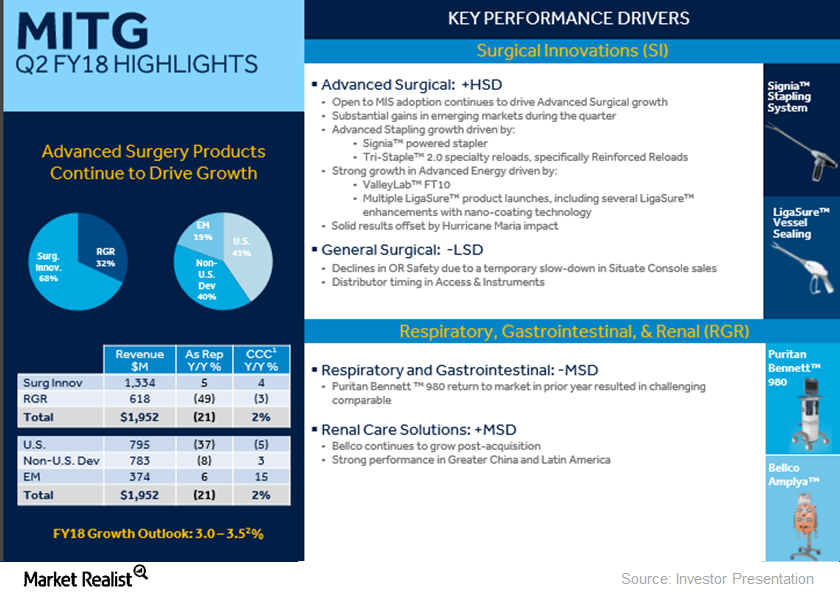

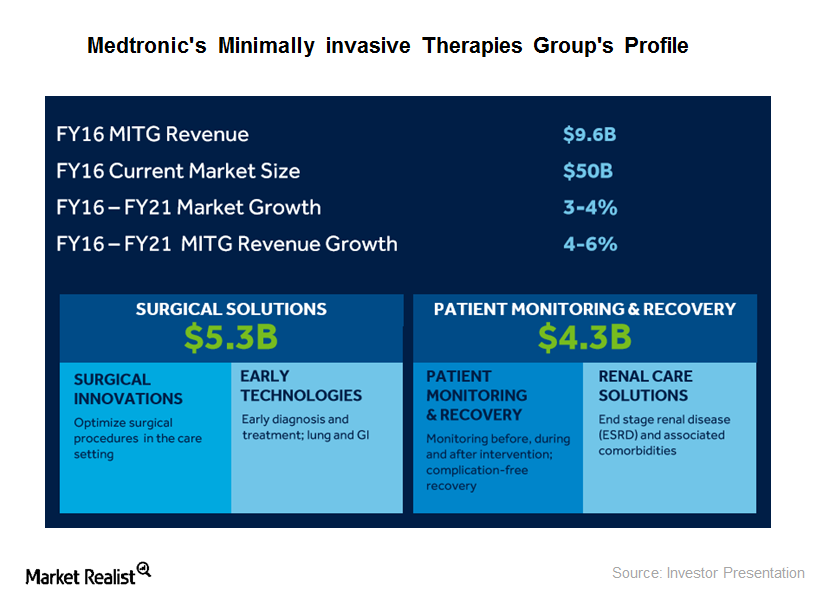

Medtronic’s Disappointing MITG Business Performance in Fiscal 2Q18

Due to the disappointing fiscal 2Q18 results, Medtronic made a downward revision to its estimates for MITG sales growth in fiscal 2018 to 3.0%–3.5%.

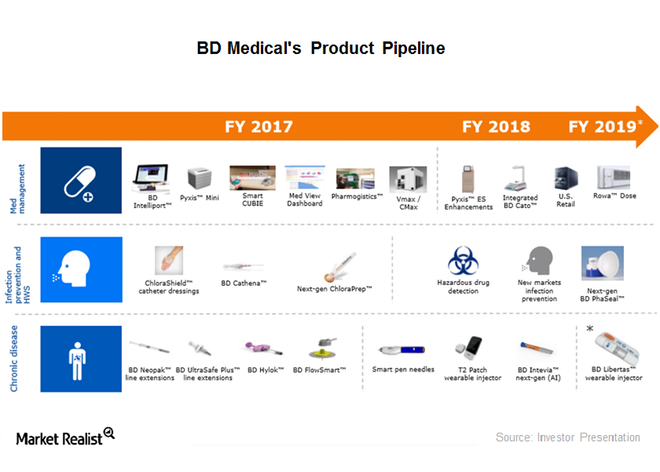

What’s BD’s Latest News in the Diabetes Management Market?

On September 19, 2017, Becton, Dickinson, and Company (BDX), or BD, introduced a new pen needle for its pen injection devices.

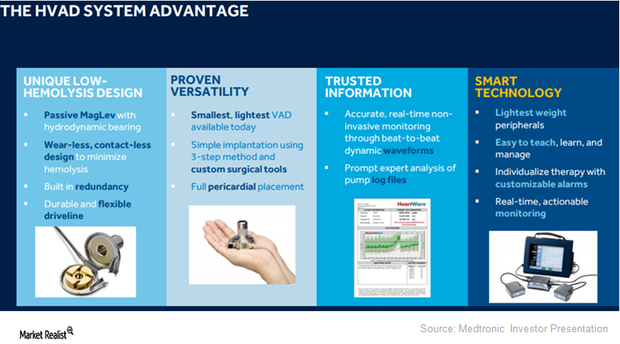

HVAD Expected to Expand Medtronic’s Presence in LVAD Segment

On September 27, 2017, the FDA approved Medtronic’s HVAD (HeartWare ventricular assist device) system as a destination therapy for advanced heart failure patients.

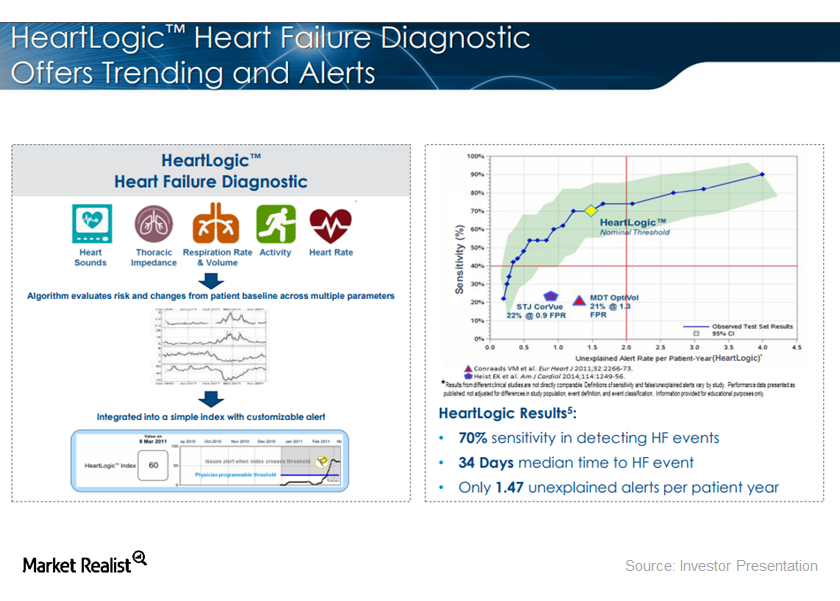

New Data Confirms the Efficiency of BSX’s HeartLogic Diagnostic

On September 19, 2017, Boston Scientific announced new data from its MultiSENSE (Multisensor Chronic Evaluation in Ambulatory Heart Failure Patients) study.

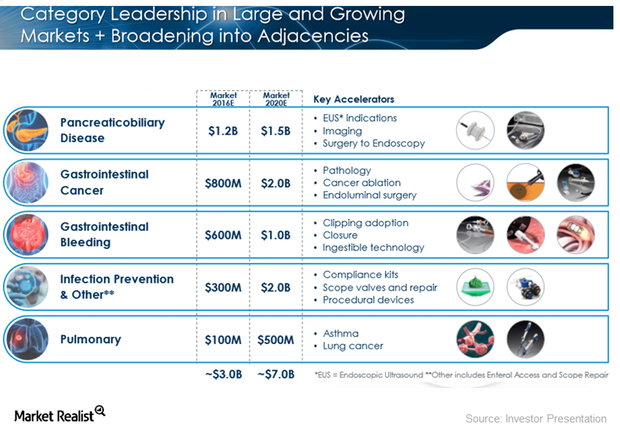

Boston Scientific Is Accelerating Category Leadership Strategy

Boston Scientific (BSX) currently has a global market opportunity of $40.0 billion, which is expected to grow to $50.0 billion by fiscal 2020.

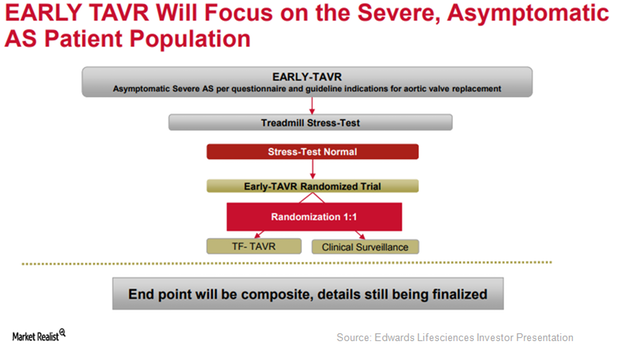

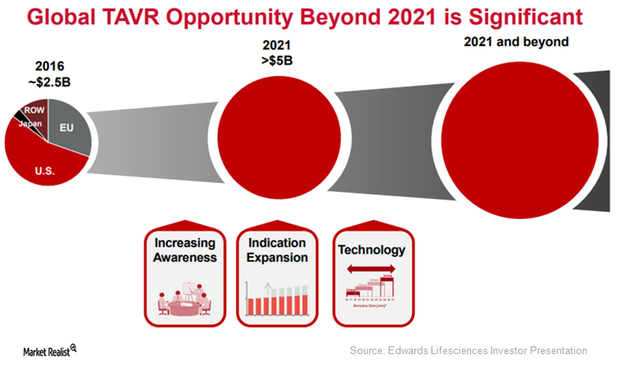

Edwards Lifesciences Focuses on Indication Expansion of SAPIEN 3 in 2017

To further expand the label of its transcatheter heart valve (or THV), SAPIEN 3, Edwards Lifesciences (EW) is currently involved in enrolling patients in its EARLY-TAVR trial.

Edwards Lifesciences’ Mitral Regurgitation Segment

To diversify its focus beyond aortic structural heart conditions, Edwards Lifesciences (EW) acquired CardiAQ Valve Technologies in August 2015.

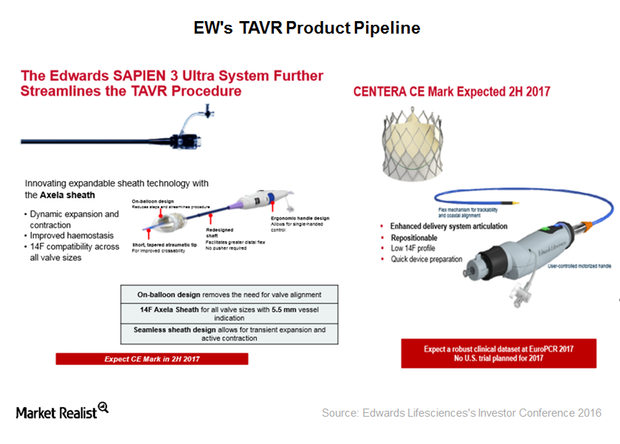

Edwards Lifesciences Focuses on Launch of SAPIEN 3 Ultra and CENTERA Valves

Edwards Lifesciences’ (EW) SAPIEN 3 Ultra system is a next-generation platform, with expandable Axela sheath technology and on-balloon delivery design.

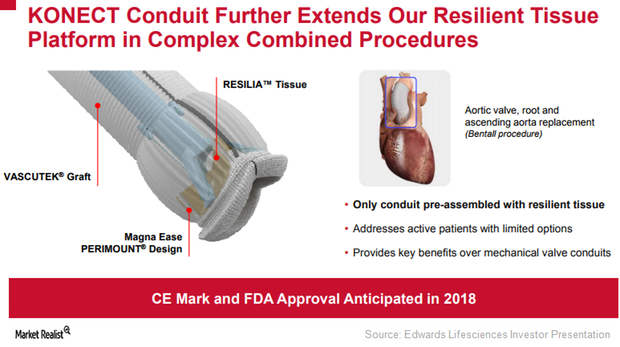

Edwards Lifesciences: Focused on Inspiris Resilia and Konect

To extend the durability of the Inspiris Resilia surgical aortic valve, Edwards Lifesciences (EW) has incorporated a new tissue platform, Resilia tissue.

Can Edwards Intuity Elite Boost Edwards Lifesciences’ Revenues?

With the Edwards Intuity Elite valve system, Edwards Lifesciences aims to offer a minimally invasive therapy to complex aortic stenosis patients.

Transcatheter Heart Valve Therapy: Growth Driver for Edwards Lifesciences

In 2Q17, Edwards Lifesciences’ (EW) Transcatheter Heart Valve Therapy segment reported revenues close to $316 million, which represents year-over-year growth of ~28%.

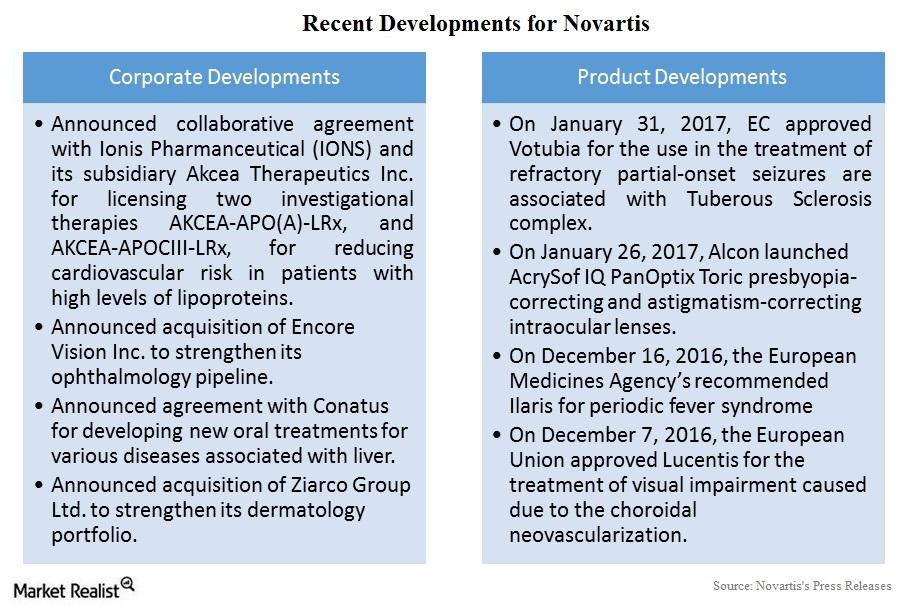

Novartis’s Recent Developments

Novartis (NVS) reported flat revenues at constant exchange rates during 4Q16 as well as in fiscal 2016. This was driven by growth in Sandoz revenues.

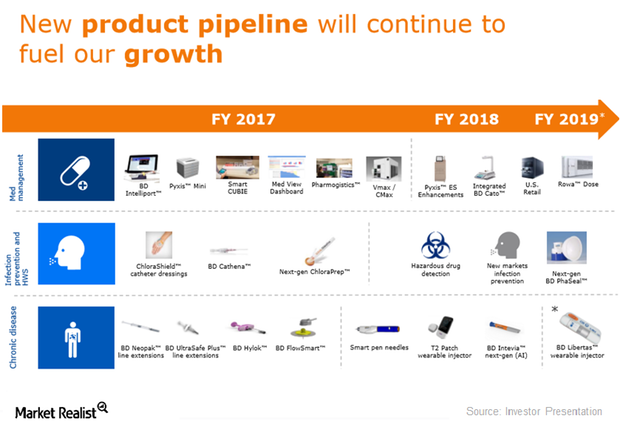

Analyzing the BD Medical Segment’s Product Pipeline

Becton, Dickinson and Company (BDX) generates ~$1 billion from its Infection Prevention business.

Inside Edwards Lifesciences’ THV Product Pipeline and Future Growth Estimates

Edwards Lifesciences (EW) has a robust product pipeline in its THV (transcatheter heart valve) segment, with Sapien 3 as the segment’s leading product.

What You Need to Know About the Micron-Inotera Deal

A major part of Micron Technology’s (MU) transition to the 20 nm node involves Taiwan’s (EWT) Inotera and its joint venture with Nanya Technology.Company & Industry Overviews What Explains the Columbia Select Large Cap Growth Fund’s Poor Showing?

The short-term performance of the Columbia Select Large Cap Growth Fund – Class A (ELGAX) is excellent, and the past six months have been great for the fund.

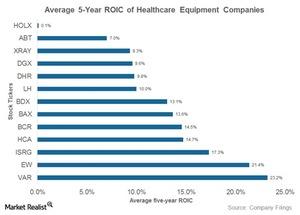

How Are Danaher’s Returns Compared to Its Industry Peers’?

Danaher’s ROIC fell steadily from 15.5% in 2006 to 8.5% in 2015, indicating that it has probably had fewer high return reinvestment opportunities since then.

Medtronic’s Minimally Invasive Therapies Group: Major Drivers

Medtronic plans to launch more than 80 products over the next three years.

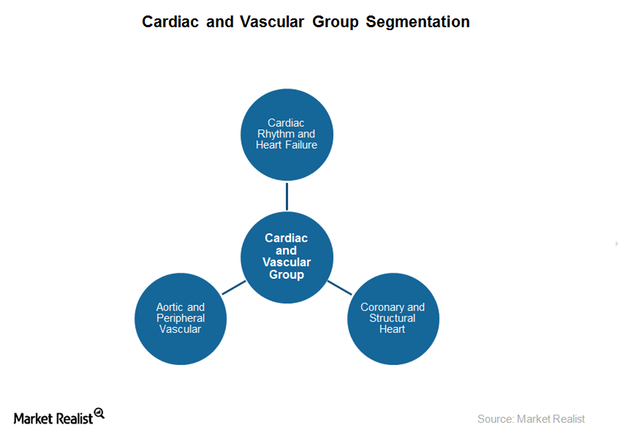

What Drives Medtronic’s Cardiac Vascular Group’s Revenues?

Medtronic’s (MDT) Cardiac and Vascular Group (or CVG) is its largest segment.

How Did Edwards Lifesciences’ Critical Care Segment Fare in 1Q16?

Edwards Lifesciences (EW) reported ~$697 million in total revenue in 1Q16. Of that, ~$134 million was contributed by the company’s Critical Care segment.

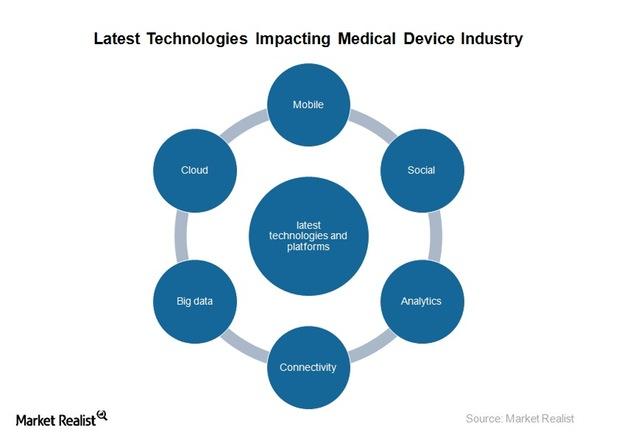

Why Technology Is a Key Driver in the US Medical Device Industry

Traditionally, the United States has been home to the most advanced technological inventions in the medical device industry.

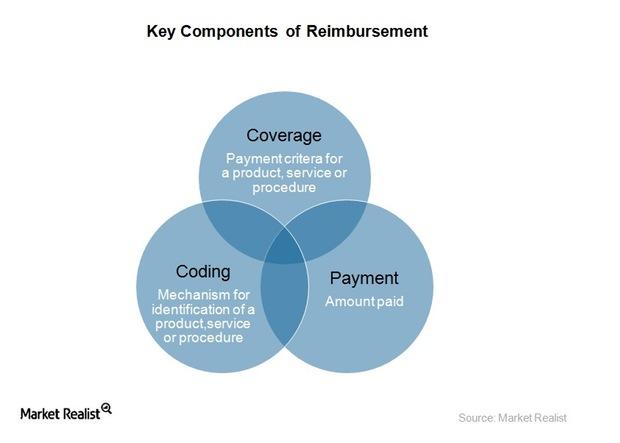

How Reimbursement Models Impact the Medical Device Industry

Coverage, coding, and payment are essential elements to obtaining adequate reimbursement for a new medical device.

Evaluating Medtronic’s Cardiac and Vascular Devices Segment

Medtronic’s Cardiac and Vascular segment consists of Cardiac Rhythm and Heart Failure, Coronary and Structural Heart, and Aortic and Peripheral Vascular.