Precision Castparts Corp

Latest Precision Castparts Corp News and Updates

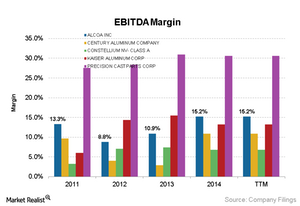

Why Profit Margins Vary across the Aluminum Value Chain

The profit margins vary across the aluminum value chain. Upstream aluminum producers’ earnings depend on their position on the cost curve.

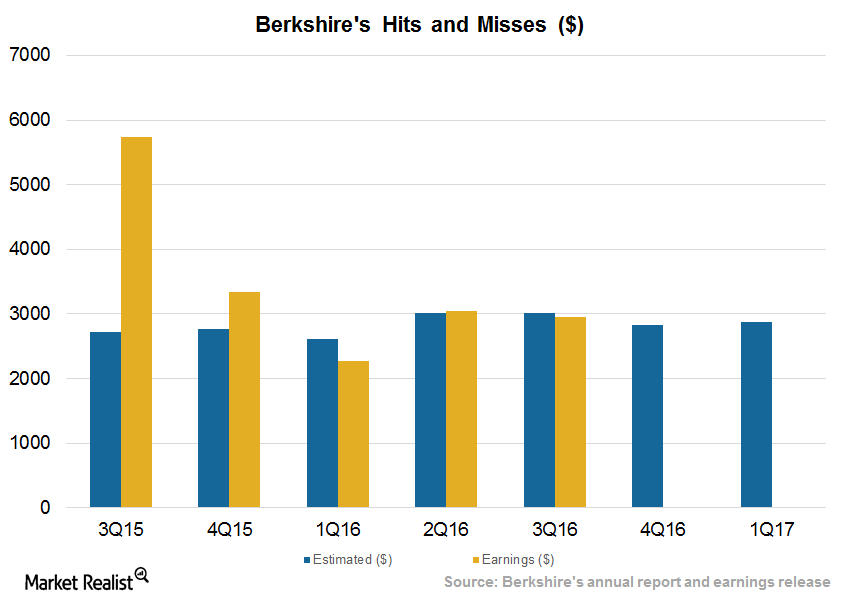

What to Expect from Berkshire Hathaway’s Earnings

Berkshire Hathaway (BRK-B) is expected to post EPS (earnings per share) of $2,829 per share in 4Q16 and $2,880 in 1Q17.

Alcoa’s Downstream Business Is Thriving: What about Upstream?

Alcoa’s upstream business has been gaining strength. It also has a downstream business, which produces alumina and primary aluminum.

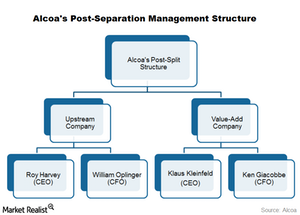

No Surprises in Alcoa’s Post-Separation Management Structure

On November 24, Alcoa announced the executive management structure to be introduced following its split.