Sarah Sands

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Sarah Sands

How OPEC’s Decision Will Impact Crude Oil’s Movement

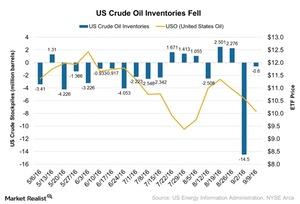

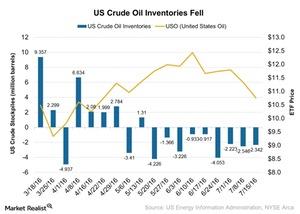

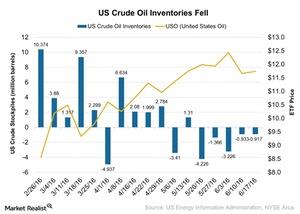

According to the EIA’s (U.S. Energy Information Administration) report on September 14, 2016, US crude oil inventories fell 0.6 MMbbls (million barrels) for the week ending September 9.

Crude Oil Prices Jumped as Inventories Fell

According to the EIA’s report on September 8, 2016, US crude oil inventories fell by 14.5 MMbbls for the week ended on September 2, 2016.

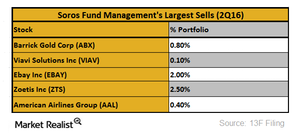

Why Did Soros Fund Management Reduce Its Holdings in Barrick Gold?

Billionaire investor George Soros, who said in April 2016 that gold was the only asset that could outperform in the current market environment, is now getting out of gold.

Will the Cyclical Sector Outperform the Defensive Sector?

The cyclical sector has a sizeable correlation with the different phases of the business cycle.

Why US Crude Oil Inventories Fell for 9th Consecutive Week

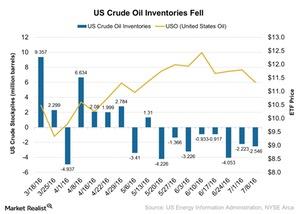

According to the July 20, 2016, U.S. Energy Information Administration report, US crude oil inventories declined by 2.3 MMbbls for the week ended July 15, 2016.

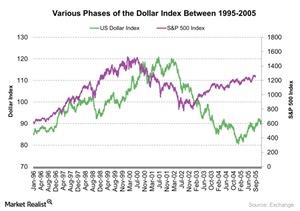

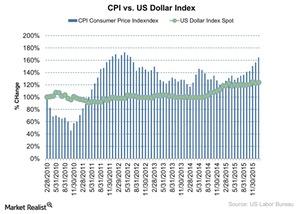

The Dollar Index and Economic Uncertainty: Is There Correlation?

The rally in the US Dollar Index can be correlated to two important events: the dot-com bubble crisis in 1999 and the Argentine debt crisis in 2001.

US Crude Oil Inventories Fell for the 8th Week: What It Means

According to the EIA’s report on July 13, 2016, US crude oil inventories fell by 2.5 MMbbls (million barrels) in the week ended July 8, 2016.

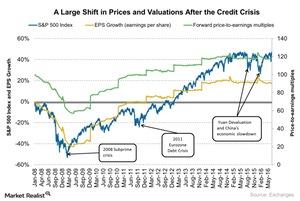

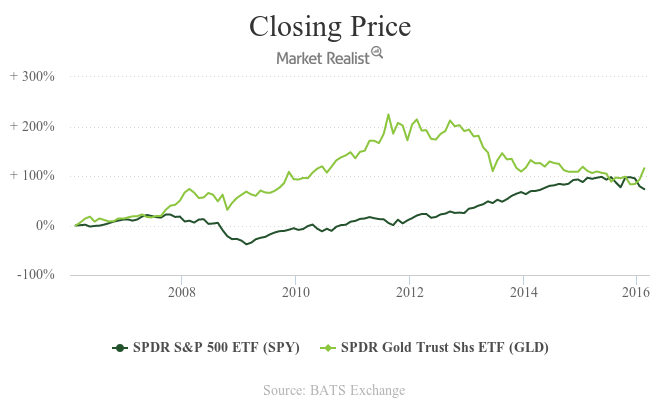

In Retrospect: How the 2008 Crisis Affected SPY’s Valuation

When the 2008 credit crisis affected the S&P 500 Index (SPY), we saw a large shift in valuations and the index level.

How Might Yields React to a Dot-Com Bubble Situation?

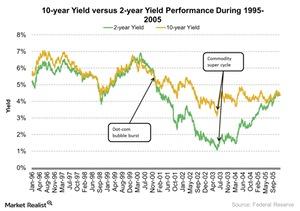

During the 1999–2002 dot-com bubble crisis, the US 2-Year Treasury yield fell by 74%. It made a high of 6.9% in May 2000 and a low of 1.8% in September 2002.

What Caused US Crude Oil Inventories to Fall Marginally?

According to the EIA’s report on June 22, 2016, US crude oil inventories fell by 0.92 MMbbls (million barrels) for the week ending June 17, 2016.

Active Fund Management: Will It Make Passive Attractive?

In recent years, the performance of various mutual funds and hedge funds followed by an active fund management strategy haven’t been so impressive.

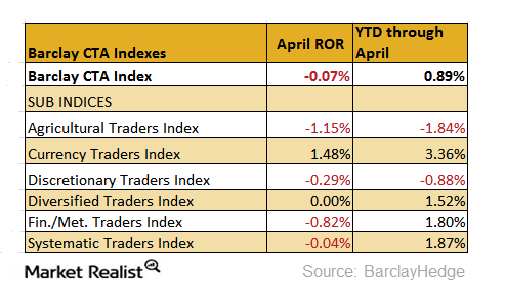

CTA Index Flat, Currency Leads, and Agricultural Funds Lag

In April 2016, the Barclay CTA (commodity trading advisors) Index remained flat. It returned -0.08% in April 2016.

Why Did India’s Industrial Production Fall?

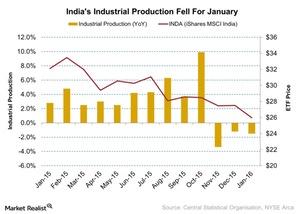

India’s industrial production fell by 1.5% in January, according to the Central Statistical Organization. In January 2015, the industrial production index rose to 2.8%.

Why Inflation Is a Double-Edged Sword for the Financial Market

Core inflation could impact the market positively as well as negatively. Higher core inflation data will depreciate the US dollar (UUP).

How Gold Correlates with the S&P 500 Index

Since July 2011, the S&P 500 Index has gained about 62% and touched its high of 2130 in July 2015. During the same period, gold (GLD) has lost about 92%.

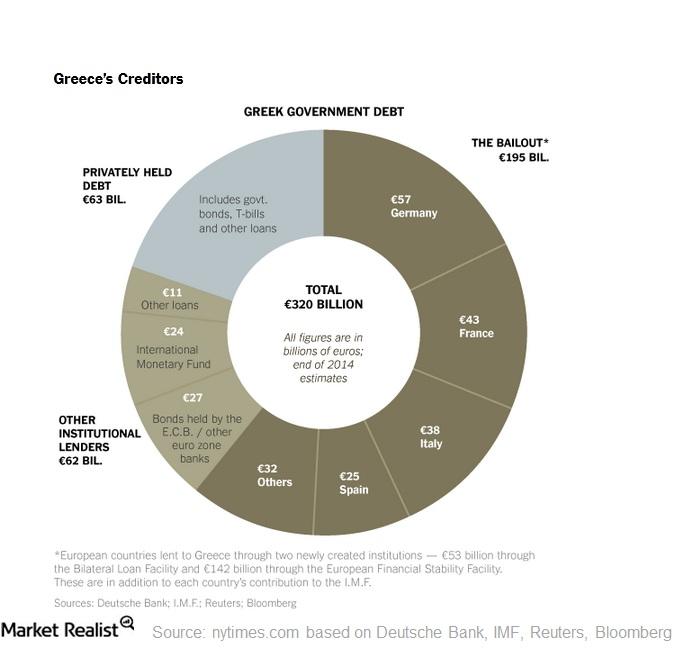

How Does the Greek Debt Crisis Impact the Eurozone?

Greece’s debt was around 250 billion euros. It’s nearly 175% of its 2013 GDP figures. The GDP could fall more in 2016. The debt crisis started in 2010.

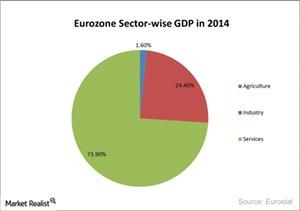

Analyzing the European Union’s GDP Composition

The EU’s (European Union) GDP (gross domestic product) depends on the service sector. The service sector contributes ~73.90% towards the EU’s (EZU) GDP.