Alumina Limited

Latest Alumina Limited News and Updates

Alcoa Is Optimistic about Aluminum’s 2018 Outlook

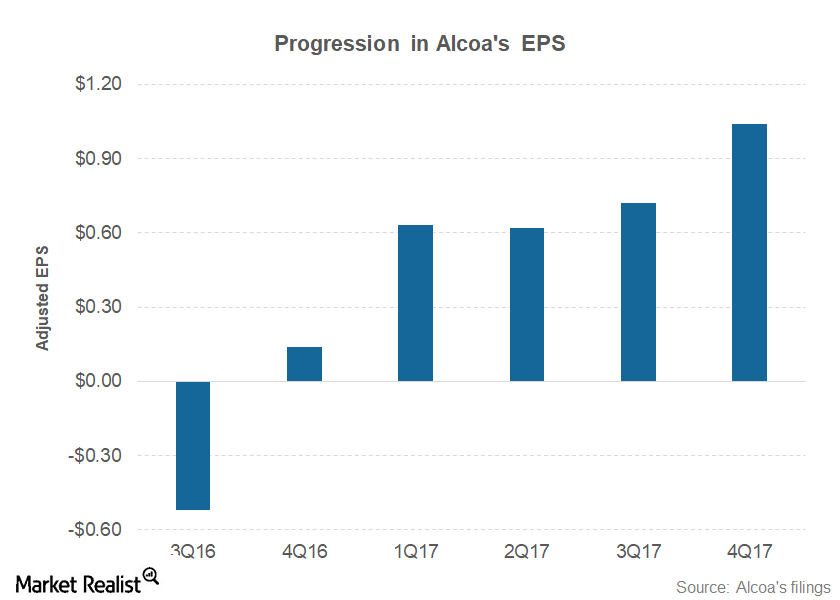

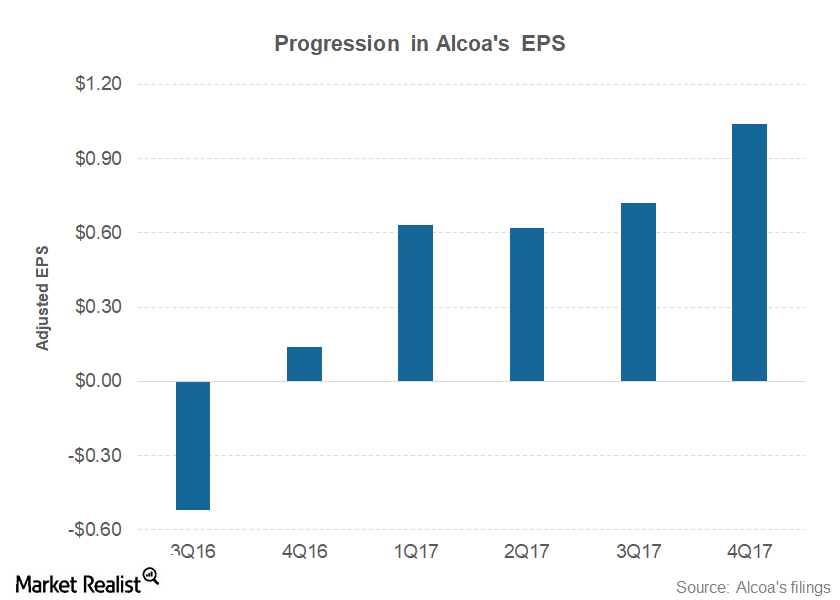

Alcoa (AA) reported its 4Q17 earnings on January 17, 2018, after the markets closed. The company posted an adjusted EPS of $1.04 in 4Q17.

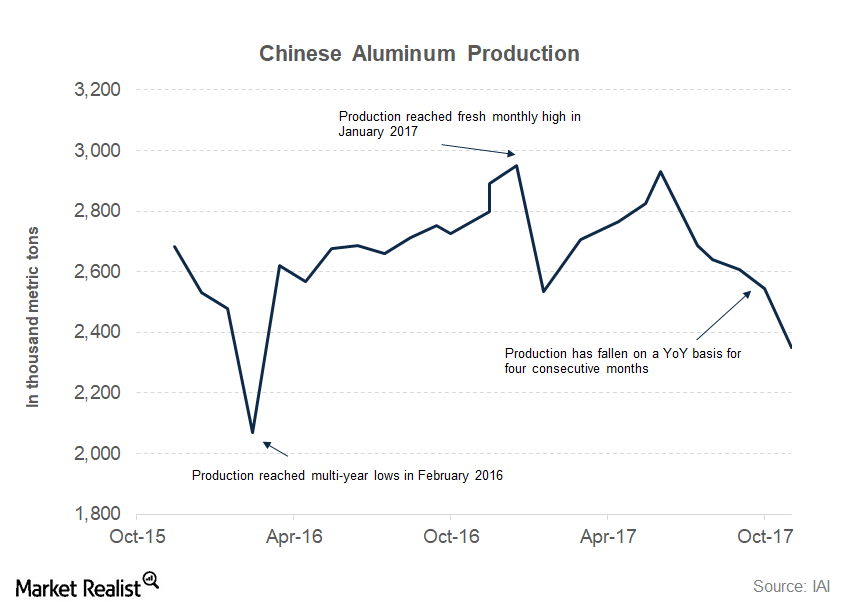

China’s Supply-Side Reforms Could Impact Aluminum in 2018

Alcoa (AA) expects global aluminum demand to exceed supply in 2018 on China’s supply-side reforms.

Analyzing Alcoa’s 2019 Outlook

On paper, aluminum’s fundamentals look strong. Aluminum markets were expected to be in a deficit of 1.5 million metric tons last year.

How Alcoa Fared in 4Q17

While Alcoa’s 4Q17 earnings rose sharply as compared to previous quarters, the quarterly results fell short of expectations.

Aluminum Supply: What Investors Should Watch in 2018

After its split, Alcoa (AA) became a pure-play aluminum producer (S32) (CENX). Like other aluminum producers, Alcoa’s fortunes are tied to metal prices.