AMC Entertainment Holdings Inc

Latest AMC Entertainment Holdings Inc News and Updates

AMC Announces New Line of At-Home Popcorn Sold Exclusively at Walmart

AMC is making it easier for you to have the movie theater experience at home with a new line of microwave popcorn available exclusively at Walmart.

AMC Has a New Ticket Pricing Plan Based on Seat Location

AMC Theatres will soon charge different ticket prices based on seat location, the company announced. Here's how the ticket tiers will work.

Check Out These AMC Movie Deals for Black History Month

Black History Month AMC deals bring discounted tickets to films featuring Black actors and creators. Here's how to get the cheap tickets.

AMC’s APE Units Come at a Bad Time for AMC Stock

As AMC Entertainment releases its preferred class of stock called APE units, AMC stock falters. Here’s the scoop. Why is it a bad time?

AMC Invests in Gold and Silver Mining: What It Means for Retail Investors

AMC Theatres announced it invested big time in gold and silver mining. What does this mean for the company and AMC investors? Here's what we know about the stake.

Who Owns AMC Theatres Now and Will Amazon Buy the Company?

Who owns AMC Theatres now and what lies ahead for the cinema chain company as streaming continues to challenge moviegoing? Will Amazon buy AMC?

Fact Check: Do Retail Investors Own 90% of AMC like Adam Aron Says?

How has the institutional ownership of AMC changed recently and should you follow the smart money, as institutional funds are known?

AMC Is Giving Away a Batman NFT — Might Have Big Value Due to Rarity

The AMC Batman NFT giveaway could deliver big value to lucky customers considering the limited supply and rarity. How can you claim the NFT?

AMC Rewards Investors With an 'I Own AMC' NFT: How to Redeem It

AMC Entertainment has rewarded its investors with an “I Own AMC” NFT. Who's eligible for the NFT? How do investors redeem the second NFT from AMC?

Are Meme Stocks Dead or Will They Bounce Back?

Meme stocks, like AMC Entertainment and GameStop, have now fallen to multi-month lows. Are meme stocks dead or will they bounce back?

AMC Stock Forecast: Why Is It Dropping and Will 2022 Be Any Better?

AMC stock is dropping sharply. What’s the 2022 forecast for meme stocks like AMC Entertainment and GameStop as the meme trade unwinds?

How to Join AMC Investor Connect in Time to Get a Free NFT

AMC Investor Connect is now offering a second NFT to members. How can you join to take advantage of it? Here's how you can join and what to expect.

What's the Value of the Spider-Man NFT From AMC and Sony Pictures?

AMC and Sony Pictures are giving away Spider-Man NFTs to movie ticker purchasers. What's the value of the NFT? Currently, the value isn't known.

AMC Theaters Will Now Accept Crypto—Here's What You Need to Know

AMC Theaters has doubled-down on adopting crypto. Now, the company will accept cryptocurrencies beyond Bitcoin for payment. Litecoin and Ethereum are included.

When Will AMC Entertainment (AMC) Stock Hit $100?

AMC stock is nearly 40 percent below its 52-week high. What’s the forecast for AMC stock? Will it go back up and hit $100?

AMC’s Stock Forecast: How High Can It Go on Reddit Short Squeeze?

The short volumes of AMC stock look high enough to trigger a squeeze. How high can AMC stock go amid the Reddit-driven short squeeze?

Would AMC Investors Receive AMZN Stock in a Deal?

AMC stock has come down after Reddit-sparked rally, reigniting talks of Amazon acquiring the theater chain.

Jim Chanos Shorted AMC—How Did He Accumulate His Billions?

Jim Chanos has taken a short position against AMC. He’s done it before and made money, but how much? Here's how Chanos made his billions.

AMC Beat Q2 Earnings, Possible Short Squeeze in the Stock

Reddit traders are talking about a short squeeze in AMC stock. Is a short squeeze going to happen in the stock after the second-quarter earnings?

AMC Stock Falls 50%—Should You Buy the Dip Ahead of Its Q2 Earnings?

Investors are interested in AMC's stock prediction to assess whether the stock will rebound or fall after its second-quarter earnings.

Crispin Odey's Hedge Fund Has Taken a Short Position Against AMC

Crispin Odey’s hedge fund has taken a short position against AMC. Did it pay off? Here's everything investors need to know about the short position.

The Ape Show Has Ended in AMC Stock, Reality Finally Sets In

On Aug. 4, AMC stock is falling again and continuing its slide. The party seems over for the "Apes" as reality finally sets in for AMC stock.

Will AMC Entertainment (AMC) Stock Go Up and Should You Buy It Now?

AMC Entertainment (AMC) stock has fallen sharply from its peaks. Will AMC stock recover and go up this week?

Is AMC Stock Done or Is Another Reddit Short Squeeze Coming?

AMC has been in a freefall. Is the Reddit rally in AMC stock done or is another short squeeze coming in the stock?

Reddit Hype Settles, Time to Sell AMC Entertainment (AMC) Stock

The retail investors on Reddit have lost interest in AMC Entertainment (AMC) stock. Should you sell AMC stock now?

AMC Stock Forecast Shows Volatility and an Uncertain Future

AMC stock is down 41 percent from its 52-week high. Why is AMC stock going down and will it go back up in the rest of 2021?

How Long Will the Greater Fool Theory in AMC Entertainment Stock Last?

AMC Entertainment stock has fallen sharply from the highs. Why is AMC stock falling and how low will it go? Here's what investors can expect.

Reddit Keeps Pumping AMC Stock, $100 Level Is Possible

AMC stock has been one of the major beneficiaries of the Reddit-fueled rally in 2021. On June 2, the stock hit its 52-week high on this pump.

AMC Entertainment (AMC) Stock Could Rise More, Reddit Takes Aim

AMC Entertainment’s stock price prediction is in sharp focus. Investors want to know if the stock will continue to go up.

AMC Entertainment Stock Slides, Matt Kohrs Holds Live Stream

Matt Kohrs is holding a live stream on YouTube on June 16 to discuss AMC. However, the stock is sliding. What are his views on the stock?

Why Is AMC Stock Dropping and Will It Recover?

AMC stock has gained more than 2,800 percent YTD and 95 percent on June 2 alone. However, on June 3, the stock has been dropping.

If AMC Stock Keeps Breaking Records, Could Hit $100 in 2021

AMC stock prediction is in sharp focus as investors target $100 after the stock surges more than 1,000 percent.

GME or AMC: Which Is a Better Stock to Buy in Short Squeeze 2.0?

Investors want to know if GameStop (GME) stock will go up like AMC stock in what appears to be short squeeze 2.0. Which is a better stock to buy?

Watch Out for the Next Reddit Meme Stocks to Explode

Reddit has a hold on the market—who would have thought? Investors need to watch out for the next Reddit meme stocks to explode.

AMC Is a Short Squeeze Battleground Stock Again, Could Keep Rising

Investors want to know how high AMC stock can go after watching it soar recently amid the short squeeze and Amazon deal talks.

AMC Stock Rallied and Short Sellers Lost Millions Again

As AMC stock rallied on May 25, it caused short sellers to lose millions. Who on the hook for the latest WallStreetBets takeover?

Enjoy the Party in AMC Stock, Leave Before Reality Check Happens

AMC Entertainment stock is rising again and WallStreetBets is attempting a short squeeze. However, the stock's prediction for 2021 isn't rosy.

AMC Entertainment (AMC) Stock Waits for a Short Squeeze

The short interest in AMC Entertainment (AMC) stock has been rising. The stock is still one of the heavily shorted stocks on the market.

AMC Stock Forecast 2025: Not a Good Long-Term Investment

AMC Entertainment stock has risen due to the short squeeze triggered by WallStreetBets. What's the stock's forecast for 2025?

AMC Stock Is Soaring Again — Not Due to WallStreetBets This Time

AMC Entertainment stock has been on an uptrend after New York allowed movie theaters to reopen. What's the stock's forecast in 2021?

Here's How You Can Rent Out an Entire AMC Theater

An AMC Theater rental could be the perfect solution getting family, friends, and more together during the coronavirus pandemic.

Are AMC Theatres Closing Amid the COVID-19 Pandemic?

AMC Theatres, the largest movie theater company in the industry, remains open despite its struggles amid the COVID-19 pandemic.

AMC Entertainment Stock Is a High-Risk Bet for Most Investors

AMC Entertainment has fallen by almost 50 percent this year. Is the stock a buy amid the sector rotation?

What Are Leon Cooperman’s Top Holdings?

In Q3 2020, billionaire investor Leon Cooperman’s top five holdings were Fiserv, Mr. Cooper Group, Alphabet, Cigna, and Trinity Industries.

What to Expect for AMC Entertainment’s 1Q18 Revenue

Analysts have projected AMC Entertainment’s (AMC) revenue in 1Q18 (ended March 31) to increase 5.2% to $1.4 billion, boosted by acquisitions.

Some AMC Theaters Are Reopening on Aug. 20 With 15-Cent Tickets

AMC plans to reopen some of its theaters on Aug. 20. The theaters have been closed for five months due to the coronavirus pandemic.

Will the Rally in Clorox Stock Continue?

The COVID-19 pandemic boosted Clorox’s sales. People started paying more attention to cleaning and sanitizing.Consumer Point72 Asset Management opens new position in Pier 1 Imports

E-commerce represented approximately 1% of total sales in fiscal 2013, 4% in fiscal year 2014, 9% in the first quarter of fiscal 2015, and 9.7% in the second quarter of fiscal 2015.

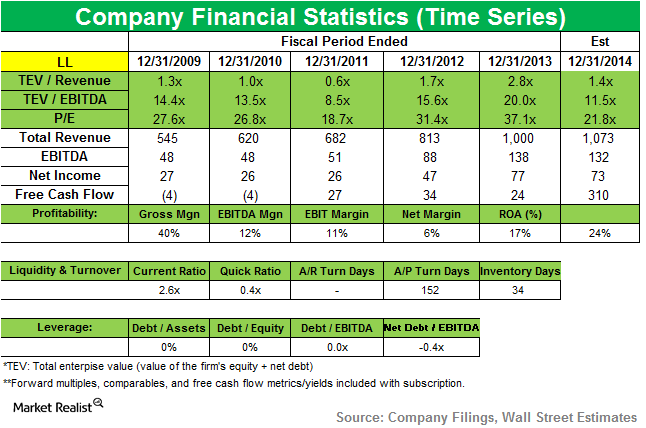

Point72 Asset Management raises stake in Lumber Liquidators

The company “saw improvement in net sales trends over the course of the quarter as inventory levels recovered and the fall flooring season began.” But the shares are down 49% in the year to date.

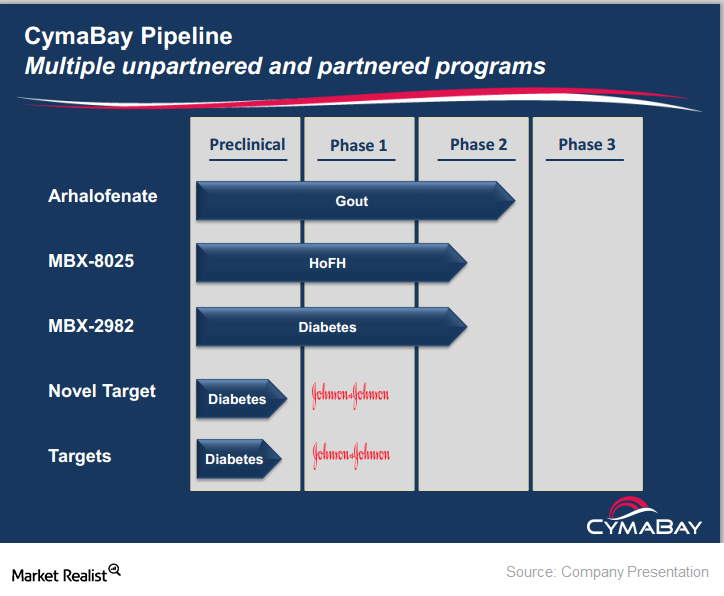

Point72 Asset Management takes position in CymaBay Therapeutics

CymaBay Therapeutics is a clinical-stage biopharmaceutical company formerly known as Metabolex. It develops therapies to treat metabolic and rare diseases with high unmet need.