Sarah Sands

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Sarah Sands

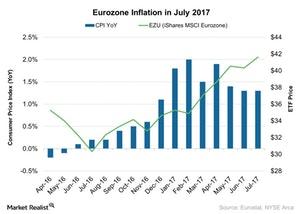

Analyzing the Eurozone’s Inflation in July 2017

On a year-over-year basis, the Eurozone Inflation Index was at 1.3% in July 2017—the same as in June, according to data provided by Eurostat.

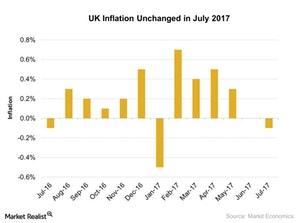

UK Inflation Fell: Possible Rough Path Ahead

According to a report by the Office for National Statistics, on a monthly basis, the United Kingdom’s inflation fell 0.1 in July 2017.

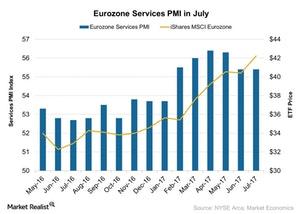

What Happened to the Eurozone Services PMI in July

The Eurozone Services PMI remained unchanged in July 2017, coming in at 55.4 but missing the preliminary market estimation.

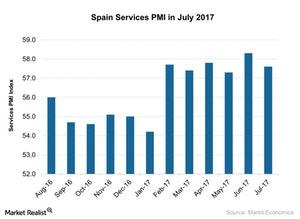

Why Spain’s Services PMI Declined in July

The Spain Services PMI stood at 57.6 in July, compared with 58.3 in June. The PMI figure didn’t meet the preliminary market estimation of 58.3.

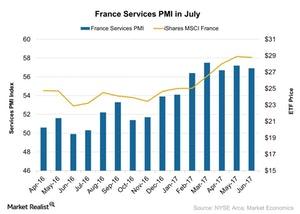

Behind the France Services PMI in July

The July France Services PMI (purchasing managers’ index) stood at 56.0 in July 2017, compared with 56.9 in June 2017, meeting the initial estimate of 55.9.

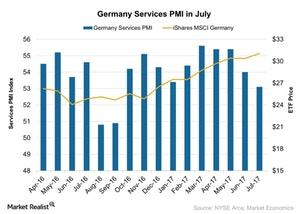

What Happened to Germany’s Services PMI in July?

The July Germany Services PMI stood at 53.1, compared with 54.0 in June 2017, falling short of the preliminary market’s estimation of 53.5.

The Latest Key Economic Indicators from Developed Nations

In this series, we’ll analyze the services PMIs for major developed nations including the US, France, Germany, Spain, the Eurozone, Japan, and the UK.

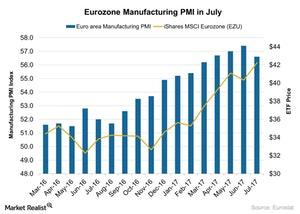

Why Eurozone Manufacturing PMI Dropped in July 2017

According to a report by Markit Economics, the final Eurozone manufacturing PMI (purchasing managers’ index) stood at 56.6 in July 2017 as compared to the 57.4 in June 2017.

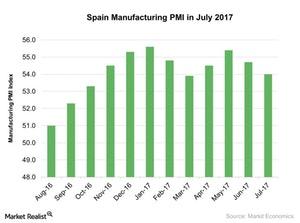

Spain’s Manufacturing Activity Fell in July

According to a report by Markit Economics, the final Spain Manufacturing PMI stood at 54 in July 2017 as compared to 54.7 in June.

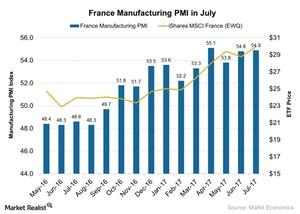

How France’s Manufacturing Activity Trended in July

According to data provided by Markit Economics, the final Markit France manufacturing PMI (purchasing managers’ index) stood at 54.9 in July 2017 compared to 54.8 in June 2017.

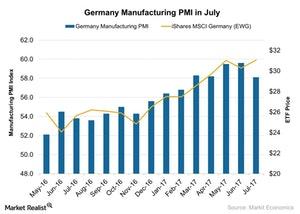

How Did Germany’s Manufacturing PMI Trend in July?

The final Markit Germany manufacturing PMI (purchasing managers’ index) stood at 58.1 in July 2017 compared to 59.6 in June 2017.

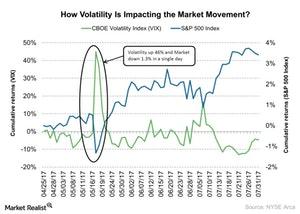

How Market Volatility Is Trending

Volatility plays an important role in the market. VIX fell nearly 8.2% in July 2017 and 20% on a year-to-date basis.

Will Marc Faber’s Asset Allocation Process Help Investors

Marc Faber is worried about the present market condition and not very optimistic about the market.

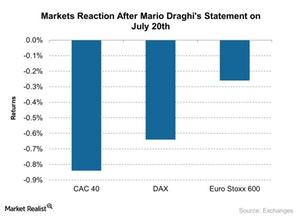

Euro Surged, Market Fell after Draghi’s Statement

When ECB president Mario Draghi announced that the interest rate remained unchanged at 0.0%, the euro fell nearly 0.30% against the US dollar.Macroeconomic Analysis Did the UK Election Affect Manufacturing in June?

The UK’s manufacturing PMI recorded a weaker improvement in June 2017. It stood at 54.3 in June compared to 56.3 in May.Macroeconomic Analysis Eurozone Manufacturing’s Constant Rise: Time to Invest?

According to a report by Markit Economics, the final Eurozone manufacturing PMI (purchasing managers’ index) stood at 57.4 in June 2017 compared to 57.0 in May.Macroeconomic Analysis Germany’s Rising Manufacturing: A Change in Sentiment

According to data provided by Markit Economics, the final Markit Germany manufacturing PMI (purchasing managers’ index) stood at 59.6 in June 2017 compared to 59.5 in May.Macroeconomic Analysis What Japan’s Manufacturing Suggests for Its Economy

Japan’s manufacturing PMI (purchasing managers’ index) stood at 52.4 in June 2017 compared to 53.1 in May.

James Gorman Says the Global Economy Is Doing Well: Why?

Gorman believes the global economy is doing well in the present scenario. However, lower volatility is a major concern.

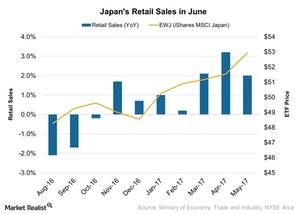

What Japan’s Falling Retail Sales Indicate for the Economy

According to the data provided by Japan’s Ministry of Economy, Trade and Industry, Japan’s retail sales rose to 2% in May 2017 on a yearly basis.

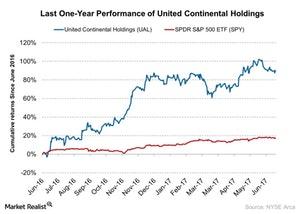

Why Barclays Thinks UAL Earnings Could Improve

UAL is currently trading at $76. Its 52-week high is $83.04, and its 52-week low is $37.64.

Soros: Why Brexit Could Lead to Lower Living Standards

Lower trade and investment flows could impact employment and wage growth, which might impact the standard of living in the United Kingdom.

What Does France’s Services PMI Indicate for the Economy?

The final Markit France services PMI stood at 57.2 in May 2017—compared to 56.7 in April 2017. The PMI was below the initial estimate of 58.0.

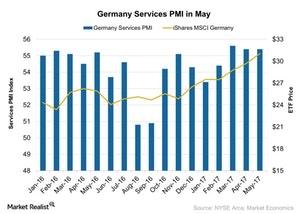

Why Germany’s Services PMI Didn’t Change in May

According to data provided by Markit Economics, the final Markit Germany services PMI (purchasing managers’ index) stood at 55.4 in May 2017.

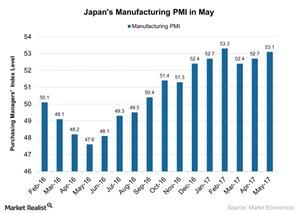

Japan’s Manufacturing PMI in May, and What to Make of It

The Japan Manufacturing PMI stood at 53.1 in May 2017, as compared to 52.7 in April, outperforming the preliminary market estimation of 52.0.

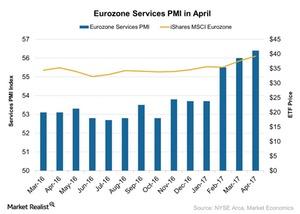

New High in Eurozone Services PMI Is Improving Outlook

According to a report by Markit Economics, the Eurozone Services PMI was 56.4 in April 2017 compared to 56.0 in March.

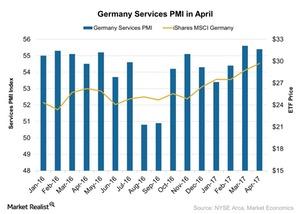

How Germany’s Services PMI Performed in April

According to Markit Economics, the Germany Services PMI stood at 55.4 in April 2017 compared to 55.6 in March 2017.

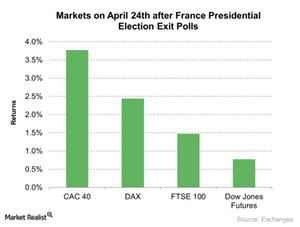

Gauging the Immediate Impact of the French Election Exit Polls

After the announcement of the French Presidential election exit polls on Sunday, April 23, 2017, global markets showed massive movement.

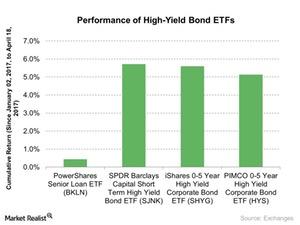

Bill Gross and High-Yield Bonds: Priced for Too Much Growth

Investors generally invest in high-yield bonds (BND) when there are expectations for higher growth in the economy.

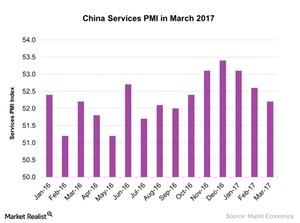

What China’s Weakening Services PMI Indicates for the Economy

Caixin China’s services PMI (purchasing managers’ index) stood at 52.2 in March 2017 compared to 52.6 in February.

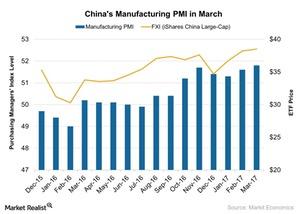

China’s Manufacturing PMI Improved: How It Could Drive Investor Sentiment

China’s final manufacturing PMI (purchasing managers’ index) stood at 51.8 in March 2017 compared to 51.6 in February, beating market expectations of 51.6.

Can March’s Manufacturing PMI Boost Germany’s Business Climate?

The Markit Germany manufacturing PMI stood at 58.3 in March 2017 compared to 56.8 in February.

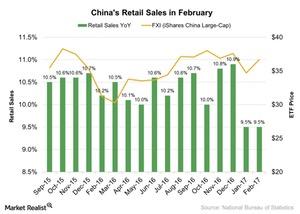

How Did China’s Retail Sales Look in February?

On a year-over-year basis, China’s retail sales were weaker in February 2017, according to the National Bureau of Statistics of China. The data were released on March 13, 2017.

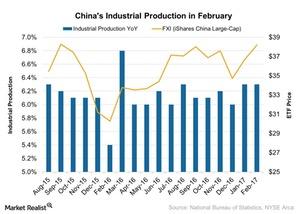

Will China’s Improved Industrial Production Impact Manufacturing?

According to the National Bureau of Statistics of China, on a year-over-year (or YoY) basis, the country’s industrial production rose 6.3% in February 2017.

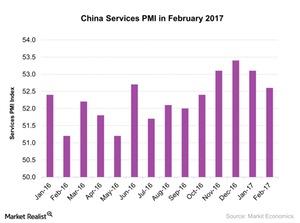

China Services PMI Could Indicate a Weaker Path for Its Economy

According to a report by Markit Economics, the Caixin China services PMI (purchasing managers’ index), released on March 2, 2017, stood at 52.6 in February 2017.

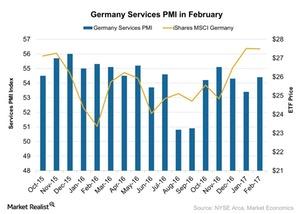

What the Strengthening of the Germany Services PMI Indicates

According to data provided by Markit Economics, the final Markit Germany services PMI (purchasing managers’ index), released on March 3, 2017, stood at 54.4 in February 2017.

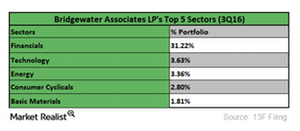

What Are Bridgewater’s Largest Holdings?

Ray Dalio’s Bridgewater Associates is a prominent hedge fund management firm. Previously, the firm held an optimistic view about emerging markets (EDC) (IEMG).

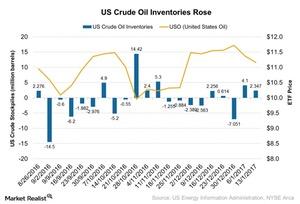

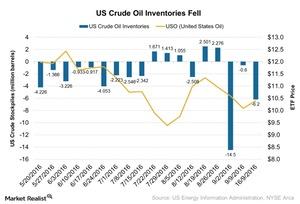

How Will Rise in Crude Oil Inventories Affect Crude Oil Movement?

According to the EIA’s (US Energy Information Administration) report on January 18, 2017, US crude oil inventories rose ~2.35 MMbbls (million barrels) for the week ended January 13, 2017.

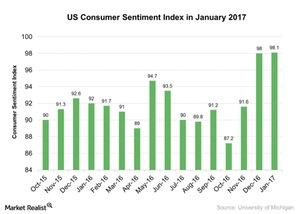

What Does the Rising US Consumer Sentiment Index Mean for the Economy?

The US Consumer Sentiment Index improved in January 2017. It stood at 98.1 in January 2017 compared to 98.2 in December 2016.

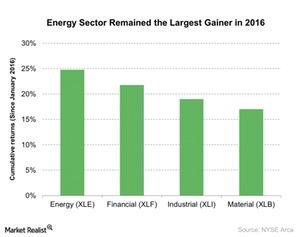

Marc Lasry on Energy Sector: A Good Opportunity?

According to Marc Lasry, heavy oil-weighted (USO) (UCO) (UWTI) stocks could be a better bet in the overall energy sector.

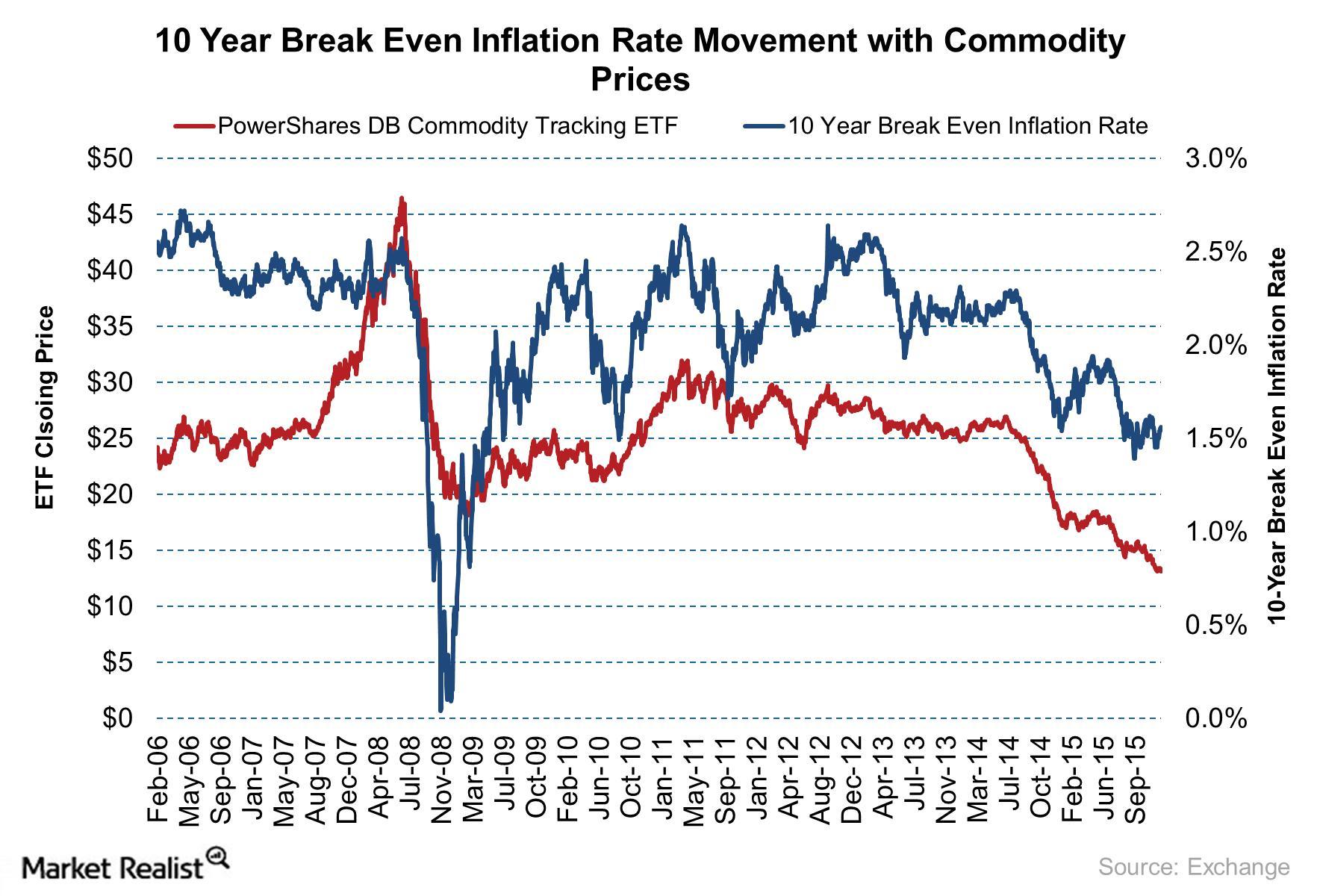

Goldman Sachs Is Long on the 10-Year US Breakeven Inflation Rate

After the announcement of the US election results, the 10-Year US Breakeven Inflation Rate showed an uptick. Goldman Sachs has advised investors to go long on the rate.

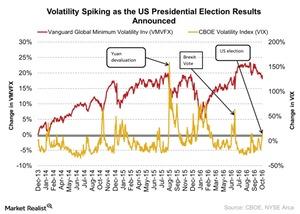

What Were the Immediate Impacts of Election Results on Markets?

The CBOE Volatility S&P 500 Index (VIX) has been rising during the past two weeks.

How Do Active and Passive Management Strategies Compare?

Jamie Dinan spoke about the performance of the hedge fund industry in an interview with CNBC.

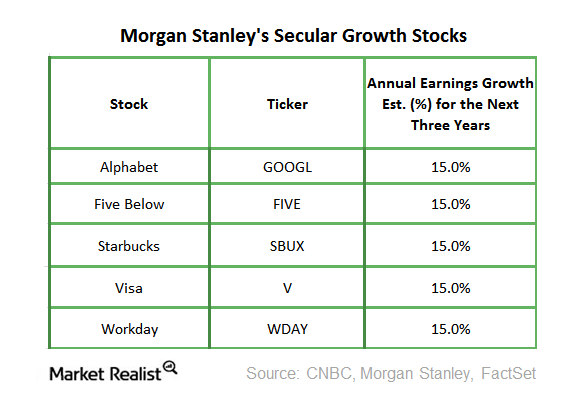

A Look at Morgan Stanley’s Top 5 ‘Secular Growth’ Stock Picks

On Friday, October 14, 2016, Morgan Stanley (MS) released a list of its favorite “secular growth” stock picks. It believes these stocks have long-term growth possibilities.

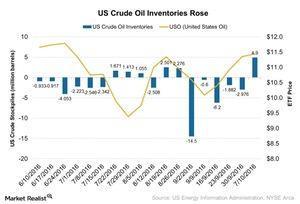

What Will Rising Crude Oil Inventories Mean for Crude Oil Movement?

According to the Energy Information Administration report on October 12, US crude oil inventories rose by 4.9 MMbbls for the week ending October 7.

IMF Warns about 3 Risks to the Global Financial System

The International Monetary Fund (or IMF) warned that there are three major risks to the global financial system in its latest report on global financial stability.

Which Economic Indicators Should Investors Watch This Week?

The most important indicator for this week is China’s monthly new loans. According to data from the People’s Bank of China, China’s (FXI) (YINN) (MCHI) new credit growth is increasing.

What Are Morgan Stanley’s Top Technology Stock Picks?

On September 28, 2016, Morgan Stanley (MS) released a list of technology (XLK) stocks that it expects could provide good returns in the months ahead.

Crude Oil Inventories and the OPEC Meeting in Focus

According to the EIA’s (U.S. Energy Information Administration) report on September 21, 2016, US crude oil inventories fell by 6.2 MMbbls.

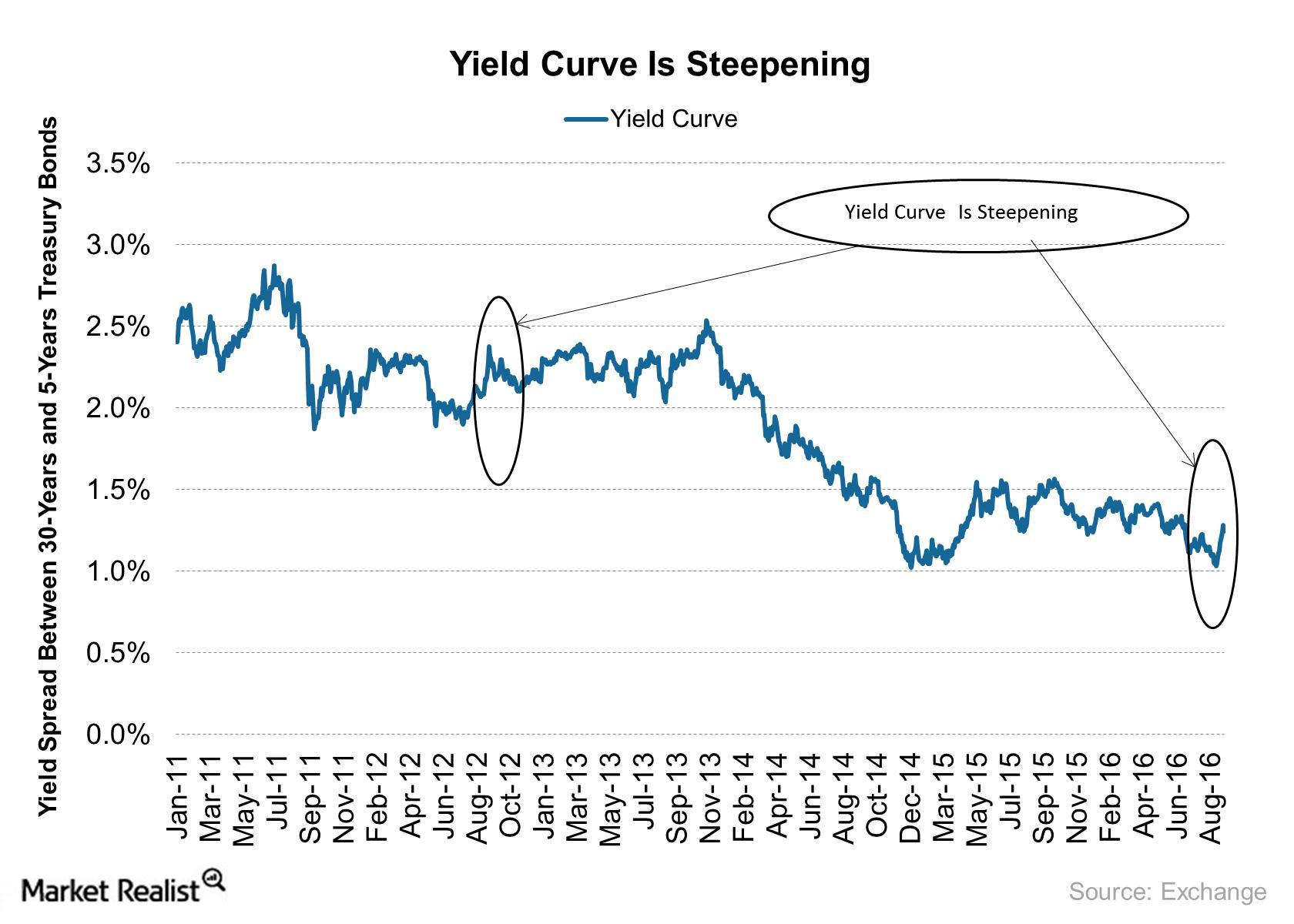

Yield Curve Is Steepening: What Does It Indicate for the Market?

In this series, we’ll compare yields across various developed markets (EFA) (VEA). We’ll also look at how a steepening yield curve affects the financial sector (XLF).