Kaiser Aluminum Corp

Latest Kaiser Aluminum Corp News and Updates

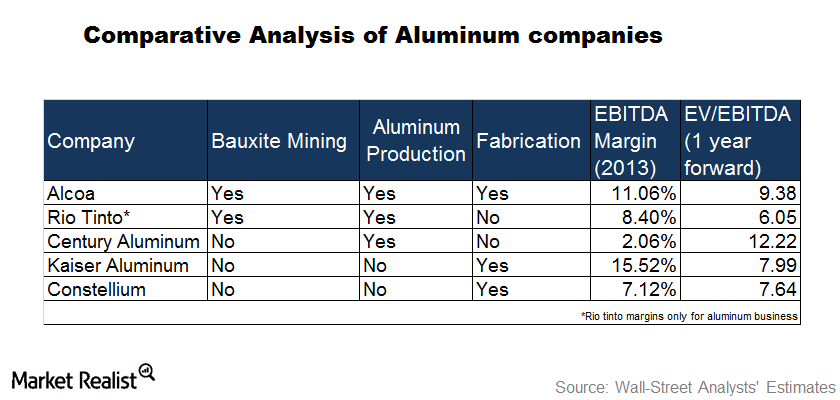

Must-know: Alcoa is placed better than other aluminum companies

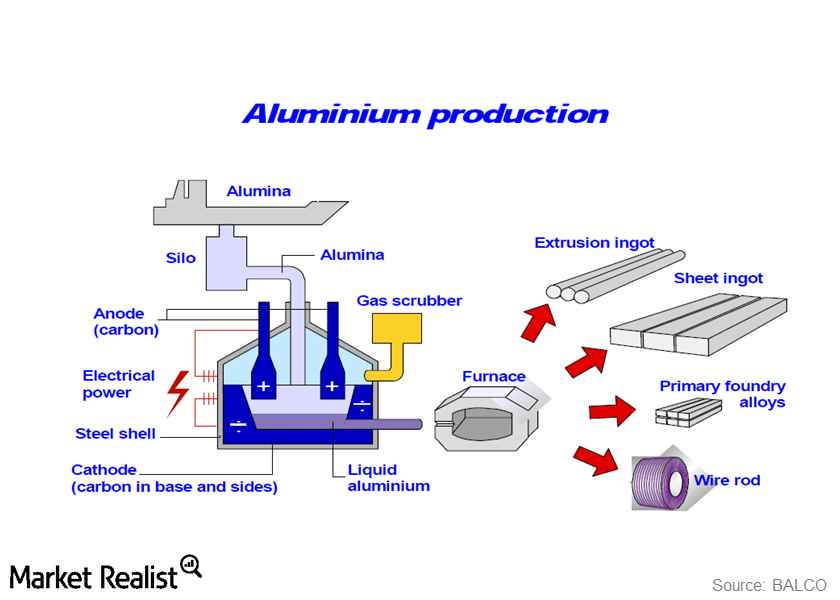

The aluminum process starts by extracting bauxite from the Earth’s crust. The bauxite is refined into alumina. Alumina is a key raw material—along with carbon and electricity.

Must-know: 3 risks that aluminum company investors face

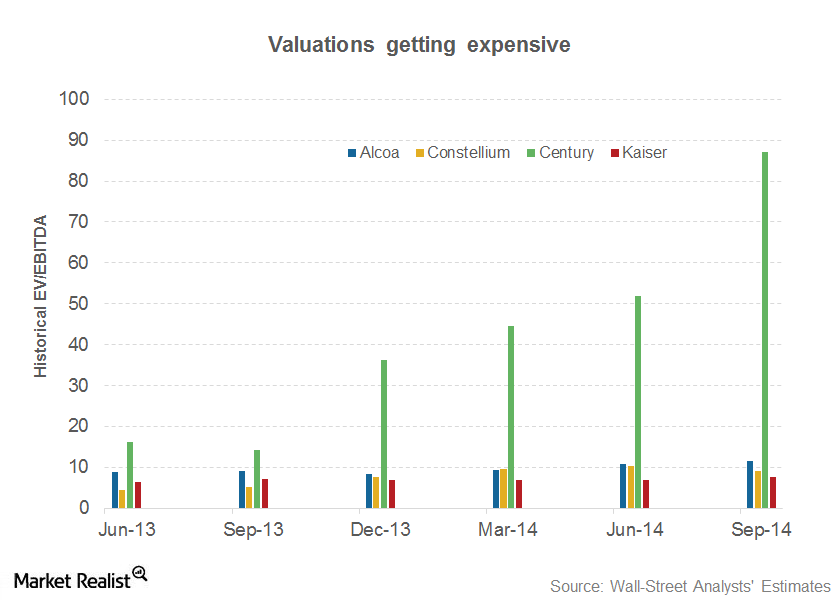

Litigations can be a big blow for aluminum producers. Litigations are expected to decrease aluminum prices and premiums. This will be negative for aluminum companies like Alcoa Inc. (AA), Century Aluminum (CENX), Kaiser Aluminum Corp. (KALU), and Constellium (CSTM).Materials Why investors should understand Alcoa’s business model

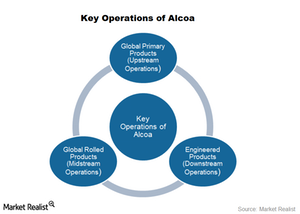

Alcoa is an integrated player in the aluminum value chain. This means its operations extend from bauxite refining to aluminum fabrication.

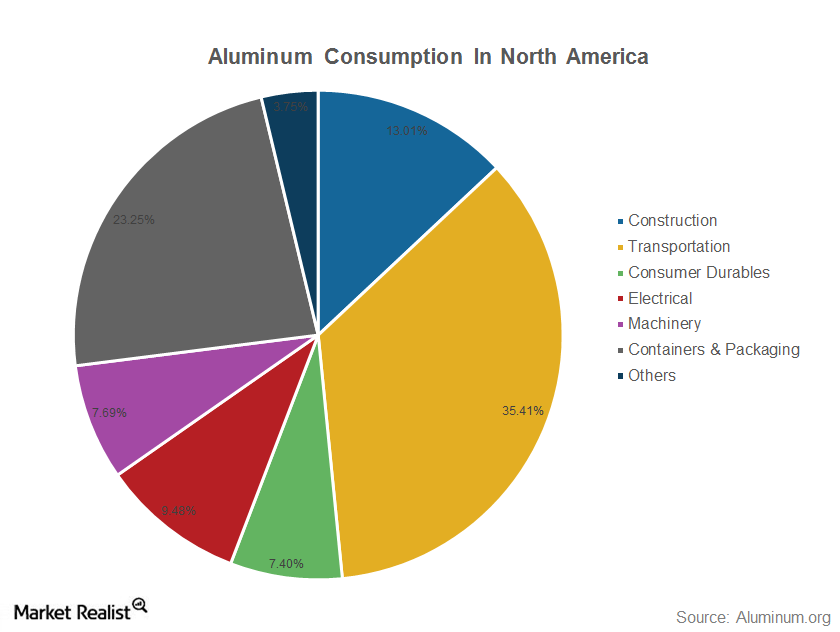

Overview: An investor’s guide to the aluminum industry

Aluminum is the most abundant metal found in the earth’s crust. It’s soft, lightweight, and durable in nature. Its low density and resistance to corrosion make it a very important metal that a lot of industries use.

Must-know: Understanding aluminum’s value chain

The aluminum industry has a value chain that consists of both upstream and downstream companies. Upstream companies are engaged in the mining and refining operations.

Key Takeaways from Alcoa’s 1Q 2015 Earnings

Alcoa (AA) reported its 1Q 2015 earnings on April 8. It reported net income of $195 million on revenues of $5.8 billion.