Berkshire Hathaway Inc. Class B

Latest Berkshire Hathaway Inc. Class B News and Updates

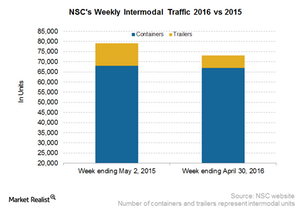

Norfolk Southern’s Intermodal Slump Equitable with Rival CSX

Norfolk Southern’s (NSC) total intermodal traffic for the week ended April 30, 2016, declined by 7.6%, at nearly 73,000 containers and trailers. This compares with 79,000-plus units in the corresponding week of 2015.

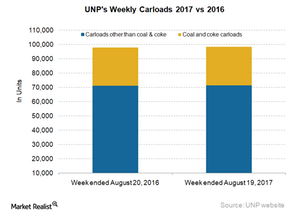

Comparing Union Pacific’s Freight Volumes with the Industry in Week 33

In week 33 of 2017, Union Pacific (UNP) recorded a marginal rise of 0.6% in its railcars, excluding intermodal.

BNSF: A Jewel in Berkshire Hathaway’s Crown

Burlington Northern Santa Fe (or BNSF) owns and operates the largest rail network in North America through its wholly owned subsidiary, BNSF Railway Company.

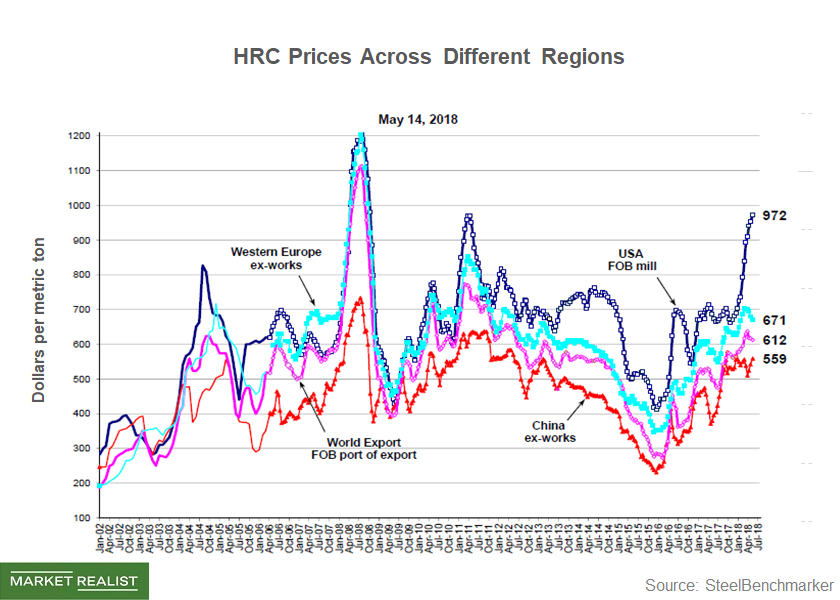

Is President Trump Robbing Peter to Pay Paul?

While higher steel prices benefit US steel producers, they raise input costs for downstream manufacturers.

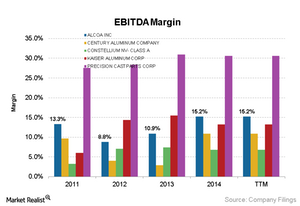

Why Profit Margins Vary across the Aluminum Value Chain

The profit margins vary across the aluminum value chain. Upstream aluminum producers’ earnings depend on their position on the cost curve.

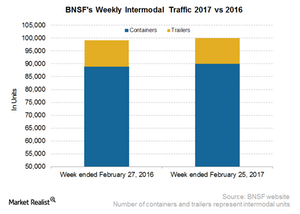

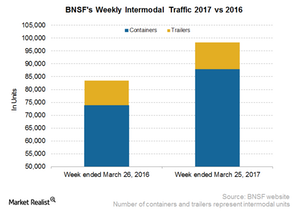

BNSF Railway’s Intermodal Volumes Matter

In the eighth week of 2017, BNSF’s overall intermodal traffic rose slightly by 0.8% YoY to ~100,000 containers and trailers.

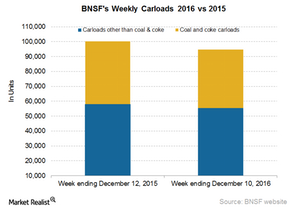

How BNSF’s Carloads Compared to Rival Union Pacific

BNSF Railway’s (BRK-B) total railcars for the week ended December 10, 2016, fell 5.5% to ~95,000 units, compared to ~100,000 units on a year-over-year basis.

Why P&G Transferred Its Duracell Business to Berkshire Hathaway

On February 29, 2016, Procter & Gamble (PG) announced the completion of the transfer of its Duracell business to Berkshire Hathaway (BRK-B).

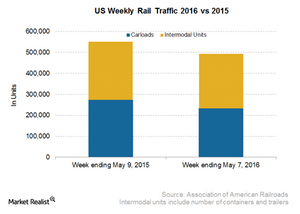

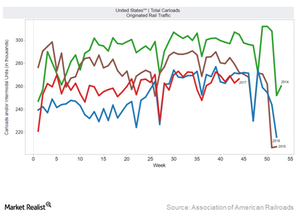

US and Canadian Rail Traffic Fell

In the week ended May 7, 2016, total US railcars went down by ~233,000, a double-digit fall of 15%.

BNSF: The Largest US Class I Railroad

Burlington Northern Santa Fe (or BNSF) owns and operates the largest rail network in North America. The company manages ~32,500 route miles of track.

How the Boeing 737 Max Crash Could Affect Berkshire Hathaway

Boeing (BA) has been feeling the heat after its 737 Max 8 aircraft crashed on March 10—the second crash in five months.

What Berkshire Hathaway Really Does, Says Buffett

Berkshire Hathaway is a huge conglomerate with diverse operations. The company’s operations are complex, so let’s take an easy-to-understand approach.Financials Why do floating rate notes, or FRNs, differ from regular bonds?

The U.S. Treasury Department’s latest issue on January 29, the floating rate note (or FRN) will fulfill two investor needs: participating in anticipated future interest rates increases and protecting principal against default.Financials Why investors should look at floating rate notes as an option

On January 29, 2014, the U.S. Treasury Department issued a new class of security: the floating rate note (or FRN). This is the first new security introduced by the Treasury since 1997.Financials Why do floating rate notes, or FRNs, differ from leveraged loans?

FRNs are usually issued in capital markets, whereas leveraged loans are arranged by commercial and investment banks. While FRNs are typically unsecured and investment-grade, leveraged loans are secured.

What Warren Buffett Might Say about Tesla’s Q3 Earnings

Warren Buffett has been somewhat critical of Tesla CEO Elon Musk. Tesla released its third-quarter earnings on Wednesday, which shattered the estimates.

Berkshire Hathaway: Apple Is a Shining Star in 2019

Berkshire Hathaway stock has underperformed the S&P 500 this year. However, Apple is outperforming the markets. Buffett has been optimistic about Apple.

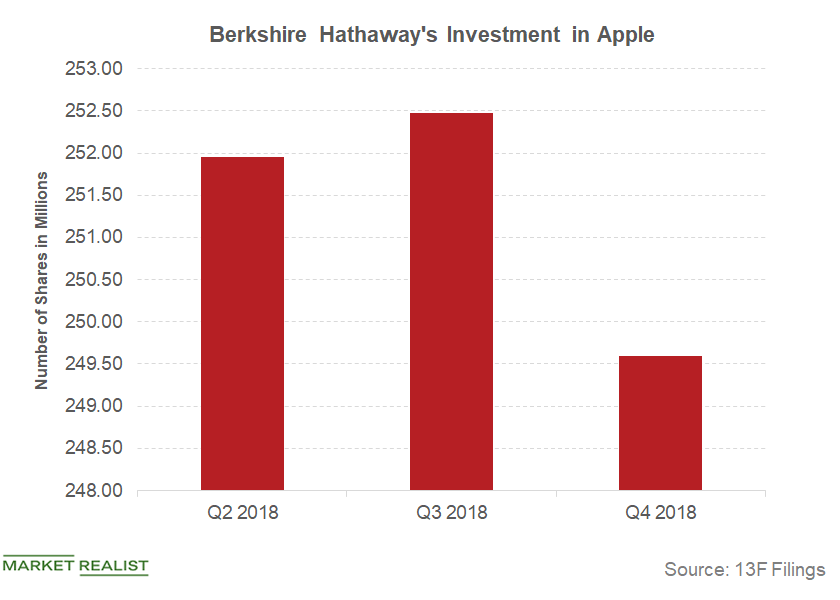

Warren Buffett Isn’t Always Right on Apple Stock

Warren Buffett has admired Apple in the past. As a value investor, Buffett was expected to add more shares when Apple stock fell in the fourth quarter.

Is Warren Buffett’s Nightmare Scenario Coming True?

Warren Buffett’s Berkshire Hathaway’s cash pile has grown steadily. At the end of Q2, the company had more than $122 billion in cash and cash equivalents.

Trade War: Are Trump and Xi Jinping Taking Buffett’s Advice?

Over the last few days, the trade war de-escalated. President Trump said that the US-China trade talks are resuming “at a different level.”

Could NIO Be on Warren Buffett’s Radar after Recent Stock Fall?

Chinese electric carmaker NIO (NIO) continued to burn cash in the fourth quarter.

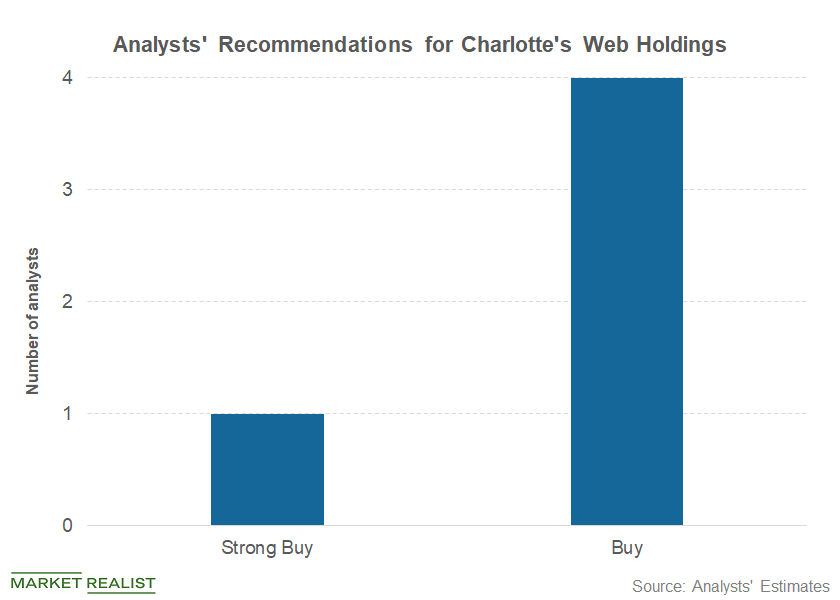

How Does Warren Buffett View Cannabis Companies?

Buffett sees companies as businesses and not just tickers. Buffett avoids businesses that he doesn’t understand.

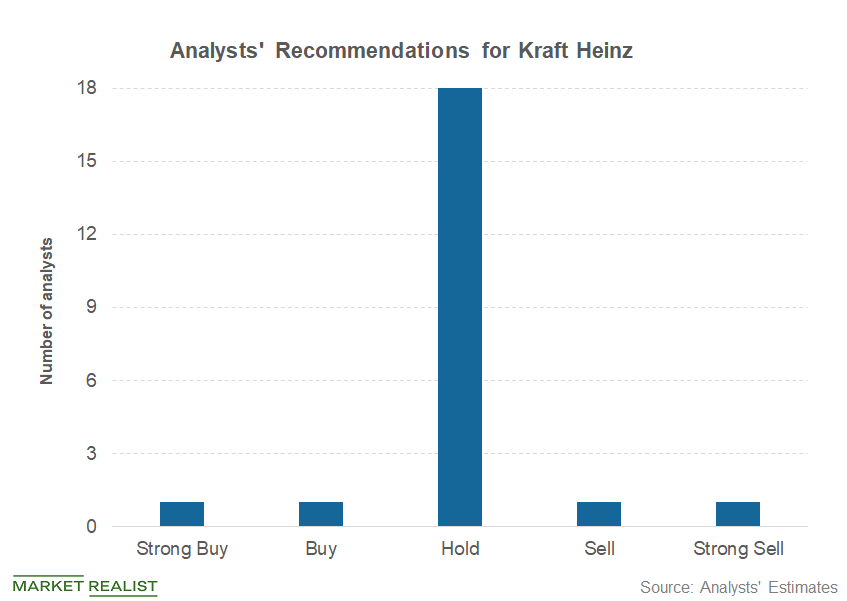

Warren Buffett Isn’t Exiting Kraft Heinz

Buffett said that considering Berkshire Hathaway’s massive stake in Kraft Heinz, it wouldn’t be easy for him to exit the company.

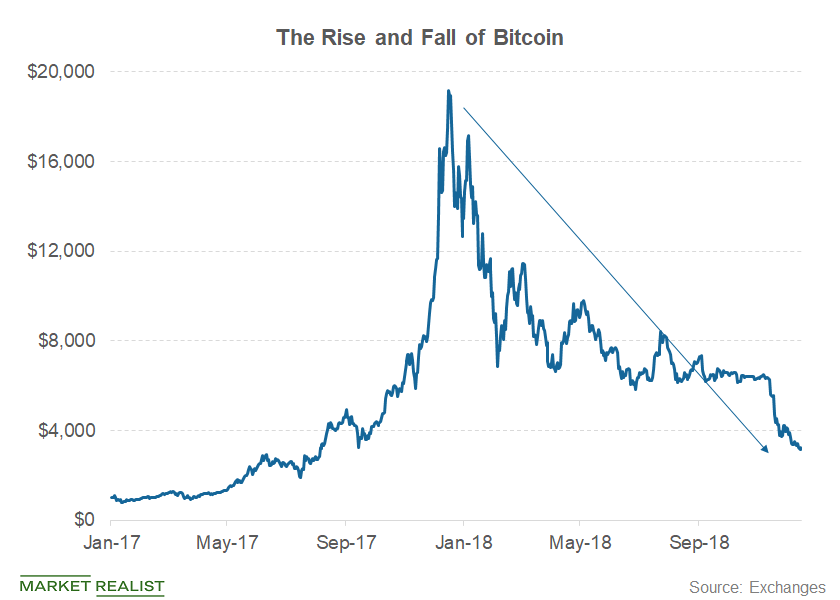

Could Warren Buffett’s Views on Bitcoin Change?

Berkshire Hathaway (BRK-B) chair Warren Buffett has never been a fan of cryptocurrencies like bitcoin.

Could Kraft Heinz Be Berkshire Hathaway’s Next Worry?

Kraft Heinz (KHC) stock opened much lower today after the company reported its earnings yesterday and missed analysts’ estimate.

Should You Have Taken President Trump’s Advice in December?

Today, US President Donald Trump tweeted, “Best January for the DOW in over 30 years.”

Remember Peter Lynch? When the King Tells, You Should Buy

We saw a sharp rally in US stocks on December 26. President Trump’s comments on US markets could have been the main driver.

Week 44 Failed to Lift US Rail Freight Volumes

In the 44th week of 2017, total rail freight traffic in the United States recorded a ~0.9% fall. Overall volumes, including intermodal, decreased to ~539,000 units.

How Harvey Affected Kansas City Southern

Kansas City Southern’s network Kansas City Southern’s (KSU) US subsidiary caters to ten US states in the Midwest and Southeast. It also runs a rail route between Kansas City, Missouri, and multiple ports along the Gulf of Mexico in Texas, Louisiana, Alabama, and Mississippi. Among the major US Class I railroads, Kansas City remains hugely […]

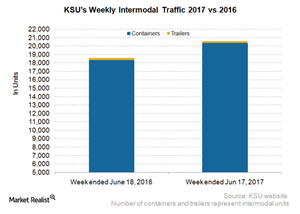

Kansas City Southern’s Containers Rose, Trailers Fell in Week 24

In week 24 of 2017, Kansas City Southern (KSU) saw its overall intermodal volumes rise 10.6%, unlike in the previous two weeks.

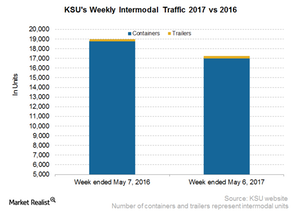

Kansas City Southern: Unfolding Its Intermodal Traffic in Week 18

In the week ended May 6, 2017, Kansas City Southern reported a year-over-year fall of 9.1% in its overall intermodal traffic.

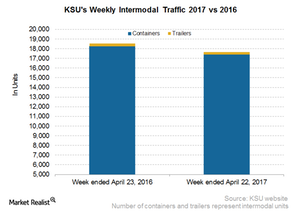

Trailers Hurt Kansas City Southern’s Intermodal Volume in Week 16

In the past few weeks, Kansas City Southern (KSU), the smallest Class I railroad company in the United States, has seen its intermodal traffic slow.

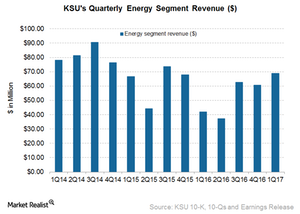

Why Kansas City Southern’s Energy Revenue Rose 64% in 1Q17

In this article, we’ll examine Kansas City Southern’s (KSU) Energy freight revenue in 1Q17. In the quarter, KSU’s Energy freight revenue was $69.0 million.

How BNSF’s Intermodal Volumes Compare in the 12th Week

In the 12th week of 2017, BNSF Railway’s (BRK-B) overall intermodal traffic rose 17.6% YoY to more than 98,000 containers and trailers.

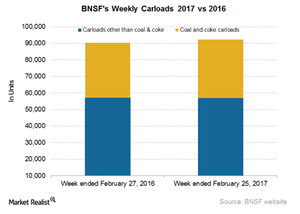

Your Guide to BNSF Railway’s Latest Carload Data

BNSF’s total railcars for the week ended February 25, 2017, rose 2.3% YoY to more than 92,000 units.

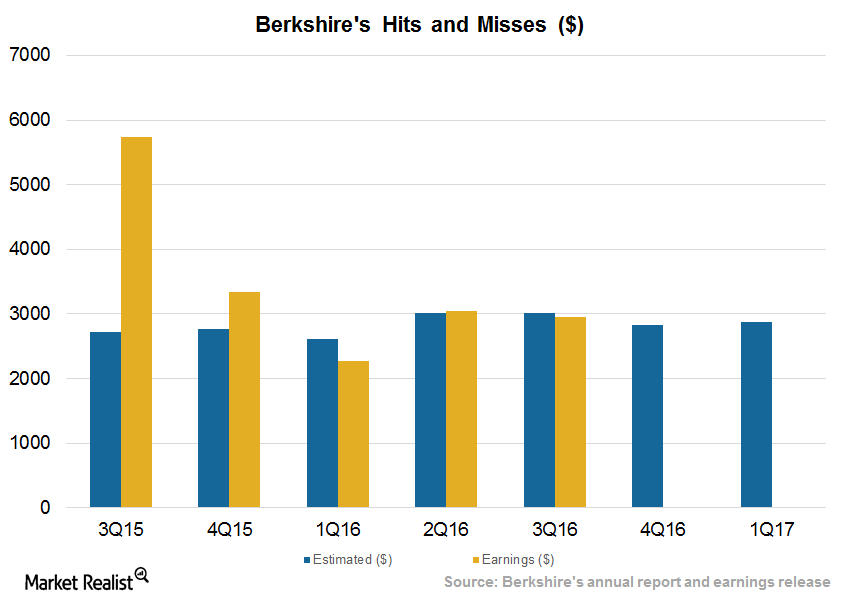

What to Expect from Berkshire Hathaway’s Earnings

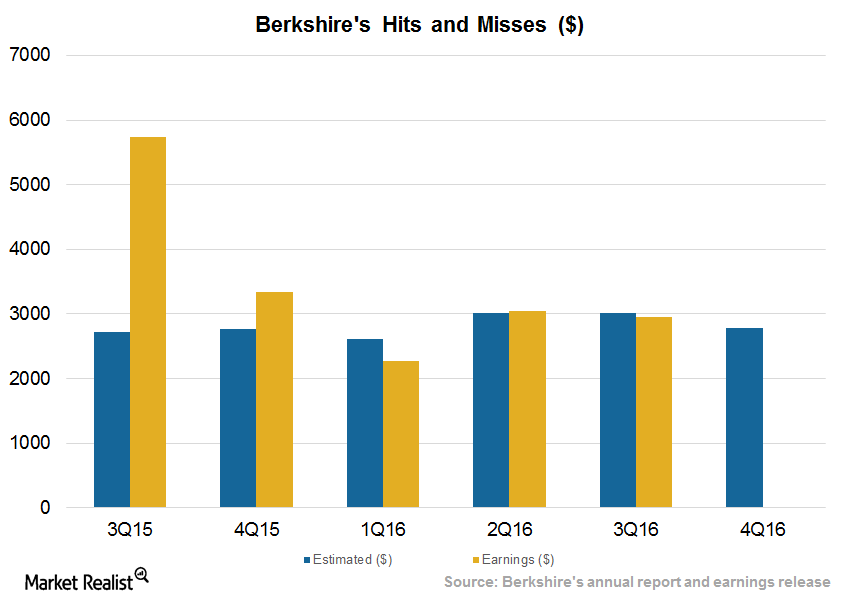

Berkshire Hathaway (BRK-B) is expected to post EPS (earnings per share) of $2,829 per share in 4Q16 and $2,880 in 1Q17.

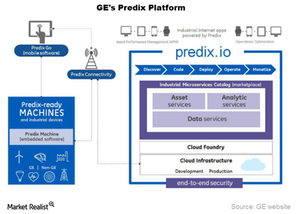

How Useful Will ServiceMax Be in GE Digital’s Industrial Internet Vision?

ServiceMax’s complementary capabilities would help GE Digital develop and expedite the commercialization of its Predix applications.

Buffett’s Berkshire Misses Estimates amid Volatile Environment

Berkshire Hathaway reported its third quarter earnings on November 5, 2016. The company missed analysts’ operating earnings per share estimates of $3,022 with reported EPS of $2,951.

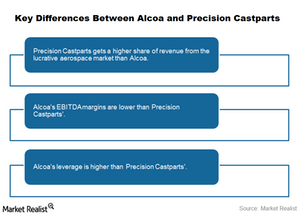

Arconic Isn’t Precision Castparts, and the Market Knows That!

Market participants who are bullish on Alcoa (AA) point to Berkshire Hathaway’s (BRK-B) acquisition of Precision Castparts.

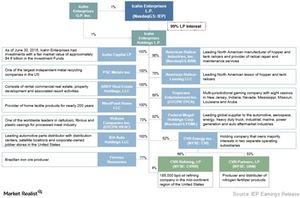

A Look at Icahn Enterprises’ Business Model

Icahn Enterprises’ investment strategy involves identifying and purchasing undervalued businesses and assets at distressed prices.

Need-to-Know Facts about the Fidelity Magellan Fund

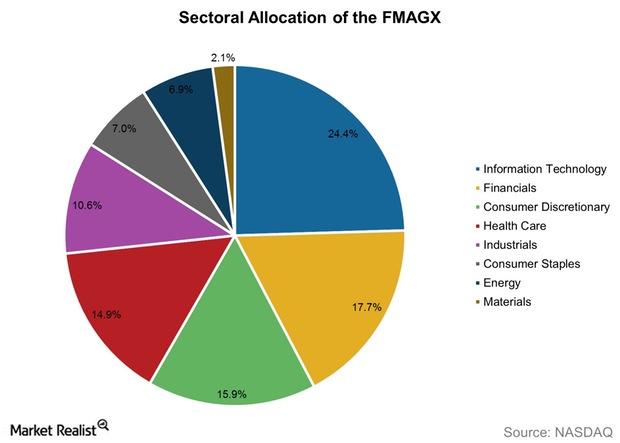

The Fidelity Magellan Fund (FMAGX) invests primarily in common stocks of US and foreign issuers. It invests in either growth stocks, value stocks, or both.

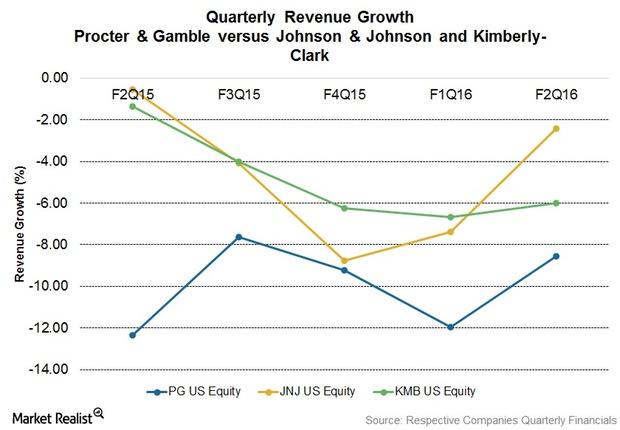

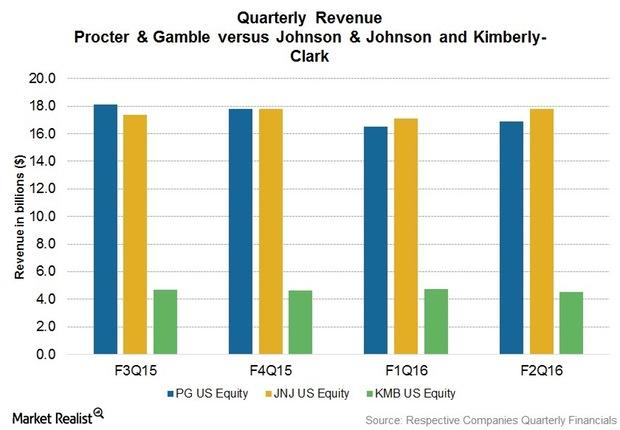

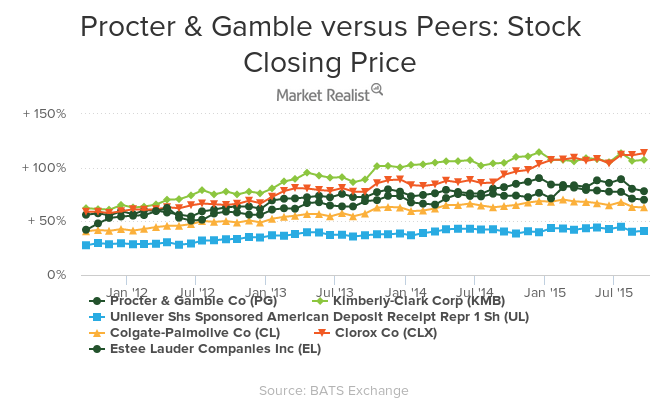

Why Procter & Gamble Is Selling Some of Its Brands

Procter & Gamble is on a mission to trim brands that are holding back its overall financial performance.

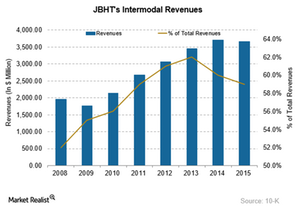

Why J.B. Hunt Transport Leads the Trucking Intermodal Space

Intermodal transportation involves the movement of freight in an intermodal container using multiple transportation modes such as rail, ship, and truck. It doesn’t involve the handling of freight when the modes are changed.

J.B. Hunt Transport Services: America’s Largest Trucking Company

One of the largest road transport companies in North America, J.B. Hunt Transport (JBHT) has transportation arrangements with all major US Class I railroads. Its operating revenues grew from $2.2 billion in 2002 to $6.1 billion in 2015.

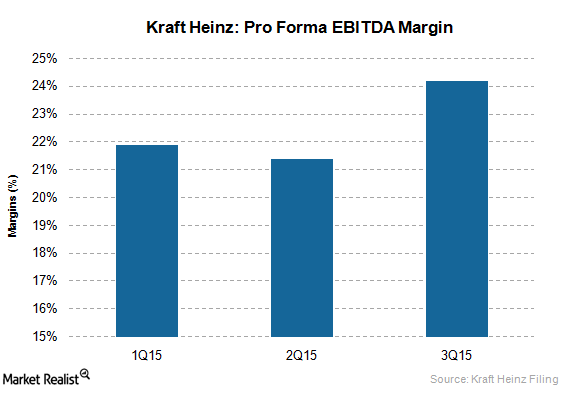

Kraft Heinz Implements Zero-Based Budgeting to Reduce Costs

3G Capital applied a ZBB approach, which starts from zero-base and analyzes every functional area for cost, to Heinz, after it acquired the firm in 2013.

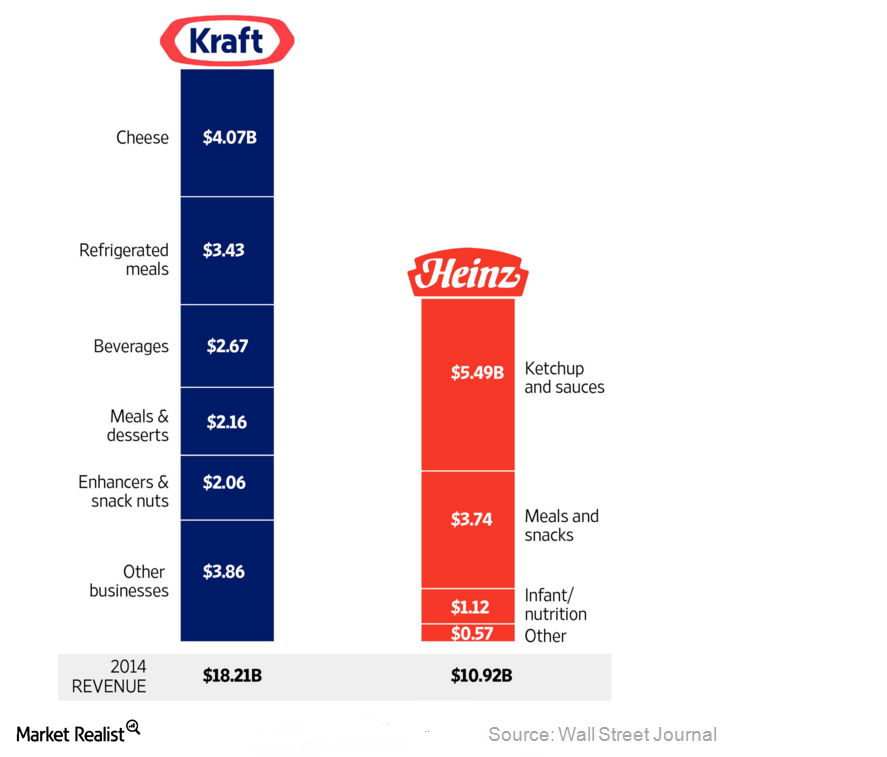

A Key Analysis of the Kraft-Heinz Merger

In early 2015, Berkshire Hathaway and 3G Capital designed the Kraft-Heinz merger by pairing the Kraft Foods Group with H. J. Heinz Company.

Alcoa’s Downstream Business Is Thriving: What about Upstream?

Alcoa’s upstream business has been gaining strength. It also has a downstream business, which produces alumina and primary aluminum.

P&G’s Strategies for Revamping its Product Portfolio

P&G plans to focus on stronger, consumer meaningful brands—brands with which P&G has the leading market position—and accordingly chooses its portfolio.

Warren Buffet’s 50-Year Vision for Berkshire Hathaway

Berkshire Hathaway has doubled its earnings and balance sheet potential since the financial crisis of 2007.

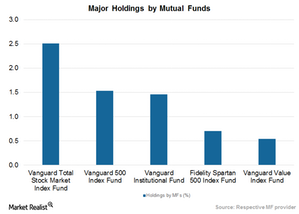

Mutual Funds Own 18% of Berkshire Hathaway

Major mutual funds prefer Berkshire Hathaway (BRK-B) over private equity firms and asset managers like Blackstone (BX) and BlackRock (BLK).