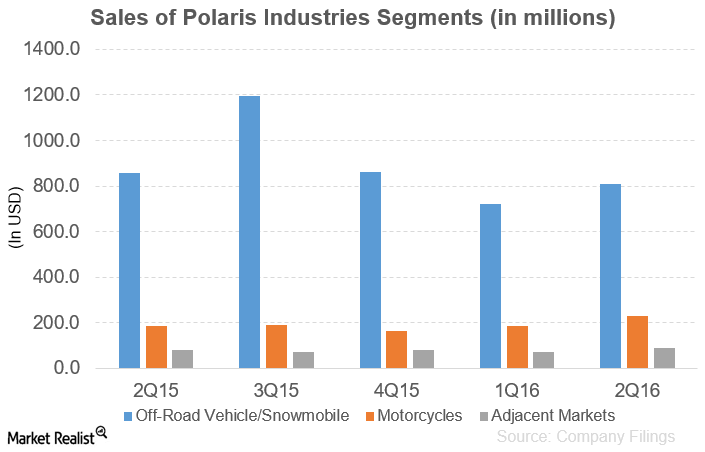

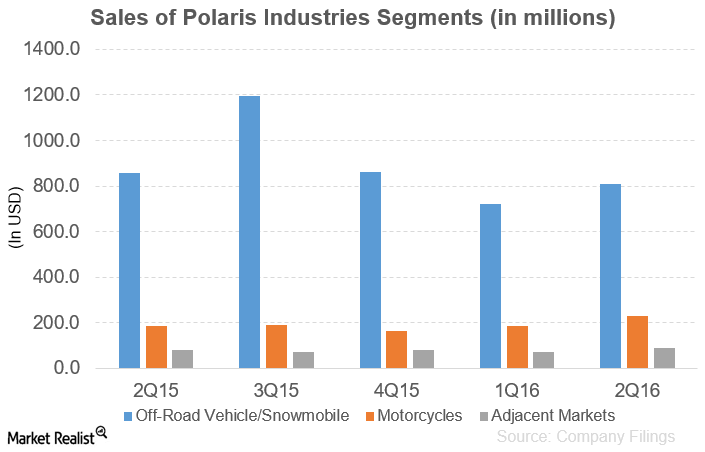

How Did Polaris Industries’ Segments Fare in 2Q16?

In 2Q16, Polaris Industries (PII) reported sales of $1,130.8 million, a fall of 0.58% compared to the corresponding period last year.

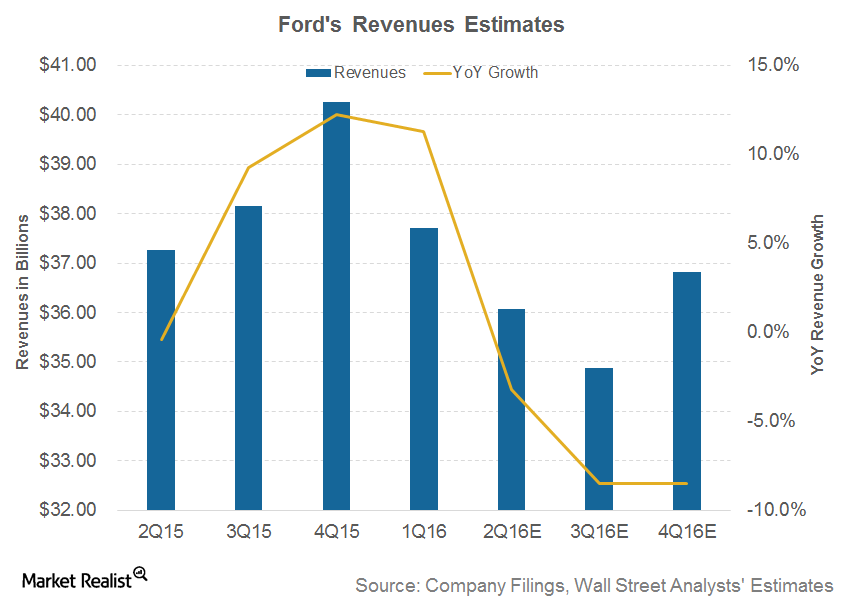

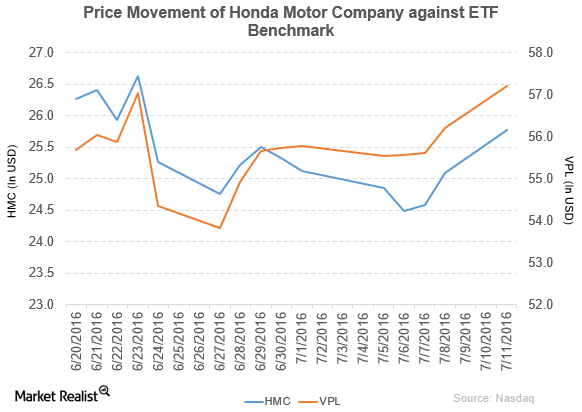

Everything you need to know about stock and business developments in the automotive sector.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.