Why Profit Margins Vary across the Aluminum Value Chain

The profit margins vary across the aluminum value chain. Upstream aluminum producers’ earnings depend on their position on the cost curve.

Nov. 20 2020, Updated 1:51 p.m. ET

Aluminum value chain

Profit margins vary across the aluminum value chain. Upstream aluminum producers’ earnings depend on their position on the cost curve. However, their earnings are highly volatile. They’re sensitive to aluminum prices. Aluminum fabricators tend to have more stable profit margins.

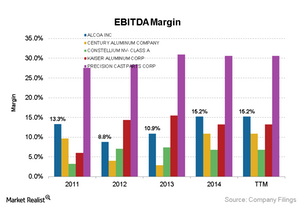

In this part of the series, we’ll explore how the EBITDA (earnings before interest, tax, depreciation, and amortization) margins differ between aluminum plays.

Profit margins

Pure play aluminum producers’ EBITDA margins, including Century Aluminum (CENX), can be quite volatile. You can see this in the above chart. In contrast, fabricators like Kaiser Aluminum (KALU) generally have stable profit margins.

Although Kaiser Aluminum offers value-add products, it also sells commodity type products like aluminum sheets, plates, and tubes. These commodity type products usually have lower profit margins compared to more value-add products like aircraft components.

Companies in the value-add space like Precision Castparts (PCP) tend to have higher and stable profit margins. The company is a leading producer of aircraft parts. Although, Precision Castparts isn’t exactly an aluminum play, its profit margins tell us the potential in the value-add component space.

Alcoa (AA) is also steering towards more value-add products in its portfolio. We’ll discuss its implications later in this series. Currently, Alcoa forms 2.53% of the Materials Select Sector SPDR ETF (XLB).

Please note that Warren Buffett’s Berkshire Hathaway (BRK-B) has announced the acquisition of Precision Castparts. The multi-billion dollar deal is essentially Warren Buffett’s bet on the strong growth in the aerospace sector. You can read more about this deal in Warren Buffet Acquires His Elephant: Precision Castparts.

In the next part, we’ll analyze aluminum companies’ leverage ratios.