Sarah Sands

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Sarah Sands

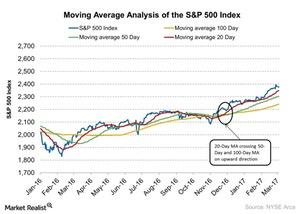

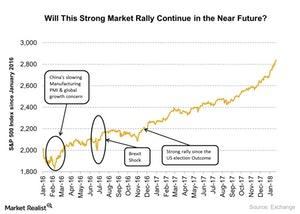

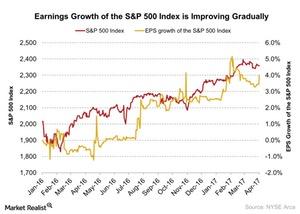

What S&P 500 Index Moving Averages Could Indicate

The S&P 500 Index is trading 1.2% above its 20-day moving average and 6% above its 100-day moving average.

These Key Economic Indicators Were Released Last Week

In this series, we’ll take a look at the global final manufacturing PMIs and services PMIs for March 2017. These indicators help us understand the business condition of an economy.

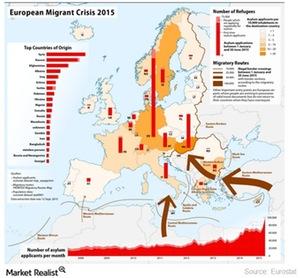

What Does the UK Really Have to Gain from Exiting the EU?

The EU’s light immigration laws allow young talent to work across the EU, but with more immigrants entering the UK, local citizens have less access to jobs.

What’s Leon Cooperman’s Largest Position?

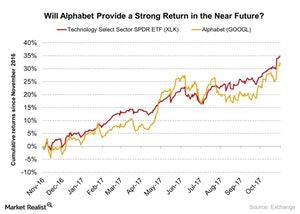

Alphabet reported its 3Q17 earnings on October 26, 2017. The company posted EPS (earnings per share) of $9.57, which beat analysts’ estimates of $8.33.

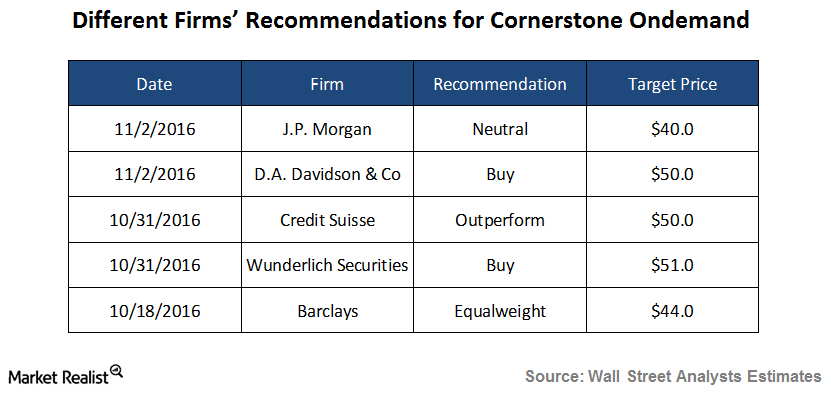

Goldman Sachs on Cornerstone OnDemand: Estimated Potential Upside of 20%

Goldman Sachs (GS) believes that Cornerstone OnDemand could provide a cash return of 37% on cash investments in R&D by 2018.

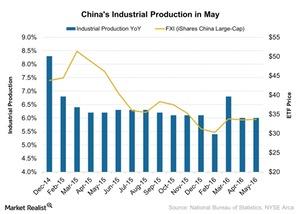

China’s Industrial Production Rises: Is Investor Confidence Back?

On a year-over-year basis, China’s industrial production increased to 6.0% in May 2016. That’s the same pace as April.

How Will the Fed Affect the Earnings Recovery Environment?

The dollar index (UUP) rallied about 22% between October 2014 to July 2016.

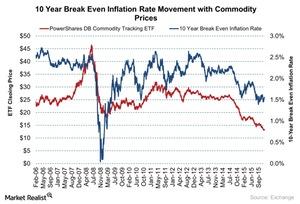

Where Will Commodities Head during Trump’s Term?

Donald Trump’s policies are aimed at strengthening job markets in the United States (VFINX) (IVV).

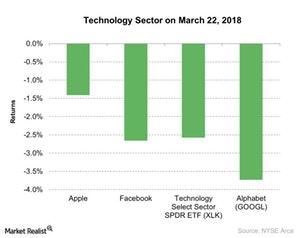

Facebook Stock Is Dragging the Tech Sector Down

The Technology Select Sector SPDR ETF (XLK) fell ~2.6% on March 22, 2018.

Why Larry Fink Thinks Markets Could See Some Setbacks

In a recent interview with CNBC, Larry Fink, CEO of BlackRock (BLK), shared his views on market movement, the US economy, and the dangerous impact of the lower interest rates.

Why Is Buffett Betting Big on Index Funds?

Buffett said in his recent interview with CNBC that the passive investment strategy or indexing strategy should work well in any market situation.

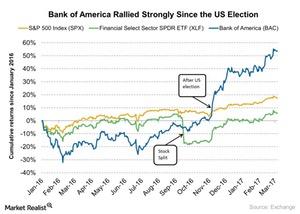

What Goldman Sachs Thinks about Bank of America

Bank of America (BAC) is currently trading at $25.26. Its 52-week high is $25.80 and 52-week low is $12.05.

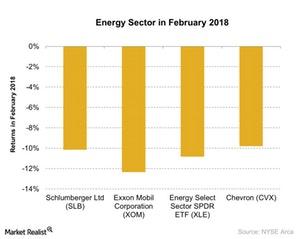

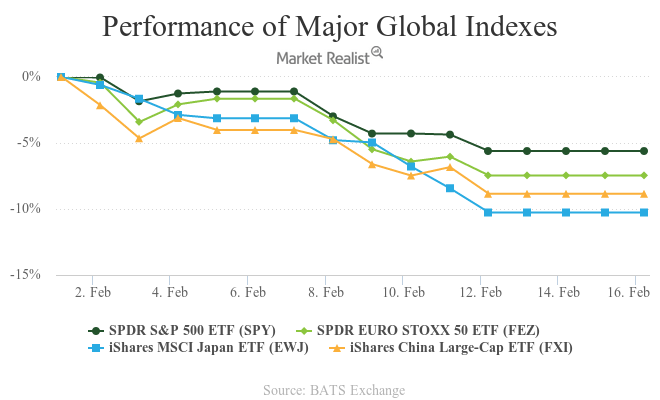

What Put Pressure on the Energy Sector in February 2018?

The US energy sector was badly affected by the recent market sell-off in February 2018.

Why George Soros Compares Facebook and Google to Casinos

Billionaire investor George Soros recently shared his views on social media companies Facebook and Google.

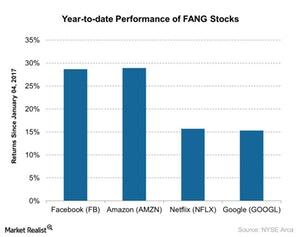

Why Marc Faber Thinks These Stocks Are Vulnerable

Facebook, Amazon, Netflix, and Google returned nearly 388%, 345%, 1,157%, and 217%, respectively, in the last five years.

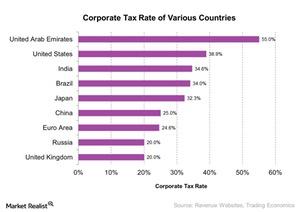

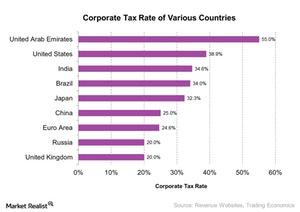

Why Buffett Believes US Businesses Aren’t Really Hurting from the US Corporate Tax

The US economy has been improving gradually, but some businesses in the US have suffered a lot over the years.

Miller: Bond Bear Market to ‘Propel Stocks Significantly Higher’

Legendary value investor Bill Miller has an optimistic view on the equity market.

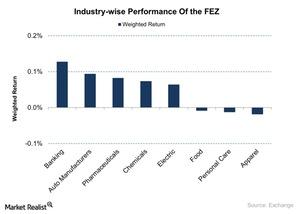

Positive Manufacturing Reports Drive the FEZ Up

The SPDR Euro Stoxx 50 ETF (FEZ) is a US exchange-traded ETF that tracks the performance of the 50 largest companies across the Eurozone.

Gundlach on Higher Yield: Watching the Copper-to-Gold Ratio

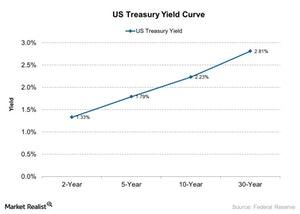

Billionaire investor and bond guru Jeffrey Gundlach also shared his view on bond yields in an interview with CNBC.

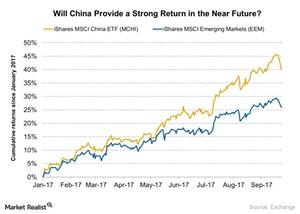

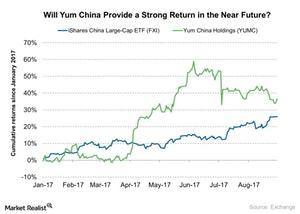

Why Marc Faber Increased His Position in China

Marc Faber said in the interview that he is becoming more positive about emerging markets and particularly China, in which he has increased his position.

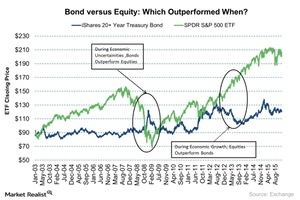

Equities or Bonds: Which Will Outperform during Trump Presidency?

On November 9, 2016, the iShares 20+ Year Treasury Bond ETF (TLT) fell 4.2% following Donald Trump’s win.

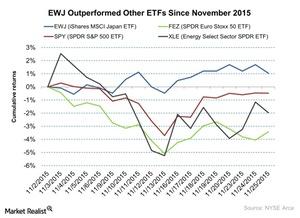

Overall Snapshot of the Market on November 25

On November 25, the SPDR S&P 500 ETF closed on a flat note ahead of the holiday. It closed at $209.3. The Energy Select Sector SPDR ETF fell by 0.81% on the day.

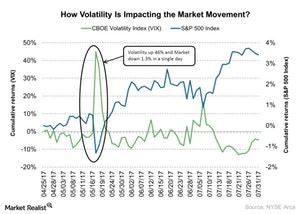

Is Jeffrey Gundlach Long on the CBOE Volatility Index?

In the previous part of this series, we saw that Jeffrey Gundlach bought the put option of the S&P 500 index (SPY) and he expects that the index could fall 3% by the end of 2017.

Why Billionaire Jeffrey Gundlach Is Buying S&P 500 Puts

In an interview with CNBC’s Halftime Report on Tuesday, August 8, billionaire investor Jeffrey Gundlach shared his views.

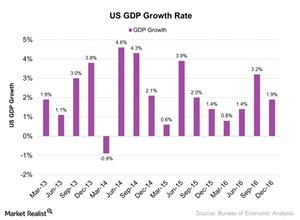

What Does Jack Bogle Predict for US Real GDP?

In 4Q16, US (SPY) (QQQ) (IVV) (VFINX) real GDP grew at an annual rate of 1.9% compared to a 3.5% rise in 3Q16.

Paul Singer Increased His Holdings in NXP Semiconductor in 3Q17

Paul Singer, the CEO of Elliott Management, increased his holdings in NXP Semiconductor (NXPI) in 3Q17, according to a recent 13F filing report.

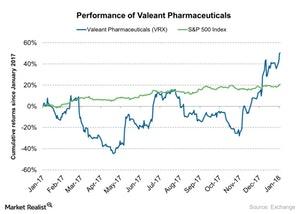

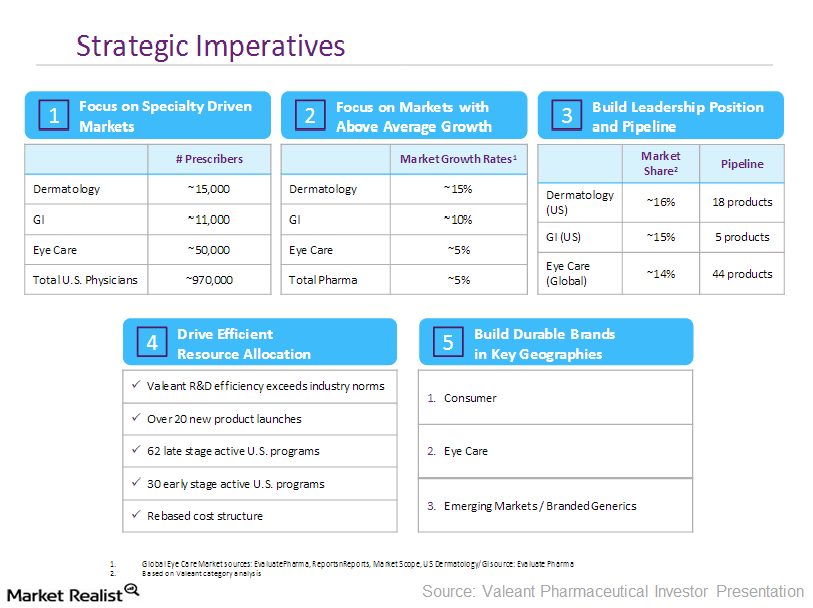

How Valeant Position Affected Pershing Square Capital Management

Valeant Pharmaceuticals is currently trading at $23.05. Its 52-week high is $23.47 and 52-week low is $8.31.

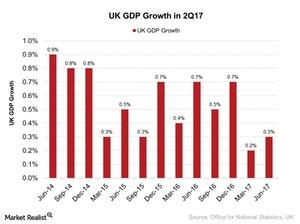

Will UK’s 2Q17 Growth Strengthen Investor Sentiment?

The UK’s 2Q17 economic growth surprised the market with a rise of 0.3% as compared to a 0.2% rise in the first quarter of 2017.

Why Druckenmiller Is Optimistic about Chinese Consumer Stocks

Druckenmiller’s firm bought 710,200 shares of Alibaba (BABA) in 2Q17. The holding accounted for nearly 5.4% of the firm’s portfolio in 2Q17.

Can European Indexes Rally in the Current Global Turmoil?

In the current global scenario, the possibility of further devaluation of the Chinese yuan is a major concern for global equity markets. The Chinese PMI data released on January 31, 2016, indicated a slowdown in the Chinese economy.

Larry Fink Says Lower Rates Hampered Savings around the World

Various central banks in developed nations (EFA) have lowered their key interest rates close to the zero level to revive their economies.

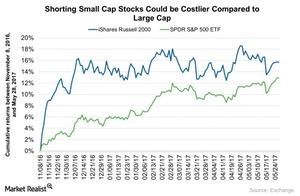

Will George Soros’s Position in IWM Provide a Strong Return?

According to the recent 13F filings, Soros Fund Management has increased its position in the iShares Russell 2000 ETF (IWM) by 36% in 1Q17 compared to the previous quarter.

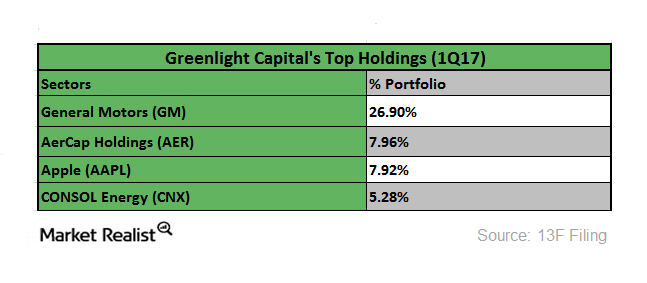

Inside Einhorn’s Greenlight Capital’s Top Holdings

Billionaire hedge fund manager David Einhorn is well known for his investment strategy, having advised long and short bets during different market scenarios.

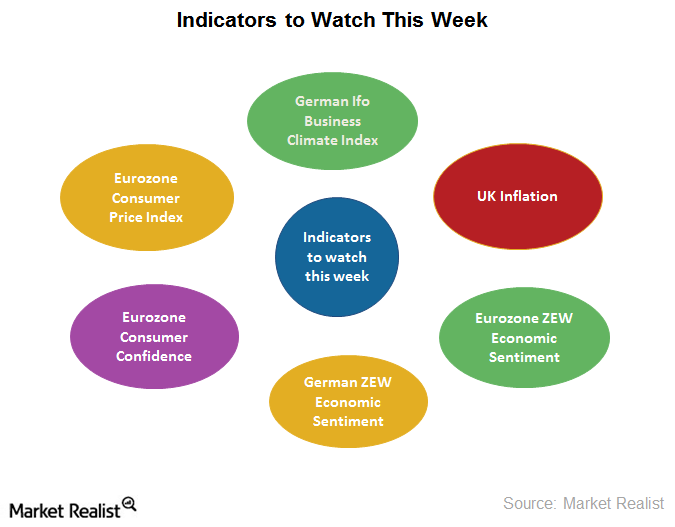

Economic Indicators Investors Should Watch This Week

If major Eurozone economic indicators improve in the coming months, we could expect those economies to regain some strength.

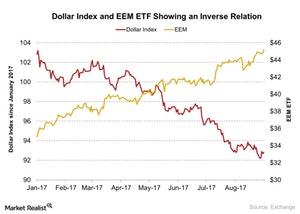

Stanley Druckenmiller Exited Position in EEM

Stanley Druckenmiller also sold his position in the iShares MSCI Emerging Markets ETF (EEM).

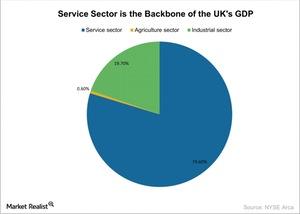

Which Sectors in the UK Will the ‘Brexit’ Decision Affect Most?

The financial sector has contributed heavily to the UK economy. Financial institutions like HSBC and Barclays will face challenges doing business in the EU.

Jim Chanos on Valeant Pharmaceuticals: Is More Pain Ahead?

Valeant is currently trading at $23.86. On a year-to-date basis, the stock returned -77%.

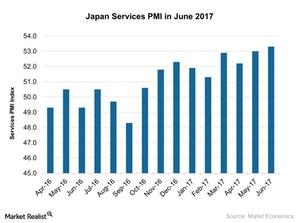

Why the Japan Services PMI Improved in June 2017

The Japan Services PMI (EWJ) (DXJ) stood at 53.3 in June 2017 compared to 53.0 in May 2017. It met the market expectation of 53.2.

How the Eurozone ZEW Economic Sentiment Index Looked in October

According to a report by the Centre for European Economic Research (ZEW), the Eurozone ZEW Economic Sentiment Index fell to 26.7 so far in October compared to 31.7 in September.

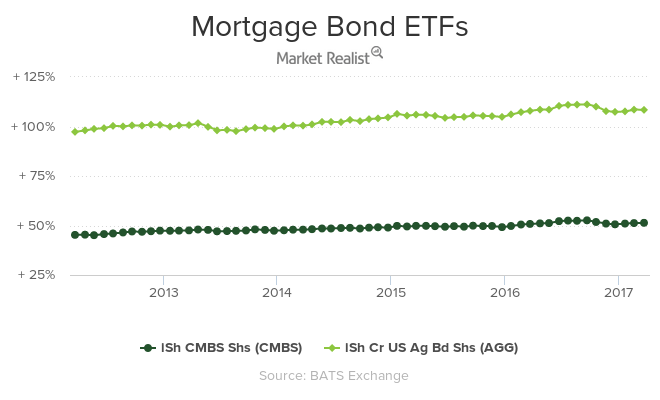

Jeffrey Gundlach Advises Investors to Invest in Mortgages

During a gradual rate hike scenario, Gundlach believes investment in mortgages is the best strategy.

Jurrien Timmer’s Take on What Will Drive Markets the Most in 2017

When asked in a recent interview his thoughts about the short-term and medium-term investment story, Jurrien Timmer said that the main issue for the market other than geopolitical risks is its valuation.

Why David Einhorn Is Betting against Amazon

On a YTD (year-to-date) basis, Amazon has returned nearly 40% as of November 3, 2017.

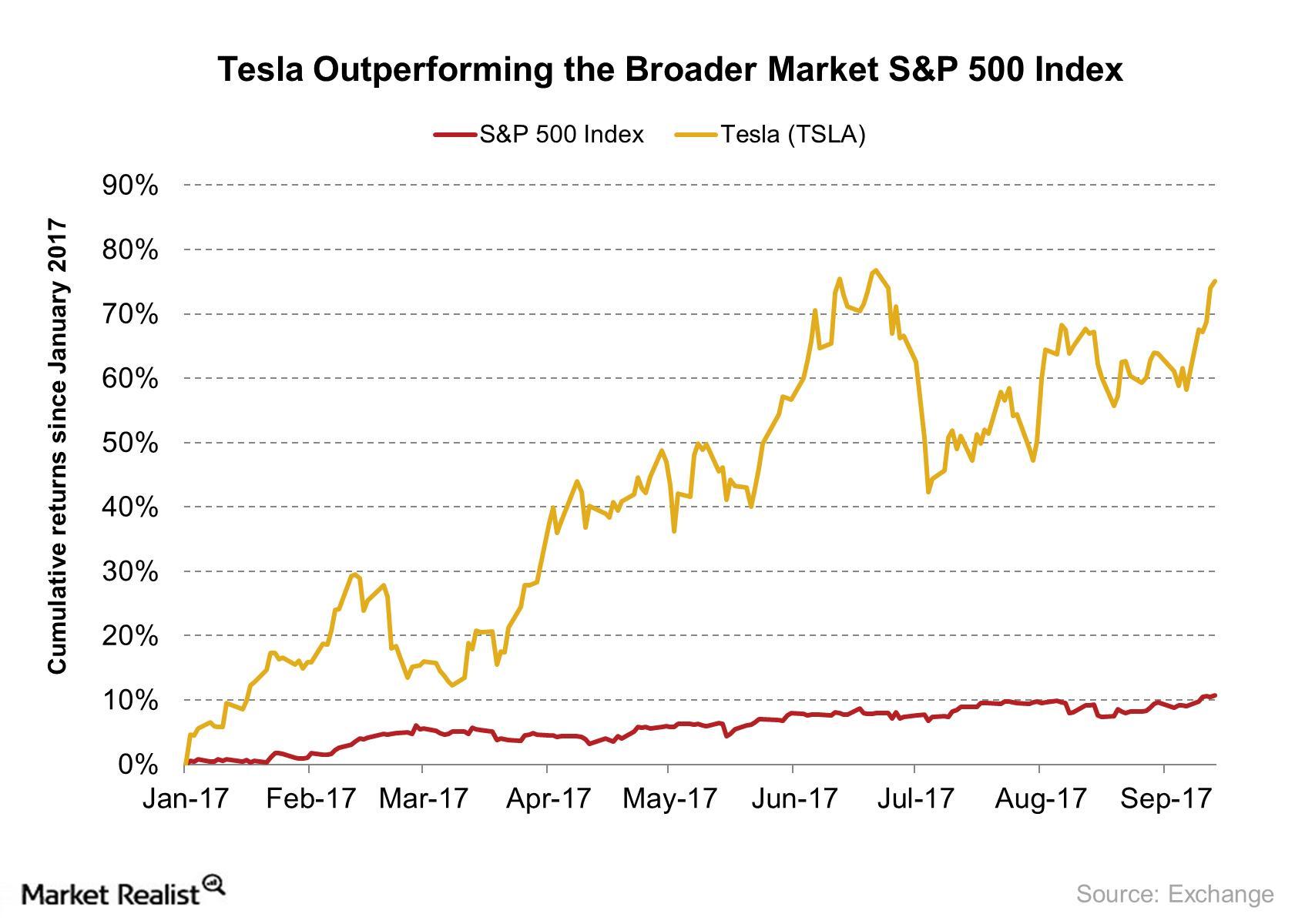

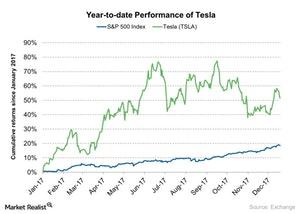

Why Jim Chanos Is Continuing His Short Position in Tesla

Jim Chanos, the billionaire investor and a well-known short seller in the hedge fund industry, said at the Delivering Alpha Conference on Tuesday, September 12, 2017, that he is continuing his short position in Tesla (TSLA).

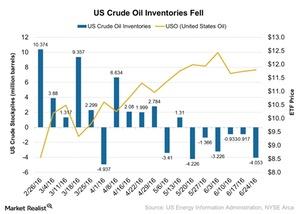

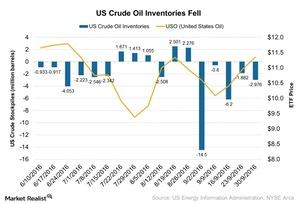

US Crude Oil Inventories Fall Again: How Is Crude Oil Reacting?

According to the U.S. Energy Information Administration’s report on June 29, 2016, US crude oil inventories fell by 4.1 MMbbls in the week ended June 24, 2016.

How Inventories and OPEC Decision Are Affecting Crude Prices

According to the EIA’s (U.S. Energy Information Administration) report on October 5, 2016, US crude oil inventories fell 3.0 MMbbls (million barrels) for the week ended September 30, 2016.

Jim Chanos on Tesla: ‘We Think the Equity Is Worthless’

Jim Chanos, a prominent short seller, discussed his view on Tesla in a recent interview with CNBC. He has a short bet on Tesla (TSLA) and said, “we think the equity is worthless.”

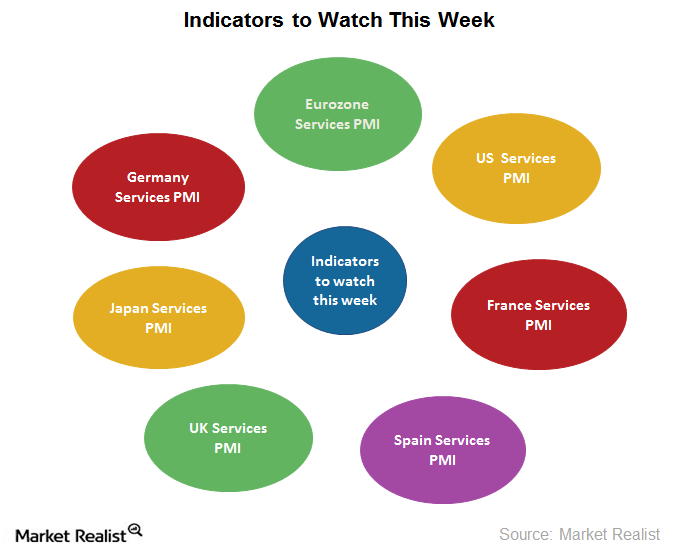

Economic Indicators Investors Should Watch for This Week

Economic indicators Key economic indicators investors should watch for this week are: US (SPY) services PMI data UK (EWU) services PMI data Eurozone (IEV) (VGK) services PMI data German (EWG) services PMI data Spanish services PMI data French (EWQ) services PMI data Japanese services PMI data US ADP employment data US non-farm payroll data Wrapping up […]

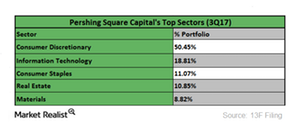

These Were Bill Ackman’s Largest Sector Holdings in 3Q17

Pershing Square Capital Management’s top sectors in 3Q17 were consumer discretionary (XLY), information technology (XLK), consumer staples (XLP), real estate (IYR), and materials (XLB).

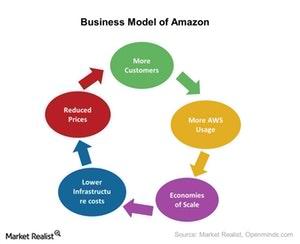

What Bill Miller Thinks about Amazon’s Business Model

Whole Foods Market (WFM) has returned nearly 40% on a year-to-date basis as of June 20, 2017.

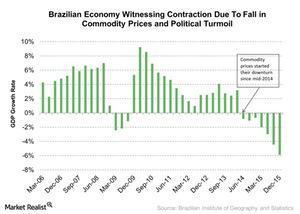

Why Is David Rubenstein Optimistic about Brazil?

The Brazilian economy is experiencing contraction due to a fall in commodity prices and the political turmoil. The commodities market is one of Brazil’s most important growth drivers.