A Look at Toyota’s Key Leverage Ratios

At the end of most recent reported quarter, Toyota’s interest coverage ratio was 80.6x. This is far better than the GM’s interest coverage ratio of 15.6x and Ford’s ratio of 14.1x.

June 14 2016, Updated 2:04 a.m. ET

Toyota’s key leverage ratios

It’s important for investors to pay attention to a company’s leverage position and related ratios. High debt levels increase the risk profile of a company because debt is a contractual obligation a company must fulfill regardless of market conditions.

In this part, we’ll take a look at Toyota’s key leverage ratios.

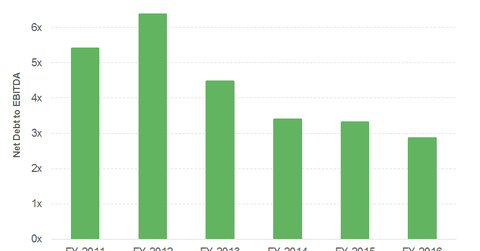

Net debt-to-EBITDA

We can define net debt as total debt minus cash and cash equivalents. Net-debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization) is an important leverage ratio to analyze a company’s financial health. At the end of most recent reported quarter ended March 31, 2016, Toyota’s (TM) net debt-to-EBITDA ratio was ~2.9x.

This is worse than its direct US peers (IYK) General Motors’s (GM) -0.47x and Ford’s (F) -0.76x. Note that both of these automakers have negative net debt, which means these companies have more cash and cash equivalents than their total debt. The net-debt-to-EBITDA ratio of Italian-American automaker Fiat Chrysler (FCAU) is 0.85x.

Interest coverage ratio

Due to the highly capital-intensive nature of the automotive business, companies tend to utilize debt extensively. Therefore, it’s not always bad to have high leverage. What matters most is a company’s ability to pay back its debt and related interest with ease. A company’s ability to meet its interest obligations can be understood by looking at its interest coverage ratio.

At the end of most recent reported quarter, Toyota’s interest coverage ratio was 80.6x. This is far better than the GM’s interest coverage ratio of 15.6x and Ford’s ratio of 14.1x. Overall, Toyota is an efficient manufacturer with higher margins and lower financial risk than its closest market peers.

Read on to the next part of this series to learn more about Toyota’s plans to deal with the challenges going forward.