Berkshire Hathaway Inc. Class B

Latest Berkshire Hathaway Inc. Class B News and Updates

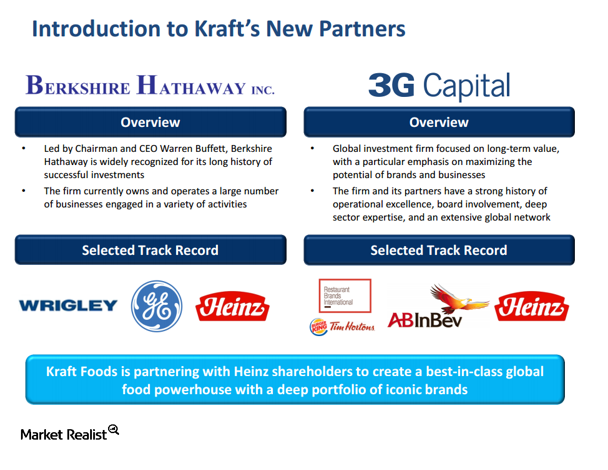

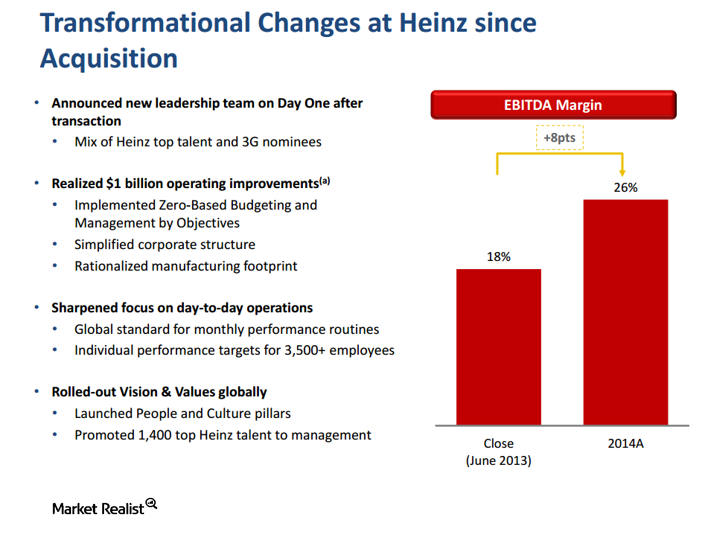

The Kraft–Heinz merger: Overview of Heinz

Kraft’s (KRFT) and Heinz’s portfolio of brands are highly complementary, which is a big reason for the Kraft–Heinz merger.

The Kraft–Heinz Merger: What If the Deal Breaks?

The Kraft–Heinz merger isn’t a typical risk arbitrage deal because you can’t arbitrage a spread. Before the deal, Kraft was trading at $62.40 a share.

The Kraft–Heinz Merger: Transaction Rationale

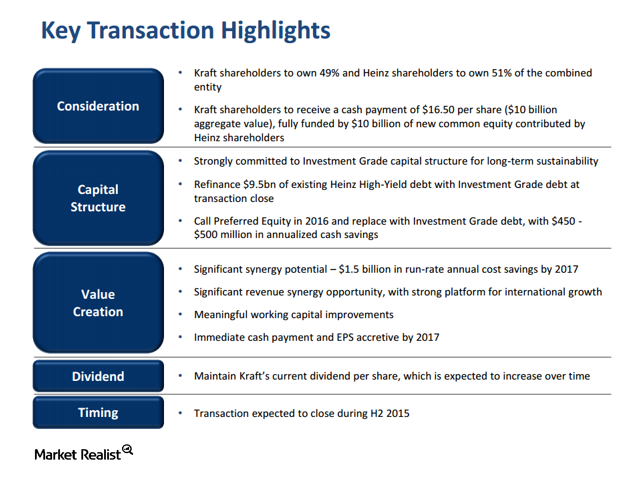

The Kraft–Heinz merger entity will maintain Kraft’s current dividend, and management anticipates it will grow.

Is Antitrust an Issue in the Kraft–Heinz Merger?

The first place arbitrageurs look to get a handle on antitrust risk is the 10-K, where companies often disclose the names of competitors.

The Kraft–Heinz Merger: Transaction Benefits for Kraft Investors

Kraft has a non-solicitation agreement with a fiduciary out. This means that Kraft could discuss another merger if approached by another suitor.

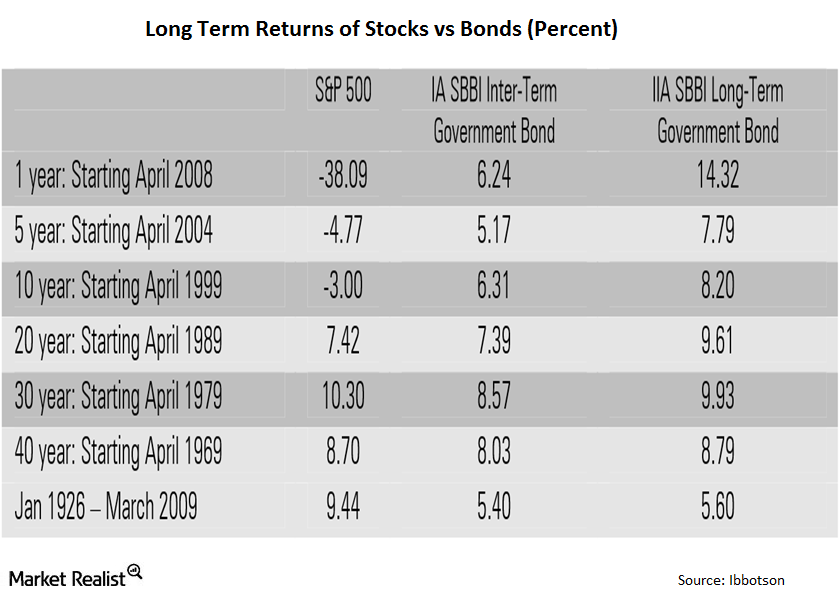

Stocks Beat Bonds over the Long Run By a Big Margin

The majority of investors believe bonds are safer than stocks. The main reason is that bonds pay regular interest.Financials What are the risks associated with short-term wholesale funding?

Short-term wholesale funding refers to a bank’s use of short-term deposits from other financial intermediaries—like pension funds and money market mutual funds. It uses the short-term deposits to invest in longer-term assets—like loans to businesses. Using these short-term funds to invest in longer-term assets causes a timing mismatch between assets and liabilities.