Alcoa Is Optimistic about Aluminum’s 2018 Outlook

Alcoa (AA) reported its 4Q17 earnings on January 17, 2018, after the markets closed. The company posted an adjusted EPS of $1.04 in 4Q17.

Nov. 20 2020, Updated 3:32 p.m. ET

Aluminum’s 2018 outlook

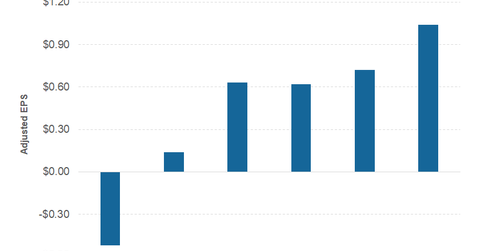

Alcoa (AA) reported its 4Q17 earnings on January 17, 2018, after the markets closed. The company posted an adjusted EPS (earnings per share) of $1.04 in 4Q17. It posted an adjusted EPS of $0.72 in 3Q17 and $0.14 in 4Q16. Alcoa’s 4Q17 earnings fell short of analysts’ top line and bottom line estimates. Alcoa’s 2018 guidance also spooked the markets. The company expects higher raw material prices (AWC), especially for caustic and graphite, to hit its 2018 earnings. Read How Alcoa Fared in 4Q17 for a detailed analysis of Alcoa’s 4Q17 earnings and 2018 guidance.

Alcoa’s 4Q17 earnings miss triggered a selling spree and the stock lost 7.0% on January 18. Alcoa pared all of its 2018 gains. Markets gave a thumb down to its 4Q17 financial performance. Previously, Alcoa had a strong 2017 and the stock gained 91.2% last year.

Series overview

For commodity producers like Century Aluminum (CENX) and South32 (S32), the macro outlook is equally if not more important than the company’s relative position in the industry. Commodity producers’ earnings are sensitive to underlying commodity prices—something they don’t have much control over.

Being a pure-play aluminum producer (XME), Alcoa’s performance is driven by aluminum market dynamics. In this series, we’ll see what Alcoa had to say about the aluminum industry’s 2018 outlook during its 4Q17 earnings call.

Let’s start by analyzing what Alcoa projects for the 2018 aluminum demand-supply dynamics.