Alcoa Corp

Latest Alcoa Corp News and Updates

Alcoa Stock Will Likely Rally More, Looks Like a Good Buy Now

Alcoa's second-quarter earnings were better than expected on both the top line and the bottom line. Should you buy AA stock now and what's the forecast?

Green Metal Stocks Help Make Your Portfolio More Sustainable

Metal production is notoriously energy-rich, but some publicly traded companies are taking a greener approach. What are the best green metal stocks?

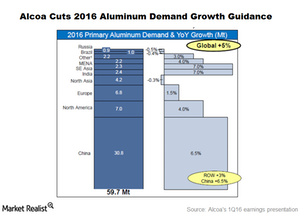

Why It’s No Surprise that Alcoa Cut Aluminum Demand Guidance

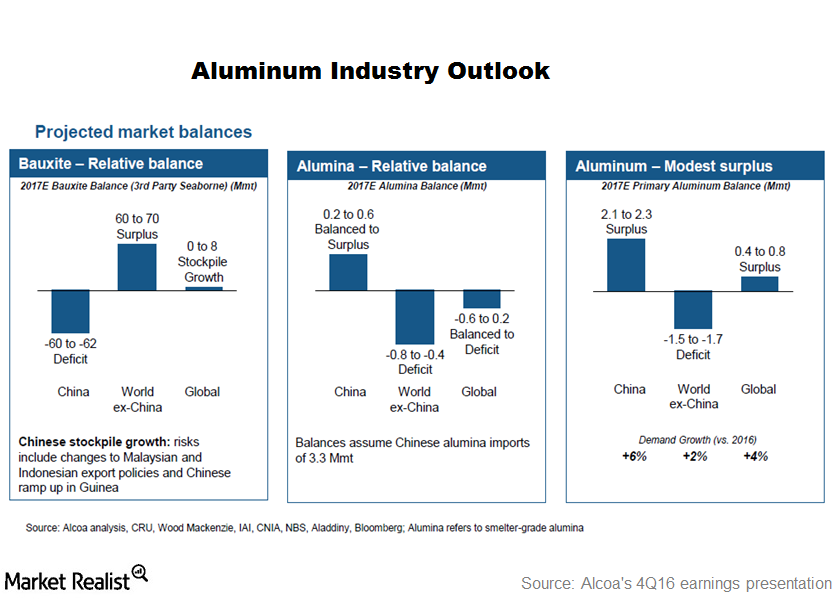

Alcoa has revised down its 2016 global aluminum demand growth projection to 5%.

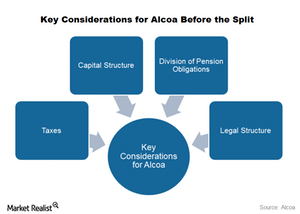

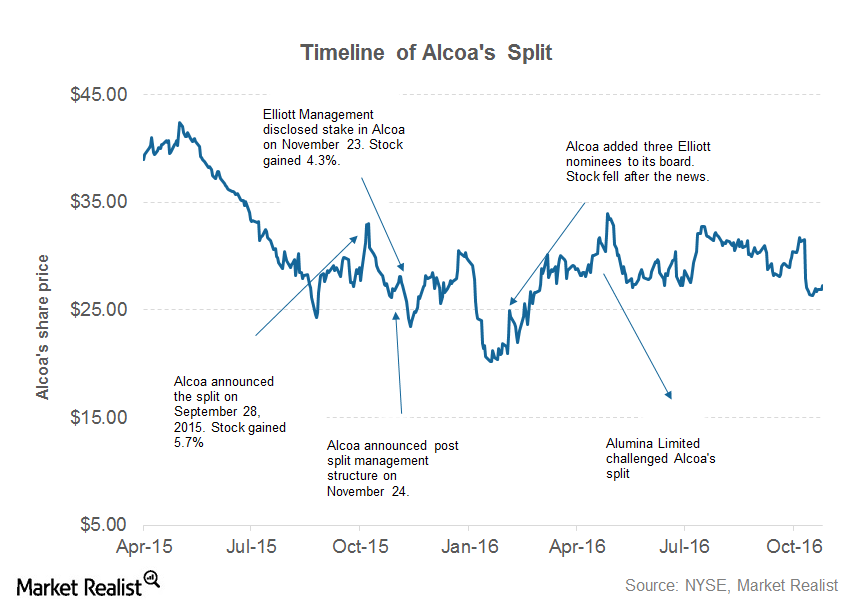

Could Alcoa’s Split Create Shareholder Value?

As an Alcoa (AA) shareholder, you might like to know whether the split will create value. The value, in this case, would basically mean whether the two separate companies would be worth more than the combined entity.

Alcoa’s 2Q16 Earnings: What Can Investors Expect?

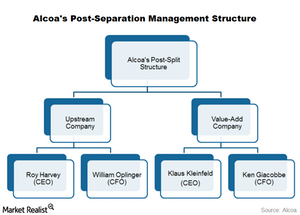

Alcoa (AA) is expected to release its 2Q16 earnings on July 11. The company is in the final stages of its split, which will create two new entities.

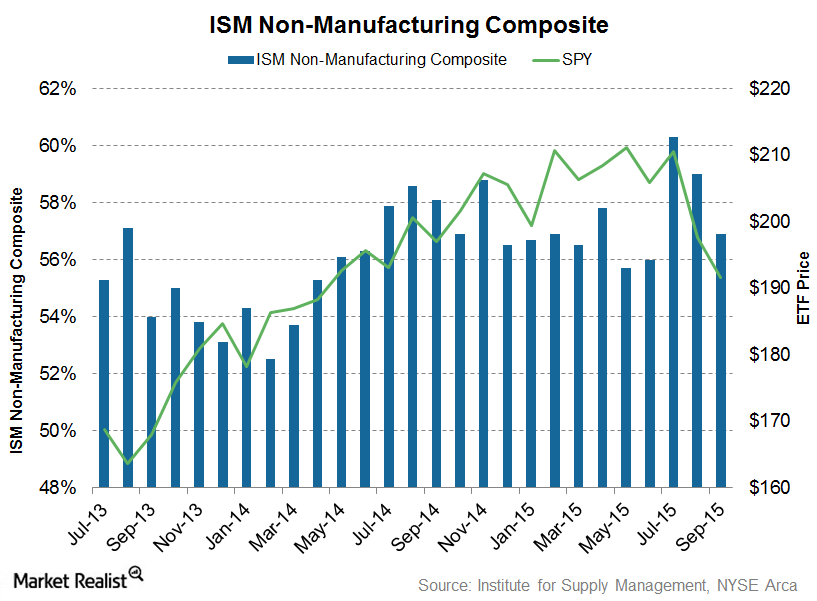

Expanding Service Sector Gives Relief to Economy in September

With manufacturing slowing, a reading of the Non-Manufacturing Index at an above-neutral level (56.9) may provide some relief to the US economy, which is highly dependent on the service sector for its economic growth.Materials Why Alcoa is improving its competitive position

Alcoa idled several smelting plants since 2007. Its aluminum smelting capacity has come down by 28% over the period. Most of these smelters had high unit production costs.

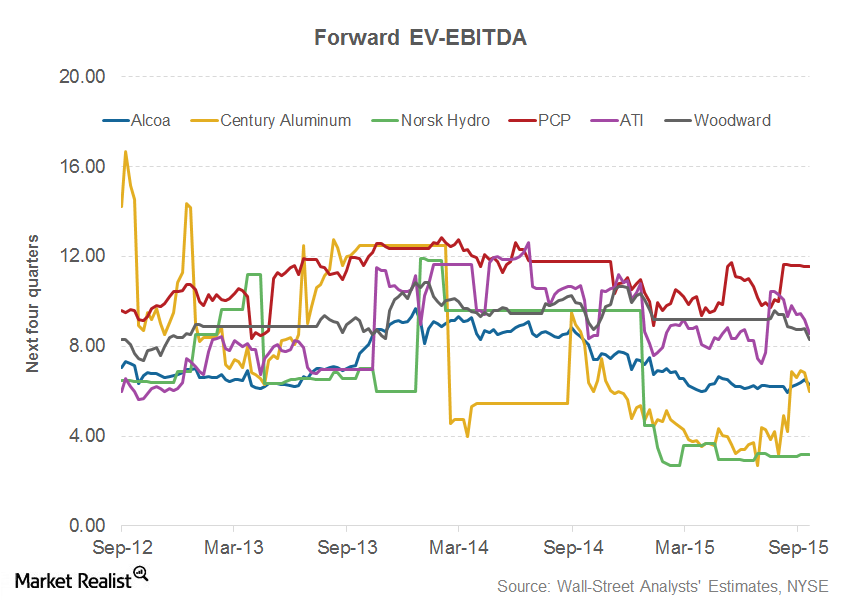

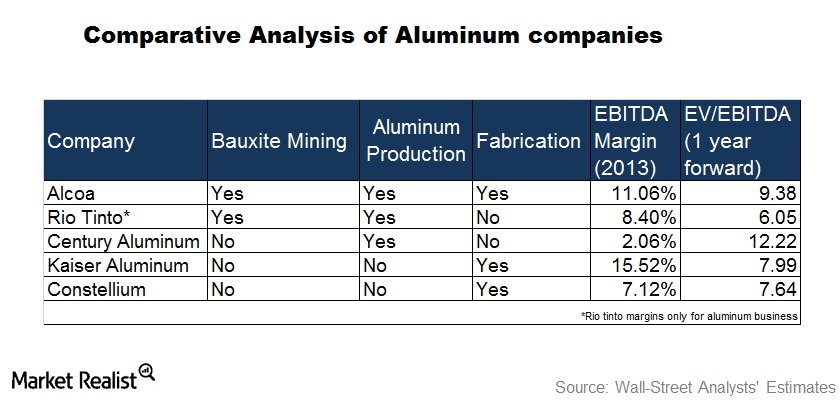

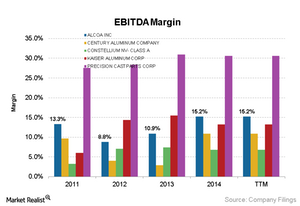

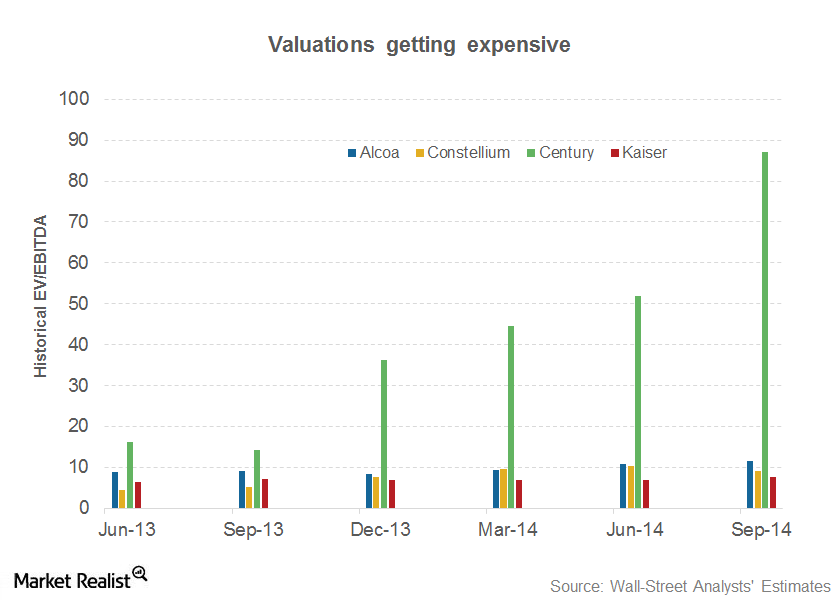

Aluminum company metrics compared

Trading on the London metal exchange determines the price for primary aluminum. Any increase in the price of aluminum benefits companies that produce primary aluminum.

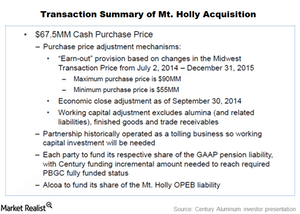

Was Alcoa Smart to Sell Mt. Holly Smelter to Century Aluminum?

In 2014, Alcoa (AA) sold its stake in the Mt. Holly smelter to Century Aluminum (CENX).

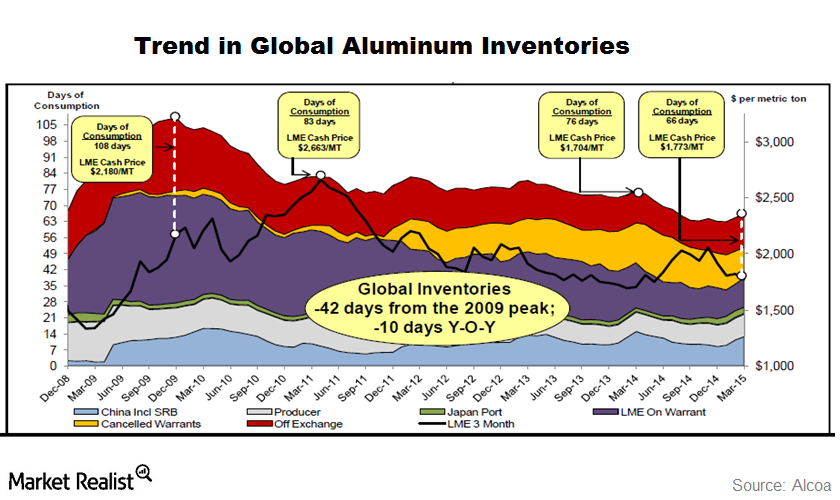

How Do Aluminum Inventories Work?

Aluminum inventories with London Metal Exchange (or LME) registered warehouses have declined this year. Aluminum inventories have been on a decline for almost two years.

Must Know: What Value Can Elliott Management Add to Alcoa?

Elliott Management noted that it plans to engage in a “constructive dialogue” with Alcoa’s (AA) board regarding Alcoa’s split transaction and “additional available opportunities to maximize shareholder value.”

Alcoa Is Optimistic about Aluminum’s 2018 Outlook

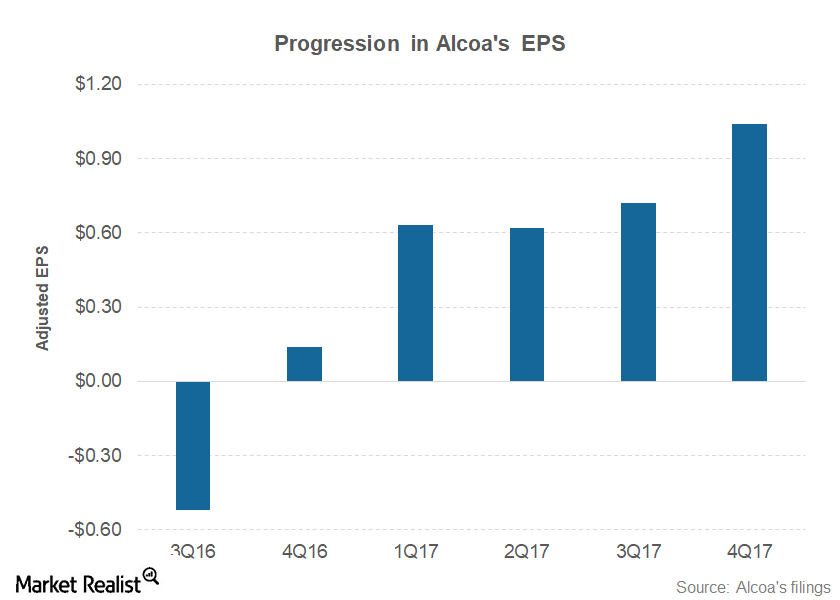

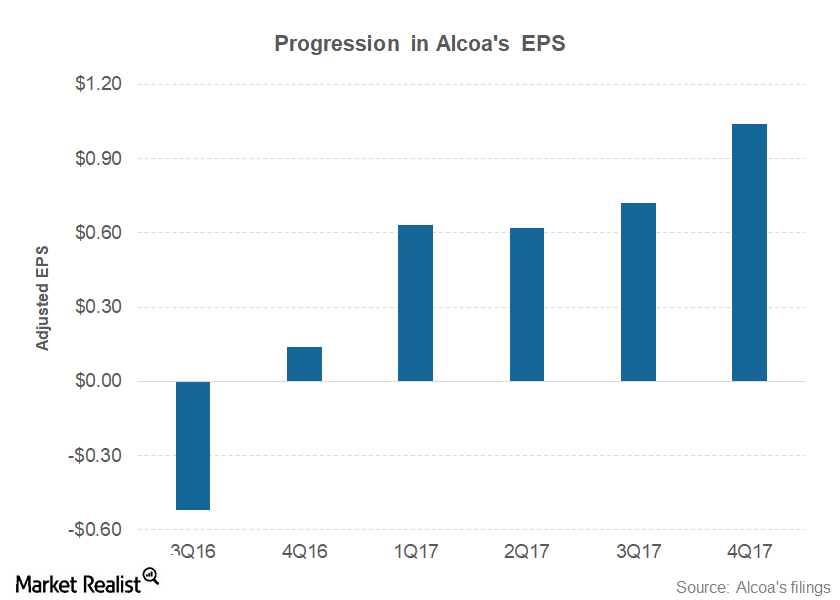

Alcoa (AA) reported its 4Q17 earnings on January 17, 2018, after the markets closed. The company posted an adjusted EPS of $1.04 in 4Q17.

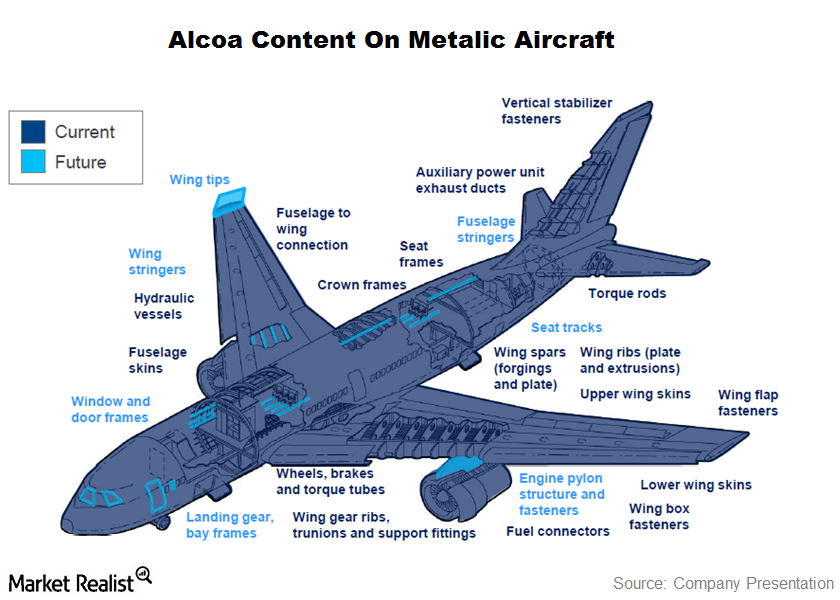

Must-know: Alcoa’s Aerospace Segment Is Important

The aerospace segment is the one of the biggest aluminum consumers in the world. Alcoa (AA) got $4 billion in revenue from aerospace companies last year.

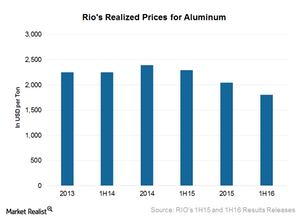

Rio’s Aluminum Division Didn’t Bow to Commodity Price Pressures

Rio Tinto’s (RIO) Aluminum division contributed 19% of its 1H16 underlying EBITDA (or earnings before interest, tax, depreciation, and amortization).

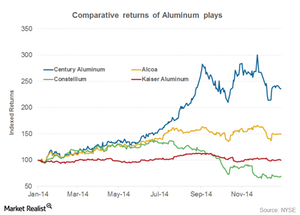

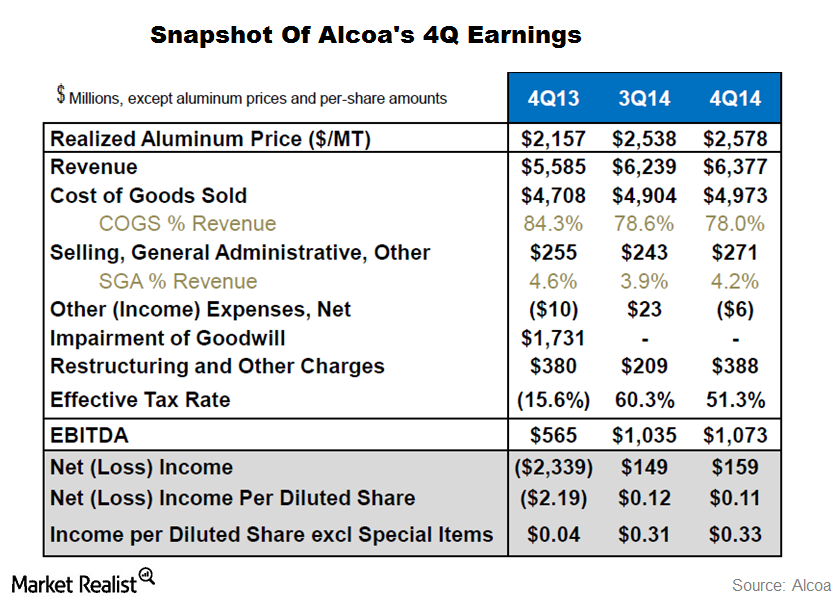

How Alcoa Looked In 2014

In this series, we’ll pay special attention to Alcoa’s 2014 performance and to how investors can play Alcoa and other aluminum companies in 2015.

Why Profit Margins Vary across the Aluminum Value Chain

The profit margins vary across the aluminum value chain. Upstream aluminum producers’ earnings depend on their position on the cost curve.

Arconic’s Tough Beginning: Controversies and Battles

Arconic is scheduled to release its 1Q17 earnings on April 25. ARNC was listed as a separate entity on November 1, 2016, when Alcoa split into two entities.Materials Must-know: Playing the aluminum value chain

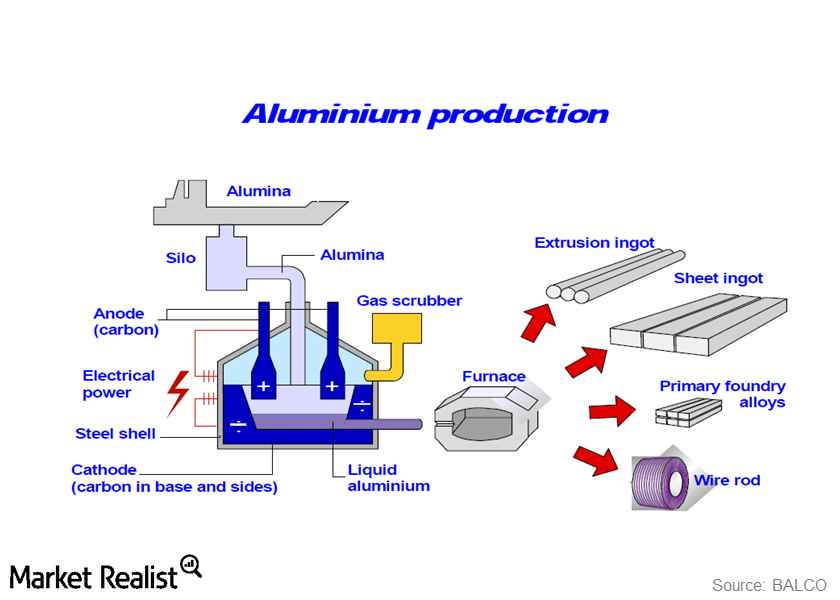

Bauxite is the most abundant metal in the earth’s crust. Because of the many impurities in bauxite, it must be refined to produce alumina.

Alcoa Beats Wall Street Expectations Again

Aluminum premiums more than doubled in 2014, which benefited primary producers like Rio Tinto and BHP Billiton.Materials Why investors need to understand the cost curve

Primary aluminum and alumina are commodity products. Producers don’t have much control over their pricing. The prices are decided by market dynamics.

Will Elliott Management Start Taking an Active Interest in Alcoa?

Elliott Management plans to engage in a “constructive dialogue” with Alcoa’s board about Alcoa’s split transaction and “additional available opportunities to maximize shareholder value.”

Markets Will Await These Updates from Alcoa’s 1Q17 Earnings Call

In 1Q17, there were rumors that Rio Tinto (RIO) could acquire Alcoa.

China’s Supply-Side Reforms Could Impact Aluminum in 2018

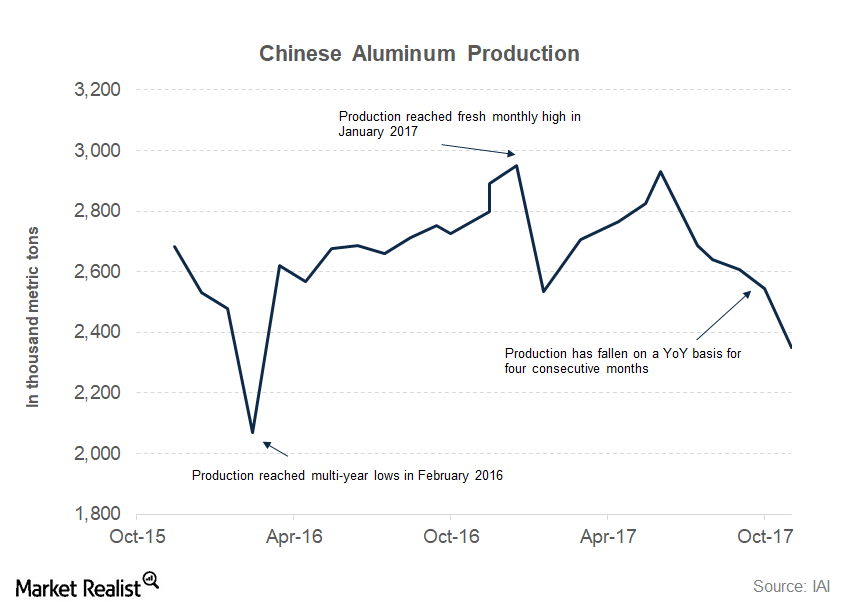

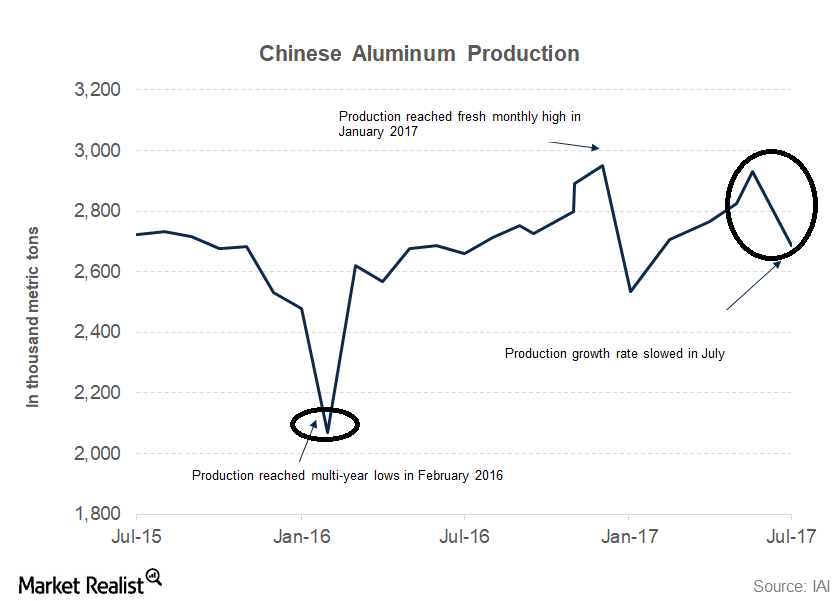

Alcoa (AA) expects global aluminum demand to exceed supply in 2018 on China’s supply-side reforms.

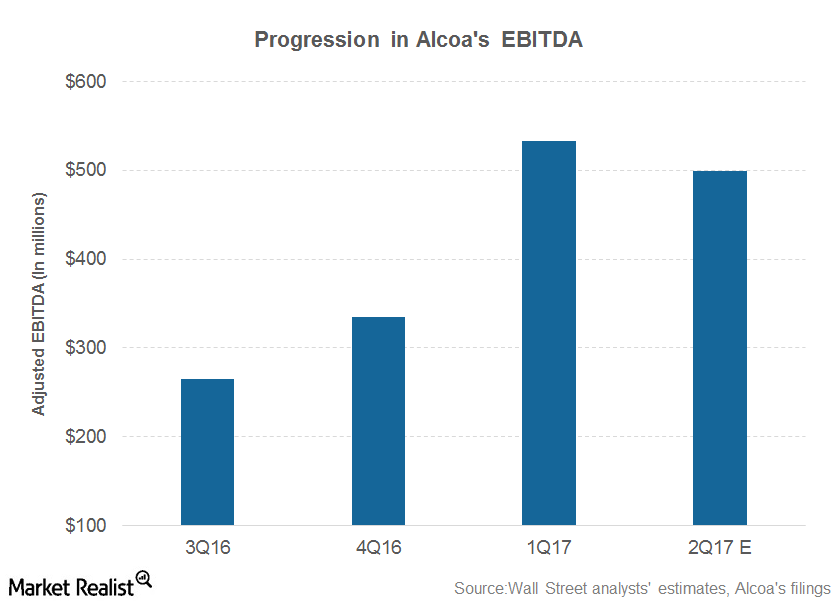

Alcoa’s 1Q17 Earnings: What Investors Need to Know

Alcoa (AA) released its 1Q17 earnings on April 24 after the markets (MDY) (MID-INDEX) closed. It held the conference call the same day.

Must-know: 3 risks that aluminum company investors face

Litigations can be a big blow for aluminum producers. Litigations are expected to decrease aluminum prices and premiums. This will be negative for aluminum companies like Alcoa Inc. (AA), Century Aluminum (CENX), Kaiser Aluminum Corp. (KALU), and Constellium (CSTM).

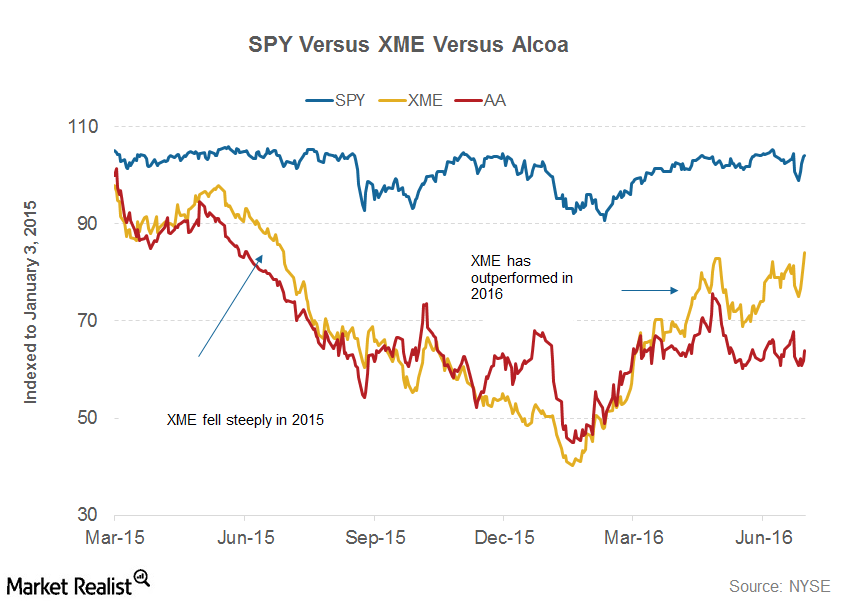

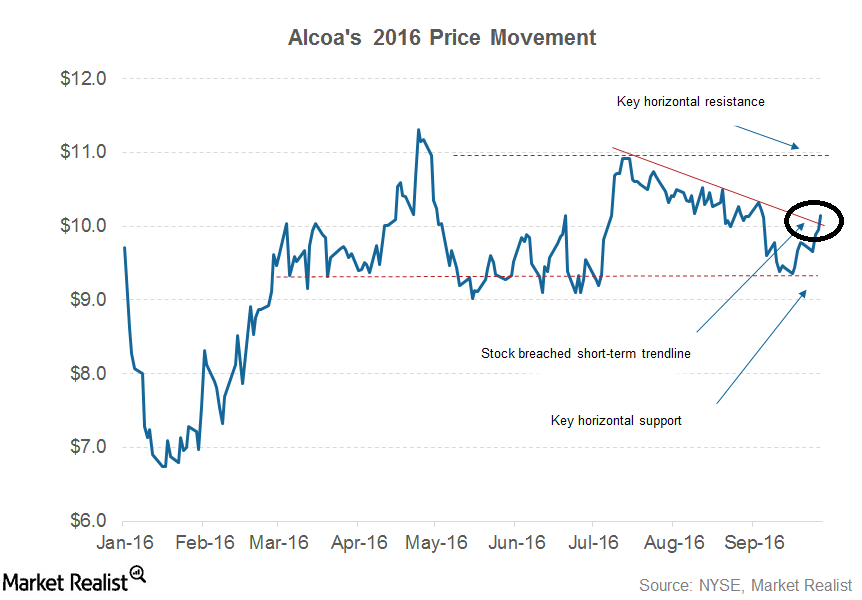

A Look at Alcoa’s Technical Indicators before Its 3Q16 Release

Alcoa’s technical indicators To make market entry and exit decisions, traders and investors analyze technical indicators. Resistance and support levels are among the most commonly used technical indicators. Resistance level Support levels typically act as a floor for stock prices. As a stock approaches its support levels, more buyers emerge while selling pressure generally subsides. […]

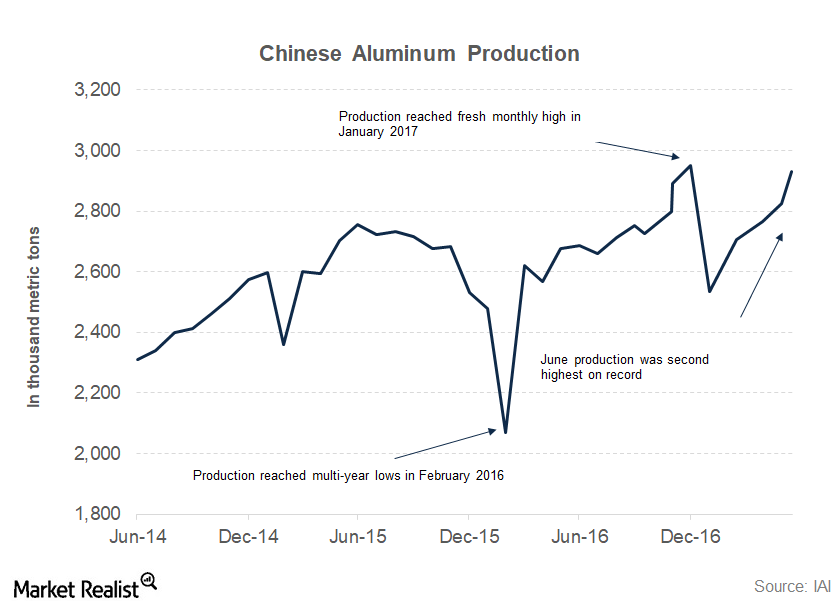

Should Alcoa Bears Like Their Chances in 2017?

Higher Chinese aluminum production could spoil the party that companies such as Alcoa and Century Aluminum (CENX) are currently enjoying.Materials Why Alcoa is positioned well to serve the automotive industry

Alcoa is working to expand its capacity in Tennessee. It’s a $275 million investment. Alcoa expects that the facility will be operational by mid-2015.

Challenges that aluminum faces as a steel replacement

Using aluminum, instead of steel, increases the vehicles’ manufacturing costs. With lower energy prices, analysts’ doubt that consumers will pay extra to purchase an all-aluminum body vehicle.

Should You Sell Alcoa Stock before Its Q1 Earnings Release?

Alcoa will likely report its first-quarter earnings on April 22 after the markets close. The stock has risen sharply from its March lows.

Why Aluminum Is An Important Metal For Investors

Investors like aluminum. They can play the aluminum industry by trading aluminum on commodity exchanges. Investors can also investment in aluminum plays.

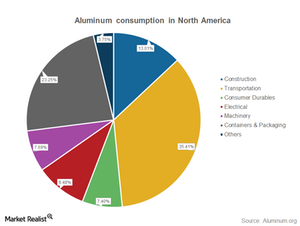

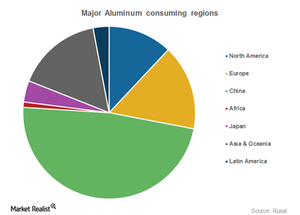

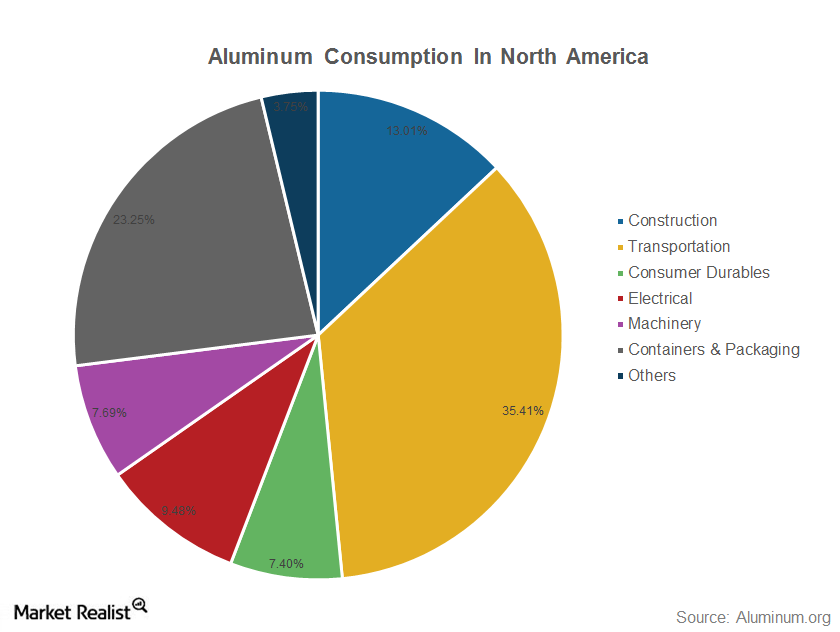

What Are The Major Regions That Consume Aluminum?

China is the biggest consumer. It consumes almost half of the aluminum that’s produced globally. However, this isn’t surprising. China is the biggest consumer of most industrial commodities.

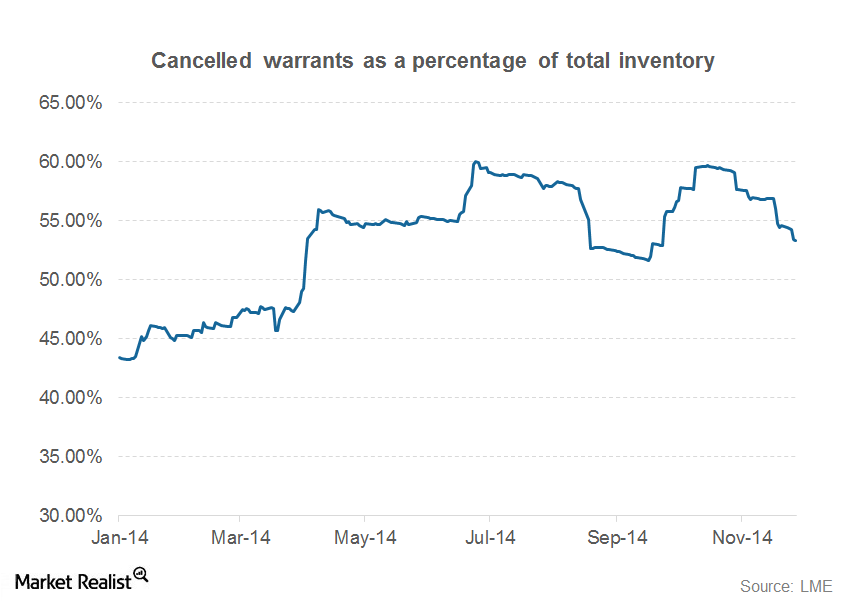

What Investors Need to Know About Aluminum Warrants

Analysts expect that most of the metal has been moving away from LME registered warehouses to non-LME registered warehouses, which typically charge less rent than registered warehouses.

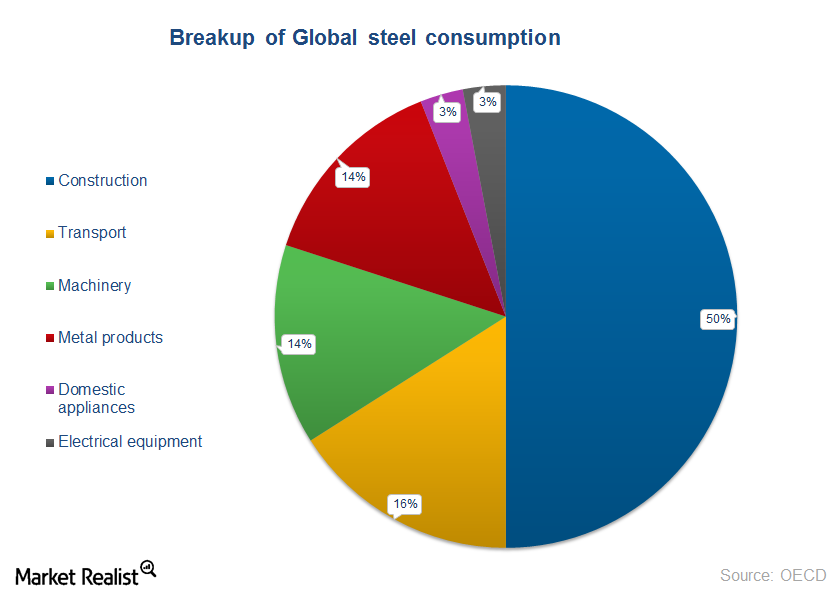

Why the automobile industry is important for metal companies

Automobile companies are one of the biggest metal product consumers. Steel and aluminum are widely used in the automobile industry. Aluminum is being used more in automobiles.Materials Why investors should understand Alcoa’s business model

Alcoa is an integrated player in the aluminum value chain. This means its operations extend from bauxite refining to aluminum fabrication.

Get Real: Why Is the Market Restless?

In today’s Get Real, we saw Tesla’s plans for China, AMD’s expectations for 2020, the state of crude oil prices, and more.

Overview: An investor’s guide to the aluminum industry

Aluminum is the most abundant metal found in the earth’s crust. It’s soft, lightweight, and durable in nature. Its low density and resistance to corrosion make it a very important metal that a lot of industries use.

Must-know: Understanding aluminum’s value chain

The aluminum industry has a value chain that consists of both upstream and downstream companies. Upstream companies are engaged in the mining and refining operations.

Get Real: Misunderstood and Undervalued?

In today’s Get Real, we focused on Bill Ackman’s Berkshire Hathaway comments, Mexico’s major cannabis milestone, earnings season, and much more.

China or US Consumers: Who’s Paying the Tariffs?

In March, President Trump imposed a 10% tariff on US aluminum imports apparently to protect US aluminum producers from imports.

Trump Tariffs: Why Alcoa’s Fears Are Coming True

Last year, President Trump slapped a 10% tariff on US aluminum imports. Alcoa didn’t support the tariffs in the first place.

Alcoa’s Q2 Earnings Report and Conference Call

On Wednesday, Alcoa (AA) released its second-quarter earnings report after the markets closed. The company reported revenues of $2.71 billion.

Analyzing Alcoa’s 2019 Outlook

On paper, aluminum’s fundamentals look strong. Aluminum markets were expected to be in a deficit of 1.5 million metric tons last year.

How Alcoa Fared in 4Q17

While Alcoa’s 4Q17 earnings rose sharply as compared to previous quarters, the quarterly results fell short of expectations.

Aluminum Supply: What Investors Should Watch in 2018

After its split, Alcoa (AA) became a pure-play aluminum producer (S32) (CENX). Like other aluminum producers, Alcoa’s fortunes are tied to metal prices.

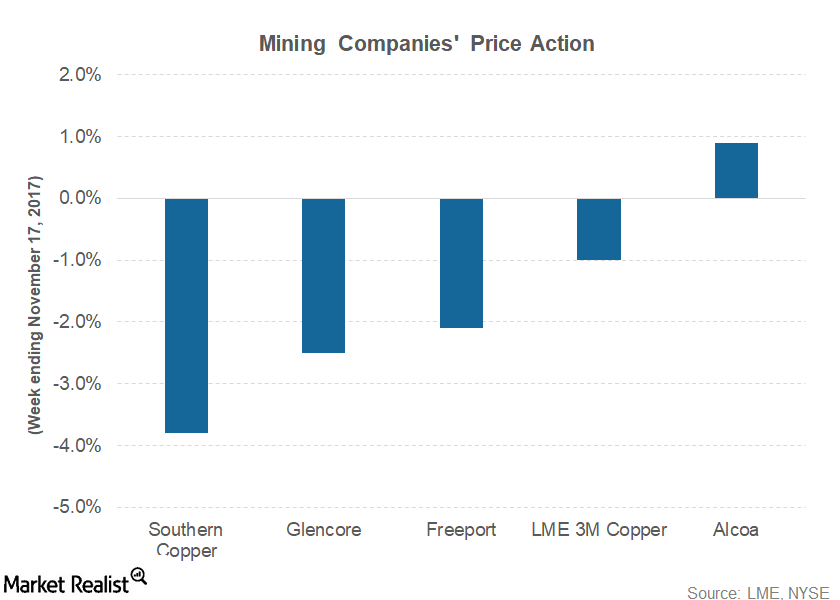

Metal Prices Fell on Demand Concerns Last Week

In this series, we’ll look at the key developments that impacted mining companies last week. We’ll also look at some of the company-specific developments that impacted mining stocks.

Alcoa Continues Its Rally as China Keeps Its Commitment

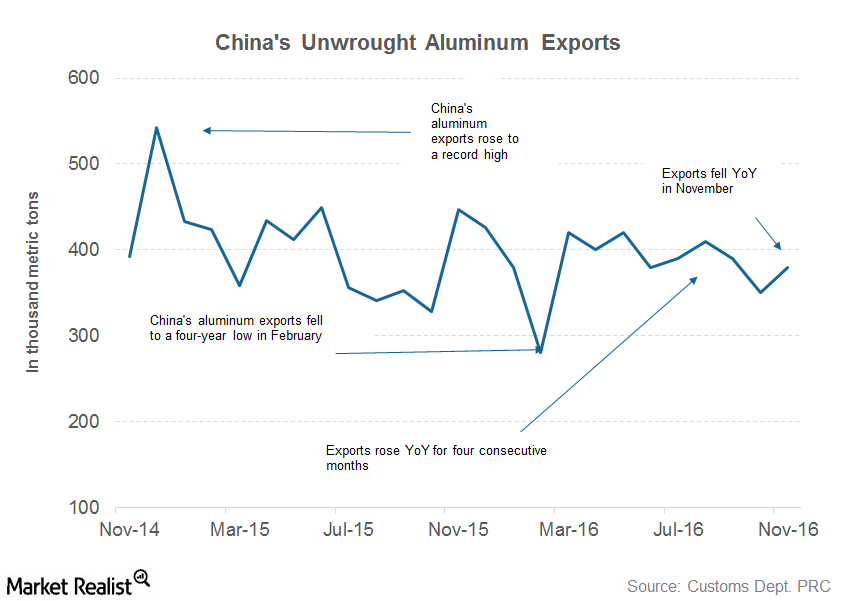

China exported 370,000 metric tons of unwrought aluminum in September, compared to 410,000 metric tons in August.

Aluminum’s Outlook: What Investors Can Expect

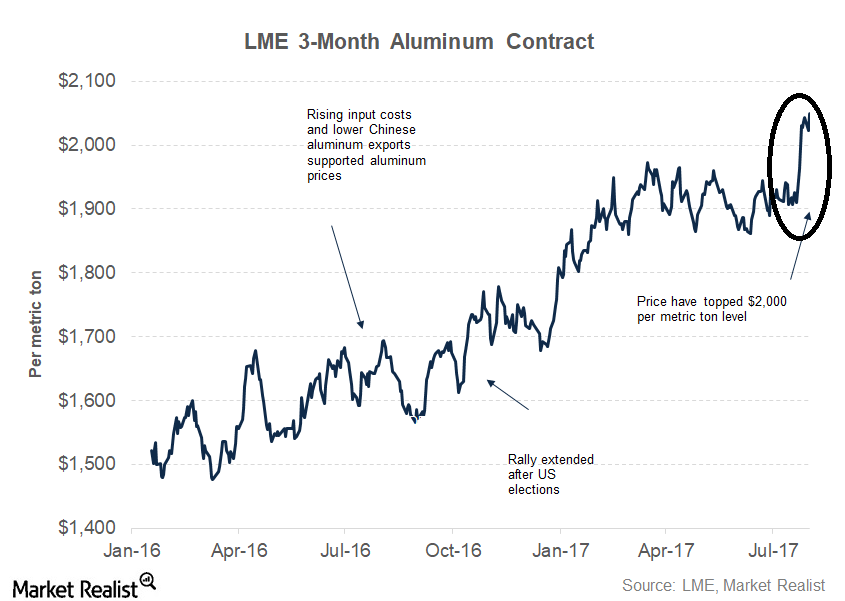

Aluminum prices have been strong in 2017 and have built on last year’s gains. The entire industrial metals space has come a long way since 1Q16.

Aluminum Prices Defy Gravity and Maintain the $2,000 Level

Aluminum prices have gained more than 22% so far in 2017. This trend was preceded by a 13.6% rise in 2016.

Is China Cutting Aluminum Capacity? Analyzing Producers’ Views

As we noted previously, aluminum prices have been strong this year. Strength has been driven by positive supply and demand dynamics.