Alcoa Corp

Latest Alcoa Corp News and Updates

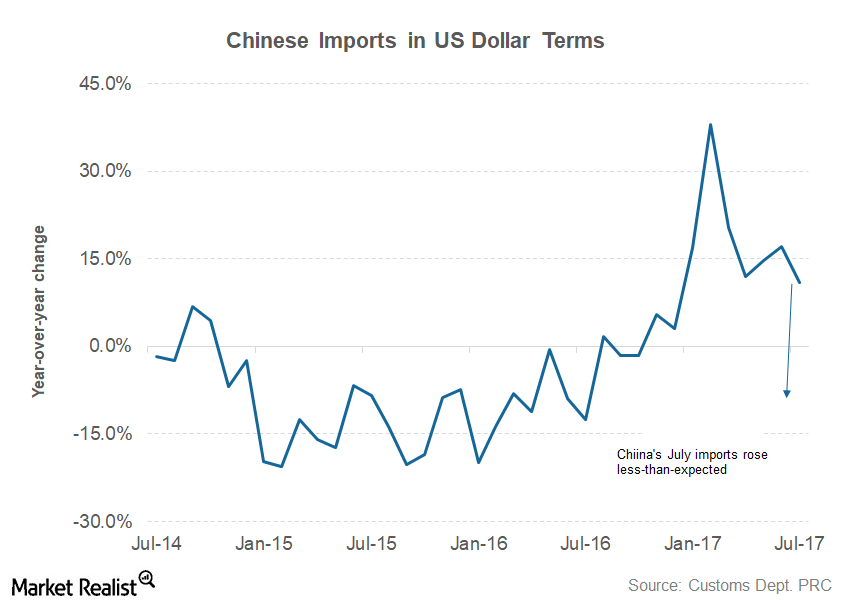

Will China’s Disappointing July Trade Deflate Metal Bulls?

On August 8, China released its trade data for July. The country’s exports in dollar terms rose 7.2% compared to July 2016 while imports rose 11%.

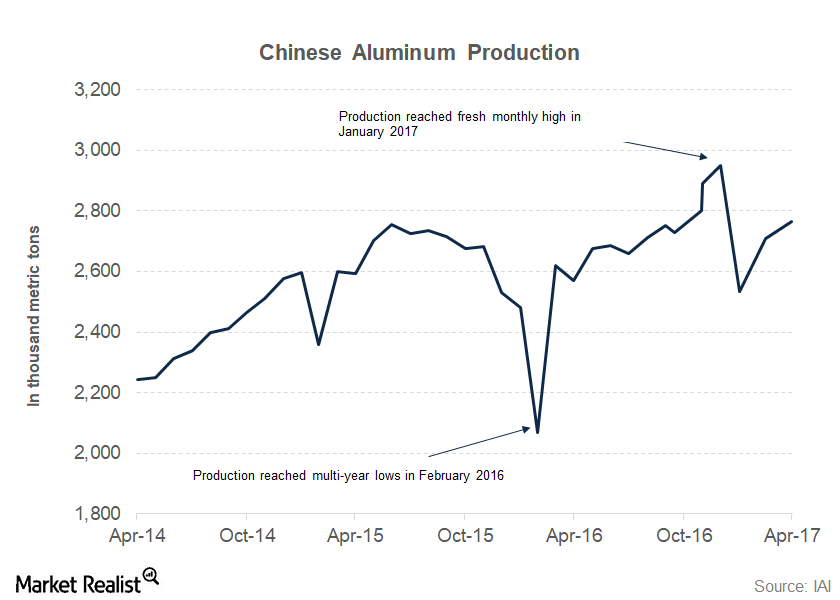

Analyzing China’s Aluminum Production Data

China produced ~2.76 million metric tons of aluminum in April—a YoY increase of 7.6%. Its production has risen 12.0% YoY in the first four months of 2017.

Could Wilbur Ross and Donald Trump Be Alcoa’s Saviors?

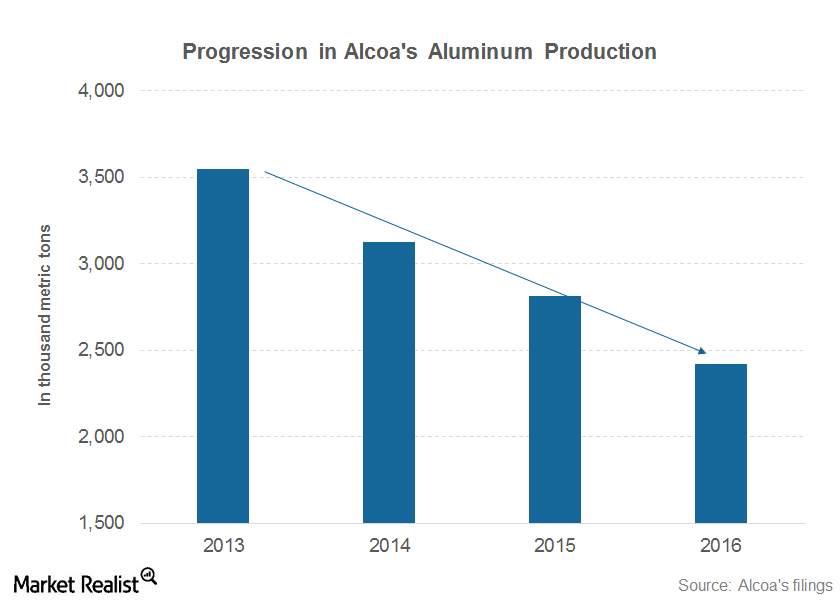

Alcoa and Century Aluminum (CENX) survives the commodity price slump by closing their high-cost capacities and negotiating better power deals for several operating plants.

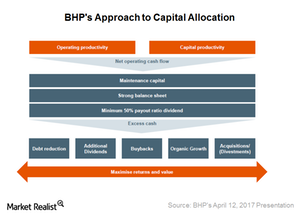

Cyclical Nature of BHP’s Business and Mechanistic Share Buybacks

The third element of Elliott Funds’ “value unlock” plan for BHP Billiton (BHP) (BBL) is the adoption of a policy of consistent and optimized capital returns to shareholders.

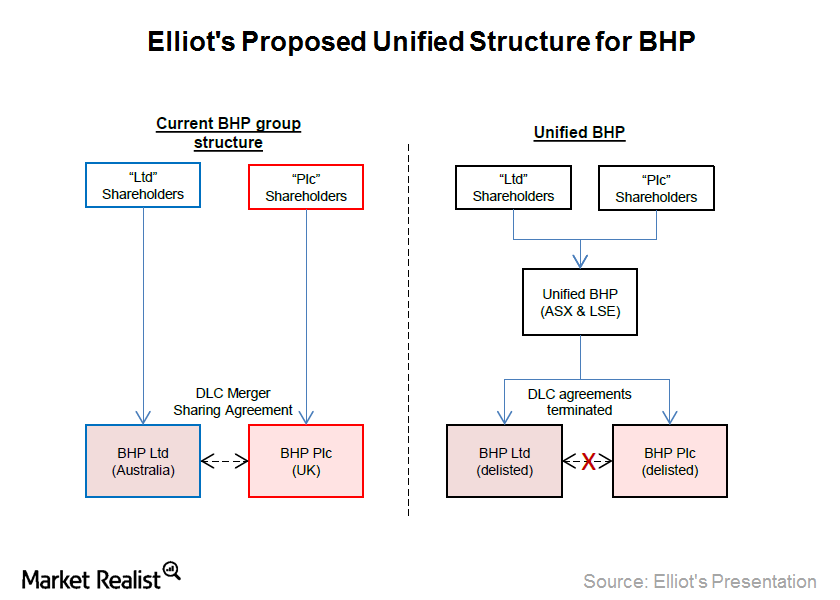

A Unified Structure for BHP: Do the Costs Outweigh the Benefits?

Elliott Funds has proposed unifying BHP Billiton’s (BHP) (BBL) dual-listing structure into a single Australian-headquartered and Australian tax resident–listed company.

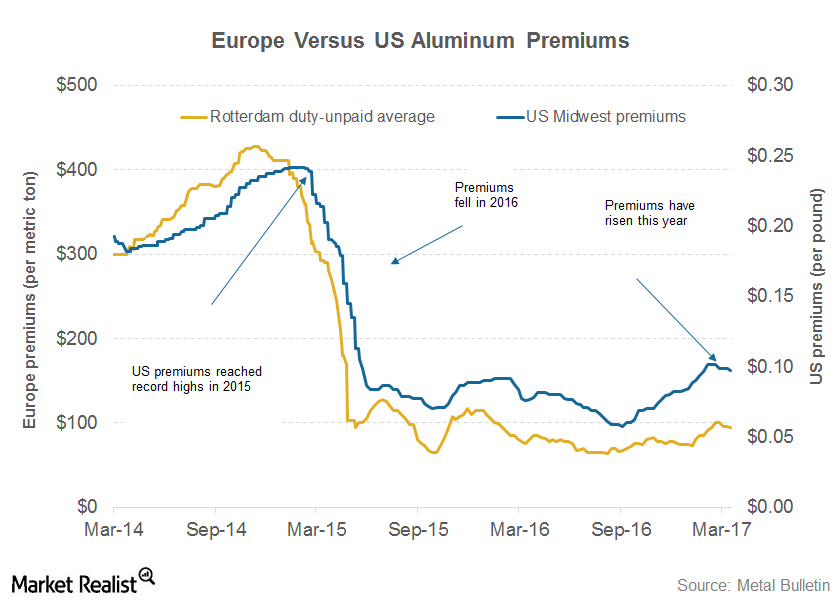

What Should Alcoa Investors Make of Aluminum Premiums?

Aluminum premiums are key indicators that investors in primary producers such as Century Aluminum (CENX), Norsk Hydro (NHYDY), and Rio Tinto (RIO) should track.

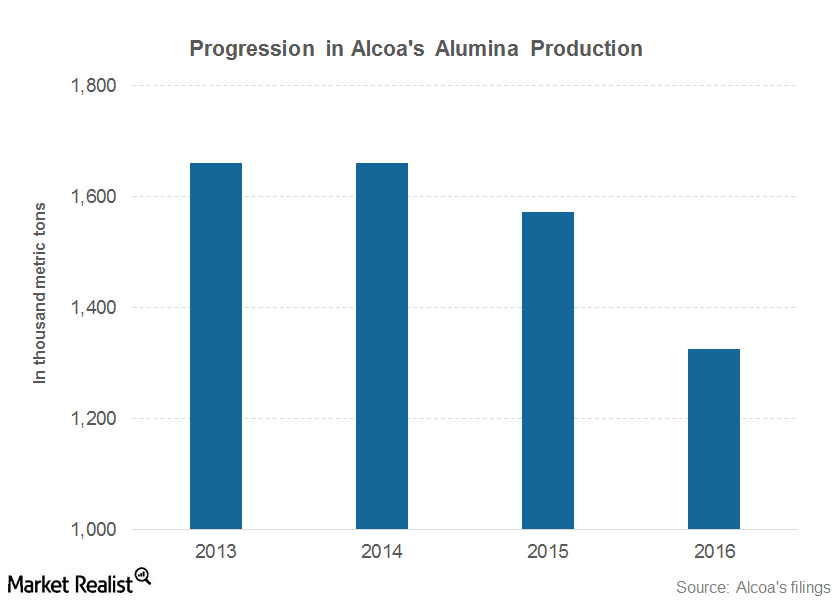

Alcoa’s 2017 Guidance: Everything You Need to Know

Alcoa (AA) expects its alumina shipments to range from 13.8 million–13.9 million metric tons in fiscal 2017 compared to 13.2 million metric tons in fiscal 2016.

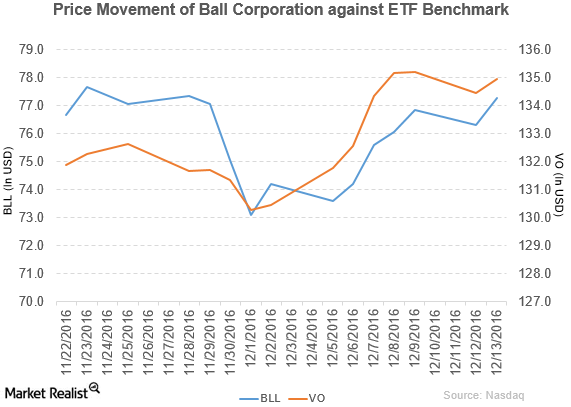

What’s the Latest News on Ball Corporation?

Ball Corporation (BLL) reported 3Q16 net sales of $2.8 billion, a rise of 33.3% compared to net sales of $2.1 billion in 3Q15.

How Did Ball Corporation’s 3Q16 Results Turn Out?

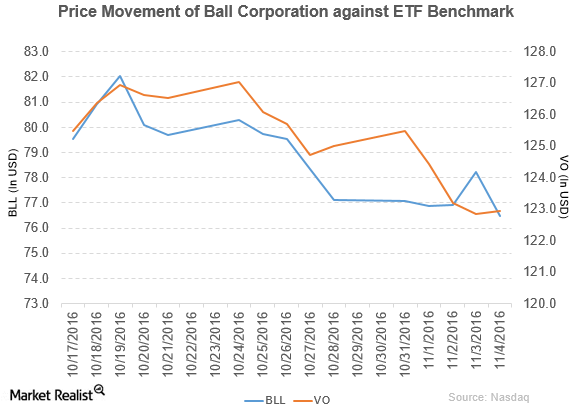

Ball Corporation (BLL) fell 0.80% to close at $76.48 per share during the first week of November 2016.

Ball Corporation Declares Dividend of $0.13 per Share

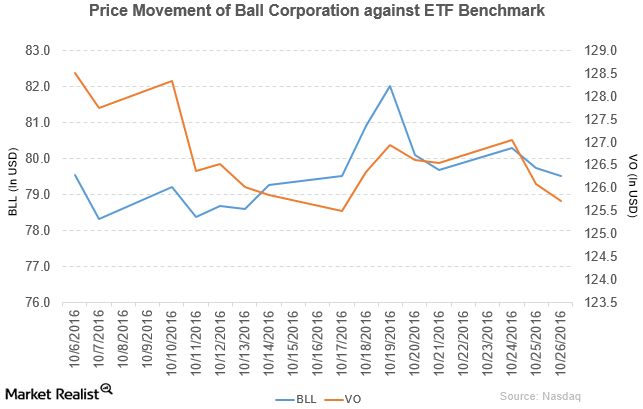

Ball Corporation (BLL) has a market cap of $13.9 billion. It fell 0.28% to close at $79.53 per share on October 26, 2016.

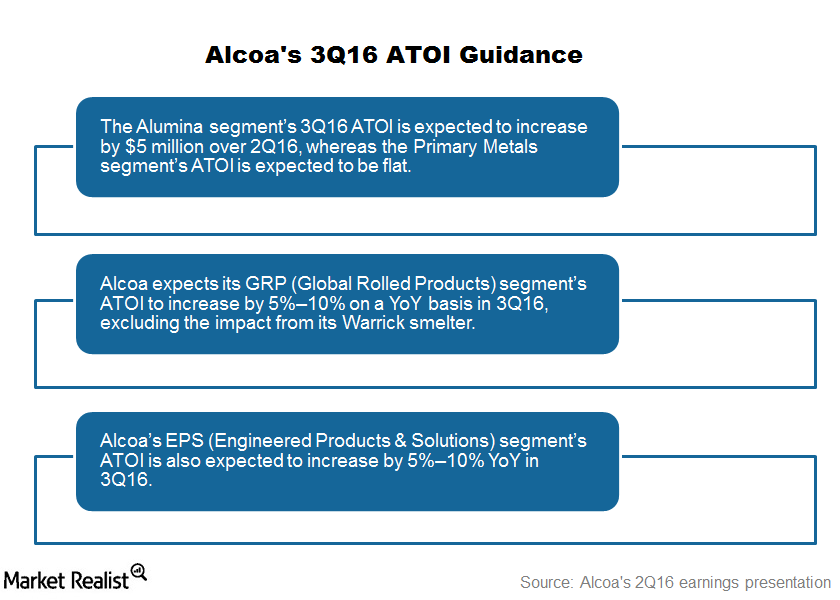

Alcoa’s 3Q16 Guidance: Everything You Need to Know

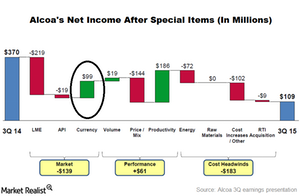

Alcoa’s 3Q16 guidance Previously, we looked at factors that could impact Alcoa’s (AA) 3Q16 revenues. In this part, we’ll look at the company’s profitability metrics. Note that there are several metrics you can use to measure an enterprise’s profitability. Alcoa releases a non-GAAP (generally accepted accounting principles) measure, the ATOI (after tax operating income). In […]

Ball Corporation Is Selling Its Specialty Tin Facility

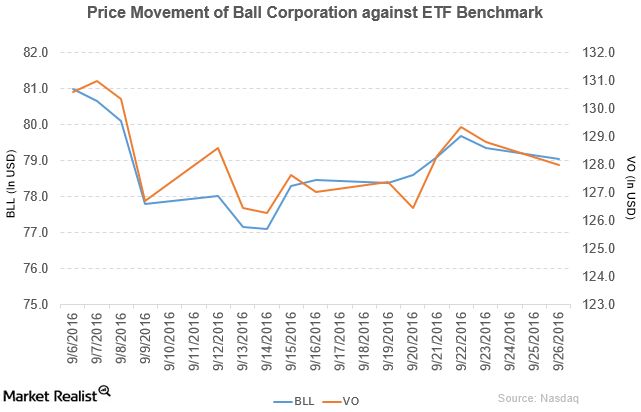

Ball Corporation (BLL) has a market cap of $13.8 billion. It fell 0.38% to close at $79.04 per share on September 26.

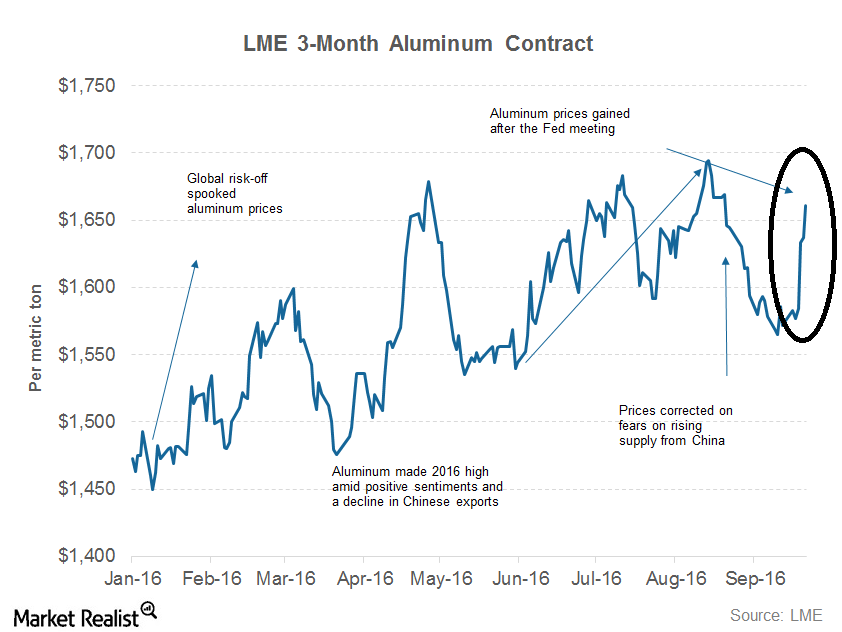

What’s Driving Aluminum Prices in 2016?

Aluminum prices have shown resilience this year. However, aluminum has been facing stiff resistance at $1,700 per metric ton.

Why Janus Thinks Ignoring Inflation Is a Mistake

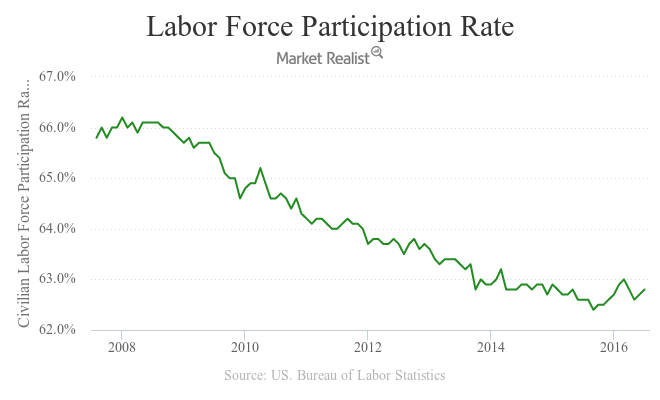

In this series, we’ll look at the Janus Asset Allocation team’s views on inflation, policy measures, and asset allocation (ITOT) (NEAR), given its assertion that inflation pressures are building.

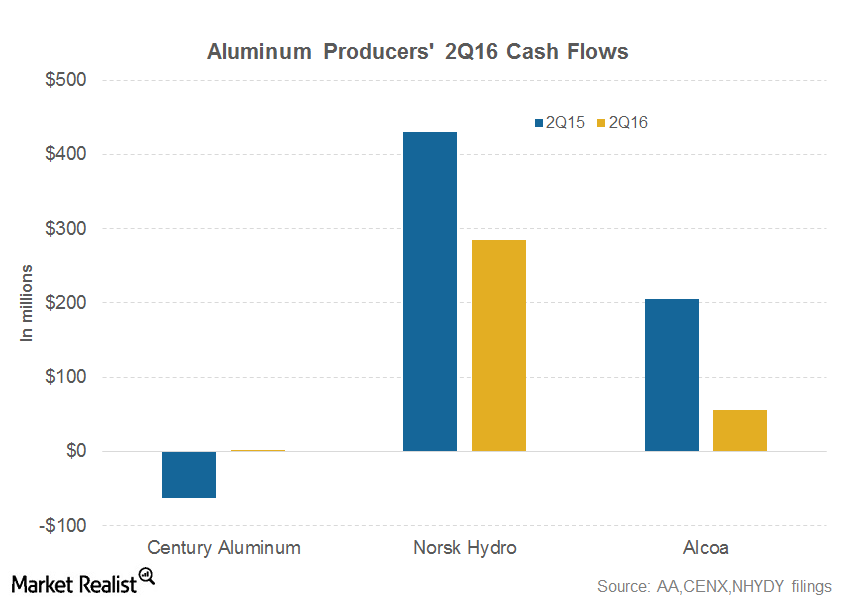

Can Alcoa Generate Positive Free Cash Flows in 2016?

Alcoa (AA) generated free cash flows of $55 million in 2Q16—compared to $205 million in the same quarter last year.

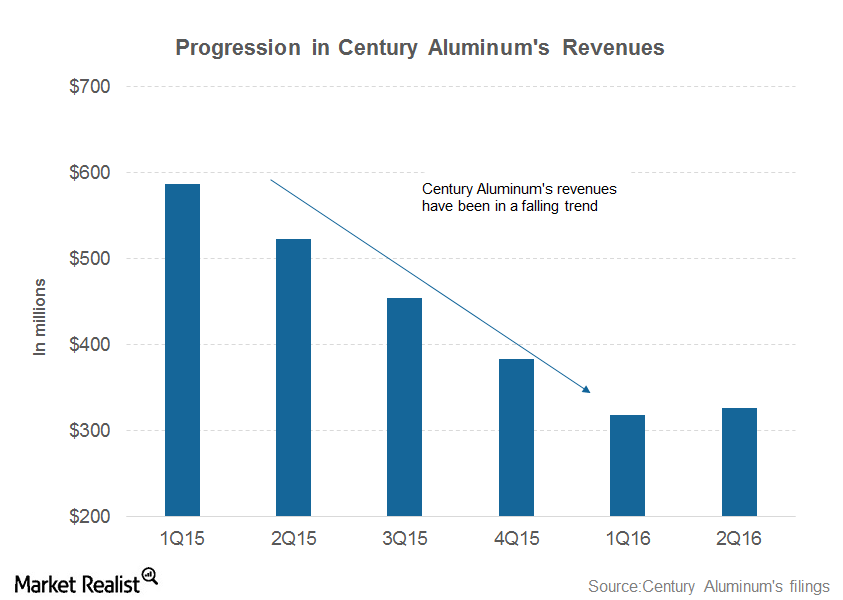

Century Aluminum Misses 2Q16 Revenues: Should You Be Concerned?

Century Aluminum reported revenues of $326 million in 2Q16. The revenue miss shouldn’t be a major concern given its performance on other metrics.

Can Higher Commodity Prices Boost Alcoa’s 3Q16 Earnings?

Alcoa expects its fiscal 2016 net income to rise by $160 million for every $100 per metric ton rise in aluminum prices.

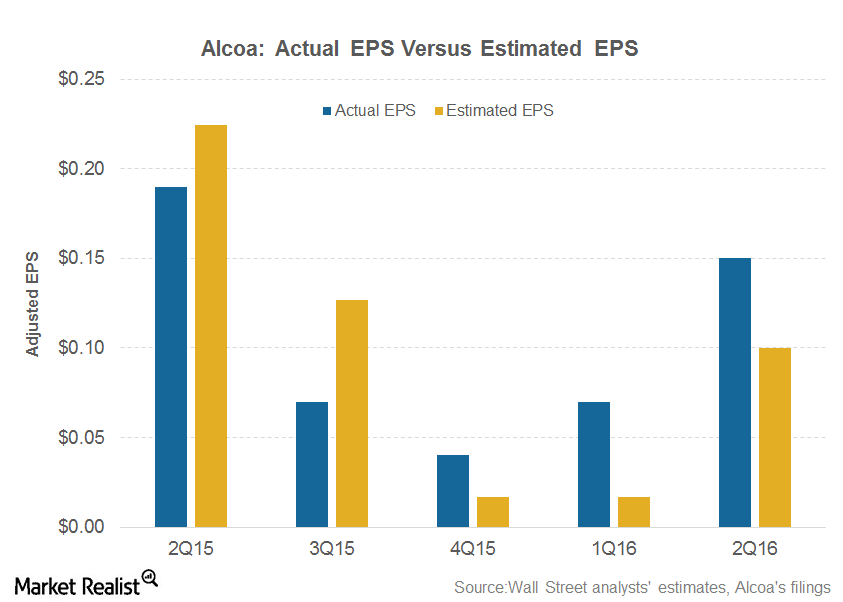

Alcoa’s 2Q16 Earnings: Everything You Need to Know

Alcoa (AA) reported its 2Q16 earnings yesterday after the market closed. Here’s what you should know.

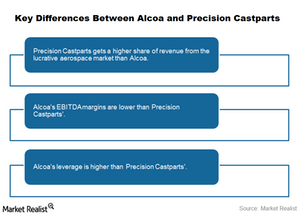

Arconic Isn’t Precision Castparts, and the Market Knows That!

Market participants who are bullish on Alcoa (AA) point to Berkshire Hathaway’s (BRK-B) acquisition of Precision Castparts.

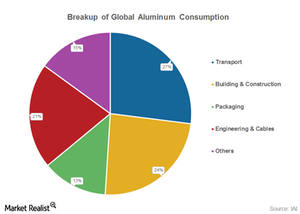

Will Aluminum Demand Grow 6% as Alcoa Is Projecting?

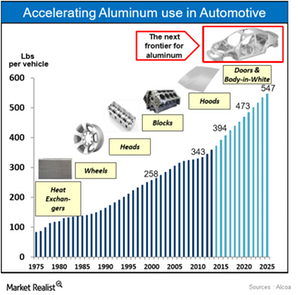

There are valid reasons for aluminum producers to feel upbeat about aluminum demand growth.

Rio Tinto Surprised the Markets with Dividend Policy Change

Rio Tinto’s 2015 results were mostly in line with market expectations. Underlying EBITDA and underlying profits were $12.6 billion and $4.5 billion, respectively.

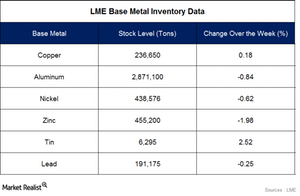

Base Metal Inventories Fell Last Week: How Much?

In the week ended January 9, copper and tin inventories increased. Levels for other base metals fell.

Alcoa’s Downstream Business Is Thriving: What about Upstream?

Alcoa’s upstream business has been gaining strength. It also has a downstream business, which produces alumina and primary aluminum.

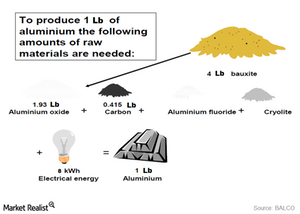

Why Are Alumina Prices a Key Driver for Aluminum Companies?

It can take almost two pounds of alumina to produce one pound of aluminum. Naturally, changes in alumina prices would impact aluminum’s production cost.

What Would a Stronger US Dollar Mean for Alcoa?

Alcoa’s value-add company will get a major portion of its revenues from Europe and is thus negatively impacted by a stronger US dollar.

The Auto Industry’s Aluminum Usage Is Increasing

The usage of aluminum in automobiles has been gradually increasing, as it improves vehicle performance, reduces CO2 emissions, and boosts fuel economy.

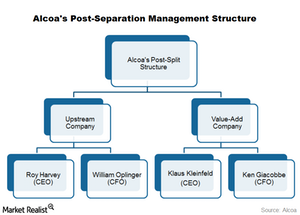

No Surprises in Alcoa’s Post-Separation Management Structure

On November 24, Alcoa announced the executive management structure to be introduced following its split.

What’s Driving Alcoa’s Stock?

Alcoa’s stock has witnessed a decent upwards move over the last few trading sessions, gaining more than 16% since November 12.

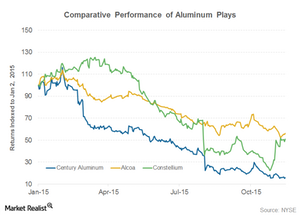

Will Century Aluminum Post a Larger-Than-Expected Loss in 3Q15?

Analysts expect Century Aluminum (CENX) to post a loss when it releases its 3Q15 results on October 29, 2015. Earnings season for the aluminum industry has started on a dull note.

Why Alcoa Did the Obvious and Is Splitting Its Value-Add Business

On September 28, Alcoa (AA) announced that it would split into two independent companies. The transaction is expected to be completed in the second half of 2016.

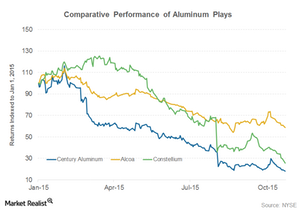

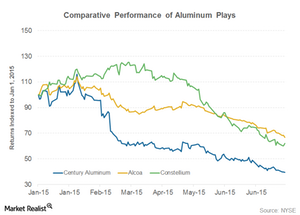

A Comparative Analysis of the Aluminum Industry

Aluminum is the second most widely used metal after steel. Investors have a special liking for aluminum. There are several ways to play the industry.

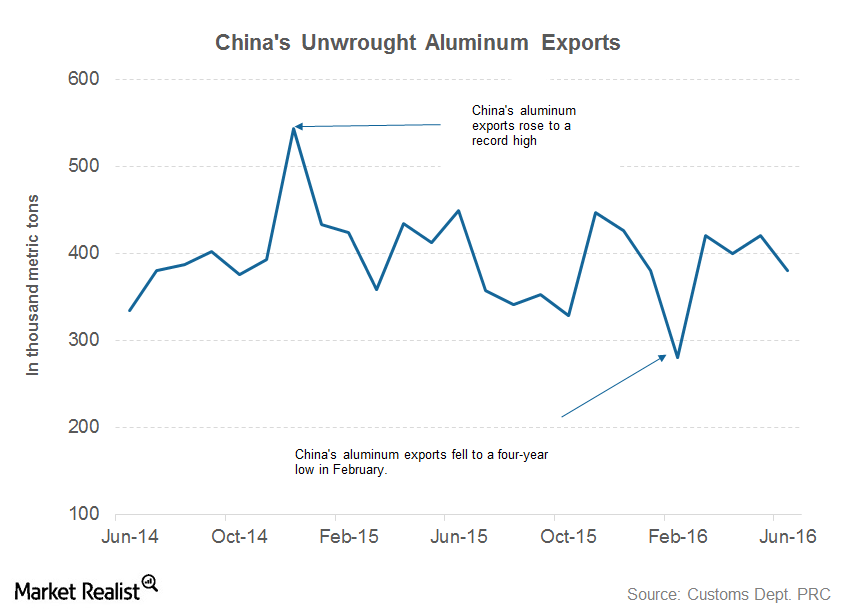

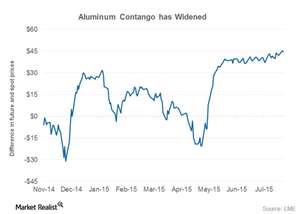

Aluminum Contango Widens as Market Expects Prices to Recover

A wider contango is generally associated with a short-term oversupply in the market. Aluminum market dynamics took a beating as China’s aluminum exports are reaching alarming levels.

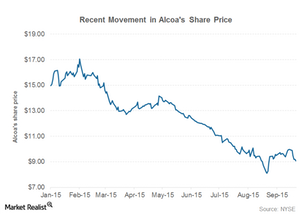

Alcoa at a 52-Week Low: What Should Investors Do?

Alcoa was trading at its 52-week low on July 23 and closed at $9.96—breaching the psychologically crucial level of $10 per share for two consecutive days.

Alcoa Continues to Sag as Aluminum Prices Fall Further

Aluminum prices have been in a downtrend for more than a month.

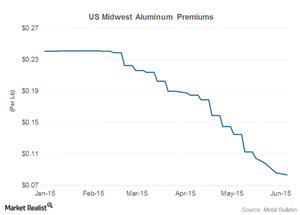

US Midwest Aluminum Premiums Are Still Caught in a Downtrend

Year-to-date, aluminum prices have lost ~9%, while physical aluminum premiums in the US have lost almost 60%.

Key Takeaways from Alcoa’s 1Q 2015 Earnings

Alcoa (AA) reported its 1Q 2015 earnings on April 8. It reported net income of $195 million on revenues of $5.8 billion.

Why Freeport Investors Should Track China’s Automobile Industry

China is the world’s biggest automotive market, where close to 22 million vehicles are sold each year. A mid-sized vehicle has ~50 pounds of copper content.

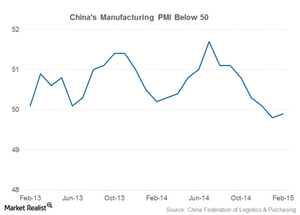

China’s manufacturing PMI below 50 for second consecutive month

China’s manufacturing PMI has been below 50 for two consecutive months. This reflects a slowdown in the Chinese economy and impacts industrial commodities.